The other day I was asked whether I was happy that the US President was…

Greece “neither thrived nor struggled” – the financial press alt world

It is my last blog post for the year. And we leave the year with not much gained from a progressive perspective. The mid-term elections in the US just swapped deficit-terrorist Republicans (who have been compromised by the big-spending Trump) with ridiculous PayGo Democrats, who are intent on repeating all their previous mistakes. The Brexit negotiations reveal how appallingly compromised the Tories have become and how venal the European Commission is. The British Labour Party fiscal rule shows that the next British government hasn’t yet jettisoned its Blairite past and its New Keynesian economic advisors are dogmatically taking Labour down a path it will regret. Italy has been bashed into submission by the European Commission bullies, which a week or so later, choose to turn a blind eye to France breaking the rules, because the Gilets threaten the whole show. And Germany still accumulates massive external surpluses in violation of European law and nothing happens. Happy New Year.

Bloomberg news published an article late last week (December 28, 2019) – As the Euro Turns 20, a Look Back at Who Fared the Best. And Worst – which gave Greece a B-grade or satisfactory grade overall. The assessor commented that “some say the pain was worth it for taming the inflation that preceded euro membership”. The B was accompanied by several A grades (Excellent) under the various criteria (“Favourable Financial Conditions”, “Greater Integration”, “Post-Crisis Competitiveness”, “Inflation Anchoring”, and “Post-Crisis Labor Costs”). It beggars belief really.

I last wrote about Greece in this blog post – The destruction of Greece – the slow-burn decline of a nation (October 9, 2018).

Bloomberg provides a description for the B grade status:

Neither thrived nor struggled: some economies had a rough time in the crisis before realizing gains, others have seen benefits of euro membership mostly pass them by.

Pitting that description against the actual data makes it clear that Bloomberg’s assessment criteria have little to do with outcomes that advance welfare.

Quite the opposite in fact.

Their scoring criteria and their scores for Greece are:

1. Favorable Financial Conditions – A

2. Ability to Borrow – C

3. Greater Integration – A

4. Pre-Crisis Competitiveness – C

5. Productivity Growth – C

6. Post-Crisis Competitiveness – A

7. Inflation Anchoring – A

8. Post-Crisis Labor Costs – A

9. Fiscal Policy Option – C

10. Pre-Crisis Labor Costs – C

And they give an overall assessment of B.

You can read what each means if the heading is not readily meaningful to you.

The fact that Post-Crisis Labor Costs scores an A (excellent) yet Productivity Growth scores a C rating (bad) tells you everything really.

The fact that labour costs have come down with a poor productivity outcome means that wages are doing all the work. And so to while workers have been forced to take massive cuts in wages, this warrants an A rating from Bloomberg.

That sets the tone for the whole exercise.

Consider these facts, some of which are not often revealed in the public commentary.

The Greek is 25 per cent smaller than it was in the December-quarter 2007 and at 18.9 per cent (August 2019), its has the highest unemployment rate in the “developed world” according to the OECD around double what it was pre-crisis.

Its youth unemployment rate remains at 36.8 per cent.

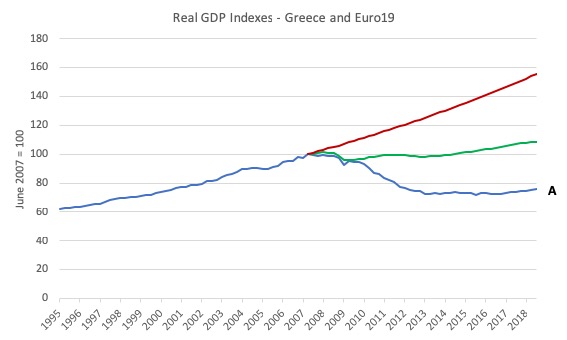

Consider the following graph which shows the actual evolution of real GDP in Greece from the March-quarter 1995 to the September-quarter 2018 (blue line).

The red line is what would have happened if Greece had have maintained its average quarterly growth rate between the March-quarter 1995 and the June-quarter 2007 (the peak before the GFC).

The green line is the evolution of the Eurozone real GDP after the June-quarter 2007.

So we can say that the cumulative real income losses of the destruction of Greece are the quarterly difference between the red line and the blue line after the peak (if there had been no GFC) or the quarterly differences between the green and blue lines had Greece behaved in the same fashion as the overall Eurozone after the crisis.

