With an national election approaching in Japan (February 8, 2026), there has been a lot…

More fun in Japanese bond markets

The Japanese bond market has been very interesting in the last week proving yet again that private bond markets cannot set yields on government bonds if the government does want then too. Next time you hear some mainstream economist claiming a currency issuing government is running deficits at the will of the investors (read bond markets) politely tell them they are clueless. Japanese once again provides the real world Modern Monetary Theory (MMT) laboratory – every day it substantiates the underlying insights contained within MMT and refutes the core mainstream propositions. The financial media referred to the Bank of Japan as putting a whipsaw to the bond markets, which in context means that the BoJ is forcing the ‘markets’ into confusion (Source). The bond markets have misinterpreted recent Bank of Japan conduct in the JGB markets (less purchases than expected, and even missing a scheduled buy up) as a sign that the Bank was weakening on its QQE commitment from last September that it would hold the 10-year JGB yield to zero and thereby allow the longer investment rates to fall. Why they doubted that commitment is another matter but within a few days over the last week the Bank demonstrated that: (a) it remains committed to that target; and (b) it has all the financial clout it needs to enforce it; and (c) the bond market investors do not call the shots.

For background to this discussion, please see this blog – Bank of Japan is in charge not the bond markets.

Essential summary points:

1. If the demand for government bonds declines, the prices in the secondary market decline and the yield rises (see blog link above to understand why).

2. Once bonds are issued by the government in the ‘primary market’ (via auctions) they are traded in the ‘secondary market’ between interested parties (investors) on the basis of demand and supply. When demand is strong relative to supply, the price of the bond will rise above its ‘face value’ and vice versa when demand is weak relative to supply.

3. Any central bank has the financial capacity to dominate the demand for any specific maturity bond in the secondary markets and thus can set yields.

Updating the recent empirical yield history for Japan

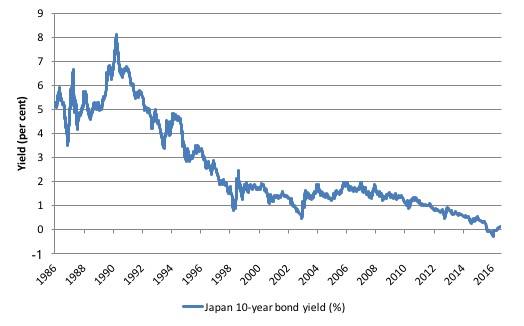

The following graph shows the history of the Japanese 10-year bond yield since it was first issued on July 5, 1986 to February 6, 2017. The daily data (all 10,953 observations) is available from the – Japanese Ministry of Finance).

There have been constant predictions since the early 1990s, that the government of Japan would run out of money because the bond markets would eventually stop buying bonds.

Well, the bond markets could stop buying bonds any time they choose to get off the corporate welfare bottle but the government of Japan would happily continue spending as much as it chose to. That is because it can always buy its own debt and even more clearly does not even need to issue the debt in the first place.

In May 2013, there was a little upturn in the 10-year bond yields, which gave the financial market commentators conniptions and the headlines in all the financial news outlets indicated that the bond markets were finally calling in the piper and unless the Japanese government instituted a major fiscal austerity campaign all hell would break loose with respect to yields.

At the time I noted that these dire predictions were nonsensical.

Please read my blog – The last eruption of Mount Fuji was 305 years ago – for more discussion on this incident.

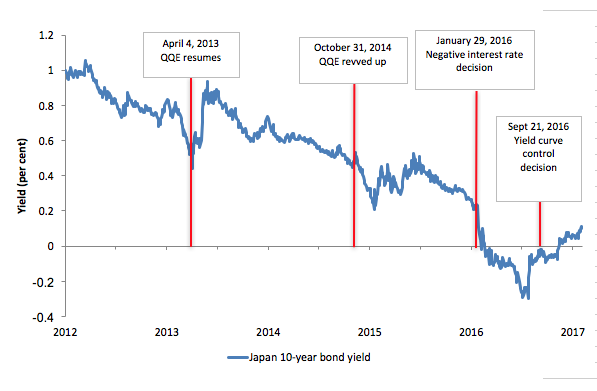

Just before that (April 4, 2013), the Bank of Japan had announced they were resuming their program of Quantitative and Qualitative Monetary Easing (QQE), which involves the Bank entering the secondary JGB market and more recently corporate debt markets and using its endless capacity to buy things that are for sale in yen, including government bonds and other financial assets.

They announced they would spend around “60-70 trillion yen” a year (see Statement Introduction of the “Quantitative and Qualitative Monetary Easing”).

