My friend Alan Kohler, who is the finance presenter at the ABC, wrote an interesting…

MMT is just plain good economics – Part 1

On August 6, 2018, British tax expert Richard Murphy who is becoming increasingly sympathetic to the principles of Modern Monetary Theory (MMT) published a blog post, which recorded an exchange with one James Meadway, who is the economics advisor to the Shadow Chancellor John McDonnell in Britain. The exchange took place on the social media page of a Labour Party insider who has long advocated a Land Tax, which McDonnell is on the public record as saying will “raise the funds we need” to help local government. He called it a “radical solution” (Source). An aside, but not an irrelevant one. It reflects the mindset of the inner economics camp in the British Labour Party, a mindset that is essentially in lockstep with the neoliberal narrative about fiscal policy. Anyway, his chief advisor evidently openly attacked MMT as “just plain old bad economics” and called it a “regression in left economic thinking” which would ultimately render the currency “entirely worthless” if applied. He also mused that any application of MMT would be “catastrophic” for Britain. Apparently, only the US can apply MMT principles. Well, the exchange was illustrative. First, the advisor, and which I guess means the person being advised, do not really understand what MMT is. Second, the Labour Party are claiming to be a “radical and transformative” force in British politics, yet hang on basic neoliberal myths about the monetary system, which is at the core of government policy implementation. Astounding really. This is Part 1 of a two-part series on this topic, most of it will be summarising past analysis. The focus here is on conceptual issues. Part 2 will focus more specifically on Balance of Payments issues.

The British Labour Party has not crowned itself in glory in the last few weeks by proposing to consider adding a UBI to its policy platform.

As many commentators have pointed out the problem with this proposal can be summarised by just considering the party’s own title – Labour Party. A party that is concerned for the welfare and aspirations of workers who work and their dependents.

Why would a progressive ‘Labour’ party want to introduce a UBI to solve unemployment when in government it could always ensure that all idle labour is productively employed?

Why would a progressive Labour Party want to surrender to the neoliberal idea that there will never be enough jobs to go round when there is patently millions of jobs that can be created to serve community and environment if the government funds them?

I dealt with that issue in the following five-part blog post series (among other posts I have published on the topic over the years):

1. Is there a case for a basic income guarantee – Part 1 (September 19, 2016).

2. Is there a case for a basic income guarantee – Part 2 (September 21 2016).

3. Is there a case for a basic income guarantee – Part 3 (September 22, 2016).

4. Is there a case for a basic income guarantee – Part 4 – robot edition (September 26, 2016).

5. Is there a case for a basic income guarantee – Part 5 (September 27, 2016).

See also the Job Guarantee Category on the right-hand side menu.

So I won’t go back into that debate here.

But the fact that the Labour Party is going down this road is no surprise really given the sort of advice it seems to be getting.

As noted in the Introduction, the main advisor to the Shadow Chancellor has been involved in a rather revealing public spat with other economists and commentators in the last week about MMT.

The short social media debate seemed to smoke out the underlying views of the advisor (James Meadway) into the public domain.

I was aware of his views previously and addressed them when I spoke at the British Labour Party Annual Conference in Brighton last September.

I provided a video of presentation and Q&A in these blog posts:

1. Video of Reclaiming the State presentation, Brighton, UK September 25, 2017 (October 4, 2017).

2. Q&A from British Labour Party Annual Conference Event, September 2017 (November 3, 2017).

One of the questions in the Q&A section covers MMT and international capital and currencies, which I was told was motivated by the concerns expressed to the questioner by the Shadow Chancellor’s advisor.

Whether that is true is not something I know but the latest offering in the social media debate by that advisor sits squarely with the concerns expressed in the question I answered last year and have written about in many fora – blog posts, refereed academic journal articles, and published books – over many years.

We dealt with the issue of currency and global financial markets in detail in our latest book – Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World (Pluto Books, 2017).

There was a lengthy section on international finance and balance of payments in that book.

I also dealt with these issues in my 2015 book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale – in the context of what might happen to a Eurozone Member State that chose to exit and reintroduce its own currency.

The issues have been around as long as we have been working on the MMT project (early 1990s) and we have considered them in depth. But still they arise and the same errors in reasoning are always behind the claims by MMT critics.

There are those on the progressive side of politics that still seem to believe that global financial markets have exclusive power over a sovereign state that issues its own currency, which means that such a state has to ensure its economic policy position is supported by these market players.

Cap in hand is the expression.

In British Labour Party circles, that view goes back to the disastrous second Wilson government when Denis Healey fell prey to Monetarism and lied to the British people about having to borrow money from the IMF to keep the nation afloat.

I don’t wish to make this blog post a personal attack on the Shadow Chancellor’s advisor though. There are enough people doing that and I don’t consider that to be particularly helpful at this stage.

But the point is that he represents a very strong current that flows through the progressive side of the debate and continually reverts back to neoliberal (by which I mean in this context mainstream macroeconomics) precepts and misconceptions.

Those misconceptions then hinder the scope for thinking. I consider MMT has to some extent liberated thought because it exposes the ideological veil that these misconceptions are used to create.

So, inasmuch as I have quoted the Shadow Chancellor’s advisor, those quotes are just representative of the problem the Left has in comprehending macroeconomics and being able to distance itself from the neoliberal surrender that has seen social democratic parties crumble in electoral support and monsters like Tony Blair in charge of workers’ parties.

There is a lineage in the Shadow Chancellor’s advisor’s comments.

The Shadow Chancellor’s advisor was formerly working with the New Economics Foundation, which has made a habit of releasing, what to many look like rather progressive policy proposals, such as their proposal to solve unemployment by cutting the working week.

I dealt with that idea in this blog post – Britain needs more hours of work not less (January 10, 2012) – and demonstrated that the NEF was operating in a neo-liberal macroeconomic paradigm which distorted the options that they proposed.

They were worried that government could not expand “tax revenues to invest in health, education, social care, and other essential services” so other solutions to mass unemployment had to be sought.

In other words, fiscal policy is constrained so supply-side shifts have to be manipulated. That is a core neoliberal position to take no matter how progressive the policies that are being proposed might appear.

So there is no surprise that in the recent period the same advisor claimed that:

MMT is just plain old bad economics, unfortunately, and a regression of left economic thinking. An economy “with its own currency” may never “run out of money”: but that money can become entirely worthless.

Okay, lets think about that for a while.

Modern Monetary Theory (MMT) is just plain old bad economics

When I read that I wondered what plain new good economics might be.

By inference from the second sentence in the quote above it suggested some body of work that was about ‘money’ holding its value. Perhaps.

But, of course, the core MMT group has never suggested a currency cannot become entirely worthless. Of course it can.

Hyperinflation will do that in a domestic sense if nominal aggregate spending from any source (government or non-government) increasingly outstrips the productive capacity of the economy to respond by producing real goods and services. Inflation accelerating into hyperinflation then becomes the adjustment mechanism to this increasing excess aggregate demand.

Further, an ever-plunging (depreciating) exchange rate towards some infinite asymptote will logically do that in an international context.

Thus, in that sense MMT is fully cognisant that a currency can become, under certain extreme conditions, worthless. But equally, MMT tells us that a government would have to be acting in a ridiculous way for these conditions to persist to the point that the extremes were reached. More about which later.

So, the question remains unanswered. What is plain new good economics?

The other inference is that the advisor has been previously associated with New Keynesian type analysis.

Presumably, the ‘New’ bit means it isn’t plain old, but then that would be a misconception, because New Keynesian economics really reverts back to many of the propositions of pre-Keynesian (neoclassical) economics, which were categorically refuted during the 1930s, by Keynes and others.

In fact, New Keynesian economics is not really macroeconomics at all given that it overcomes aggregation problems and heterogeneous agents by assuming representative agency. A ridiculous fudge for those who want it in simpler language.

