Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

The Weekend Quiz – July 4-5, 2020 – answers and discussion

Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern Monetary Theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

A rising household saving ratio combined with an external deficit that is draining aggregate demand, means that the fiscal deficit has to rise to maintain current output growth.

The answer is False.

This question tests one’s basic understanding of the sectoral balances that can be derived from the National Accounts. The secret to getting the correct answer is to realise that the household saving ratio is not the overall sectoral balance for the private domestic sector.

In other words, if you just compared the household saving ratio with the external deficit and the fiscal balance you would be leaving an essential component of the private domestic balance out – private capital formation (investment).

To refresh your memory the sectoral balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

Expression (1) tells us that total income in the economy per period will be exactly equal to total spending from all sources of expenditure.

We also have to acknowledge that financial balances of the sectors are impacted by net government taxes (T) which includes all taxes and transfer and interest payments (the latter are not counted independently in the expenditure Expression (1)).

Further, as noted above the trade account is only one aspect of the financial flows between the domestic economy and the external sector. we have to include net external income flows (FNI).

Adding in the net external income flows (FNI) to Expression (2) for GDP we get the familiar gross national product or gross national income measure (GNP):

(2) GNP = C + I + G + (X – M) + FNI

To render this approach into the sectoral balances form, we subtract total taxes and transfers (T) from both sides of Expression (3) to get:

(3) GNP – T = C + I + G + (X – M) + FNI – T

Now we can collect the terms by arranging them according to the three sectoral balances:

(4) (GNP – C – T) – I = (G – T) + (X – M + FNI)

The the terms in Expression (4) are relatively easy to understand now.

The term (GNP – C – T) represents total income less the amount consumed less the amount paid to government in taxes (taking into account transfers coming the other way). In other words, it represents private domestic saving.

The left-hand side of Equation (4), (GNP – C – T) – I, thus is the overall saving of the private domestic sector, which is distinct from total household saving denoted by the term (GNP – C – T).

In other words, the left-hand side of Equation (4) is the private domestic financial balance and if it is positive then the sector is spending less than its total income and if it is negative the sector is spending more than it total income.

The term (G – T) is the government financial balance and is in deficit if government spending (G) is greater than government tax revenue minus transfers (T), and in surplus if the balance is negative.

Finally, the other right-hand side term (X – M + FNI) is the external financial balance, commonly known as the current account balance (CAD). It is in surplus if positive and deficit if negative.

In English we could say that:

The private financial balance equals the sum of the government financial balance plus the current account balance.

We can re-write Expression (6) in this way to get the sectoral balances equation:

(5) (S – I) = (G – T) + CAB

which is interpreted as meaning that government sector deficits (G – T > 0) and current account surpluses (CAB > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G – T < 0) and current account deficits (CAB < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

Expression (5) can also be written as:

(6) [(S – I) – CAB] = (G – T)

where the term on the left-hand side [(S – I) – CAB] is the non-government sector financial balance and is of equal and opposite sign to the government financial balance.

This is the familiar MMT statement that a government sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)) plus net income transfers.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

You can then manipulate these balances to tell stories about what is going on in a country.

For example, when an external deficit (X – M < 0) and a public surplus (G – T < 0) coincide, there must be a private deficit. So if X = 10 and M = 20, X – M = -10 (a current account deficit). Also if G = 20 and T = 30, G – T = -10 (a fiscal surplus). So the right-hand side of the sectoral balances equation will equal (20 – 30) + (10 – 20) = -20.

As a matter of accounting then (S – I) = -20 which means that the domestic private sector is spending more than they are earning because I > S by 20 (whatever $ units we like). So the fiscal drag from the public sector is coinciding with an influx of net savings from the external sector. While private spending can persist for a time under these conditions using the net savings of the external sector, the private sector becomes increasingly indebted in the process. It is an unsustainable growth path.

So if a nation usually has a current account deficit (X – M < 0) then if the private domestic sector is to net save (S – I) > 0, then the fiscal deficit has to be large enough to offset the current account deficit.

Say, (X – M) = -20 (as above). Then a balanced fiscal position (G – T = 0) will force the domestic private sector to spend more than they are earning (S – I) = -20. But a government deficit of 25 (for example, G = 55 and T = 30) will give a right-hand solution of (55 – 30) + (10 – 20) = 15.

The domestic private sector can net save.

