The other day I was asked whether I was happy that the US President was…

More Germans are at risk of severe poverty than ever before

Just how poorly the Eurozone is performing is usually illustrated with reference to Greece, then Spain, then Italy and Portugal. The weakest links among the Member States. Not to mention Cyprus, Finland and then some. But the other way of looking at the same question is to focus on the strongest link in the currency union – Germany. A new report from DIW Berlin (German Institute for Economic Research) (released July 5, 2017) – Einkommensschichten und Erwerbsformen seit 1995 (Income levels and forms of employment since 1995), which is only available in German, tells a pretty sombre, if not bleak story as to what has been happening in the Eurozone’s powerhouse over the last 18 years. It demonstrates that not only is the German model wrong for the rest of the Member States, but it is also not generating sound outcomes for its own citizens – well the lower- and middle-classes to be more exact.

I have written about why the German approach is not a suitable economic model to follow, including the following:

1. The German model is not workable for the Eurozone.

2. Germany is not a model for Europe – it fails abroad and at home.

3. German trade surpluses demonstrate the failure of the Eurozone.

4. Germany should look at itself in the mirror.

The latest research from DIW Berlin (cited above) provides more evidence, which support my position.

In what follows I provide my translation rather than the original text. Where quotes are made they are direct translations rather than putting the German text into my own words.

The DIW research notes that:

The distribution of disposable incomes and the types of employment have changed significantly in Germany over the last two decades.

Their research seeks to examine this evolution since 1995.

The study used the Sozio-oekonomisches Panel (SOEP) longitudinal micro dataset for Germany which was recorded annually from 1984 (West) and since 1990 for the unified Germany.

This is an excellent data set, which I have used myself when studying the impacts of the Hartz reforms in Germany. See – Labour Reform and Labour Mobility within Cities: have the Hartz reforms succeeded?.

They choose to examine the income distribution in terms of the number of people with low, medium and high incomes (“niedrige, mittlere oder hohe Einkommen”).

They express these categories relative to the median of the population and define a poverty risk threshold (“Einbeziehung der Armutsrisikoschwelle”) as 60 per cent of the average net household income of the total population.

They find that:

1. The share of workers in the population who are classified as “poverty stricken (“Armutsbedrohten”) has increased. The number of people in severe poverty (less than 46 per cent of the median income) has increased considerably since the end of the 1990s.

2. The share of high income workers has increased.

3. Low-paid employment is now higher than it was 20 years ago. The proportion of low-income workers has increased from 24.4 per cent to 33.7 per cent and the share of low-wage workers rose from 16.7 per cent to 24.5 per cent. The share of of low-wage workers has remained relatively stable since about 2007.

The Hartz reforms, which started in 2003, accelerated the casualisation of the labour market and the precariousness of work increased. Hartz II introduced new types of employment, the ‘mini-job’ and the ‘midi-job’ and there was a sharp fall in regular employment as a consequence.

Mini-jobs provide marginal employment with no security or entitlements and allow workers to earn up to 450 euros per month without paying taxes, while the on-costs for employers are significantly lower. The no tax obligations also mean that the worker receives no social security protection or pension entitlements.

The neo-liberal interpretation of these changes is that Germany underwent a ‘jobwunder’, or jobs miracle.

However the speedy increase in employment can also be viewed less optimistically.

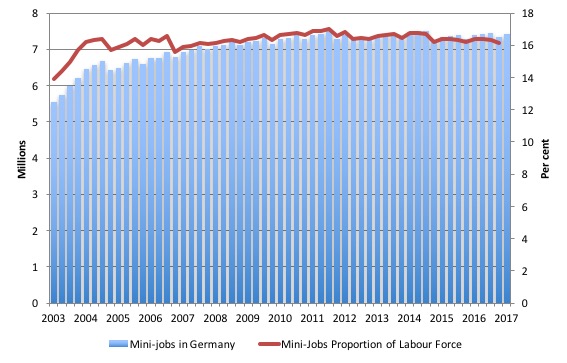

The following graph charts the history of the mini-jobs since 2003. In June 2017, there were 7.4 million ‘mini-jobs’, which represented around 16 per cent of the labour force between 15 and 64 years of age.

As the DIW study found, this proportion has been fairly steady since late 2007 after a rapid increase in the earlier years of the scheme.

The rapid increase in mini-jobs meant an increasing (and sizeable) proportion of the German workforce were forced to work in precarious jobs with extremely low pay and were excluded from enjoying the benefits of national income growth and the chance to accumulate pension entitlements.