I considered the New Keynesian approach in several blog posts but this one will do – Mainstream macroeconomic fads – just a waste of time (September 18, 2009).

Even Marx knew in the middle of the C19th that many of the propositions that remain embedded in the current, dominant New Keynesian approach were flawed to the point of being useless.

And prominent economist, Willem Buiter, who is hardly a radical economist or an MMT proponent, was motivated to write in the Financial Times ((March 9, 2009 – now deleted but available here) – The unfortunate uselessness of most ‘state of the art’ academic monetary economics – that:

Most mainstream macroeconomic theoretical innovations since the 1970s (the New Classical rational expectations revolution … and the New Keynesian theorizing) … have turned out to be self-referential, inward-looking distractions at best. Research tended to be motivated by the internal logic, intellectual sunk capital and esthetic puzzles of established research programmes rather than by a powerful desire to understand how the economy works – let alone how the economy works during times of stress and financial instability. So the economics profession was caught unprepared when the crisis struck … the Dynamic Stochastic General Equilibrium approach which for a while was the staple of central banks’ internal modelling … excludes everything relevant to the pursuit of financial stability.

See also the blog post – ECB research provides a withering critique of mainstream macroeconomics (May 29, 2018) – which also provides further references along the same path.

So that seems to put the dominant mainstream approach to macroeconomics in the plain old bad camp.

Thus, the question remains unanswered. The most obvious conclusion is that the statement “MMT is just plain old bad economics” has no real foundation – it is just a put down to make the writer seem erudite.

In fact, as my MMT colleague Scott Fullwiler has captured in tweet form, there are several novel (that is, new) features that MMT has introduced into the economics literature that significantly improve our understanding of how monetary systems function.

These features are absent in the mainstream approach.

I expanded on that theme a bit (like a lot) in this series of blog posts:

1. Modern Monetary Theory – what is new about it? (August 22, 2016).

2. Modern Monetary Theory – what is new about it? – Part 2 (long) (August 22, 2016).

3. Modern Monetary Theory – what is new about it? – Part 3 (long) (August 25th, 2016).

The veracity of the arguments (both the tweet and the more detailed work mapping out the contribution of MMT) remains intact despite increasing attempts to criticise them by mainstream economists.

A logical conclusion is that MMT, in its current form, which clearly draws on many brilliant antecedents, and then adds new components, should be considered at the frontier of macroeconomics, while New Keynesian thinking is the degenerate paradigm (in the Lakatosian sense).

But there is a more important point and the Labour advisor reveals his ignorance when he talks about “MMT prescriptions” in the debate.

He wrote (see Richard Murphy’s blog post for verification):

Well, I disagree – in terms of what a genuinely radical and transformative Labour government would need to do on the economy, its prescriptions are close to catastrophic (for all that it has grasped some correct formal insights ahead of neoclassicism). Any country that isn’t the US trying to apply MMT’s prescriptions would find itself in the same position.

This appeared to be a poorly crafted paragraph. But the point we should focus on is the statement about the application of “MMT prescriptions”.

Exactly, what are those prescriptions?

Here we encounter a misconception that I have dealt with many times.

This short excerpt from a longer lecture I gave in New Zealand last year expresses the point succintly. The full lecture (54 minutes) is available – HERE – and traverses many of the issues that I am writing about now.

I have stated this point often but it still seems to escape the attention of many critics (and second-generation MMTers, for that matter).

MMT is not a regime that you ‘apply’ or ‘switch to’ or ‘introduce’.

Rather, MMT is a lens which allows us to see the true (intrinsic) workings of the fiat monetary system.

It helps us better understand the choices available to a currency-issuing government.

It is not a regime but an accurate perspective on reality.

It lifts the veil imposed by neo-liberal ideology and forces the real questions and choices out in the open.

In that sense, MMT is neither right-wing nor left-wing – liberal or non-liberal – or whatever other description of value-systems that you care to deploy.

I mean by that, that while MMT provides a clear lens for viewing the system, to advance specific policy platforms, one has impose a value system (an ideology) onto that understanding.

For the Labour advisor to talk about “MMT’s prescriptions” reveals he hasn’t fully understood that distinction.

The point is that MMT is what is. Britain’s monetary system is governed and operates under the principles outlined by MMT.

It is not a matter of moving to MMT.

By eschewing the discretionary use of fiscal policy and imposing fiscal rules one is not exercising ‘non-MMT’ policy options.

The MMT lens allows us to tease out and more accurately predict the consequences of such a policy choice.

But there are no ‘non-MMT’ policy options. That is not very well understood.

So when the Labour advisor talks about a state where MMT policy prescriptions are being chosen he is revealing his ignorance of these distinctions.

What he is actually referring to are specific policy proposals that have been advanced.

Which I can only deduce are related to the use of fiscal flexibility given that his supply-side agenda is hardly ‘tame’ – nationalisation, tightly controlled government procurement policies.

Clearly, British Labour have adopted the neoliberal position on fiscal rules and I will discuss this more in Part 2.

I have written extensively about why adopting such rules is poor policy and likely to be counterproductive and unworkable.

Just look what happened in the Eurozone when the GFC hit! The Stability and Growth Pact thresholds were blown out of the water just by the movement in the automatic stabilisers, much less any discretionary stimulus packages that governments might have considered or introduced.

Please see the following blog posts (among others):

1. Seeking zero fiscal deficits is not a progressive endeavour (June 18, 2015).

2. Jeremy Corbyn’s ‘New Politics’ must not include lying about fiscal deficits (September 15, 2015).

3. British Labour has to break out of the neo-liberal ‘cost’ framing trap (April 12, 2017).

4. British labour lost in a neo-liberal haze (May 4, 2017).

5. When neoliberals masquerade as progressives (November 9, 2017).

6. The lame progressive obsession with meaningless aggregates (November 23, 2017).

7. The New Keynesian fiscal rules that mislead British Labour – Part 1 (February 27, 2018).

8. The New Keynesian fiscal rules that mislead British Labour – Part 2 (February 28, 2018).

9. The New Keynesian fiscal rules that mislead British Labour – Part 3 (March 1, 2018).

But isn’t the Job Guarantee an ‘MMT prescription’?

Now, someone might pop up and claim that because I have argued extensively that the concept of a Job Guarantee is intrinsic to MMT then I am trying to have it both ways.

Isn’t the Job Guarantee an ‘MMT prescription’.

Which compromises the ‘lens’ bit, doesn’t it?

Again a deeper understanding of economic theory is required to understand the nuance here.

The employment buffer stock framework is intrinsic to MMT because it supercedes the various mainstream (including Keynesian) versions of the relationship between unemployment and inflation (the so-called Phillips curve), which historically was seen as the ‘missing equation’ in the standard macroeconomics, linking the product market to the labour market and the real economy (output and employment determination) to the nominal economy (price level determination).

I know that is a mouthful and probably meaningless for non-economists but it is for the record and if you are curious you will explore the idea further.

Then you will: (a) understand the intrinsic nature of the Job Guarantee to MMT, and; (b) you will never again say that the T in MMT is redundant.

Sure enough there are descriptive elements of MMT like any body of thought. So at one level, the sectoral balances framework is just an accounting record. But linking the elements within that record has to be theory in order of us to make sense of it and to use it in a diagnostic and predictive manner.

So, while the Job Guarantee superficially appears to be a policy prescription, which would suggest that MMT is more than just a superior lens through which you can understand how the monetary system actually works and better appreciate the capacities of the currency-issuing government, the reality is that if one establishes that ‘economy’ is about the elimination of inefficiencies, then the choice between the two price stabilising realities:

(a) a NAIRU unemployment buffer stock system; and

(b) a Job Guarantee employment buffer stock system, is a non-choice.