Either way, the way Greece was treated has involved massive losses.

Remember that real GDP (or income) is a flow – every quarter it appears and any losses are permanent – they can never be regained.

So each quarter that the Troika was bludgeoning Greece into a sort of ‘colonial’ submission to neoliberalism, these losses were accumulating.

Stating that the Greek economy is now some 25 per cent smaller that it was, understates the severity of the situation.

The percentage gap between A and B, for example, is some 43.4 per cent.

The percentage gap between A and C is 105.2 per cent.

On a per capita basis, the cumulative income losses arising from the fact that Greece didn’t keep track with the rest of the Eurozone amounts to some 53,625 euros per person in Greece by the September-quarter 2018.

That is, on average every single Greece person would be 53,625 euros better off in income terms alone had the Greek real GDP kept pace with the Eurozone aggregate.

The cumulative gap is a monstrous 121,178 euros per person if we calculated it using the cumulative losses between the red and blue lines.

Whichever way you cut it, these losses are massive but dwarf the extra losses that come from the damage, for example to community health, etc.

And all of those losses were deliberately inflicted on the nation by the technocratic bullies in the Troika.

That is why any nation that can get out of the Eurozone (and the EU in general) would easily create net benefits in a fairly short run period.

All the Project Fear predictions of catastrophe never really compare what they think will happen with what already has happened.

There is no way the income losses would have been as great had Greece left the Eurozone.

And all the Brexit predictions from the Remainers are similarly biased.

International competitiveness

While Bloomberg gave Greece an A rating for international competitiveness, which they calculate by answering this question:

Did countries that needed it manage to rebalance their trade position during the crisis?

So:

Calculation: Difference between trade balance (exports minus imports as a share of GDP) in 2008 and 2017, compared with euro-area average. Countries that ran deficit in 2008 and saw change ≥ 20% higher than euro area scored A, ≥ 20% below are C, rest (including nations that ran surpluses in 2008) are B.

This is not a universally-accepted method of computing international competitiveness.

For example, Greece’s goods and services external deficit in the March-quarter 2007 amounted to 18.8 per cent of GDP. By the June-quarter 2018 it as down to 0.8 per cent of GDP and was in surplus at the end of 2007.

Bloomberg think this is a good outcome.

The reality is less obvious.

Sure enough Greek exports have risen from 10,601.7 million euros in the March-quarter 2007 to 21,632.2 million in the September-quarter 2018. This is on the back of a substantial growth in world trade.

But imports have fallen by 23 per cent from 22,217.7 million euros to 16,937.2 million euros, which means that in material terms, the Greek people have less goods and services available to them.

Austerity will typically lead to a shrinking of a trade deficit because it reduces national income, which, in turn, reduces import spending.

I don’t judge that to be a good outcome at all.

As an aside, Bloomberg gave an A rating to Germany which had a goods and services external surplus of 6.7 per cent of GDP in 2007 and this has expanded to 7.6 per cent by the June-quarter 2018.

As we will discuss below, Germany gamed its Eurozone partners and in its wilful pursuit of increasing external surpluses while suppressing domestic demand, it ensured nations such as Greece would be forced to run external deficits and build up external debt obligations.

The house of cards came crashing down in 2008 but the adjustment was not forced onto Germany. Nations such as Greece were forced to make the adjustment.

And on the more sensible measures of international competitiveness – versions of real exchange rates – the situation is also less obvious, even after the massive cost cutting that has gone on in Greece as part of the bailout programs.

The Bank of International Settlements (BIS) produce monthly – Effective exchange rate indices (REER) – which you can learn about from their publication – The new BIS effective exchange rate indices – which appeared in the BIS Quarterly Review, March 2006.

Real effective exchange rates provide a measure on international competitiveness and are based on information pertaining movements in relative prices and costs, expressed in a common currency. Economists started computing effective exchange rates after the Bretton Woods system collapsed in the early 1970s because that ended the “simple bilateral dollar rate” (Source).

The BIS ‘real effective exchange rate indices’ (REER) adjust nominal exchange rates with other data on domestic inflation and production costs.

The BIS say that:

An effective exchange rate (EER) provides a better indicator of the macroeconomic effects of exchange rates than any single bilateral rate. A nominal effective exchange rate (NEER) is an index of some weighted average of bilateral exchange rates. A real effective exchange rate (REER) is the NEER adjusted by some measure of relative prices or costs; changes in the REER thus take into account both nominal exchange rate developments and the inflation differential vis-à-vis trading partners. In both policy and market analysis, EERs serve various purposes: as a measure of international competitiveness …

If the REER rises (falls) then we conclude that the nation is less (more) internationally competitive.

