In the annals of ruses used to provoke fear in the voting public about government…

The ‘rats’ are deserting the mainstream ship – and everyone wants in

It is Wednesday today and only a short blog post. I am heading to New York city today from London. More on that tomorrow. It is clear now that journalists from all over the globe are starting to pick up on the shifts in policy thinking that I have been writing about – the admission by policy makers that monetary policy has reached the end of its effective life (not that it was ever particularly effective) and that there is a crying need for a return to fiscal dominance, which was the norm before the neoliberal era began several decades ago. We have not yet reached the stage where the dots are being fully joined – monetary policy dominance dead -> fiscal policy dominance desirable -> neoliberalism dead. But that will have to come because the fiscal policy activism will have to be aimed at addressing targets that have been neglected by the neoliberal era – real wages growth, quality and security of employment, restoration of public services, environmental care priorities, scope and quality of public infrastructure, and the like. But as the journalists are starting to file copy on this topic, some are very lazy – and just want to have it on the record that they were part of the throng. One of the laziest offerings I have read was published today in the Australian on-line newspaper, The New Daily (September 23, 2019) – The economic weapon too hot for the RBA to mention: Helicopter money – and written by finance journalist Michael Pascoe, who is usually more careful with his words. While many might think any publicity is good for the spread of our Modern Monetary Theory (MMT) work, my view is that falsely constructing MMT can add to the already stifling dissonance among the public that has been mislead for years by the framing and language of the mainstream economists.

Being lazy

Michael Pascoe begins with the questions:

What if the Reserve Bank had an economic weapon that would let the government have its budget surplus cake and eat it too?

A weapon that could push billions of dollars directly into the economy without increasing Commonwealth debt or moving interest rates?

Yes.

Neither question is particularly profound.

Anyone who would pose them as if they were sort of unfathomable mysteries is just rehearsing the usual mainstream economics narratives that suppress clarity about what it means to be a currency-issuing government.

The Australian government is a currency issuer.

And as the monopoly issuer of the currency, its spending can never be intrinsically revenue constrained.

The Reserve Bank of Australia is a creature of government legislation, the – Reserve Bank Act 1959.

It tells us that:

1. “the Governor is the accountable authority of the Bank”.

2. “The Bank has such powers as are necessary for the purposes of this Act” – which are extensive in relation to the issuance of currency.

3. The Treasurer has powers to override the decisions of the Bank.

4. “The Governor and the Secretary to the Department of the Treasury shall establish a close liaison with each other and shall keep each other fully informed on all matters which jointly concern the Bank and the Department of the Treasury.”

5. “The Governor and the Deputy Governor … are to be appointed by the Treasurer”.

6. “The Bank shall, in so far as the Commonwealth requires it to do so, act as banker and financial agent of the Commonwealth.”

7. The Treasurer can determine the distribution of any profits the RBA makes including that “the remainder shall be paid to the Commonwealth”.

8. The RBA issues the currency under the direction of the Treasurer.

That is pretty categorical.

There is no question that the government can spend its currency into existence without have to increase Commonwealth debt. It never needs to issue Commonwealth debt.

And when it does issue Commonwealth debt, such transactions are not providing the ‘funds’ that enable the government to engage in the act of spending.

In fact, as I have noted often, the non-government funds that are used to purchase the debt are correctly seen as being past deficit spending that the government has not yet taxed away.

And, further, all spending comes from ‘nowhere’ – some official in the Department of Treasury (the policy arm) telling some official in the Department of Finance (the accounting arm) to instruct an official in the RBA (the currency arm) to change some numbers in relevant accounts to facilitate the accounting record of the spending decisions.

So if you understand that you will easily see how lazy the Michael Pascoe article is.

He talks about this “weapon” as bing in some way an “unconventional option” which no RBA official dares talk about because:

You don’t want little kids to get ideas about dynamite fishing in the dam.

He calls the ‘weapon’ – “helicopter money” and claims (in the sense of trying to ‘scare the horses’) that it is:

… at the nuclear end of the central bank’s arsenal and, like nuclear reactions, is powerful and dangerous, requiring very careful control.

And soon after we get the obvious links that have held back understanding for decades:

It’s a process that can take an economy the way of hyperinflation – the Weimar Republic, Zimbabwe, Argentina.

