I have been a consistent critic of the way in which the British Labour Party,…

Jeremy Corbyn’s ‘New Politics’ must not include lying about fiscal deficits

One cannot but be very happy that Jeremy Corbyn has assumed leadership of the British Labour Party if you sit on the progressive side of politics. His elevation to the top job has all but closed the door on the compromised years of New Labour. The so-called Blair-ites have been declared yesterday’s new and not before time. Their embrace of neo-liberalism and the ‘light touch’ approach to the financial sector allowed the destructive period set in place by Margaret Thatcher in the 1980s to become more intense (for example, the decline of manufacturing and the increasing dominance of the unproductive financial sector). But as I have indicated before, some of the language and promises coming out of the Corbyn camp appear to be within the neo-liberal paradigm and, in many ways, not an advance on the New Labour shemozzle. I know that the claim will be that they have to be cautious for political reasons not to open themselves to attacks from the conservatives given the public fear of fiscal deficits, after years of indoctrination. But then their claims to be heralding in a ‘new politics’ would seem to be rather lame if they are prepared to lie or obfuscate about the role and meaning of fiscal deficits just to get some political advantage. Further, at some point they will have to take this issue on if they want to forge a truly progressive new political agenda. Otherwise, they will wallow in the confused space where they cannot break out of the neo-liberal mould while banging on about how fair they will be. They have five years before the next election – and that is plenty of time to reeducate the public. That process of messaging and re-framing should start now. Accordingly, they should take the political flack now and trust in their messaging and re-framing.

Jeremy Corbyn’s leadership campaign was aided by direct mailout to Labour Party members with the envelopes emblazoned with the following:

The outstanding results in the Leadership election reflected the appeal that this type of language has for the members who have suffered years of mind-numbing, me-too-type narratives from smooth talkers like Blair and Brown and the rest of the New Labour politicians.

The hypocrisy of the New Labour approach was amazing to watch from afar. They took Thatcher’s initial largesse provide to the financial markets (deregulation etc) and turned it into a monster, which if not for state support, would have collapsed spectacularly in the GFC.

They preached equity yet watched income and wealth inequality rise under their stewardship.

They participated in an illegal invasion of Iraq which has completely destabilised the World. One upshot of their criminality in this regard is the worst humanitarian tragedy since World War 2 that is playing out before our eyes at present as tens of thousands of people are being displaced.

Corbyn has to some extent revitalised the British Labour Party with literally hundreds of thousands of new members and, significantly, a whole new brigage of youthful supporters suddenly engaged with the traditional political process, probably for the first time.

That is an exciting development. We were excited when Syriza was elected. But the anticipation that something good would come out of that outcome lasted for moments as it became obvious that they were not prepared to advocate taking Greece out of the Eurozone – to freedom.

Once Syriza tried to play ‘chicken’ with the Eurofin ministers while claiming they were staying in the Eurozone then it was only a matter of time before total humiliation at the hands of the Germans would occur. It took 6 months as the capitulation was slowly dragged out of them – painfully and destructively.

The press have moved on from Greece, but the damage inflicted on the people is accelerating – but then it is their problem, n’est-ce pas? That was yesterday’s news.

Now the progressives are seeing Corbyn as the saviour with his ‘new kind of politics’.

For me, a ‘new kind of politics’ must start with new grand visions clearly articulated with proper ‘causal’ understandings conveyed.

Some of the challenges facing the UK economy include unemployment and low-quality employment. So a grand vision might be “Zero waste of Brits” – which makes the people the central target or destination that aspirations are intending to reach.

But then how might Britain achieve that grand goal? Well that is where the causality comes in? The vision must be accopmanied by so-called ‘force’ statements. Force is energy exerted onto something to push it to a desirable destination.

So we want everyone who can work to have a job and have as many hours of work that they desire to work. We don’t want people in zero-hour contracts. We want people to have some income security. We don’t want people being paid below socially-acceptable minimum standards.

That is a grand vision. But then the right-wingers would claim the same thing – and of course mean something quite different.

But that grand destination has to be reached. How? Well the right-wingers including the New Labour lot think it can be reached via market forces largely unfettered by the interference from government policy.

Take away income support benefits and people will search and take any job and then the ‘cream rises to the top’. This is the type of market-based claims that are rehearsed relentlessly by the conservatives (including New Labourites).

But casting our eyes around tells us that the years since Thatcher have not delivered on that grand vision no matter how the conservatives would like us to believe it had.

The GFC was a particularly nasty manifestation of what has gone wrong with the current approach to politics and policy that the Tories and New Labour followed.

So the ‘new kind of politics’ has to explain in detail the different causal routes (or forces) that will deliver that grand vision.

Enter a new discussion of the capacities of the currency-issuing government and the role of fiscal policy (including deficits).

Explain how employment is a direct outcome of spending of one sort or another.

Explain how one person’s spending is another person’s or persons’ income.

Explain that if non-government spending is insufficient to generate enough sales to fully employ people in jobs that the ‘grand vision’ believes are acceptable then there is only one sector that can fill the gap.

Explain how government deficits fill the gap and increase incomes and wealth in the private sector.