On October 31, 2014, the Bank of Japan announced it was expanding the QQE program.

It would now “conduct money market operations so that the monetary base will increase at an annual pace of about 80 trillion yen (an addition of about 10-20 trillion yen compared with the past).”

Then on January 29, 2016, the Bank issued the statement – Introduction of “Quantitative and Qualitative Monetary Easing with a Negative Interest Rate” – which augmented the QQE program – continuation of the annual purchases of JGB of 80 trillion yen and the application of “a negative interest rate of minus 0.1 percent to current accounts that financial institutions hold at the Bank”.

I considered that decision in this blog – The folly of negative interest rates on bank reserves.

Here is what has happened to the 10-year JGB yields since 2010 to February 6, 2017, with the announcements demarcated by the red vertical lines.

The explosion in yields clearly did not pan out as the financial press predicted. The yields followed exactly the course that Modern Monetary Theory (MMT) predicted – down and then up more recently as the Bank has seemingly varied its QQE program (more about which later).

The fact that the Bank of Japan has been buying up government debt at its leisure is because it can add bank reserves denominated in yen anytime it chooses and up to whatever amount it chooses – without constraint.

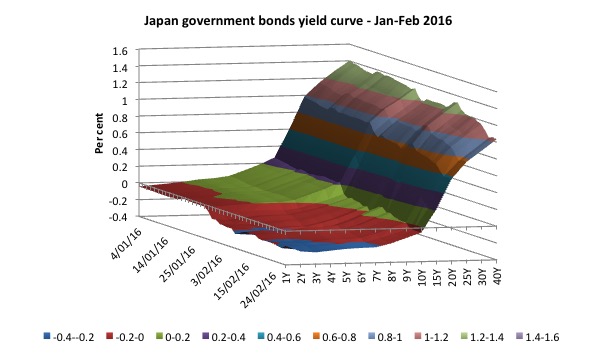

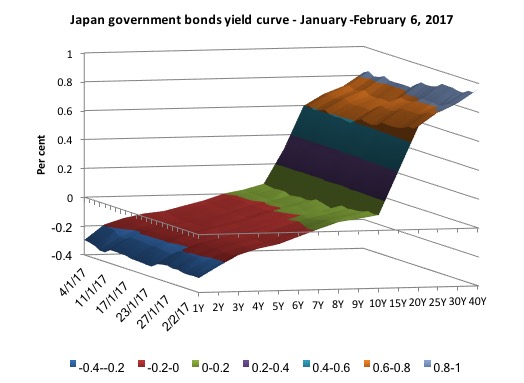

The next three surface charts let us see the evolution of the JGB yield curve as the policy position of the Bank of Japan has changed over the last year.

For readers unfamiliar with reading surface charts of yield curves, the vertical axis shows the yields (depicted in the coloured legend at the bottom of the graph). The horizontal axis shows the maturity of the debt instrument issued from 1-year to 40-year JGBs.

The depth axis shows the date – which in the first case is from January 4, 2016 to February 29, 2016.

The shifting coloured patterns and the descending values across all maturities indicates that the Japanese government bond yield curve has flattened considerably since the beginning of 2016 and negative yields have spread out to the 10-year bond issues and even more negative yields have spread from the 1-year bonds out as far as 7-year bonds.

The flattening and the negative yields is a quite extraordinary occurrence. It has never been as flat as this across the maturities span.

At the February 23, 2016 auction for 40-year bonds, the Yield at the Lowest Accepted Price was 1.130 per cent – that is, people were prepared to ‘save’ for the next forty years (until March 20, 2055) at 1.130 per cent!

At the February 16, 2016 auction for 20-year JGBS, the yield accepted was 0.792 per cent (these bonds will mature on December 20, 2035).

Even at these returns, the bond market dealers were clearly still queuing up to get as much Japanese government debt as they could get their hands on (as evidenced by the Bid-to-Cover ratios).

But, further to that, the Bank of Japan was clearly demonstrating its capacity to control yields at whatever level they choose.

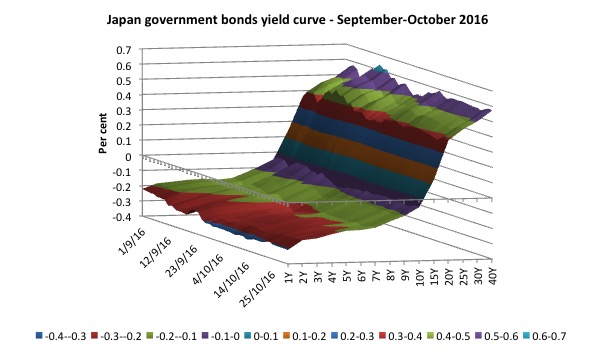

Now consider the next graph, which shows the surface chart for the Japanese government yield curve between September 1, 2016 and October 31, 2016.

it depicts the extraordinary situation where the yield curve has continued to flatten throughout the year (compare the two surface graphs) and the yields up to 10-year bonds are more negative than previously.