Okay, I am not going to provide a history lesson here.

Please read my blog post – Zimbabwe for hyperventilators 101 (July 29, 2009) – for more discussion on this point.

Note that has been in the public domain for more than a decade.

So any person who was interested in the topic and tying it to Modern Monetary Theory (MMT) would surely have done the simple research to see what the core body of MMT work might have said about Zimbabwe and associated hyperinflation discussions.

Obviously, laziness reigned and Michael Pascoe thought he could then write:

There is a tribe of “modern monetary theory” economists who claim the government doesn’t need to ever worry about budget deficits, that governments can just let debt rip to keep the economy running.

The helicopter money concept is different – there’s no government borrowing.

Well, I suppose being a “tribe” is slightly more organic than being a ‘sect’, which is another collective label that is bandied around by those seeking to discredit us.

But his description of our work is plain wrong.

1. We do not claim (and have never claimed) that the government never needs to “worry about budget deficits”. We contextualise the fiscal position in a way that mainstream economists fails to.

We show the conditions that will determine whether a particular fiscal position is appropriate or not.

But we do that by analysing the real economy and how the spending and saving decisions (and outcomes) of the government and non-government sectors impact on the real economy.

We see no meaning in analysing financial ratios or aggregates in isolation.

So, under certain circumstances, a fiscal deficit of 3 per cent of GDP will be appropriate, but, under other circumstances, a fiscal surplus of 3 per cent of GDP might be required to maintain responsible fiscal policy.

Then, again, a fiscal deficit of 10 per cent of GDP might be warranted.

The point of departure of the MMT economists, such as myself, is that the fiscal position is only relevant when we consider the real state of the economy.

It is never a matter of financial solvency.

2. The core MMT position is the a currency-issuing government should not issue debt.

It should use the central bank-treasury nexus to ensure that fiscal policy is implemented and bank accounts are credited and debited, as appropriate to facilitate that implementation.

That is identical to ‘helicopter money’.

I have written about that extensively:

1. Helicopter money is a fiscal operation and is not inherently inflationary (September 6, 2016).

2. Keep the helicopters on their pads and just spend (December 20, 2012).

3. The consolidated government – treasury and central bank (August 20, 2010).

Those blog posts provide the detail that defines what an MMT understanding provides. I urge you to read them so that you are clear on these issues.

Sure, as Michael Pascoe notes:

What’s interesting now is that influential, relatively conservative economists are proposing ways to use the nuclear option safely given that the developed world has reached the limits of monetary policy and many governments’ fiscal options are also limited.

But the MMT economists have consistently argued in this way and the rest of the profession is slowly catching up as their previous prognostications have been demonstrated to be false, ineffective or something similar.

The rest of Michael Pascoe’s report just follows the trail of the ‘rats’ who are deserting the mainstream ship and starting to advocate for policies that better exploit the currency-issuing capacity of the elected government.