Explain how running government surpluses or trying to run them destroys private sector incomes and wealth.

And so on.

Spending is the force, the incomes and jobs are the destination.

But then you read Op Eds that are coming out from Labour Party stalwarts that belie the idea that Britain is truly entering a period of new politics.

For example, the UK Guardian article (September 12, 2015) – Simply protesting against austerity will not enable Labour to win – by one, Peter Hain who was a Cabinet Minister in the New Labour governments and retired at this year’s election.

The main argument is that a successful political strategy cannot be just a protest against the orthodoxy of the day. It needs a vision.

Hain says:

The party now needs a serious alternative to the suffocating neoliberal orthodoxy of cuts, shrinking the state, privatisation and job insecurity. That has to start by defending the economic record of the last Labour government, because otherwise we will be trapped in that neoliberal orthodoxy just as, sadly, we were in the last parliament with an austerity-light policy.

Before the banking crisis, Labour delivered a record 10 years of continuous economic growth, low inflation, low interest rates, record employment, record infrastructure investment and rising living standards.

Yes.

But this appeal to the wonderful New Labour record is slippery indeed.

Record employment is mostly a product of the scale – everything was larger. It also oversaw mich higher unemployment that it inherited.

Unemployment increased from 2.1 million to 2.6 million between mid-1997 and mid-2010 even though it fell during the first two terms of government.

And the lowest unemployment rate it achieved was still more than 1 per cent higher than Britain tolerated in the early 1970s.

And talking about those first two terms, one could argue that the ‘pro-market’ stance adopted by Blair and his cronies set in place the conditions that accelerated the vulnerability of the British economy to the financial meltdown if not helped cause the GFC.

Remember the classic 2005 – Speech – by the Gordon Brown to the Confederation of British Industry (CBI).

The better, and in my opinion the correct, modern model of regulation – the risk based approach – is based on trust in the responsible company, the engaged employee and the educated consumer, leading government to focus its attention where it should: no inspection without justification, no form filling without justification, and no information requirements without justification, not just a light touch but a limited touch.

The new model of regulation can be applied not just to regulation of environment, health and safety and social standards but is being applied to other areas vital to the success of British business: to the regulation of financial services and indeed to the administration of tax. And more than that, we should not only apply the concept of risk to the enforcement of regulation, but also to the design and indeed to the decision as to whether to regulate at all.

The blind belief that the financial markets were actually calculating risk in any meaningful way dominated this period of financial deregulation. New Labour propounded the myth that self-regulating markets will deliver optimal outcomes.

As we have seen, the risk-based approach badly failed and was always going to fail.

The fact that New Labour built on the destructive tendencies started by Thatcher with respect to financial markets and the resulting damage of the crash will be their legacy. It was neo-liberalism exemplified.

So it is a little odd that Hain (clearly trying to protect his own repute as part of Blair’s team) thinks Labour only turned neo-liberal (and austerity-lite) in its last term of office.

Further, note the reference to “record infrastructure investment” and see the analysis below. The reality is that New Labour maintained the historic low public investment ratios that began with the Thatcher assault on public sector net investment.

New Labour did spend more than anyone previously on public sector net investment but then that is hardly a record worth defending given that the economy was also growing (and by a faster rate) and everything was getting bigger in nominal terms.

But the share of public investment in total national income languished at the low levels that Thatcher had created. There was only minor improvement in this ratio during New Labour’s tenure.

Peter Hain then considered New Labour was a success because:

Britain’s budget deficit and national debt were low compared with most advanced economies – and significantly lower than that inherited from the Tories in 1997 … The truth is that Labour’s pre-crisis budget deficit of £39bn, or 2.7% of GDP, was dwarfed by the colossal cost of saving Britain’s failing banks-which by 2009 was equivalent to 90% of GDP.

Which tells you almost everything.

During New Labour’s tenure the external deficit average around 1.9 per cent of GDP rising from near balance in 1997 to around 2.6 per cent by 2010.

So you know the external deficit was increasingly draining spending from the British economy during this period. I don’t want that interpreted as being a bad thing. But the fact means that you cannot evaluate the fiscal stance and outcomes in any meaningful way without considering the behaviour of the other sectors – external and private domestic.

Further, New Labour oversaw a decline of the British household saving ratio from around 6 per cent of disposable income in 1997 to around minus 3.3 per cent in early 2008, before the crisis hit.

The ‘light regulation’ pushed unsustainable levels of debt onto British households which went into the property boom and resulting crash where prices fell by around 15 per cent.

As Aditya Chakrabortty wrote in his UK Guardian Op Ed (May 30, 2014) – Britain is still feasting on credit – and the next crunch will hit in 2016 – the collapse left many British mortgagees in negative equity, which has evolved into around “770,000 ‘mortgage prisoners’ – households who, perhaps because they’re self-employed or have low equity in their homes, will find it very hard to remortgage on to a cheaper deal.

We read that:

The story of British households is simply told: we went into the crash with historic levels of debt; we cut back a bit, but are still burdened with debts worth about 140% of our income – higher than the eurozone and even credit-happy America. In cash terms, household debt is way above that racked up by the government – even though the right only bangs on about the latter.

