These notes will serve as part of a briefing document that I will send off…

RBA cuts rates as a futile exercise as Dr Schwarze Null demands fiscal action

I am now back in Australia after the latest cross-country run and so am falling back to routine. Which means a relatively short Wednesday blog post. Yesterday, the Reserve Bank of Australia cut their policy interest rate by 0.25 points to 0.75 per cent, a record low level. The RBA governor cited the weakness in the labour market as the reason for the cut and continued to suggest that the Government, which is pursuing its mindless austerity goal to record a fiscal surplus as the economy tumbles towards recession, should expand fiscal policy to kick-start growth. Once again, a central bank is being pushed into ‘record-making’ policy territory because the treasury-side of government will not use its fiscal capacity responsibly. This is now a global trend and even the likes of Dr Schwarze Null is calling for more fiscal action. Another day passes that demonstrates the mainstream New Keynesian approach is rapidly being abandoned by policy makers and an era of fiscal dominance approaches. Not before time.

RBA decision

The interesting aspect of the RBA’s decision, encapsulated in the closing remarks of the – Statement by Philip Lowe, Governor: Monetary Policy Decision (October 1, 2019) was the inference that Australia was a long way from being at full employment, despite claims by the Government to the contrary.

The Governor said:

It is reasonable to expect that an extended period of low interest rates will be required in Australia to reach full employment and achieve the inflation target

A journalist asked me this morning what is the definition of full employment.

I told him that full employment is when everyone who wants to work has sufficient hours to satisfy their desires.

Historically, 2 per cent unemployment was considered to be full employment (before the NAIRU nonsense) – which was the frictional level.

With better information systems (computer networks, etc), the frictional level is likely to be lower (people can access job information more easily and employers can access workers more easily). How much lower is an empirical matter. Probably a few points.

Further, Australia now has underemployment as a new problem (since 1991).

So my operational full employment benchmark is 2 per cent unemployment and zero underemployment and participation rates at trend levels.

That means we are something like 1,060 thousand FTE jobs short of that benchmark at present, once we add the FTE underemployment to the unemployed and adjust for participation shortfalls.

A simple way to find out how far below full employment the Australian labour market is would be for the Federal Government to offer anyone who wants to work an unconditional job offer at a socially-inclusive minimum wage.

The number of people that turn up for work would be the degree of non-inflationary slack in the economy.

I expect that to be well over the 1 million mark.

The RBA seems to agree in principle that they need to keep cutting rates, and, possibly, introducing some non-conventional monetary gymnastics (QE) to push the economy back towards full employment, given that the fiscal drag coming from the Government is killing growth.

The Government has repeatedly said it is about jobs, jobs, jobs and claimed the labour market is booming.

The reality is that they are about ‘jobs, jobs, jobs’ but the data shows the labour market is in a parlous state.

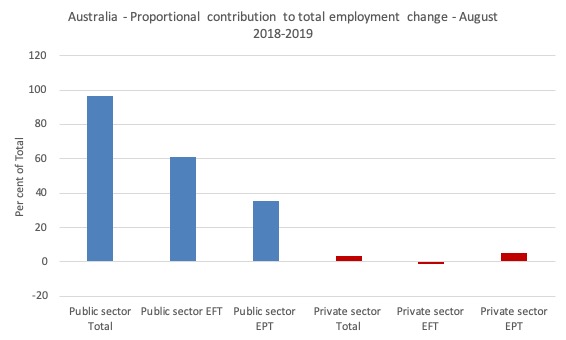

The following graph shows the proportional contribution to the change in total employment from August 2018 to August 2019 (in percent) by sector (public or private) and type of employment (full-time or part-time).

Over this period, 312 thousand jobs have been created (net) and 301 thousand of those have been in the public sector – 96.5 per cent.

That is why I say the Government is certainly about ‘jobs, jobs, jobs’ although most of those gains have been at the state government level.

Conversely, the private labour market has created just 10 thousand net jobs over the same period – stagnation is the word.

The RBA is clearly aware of this and is increasingly of the view that monetary policy is not going to be sufficient.

In the day after the decision (today, that is), further evidence of the ineffectiveness of the monetary policy decision has come to light.

The so-called ‘big four’ banks have refused to pass on the interest rate cut to their customers (mortgage rates etc).

The greed of the banks reduces any impact of the policy cut, although even if the banks had have passed on the full cut, the policy change would not have had much impact anyway on the real economy.

Things are set to get worse from here.

More voices promoting a shift to fiscal policy

I have been documenting the shift in narrative about the mix between monetary and fiscal policy that is now gathering pace as more and more influential voices are calling for more fiscal activity.

While many of these voices are couching their calls within the mainstream paradigm, largely because they do not want to make it too obvious that they are effectively admitting they have been wrong for decades, the fact remains there is a rather seismic shift underway and where it goes to from here is another question.