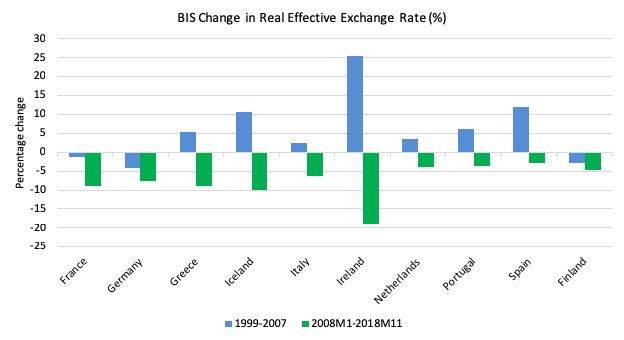

The following graph shows the movement in real effective exchange rates for various Eurozone nations plus Iceland. The two periods are from 1999-2007, that is, the Eurozone period before the crisis; and the period from January 2008 to November 2018.

I included Iceland because it suffered very badly in the crisis but has its own exchange rate. The bars indicate the percentage change in the REER over the two periods.

The degree of real wage cutting in the sample of nations shown has been quite different in the austerity period. Real wages have been undermined by a combination of nominal wage cuts and tax hikes (for example, the VAT increases in various nations as part of their austerity packages).

Most nations have not cut nominal wages (Greece is the standout with wage cuts of between 15 and 25 per cent depending on how one measures it).

Comparing Greece with Iceland we know that according to the AMECO database, Nominal compensation per employee rose in Iceland by 66.4 per cent over the period 2008 and 2018, whereas they fell by 28.4 per cent in Greece.

Yet, as the REER graph shows, Iceland increased its international competitiveness by more than Greece (REER fell by 9.9 per cent compared to 8.8 per cent) because its exchange rate depreciated.

And, more importantly, with respect to the external imbalances within the Eurozone, the graph shows that Greece has barely improved its international competitiveness relative to Germany in the period following the crisis.

The Eurozone nations tend to move in lockstep and so gains from measures that might be taken internally are lost

Italy, Portugal and Spain have experienced relative loss of external competitiveness against Germany over the period.

Please read my blog – Eurozone unemployment – little to do with international competitiveness (March 23, 2015) – for more discussion on this point.

Macro imbalance procedure

On the EU Home Page we can read about the – Excessive imbalance procedure – which describes the:

… enhanced surveillance mechanism to ensure compliance with the macroeconomic imbalance procedure that can be activated for countries identified with excessive imbalances …

Euro area Member States that repeatedly fail to submit corrective plans considered sufficient by the Council or to implement them face the possibility of sanctions, including fines.

Note: possibility.

If the nation is Greece, or, more recently Italy, the possibility increases to near certainty.

If the nation is Germany or the Netherlands, eyes look the other way.

Or more recently, France, look the other way.

Welcome to the Eurozone, the EU most corrupt evolution.

I wrote about this issue in this blog post (among others) – Germany – a most dangerous and ridiculous nation (December 27, 2017).

Other related blog posts include:

1. Massive Eurozone infrastructure deficit requires urgent redress (November 27, 2017).

2. Wolfgang Schäuble is gone but his disastrous legacy will continue (October 16, 2017).

3. The chickens are coming home to roost for Europe’s so-called powerhouse (August 10, 2017).

4. More Germans are at risk of severe poverty than ever before (July 6, 2017).

5. German trade surpluses demonstrate the failure of the Eurozone (April 24, 2017).

6. The European Commission turns a blind eye to record German external surpluses (October 31, 2016).

It is clear that Germany’s dominance in the Eurozone both politically and economically means it can force the adjustment to overall ‘unsustainable’ external positions onto both its own citizens (lowering their material living standards), and, more obviously, onto citizens of other EMU nations.

If Germany couldn’t bully nations like Greece, Italy, Spain and even France, Germany’s dangerous domestic strategy would be less effective.

If all EMU nations followed Germany’s lead – then there would be mass Depression throughout Europe.

While the architecture of the monetary union is flawed at its most elemental level – these nations should never share a currency – the fact that Germany has crafted a strategy based on the immiseration of its Eurozone partners makes it more vulnerable to crises.