Meanwhile, the unemployment rate rose during their tenure.

So the “low” “budget deficit and national debt” was actually signalling policy failure not the hallmark of responsible fiscal management.

In 2007-08?, the fiscal deficit was 0.44 per cent of GDP and it accompanied an external deficit of 1.2 per cent of GDP.

In other words, the net contribution to demand from the government sector was not sufficient to offset the drain on demand from the external sector and as a consequence the private domestic sector continued to run a deficit (spending more than its income) of 0.8 per cent of GDP.

The private domestic deficit had fallen in the years leading up to 2007 but the household saving ratio (as a percent of disposable income) was still negative and had been negative since the December-quarter 2004. It only turned positive again (that is, households resumed saving) in the December-quarter 2008 as the reality of the crisis started to dawn on the excessively indebted British households.

The private investment ratio (capital formation as a percentage of GDP) had also fallen from 19.8 per cent in the second-quarter 2000 to 18.8 per cent in the December-quarter 2007.

So the dynamics of the private domestic deficit were being largely driven by household dissaving and increasing their indebtedness.

The economy was growing but in an unbalanced way – too much private debt and too small public deficits.

The fact that Peter Hain chooses to use isolated financial ratios (“budget deficit and natinoal debt”) to play the “low” is good card tells us that he doesn’t want the readers to understand the way in which the fiscal outcome is intrinsically linked to the other sectoral balances and they are linked together via national income movements.

He might not recognise the point that the “low” fiscal deficits that New Labour were boasting about in 2005 and 2006 had helped to create the destructive forces that would come to roost a year or two later.

This deception gets worse when he prescribes that Jeremy Corbyn has to bring “public finances back into balance” by speeding up growth.

Thinking back to the New Labour era, the continuous growth was aided by the fiscal deficits and would have come to a crunch much earlier, given the private debt escalation, had the government tried to run a fiscal surplus.

A nation can safely run a fiscal surplus if the external sector is adding so much to spending in the domestic economy that the government can provide an appropriate level of services and the desires of the private domestic sector to save can be met.

Continuous growth that was associated with relatively large external deficits and unsustainable private sector credit expansion, would not suggest a fiscal surplus or balance was appropriate then, especially when we know that the British economy was not suffering from over-full employment.

So in what sense is a fiscal balance of zero appropriate?

Britain will not generate large external surpluses in the foreseeable future, which means the only way that the private debt situation can be brought under control without driving the economy back into recession, is for the government to increase its fiscal deficit.

How do the Blairites propose that Britain will create external surpluses that are of sufficient magnitude to meet the desires of the private domestic sector to net save, while at the same time, ensuring overall spending is sufficient to achieve full employment and allow the government sufficient spending scope to provide first-class public services and robust public infrastructure development?

Given history and the current circumstances, I would think an on-going fiscal deficit – larger than it is now – is the correct strategy if the well-being of the British people is to be advanced.

And that narrative should be introduced into the public debate immediately to underpin a period of ‘new politics’ where the public are fully appraised of the options available and the implications of these options fully explained.

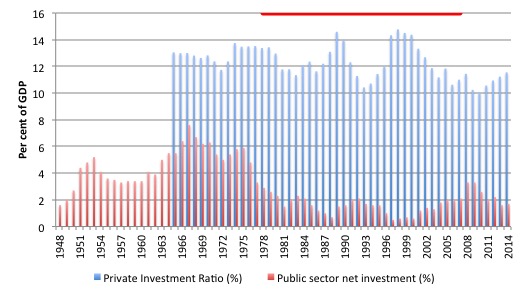

To reinforce our understanding of the failure of the Blair years here is some analysis of what happened to investment.

The Thatcher-Blair years resulted in a very stark reduction in public sector investment and no visible improvement in private business investment as a per cent of GDP.

The following graph shows Private business investment (as a per cent of GDP) and Public sector net investment (as a per cent of GDP) from 1948 to 2014 for Britain.

The data is taken from the Office of National Statistics (Private investment) and a Dataset provided by the British Office of Budget Responsibility (Public investment).

The data for Public sector net investment was provided in financial years after 1954 but I just squeezed it into calendar years to match the National Accounts data. For a blog this is fine and does not alter the outcome significantly.

The red horizontal line is to mark the Thatcher then Blair years for those who cannot recall.

Clearly, there is a cycle in the data and the deep recession in the early 1980s is evident. Thatcher made that recession worse than it had to be.

But the most striking aspect of the graph is what has happened to Public sector net investment (which is the spending on productive public infrastructure net of depreciation) in the Thatcher-Blair years.

There was a significant reduction in public sector infrastructure investment and a visit to Britain now sees the impacts of that realignment in public spending.

The other point is that the neo-liberals can hardly say that private business investment as a per cent of GDP took up the slack left by the sharp and sustained reduction in public investment.

The neo-liberals talked endlessly in the 1980s about how privatisation was just a process of shifting expenditure and employment from the inefficient public sector to the efficient private sector.

Critics of privatisation predicted that it was really about cutting spending and employment.