I keep running into economists when I am abroad …

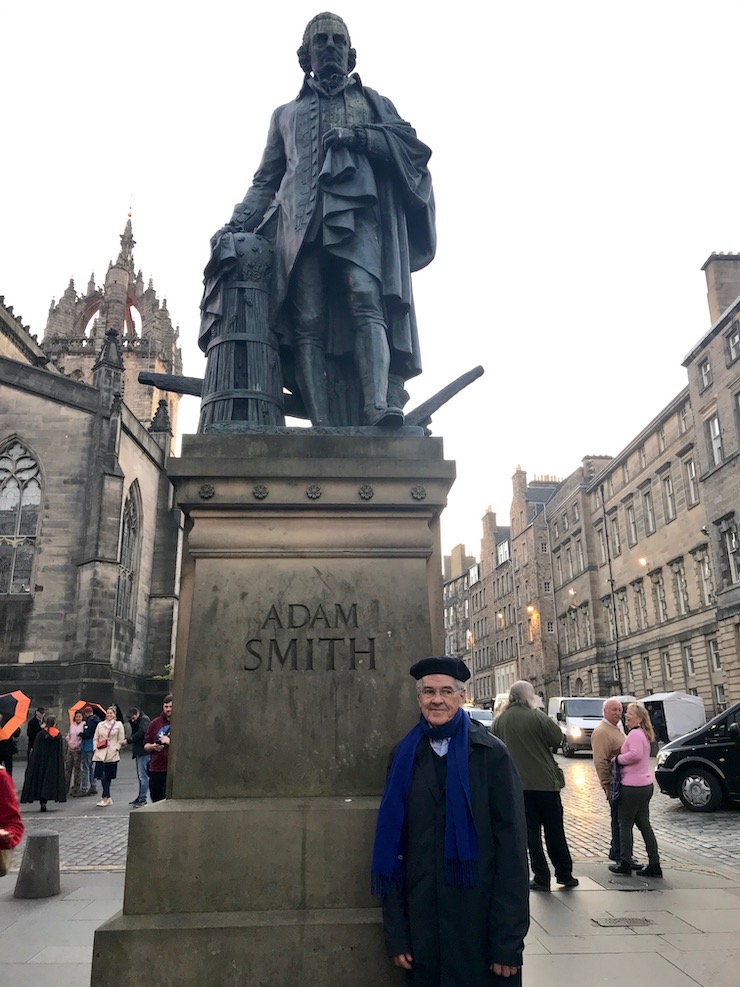

The Adam Smith Wikipedia Page, tells us that:

A large-scale memorial of Smith by Alexander Stoddart was unveiled on 4 July 2008 in Edinburgh. It is a 10-foot (3.0 m)-tall bronze sculpture and it stands above the Royal Mile outside St Giles’ Cathedral in Parliament Square, near the Mercat cross.

It was funded by the Adam Smith Institute and is located at 192 Royal Mile, Edinburgh EH1 1RF.

The problem is that many people think of Smith as being the father of ‘free market’ economics (the so-called ‘invisible hand’ of the market).

The reality is that his body of work which is often summarised by his 1776 book – The Wealth of Nations – also includes his earlier book in 1759 – The Theory of Moral Sentiments.

Taken together, they do not provide a manifesto for the unfettered greed that the likes of the Adam Smith Institute would like to promote.

I will write more about his some time in the future.

This is music …

I was taking a deep breath this morning in London after a somewhat whirlwind week of bunny-hopping around Europe talking about MMT and the Green New Deal.

This song – Flamingo – is taken from the 1959 Blue Note album – The Sermon.

This was a monster recording and featured Jimmy Smith (Hammond organ), Lee Morgan (trumpet), Art Blakey (drums) and one of my favourites, Kenny Burrell (guitar).

It was recorded on February 25th, 1958 at the Manhattan Towers in New York City.

At the time – Lee Morgan – was just 19 years old and only lasted to 33 years of age. He was shot by his de facto wife in a jazz club where he was performing.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

The article links to a paper written by Stanley Fisher and others for Black Rock Institute “Dealing with the next downturn:From unconventional monetary policy to unprecedented policy coordination” … Stanley Fisher is one of the most influential New Keynesian economists.

There is something fishy there.

“The strength and persistence of global precautionary saving pushed real interest rates below growth, driven by the decline in both neutral rates and the term premium – the latter now near -50 basis points in G3 bond markets, according to our estimates. … But a significant increase in borrowing by governments globally could absorb part or all of this saving glut, pushing real interest rates towards or even above growth.”

The authors still see the process of issuing government debt and financing government spending as depending on the presence of preexisting “savings”. They got the causality wrong. This is the naive classical version of loanable funds theory in action. The monetary savings are the residual between what has been earned by the private sector and what has been spent. Michał Kalecki has convincingly demonstrated that spending comes first. You cannot save money which has not been spent into existence either by taking a loan in a bank or by the government sector consisting of a central bank and treasury, creating currency.

What New Keynesians cannot see is the following chain of phenomena:

1. The redistribution of disposable income towards rich lowers overall marginal spending propensity of the society. We can assume that poor spend whatever they got while the rich spend (per annum) a fixed fraction of their expected wealth. And even this is optimistic.

2. Investment spending depends on anticipated profits on new capital. No company and no individual will spend just because they have earned money. Saving in liquid monetary assets is mostly not “precautionary” or a result in the changes of the Keynesian liquidity preference. It is the residual. It is forced saving as in unbalanced communist economies of the late era where it was called an inflationary overhang. Stanley Fisher should have remembered this. But the forced saving of the rich in capitalism is not latent CPI inflation. It is their wealth they are hoarding.

