The other day I was asked whether I was happy that the US President was…

The European Commission turns a blind eye to record German external surpluses

Data released by Eurostat (October 20, 2016) – EU28 current account surplus €13.5 bn – shows that the EU28 ran a significant current account surplus in August 2016 following a surplus of €11.3 billion in July. The August result is up €5.3 billion on August 2015. Net trade in goods and in services is more or less equally balanced. The stunning result is that the German current account surplus in August 2016 was €17.87 billion up from €14.43 billion in August 2015., while the next largest Eurozone Member State surplus was Italy at €3.37 billion. Germany is also running a fiscal surplus of around 1.2 per cent of GDP at present, which means the private domestic sector is saving massive amounts, which, in turn, not only results in subdued demand within Germany (and low growth) but also reduces import spending. In turn, this reduces growth in other nations. The stunning fact is that the European Commission is doing nothing about this massive imbalance despite Germany being in serial contravention of the rules relating to macroeconomic imbalances. The Brussels jackboot is quick to kick Greece but stays well away from sanctioning Germany, even though the German behaviour is much more deleterious to the viability of the common currency.

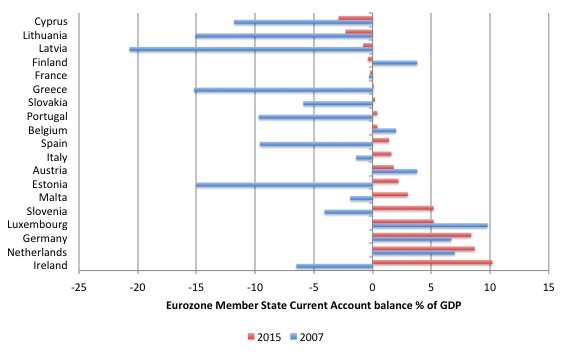

The following graph shows the current account balances as a percent of GDP for the 19 Eurozone Member State nations as at 2007 and 2015. They are ranked from smallest to largest as at 2015.

In the early days of the Eurozone, there were dramatic shifts in the current account balances (which reflect trade and income flows between nations).

Germany’s ‘mercantilist’ strategy dominated the early years and they started to record very large external surpluses which were mirrored by expanding external deficits in the peripheral economies (the PIIGS)

What happens if a nation exports more than it imports (ignore, for simplicity, the income side of the current account)?

The net outflow of real goods and services would be accompanied by accumulating financial claims against the rest of the world.

This is because the demand for the nation’s currency to meet the payments necessary for the exports would exceed the supply of the currency to the foreign exchange market to facilitate the import expenditure.

How might this imbalance be resolved? There are a number of ways possible.

A most obvious solution would be for foreigners to borrow funds from the domestic residents. This would lead to a net accumulation of foreign claims (assets) held by residents in the surplus nation.

Another solution would be for non-residents to draw down local bank balances, which means that net liabilities to non-residents would decline.

Thus a nation running a current account surplus will be recording net private capital outflows and/or the central bank will be accumulating international reserves (foreign currency holdings) if it has been selling the nation’s currency to stabilise its exchange rate in the face of the surplus.

Current account deficit nations will record foreign capital inflows (for example, loans from surplus nations) and/or their central banks will be losing foreign reserves.

Large current account disparities emerged between nations in the 1980s as capital flows were deregulated and many currencies floated after the Bretton Woods system collapsed.

European nations such as Germany, the Netherlands and Switzerland were typically recording large and persistent current account surpluses and with a significant proportion of their trade being with other European nations, the imbalances grew within Europe as well as between Europe and elsewhere.

German government policy (Hartz reforms – see below) deliberately created widening imbalances in Europe by undermining the competitiveness of the other nations through the harsh attack on its own workers.