It is clear from the above graph that there was a net reduction in total investment in the British economy as a proportion of GDP when Thatcher took office, which was sustained through the Blair years.

That reduction hasn’t been a good thing for Britain.

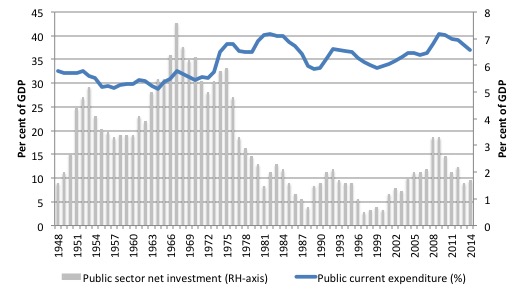

Further, as the next graph shows the public sector retrenchment was not so much in terms of the proportion of recurrent spending (as a per cent of GDP) which has been around 35-40 per cent of GDP since the mid-1970s.

Rather, the damage was inflicted on Public sector net investment, which undermines both current growth and employment and future potential growth.

The article by Peter Hain is not an isolated contribution from Labour Party insiders. The person touted as being the new Shadow Chancellor, John McDonnell wrote on August 11, 2015 – Jeremy Corbyn would clear the deficit – but not by hitting the poor – was similarly adopting this ‘safe’ strategy to deflect obvious attacks from the Tories.

I analysed that article in this blog – Corbyn should stop saying he will eliminate the deficit.

Just to reiterate, John McDonnell claims that British Labour under Corbyn will be:

… eliminating the deficit and creating an economy in which we live within our means.

The reference to “living within our means” is an oft-used metaphor that is intended to promote the idea that the government is behaving excessively and that sacrifice is needed and therefore cuts are necessary if it is running a fiscal deficit.

The metaphor doesn’t ask us to think about the nature of the ‘means’ that a currency-issuing government might have or whether such a concept is even applicable to this institutional.

What are the means available to a national, currency-issuing government. Certainly they are not defined by the size of the deficit.

For a private household, our means are restricted by the financial resources that we can garner which then allows us to purchase real goods and services. Those financial resources include our incomes, our prior saving, our capacity to sell previously required assets (real and financial), and our capacity to borrow.

None of those constraints are applicable to a currency-issuing government. Political constraints aside, the actual constraint that such a government faces is the available real goods and services including all the idle labour that are for sale in return for British pounds.

The idle real resources define the ‘means’ available to the British government and the fiscal space that is possesses.

It can create more fiscal space if it chooses by reducing the purchasing power of the non-government sector (for example, by increasing taxes) and increasing the stock of idle resources available for purchase.

Balancing the fiscal position has no obvious relevance to this concept of fiscal space.

Finally, I also thought this article in the Sunday Observer (September 13, 2015) – Conservatives see a chance ‘to discredit socialist thinking once and for all’ – was ridiculous.

The proposition is that the Tories will avoid ‘playing the man’ and will instead “beat him with clear intellectual arguments”.

And what might those arguments be:

… It is a chance for us to discredit socialist thinking for good.

Framing! Corbyn does not advocate Socialism. He even publicly denied that “he would reinstate clause IV of the Labour party constitution, which committed the party to nationalising industry and was scrapped by Tony Blair 20 years ago” (Source)

A Socialist agenda is not defined by “higher spending, higher taxes and more borrowing” by the government sector. It just goes to show how language has evolved (deliberately) and is now so misused that terms lose meaning but still carry a potent message to an indoctrinated public.

As a slight digression even if there was a fully-Socialist economy with no coherent private domestic sector, it wouldn’t necessarily follow that the central government would be running a large fiscal deficit or even a deficit at all.

If a nation such as Norway suddenly became truly Socialist and the private Capitalist sector was eliminated, the national government would still have to run a surplus (probably) because of the strength of its North Sea resources exports. Otherwise there would be too much spending and inflation would result.

Conclusion

Playing ‘safe’ by lying about deficits and the role of government because it neutralises or reduces the veracity of the political attacks that the Tories will mount is not ‘new politics’.

That sort of ‘safe’ strategy is the old, failed politics and has no place in a truly progressive strategy. There is five years to the next election.

That is plenty of time to start the process of re-education which will force a change in the public debate because then the conservatives will have to explain why fiscal surpluses are desirable rather than just asserting their view and reinforcing the lack of credible explanation with a series of metaphors that play on our ignorance.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Well he is the new shadow chancellor now. If they go with deficit reduction, even as an *outcome* of higher investment and growth its a guaranteed defeat in 2020. It’s not enough to ignore it, or downplay it, or sideline it – they have to meet the question head on. They have to get the public to question the very nature of money, whence it came and where it went.

I do find it amazing how politicians reach for the comfort zone every time despite the evidence before their very eyes – i wonder if expertise (or rather the lack of it) is the root cause. He surely *must* know about sectoral balances, or at least have the wherewithal to be intellectually curios to understand it. I’m guessing Rich Murphy has discussed this with him already given PQE, surely ?

If he doesn’t understand this simple concept already then this whole thing will be stillborn like Greece and its Syriza mark II.

A rise of UK fiscal deficits in the context of the wider austerity Europe and mercantile Asia will possibly suck in 10s of millions of people on a ever more crowded island.