4. DIW also found that in the higher-income categories more people have regular jobs.

5. Despite the rise in employment, income inequality is higher than 20 years ago, with the main shifts occurring between 1995 and 2005.

6. The proportion of those with median income (grouped as 77 per cent to 130 per cent of the median) has fallen by 6 percentage points over the two decades (from 47.8 per cent to 41.4 per cent).

7. There are now more people (29 per cent) with incomes below 77 per cent of the median. In 1995, this proportion was 25 per cent.

8. The share of those with over 169 per cent of the median has risen from 12 to 14 per cent.

9. Labour force participation has grown significantly since 1995, particularly among women and the elderly.

10. Standard working conditions have increasingly given way to what they term atypical employment (minijobs etc).

These shifts include an increase of workers employed for less than 15 hours a week, a rise in temporary jobs, a rise in self-employed, and a rise in other forms of non-standard (low-wage) employment.

Taken together, these trends indicate a declining quality of work in terms of security of tenure, ability to gain higher pay and protect conditions, and capacity to have discretion in the workplace.

DIW conclude that:

Insgesamt machen diese Entwicklungen deutlich, dass der erfreuliche Beschäftigungsanstieg der vergangenen Jahre nicht alle gleich erreicht hat und alleine nicht ausreichen dürfte, um allen in der Gesellschaft Wohlstand und Teilhabe zu ermöglichen

“All in all, these developments make it clear that the pleasing rise in employment over the past few years has not been spread equally and has not been sufficient to enable everyone in society to achieve prosperity and participation”.

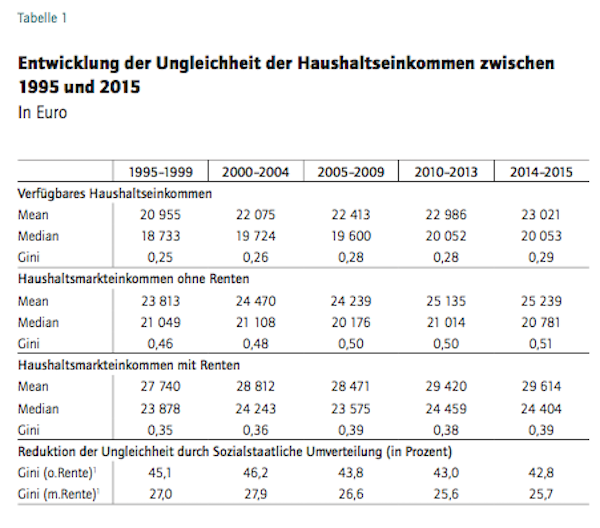

In tracing the rise in income inequality, they produce the following Table (their “Tabelle 1”).

The headings are:

- “Verfügbares Haushaltseinkommen” – Disposable household income.

- “Haushaltsmarkteinkommen ohne Renten” – Household income before taxes and transfers.

- “Haushaltsmarkteinkommen mit Renten” – Household income after taxes and transfers.

- “Reduktion der Ungleichheit durch Sozialstaatliche Umverteilung” – Reduction in income inequality due to the social redistribution system.

The Gini coefficient is a measure of inequality (higher values indicate rising inequality). A Gini of 1 indicates 1 person has all the income, 0 indicates the income spread evenly)

We observe that the overall Gini coefficient has risen from an average of 0.25 between 1995-1999 to 0.29 between 2014-15. That is a large jump. We should put that figure in context. The US has a Gini coefficient of 0.46. the UK 0.33, Australia 0.35, France 0.33, Italy 0.35.

The other interesting thing about Table 1 is that while the redistributive effect of the taxes and transfer system in Germany has a significant role in reducing inequality that impact has declined over the period analysed.

But the report notes that the rising income inequality is not the result of significant changes in the taxes and transfer system but rather “profound changes in the labour market (“Vielmehr hat die Zunahme der Einkommensungleichheit mit tief- greifenden Veränderungen am Arbeitsmarkt zu tun”)

These profound labour market changes include:

1. The employment rate (employment as a per cent of working age population) for 25 to 64 year olds, has risen continuously from almost 70 percent to about 80 per cent between the periods 1995-99 and 2014-15.

2. For males, the rate has increased from 79 per cent to 84 per cent.

3. For women, the rate has increased from 57 per cent to 73 per cent.

4. Another feature is the rising employment rates for older workers – the 55-64 age group has risen from 41 to 64 per cent between 1995 and 2015.