So by only focusing on the household saving ratio in the question, I was only referring to one component of the private domestic balance. Clearly in the case of the question, if private investment is strong enough to offset the household desire to increase saving (and withdraw from consumption) then no spending gap arises.

In the present situation in most countries, households have reduced the growth in consumption (as they have tried to repair overindebted balance sheets) at the same time that private investment has fallen dramatically.

As a consequence a major spending gap emerged that could only be filled in the short- to medium-term by government deficits if output growth was to remain intact. The reality is that the fiscal deficits were not large enough and so income adjustments (negative) occurred and this brought the sectoral balances in line at lower levels of economic activity.

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 2:

Assume that total employment grew in a particular month in net terms yet unemployment still rose. You also know that the labour force participation rate fell marginally. Taken together this information tells you that:

(a) Labour force growth outstripped employment growth but was less than the growth in the working age population.

(b) The working age population grew faster than employment and offset the decline in the labour force.

(c) The labour force grew faster than employment but you cannot tell what happened to the working age population from the information provided.

The answer is Option (a) The labour force grew faster than employment but not as fast the working age population.

If you didn’t get this correct then it is likely you lack an understanding of the labour force framework which is used by all national statistical offices.

The labour force framework is the foundation for cross-country comparisons of labour market data. The framework is made operational through the International Labour Organization (ILO) and its International Conference of Labour Statisticians (ICLS). These conferences and expert meetings develop the guidelines or norms for implementing the labour force framework and generating the national labour force data.

The rules contained within the labour force framework generally have the following features:

- an activity principle, which is used to classify the population into one of the three basic categories in the labour force framework;

- a set of priority rules, which ensure that each person is classified into only one of the three basic categories in the labour force framework; and

- a short reference period to reflect the labour supply situation at a specified moment in time.

The system of priority rules are applied such that labour force activities take precedence over non-labour force activities and working or having a job (employment) takes precedence over looking for work (unemployment). Also, as with most statistical measurements of activity, employment in the informal sectors, or black-market economy, is outside the scope of activity measures.

Paid activities take precedence over unpaid activities such that for example ‘persons who were keeping house’ as used in Australia, on an unpaid basis are classified as not in the labour force while those who receive pay for this activity are in the labour force as employed.

Similarly persons who undertake unpaid voluntary work are not in the labour force, even though their activities may be similar to those undertaken by the employed. The category of ‘permanently unable to work’ as used in Australia also means a classification as not in the labour force even though there is evidence to suggest that increasing ‘disability’ rates in some countries merely reflect an attempt to disguise the unemployment problem.

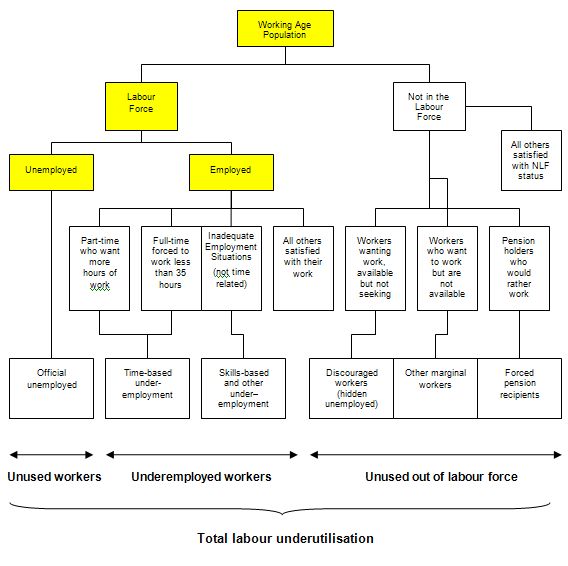

The following diagram shows the complete breakdown of the categories used by the statisticians in this context. The yellow boxes are relevant for this question.

So the Working Age Population (WAP) is usually defined as those persons aged between 15 and 65 years of age or increasing those persons above 15 years of age (recognising that official retirement ages are now being abandoned in many countries).

As you can see from the diagram the WAP is then split into two categories: (a) the Labour Force (LF) and; (b) Not in the Labour Force – and this division is based on activity tests (being in paid employed or actively seeking and being willing to work).

The Labour Force Participation Rate is the percentage of the WAP that are active. So if the participation rate is 65 per cent it means that 65 per cent of those persons above the age of 15 are actively engaged in the labour market (either employed or unemployed).