These people will not have access to higher energy density per capita.

Capitalistic efficiency will merely increase as it burns more people up inside the urban zoo.

Yee guys somehow fail to understand that the UK is merely London’s green belt now , its days as a industrial hinterland is over.

Its impossible to engage in productive jobs under present circumstances.

All production is now outside of the UK and is likely to remain so.

But it cannot be said that the UK has become de -industrial as it still consumes industrial products. (It is not a agrarian society but a burb society pretending to be agrarian )

Please get your little auld heads around the concepts of the bleeding obvious.

A sense of capitalistic scale is needed.

Dear Bill

Canada is currently in a federal election, which will be held on the 19th of October. For the first time ever, the NDP (New Democratic Party), roughly Canada’s equivalent of Labour, is leading in the polls. Tom Mulcair, the leader of the NDP, is going out of his way to assure the electorate that he will run balanced budgets if he becomes Prime Minister. He is accusing the Liberals of fiscal irresponsibility because they proposed to run moderate deficits for the first 3 years in order to stimulate the economy. All 3 main parties, Conservatives, Liberals and the NDP, swear by balanced budgets. There aren’t many people anywhere in the world, it seems, who believe in functional finance.

Regards. James

Dear Bill,

Sometimes I wonder if it would be easier to just deceive the indoctrinated public and media into believing that you’re running fiscal surpluses on the books, but then using proxy means to run OMF (Over Monetary Financing); like Corbyn’s “PQE”, so the government sector overall is running net fiscal deficits despite saying and making it look like it is running fiscal surpluses. This would also allow it to cut down on that feral corporate welfare of government bonds in the process. Essentially have the proxy public body run large OMF deficits and then let the government tax back its own newly created currency to buy back its corporate handouts (bonds).

Once the policy is shown to work and proxy OMF proves to be a huge success, simply pull back the curtain and reveal to the public that the entire time the government sector was actually running net fiscal deficits. Then the public will have no choice but to accept the empirical truth they experienced first hand; that OMF isn’t inherently inflationary and continuous fiscal government sector deficits are not only okay, but an essential policy tool to deal with insufficient non-government sector demand.

I mean seriously Bill, if the public are foolish enough to be tricked into thinking Austerity makes them better off, then it can’t be that hard to fool them into thinking you’re running surpluses when you’re really not. Seems a lot easier than swimming against the current… Better to swim around before heading towards the shore.

“I’m guessing Rich Murphy has discussed this with him already given PQE, surely ?”

The general ‘trick’ that they’re going to try and play is balance the current budget and let the capital budget float.

What that means is that government spend can only be on capital projects – stuff than can be capitalised in accounting terms. What that does is make the numbers look good because you gain a real asset every time you do something.

But it leads to the old Labour problem – you can build wonderful universities but you can’t afford to put anybody in them, you can’t train people to run them and you can’t do the research and development to make the best use of them – because anything to do with improving human beings is a *current* budget spend. And that’s because humans can’t be owned and therefore capitalised in accounting terms.

The other issue, which Bill alludes to above, is that public investment in the UK is rather small, and the current budget deficit is rather large (1.6 times net investment). Given the tax gap that requires a hell of a slug of investment spending to close.

I have the feeling that there are people who believe that if they just do some investment spending the current budget deficit will return to ‘normal’ where normal is what it was in the mid 2000s – without realising that was caused by a massive amount of private sector borrowing which isn’t going to, or at least shouldn’t, come back.

I might crunch the numbers this morning – if I can find an ONS presentation that is conducive.

Jesse Hermans has a point. Because of all the misinformation out in society about economics, it should be simple in principle to go along with the rhetoric, [hopefully what Canada just might be doing] and then say they just have to deficit spend to save the country. All the other false notions pointed out in Warren Mosler’s, 7 deadly Innocent frauds book can figure later. I mentioned earlier MMT supporters need a Joseph Bernays figure to shift public opinion away from the current Neo-Liberal vice like grip on policy.

It’s time to act smart and not just wise.

Corbyn is more or less on cue. We were near overdue for another tosser to join the pixie parade.

Obummer is on the way out with his destructive weasel way not quite completed.

Cameron,Merkel and Hollande can’t quite decide whether to be destructive or just ineffectual. That is the European way.

But hope springs eternal in the minds of those who haven’t figured out that the system is broken.

Absolutely agree with John Doyle and Jesse Hermans.

PQE or OMF is a lot easier to “sell to he public” than increased deficit spending.

Now I hope John McDonnell change the tune and does not mention the deficit again. I know he did in his blog, but that is the agenda of the Conservatives. Even mentioning it and denying that you are a “deficit denier” plays clearly into their hands.

Move the conversation on, reframe it, promote PQE or OMF (which will be advocated by Adair Turner in his new book when it comes out in October – although within strict limits).

Otherwse excellent analysis by Bill, the only point to mention, of course is that some public expenditure happened with very, very expensive Private Finance Initiative Contracts in the second half of the Labour government. That will not be shown on the statistics, as it is “off-balance-sheet” financing. But these expensive PFI contracts are still being signed by the Conservatives, “to keep the deficit down”. A further point with which to attack the Conservatives.