While the likes of Bloomberg extol the virtues of Germany’s ‘export powerhouse’ the reality is that Germany’s behaviour is as an embarrassing example of policy vandalism and an illegal assault on the rules that Germany has signed up to follow and which it enforces onto other nations at great cost (for example, Greece).

Why illegal? Because it is directly related to Germany’s violation of the Macroeconomic Imbalance Procedure, which specifies under its so-called Scoreboard Indicators that the “major source of macroeconomic imblances” includes a:

3-year backward moving average of the current account balance as percent of GDP, with thresholds of +6% and -4%

So the upper warning threshold (for an external surplus) is 6 per cent of GDP.

The problem is that the several Eurozone nations have been in breach of these rules for several years.

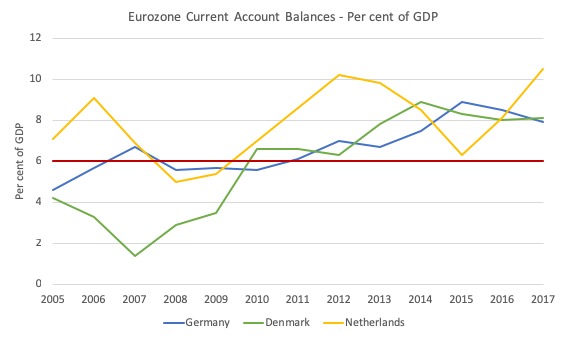

The following graph shows the current account balances as a per cent of GDP for Germany (blue), Netherlands (orange) and Denmark (green) from 2005 to 2017.

The red horizontal line is the upper warning threshold.

While other nations are also currently in breach, these three nations have systematically violated the rules since at least 2011.

Imbalances are meant to trigger “the alert mechanism report (AMR)” – the latest being issued on November 21, 2018 – 2019 European Semester: Alert Mechanism Report.

We read that:

Four EU countries currently exceed the MIP scoreboard threshold on account of surpluses. Values above threshold have been observed in Denmark, Germany and the Netherlands for several years and in Malta more recently. In 2017, the German surplus declined by 0.5% of GDP, while the surplus in the Netherlands widened by 2.5% of GDP. In all these four cases, those surpluses outturns are well above what can be explained by fundamentals, always by at least 5 percentage points of GDP.

Further:

… the current account surplus of the euro area is mainly the result of large surpluses recorded in Germany and the Netherlands, whose combined external positions account for the bulk of the euro-area surplus (Graph B.1). Since 2016, the gradual reduction in the German current account surplus is associated with the stabilisation of the surplus recorded by the euro area.

And:

Some Member States are characterised by large and persistent current account surpluses that also reflect, to a varying degree, subdued private consumption and investment, in excess of what economic fundamentals would justify. This is the case notably for Germany and the Netherlands. In the case of Germany, it is combined with deleveraging in all sectors of the economy, even though debt levels are not comparatively high. In the Netherlands, a large surplus is coupled with a high stock of household debt and strong house price growth. The large and persistent surpluses may imply forgone growth and domestic investment opportunities that bear consequences for the rest of the euro area in a context of still below-target inflation and an external backdrop that is becoming increasingly uncertain and may turn less supportive.

And:

In March 2018, the Commission concluded that Germany was experiencing macroeconomic imbalances, in particular related to its large current account surplus reflecting subdued investment relative to saving both in the private and public sector.

Sanctions?

None.

The facts are obvious:

1. Germany has been running current account surpluses above the allowable threshold since 2011 – averaging 7.5 per cent of GDP since then and averaging 8.4 per cent of GDP over the last three years.

2. It has been running fiscal surpluses since 2014, 0.6 averaging per cent of GDP since then.

3. The two aggregates are intrinsically linked via national income changes.

4. There are no policy shifts foreshadowed that would suggest anything is going to change much.

The causal links between the balances is clear.

By suppressing domestic demand – public and private consumption and capital formation investment – through its attacks on wages growth and fiscal austerity, Germany stifles imports.

What happens if a nation exports more than it imports (ignore, for simplicity, the income side of the current account)?

The net outflow of real goods and services would be accompanied by accumulating financial claims against the rest of the world.

This is because the demand for the nation’s currency to meet the payments necessary for the exports would exceed the supply of the currency to the foreign exchange market to facilitate the import expenditure.