3. The difference between the not consumed income (savings) and investment spending is the growth in liquid monetary assets (currency, bank money and bonds). This is first accounting identity (the accrual process providing stock-flow consistency) . The second accounting identity is that the growth in liquid monetary assets is identical to the growth in the sum of private sector and government liabilities (debt).

4. The credit expansion of the private sector (mainly binging on mortgages) has largely run its course, households are indebted up to the hilt. Obviously increasing government spending will increase the flow of money through the system, increase the GDP due to the (super)multiplier effect and as a consequence increase the hoarding.

5. Whether this hoarding occurs in bonds or currency or deposits is irrelevant as long as interests rates do not change. This is money or “near money”. At a stable zero rate there is no difference between bonds and currency.

5. The unintended consequence of the growth the stock of unspent money / near money is a bubble in everything. How a sane person can anticipate that a startup which has never made any profits and whose business model is based on finding loopholes in labour law will grow almost indefinitely and should be valued at tens of billions of dollars? It is pets dot com all over the place – again. Buying preexisting shares or preexisting assets does not get rid of money and requires someone else to sell. The quantity of money and shares / land / gold remains constant. There is no true anchor there as there is no buffer stock. New shares will only be issued if companies want to spend in physical capital. But this is determined by the need to expand production. This need may only arise if expected aggregate demand increases (possibly due to increased government spending), then the investment accelerator will kick in.

6. Fiddling with negative interests will only make the bubble in everything grow bigger. The “inflationary overhang” known from imbalanced communist economies (where consumption was suppressed due to physical shortages of goods) is indeed inflationary – causing an inflation in the prices of assets as there is an objective shortage of assets. The most striking example is the housing bubble in Australia, initially ignited by artificially constraining the supply of residential land (“Sydney is full” – Bob Carr. Or rather “Sydneysiders are fools”) . The ratio of the value of properties (mainly determined by the value of land) to average disposable income keeps rising… Freshly built townhouses near the place I am living are flogged for $720k and this is 40 km away from the centre of Sydney. Just insane.

7. If they want to get rid of the imbalance causing the stagnation they should tax the rich to start confiscating the hoard, reduce tax burden on the poorest and simultaneously increase government spending. There are two knobs which need to be turned simultaneously not the only one, if they want to save capitalism from its own contradictions. They may do the latter and start flying helicopters loaded with money. They will never do the first. Someone will write another New Keynesian paper finding another source of the frictions in the system. My garage will be worth a million but my kids will have to live in tents in the backyard because they will never be able to buy houses on their own and renting is even more expensive than paying back the mortgage.

There are red ants crawling under the Black Rock. From the same paper

[About the the “standing emergency fiscal facility”]

“Our proposal stands in sharp contrast to the prescription from MMT proponents. They advocate the use of monetary financing in most circumstances and downplay any impact on inflation. Our proposal is for an unusual coordination of fiscal and monetary policy that is limited to an unusual situation – a liquidity trap – with a pre-defined exit point and an explicit inflation objective.”

I believe one of the main errors in New-Keynesian theory is the following:

They don’t understand that liquidity preference actually works. Hording (near) money is not a “friction”, it ls the residual. They may pay lip service to Keynes but their equations contradict General Theory – the function which is optimised in the DSGE model is the sum (integral) of the utility function over time from now till the end of times yet there is no utility in wealth hoarding. What has been earned in the current period must be either consumed or invested and the models do not properly integrate “money”

The second grave error is the absence of social classes therefore they are modelling market socialism in the best case. Yet the rich are the ones who maximise a goal function consisting of the stock of wealth and current / discounted consumption. I don’t even know if this can be mathematically optimised with 2 social classes without making additional ad-hoc assumptions but even if can be done the model will still suffer from the insanity of rational expectations.

Therefore the so-called “market interest rate” is an artefact and the assumptions of the Wicksellian loanable funds theory are not met. There is no such a thing as a “liquidity trap” either.

The whole thing can be modelled perfectly well as in a SFC environment but we can’t predict the future and maybe this is better for all of us.