Is there not an axiom or cliche that Generals are adapted to fighting the last war?

Which I think means that leaders, including political leaders are reluctant to set aside obsolete or bankrupt strategies and tactics. This is even so when those very same strategies proved to be useless and even damaging to their cause.

Labour, Miliband and Syriza were both the victims and adherents to this phenomena, traveling down the very path to certain failure.

Millions upon millions were slaughtered in the trenches of WW1 demonstrating this reluctance to change from tactics that were utterly obsolete and self-defeating.

Whether Mr. Corbyn and his advisers are willing or able to come to grips with the required changes in strategy/tactics/policy remains to be be seen.

In that vein, Jeremy Corbyn’s ‘New Politics’ must not include lying about fiscal deficits, is a critical piece of advice.

Have a look at this ;

http://www.socialeurope.eu/2015/08/is-deficit-fetishism-innate-or-contextual/

Bill,

History repeating? I remember Michael Foot and how that ended.

Blair/Brown now replaced by Cameron/Osborne succession battle – EU referendum and economic stall in 2016/7 will lead to interesting times with one policy SNP in the mix!

Regards

Just to say congratulations to Jeremy.Let us hope Bernie is next.

It has got this old cynic to join the party.

Have to agree with comments relating to OMF.

As Bill has said many times better not to hand over bonds to

account for the difference between government spending and taxes raised.

Whatever the OMF schemes ,Infrastructure projects ,work programmes,social credit

or my preference a combination of all three with a secure savings retirement scheme

and a new progressive tax on land value and rent controls the goal should be no

bonds issued.

But on this and many other issues which threaten the hegemony of the very wealthy

expect a determined counter fight.Admitting the reality of fiat currency.that the monetary

power of the state can direct resources for the benefit of the many will not go unchallenged.

If you haven’t noticed some people are very keen to own and control as many resources

as they can.

@Kevin.

Nope , it will not threaten the connected capitalists.

Distribution will however.

That is why we will never get it until system collapse which by that stage will benefit nobody.

PS

Pray tell where will the UK get the physical resources to push wealth ever upwards ?

Investment requires real stuff does it not ?

From the global hinterland…..which means less real consumption for others , which means they will be forced into the city.

Capitalism is a demonic vortex.

@matt usselman Jesse Herman +John doyle.OMF would still involve deficit spending(gov spending greater than tax revenue) its just that it’s matcheted by debt issuance to CB as opposed to private sector.

The public would still need to be persuaded that deficit spending is necessary to offset growing private debt.

Regardless of how it’s “financed/facilitated”

The UK is more or less fully integrated with the European supply chain.

This is not rocket science.

We are essentially dealing with one global bank now.

One bank to rule them all.

If one or two major European countries engage in fiscal expansion where do you think people will move ?

Imagine the epic waste of resources !!!!!!as people move further and further away from real resources.

The real distribution losses will further increase.

Well, Jake, as I have said elsewhere, you can’t fix stupid. That’s what my first message above is complaining about!

I must agree with James Schipper that Mulcair’s balanced budget promise is very disappointing given that Canada’s now in a technical recession. I’m not sure what else he could do since it is a given in Canada’s highly concentrated mass media that deficits are always a symptom of fiscal irresponsibility and balanced budgets are good even though Harper’s balanced budget fetish is what caused this recession. When bank economists, the only kind that get column space, are giving macroeconomic advice, that is what you end up with. Trudeau tried educating the public in an interview when he said that as economic activity picks up, budgets tend to balance themselves and he was widely and roundly pilloried as a tiro, unfit for governing. Harper mentions that ‘budgets balance themselves” overtime Trudeau and the economy come up.

That would be “every time” in the last sentence above.

John McDonnell, one of those orchestrating Corbyn’s campaign, has indicated to me that he and Corbyn understand the message of MMT. The expectation one would draw from that is that during the next 5 years, Corbyn and the team he puts together will try slowly to change the economic narrative in an MMT-like direction. The bickering is from Blairites who see their guru’s legacy going down the toilet where it belongs, and they are understandably unhappy about this. But if Labour is to move forward in a realistic way, this is what has to happen. And in the next election, if Corbyn is successful in altering the economic narrative in the MMT direction, those who remain wedded to Blairism, despite its macroeconomic absurdity, will need to be deselected and not allowed to run under the Labour banner. That is, if they haven’t deselected themselves. Some members of the Cabinet have already resigned their positions and gone to the back benches because they do not share Corbyn’s “vision”.

The scale of Corbyn’s victory is staggering. And part of the credit has to go to Ed Miliband who changed the election rules and made them more democratic. Corbyn could not have won had the Parliamentary Labour Party had their way, as they are almost all Blairites in one way or another. It is clear that many sitting Labour MPs are aghast at Corbyn’s victory. However, Blunkett, who was against Corbyn before the election results came out, has adapted quickly and made intelligent comments about what the party members should do in light of this landslide victory. If ever there was a mandate, this is one. And it is firmly against austerity and for social programs.