It could end badly and I will write more about the possible paths in another blog post when I have collected my thoughts more carefully.

A notable intervention came from the former German Finance Minister last week.

In a speech on September 25, 2019 – Rede von Bundestagspräsident Dr. Wolfgang Schäuble auf dem Parlamentarischen Abend beim BDA, BDI und der DIHK (“Speech by President of the Bundestag Wolfgang Schäuble at the parliamentary evening at the BDA, BDI and the DIHK”) – we heard a nuanced version of the need for fiscal activism.

This was in the context of Germany which is now clearly lagging behind in digital technology, is facing a deteriorating public infrastructure, and has a motor car industry that is based on declining technology.

The quoted sections that follow are my translation of the original German.

The former German finance minister was reflecting on the progress of Germany in a world that is being “confronted with almost unprecedented disruptive changes” – specifically in relation to globalisation and digitalisation.

These changes are imposing a sort of “stress test” on German prosperity.

He concluded that the “great stability over the past few years” in Germany is now dissipating and that “the German economy is no longer running very well … the key data is clear”.

Slower growth rates and a deteriorating labour market signal that the “long upswing of the last decade could have come to an end”.

He clearly is not reflecting on Greece here! That nation hasn’t seen any ‘upswing’ since the GFC.

But in the German case, he argued that this long upswing had bred a culture of business complacency – “a self-satisfied modesty that consumes the substance.”

In relation to Germany, Wolfgang Schäuble said that “Our main problem is not a lack of money”.

In the context of the Eurozone, where all the member States use a foreign currency (the euro), this is not the same statement that the currency-issuing government faces no financial constraints in its spending choices.

The point about Europe at present is that there is a huge pool of savings in the non-government sector that are not being directed into productive investments.

Wolfgang Schäuble says that “company balance sheets show high liquidity, and the household saving rate remains high.”

The problem is that the reliance on monetary policy is not leading to productive investments. This observation is now becoming a consensus and marks a major departure from the mainstream macroeconomic consensus.

According to Wolfgang Schäuble, more central bank policy machinations are not the answer.

He wants innovation, “scientific and technical progress”, and increased investment in “education and research”.

He claimed that apart from these rapid developments, environmental “sustainability” has become a “central dimension”.

The challenge is to pursue:

… the three aspects of sustainability – economic, social, ecological – better than before. This includes taking the risk to think new things behind the status quo. The willingness to question one’s own mentality to some extent, possibly also our traditional model, first of all to save, then to invest the saved – because it turns out to be too dynamic given the changes we need to respond to.

And in giving some substance to what this might mean for policy, Wolfgang Schäuble was clear:

It’s about being more flexible, more courageous – but not overdoing it. We must also continue to measure up to the task of permanently combining ecological and economic sustainability …

That is why we will also have to invest much more outside of our country, outside Europe – especially since the considerable German current account surpluses are already considered by many to be a problem for the world. The big problems today are cross-border. We are only good in the long run if we help to increase the prosperity of the people in our neighborhood, in Southern and Central Europe, in the Middle East, especially in Africa.

This means fiscal policy!

He said the major global problems – migration, terrorist risk, climate – “can only be solved if we invest more in other countries”.

However, don’t think the the man who extolled the virtues of the ‘schwarze null’ is shifting positions too much.

He also said that fiscal policy had to expand “within the limited scope of our debt brake”. And so while he is expressing a recognition that current policy is failing to meet the economic, social and ecological challenges and will need public investment that investment will be strictly limited.

Some progress, but mostly backward.

But the direction of the pressure is clear.

One of the groups, that Wolfgang Schäuble was addressing in this Berlin speech, was the BDI – the self-proclaimed “Voice of German Industry”.

The BDI put pressure on the German government last week to increase investment spending to address the “big investment deficit”.

He wanted the German government to abandon its obsession with fiscal surpluses and use its borrowing capacity to provide investment opportunities for German industry.

So some progress.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

Just when I was starting to forget this despicable character, the revenant of finance makes yet another comeback.

This time, however, I’m interested to know how the german public will react when it has to choose between listening to its favorite zombie or adhere to the “swabian housewife” mentality they so cherish and that said zombie promoted until just recently. I find myself in a difficult spot becasue I know fiscal policy is the way to go but I don’t want Schäuble to attach his name to any succesful implementation that could whitewash the single decades-long crime that has been his political life.

The BDI ara bunch of retrograde capitalist ghouls and are of course demanding, that investments be of public nature so private profits can resume. They will just as loudly call for the “modernization” of labor law, the relaxation of the “crushing” tax burden on the “Mittelstand” and the consolidation of state finance, thus social cuts, as soon as they hit their targets again. They are against state intervention until they aren’t, but as soon as they are set it’s everyone for themselves again.

I don’t share Bill’s (mild) optimism. I see it more as a call for the (further) subordination of the state to capital’s needs, than the recognition of fiscal policy as a (the most?) powerful tool in the shed for the pupose of stimulating the economy.