Anyway I have to go… maybe it’s better not to think about the whole thing too much

I read the Pascoe piece and struggled to get through it.

Pathetic reporting. An attempt to critique MMT and there is no MMT in that article. It seems he hasn’t read an MMT journal articles or the thousands of words written by MMT academics.

I notice a lot of articles from progressives around the ‘Surplus run on the back of NDIS underfunding’ Which still frame a surplus as a desirable goal!

I caught an episode of The Drum recently where the host said ‘It’s economics 101 you run a surplus during the good times and deficits during the bad times’ and then the panel of ‘progressives’ discussed the need of spending to invest under a paradigm of investment making a commercial return or paying back a dividend to the government. We had that policy with the NBN.

I only hope we can breakthrough with an mmt framing before it is too late to do anything about climate change.

Hi Bill,

I read Michael Pascoe article and replied to his tweet yesterday.

I pointed out that he misunderstood or misrepresented MMT and suggested that he took the time to speak to some MMT economists.

notwithstanding the complete nonsense in his article, I do believe that he is on most things relatively progressive, and he still caught in the neo-liberal paradigm.

It may be worthwhile to reach out to him and to offer to explain MMT properly. Given his platform on programs such as The Drum, he could be an extremely useful proponent of spreading the MMT body of work.

Adam Smith’s work is a critique of mercantilism. To read it as a nod for free market capitalism is insane. Smith even went as far to describe workers as alienated, self estranged, and powerless.,

Looks like I’ll be giving Birdland Records in Sydney a call tomorrow. Wonderful music choice Bill

The perpetually disappointing Richard Holden often says in his articles on The Conversation that it would create inflationary pressure if the government spent without issuing bonds. I don’t see how that can be true. Commonwealth Government Securities are a highly liquid asset. They are very close to being reserves or physical cash. You can sell them at any time.

Maybe he is thinking of the US Government’s War Bonds during World War Two. There was no secondary market for those bonds. Once you bought your $18.75 bond you had to wait ten years and then the government would pay you $25 (your principal plus $6.25 in interest). Obviously this is very different from the way that Commonwealth Government Securities are designed. The war bonds were designed to entice people to do long-term saving. These bonds were designed to create a leakage from the expenditure cycle. They reduced the spending power of the non-government sector.

@Nicholas – I would have thought war bonds were to simply mop up the excess reserves the government created by spending on the war effort.

G’day Bill. This is my first comment on your blog – been lurking for a while though.

This Michael Pascoe piece really got under my skin. But what continually makes my blood boil, is his embodiment of the arrogance of mainstream economics, and economics journalism at large. According to his tweet (https://twitter.com/MichaelPascoe01/status/1176838992806858752), he’s read this blog post. His response is rather insulting, but I suppose one would expect as much. Of course, there is nothing of substance in his response, he simply continues with the usual twitter-journalism (character assassination and smears, just limited to 240 characters at a time).

What baffles me is how these journalists can dismiss, slander, and misrepresent MMT, without actually speaking to the academics behind it, or analysing the core principles. Every single one of these articles reads exactly the same – platitudes about basic facts with regards to currency-issuing governments, followed by fear-mongering about outcomes which aren’t associated with MMT at all.

It’s disgusting. However, there is a little joy in recognising how ignorant they will look in retrospect, once fiscal dominance truly takes hold again.

Great article.

The article by Pascoe shows that relying on the press certainly has its drawbacks since his lens is so colored by his narrow experience in the world that citizens do not realize that MMT is the jewel and its understanding empowers us to do what needs to be done.

Awesome comment Adam K.

“How a sane person can anticipate that a startup which has never made any profits and whose business model is based on finding loopholes in labour law will grow almost indefinitely and should be valued at tens of billions of dollars?”

Lets see, Tesla, Uber, Lyft, Instagram,… etc.

M –> C –> M’

more like

M –> C –> m + gamblers money

“My garage will be worth a million but my kids will have to live in tents in the backyard because they will never be able to buy houses on their own and renting is even more expensive than paying back the mortgage.”

Thanks for understanding young people. =)

I really try but I used to get very unhappy. I didn’t want the rat race (game of musical chairs really as Keynes put it) but if i don’t participate in it, i’m called a loser.

