In the annals of ruses used to provoke fear in the voting public about government…

RBA appeal to NAIRU authority is a fraud

The mainstream press is now seeing through the Reserve Bank of Australia’s behaviour, which I take as a sign of progress. For example, there was an article on the ABC News Site yesterday – Reserve Bank accused of ‘economic gaslighting’ as wages growth misses forecasts, again. I noted yesterday that the latest evidence contradicts the RBA’s claims that wages are growing too fast and provide it with a rationale for further interest rate increases, despite the inflation rate falling over the last several months, and real wages declining by more than has ever been recorded. Last week, the RBA Governor and his staff appeared before a parliamentary committee to justify thee rate hikes. We learn a lot from the session – none of it good. The basic conclusion is that the RBA thinks they can hoodwink our politicians into believing that their is a ‘technical authority’ based in statistics for their actions, when in fact, no such authority exists.

Background Reading

Regular readers will know that I have written about the NAIRU concept before and have done years of work on the topic:

1. My PhD thesis included a lot of technical work (theoretical and econometric) on the topic – beginning in the mid-1980s, when I was just starting out.

2. In my 2008 book with Joan Muysken – Full Employment abandoned – we analysed the technical aspects of the NAIRU in detail.

3. Many refereed academic papers.

4. The following blog posts (among others):

(a) The NAIRU should have been buried decades ago (December 9, 2021).

(b)The NAIRU/Output gap scam reprise (February 27, 2019).

(c) The NAIRU/Output gap scam (February 26, 2019).

(e) No coherent evidence of a rising US NAIRU (December 10, 2013).

(e) Why we have to learn about the NAIRU (and reject it) (November 19, 2013).

(f) Why did unemployment and inflation fall in the 1990s? (October 3, 2013).

(g) NAIRU mantra prevents good macroeconomic policy (November 19, 2010).

(h) The dreaded NAIRU is still about! (April 6, 2009).

So I think I am qualified to discuss the topic.

Why the NAIRU concept should be discarded

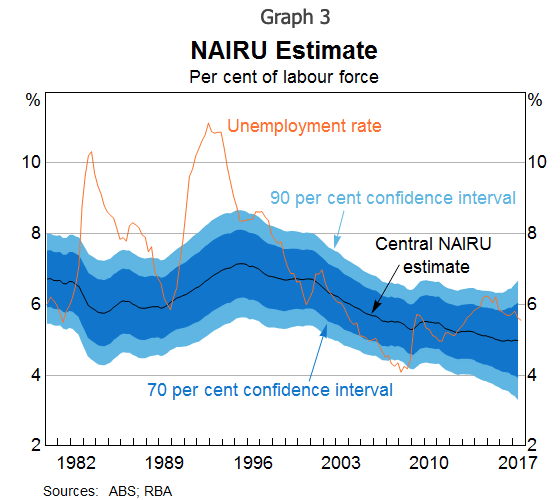

In this speech from the former deputy governor of the RBA – Uncertainty (October 26, 2017) – an interesting graph was presented (which I repeat here).\

In the links to previous blog posts above I have discussed this uncertainty issue at length.

A policy maker wants to know certain things with some degree of accuracy as part of their task of pulling levers/pushing buttons to get some quantitative and qualitative outcome.

That was the reason the National Accounts framework, for example, was introduced in the 1940s – to provide some measurement framework for policy makers to use, in the post WW2 era where governments had become committed to maintaining full employment through the appropriate use of fiscal policy (spending and/or taxation adjustments).

A framework that produces estimates of variables that are highly variable and have wide standard errors is not particularly useful for policy.

In forecasting, statisticians produce what are known as ‘point estimates’ (the predictions) but because there is statistical uncertainty in the estimates they also produce confidence intervals based on the ‘standard errors’, which are a measure of the sampling variability of the point estimates.

A 95 per cent CI for example, tells us that we can be 95 per cent certain that the true value of the variable lies within that interval.

The wider the interval, the less useful that prediction becomes.

The graph above shows that the standard NAIRU estimation techniques, which I am very familiar with (and have used extensively in my academic work), produce very wide confidence intervals.