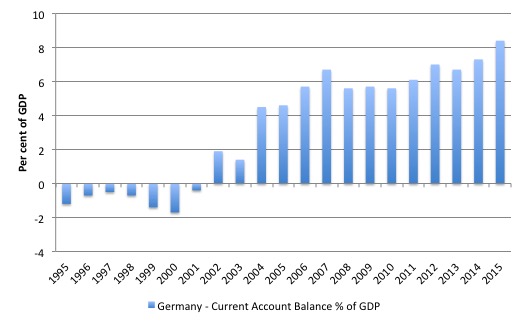

The next graph shows the evolution of the German current account balance (as a % of GDP) from 1995 to 2015. Germany’s current account surplus 8.6 per cent in 2015 is a record outcome for that nation.

As we see, when Germany entered the Eurozone, it was recording small external deficits but throughout the early part of the common currency, it clearly shifted focus and started to run ever increasing current account surpluses.

From a sectoral balance perspective, with an external surplus of 8.4 per cent of GDP and a fiscal surplus currently standing at around 1.2 per cent of GDP, the private domestic sector must be running a surplus of around 7.2 per cent of GDP – a massive domestic saving amount.

There is massive scope for the German government to expand its net spending (reduce its surplus) to stimulate domestic spending and import spending, which would reduce the massive and unsustainable external surplus.

The German turnaround came in 2001 when export growth (value) was 6.83 per cent and imports grew by only 1.9 per cent.

In 2003, Chancellor Schröder unveiled his Government’s ‘Agenda 2010’, which was aligned in concept, design and timeframe with the EU’s Lisbon Strategy, and signified that his coalition government was now unambiguously pursuing a neo-liberal agenda.

Agenda 2010 aimed to attack income support systems. It was dressed up in the language of flexibility and incentive, but was based on the mainstream view that mass unemployment was the result of a workforce rendered lazy by the welfare system, rather than the more obvious alternative, that it arose due to a shortage of jobs.

The so-called ‘Hartz reforms’ were a major plank of the strategy and resulted from a 2002 commission of enquiry, presided over by and named after Peter Hartz, a key Volkswagen executive.

Hartz himself was lauded at the time by the neo-liberal cheer squad, but by 2007 was sentenced to a prison term for corruption and in disgrace.

The aim of the ‘reforms’ was clear: unemployment benefits had to be cut and job protections had to go. The recommendations were fully endorsed by the Schröder government and introduced in four tranches, Hartz I to IV, starting in January 2003.

The changes associated with Hartz I to Hartz III, took place over 2003 and 2004, while Hartz IV began in January 2005. The changes were far reaching in terms of the existing labour market policy that had been stable for several decades. The changes were consistent with those that have been pursued in other industrialised countries, following the agenda outlined in the OECD’s Job Study in 1994.

The so-called supply-side focus advocated that continued income support should be conditional on a raft of increasingly onerous activity tests and training schemes.

Further, governments abandoned their responsibility to reduce unemployment with properly targeted job creation schemes. Public employment agencies were privatised, spawning a new private sector ‘industry’, the management of the unemployed!

The upshot of this German labour market repression (see below) was the employment growth became centred on the so-called mini-jobs, which were precarious jobs with extremely low pay and workers are excluded from enjoying the benefits of national income growth and the chance to accumulate pension entitlements.

The other obvious result was the suppression of real wages growth, and, in turn, flat-lining domestic demand growth.

Schröder’s austerity policies forced harsh domestic restraint onto German workers, which meant that Germany could only grow through widening export surpluses – which meant expanding exports and suppressing import spending.

The large export surpluses also provided the funds to loan out to other nations. Germany didn’t experience the same credit explosion as other nations but German banks were prominent in the debt build up elsewhere in Europe.

The suppression of consumption in Germany and the reliance on exports to maintain growth was very damaging to the peripheral states.

The growth in employment in Germany in the lead up to the crisis was not due to a well-functioning monetary union. Rather it reflected its malfunctioning because it depended on widening trade imbalances, huge surpluses in Germany and some of its neighbours against widening deficits in the periphery, covered by unsustainable capital flows from the former to the latter.

That sort of unilateralism is not sensible in a monetary union, especially one that deliberately eschewed a federal fiscal transfer system.

It not only undermined the welfare of Germany’s EMU partners, but also meant that the living standards of German workers were reduced.