You can also see that the Labour Force is divided into employment and unemployment. Most nations use the standard demarcation rule that if you have worked for one or more hours a week during the survey week you are classified as being employed.

If you are not working but indicate you are actively seeking work and are willing to currently work then you are considered to be unemployed. If you are not working and indicate either you are not actively seeking work or are not willing to work currently then you are considered to be Not in the Labour Force.

So you get the category of hidden unemployed who are willing to work but have given up looking because there are no jobs available. The statistician counts them as being outside the labour force even though they would accept a job immediately if offered.

The question gave you information about employment, unemployment and the labour force participation rate and you had to deduce the rest based on your understanding.

In terms of the Diagram the following formulas link the yellow boxes:

Labour Force = Employment + Unemployment = Labour Force Participation Rate times the Working Age Population

It follows that the Working Age Population is derived as Labour Force divided by the Labour Force Participation Rate (appropriately scaled in percentage point units).

So if both Employment and Unemployment is growing then you can conclude that the Labour Force is growing by the sum of the extra Employment and Unemployment expressed as a percentage of the previous Labour Force.

The Labour Force can grow in one of four ways:

- Working Age Population growing with the labour force participation rate constant;

- Working Age Population growing and offsetting a falling labour force participation rate;

- Working Age Population constant and the labour force participation rate rising;

- Working Age Population falling but being offset by a rising labour force participation rate.

So in our case, if the Participation Rate is falling then the proportion of the Working Age Population that is entering the Labour Force is falling. So for the Labour Force to be growing the Working Age Population has to be growing faster than the Labour Force.

So the correct answer is as above.

Of the second option:

The working age population grew faster than employment and offset the decline in the labour force arising from the drop in the participation rate.

Clearly impossible if both employment and unemployment both rose.

And of the third option:

The labour force grew faster than employment but you cannot tell what happened to the working age population from the information provided.

Clearly you can tell what happened to the working age population by deduction.

The following blog post may be of further interest to you:

Question 3:

The European Commission has temporarily relaxed the fiscal restrictions on national governments that are applicable under the Stability and Growth Pact, which means that the solvency risk facing several EMU members is also temporarily resolved.

The answer is False.

Linking of solvency risk and the Stability and Growth Pact is false.

The Stability and Growth Pact which is summarised as imposing a rule on EMU member countries that their fiscal deficits cannot exceed 3 per cent of GDP rule and their public debt to GDP ratio cannot exceed 60 per cent. In the links provided below you will find extensive analysis of the nonsensical nature of these rules.

The SGP was designed to place nationally-determined fiscal policy in a straitjacket to avoid the problems that would arise if some runaway member states might follow a reckless spending policy, which in its turn would force the ECB to increase its interest rates. Germany, in particular, wanted fiscal constraints put on countries like Italy and Spain to prevent reckless government spending which could damage compliant countries through higher ECB interest rates.

In my 2015 book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (published May 2015) – I showed that these figures were highly arbitrary and were without any solid theoretical foundation or internal consistency.

The rationale of controlling government debt and fiscal deficits were consistent with the rising neo-liberal orthodoxy that promoted inflation control as the macroeconomic policy priority and asserted the primacy of monetary policy (a narrow conception notwithstanding) over fiscal policy. Fiscal policy was forced by this inflation first ideology to become a passive actor on the macroeconomic stage.

But these rules, while ensuring that the EMU countries will have to live with high unemployment and depressed living standards (overall) for years to come, given the magnitude of the crisis and the austerity plans that have to be pursued to get the public ratios back in line with the SGP dictates, are not the reason that the EMU countries risk insolvency.

That risk arises from the fact that when they entered the EMU system, they ceded their currency sovereignty to the European Central Bank (ECB) which had several consequences. First, EMU member states now share a common monetary stance and cannot set interest rates independently. The former central banks – now called National Central Banks are completely embedded into the ECB-NCB system that defines the EMU.

Second, they no longer have separate exchange rates which means that trade imbalances have to be dealt with in monetary terms not in relative price changes.

Third, and most importantly, the member governments cannot create their own currency and as a consequence can run out of Euros! So imagine there was a bank run occurring in Australia, while the situation would signal mass frenzy, the Australian government has the infinite financial capacity to guarantee all deposits denominated in $AUD should it choose to do so. If the superannuation industry collapsed in Australia, the Australian government could just guarantee all retirement incomes denominated in $AUD should it choose to do so. The same goes for any sovereign government (including the US and the UK).