Only (b) is closer to being efficient, given the massive wastage of income and human potential that arises.

So the Job Guarantee is much more than a simple ‘policy prescription’.

It is an essential component of a macroeconomic stability framework, a point that is lost on many, who only construct it as a job creation program.

I discussed that aspect of MMT in the blog posts (cited above (3 part series ‘What is new in MMT’).

That macroeconomic stability device is the MMT answer to the Phillips curve, which no economist would say is not an intrinsic theoretical device in mainstream macroeconomics.

The fact that the Phillips curve, as a theoretical device, is then used to offer policy options (or not), is beside the point.

Theory typically has a praxis attached to it. Otherwise why would we bother.

And even if we take the view that an employment guarantee is a policy prescription rather than something more theoretically intrinsic, does the Labour advisor truly believe that a national government that introduced a Job Guarantee would see its currency dropped by speculators to the point of it becoming worthless?

Why would they do that?

Did they do that at the time of the GFC when fiscal deficits rose many multiples what they might do in the first year of a Job Guarantee?

No.

He might be trying to claim that a Job Guarantee would alter the balance of power between capital and labour and thus represent a paradigmic challenge to the capacity of business to make profit.

He might in the same breath cite the great article by Michał Kalecki from 1943 which I examined in some detail in this blog post – Michał Kalecki – The Political Aspects of Full Employment (August 13, 2010).

This is a favourite of what we might call the neoliberal Left who, in their paranoid belief that global financial markets are all powerful and reduce currency-issuing, sovereign governments to mendicancy status, try to proffer ‘evidence’ that business will close down any government that dares aspire to attain full employment.

Well, historically, Kalecki was proven wrong in this regard. For three decades after his article was published governments successfully sustained true full employment despite the resistance from some quarters of the industrial capitalist community.

Where were the capital strikes? And all the rest of it.

Sure enough, in the 1960s, there was currency instability as the Bretton Woods fixed exchange rate system was finally giving in to its inherent inconsistencies – well summarised by Robert Triffen’s Paradox – where the US had to supply US dollars and thus run large current account deficits, which in turn, led to fears that the dollar would fall in value.

But that currency instability was linked to the exchange rate arrangements not the fact that most nations were running continuous fiscal deficits over this period to support income growth and satisfy the desires of the non-government sector (especially the private domestic sector) to save overall and thus sustain aggregate spending at levels consistent with full employment.

I also considered his claim that the full employment aspirations of a government would always be undermined by capitalist resistance in an article I published in the Journal of Economic Issues in 1998 – W.F. Mitchell (1998) ‘The Buffer Stock Employment Model and the NAIRU: The Path to Full Employment’, Journal of Economic Issues, 32(2), 547-55 – Download.

There is no doubt that there was resistance from capital during the full employment decades following the Second World War.

But the thirst for social democracy was so powerful that governments were able to countervail that resistance. Politically, the idea that a nation could sustain vastly elevated levels of labour underutilisation just didn’t cut it in these periods.

Conservative and Labour governments alike were forced by public sentiment to prioritise full employment.

It was not until the Monetarists emerged and circumstances allowed the ideology associated with those economic ideas to begin its four or so decade domination that public sentiment changed.

But the change came from a massive misinformation campaign assisted in Britain by the Labour politicians that had become infested with neoliberal ideas, if not ideology. They were duped by the Monetarist claims into abandoning social democratic policy positions.

And then Thatcher, Major, Blair and so on followed in the same deceptive manner.

Capital resists impingement on their profits, it abhors the idea of sharing national income with workers, but it has to work through the legislative domain of the nations it operates (produces and/or sells) in.

Moreover, in the contemporary setting, when I explain the concept of a buffer stock of employment to hard core business types, who aren’t posturing for political purposes on the public stage, they are uniformly supportive.

Why?

They see it as a way to reduce hiring costs because the workers have not become dislocated from the labour market in the same way as the long-term unemployed become.

Teaser to Part 2 on Monday

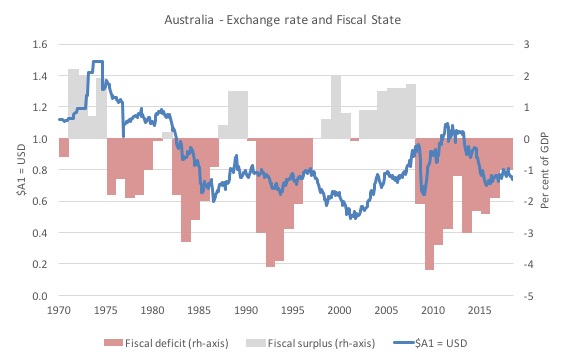

Consider this graph, which shows the Australian dollar exchange rate against the US dollar from 1970 to 2018 (using left axis) and the Federal fiscal balance over the same period (using right axis).

For clarity I separated years that the Federal government was in deficit (red bars) and years it was surplus (gray bars). The other point to note is that the fiscal data is for fiscal years, while the exchange rate data is monthly.

To provide concordance I just assumed that the fiscal balance for each fiscal year (July-June) was the same in each month of the corresponding year to allow me to map annual data into monthly space. That is why the fiscal data is very block-like in appearance.

It doesn’t distort the general point however.

Australia is a small, open economy, which also has most of its trade defined by primary commodity exports and advanced manufacturing imports.

It is not like a nation that exports industrial goods, which tend to have more stable prices on international markets. Primary commodity prices fluctuate dramatically, often quickly and in unpredictable ways.

For example, Australia’s terms of trade fell by 13.3 per cent in the five quarters to the June-quarter 1986 (agricultural and mineral prices fell sharply). Australia’s GDP fell by around 10 per cent in the March-quarter 1986 as a result because export volumes were suddenly selling at much lower prices.

So Australia knows a lot about currency instability and shifts from an Australian dollar buying 50 cents US (or equivalent in other currencies) in one period to near parity in the next without any other major change in policy or economic structure being the cause.

The point of the graph is that you will see no particular relationship between our exchange rate movements, which are largely driven by the terms of trade movements in the primary commodity markets, and the fiscal position adopted by government.

You will see that in the period that the Federal government was running ever-increasing surpluses, the exchange rate fell to its lowest levels in the modern (fiat currency) era.

And at times when deficits were rising, the currency was appreciating and other times, when in fiscal deficit, the currency depreciated.

And you can see that for the vast majority of the period shown, the Federal government was in deficit.

I could extend the period if there was comparable data and the story would not alter.

If I used another nation, the story would not alter.

In fact, there has never been a statistically robust relationship found between the fiscal conduct of a currency-issuing government and the movements in exchange rates.

So why do the Left immediately rehearse their paranoia that a currency will be rendered worthless via exchange rate sell-offs by the speculators, when it is proposed that a nation runs a fiscal deficit and uses that net spending to support non-government saving desires, sustain full employment and build productive infrastructure?

Conclusion

On Monday, I will consider how currencies become worthless (or not).

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

Does this mean that the UK won’t be getting back £350million regularly to use for the NHS as Jeremy Corbyn said? Oh and others.

Thank you. Brilliant article!

It is becoming very clear ro me that Left wing economists in the mainstream are always pleading as if they are trying to sell something like a used car salesman. Walking on egg shells not wanting to upset anybody.

Right wing economists say this is what the BOE will do and this is what the banks will do and we are going to do this and that and we don’t care what you think about it. We don’t need to sell anything we are just going to do it.

Mainstream Left wing econ try and fit their theories into the current structure laid out to them by the FIRE sector.

What they should be doing is saying NO !

This is what we are going to do with the banks and the central bank. We are going to do X and then Y and add on Z.