And what the recent data confirms is that Germany is still gaming its EMU partners, except this time, it has been active in killing prosperity in the rest of the Eurozone.

The failed Macroeconomic Imbalance Procedure

In March 2010, the European Council met in Brussels do respond to the on-going crisis. The leadership admitted that situation was dire but chose exactly the wrong adjustment path.

Instead of relaxing the ridiculous fiscal rules, they tightened them.

The March 25, 2010 Statement by the Heads of State and Government of the Euro Area stated:

The current situation demonstrates the need to strengthen and complement the existing framework to ensure fiscal sustainability in the euro zone and enhance its capacity to act in times of crises.

For the future, surveillance of economic and budgetary risks and the instruments for their prevention, including the Excessive Deficit Procedure, must be strengthened. Moreover, we need a robust framework for crisis resolution respecting the principle of member states’ own budgetary responsibility.

The German agenda was clearly to make the SGP conditions even more onerous so as to further constrain discretionary fiscal policy, which ensured that only nations with strong export positions would have any chance of sustained growth.

Soon after the March 2010 European Council meeting, conservative German academic Hans-Werner Sinn used his Wall Street Journal Op Ed article (April 19, 2010) – How to Save the Euro to lecture nations such as “Greece, Italy, Spain and Portugal” to stop using “their membership in the European monetary union as the right to pay for their imports with bonds rather than real resources.”

He called for new Stability and Growth Pact (SGP):

… one that would be formulated to impose ironclad debt discipline. What is needed are modified debt rules, hefty sanctions, and most of all, a system of rules that automates the levying of penalties, leaving no room for political meddling.

What transpired is well known. The European Union introduced three new ‘governance’ measures – the Six-Pack, the Two-Pack and the Fiscal Compact.

All three initiatives sought to further restrict the fiscal flexibility of the national governments. All three took the monetary union further into the mire and further away from an effective solution to its woes.

The presumption was that if the fiscal rules were tighter and behaviour more closely monitored and controlled, the SGP would be enforceable and the so-called fiscal crisis would dissipate.

This signalled a preparedness on the part of the European leadership to let higher unemployment and poverty become the adjustment mechanism rather than increased government spending.

The so-called ‘reinforced Stability and Growth Pact (SGP)’ became operational on December 13, 2011.

The European Commission, 2011). The Official Memorandum from the European Commission (December 12, 2011) – EU Economic governance “Six-Pack” enters into force – said the so-called ‘Six-Pack’ comprised “five regulations and one directive”.

The innovation was the creation of a new ‘Macroeconomic Imbalance Procedure’, which was described as a “new surveillance and enforcement mechanism”.

Essentially nations would move into the Excess Deficit Procedure (EDP) more quickly and there would be harsher sanctions for compliance failure.

The Six-Pack specified a more rigorous imposition of financial sanctions if a nation fails to follow “specific recommendations” to get its deficits below 3 per cent of GDP. Further, if the “60% reference for the debt to GDP ratio is not respected” then the EDP will begin “even if its deficit is below 3%’ and the nation will have to reduce the ‘gap between its debt level and the 60% reference … by 1/20th annually (on average over 3 years)”

There were other grand statements of shock and awe if government dared used their fiscal capacity to bring down the mass unemployment.

As we have seen in the recent Spanish farce these tough words and new rules were not meant to be understood literally. To shore up the PP Conservatives in Spain, the European Commission turned a blind eye to the Spanish government’s fiscal balance in 2015 and, surprise surprise, the deficit grew to 5.2 per cent of GDP and real GDP growth turned from negative to positive.

Unemployment then started falling.

Please read my blog – Spanish government discretionary fiscal deficit rises and real GDP growth returns – for more discussion on this point.

But of interest to today’s blog is the series of interventions that the European Commission detailed under the so-called Excessive Imbalances Procedure (EIP), which aims to reduce macroeconomic imbalances (particularly unit costs and so on).

The European Commission claimed that it would force nations to submit “a clear roadmap and deadlines for implementing corrective action”.