I’m slowly arriving at the conclusion that a massive revitalization of the labor movement will be necessary to allow the insights of MMT to be used for the good of the many and not for the perpetuation of the status quo.

Cheers!

Bill,

Where did you get that data about the jobs from?

Dear Joymo (at 2019/10/02 at 6:30 pm)

Table 26a https://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/6291.0.55.003Aug 2019

best wishes

bill

“socially-exclusive minimum wage”

Should be socially-inclusive.

“Retrograde capitalist ghouls” , a perfectly apt description, which despite the banal implications, brought a chuckle.

The global corporate oligarchy that really runs our nations is overwhelmingly powerful. For example the urgent warnings of 98+% of the scientific profession about the existential threat of global warming is generally ignored, downplayed or countered whilst the fake news of the neoliberal mainstream economics profession that probably makes up 98% of that profession is of course accepted as that is their creation.

The neoliberal parasites have been harming their hosts for decades and are only now thinking of slightly changing course as their ideology has hit a roadblock and cannot deliver ever increasing sources wealth so easily as before. Interest rates are at record low levels and speculative bubbles have been inflated by all means possible. Debt servitude and economic rents have been applied to the max but the populace can’t afford to give much more. Unions have been destroyed and working conditions have been undermined. Government services and infrastructure have been systematically degraded or destroyed. Industries have been off-shored and the parasitic FIRE sector has been unleashed but is running out of new ways to scam everyone else. The best assets have been privatised and the political class has already been hijacked to deliver zero taxation, subsidies, crony capitalism and predatory capitalism.

The corporate oligarchy don’t really care that their hosts have become critically anaemic and weak, but some now see that more wealth can be made if the host is allowed to recover a little.

We MUST rid ourselves of these parasites, don’t give them the chance for reform and to continue to fool a wilfully ignorant and misinformed electorate, otherwise they will continue to dominate us and lead us to brutal state/corporate feudalism ending with environmental apocalypse.

The fact that the parties of the ‘left’ have not yet woken up to the fact that the neoliberal experiment has failed totally, is now being partially rejected by its overlords and that this is the golden moment for decisive change, is a betrayal of the worst kind.

@Hermann

“The BDI ara bunch of retrograde capitalist ghouls and are of course demanding, that investments be of public nature so private profits can resume. They will just as loudly call for the “modernization” of labor law, the relaxation of the “crushing” tax burden on the “Mittelstand” and the consolidation of state finance, thus social cuts, as soon as they hit their targets again. They are against state intervention until they aren’t, but as soon as they are set it’s everyone for themselves again.”

That was a great post, thanks!!

“There are other significant ‘anomalies’ that have challenged the old as well as the new mainstream approaches. While theories place great store by the role of interest rates as the pivotal variable that has significant causal force, empirically they seem far less powerful in explaining business cycles or developments in the economy than theory would have it. In empirical work, interest rate variables often lack explanatory power, significance or the ‘right’ sign. When a correlation between interest rates and economic growth is found, it is not more likely to be negative than positive. Interest rates have also not been able to explain major asset price movements (on Japanese land prices, see Asako, 1991; on Japanese stock prices, see French and Poterba, 1991; on the US real estate market see Dokko et al., 1990), nor capital flows (Ueda, 1990; Werner, 1994) – phenomena that in theory should be explicable largely through the price of money (interest rates). Furthermore, in terms of timing, interest rates appear as likely to follow economic activity as to lead it.”

@ Postkey

Your post is enclosed in quotation-marks but you don’t attribute it to its source.

It would be good to be told who it was who wrote it, and in what medium it appeared! She or he appears to have drawn a bead on the target, right between the eyes.

Cheers!

Regarding the German economy, the September PMI figures got a certain amount of publicity. The following is a quote from the tradingeconomics website:

So basically, the German manufacturing industry, the heart of their economy, is shrinking. And it’s not the only one in the EU to be doing so.

Sometime ago the professor wrote that business community in Australia always ask for tax breaks to create jobs.

Then, you look at the numbers: 96.5 percent jobs are created by the state.

Its hilarious.

Good comment there Hermann. I am skeptical about characters like Schauble too.

@HermannTheGerman

“I find myself in a difficult spot becasue I know fiscal policy is the way to go but I don’t want Schäuble to attach his name to any succesful implementation that could whitewash the single decades-long crime that has been his political life.”

I share your pain – I detest the man almost as much as you do. Still, it’s much worse for you! Commiserations.

Dear Bill

The Rba is urging the federal government to provide fiscal stimulus. Is there a page (s) on your blog that explains in depth the technical processes involved in government spending, Does the government have to approve the spending through a bill? Are there parts of government spending that is constant that doesn’t require a bill or amendment? What is the actual process from cradle to grave for government currency in Australia? I hope I have explained my question properly. Thanks Bill.