But an EMU member government coan not do this and their banking or public pension systems can easily become insolvent.

Further, it could reach a situation where it did not have enough euros available (via taxation revenue or borrowing) to repay its debt commitments (either retire existing debt on maturity or service interest payments). In that sense, the government itself would become insolvent.

A sovereign government such as Australia or the US could never find itself in that sort of situation – they are never in risk of insolvency.

So the source of the solvency risk problem is not the fiscal rules that the EMU nations have placed on themselves but the fact they have ceded currency sovereignty.

The following blog posts may be of further interest to you:

- Euro zone’s self-imposed meltdown

- A Greek tragedy …

- España se está muriendo

- Exiting the Euro?

- Doomed from the start

- Europe – bailout or exit?

- Not the EMF … anything but the EMF!

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

Off-topic but I couldn’t resist quoting this gem from ‘The coronavirus recession is like no other – and it risks becoming a chronic problem’ by David Taylor on the ABC News website:

“While governments are fiscally restrained, there’s virtually no limit to what central banks can do in terms of stimulus – including money printing.”

Re “money printing”: is money debt? Can government create ‘debt-free’ money?

That is a current debate on politicalforum.com (under the heading “MMT; overcoming the political divide”)

One member sought Warren Mosler’s advice; Mosler emailed this answer:

“and the dollar is a government liability – a tax credit, and your asset that can be used to pay taxes”.

So can the government issue these “liabilities” without these “liabilities” being a liability to the issuing government ie debt-free for the issuing government?

I made this comment in the debate:

“But as I said, the people in the Melbourne towers will need to be supported by government IOU’s (if that is what money is) during the lock-down; and it’s insane to think the only way the government can get those IOU’s – to fund that support – is by borrowing (with interest) said IOU’s from private sector investors.

Replying to Neil Halliday July 5 at 14:17 :

Yes, all money is debt & credit by the Chartalist definitions. You can use other definitions which make it not so, but they’d be weird. So you cannot have “debt free money” there is no such thing. So ignore those Internet chats, they are misleading you. State money (the AUD for example) is credit to us (tax credit and bank credit) and debt to the government. But when we take out bank credit, we owe it back to the bank as proper debt. With government issue currency it is a totally different kid of debt, and it is better to refer to it as “obligation” rather than liability or debt. Since the government (and it’s registered bank agents) is the monopoly currency issuer it can always honour It’s debt. But that normally refers t bonds, which the buyers of are owed principle + interest. It does not refer to currency spent into existence by appropriations. That money is spent with no strings. But we do not say it is debt-free, because the government is obliged (by law) to redeem any of this money back in receipt of a tax payment.

This makes it clear that money not held in Treasury bonds, is not entirely debt-free, it is always a liability the government is obligated to redeem for tax payment. That is however a very different sort of obligation than a credit card debt or a bank loan debt. Once you understand this difference then MMT will be clearer, and the confusion over the different uses of the word “debt” will be clear.

What Positive Money folks think is “debt” is too naive, they regard tax obligation (the obligation of the government to redeem it’s currency for tax extinguishing) as not a debt, but they’re wrong.

This understanding seems unique to MMT and maybe some post-Keynesians. No other school of economic thought recognizes this, apparently. If they do they do not put it in their textbooks like Mitchell, Wray and Watts do. To my mind this makes all the others schools of economics fantasy studies.

It is also why Bitcoin (and most other crytocurrencies) are not money. No one in the world guarantees to redeem Bitcoins for anything. So all it amounts to is a payments system, and the conversion to Satte currencies is way over-priced, which will cause many people a lot of grief when these ponzi schemes come unravelled. it is quite sad. In some circles that I frequent (free software hacker culture) there is a rave about Bitcoin. They are talking up the price and going through a classic ponzi scheme. They think they are smart (and this includes Nassim Taleb, so they are smart, in some fields). Some fo them are going to lose big time at some future date when those conversion prices collapse. All it will take is a whiff of a fall in psychological confidence.