The whole system was to be subjected to a huge surveillance operation (EU monitoring) with rigorous enforcement (fines equal to 0.1 per cent of GDP) and central intervention in a nation’s budgetary process.

The Eurozone leaders were still not satisfied with these new restrictions. They decided to introduce an even more onerous set of fiscal rules under the guise of the 2012 – Treaty on Stability, Coordination and Governance in the Economic and Monetary Union (TSCG) – also known as the ‘Fiscal Compact’.

These changes were driven by the Germans, who in 2009 enshrined a ‘balanced budget rule’ or ‘debt brake’ in their Basic Law (Constitution).

From 2016, the rule will make it illegal for the federal government to run a structural deficit larger than 0.35 per cent of GDP, while from 2020 the German states are prohibited from running any deficits.

This effectively means that once operational, that outstanding public debt will eventually disappear. Previously there were debt limits in place to guide German economic policy but after 2016, the ceiling cannot be breached.

Only in exceptional and rare situations, which are beyond the control of the government can the rules be temporarily breached but any deficits incurred would have to be offset by surpluses soon after.

Predictably, in their OCtober 2011 Month Report of the Deutsche Bundesbank there was an article – The Debt Brake in Germany – Key Aspects and Implementation – that waxed lyrical about the new tougher German approach.

The Bundesbank considered the move to be “a very welcome development and a clear improvement”.

Consistent with their deflationary bias, they recommended that all levels of government:

… incorporate a safety margin below the constitutional ceiling … [to avoid] … the need for short-term adjustments that could have a procyclical impact, particularly given unexpected adverse developments.

In other words, they wanted the government to run fiscal surpluses as a matter of course, imparting a constant fiscal drag on economic growth independent of the state of the economy.

In the context of German domestic policy, this means the only source of growth would be net exports.

A debt brake means that all investment in public infrastructure has to come out of current revenue, which violates the basic economic principle that the costs and benefits of such provision should be spread out over time, so the current generation doesn’t bear the costs and the future generation enjoy the benefits.

Further, it works on the assumption of symmetrical economic cycles, such that any deficits incurred in a downturn can be more than offset by surpluses in periods of stronger growth. But cycles are typically asymmetric and deep recessions can require extended fiscal deficits to sustain the recovery.

The telling point is that the Bundesbank didn’t mention Germany’s place in the Eurozone or the mass unemployment that was ring-fencing that nation as a result of the lack of spending throughout the monetary union other than to say that:

Not least given the importance of the Ger- man debt brake as a benchmark within the euro area, it is crucial that it is implemented rigorously and in a manner that is true to its intention.

The Fiscal Compact adopted by the European Union, unfortunately, embodied much of the German approach, including the preference that the ‘balanced budget rule’ be binding and embedded into permanent constitutional provisions.

The so-called ‘independent’ surveillance and monitoring bodies would quickly refer infractions to the Court of Justice of the European Union, which under Article 8 of the Treaty, was given new capacities which co-opted it to become part of the austerity enforcement.

But back to the ‘Macroeconomic Imbalance Procedure’ embedded in the Six-Pack, which exposes the inherent, anti-people biases that dominate European policy making.

The stated aim of the MIP surveillance mechanism was outlined in the Occasional Paper 92 released on February 2012 by the European Commission – Scoreboard for the surveillance of macroeconomic imbalances.

We read that it was designed:

… to identify potential risks early on, prevent the emergence of harmful macroeconomic imbalances and correct the imbalances that are already in place.

The so-called MIP Scoreboard uses ten “early warning” indicators that provide information about “macroeconomic imbalances and competitiveness losses” which are easy to compute and communicate.

Note the emphasis on early!

Threshold values (positive and negative) are provided to assess when there is an imbalance. The priorities were clear.

A nation that had endured an unemployment rate of say 9.9 per cent for the last three years is not considered to be imbalanced, given the warning threshold is 10 per cent.

The Commission chose this very high threshold due to a “focus on adjustment in labour markets and not on cyclical fluctuations.