Everything seems to be to appease the banking class. Now is the time to change that and the first thing to do is reverse Masstricht and the changes they made to the BOE

https://publications.parliament.uk/pa/cm199900/cmselect/cmtreasy/154/cor15402.htm

I’m not sure why mainstream left wing economists are always walking around with a white flag and float around as if they are trying to sell the big issue.

Is it to do with departmental funding, speaking tours, book sales and posts they can get outside of their class rooms ????

As they write their economic theories for those who have the money instead of those that don’t.

Dear Bill,

A great riposte, which will, hopefully, help the message to permeate through to the current Labour leadership.

Meadway clearly hasn’t understood, or wanted to understand, MMT – but in the priceless words of Upton Sinclair: ‘It is difficult to get a man to understand something, when his salary depends on his not understanding it.’

To be (undeservedly!) fair, it must be very hard to have to reverse everything you have professionally believed in a career, and some people are obviously unwilling to even consider that they may have been badly educated, backed the wrong horse as a result, and change path accordingly.

Re: “So why do the Left immediately rehearse their paranoia that a currency will be rendered worthless via exchange rate sell-offs by the speculators, when it is proposed that a nation runs a fiscal deficit and uses that net spending to support non-government saving desires, sustain full employment and build productive infrastructure?”

Perhaps we have to reluctantly wheel out the “No True Scotsman” argument: That those who subscribe to that way of thinking are not, in fact, on the Left at all?

Best, Mr S.

“There are those on the progressive side of politics that believe that global financial markets have exclusive power over a sovereign state that issues its own currency, which means that such a state has to ensure its economic policy position is supported by these market players.”

Nails it for me and everything mainstream left wing econ do is to appease to that power. Like a bunch of priests at an alter worshipping a higher power.

Dear Mr Shigemitsu (at 2018/08/09 at 7:43 pm)

Thanks for the edits. I deleted a bit of your comment that covered them but I am grateful.

I was rushing (as usual) today after a long flight.

best wishes

bill

No worries! : )

Derek Henry are you trying to say that austerity and neoliberalism are not a religion?

Derek, you correctly write:

‘I’m not sure why mainstream left wing economists are always walking around with a white flag and float around as if they are trying to sell the big issue.’

I think this is because the bar is always set higher for the Left because the Right, when it screws up, uses the excuse that it’s the market as if it were a non-human agent like a weather system but when something negative happens on the Left’s watch it’s ‘their fault’ because Government is ‘always bad.’

This has lead to an unnecessary, partly subconscious, supplicatory stance. Especially so after neo-liberalism has become mental wallpaper. As you say, they need to stop. Mass therapy to improve self-esteem?

Mr S, Meadway is in a bind. Even were he to believe that he should espouse something along the lines of MMT, which in fact he does not, McDonnell either would not let him or would not have hired him in the first place. McDonnell is the real problem here. He got his chops doing microeconomics for the GLC. And most of what he is doing is carrying his micro understanding into the macro domain. Additionally, he appears to be either unwilling or unable to change his views in his newer economic environment. I don’t get the impression that Meadway is advising McDonnell. Rather, I see Meadway operating as McDonnell’s mouthpiece, thereby providing McDonnell a fall guy should it all hit the fan.

There are rumors that McDonnell is positioning himself to replace Corbyn should the appropriate circumstances arise to facilitate this. This may render him even more rigid in his economic views, in part because of the Blairites in the party.

His unwillingness, if that is what it is, is not due to lack of information. A number of us, some in the UK MMT group (some of whom commented on the Murphy blog post), have sent him MMT related articles and blog posts. None of this seems to have had any effect. He wrote to me once to say that he got MMT, but then flatly contradicted this statement a few days later. In my view, he is hopeless, but Corbyn will not replace him.

Simon, therapy for the masses will be resisted and will not work for the individuals in question. Maybe the only way to stop them is to make them an offer they can’t refuse. So to speak.

Regarding McDonnell’s comment that land tax

‘will “raise the funds we need” to help local government.’

The word ‘local’ means this statement taken is, at least in isolation, not necessarily inconsistent with MMT.

McDonnell’s advisor was completely straw-manning, claiming that MMT doesn’t acknowledge currency debasement and inflation.

The starvation of local governments via austerity from central government was/is of course unnecessary and counter productive, will Corbyn and McDonnell continue down this path? It seems unlikely.

And at the same time any shift in policy towards LVT would undoubtedly increase the efficient use of real resources (particularly when compared to the dismal and regressive council tax), this would in turn lower the total public debt necessary to maintain full employment (relative to what it might otherwise be, if not absolute).

bill,

I may be wrong, but I think that when you claim that “100 dogs running into the field and only 94 bones are buried there” or when Warren Mosler claims that the creation of currency brought the possibility of unemployment, you were just trying to describe the real world as it is: if government spending is not high enough, there will be unemployment.

However, I believe that the JG is just one of many policy proposals to solve the problems you described above. There could be other interesting solutions, maybe even better than the JG. For example, the government could discretionary spend in underutilised sectors. Maybe it didn’t work before because keynesians did not had the MMT’s superior monetary understanding at that time. Maybe some people in the right-wing political spectrum would propose some kind of public-private partnership to end unemployment, I don’t know. Some far right may even propose that a war to Iraq is the best solution for unemployment, who knows? Those are all policy proposals (prescriptions) like the JG is, in my opinion – and some have potential to be even better. When MMT gets spread all around the world (I hope) I guess we will see many, many other policy proposals.

That’s why I personally classify the JG at the “prescription” side, not the “description” one, and I think that it makes difference for the debate, but, again, I may be wrong.

It feels to me that JG cannot be the only, natural solution for the problem, as if natural/economic “laws” described that the JG is the single adequate policy. Maybe what is an economic “law” is that without enough government spending, there will be unemployment, and the JG proposal gets confused with that “law”, I don’t know.

(Of course, at the end of the day, even the descriptive side is theory, as everything in science is, but it is a theory much more supported by real world evidence than the orthodox theory is).

You speak a lot of truths Larry and I agree that John McDonnel’s intransigence is a real roadblock. His microeconomic ‘understanding’ at the GLC caused his fall-out with Ken livingstone and I can see that the same ‘understanding’ persists. Similarly, his rejection of Keynesian solutions long precedes his current position as shadow chancellor.

Having heard James Meadway speak on a number of occasions, it is clear that he is trying to find ways through mainstream economic models to curtail the City and rectify what he sees as the structural problems of the UK economy. I am quite sure that he has exemplary intentions… but his hands are rather tied

In addition, I remember John McDonnell in a meeting mentioning the UBI whilst also acknowledging that James Meadway was not convinced that it was a good idea. James Meadway’s face suggested much stronger opposition. As you say, he may well be in a bind of John’s making.

I’ve wondered whether Labour’s proposed “National Education Service” could actually provide all the macroeconomic functions hoped of a JG. The National Education Service in its strongest form would be free education with bursaries for people of all ages and include non-academic vocational courses. If someone was out of work, they could join a course to learn whatever skill they thought might suit their aspirations whether it be construction work, or hairdressing or programing or whatever. If people are receiving a bursary to do that, then isn’t that in effect a JG job?

In general, I’m a huge fan of John McDonnell. I’m not so worried about his lack of engagement with MMT though I welcome your efforts to reach out to his team. If we have very progressive spending and tax policies, then there will be much less need for deficits won’t there because it is the rich who have a high propensity to save and it will no longer be them who is getting the money? McDonnel is proposing lots of investment and his “fiscal rule” (from Simon Wren Lewis) allows deficit spending for investment and deficit spending in general when interest rates are at zero and yet stimulus is needed (I’m no fan of this rule BTW). In the context of highly progressive tax and spending realignments transfering from rich to poor and more importantly dramatic trade union power increases (sector wide collective bargaining) -my impression is that “fiscal rule” would nevertheless be compatible with full employment policies. Please correct me where I’m wrong in this.