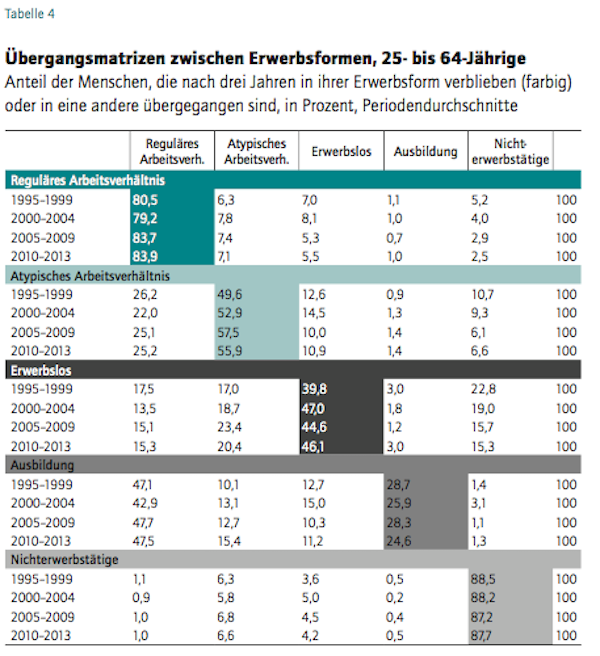

I thought this Table (Tabelle 4 in the DIW Report) was very interesting. It shows the proportion of people who have remained in their current labour force state after three years or passed (in per cent).

The labour force categories are:

1. Reguläres Arbeitsverhältnis – Regular employment (gaining social security protection etc).

2. Atypisches Arbeitsverhältnis – Atypical employment (outside of usual protections).

3. Erwerbslos – Unemployed.

4. Ausbildung – Participation in Education.

5. Nichterwerbstätige – Not in labour force.

So, for example, over the period 1995-1999, 80.5 per cent of workers who were in regular employment in 1995 remained that way by 1999, whereas in the most recent period 2010-2013, the proportion had risen to 83.9 per cent.

Workers stuck in Aytpical jobs increased dramatically over the entire period. In 1995, 49.6 per cent of these workers remained that way in 1999. But by 2010, 55.9 per cent were stuck in that category by 2013.

Further over the period the chances of an Aytpical worker transitioning to Regular employment fell slightly.

There was also inertia among the unemployed. Earlier 39.8 per cent of jobless workers would remain in that state after three years. By 2010-13, that proportion had risen to 46.1 per cent and the chances of exiting unemployment into regular employment had dropped.

It was more likely an unemployed worker would re-enter employment in an atypical job (such as a mini-job).

Conclusion

Overall, the DIW study reveals that while Germany has been able to expand its total employment rate (so employment has grown more quickly than the underlying population), the quality of work has declined and income inequality has risen.

Moreover, the incidence of poverty and severe poverty has risen sharply.

There has been a concerted attack on the German “middle class” as the distribution of jobs has polarised.

Fewer people now enjoy the benefits and security of regular employment.

More Germans are now vulnerable to precarious employment, income insecurity and single-income families in particular are exposed to a much higher risk of poverty.

It doesn’t look like a success story to me.

And meanwhile German capitalists are increasingly finding ways to penetrate Eastern European labour markets to hasten the attack on working (and living) standards in within Germany.

The big bully has built a house of cards for its own people. Crazy really.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

And they neglects their infrastructure because obsession with budget balance/surplus. But EU is not about the wellbeing of the European people, it has developed to an hydra that have its prime aim to derail the welfare states that the European nation states developed in the post war period.

It is totally incomprehensible why the left love EU, that Socialdemocrats in Euope abandoned its labour base is one thing, but that the more “hard core” left loves EU is a mystery. That Americans ain’t so well-informed about the world we have to leave vet with, but still the US lefts relentlessy attacks on Brexit is odd. As EU was the best thing since sliced bread, TINA for Europe.

Dear Bill

The percentage of Germans who earn less than 10 euros per hour is higher in France.

I don’t get it. Verfügbares Haushaltseinkommen is 20,955 on average, but Haushaltsmarkteinkommen ohne Renten is 23,813 on average. Why is the second figure larger? it can only be because it includes taxes. Haushaltsmarkteinkommen mit Renten should also include taxes. It is the verfügbares Haushaltseinkommen that has to be after taxes and transfers.