Which means? That they do not consider the unemployment problem in terms of insufficient jobs being caused by deficient levels of spending but rather consider the only policy concern to be so-called “structural” issues.

This in turn concentrates their attention on “market impediments”, the standard neo-liberal, supply side bias that has failed since it became the dominant approach in the early 1990s.

In the Commission’s annual ‘Alert Mechanism Report’, which is based on a review of the MIP scoreboard, any reference to unemployment is usually accompanied by some conclusion that wages are too high and need to be reduced in line with productivity growth.

There is no recognition that the enduring recession has caused both productivity growth to slump and jobs to disappear due to a lack of spending.

The European policy makers are thus ‘content’ with very high levels of unemployment yet they hide their intent in a language of deception.

Another bias is evident in the way they deal with current account deficits and surpluses, which is the focus of today’s blog.

The Commission concluded that unlike current account deficits:

… sustained current account surpluses do not raise the same concerns about the sustainability of external debt and financing capacities, concerns that can affect the smooth functioning of the euro area.

As a consequence of this value judgement, the MIP thus accorded:

… a greater degree of urgency … [to] … countries with large current account deficits and competitiveness losses.

The upper warning threshold (for a surplus) is 6 per cent of GDP.

As a matter of sectoral balances arithmetic, if the balanced budget rule is satisfied by a nation sitting on the current account surplus threshold, then its private domestic sector will be saving overall 6 per cent of GDP.

Where will those savings go?

I have discussed how Germany maintained its external competitiveness once it could no longer manipulate the exchange rate in previous blogs.

Please read my blogs – Germany is not a model for Europe – it fails abroad and at home and Germany should look at itself in the mirror– for more discussion on this point.

The Hartz reforms reduced the capacity of workers to share in the productivity growth of the economy and suppressed domestic demand.

Profitable investment opportunities were limited in the German economy as a result and capital sought profits elsewhere.

The persistently large external surpluses (and 6 per cent is large) were the reason that so much debt was incurred in Spain and elsewhere.

Soon after the new procedures were put into place, the European Commission published (March 3, 2014) – Alert Mechanism Report 2014.

It concluded that Germany had a macroeconomic imbalance as a result of its current account surplus being above the 6 per cent threshold.

It Commission acknowledged that the large surpluses have been, in part, due to the suppression of domestic spending and hence imports.

But it praised the surpluses because they “provide savings to be invested abroad”.

The point is that if the current account surplus is 6 per cent (say) then Germany is clearly supplying large flows of capital to the rest of the world.

Such surpluses rely on offsetting external deficits elsewhere.

While the European Commission concluded that Germany would have to find ways to ‘strengthen domestic demand and the economy’s growth potential”, it dodged the main issue.

Higher domestic demand in Germany required faster wages growth both to boost the very modest consumption performance and to attract investment into the domestic market.

But such a change would be at odds with the mercantile mindset that dominates the nation because it would reduce the competitive advantage that Germany enjoys over other nations that have treated their workers more equitably.

Clearly, the European Commission has not acted to stop Germany gaming the system even further.

In the most recent Alert Mechanism Report 2016 (published November 26, 2015), the Commission said:

Countries such as Germany, the Netherlands … continue to post very high surpluses. These large and persistent surpluses show no tendency to correct. While current account surpluses in countries with an ageing population like Germany are to be expected, and recent oil price and exchange rate developments had a favourable impact on the trade balance, the current value of the surplus appears well above what economic fundamentals would imply.

In the case of Germany, when allowing for the position in the business cycle, the cyclically- adjusted surplus is higher than the headline figure …

Trying to claim that the suppressed import situation in Germany and the massive saving rate are due to an ageing population is typical European Commission obfuscation.

On February 26, 2016, the European Commission released its – Country Report Germany 2016 – which is one of the new ‘in-depth reviews’ under the MIP.

It noted that:

1. “the recovery in private investment has been uneven and despite recent efforts, public investment remains low.”

2. “Weak investment has contributed to the high and persistent current account surplus and poses risks for the future growth potential of the German economy”.