Simon,

It is not good enough the mainstream left instead of walking around with a wishbone they should get a backbone

stone,

“The National Education Service in its strongest form would be free education with bursaries for people”

“If people are receiving a bursary to do that, then isn’t that in effect a JG job”

Well, here we have yet another proposal to solve unemployment and price instability, and it seems very interesting. I don’t know wheter it could be called “JG”. I guess it is very similar to JG, but I think you couldn’t call it JG, because you would not be giving an actual job to the unemployed, and there could be real consequences there, I don’t know…

I don’t know whether McDonnell is an advocate, but Corbyn has advocated a version of a land value tax and the Labour Land Campaign that advocates this approach to taxation seems to me to be redolent of the taxation ideas of Henry George.

This seems to me to be a retrograde step and an instance of Labour adhering to the belief that taxation is needed for government spending, which fits with their notion of book balancing. I don’t know anyone involved in this campaign so don’t know how central this idea is to their main program.

“I’ve wondered whether Labour’s proposed “National Education Service” could actually provide all the macroeconomic functions hoped of a JG”

One other thing a Job Guarantee does is enforce a minimum wage, not effected by regulations, complaints, tribunals, etc., but effected in the most direct way possible — by paychecks.

I think the big private-sector actors have a strong reluctance to pay people for anything. This would make the 100 dogs / 94 bones narrative accurate regardless of initiatives in education.

stone,

“The National Education Service in its strongest form would be free education with bursaries for people”

“If people are receiving a bursary to do that, then isn’t that in effect a JG job”

To an extent yes, but I think that’s putting things back-to-front. Undertaking education or vocational training is often cited as being suitable for a JG job (including I think by Bill in the past) – and could be very popular and beneficial for some people, but it wouldn’t be suitable for everyone. Some people might prefer an ordinary run of the mill, get-on-with-it-and-do-it job. From the other perspective, a lot of the work that could be usefully done towards communities wouldn’t necessarily require much training/education (eg maintaining local parks), and thus would be excluded from an NES.

So if you want to see education bursaries paid at a living wage, better to argue for that in a JG framework, than try and shoehorn a JG arrangement into an NES.

“there are no ‘non-MMT’ policy options.”: I’ve added that one to my list of favorite Bill Mitchell quotes. It’s quite a powerful statement really, highlighting the fact that MMT is foremost a collection of irrefutable facts about the nature of money and fiscal policy as instruments in the exercise of political will.

Economically speaking, things are as they are, for better or worse, mostly by human design and not by as yet undiscovered acts of nature.

@Stone,

I like your National Educational Service analogy to the JG.

@DerekHenry: Love the “wishbone”->”backbone” comment. 🙂

Re: McDonnell: One of his Shadow Treasury team is one of our local MPs. I sent her a copy of “Reclaiming The State”. I don’t suppose she read it though.

Re: The GBP going through the floor because of “MMT”, the headline in the Guardian this morning was : “Pound slides as no-deal Brexit fears prompt global selloff”.

So, thanks to the Tories making a complete

bollocksHorlicks of Brexit, the pound is going to be so low soon that I doubt if “MMT” or anything else could make it sink much lower.I seriously think that the Tory government is going to realise at some point that they have made such an irrevocable mess of it all that they’ll contrive an election which they will make sure they will lose and leave Corbyn to try to pick up the pieces.

Larry, I’m not sure if you intended to imply from your last comment that taxation is not needed at all?

For as Richard Murphy points out, there are many reasons for having taxation that have nothing to do with funding government spending. One of his recent blog posts summarises the main ones:

http://www.taxresearch.org.uk/Blog/2018/06/12/achieving-fairness-in-the-tax-system/

Stephanie Kelton also mentioned a few of them here:

”You don’t tax the rich because you need their money in order to feed a hungry kid or fix a crumbling bridge. You tax the rich because they are too damn rich and extreme concentrations of wealth especially, but also income, are bad for the functioning of the economy, are bad for democracy. That’s the rationale for taxing the rich. Not because we can’t do other things unless we get money from them to pay for it.”

I believe John McDonnell is strongly supportive of LVT and has been a long time member of the Labour Land campaign.

It is true that the Labour leadership and their advisors haven’t grasped, or are not yet prepared to admit, that taxation is not needed to fund govt spending. But this doesn’t mean they should not propose improvements to the taxation system.

@Larry,

Depending on how it was implemented, I think there might be some merit in a Land Value Tax that was levied locally, and able to be spent locally by the local authority, to supplement what they get from council tax and business rates, given that they are a user of currency and not an issuer of currency.

Of course though, the cuts in central government grants to LA’s should all be reversed, and grants generously supplemented where appropriate.

I can’t now remember the details of what Henry George proposed; I can remember not liking them much when I actually read them, although the principle seemed reasonable enough on the face of it, i.e. that a landowner should not be able to profit from increases in the value of his land to which he has not contributed at all.

J Christensen,

“MMT is foremost a collection of irrefutable facts about the nature of money and fiscal policy as instruments in the exercise of political will.”

Would you consider that the JG proposal is an irrefutable fact about the nature of money and fiscal policy? Or would you consider that it is one of many refutable policy proposals? I cannot avoid thinking that the second option seems more adequate…

I love the posts where Bill gets angry. Not sure the title of this one is such a good idea though. And waiting for Monday for the next installment is going to be difficult for me. I guess I can reread the thirty or so posts that are linked to in this installment. That will keep me busy for most of that time.

Andre: While there are other ways to generate employment, some ideas are just better than others, and it’s doubtful that without a policy directly aimed to producing full employment (JG), full employment at a living wage with it’s ability to stabilize prices could be achieved.

Things like public-private partnerships, have already been tried, the military-industrial complex being among the worst, end up simply providing a means for certain private interests with no good public purpose in mind, to feed directly from the money issuer, while others are given nothing, like the runt pup unable to find a teat to suckle nourishment from, or the minimum of 6 dogs who do not return from the field with at least one bone, in the example above.

A major obstacle for democracies delivering on the broader public good, is the cloud of engendered ignorance that shrouds most people from an understanding of the underlying realities, making them quite vulnerable to undemocratic manipulations, favoring outcomes which are not to their own benefit. The encapsulation of the rules by which sovereign money works within the body of MMT, makes it an indispensable tool for the promotion of functional democracies.

Bill,

When MMT says the stability and internal value of the currency is paramount (as you do above) it doesn’t seem to be convincing to MMT’s critics. That’s the core problem for MMT, particularly when, the same sentence extolling the virtues of maintaining a stable currency, contains the phrase “deficits don’t matter”. The neoliberal bells begin to clang. MMT is on a hiding to nothing.

People with money (not only Big Money but also Small Money) just don’t trust governments. That is the reality. History is on their side. And there is no need to recite the usual historical episodes of currency debasement that are brought to attention at this point (whether valid or not). MMT will have to work hard to get traction.

You say above that MMT is apolitical – it is merely a fundamental way at looking at the functioning of an economic/monetary system – which it is. Yet you spend most of your time kicking neoliberal heads and arse. Nice sport but I can’t see it getting results, i.e. selling MMT to the masses and the elites for that matter. All it does is expand the divide. (Perhaps the divide will never be bridged or is even unbridgeable.)

Sometimes reading your blogs, it is difficult to disentangle the political invective from the economics. It’s clear that the majority of your readership is happy to join you in kicking heads. Some, I would say, would be happy to shut down the foreign exchanges and close the ports and join the other hermit kingdoms of the world. 🙂

I think the economics of MMT is interesting. Personally, I would rather spend time reading how MMT works rather than trudging through paragraph after paragraph of politics. There’s enough of that elsewhere. Perhaps I should stop reading your blog and wait for your new textbook that’s coming.