Regards. James

/Lars, many love the EU for other than economic reasons and the elites play on this. When I speak to people about the EU, economics is almost never mentioned. And when it is, the defects are seen as an unfortunate aberration. Sadly, it is the German elites who are masterminding the Euro fiasco. I am uncertain how widely understood this is among the general populations of the countries of the Eurozone.

interesting blog post,

another dimension to consider,in ight of the support of the status quo reflected in the re-election of

the political incumbents is the stable land prices and tenant favourable laws.

according to this date avg german only spend 25% of income on rent where as the rest of europe spend as much as 39%(i.e. uk and spain)-now data shows it is as high as 52 in UK,and 88%for under 24 yr olds

source:

Larry, I agree and I think this is to do with the disconnect between the economic policies of austerity and the patina of social liberalism draped over it.

people keep thinking that there is a ‘progressive’ EU waiting to be revealed under the neo-liberal one and that if we ‘stick in there’ it will come about.

We can see in the UK that Labour is tying itself in knots over this cognitive dissonance in stead of saying: ‘let’s get the hell out of this nightmare and create jobs/infrastructure/sustainable energy/social care/housing with out own currency.’

More and more people are just expecting this conglomerate to fall apart. Why to accept poverty when you can try to find ways to be more prosperous? Real wages are stagnated on a low level during these euroyears.

Isn’t the situation everywhere in the Capitalistic world, and not just in Germany and the EU?

The rich get richer and the poor get poorer.

Australia is hardly an egalitarian society, considering the legal tax-haven for super.

Is there any other country which exempts millionaires to pay any tax on their super income if they are over sixty.

Simon, they can do what you suggest without leaving the EU. In that respect, for the most part, the EU is an irrelevance.

What has been astonishing to me is how incompetent the Tories have been when there has been a crisis. May appears to have an unerring ability to make the wrong decision virtually every time. Davis also appears to have an unerring ability to misunderstand, and misstate, what has been said to him if it conflicts with what he thinks ought to happen. Then there is Hunt who has been unable to answer straightforward, albeit critical, questions about the health service and social care, and fumbling them like it was his first day on the job. And then there is the execrable, and unbelievably dim, Fox who seems to think a British tie is some sort of solution to a difficulty, no doubt aping the one he was wearing, blue with yellow dots evocative of the EU logo, when he made this ridiculous remark. You couldn’t make it up.

Also of interest. See the development of the labor force in East Germany compared to West G. http://www.ak-etr.de/index.php/id_166.html

Germany has implemented the neo-liberal path that has been so stupidly followed by all the main english speaking countries which is not surprising as the so called ‘Austrian School’ was one of the intellectual sources of neo-liberalism.

Germany however outsmarted the rest of Europe by implementing the eurozone which combined with their large manufacturing base and its elaborate support structure of advanced education, state supported R&D, patient capital, large globally based manufacturing corporations, a web of subsidies and incentives, low cost component suppliers in Eastern Europe and elsewhere, cheap loans for the rest of Europe to encourage consumption of German goods and economies of scale; which resulted in a net diversion of Europe’s productive capacity into Germany.

As Jake already mentioned Germany wisely did not go down the path of rampant property speculation like much of the rest of the developed world and so rentals have remained much more affordable but don’t hold your breath as with the neo-liberals in charge this scam to easily enrich the wealthy may also be implemented at some point. I suspect that asset stripping of underperforming corporations by rapacious profiteers was much less prevalent in Germany than in the U.S. as well.

The EU has provided a free trade zone that primarily benefited Germany while protecting German industry from even more competitive nations in East Asia. The best of both worlds but given Germany’s trade surplus with China, Germany will come under increased pressure to reduce the EU’s trade barriers. Given that nations like China can implement automation technology, innovation and R&D as effectively as Europe, the U.S. or Japan but also have the advantage of relatively low cost labour, lower government taxes and other imposed costs such as environmental protection standards; a moderate level of trade protection remains essential for European nations or ultimately all production will be outsourced to China or new players like India.

So the EU free trade (and external trade protection) zone is probably a good idea, the common European currency zone must however be abandoned so that weak trade performers can devalue and MMT style fiscal stimulus, compassionate social democracy and a Job Guarantee must replace all aspects of neo-liberalism. Reinvigoration of democracy at all levels, an effective, truthful and relevant mass media and an informed and engaged electorate may be needed first.