3. “Overall, Germany has made limited progress in addressing the 2015 country-specific recommendations” – in other words, has defied the rules that it forces other nations such as Greece and Portugal to accept at great cost to the citizens of those nations.

4. “The persistently high current account surplus widened further in 2015 and is projected to remain above 8 % of GDP in 2016-2017 … the surplus and its persistence rather reflect structural features of the economy, including strong competitiveness in manufacturing and high revenues from private investment abroad. But it also reflects subdued investment and a high level of savings.”

5. “There appears to be further room for wage growth without endangering Germany’s competitiveness” – in other words, Germany should stop gaming its partner Member States and allow it own citizens to finally enjoy some real wages growth.

6. “Public investment remains subdued … Thus, a significant infrastructure investment gap remains. The design of federal fiscal relations may have contributed to persistent (especially municipal) underinvestment. In addition, overall public and private expenditure on education and research has only slightly increased in recent years and is likely not to have reached the national target for 2015” – in other words, the German government is undermining the future of its next generation by mindlessly running fiscal surpluses while suppressing essential growth in public infrastructure.

Export-led growth mania

Despite warnings from the United Nations Conference on Trade and Development (UNCTAD) outlined in its annual – Trade and Development Report 2010 – the European Commission continues to pursue an export-led growth approach.

UNCTAD provided some sober assessment of the dominance of export led growth strategies among policy makers and multilateral agencies such as the IMF and the OECD.

UNCTAD considered that a reliance on such strategies combined with the imposition of fiscal austerity would worsen growth and increase poverty.

UNCTAD concluded that a fundamental rethink was needed to reorientate policy towards stimulating domestic demand and employment creation.

UNCTAD considered that an expansion of fiscal policy in Europe was essential to avoid an extended period of recession and economic stagnation.

The current policy orthodoxy in the Eurozone is at odds with that advice. The European policy makers have conjured up the argument that if government deficits are cut and so-called ‘internal devaluation’ is pursued (which means cuts to wages, pensions and other production costs), two sources of growth will emerge as a result.

First, there will be a ‘Ricardian’ private domestic spending boom, discussed earlier. Second, even if domestic spending does not pick up, the process of wage and price deflation brought on by the ‘internal devaluation’ will increase the nation’s external competitiveness and spawn export led growth.

The evidence suggests internal devaluation does not provide a sound basis for growth. First, it is a ‘race to the bottom’ strategy that attempts to drive down unit costs via cuts in wages, which undermine domestic spending.

But if workforce morale also falls as a result of the wage cuts, it is likely that industrial sabotage and absenteeism will rise, undermining labour productivity.

Further, overall business investment is likely to fall in response to declining spending, which also erodes future productivity growth.

There is thus no guarantee that there will be a significant fall in unit labour costs.

There is robust research evidence to support the notion that by paying high wages and offering workers secure employment, firms enjoy higher productivity growth and the nation improves its international competitiveness as a result.

Eurostat data shows that between 2008 and 2013, labour productivity per hour worked rose by 1.8 per cent in Germany, but fell in Greece, the worst hit by the austerity, by 8.5 per cent and in Italy by 0.7 per cent.

So not only does the internal devaluation approach fail to lift competitiveness, it locks in a low productivity path, which undermines increases in real living standards.

The massive costs for nations being subjected to these austerity programs in the form of millions of lost jobs and the very high youth unemployment are much higher in the long term than any benefits that might arise. Second, the imposition of domestic austerity and a reliance on net exports for growth cannot work for all nations.

Does internal devaluation boost external competitiveness?

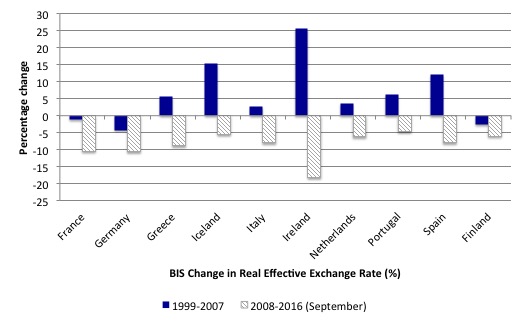

The Bank of International Settlements published monthly ‘real effective exchange rate indices’ (REER), which are internationally accepted measures of international competitiveness that adjust nominal exchange rates with other data on domestic inflation and production costs.