How might this imbalance be resolved? There are a number of ways possible.

A most obvious solution would be for foreigners to borrow funds from the domestic residents. This would lead to a net accumulation of foreign claims (assets) held by residents in the surplus nation.

Another solution would be for non-residents to draw down local bank balances, which means that net liabilities to non-residents would decline.

Thus a nation running a current account surplus will be recording net private capital outflows and/or the central bank will be accumulating international reserves (foreign currency holdings) if it has been selling the nation’s currency to stabilise its exchange rate in the face of the surplus.

Current account deficit nations will record foreign capital inflows (for example, loans from surplus nations) and/or their central banks will be losing foreign reserves.

Large current account disparities emerged between nations in the 1980s as capital flows were deregulated and many currencies floated after the Bretton Woods system collapsed.

European nations such as Germany, the Netherlands and Switzerland were typically recording large and persistent current account surpluses and with a significant proportion of their trade being with other European nations, the imbalances grew within Europe as well as between Europe and elsewhere.

Think about the sectoral balances arithmetic. If a Member State achieve a balanced fiscal outcome and is sitting on the current account surplus threshold (6 per cent), then its private domestic sector will be saving overall 6 per cent of GDP.

Where will those savings go?

I have discussed how Germany maintained its external competitiveness once it could no longer manipulate the exchange rate in previous blog posts:

1. Germany is not a model for Europe (March 2, 2015).

2. Germany should look at itself in the mirror (June 17, 2105).

The savings may go into the domestic economy if there are profitable opportunities to invest. But in Germany’s case, its whole strategy was based on suppressing domestic demand (Hartz reforms, wage suppression, mini-jobs etc), and so profitable investment opportunities were limited in the German economy.

As a result and capital sought profits elsewhere.

The persistently large external surpluses which began long before the crisis (and 6 per cent is large) were the reason that so much debt was incurred in Spain and elsewhere. German investors pushed capital externally.

Germany is clearly supplying large flows of capital to the rest of the world and together with The Netherlands dominates the Eurozone in this regard.

The combination of domestic demand suppression and huge external surpluses means that Germany’s outflow of capital is ridiculous.

By deliberately constraining the standard of living of its citizens and undermining its own public and private infrastructure, the German government has also damaged its EMU partners.

To resolve this problem (which is a massive imbalance between domestic saving and investment), Germany requires higher domestic demand and faster wages growth both to boost the very modest consumption performance and to attract investment into the domestic market.

It also could stimulate public spending – say, to start the long process of restoring quality to its public infrastructure which has been seriously degraded by the austerity mentality of successive German governments.

But such a change would be at odds with the mercantile mindset that dominates the nation because it would reduce the competitive advantage that Germany enjoys over other nations that have treated their workers more equitably.

And, the European Commission has not acted to stop Germany gaming the system even further.

Conclusion

The European Commission is good at bullying the weaker nations, who feel inferior members of the ‘European Project’, but won’t lay a glove on Germany.

That is why realistic progressive reform in the Eurozone will not be possible.

Happy New Year!

Film to support and spread

A new film covering the “covert privatisation of the UK’s revered National Health Service” – Groundswell: The Grassroots Battle for the NHS and Democracy – was released on December 21, 2018.

It is a 78 minute documentary that documents the way the “global free-marketeers who have dominated society for over 30 years” have been trying to get their filthy hands on the NHS to turn it towards a private profit making venture rather than a community health service.

The filmmaker – John Furze – is seeking a small contribution to watch the movie – and I urge all readers to give him your support.

These ventures are essential to help communities fight against neoliberalism.

Call for financial assistance to make the MMT University project a reality

I am in the process of setting up a 501(c)(3) organisation under US law, which will serve as a funding vehicle for the MMT Education project – MMT University – that I hope to launch early-to-mid 2019.

For equity reasons, I plan to offer all the tuition and material (bar the texts) for free to ensure everyone can participate irrespective of personal financial circumstance.

Even if I was to charge some fees the project would need additional financial support to ensure it will be sustainable.

So to make it work I am currently seeking sponsors for this venture.

The 501(c)(3) funding structure means you can contribute to the not-for-profit organisation (which will be at arm’s length to the not-for-profit educational venture) in the knowledge that your support will not be publicly known.

Alternatively, if you wish to have your support for the venture publicly ackowledged there will information presented on the Home Page of the MMT University to acknowledge that funding.