I should have added that if Corbyn and his team do not do what Bill contends they must do in order to combat the neoliberal virus that has invaded the body politic, then Corbyn will fail. And the Labour Party may then be relegated to the dustbin of history. The Blairites fear that will be the case as a consequence of Corbyn’s victory, but for the wrong reasons.

Corbyn doesn’t advocate socialism?

I though socialism could refer to a mixed economy with a large public sector alongside a private sector (light industry and small and medium sized enterprises still being private).

With a large public sector and high quality public services.

And that communism involved the complete banning of private enterprise.

I could be wrong here about the full and correct definition of socialism vis a vis communism.At some point it is all about degrees of public ownership(All countries have a socialist publicly owned military)

The return of the public ownership clause may not be necessary. But the article refers to the days of British Leyland.

The privatised car industry has been very strong in the UK in manufacturing cars and providing employment,however it is curiously dominated by foreign state owned car companies?

Which seems a paradoxical critique of nationalised industry.

“Higher taxes,more borrowing,higher spending”

MMT better equips those who advocate higher public investment and spending in the economy about the capacity of currency issueing governments.Larger deficits means that taxes can be cut and spending increased if the sectoral balances indicate that this would be necessary to maintain aggregate demand to maintain high employment and a prosperous economy.This doesn’t necessarily lend itself to socialism,but socialism definitely needs MMT,an understanding of sectoral balances.

Unless my understanding of the word socialism is wrong(large public ownership,public sector/services,economic rents taxed out of the economy,mixed economy),I do think those on the left should not run away from it.

By and large couldn’t most of Jeremy corbyn positions be described as Socialist,such as renationalising rail,energy companies and scrap university tuition fees and reintroducing maintenance grants.

A sidenote:Here’s a thought for energy companies;if it is deemed that their is a role for a public energy company to produce energy and supply energy at cost to put downward pressure on energy prices.why not simply set up a new instead of acquiring equity in existing private companies.

Jake Jake Jake……

The best competition for gas monopolies is to overturn the ban on domestic coal burning and to destroy the carbon tax.

Their vice like grip on the populations purchasing power would end in a flash.

Mining in England only makes sense when you have domestic direct burn (not wasteful electricity generation )

Mass electricity generation 1970s style depends on outside surpluses (which indeed still exists)

With the use if modern solid stoves it would in fact reduce the real carbon footprint of the UK rather then its fictional “national” co2 output which depends on a vast amount of off shoring.

No doubt local pollution would increase but the cost of economic externalities would have to be dealt with nationally rather then with multinational corporate bodies.

Of course the nat gas companies would officially engage with the consequences of bankruptcy rather then offloading the costs on the general population.

So I guess the torture will continue for some time.

Could we please at least witness the arrival of a social credit voice and not yet another flipping Marxist on a national production drive.

His motto would be perhaps drink more and drive less ( and I am not talking about fascist health and safety laws)

If we could only resurrect dear old Oliver Reed and stick him up on a platform.

The man would be the best candidate to illustrate the absurdity of the capitalist ballot box democracy.

@larry

“John McDonnell, one of those orchestrating Corbyn’s campaign, has indicated to me that he and Corbyn understand the message of MMT.”

I am often charged with implementing significant changes in the way people do things and these changes can require fundamental changes the way they think about the subject.

One of the most difficult things to understand in these situations is whether they are making the fundamental adjustments or whether they are conducting a process of mental gymnastics to frame the information within their current paradigm.

Maybe set the Corbyn team some of Bill’s Saturday quiz questions?

Paul, with all due respect, I think that setting them quiz questions might be considered offensive. I agree with your point that it is sometimes difficult to distinguish between someone actually understanding a new set of concepts and someone conducting “mental gymnastics” in order to understand the new information within the world view they already possess.

Ken Livingstone proudly pointed out that John McDonnell, when he was in charge of finance at the GLC, always balanced the books. In view of the latter’s recent utterances, that doesn’t bode well. Let’s hope you’re right Larry.

larry. David Blunkett when he was leader of Sheffield City Council used a similar “trojan horse” (Sheffield Partnership Housing Programme) to the PQE National Investment Bank format to outwit Thatcher and continue building social housing. He also used it to build new sporting facilities in Sheffield as part of the World Student Games event Sheffield hosted. He’s had to be reminded of all of this and it’s the reason I believe he’s coming round to Corbynomics.

Andy, to be fair to McDonnell, no council is a sovereign currency issuing entity. They are akin to a firm, therefore, they have to balance their books. Hence, one has to conclude that he was doing what needed to be done in that particular context. One would not expect his GLC mindset to remain unchanged in his new position, that of Shadow Chancellor, which will require a different mindset. At least, that is what I would hope would be so.

The Labour leadership election results will discombobulate at least one member of the commentariat who has said that, were McDonnell appointed Shadow Chancellor, there would be an explosion. This was mentioned on the BBC shortly after announcement of the leadership election results. No explanation of this nor follow-up. Just silently dropped in and then just as silently dropped out. Who, at that particular moment, would make such an “explosive” remark?