Bill,

“In fact, there has never been a statistically robust relationship found between the fiscal conduct of a currency-issuing government and the movements in exchange rates.”

Forget the statistically robust relationships.

Looking at your chart, it is pretty clear that the three periods of consistent surpluses do coincide with a rising currency.

And during the long period from 1970 to 2002, the decline in the currency coincided with periodically increasing deficits. But of course there were other things at play, mainly the destruction of Australia’s manufacturing industry during this period.

How much of the rise in the currency from 2002 on is due the the Howard/Costello era surpluses is moot. This period coincides with the rise of China and Australia’s deepening economic relationship with China and the resulting mining boom.

And from 2008 onwards, the falling deficit has coincided with a rising then falling currency.

I would say it is difficult to make a case one way or the other.

Andre: I tend to view the JG from a control systems perspective. Other methods would lead to less precise (and more wasteful) control for the two variables for which the JG is proposed , full employment and price stability. It’s an elegant solution for what can and has in the past been a messy and complicated problem.

The problems of unemployment and inequality have been recognized for sometime now, since neoliberal ideology took hold of policy developers; mainstream economics seems devoid of any answers.

Dear Bill

This is a cogent refutation of nominally progressive policy positions.

May I make a suggestion for extra work that you could pile on to the already groaning weight of the sterling contributions that you make as an academic and public intellectual and all-round exemplary human being?

I would love it if your website kept track of the current Australian fiscal deficit, the preferred deficit (to achieve loose full employment via a Job Guarantee), the output gap. Then at a glance people could grasp the immense non- inflationary fiscal space available to the federal government.

You could add a note that describes your assumptions and reasoning – for instance, a conservative estimate of the fiscal multiplier that would derive from the net injection into the domestic private sector.

If you have the capacity to get by on negligible sleep, perhaps you could maintain similar dashboards or tracking displays for the United States, the United Kingdom, and Japan.

Best wishes

Nicholas

No, those policies by themselves would still leave a large amount of labour wastage. It is necessary to target spending directly at creating jobs for everyone who wants work and isn’t getting it from the private or regular public sectors. That’s what a Job Guarantee is for. Generalised fiscal stimulus aka pump priming won’t ensure that everyone who wants work, including the long-term unemployed, will get work. That is because employers do not want to hire the long-term unemployed. The policies that you’ve listed would reduce inequality of income to some degree but they wouldn’t achieve full employment. Only a universal and unconditional offer of a minimum wage job can achieve full employment with price stability.

Oh dear, MMT is merely a lens on how humans conduct economic matters is it; just like Amiens was a lens on how humans conduct warfare, except that it was also a practical example of (ramshackle) theory put into effect.

Its enormous slaughter reduced mankind to utter wretchedness before the benefits of scientific, technical and social advancement flowed forward to lift humanity to unprecedented levels of welfare.

Its time now to rise above the disparagement inherent in MMT’s condemnation of alternative economic principles; a war that has been going on ever since the advent of the industrial revolution; or are we to sink into ideological open conflict before humanity once again rises above the creative destruction that ruins nations, families and individuals.

Generalised (i.e. untargeted) fiscal stimulus is also more likely to be inflationary than the JG, and other “MMT-aware” measures.

Bill talks about the JG providing an employment buffer-stock of workers, in contrast to the stock of unemployed workers that exists under conventional/neoliberal economic policies. Unemployment is also a tool used by the unenlightened (or the downright evil) to force or keep wages down & to discourage trade union membership and union / worker militancy. As demonstrated by Thatcher in the 1980s.

J Christensen,

“Other methods would lead to less precise (and more wasteful) control”

Would them? Is there hard evidence on that? Wouldn’t it be more wasteful to create a broad JG program that could generate many inefficiencies and also be assaulted by misguided politicians? Wouldn’t it be better to target directly some sector or some projects, like building more schools or maybe more railroads, even if policymakers were not so quickly responsive? Or wouldn’t it be better if a well done, novel public-private partnership, designed with the right incentives, was built? Or wouldn’t it exist any other alternatives? I mean, the fact that we are not creative enough to think about alternatives does not mean that the JG is the best one, isn’t it?

I genuinely do not have answers for those answers, and the problem is that I believe that the MMT community also do not have. That is why I do not take the JG from granted, and I do not believe that it is a hard fact that the JG is the best solution (opposed to the hard facts that dollar is not convertible to gold, that currency is issued at will by the government, that lack of government spending leads to unemployment etc). That is why I believe that the JG is part of the “prescriptive” side of MMT, not the “descriptive” one. Descriptions are related to hard facts – you just list or describe them as they are. Prescriptions are related to yet doubtful paths. I don’t know, I may be wrong, but that is what is going through my mind.

Andre, I believe that one of the features of a Job Guarantee is that is hiring ‘off the bottom’ for mostly unemployed labor for which there is already no or little market. And therefore not competing for mostly already employed people with the private sector which is what Keynesian fiscal stimulus sometimes amounts to. Which is one of the ways a buffer stock of employed people can be less inflationary than ordinary government spending. In any event a Job Guarantee is a public/private partnership. People working at a JG job do not suddenly stop being private citizens.

But I agree with you that this descriptive/prescriptive debate is weird. MMT may very well describe how the economy and the government already interact and work in the US. But if I wanted to look for my local JG program office I doubt I will find it. Maybe someone can describe its location to me- that would clear the issue up for me at least.

Jerry Brown,

“In any event a Job Guarantee is a public/private partnership. People working at a JG job do not suddenly stop being private citizens.”

I was talking more about something like the AmWorks program in the fictional House of Cards series. It is something like the government pays private companies who employ people under some circumstances. It is very vague, but something like that could work, I don’t know. The general message is that maybe there is some kind of program that the government can develop to make private companies employ what otherwise would be unemployed people, but I don’t have any good detailed ideia in mind (but I bet a lot of people would formulate one ideia quickly if they could understand MMT and think a little)

A light hearted view of aggregate spending and targetted employment policies for the weak.

https://medium.com/@michael.a.berks/effective-vs-aggregate-demand-i-say-tomato-you-say-728f9827ca7f

Excellent blog. A new insight for me was that New Keynsian is not macro economics at all because it resorts to representative agents. Who are perfectly rational optimisers!

Thanks Bill.

@Henry Rech

If “people with money don’t trust governments” why do they own so many Treasuries?

The MMt job guarantee is not descriptive as it does not exist.

Of course you can argue it is the best available inflation control policy

but that is prescriptive.The lens cannot see what is not there!

On currency depreciation of course speculators will attempt to make money

on currency markets if a government were direct about monetary soverignty

but so they would if Corbyns labour party were elected without a mmt

understanding or if a country leaves the EU. It is what parasites do!

Michael Berks: Loved the gardening analogy!

For those who do not like the lens analogy, there is an alternative. In analytic philosophy terms, MMT is a descriptive theory as opposed to a normative theory such as the original version of game theory. For von Neumann and Morgenstern, game theory did not describe how people played but rather specified what a player needed to do to win or draw, that is, what the winning strategies were in a given setup.

Going back to MMT, a descriptive theory is in principle falsifiable by empirical evidence. That is, if the theory specifies that what ought to be the case either does not take place or does not exist, then the theory has failed to be corroborated in this instance and may be on the road to falsification. So far, MMT has met all empirical tests and remains well corroborated. This is not the case for the mainstream neoliberal/neoclassical theory. Even its basic assumptions do not pass critical empirical scrutiny.

MMT is the most fully developed and best corroborated alternative to the mainstream theory there is.