So wide to be useless.

When the NAIRU concept first surfaced in 1975, econometricians set about estimating the ‘unobserved’ variable.

I have explained how they did this in the blog posts cited above.

If you want an academic treatment (very technical) then either my PhD thesis or my 2008 book (see above) is where you should go for an understanding.

In the 1980s, after governments had abandoned full employment as a policy goal and instead used unemployment as a policy tool to deal with inflationary pressures that were lingering after the OPEC oil price hikes of the 1970s, mainstream economists started to produce rising estimates of the NAIRU and used those results to justify their claims that even as the official unemployment rate rose from 2 per cent to 8 per cent in a matter of years, there was still no role for aggregate demand policy (that is, fiscal stimulus) because all the increase in unemployment was structural or voluntary.

I was just starting out in my academic career at this stage.

The mainstream claims were unadulterated nonsense but such was the iron grip on the policy debate held by the mainstream Monetarist purge that policy makers went along with it and economies operated well below the true potential.

The revised NAIRUs had the effect of deliberately deflating what the true potential capacity was.

Most of the research output confidently asserted that the NAIRU had changed over time (although reasons for these changes were scant) but very few authors dared to publish the confidence intervals around their point estimates.

There was one noted exception (mainstream econometricians Staiger, Stock and Watson in 1997) and their so-called “state-of-the-art” estimation of NAIRU models led them to conclude that:

… these estimates are imprecise; the tightest of the 95 percent confidence intervals for 1994 is 4.8 to 6.6 percentage points. If one acknowledges that additional uncertainty surrounds model selection and that no one model is necessarily ‘right’, the sampling uncertainty is prudently considered greater than suggest by the best-fitting of these models.

What they came up with (Page 39) was 95 percent confidence intervals for the US NAIRU of 2.9 percent to 8.3 percent.

In other words, they were claiming that they were equally confident that the NAIRU was 2.9 per cent or 8.3 per cent or somewhere in between.

This range of uncertainty about the location of the NAIRU is clearly too large to be at all useful. Say the unemployment rate was currently 6 per cent. Then at the lower confidence interval bound (2.9 per cent) this would allow for a major fiscal expansion without inflationary consequences (using the flawed NAIRU logic).

But if the NAIRU was actually at the upper confidence interval bound (8.3 per cent), then according to the same (flawed) logic such a fiscal expansion would be highly inflationary.

The econometricians were unable to discriminate between the two possibilities – they were equally confident that both were true.

Undaunted by these ridiculous results, the policy makers ignored the imprecision of the estimates and just focused on point estimates (that is, ignoring the confidence bands), which invariably supported their ideological preference against any government fiscal intervention.

On October 22, 2021, the current governor of the RBA, Philip Lowe presented at a ‘Conference on Central Bank Independence, Mandates and Policies’ in Chile.

In his – Speech – to the gathering he said this (among other things):

In terms of full employment, we do not have a numerical target and I don’t think it makes sense to do so. Experience has taught us that the non-accelerating inflation rate of unemployment (NAIRU) moves over time and is influenced by many factors outside the control of the central bank … Setting the wrong targets would create a conflict with the inflation target, which would lead to policy uncertainty and poor outcomes.

In other words, they had little idea of central concepts that they claimed conditioned the policy decisions over interest rates.

Fast track to February 17, 2023

Last Friday, the RBA governor made a regular appearance before the House of Representatives Standing Committee on Economics to discuss the – Review of the Reserve Bank of Australia Annual Report 2022

The 34-page transcript of the proceedings details exactly why the headlines about ‘gaslighting’ are now emerging.

Basically, the Governor and his RBA economists are interrogated by the Committee members who are MPs in the House. It is largely a political exercise but this is effectively the only accountability that the unelected RBA Board is subject to.

Lowe was asked what ‘the optimal fiscal policy stance’ should be (p.13 of the transcript) and replied:

If you say fiscal policy is really just to deal with structural issues, then fiscal policy needs to continue with repairing the budget and getting it back into reasonable balance, and monetary policy is the swing variable. That’s the way that economic policy works in most countries. Two reasons we ended up in that position are that it’s hard for the political class to take the short-term decisions to manage the cycle. We’re raising interest rates. I can tell you it’s become very unpopular. It’s easier for me to be unpopular than it is maybe for some people in this building.