Andy, I should have added that I, too, hope that what he wrote on 11 August was done for political purposes and not because he actually believes that that is the way to run the finances of a sovereign nation that has fiat currency issuing powers with the added benefits of floating exchange rates.

Bill –

Of course Corbyn advocates socialism! He wants a lot more redistribution of wealth (which is what socialism’s been about for the last three decades) and he also wants quite a lot of nationalisation (which is what socialism used to mean). But no socialist wants “a fully-Socialist economy with no coherent private domestic sector” because anyone who wants that is a communist, not a socialist.

One of the first things the Blair government did was to cancel about half the plans for new roads, with no corresponding increase in other infrastructure funding. They also kept hiking the fuel tax rate. But it was their neglect of infrastructure, not their tight fiscal policy, that was the problem. The latter was counteracted by loose fiscal policy – mostly quite successfully, though they did initially get the settings wrong.

Growth of the economy should not be balanced any more than budgets should be!

The fact that Britain has a floating currency means that sooner or later it’s likely to fall to the level where there will be an external surplus. And Corbyn won’t have the opportunity to get in before 2020 – it’s not safe to assume the private sector will still want to net save by then.

Once Syriza tried to play ‘chicken’ with the Eurofin ministers while claiming they were staying in the Eurozone then it was only a matter of time before total humiliation at the hands of the Germans would occur. It took 6 months as the capitulation was slowly dragged out of them – painfully and destructively.

The press have moved on from Greece, but the damage inflicted on the people is accelerating – but then it is their problem, n’est-ce pas? That was yesterday’s news.

Now the progressives are seeing Corbyn as the saviour with his ‘new kind of politics’.

Awakening the European Left: An interview with Greek MP Costas Lapavitsas on Popular Unity & the case for a progressive Grexit– worthwhile reading on Greece & on Corbyn. Yesterday’s news is important! I think Lapavitsas is righter about what happened in Greece than Bill. IMHO Tsipras snatched defeat out of the jaws of victory, choosing needless pain & suffering over the unexpectedly good outcome of the negotiations and Syriza’s strategy – negotiated Grexit and the resounding victory in the referendum of the beliefs he claimed to represent. It didn’t have to happen that way; it was one man’s foolish and arrogant decision, made possible by the ignorance of the many.

Lapavitsas: I would ask them [Corbyn’s team] to look more closely at Greece because they can learn from its experience and strengthen their case, but they would have steer well clear of Syriza, which expresses nothing progressive any more. Good advice.

Of course I was somewhat tongue in cheek, however, I feel a bit like we’re back to hoping they get it rather than knowing that they do. A hybrid bolt-on of MMT to deficit doveism will kill MMT dead.

I think we’ve all waited too long for this chance and we owe it to ourselves not to let it slide. So, any ideas on what we can do, as MMT supporters, to try and tease out of the Corbyn team exactly what their position is?

Sorry, Paul, I had sussed that out after posting the comment but was unable to revise it. I am not certain what Corbyn and McDonnell’s actual position on the economy is yet, but am trying to find out.

I sometimes wonder if it would not be salutary for politicians to target the whole idea of a ‘deficit’ as being merely an accounting identity that masks the reality of a country’s true position over time. If one incorporates other measures that reflect changes in capital gains held overseas not based merely on book value mediated by exchange rate values, but reflect net returns/safe earnings potential, the deficit picture might be different. I suppose the question comes down to whether the official figures really reflect a country’s true asset position, trade flows, and capacity for income generation. People seem to have developed a fetish for the official deficit figures. Is it possible to change the debate to the accuracy of the figures? Maybe not.

whether you like the term or not it is the concept of People’s QE which

distinguishes Corbyn from traditional left/centre economics.

I expect for the parliamentary Labour Party it will be as big a no no as

the EU and NATO.It really does begin to lift the smokescreen in to the

real nature of Fiat currency.If Corbyn is forced to abandon people’s QE

we know we will have a Syriza sell out moment.

Andy,

Did Ken Livingston also proudly point out that he sacked John McDonnell?

McDonnell once told supporters that he would like to go back in time to assassinate Margaret Thatcher, that a former Employment Secretary should be lynched and that the IRA should be honoured becasue it was they who bought peace!

His pamphlet “Another World is possible” is more an attack on New Labour than the Conservatives.

Anybody hoping that Corbyn and McDonnell will lead an economic revolution are clutching at straws!

In NZ it is against the law to run budget deficits. Under the Public Finance Act the Government must balance the budget over the medium term. This us described in the Act as sound economic principles. Another gift from Roger Douglas and Ruth Richardson.

Neil Wilson

The general ‘trick’ that they’re going to try and play is balance the current budget and let the capital budget float.

“What that means is that government spend can only be on capital projects – stuff than can be capitalised in accounting terms. What that does is make the numbers look good because you gain a real asset every time you do something.

But it leads to the old Labour problem – you can build wonderful universities but you can’t afford to put anybody in them, you can’t train people to run them and you can’t do the research and development to make the best use of them – because anything to do with improving human beings is a *current* budget spend. And that’s because humans can’t be owned and therefore capitalised in accounting terms.”

But surely you could capitalise the provision of services, which usually needs people. Indeed doesn’t PFI do this?