Bill and the other MMT economists know the solutions for full employment and much better living standards for all, but the rapacious corporate barons that hold all levers of power in our corrupted democracies and in the autocratic world like things just the way they are. Will the electorates of the world ever wake up and reject more neo-liberal poison before the democratic process is completely emasculated?

two cents from this side of the pond…..the problem is universal…..and endemic to our market-driven economies because of a flaw in capitalism–the inexplicable belief that the market can provide anybody wanting a job, with a job…it is pure BS…..

Council of Economic Advisers/Economic Policy Institute:

Unemployment [hereafter UE] has an adverse dollar impact on the market-UE eats into the bottom line…..and we know this by common sense, alone….we can’t have 10 million Americans looking for work-that can’t find any-without the loss of their income in the market having an adverse impact on the economy-but like some deep, dark secret we never talk about this loss, or have an independent economic index such as GDP to measure this factor on the health, or ill, of our economy-WHY? UE is a NO ONE WINS…..the jobless lose, civility loses [Ferguson, etc.,], and the MARKET loses, to wit:

THE LAW OF DIMINISHED INCOME TO THE MARKET FROM UNEMPLOYMENT [hereafter D/UE LAW]

3% is the zero-sum threshold above which unemployment triggers diminished labor training and skills, under-utilizing capital resources, reducing the rate of productivity advance, increasing unit labor costs, reducing the general supply of goods and services–and the loss in income to the Market is compounded exponentially with each percentage point of increase in unemployment, above 3%.

The solution proposed, here, is an expanding and contracting public workforce, that expands during downturns in the market, and contracts as the market recovers [AKA The Buffer Stock Employment Model]: THE NEIGHBOR-TO-NEIGHBOR JOB CREATION ACT [Amazon, hereafter NTN]: a Pro-Market, deficit-neutral, federally mandated Social Insurance [a condition of employment], to provide a fund to hire/train our UE, triggered at 3% UE per the “legal authorization” in Public Law 15 USC § 3101 [under NTN at no time would our UE rate in America exceed 3%]. Jobs beget jobs, and for a modest 4% of salary policy cost, NTN will create more “private-sector” jobs in 6 months, than our current path [HR 2847-The HIRE Act]–in 6 years!

Jim Green, Candidate for Congress, Dist 21, TX, 2000

Thank you for contacting the White House

Rent in the context used means superannuation or pension. The germans have many deductions from their gross pay. There is rentenvericherung (pension), krankenvericherung (health insurance), pflegevericherung (old age care). A big drag on agg demand and none really needed for such a rich nation. Gov does austerity while the 9% gdp external surplus goes direct to the 1%.

Jim, so true that mass unemployment is an inevitable shortcoming of a free market and a scourge that damages the whole economy and not just its unfortunate victims but why is 3% unemployment the upper limit before action must be taken? I think Bill would set the macroeconomic policy levers and his Job Guarantee Program to achieve close to zero unemployment and underemployment with just those transitioning between jobs or unable to work remaining unemployed, if he ever got the chance.

Germany along with the rest of the old ‘first world ‘ is

seeing generational economic decline for the broad masses .

Fiscal pragmatism(excepting the reality of fiat currency) alone

is no defense ,Japan has had the longest period of flat-lining wages

of all the OECD nations.

Andreas….I like the opportunity for “0” UE…I just don’t think it is realistic in today’s political climate-whereas 3% is workable-is 90% effective in getting to our goal…..maybe a generation or two down the road…..today, economists are all over the map on “full employment”….for instance, Ali Velshi, economic guru for MSNBC in the U.S. believes 5% UE is “full employment”-so from his perspective we currently have full employment in the U.S.-which I see as absurd! The harbinger throughout all of the countries in the OECD is the archaic belief that “The market can provide anybody wanting a job, with a job”-it is PURE BS-but until the OECD throws out this ERRONEOUS BELIEF in their job creation policies, the Eurozone will suffer with 10% plus UE, or the extremely oppressive 25% youth UE in Greece and Spain! The stumbling blocks standing in the way of our market-driven economies evolving, are 1] the entrenched belief that Job Creation should be addressed via the “market”….and 2] being blind-sighted in looking for alternative Job Creation-they are not looking for a solution, because they [erroneously] believe they have one….

james, the average household income which includes households receiving pensions (renten) is lower compared to only households having a regular income, because pensions are pretty low in germany. it has nothing to do with taxes.