This is a succcinct demonstration of the depoliticisation of macroeconomic policy that neoliberalism has spawned.

Lowe is not elected by the voters and is not accountable to us.

So he can engage in monetary policy decisions that deliberately increase unemployment, cut incomes, redistribute incomes from poor to wealthy (which is what monetary policy does effectively) and the politicians we elect can then say it was not their doing.

So the politicians see outcomes that satisfy the class interests that fund their electoral campaigns and guarantee them consultancies, directorships etc after they leave office, yet they take no responsibility or blame for the policies that lead to those outcomes.

Lowe was also asked about the NAIRU “through this persent period of very low unemployment” and replied that the job of his staff was “to pin that slippery concept down”.

He handed the floor to the staff member who claimed:

Our models do require estimates of the NAIRU … we thought that the NAIRU was somewhere in the high threes to low fours. I think the evidence that we’ve seen with how quickly wages growth has picked up, is it’s probably in the low fours more than the high threes. I think it’s manifest that we are below the NAIRU at the moment, but the NAIRU does move. That’s our staff view—that’s what we put in for our forecast—but I have to tell you if you use a standard conventional model to model these things, they’re not designed to handle the supply shocks that we have seen over COVID.

At the current unemployment rate (3.7 per cent), real wages are falling faster than previously seen in Australia.

It beggars belief that the labour market is ‘above full employment’, especially when the broad labour underutilisation rate (the sum of unemployment and underemployment) stands at 9.6 per cent.

What this RBA functionary is effectively trying to say is that full employment in Australia occurs when the labour wastage rate of more than 10 per cent of the available labour force.

So we need to ‘waste’ (that is, not use) more than 10 per cent of the available and willing labour before we are at full employment.

Beggars belief.

This has been the mainstream mantra since the 1980s.

It is why productivity growth has slumped.

It is why income inequality has risen.

It is why there has been a massive redistribution of national income to profits and away from wages.

But the functionary is telling us that the RBA has formed the view that the NAIRU is above the current unemployment rate, which is why they are deliberately setting about to increase unemployment.

Further, she claims the current unemployment rate is delivering unacceptable “wages growth” – unacceptable in the NAIRU logic because they believe that is pushing the inflation rate up.

Yet, as I note above, real wages are being cut at present.

Nominal wages growth is moderate and cannot in any acceptable ‘model’ be said to be driving the inflationary pressures.

To claim otherwise, as in the RBA case, is to just pretend to be operating in a technically precise environment, when in fact there is no precision here and the interest rate rises cannot be justified by a conclusion that we are above full employment.

The graph above tells you how imprecise the RBA NAIRU estimates are.

Let’s just assume for the moment that the point estimates of the NAIRU are in fact “low fours”?

What are the standard errors and the CIs for this point estimate?

The RBA conveniently doesn’t publish them.

But, certainly the lower band of the intervals will be well below the current official unemployment rate.

Which means that there is no ‘technical’ difference between “high threes” and “low fours”.

It would be lying to claim otherwise.

Which means there is no policy information that the NAIRU estimates in this case can provide about whether we are above or below full employment.

Which, in turn, means the RBAs justification for the interest rate hikes fails.

They are ‘gaslighting’ us.

Further, in the latest RBA – Statement on Monetary Policy – February 2023 – we encounter “Box C Supply and Demand Drivers of Inflation in Australia”.

One method for decomposing the inflation rate into supply and demand drivers, suggests that of the 7.8 per cent current inflation rate, only about 2 per cent can be attributed to so-called ‘Demand drivers’.

Graph C.3 shows that “supply shocks account for around three-quarters of the pick-up in inflation”.

So once we allow the transitory supply factors arising from the pandemic, the Ukraine situation and OPEC to abate, the inflation rate would drop dramatically and probably be close to the RBA’s target range if not within it.

Which raises the question, why is the RBA set on deliberately pushing people out of work and forcing low-income families to default on their mortgages given that reality?