If the real effective exchange rate rises (falls) for a nation, then it signals a loss (gain) in its international competitiveness.

The next graph shows movements in real effective exchange rates since January 1999 until September 2016 for selected Eurozone nations and Iceland.

Two sub-samples are shown: January 1999 to December 2007 and January 2008 to September 2016, roughly coinciding with the period of growth and the period of recession and its aftermath.

The data shows that following the introduction of the euro, international competitiveness for all the nations shown declined except in the cases of France and Germany. Further, Germany made relative gains on the rest.

Following the crisis, the general tendency has been for real effective exchange rates to decline.

However, the real effective exchange rate for Greece was only 8.8 per cent lower in September 2016 than in January 2008 as a reflection of its massive austerity program it has endured.

By comparison, the real effective exchange rate for Germany has fallen by 10.6 per cent since the beginning of 2008.

Of these Eurozone nations, only Ireland has improved its position relative to Germany since the onset of the crisis. The others have lost competitiveness, which suggests that the massive pain from the internal devaluation process (mass unemployment, wage cuts etc) have been for nought.

The comparison of these fixed exchange rate euro nations with Iceland is striking.

The fundamental differences between the Eurozone nations and Iceland are threefold: (a) Iceland issues its own currency while the other nations use a foreign currency; (b) Iceland enjoys a floating exchange rate; and (c) Iceland sets its own interest rate. These are the characteristics that differentiate sovereign from non-sovereign nations in terms of the currency in use.

Iceland has experienced a substantial gain in its international competitiveness in recent years with less austerity and less hardship being imposed on its citizens.

The results for Iceland are actually conservative because its percentage gain in competitiveness from its maximum index value (November 2005) and September has been 17.8 per cent, second only to Ireland (21 per cent).

There is reason to distrust the Irish data given the sensitivity that has been revealed in recent quarters with respect to tax law etc.

Third best was Germany, improving by 14.3 per cent on its maximum value in January 1999 compared to September 2014.

Please read my blog – Export-led growth strategies will fail – for more discussion on this point.

Conclusion

Overall, Germany maintains its destructive role in the Eurozone by suppressing domestic demand and forcing austerity onto its partner Member States, while hiding behind the common exchange rate.

If there was no common currency, the German mark would have been appreciating significantly and would have undermined it trade advantage by some margin.

What we are seeing is a sort of reprise of the fixed exchange rate system under Bretton Woods applied to the Eurozone.

The only adjustment possible for nations running external deficits in the face of the massive external surpluses being run by Germany is to repress domestic demand through wage suppresion, cutting pensions etc.

Clearly these policies are not allowing the other Member States to make relative competitive gains against Germany. It is a race-to-the-bottom – towards the impoverishment of European citizens.

Of course, this is a major problem because of the fiscal suppression. Greece could easily solve its Depression if it was free to expand government spending. German’s suppression of imports would then be of no concern to anyone other than its own citizens who are materially worse off as a consequence of the mercantilist strategy.

Germany should also expand its net public spending to provide some demand throughout the Eurozone. I understand the Bundesbank arguments that public imports are low so the direct impact on other Eurozone Member State exports would be fairly modest.

But the multiplier effects of the stimulus would boost private German incomes and promote much more import growth – which would benefit nations such as Greece (tourism etc).

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

Hello,

Wow, that is an analysis that one would never read in the newspaper or business journal. A breath of fresh air.

I think the German position makes sense if you are a member of the 1% in Germany, in which case you are farming your citizens for rent and also the rest of Europe.

A book could be written here along the same lines as Micheal Hudson’s American Super Imperialism, however, about Germany and be called German Super Imperialism.