In short: the point is monetary things properly are always an equal debt & credit. If not, they are something other than money. For example, gold was never money. Grains of barley were never money. Those commodities were used to measure units of money, the real money was always the record of how much of the unit you owed to whom, and how much of the units were owed to you. This is pure data, a unit of account, not the actual gold or barley. So you only ever needed the records (in ink on a ledger book for instance), not the actual gold or barley. However, if you mined gold or grew barley you’d be privileged under such a system, since you could hand-over your commodity stuff in that case and get your account incremented. Nowadays who is privileged under fiat currency systems? Answer: whoever legally can emit the account records new, ex-nihilo, non-fraudulently — i.e., only the government and It’s registered banking agents.

A final word, for now, is that anyone can create non-State money ex-nihilo, you just write an IOU on a scrap of paper. That’s because an IOU is a credit to the receiver and a debt to you, so it is classified as money. The problem in making this useful in purchasing things is to have it be accepted. Unless you have a trusted promise to redeem your IOU’s for something folks need or want, likely you will not be able to replace the State currency!

Neil, IMHO the ability of a currency-sovereign government to call money into existence NOT linked to debt (by federal bond sales, funneling through private banks, etc.), this inherent sovereign capacity to create money ex nihilo merely by making decisions to invest it in necessary and responsible ways to rescue both people and planet, is the most stunning and hopeful revelation brought by the MMT lens. It is, without the slightest exaggeration at this perilous time, a matter of life and death for the human species and for all living things, and thus ranks among humanity’s greatest intellectual discoveries. It is no less than the counterpart, in economic thought, to the idea of democracy in political thought. Thus, I remain dumbfounded and demoralized by what appears to be the inability of so many, even among MMT advocates, to recognize the absolutely extraordinary nature of this intellectual gift from the hands of what began as a small group of renegade economists, including, of course, the author of this bog. To me, it’s as if the apostle Paul, after his life-changing road-to-Damascus experience, merely picked himself up and continued down the road in matter-of-fact fashion, mulling over this or that detail of the experience while trying to figure out how he might best convince his fellow rabbis that they had it wrong about this guy called Jesus.

It is many years since I first asked the question ‘where does new money come from?’ having realised that the total amount of money in existence must be continuously increasing with the effects of population growth, inflation and rising living standards. Finding Prof. Bill Mitchell has finally given me a fully understandable answer.

Perhaps, ironically, the difficulty is that so many people just cannot accept that the answer is so simple. Modern fiat money is not something that has intrinsic, inviolable properties like the mass of an atom of gold. Money is nothing more than a social construct, an idea which serves a useful purpose and who’s properties are, and should be, moulded and mandated by human ingenuity to suit it’s intended purpose. If the people will benefit from money being something which a nation’s appointed authority can conjour out of nothing with no consequent liability for ‘debt’ (another social construct) then that is what it should be. In the words of Jean-Luc Picard, “Make it so!”.

Bijou Sunday, July 5, 2020 at 17:10

Excellently composed!

Enlightening, informative, coherent, clear and complete!

Thank you!

We need to invent a tax that the rich can’t avoid or pass on to their customers.

If we assume that competition between corps. will make it harder for them to pass on taxes to their customers then we need to end the monopolies that have been allowed to be formed in the neo-liberal era. This will ensure that there is a lot of competition.

But, we still need some new kinds of taxes that are harder to avoid or pass on to the corps. customers.

My MAIN idea in this post is —

1] Tax corps. with a progressive profits tax. If corps. are like people as the USSC has said then it is OK to impose a progressive (i.e. not flat) income/profits tax on them.

. . . The problem with this is that corps. have subsidiary corps. that they own. This lets them move profits around between their subsidiaries. They often even lose money in American subsidiaries and make all their profit in some foreign subsidiary.

So, 2] How about a progressive tax of the corps’ stock price on the NYSE.

. . . The idea is to use computers to automatically keep track of every stock transaction and calculate the average price of every corps’ stock every day and then average the day’s prices over a month and and send a tax bill based on that average price to the corp..

. . . The rate charged should be progressive with larger corps. paying a larger percentage.

. . . The stock price is the *wealth* of the corp.. So this is a wealth tax, not an income tax. The corps. can’t move their wealth around as easily as they can move their income/profits around.

This idea puts monopolies and other huge comp. at a disadvantage, if the tax is progressive enough.

Can anyone think of any way that the corps. could avoid this tax? A way for them to move their wealth reflected in their stock price elsewhere, etc.

.