For-profit firms should not be permitted to use JG workers. That would turn the JG into a wage subsidy scheme that would weaken workers’ bargaining power and encourage inefficient business practices. Involving for-profit firms in a JG would defeat a core feature of a JG, which is to avoid displacing private sector activity. The whole point is to provide jobs to those workers whom the private sector does not want. When private sector demand for labour picks up, some JG workers will move from minimum wage jobs in the JG workforce to higher paid jobs in the private sector.

Kevin Harding

‘Of course you can argue it is the best available inflation control policy

but that is prescriptive.’

Indeed, and I’m not convinced it (JG) is. and considering this was originally a reference to McDonnell’s advocacy of land tax it is worth considering the evidence of land tax vs inflation.

One case in relatively recent history is Denmark’s brief experiment 1957-60 where they more than doubled their (still operative) land value tax rate from 1.2% to 2.6%.

Speculation stopped before the change was even in place, core inflation fell from 5% to 1%, IR’s were lowered. The economy improved markedly and voter satisfaction was high.

Sadly the property lobby succeeded reversed the policy and the coalition fell, inflation quickly rose to 7%.

This makes sense, today in the US 42% of CPI inflation is rental and mortgage repayments, by far the largest core component. So whilst land rent is not the only rent-seeking in the modern economy, it is by far the most significant and a large driver of inflation (rather than wage rises themselves).

Again, I doubt McDonnell really grasps MMT, or even LVT that well, but it’s better to be right for the wrong reasons.

Bill,

When it comes to a Job Guarantee, is the question of “What jobs” not important? If the jobs created do not commensurately increase the goods and services available on aggregate, would the money spent to fund them not be inflationary? Would not paying for people to dig holes and fill them in again be way less valid than paying people to fill in potholes in the road so that driving becomes more efficient?

And in that sense, is there not a nugget of truth in McDonnell’s insistence that deficit spending can only be considered for investment, albeit his very narrow definition of investment?

I’m not sure the UBI or the Land Value Tax need to be seen as in conflict with MMT.

The Land Value Tax is partly hoped to help ensure effective use of land and affordable housing by converting land from being a convenient saving medium for storing wealth into being an ongoing cost that people will only pay if they currently need it. Currently people buy property in eg prime central London in the expectation that should they need that money in the future, they can sell up at a profit. That phenomenon pushes home prices (and many workplace rents etc) beyond what makes any sense. By contrast, with a LVT, we would get a less distorted market choice as to how land was allocated.

I also think it is far preferable to pool LVT from across the nation rather than spending it locally. It is areas that are in decline that will have worthless land and those are the areas that need an injection of spending. Rather than having people move to where there is money, it is better that the money moves.

The UBI is not necessarily a capitulation to the idea that we can’t have full employment. It can alternatively be seen as a way of ensuring that everyone has some measure of financial freedom and that in doing so it can improve the economy and society. Many/most businesses and cooperatives start off with the benefit of founders who have some savings of their own or personal contacts who support them whilst they are getting things off the ground. I know that was the case with both my sets of grandparents who had relatives and friends who mortgaged houses or sold cattle etc to help them get started. As things stand, only a minority of people are in a financial situation where they can afford to start off on their own or form cooperatives with fellow workers etc. With a UBI, anyone who thinks that they could do better running things themselves could give it a go with the UBI tiding them over until things took off or they gave up. It needn’t be a large UBI. The modest levels of UBI described in “revenue neutral” proposed conversions of current income tax and means tested benefit levels into a UBI would be enough to expand many people’s options.

larry,

“MMT is the most fully developed and best corroborated alternative to the mainstream theory there is.”

Well, anything is better than mainstream theory, you are not being fair. It is as if you are comparing my medical background (which I have none) to the medical background of someone practicing witchcraft. Of course I would be a better doctor than a charlatan, but that doesn’t mean that I’m a good doctor…

“So far, MMT has met all empirical tests and remains well corroborated”

I do agree with you that many claims made by the MMT community have met all empirical tests (like that the dollar is not convertible to gold, sovereign governments can issue money as they wish, lack of government spending brings unemployment, etc). Those tested claims are the ones I would classify as “descriptive” or “positive”.

However, I do not agree that the JG has met any empirical tests. For me, the claim that “the JG is the best solution for unemployment and price instability” or “the JG is the only solution” are claims that did not meet any emprical test. One day they may, but until today they haven’t. And I guess that even if we eventually find out that the JG is a good solution, we will not be sure that it is the best one or the only one, and that is why I classify the JG policy as “prescriptive” or “normative”, and I think this kind of classification is important for the discussion. Of course, I may be wrong

I wonder what reaction, if any, people have to the current situation in Turkey, where the currency has lost a lot of value in a short time. I don’t know much about the situation there, but according to a report on BBC news, it’s because of “the market’s” concerns about the country’s growing debt. Later in the report, this was qualified as “foreign debt”. Well, we know Bill and other MMT experts do not encourage debt in a currency other than one’s own, although I suppose there might have been special circumstances forcing Turkey to take on this debt at some time.

I’m not of course suggesting that Turkey’s problems are related to MMT – I have no idea if the Turkish government / Treasury is MMT-aware – it probably isn’t.

However, I know some people who are basically sympathetic to MMT who do worry about what effect large deficits and large public debt might have on the exchange rate, even though we who support MMT ideas have no problem with large deficits when appropriate, and know that large public debt implies large private savings.

US left-wing economist Doug Henwood is apparently preparing an article for Jacobin magazine where he will supposedly debunk MMT.

Some tweets from him on MMT are below. He obviously has utter contempt for MMT just like Meadway.

It’s mostly insults. So may not be a very encouraging sign about his upcoming Jacobin article.

https://twitter.com/search?q=MMT%20from%3Adoughenwood&src=typd

“Yield on benchmark Turkish government lira-denominated bond hits 20%: the crisis that MMT said couldn’t happen!

MMT people feel so persecuted. It’s cute.

Another thing I’ve noticed about MMT adherents-disagreement is always a matter of misunderstanding, not actual disagreement.

MMT reminds me of my Catholic childhood, reciting the catechism from memory.

The MMT people are hilarious in the way they treat resource constraints as “handwaving.”

yup, and MMT is snake oil

oh right, you’re into MMT – who needs taxes when you’ve got the magic printing press?

MMT seems only slightly more respectable than astrology, but maybe that’s just me”

eg,

Money people invest in treasuries because there aren’t many low risk alternatives.

They are perceived as low risk because governments of this day say the “right” things about deficits and inflation and generally perform to expectation.

If inflation was a domestic phenomenon and beyond expectations, they would turn to another currency.

If inflation was a general problem and beyond expectations, they would turn to hard assets and equities.

When a government says deficits aren’t a problem and deficit funding by money creation is OK, then money people will lose trust. That’s the way they have been trained to think in part and also that way of thinking perpetuates a set of values which they, by and large, adhere to.

Anyway, that’s the way I look at it.

Mike Ellwood, I also wonder if the situation in Turkey has any implications as to MMT. I don’t know much of anything about the country or how it has been run for the last few years. From what I can tell from a few news reports Turkey consistently runs a trade deficit which MMT says is a benefit. But it also has debt in foreign currency, as do many of the businesses there. And its currency has been losing value, so maybe this is a case where trade deficits were not a benefit? Plus now they have to deal with my moronic President and who knows how that will turn out.

I was actually just discussing this issue in comments at Mark Thoma’s blog. I had to say that beyond recommending not ever incurring debt in a foreign currency that I really don’t know what MMT would say about Turkey. And that I did not think the Turkish situation was a good test as to whether MMT was right or wrong. Which of course did not quite satisfy the other party. Maybe some people here have some answers?

The Turkish Government is not truly sovereign because it owes large amounts in foreign currencies.

It needs to pay off those foreign currency-denominated debts and use a Job Guarantee and discretionary fiscal policy choices to make full and socially valuable use of resources available for sale in the Turkish currency.