It is all about conquering other countries with financialisation and not with armies. Loading them up with debt lent from your trade surplus and then extracting rent and concessions and influencing domestic policy forever.

The Germans are so superior to the other Europeans and the rest of the world for having such a strong high technology economy, products and services in great demand throughout the world and an educated, disciplined and productive work force that they truly deserve to be honoured by being allowed to adopt their own currency the Deutschmark. The Euro is just not good enough for them and better suits the lower Europeans.

I am sure the wise German people would vote to restore the Deutschmark.

I love the idea that to increase economic growth all we have to do is cut wages. I know that every time my income goes down the first thing I think of is spending more money.

Dear Bill

Your headline should have been: The European Commission turns a blind eye to German and Dutch external surpluses.

The Dutch are even bigger mercantilists than the Germans. In 2014 the Dutch current-account surplus was 11% of GDP. The German one was never that high. The Swiss, who are not an EU member but have a free-trade agreement with the EU, are the champion of the mercantilists in Europe.

Regards. James

Dear James Schipper (at 2016/10/31 at 9:41 pm)

Yes, the Netherlands external surplus was 8.7 per cent of GDP in 2015 and the Danish surplus was 9.3 per cent (although the latter is not a Eurozone Member State). But the glaring fact is that the German external surplus accounts for around 75 per cent of the overall Euro surplus – it dominates. The Dutch surplus is minuscule in terms of the overall Eurozone.

Further, I don’t see the Dutch continually attacking Greece and other nations, although a Dutchman Djisselbloem makes up for it I suppose.

best wishes

bill

All this is just ammo for the Italians to vote themselves out of the EU in the referendum. One comment I saw today said it’s a much bigger event than Brexit. ” I keep telling you to pay attention to the Italian referendum scheduled for December. It’s massively significant, and nobody is paying attention to it. It could affect the global economy more than the US election will. Seriously, I cannot state that strongly enough” John Mauldin.

On top of that the Germans also expect high returns on their savings. Which is why Deutsche Bank is currently in trouble. Der Spiegel recently had a long article discussing the banks issues — which is mostly blamed on foreigners and Deutsche Bank trying to emulate foreign banking practices, but without any discussion about the demands/desires of German savers. German savers expect high returns on their savings, but where are those returns going to come from? Certainly not Germany as the growth rate is too low to supply the sort of returns the desire. At this point or relatively low growth world wide, where are the sort of returns that German savers expect/desire going to come from? This is certainly a recipe for financial instability where you have a large amount of money chasing high returns in a low return world.

John Doyle. The Italian referendum is about constitutional reform making it easier for the ruling government to pass legislation. Are you assuming a big rejection of this referendum proposal will set the ball rolling on returning to the lira or even Italy leaving the EU? I hope this happens but the connection looks tenuous.

heres an idea bill,

any chance of a comparative analysis of the current euro zone currency system dynamics v the currency dynamics in play during the inter war period between ww1 and ww2.

perhaps everything old is new again.

Hi Professor Mitchell,

good piece. Michael Pettis has written extensively about this too. So have Temin and Vines in their book ‘The Leaderless Economy’.

Question – your real exchange rate chart shows that essentially all Eurozone countries have had a real exchange rate depreciation over the second time horizon. Presumably this is due to the weakening of the EUR/USD nominal exchange rate. Given that there has been little ground made on internal rebalancing, do you see a risk that, via the weaker currency, the Eurozone as a whole exports a glut of savings that will ultimately force a negative adjustment on the US? Secondly, is it a possibility that the fall in commodity prices and subsequent narrowing of surpluses in commodity-exporting economies has prevented this glut from impacting the US thus far?

Excellent analysis

After 2016 the deficit cannot exceed 0.35 of GDP,wow.

That will eventually cause a lot of problems,especially if it is still in place after a potential currency change.

what is really surprising is the next second country in term of surplus, Italy. I am astonished to see people talking about Italian referendum knowing nothing about Italy. Mr Mauldin is a clear example of that. Does he really consider Mario Monti (No camp) a populist?