@Alan Dunn

Where the typical caricatures of Adam Smith are concerned (ie. “the invisible hand means greed is good”) I am increasingly convinced that this is not mere misinterpretation, but rather pernicious misrepresentation bought and paid for by the unearned income crowd (call them what you will — userers, oligarchs, aristocrats, the FIRE sector, etc) as outlined by Michael Hudson and Philip Pilkington, among others.

Thank you for your relentless work and dedication to all of us. You are an incredible man.

Even Schaeuble has jumped on to the fiscal policy bandwagon – sort of.

https://uk.reuters.com/article/uk-germany-budget-schaeuble/germanys-schaeuble-heats-up-debt-debate-with-call-to-rethink-fiscal-policy-rethink-idUKKBN1WA2BU

Michael has defended his stance (https://twitter.com/MichaelPascoe01/status/1177005534261604352) with the usual deferral to some other misguided and straw-man-hating article by some other (anonymous) tired old neoliberal economics commentator.

It starkly reminded me of what I got out of Greg Jericho when we had a similar exchange a few months ago (https://twitter.com/GrogsGamut/status/1143348092667719680).

This just further demonstrates my point about the elitist circle of economics journalists I mentioned in my previous comment.

@Adam K.:

As usual, excellent and insightful comment.

@Alan Dunn & eg:

The neoliberal project is more than mere (fake) economics and the “appropriaton” of the historical figure of Adam Smith for the neoliberal cause is just part of the long game they have been playing literally since the second world war led FDR to take some power away from them. The “deification” of historical figures to the point of making prophets out of them, while misrepresenting their work and actions to fit the pusrpose, is part of their pushing of a theory of history in which a causality is constructed that leads to the current system as the only logical outcome of past events. It goes hand in hand with what Germans call the “Menschenbild”, i.e. a “conception of man”, that portraits him/her as a purely selfish individual with no responsibilities to anyone but himself. What started as mere justifications of greed, has evolved into a celebration of it. Having successfully achieved the supremacy over the interpretation of history and of “the nature of man” as a greedy, rational individual, it is easy to portray any kind of measure that doesn’t fit into this mold as being either naive or just plain “illogical”. Hence, the whole “there is no alternative” bollocks.

I’m aware of the fact that I constantly refer to “them” without “naming the names”. This is due to the fact, that it is part of the neoliberal agenda to dilute and externalize responsibility.

Dilute: work so that as many agents as possible can claim a sort of “plausible deniability” and escape any negative consecuences. Certainly, a “pawn” will be sacrificed now and then those who matter are protected this way.

Externalize: claim that it is the “market forces” that demand the actions you take and that you are merely responding to them. In fact, this is YOUR fault as a consumer for buying an Iphone. It is therefore you, lowly consumer, who is exploiting those workers and plundering the earths ressources.

However much I despise them, they have done a remarkable job of marketing a morally repulsive ethos and a political/economical agenda that blows up in the face of every empirical analysis. It’s almost as if they made an alcoholic out of us and convinced us that we will have to drink ourselves out of every problem caused by our drinking. We on the left should take notice of this, study the methods used against us, and come up with a system of thought of our own, so that we don’t have to keep “playing away at Neoliberal Utd”.

Cheers!

Thank you Adam K, (and others). I like the way the comments section here is accommodating to a range of levels. ‘Seniors’ like myself who lugged Samuelson on weekday evenings to either Science Theatre, (Dr Neil Runcie lecturing, as I recall), or sitting in a Tute trying to make sense of it all. Runcie can’t have been all bad, as he mentioned Joan Robinson in passing, whom, I’m sure, most in that cohort would never have heard of. But I digress…

Toby, we all sense your frustration, but I’m more in tune with Charlie’s approach, (and that of Warren Mosler, and indeed, V I Lenin); that ‘patiently explaining’ is the key. Or, just asserting a ‘different view’. Pascoe, in an optimist’s world, would be a valuable win-over.

No-one in a high profile role such as Pascoe’s will find it easy to say “yeah OK, I get it now, though I didn’t before”. (male ego comes into this as well). Witness another ‘progressive, Alan Austin, who occasionally has ecs pieces on Independent Australia. His vehemence when tackled is way out of proportion to the comments, but stridency rarely increases the result when we’re putting the MMT case.