And the evidence is becoming clearer that the inflation rate in the US and globally is about to fall very quickly as supply chains improve their capacity to gets goods to market and commodity prices decline.

Conclusion

We are living through a very bleak intellectual period of history.

Our prosperity is in the hands of policy makers that hide behind smokescreens of alleged ‘technical knowledge’, which they use to bluff us into believing they have precise knowledge.

We cannot dispute their statements because we are ignorant.

In this context, I am an expert and I can tell you their appeal to ‘technical authority’ is just a fraud.

Their models are fictional and useless for the purposes they are used for.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

In ancient times the high-priests would declare due to their superior knowledge of the workings of the world, there needed to be the sacrifice of 100 virgins to appease the gods, for the latest crop failures. (we now know the high-priests knew nothing about how the world really worked and were blood-thirsty psychopaths)

In modern times the economic high-priests use the NAIRU (fake economic knowledge) to sacrifice people on to the unemployment scrap heap in order to fight inflation. When we all know the inflation we have at the moment is caused by transitory supply-side disruptions.

Charlatans allways give you false arguments to push their agenda.

The central bank of Australia is no better than any other western central bank.

Their audience is not the Australian people, but the Australian Finance, Insurance and Real Estate sector, aka FIRE sector: it’s in the interest of commercial bankers that they are hiking interest rates (interest paid on reserves).

It’s akin to a mafia, similar to the Godfather movie trilogy.

It begins as a racket but ends up as a giant “legitimate” business – as legitimate as money can buy.

And you have a crime committed – by legitimate means – against the Australian people.

Same at the EU blob.

Bill, this entence is confusing.

“What this RBA functionary is effectively trying to say is that full employment in Australia occurs when the labour wastage rate of more than 10 per cent of the available labour force.”

I think it has 2 main clauses.

The 1st is, “What this RBA functionary is effectively trying to say is that full employment in Australia occurs…”

The 2nd is “… when the labour wastage rate of more than 10 per cent of the available labour force.”

The 1st clause is fine. The 2nd one has no verb.

It might be “… when the labour wastage rate [-]of[/-] [add ‘is’] more than 10 per cent of the available labour force.”

Please, anyone help me out. I’m confused.

Using MS econ. when the UE rate is above the NAIRU the RBA or Gov. should __blabk_______.

Using MS econ. when the UE rate is below the NAIRU the RBA or Gov. should __blabk_______.

Thank you.

Please, anyone help me out. I’m confused.

Using MS econ. when the UE rate is above the NAIRU the RBA or Gov. should __blabk_______.

Using MS econ. when the UE rate is below the NAIRU the RBA or Gov. should __blabk_______.

The Answer is the same for both examples.

Neither of them should ever refer to or mention the NAIRU unless they are admitting that it’s a farce and completely worthless concept.

The government should work to maintain full employment in the sense that everyone who wants a job has a job.

The RBA should stick to its 1959 charter – rather than wander off and work exclusively for corporations.

“Our models tell us this prophylactic kills between 50% and 120% of the people who die from a particular disease, but we have faith it’s in the lower 50s and should distribute it to everyone immediately.”

“Our models tells us that this airplane design change can cause between 20% less and 5% more accidents. Experience tells us we should such to implement it as soon as possible.”

On any other field, they would be laughed out of a career. Well, maybe not so much these days of no consequence multi-nationals until disaster, but still…

Is “central bank independence” (lack of direct political accountability of the central bank) the underlying cause of these issues? I’m not attempting to advocate for or against such independence here … Just asking whether the underlying issue is the degree to which we want to make the technocracy (central bankers in this case) directly accountable to the people.

Through the MMT lens, are the operations of central bank seen as auxiliary operations of the Treasury Department, and therefore subject to the same political process as all other departments of the executive branch of government (ultimately accountable to the President)?

John B.,

I would say that central bank independence explains a lot about *why* central bankers prefer the bank-centric interventions they tend to like, but ultimately their conclusions are wrong regardless of how “independent” they are, and would be just as wrong if they sported such ideas wearing Treasury hats. I think we’re all fine with subordinating Fed to Treasury, to be sure.