To ensure the project has longevity I am hoping to obtain some long-term support proposals.

At present, I estimate I will need about per year.

Note that most of these funds will support an administrative support staff (1 person fractional), data charges, and video editing and design staff (as needed).

I will personally take no payment for the work I am putting into the project nor will other key Modern Monetary Theory (MMT) academics, who have agreed to help in the educational program.

So I cannot do this without sufficient support. My research group does not have the financial capacity to support this venture.

I also do not wish to place advertisements on my blog posts.

You will be contributing to a progressive venture.

Please E-mail me if you can help.

I have some funding pledges already but I am not near the target yet.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

“Thus a nation running a current account surplus will be recording net private capital outflows and/or the central bank will be accumulating international reserves (foreign currency holdings) if it has been selling the nation’s currency to stabilise its exchange rate in the face of the surplus.”

This goes a bit further than the recent two-part blog in response to the Keen-Mosler debate in that it shows that the Central Bank ends up with foreign exchange where a country has a trade surplus. In the event that there is a shortage of a particular currency it will push up the exchange rate and the Central Bank will have to sell its currency to bring it back down. The BoE told me they have no role in foreign trade – but whilst they do not in respect of individual trades, they do in aggregate.

In the case of Germany, since intra-EZ trades are settled via Target2, it ends up as an imbalance between surplus and deficit countries. It would only work in the way the Euro was supposed to work if all the member countries had equal trade between one another – which is what the convergence criteria were supposed to address.

I hope that makes sense.

My understanding is that the Eurozone recreates the problem of a system of fixed exchange rates: if your nation has a current account deficit, you need to use internal devaluation (a rising unemployment rate) to make the balance of payments adjustment.

Whereas if you have your own floating currency, a falling exchange rate makes the adjustment.

A falling exchange rate is always less harmful than a rising unemployment rate.

The current account deficit countries in the Eurozone have suffered asset bubbles and elevated unemployment rates because of Germany’s excessive current account surpluses.

The size of Germany’s current account surpluses breach Eurozone rules but Germany is never held accountable for those breaches.

I said it before. I’ll say it again: “Large stubborn trade imbalance always indicates injustice and disease. All over the world the wealthy and the powerful are driving down wages, so that the people of their country can’t afford to buy all the things they produce. The wealthy and the powerful want the savings so they can export them to another country and build up claims against those people.” The wealthy and the powerful want to acquire all value to themselves. Only force compels them to share. War comes from their use, the subjugation and subordination of domestic population, a tool to violently strip others of their wealth. The League, United Nations; weak attempts of community to restrain.

The extent of double-dealing in which the EU’s highest levels of governance are totally complicit is breathtaking.

The EU purports to espouse exalted aspirations towards the brotherhood of European nations, so that the terrible wars which have ravaged the continent up until the very recent past shall never be repeated – and then proceeds with stunning cynicism to create and expand conditions in which precisely those ancient enmities and mutual suspicions are most likely to be reawakened.

Germany (with one or two subservient acolytes in tow) is pursuing a policy of barefaced mercantilism – a consciously-designed zero-sum game in which winner(s) take all and losers are reduced to servile dependence, to be hollowed-out and (presumably) in the end-game absorbed.

Within its byzantine and ever-expanding maze of governing organs and dense thicket of regulations the EU includes under the umbrella of the Fiscal Stability Treaty the “Macroeconomic Imbalance Procedure, an early warning system and correction mechanism for excessive macroeconomic imbalances”:-

“Macroeconomic imbalances

5. Regulation 1176/2011: On the prevention and correction of macroeconomic imbalances.

The regulation lays out the details of the macroeconomic imbalance surveillance procedure and covers all EU member states.

6. Regulation 1174/2011: On enforcement action to correct excessive macroeconomic imbalances in the euro area”.

The most glaring case of the brazen and consistent flouting of this law, *which it is*, is – as Bill points out – Germany. There has been not even the glimmering of any intent on the part of the Commission, whose legal duty it is to operate the rules, to take any steps whatsoever towards compelling Germany to comply, on pain of sanctions for failure to do so. Germany’s complete non-compliance is regularly and punctiliously recorded – then the Commission just looks the other way, towards those unfortunate victims who can much more easily be coerced. This is the canker which is eating away at what is left of the EU’s original high-sounding ideals – a cynical retreat from them in the face of raw power.

The poorest country in EU is not Greece but Bulgaria…