Ben Eltham is another… “I make a point of not engaging with MMTers”. So I never reference MMT in his Twitter feeds, but will state a view which reflects when I feel it may be of benefit. delivering it right, as well as getting it right (Bill’s QC issue), matters a lot, I think.

But yes, more and more will be referencing MMT, (they’ll find it harder to ignore it when their peers are doing so), and we’re seeing that excruciating stage where they *think they know what it’s all about, but seems below them to even pick up, say, Soft Currency Economics.. Frustrating, but as Zsa Zsa Gabor might say “Vot *can you do, darlink?”

… my Twitter tag, for those who wander its halls, is @PaulHenry524.

… oh, it’s happening across the world. Scott Fullwiler just today lamenting, on Twitter ( @stf18 ),

‘Still waiting for a technical critique of MMT or some aspect of it that actually dives deeply into technical MMT literature on the same issue(s). If anything, the trend is the opposite, the norm being now to critique as if no such literature from MMT exists.’

Yep… we seem to be in a ‘one step forward, two steps back’ in interlude right now. II really must stop referencing Lenin).

Looks like you were ahead of the curve on south africa too.

”if we dont pay the debt to the market we well become greece, zimbabwe, venezula!”

How do these people still get traction is beyond me.

I gave up trying to explain MMT straightaway. I thought just the 3-sector identity would do for a start, since it has no dependency on fiat currencies etc. Still very hard. Simple accounting is too hard for some. The afore-mentioned Alan Austin wanted to “validate” this identity, by plugging in data-sets. I confess I lost patience. My fault.

For the interest of ppl here, ICTMI. Some of us have ‘commented’. |-:

https://twitter.com/MichaelPascoe01/status/1177005534261604352

I was just watching an interview on a Youtube American financial channel with Nigel Farage (I know, I know…), and towards the end, Farage started talking about the tension between Central Banks and governments, and the importance of fiscal stimulus. Immediately the interviewer jumped in and mentioned MMT.

As usual, Bill is calling it right: everyone is now talking about fiscal stimulus.

@ Toby Harradine

Thursday, September 26, 2019 at 10:16

Hi Toby, out of curiosity I read your twitter exchange with Greg Jericho, and then followed his link to the “What’s the Point of Modern Monetary Theory?” article that he’s chosen to set his course by.

That article quoted some of the usual suspects (like Henwood) to make the author’s case, but as we’ve become accustomed, it was just yet more misrepresentation, some ‘not even wrong’, some more nuanced.

That Greg Jericho would base his dismissal of MMT on such shoddy work is very disappointing.

For some years now MMTers have been giving Greg a polite nudge (and sometimes not so polite) towards MMT but all our entreaties have been met with a puzzling silence.

I’ve naively believed that Greg was perhaps still doing the reading before “coming out”; instead he’s chosen to join the likes of Michael Pascoe down the rabbit hole.

As an exercise I tallied some of the misrepresentations in that article to add to either our despair or amusement.

Henwood: “It’s a phantasm, a late-imperial fever dream, not a serious economic policy.”

Portes: “The claim that that MMT means that a future government can dodge hard choices about how to pay for decent public services is just plain nonsense.”

Sawicky: “By means of increased public debt, we can expand public spending. In fact, we must. At the end of the day, however, a politically evasive monetary theory should not be the basis for a progressive movement.”

Barro: “If the government prints and spends money when the economy is at or near full employment, MMT counsels (correctly) that this will lead to inflation, and prescribes deficit-reducing tax increases to reduce aggregate demand and thereby control inflation.”

Jayvee and Mason: “The difference between MMT and orthodox policy can be thought of as a different assignment of the two instruments of fiscal position and interest rate to the two targets of price stability and debt stability.”

Breunig: “…and ends by pondering whether MMT is really just a very roundabout way of arguing that we should manage the price level through the fiscal authority and the debt level through the monetary authority rather than the other way around.”

“Thus, you need to use taxes and borrowing to delete the new money and avoid inflation. Understood this way, all government spending is financed by money creation, and taxation and borrowing exist only to offset the inflation caused by that spending.”

“The real point of MMT seems to be to deploy misleading rhetoric with the goal of deceiving people about the necessity of taxes in a social democratic system.”