Bill says ” i have stated this point often but it still seems to escape

the attention of many critics( and second generation MMTiers for

that matter).MMT is not a regime you”apply” or “switch to” or “introduce”

On the other hand a job guarantee inflation buffer scheme is exactly

some thing a MMT government would apply or introduce and yet it is central

to MMT which is not something you apply.

It is a logical fail easily rectified by the distinction between the descriptive

lens( a wonderful metaphor) and the proscriptive program. Of course both

lens and program can be essential to MMT and the program can be shaped by the lens.

If a JG program is essential to MMT it is not just a lens and it is something you apply.

Hi All

2 comments-

The more interesting I think is that where I have seen posts from Simon Wren-Lewis defending the fiscal credibility rule his main point seems to be that it doesn’t affect a future Labour administration’s ability to deficit spend because it’s a rolling 5 year plan to balance the budget and it doesn’t apply when interest rates are low or zero. So for me it would seem his main defence is that the rule is irrelevant and would not stop the administration from getting on with what we all know needs to be done. That is to expand spending in a way that benefits those most affected by unnecessary austerity and increases sustainable, equitable wellbeing as best as is possible. The rule then only becomes a problem at a point where it does conflict with what needs to be done and a Labour administration prioritises it’s “fiscal credibility” over the welfare of the people.

The problem above could happen at any time but on balance for what it’s worth personally I think a vast amount of good could be done before that point is reached and I could live with the dishonesty of making an irrelevant commitment if it helps get elected. People are dying too soon and lives are needlessly blighted daily by austerity.

Above qualified of course by the fact I’m not an academic economist, haven’t studied from all angles for years, read all the journals, books etc and so may have misunderstood or have missed something vital.

Second and minor point is that many commenters who are adamant a job guarantee is prescriptive may have missed Bill’s point under “But isn’t the Job Guarantee an ‘MMT prescription’?”. His 5th para under that heading is key to understanding it I think, only MMT identifies the buffer stock mechanism and that’s descriptive, in comparison to that insight, whether it is an unemployed or employed buffer stock is not a major issue, academically. In practical terms it’s very important though. Apologies if everyone completely understands that already!

Thanks as always to Bill and all who comment, your contributions are always fascinating, John

John,

I read all the post, including the one you said, but I still have trouble in agreeing…

In my mind, it is a fact that lack of government spending leads to unemployment. That is, in my understanding, just a description of how the world works. And I guess that, at this point, we are all agreeing.

Then, the claim that “if you want to eliminate unemployment then the government needs to create some sort of buffer stock mechanism” is also a description. The qualification (if you want to eliminate unemployment) is important. Still agreeing so far, I guess.

Then claiming that “eliminating unemployment is an absolute value or agenda that the government should always pursue” is troublesome, because a descriptive theory should not, in my opinion, dictate agendas or values – that is for politics and prescriptive (normative) theories. I agree with the “eliminate unemployment” agenda, but I don’t think that it should be in a descriptive theory, like “we should build buildings with three floors at most” is not a subject that physics talks about, because physics is about describing the physical laws, not get involved in politics of demography and urbanism. I guess at that point we disagree.

At last, claiming that “JG program is the best kind of buffer stock there is” or “is the only one” does not seem to be descriptive. The JG is a specific kind of program, and there could be many more kinds of buffer stock programs, very distinct from the usual MMT JG, like the ones I suggested previously (public-private buffer, discretionary buffer, military buffer, etc). I don’t think it is proven that the JG is the superior one. Claiming that it is the superior one and that MMT just describes what would be the best buffer with JG doesn’t seem reasonable to me, I don’t know…

Good post John.

I can remember Gordon Brown (when he was Chancellor) defending “borrowing to invest”, as distinct from borrowing for day to day expenditure. In other words, very similar language to the “fiscal credibility rule”. I don’t know what Gordon Brown really knew. I do know he was/is a very clever man, and it is hard to believe that he would not instantly understand the essentials of MMT on first reading.

We MMT-ers know that it’s actually ok to “borrow” (i.e. deficit spend, if necessary) in order to e.g. pay NHS salaries, which is “day to day expenditure” and may not count as “investment” in Gordon Brown’s or John McDonnell’s or Simon Wren Lewis’s terms. But if it helps Labour get elected, perhaps it’s not such a bad thing, if, and it is a very big IF, they actually understand the truths that MMT reveals. Unfortunately, if we are to believe the language they are currently using, it appears that they do not.

Well, I have to agree MMT is just plain old bad economics. It’s plainly baaad economics in old 1970’s American-speak. The baaadest economics in the whole damned town. In other words:

Well the South Side of the planet

Is the baddest part of Hell

And if you go down there

You better just beware

Economist named Bill Mitchell

Now Billy more than trouble

You see he stand ’bout six meters four

All the Aussie ladies call him “Treetop Lover”

All the men just call him “Sir”

And it’s bad, bad Bill Mitchell

The baddest economist in the whole damned world

Badder than old Abba Lerner

And meaner than a junkyard dingo

Now Bill’s a worldly philosopher

And he like his fancy math

And he like to wave his econometrics

In front of everybody’s nose

He got a custom accounting identity

He got a Job Guarantee plan too

He got a weekly quiz on his website for fun

He answers questions there from you

And it’s bad, bad Bill Mitchell

The baddest economist in the whole damned world

Badder than old Abba Lerner

And meaner than a junkyard dingo . . .

(P. S. Economists are advised to stay away from wives of jealous men or husbands of jealous wives)

Dear André (at 2018/08/12 at 12:36 am)

Superior is defined specifically in relation to purpose.

You might be able to come up with many ‘buffer stocks’ a government could purchase – but only the Job Guarantee will provide full employment (loose) and price stability.

best wishes

bill

To my mind a “National Education Service” as proposed by Labour, that had decent bursaries and catered properly for those without academic aspirations is the best sort of JG I’ve heard proposed. I’m just thinking of actual situations I’ve come across personally. A friend works as a construction labourer. He wanted to train as a bricklayer but couldn’t afford to take time off work to train. I just can’t conceive that, if he was off of work, he would prefer to do litter picking or whatever the classic JG tasks would be, rather than take up such a training opportunity. Likewise with other vocational skills such as elder care, or basic accounting etc etc. If people widely had extra skills, then they would also be more able to challenge existing firms by setting up new enterprises of their own perhaps using a UBI to tide them over whilst they were setting up.

Something that widely gets mentioned as an example of suitable JG employment is “conservation work”. I’m not entirely sure what is meant by that. Conservation just requires re-introduction of native species and removal of invasive species and then for it all to be left well alone. It takes knowledge and specialist skill to set up a proper re-wilding but then the less done the better. Efforts to make use of a glut of unskilled workers can do massive harm. Back in the 1980s, the river where I grew up was “renovated” as a ManPowerServices job creation scheme project. The water vole population was wiped out and still hasn’t returned.

@Henry Rech

Thank you for sharing your understanding of why investors buy treasuries.

That its a function of governments “saying the right things” is hardly persuasive in cases like the 100 year Austrian bond — what possible prospect is there for investors to guess what governments will be saying in 10 years, let alone 50 and beyond?

The general populace does not comprehend that the monetary system creates “unemployment” in the supposed service of price control. It effectively is a Job Guarantee, where to only available job is to be wretched and poor.

The MMT lens puts the psychopathy of monetary policy and austerity in sharp relief. That price stability and general prosperity are not caused by these policies, but rather targeted poverty and deflation. It shows that a JG will meet the claimed objectives and (if I follow correctly) that any state of general prosperity and price prosperity would involve a form of JG.

eg,

“what possible prospect is there for investors to guess what governments will be saying in 10 years, let alone 50 and beyond?”