At October 31, 2016, the 15-year bond was yielding just 0.127 per cent down from 0.599 per cent at the start of the year.

30-year bonds were yielding 1.282 per cent and 40-year bonds 1.402 at the start of the year. By October 31, 2016, they were down to 0.505 per cent and 0.574 per cent, respectively.

So investors are only requiring a return of 0.574 per cent to invest in bonds that will mature in 40 years time. That is, they will take whatever corporate welfare is on offer. Mendicants!

In line with the decisions at the Monetary Policy Meeting on April 4, 2013 (Introduction of the “Quantitative and Qualitative Monetary Easing”), the Bank bought JGBs worth between 10 and 12 trillion yen per month in the secondary bond market – that is, after they are issued to the authorised dealers who participate in the auction process and begin to be traded.

That amount escalated with subsequent announcements.

At the September Monetary Policy Meeting (MPM) which was held over September 20-21, 2016, the Bank of Japan’s Announcement introduced what they called a “New Framework for Strengthening Monetary Easing: ‘Quantitative and Qualitative Monetary Easing with Yield Curve Control’ (QQE)”.

On September 30, 2016, the Bank of Japan released the – Summary of Opinions – of the MPM attendees.

We understood this summary in greater detail when the Bank publicly released the – Minutes of the Monetary Policy Meeting on September 20 and 21, 2016 – on November 7, 2016.

The Bank’s growth strategy aimed “to achieve a sustainable increase in private consumption” and to help in that regard they considered they should:

… should strengthen monetary easing … and exert upward pressure on wages together with the government’s growth strategy.

Accordingly, the Bank (in pursuit of its “price stability target of 2 per cent … decided to introduce QQE with Yield Curve Control.

The Bank said that “yield curve control” was “consistent with monetary easing measures that the Bank has been implementing thus far” but (along with its “inflation-overshooting commitment” represented:

… a paradigm shift in monetary easing policy, which is appropriate in terms of achieving the price stability target at the earliest possible time.

‘Yield curve control’ will see “the Bank … control short-term and long-term interest rates”. Yes, read that again – the central bank will control interest rates at the short- and long-ends of the market.

The Bank said that its analysis had shown that economic activity had responded well to the “decline in real interest rates” (the nominal interest rate minus the rate of inflation) and Japan had ended its period of deflation as a result.

They saw ‘yield curve control’ as the way it could lock in the further “decline in real interest rates” by controlling nominal interest rates at all parts of the yield curve.

If you want a quick primer on yield curves go to these blogs – Operation twist – then and now and Japan – another week of humiliation for mainstream macroeconomics.

I have a video in the first of these blogs showing movements in the yield curve and you can relate the current Bank of Japan policy to the way in which the US Federal Reserve Bank successfully flattened the yield curve (controlled all rates).

The Bank of Japan set the following “guidelines for market operations” under this policy:

1. In terms of its short-term policy interest rate, the “Bank will apply a negative interest rate of minus 0.1 per cent to the Policy-Rate Balances in current accounts held by financial institutions at the Bank.

2. In terms of the long-term interest rate, the “Bank will purchase Japanese government bonds (JGBs) so that 10-year JGB

yields will remain more or less at the current level (around zero percent).”

In this regard, the Bank said it would “introduce the following new tools of market operations so as to control the yield curve smoothly”:

(i) Outright purchases of JGBs with yields designated by the Bank (fixed-rate purchase operations)1

(ii) Fixed-rate funds-supplying operations for a period of up to 10 years (extending the longest maturity of the operation from 1 year at present)

This means that it will stand ready to buy unlimited amounts of Japanese government bonds at a fixed rate whenever it desires.

On November 1, 2016, the Bank released an announcement – Outline of Outright Purchases of Japanese Government Securities – which operationalised the plan.

The announcement told us (among other things) that in relation to the “fixed-rate method”:

1. The BoJ would purchase bonds across the maturity range (2-year, 5-year, 10-year, 20-year, 30-year and 40-year bonds).

2. “The Bank will conduct the auction as needed, such as when the level of the yield curve changes substantially”.

3. “Depending on market conditions, the Bank may set the purchase size per auction to a fixed amount or to an unlimited amount.”

4. “Purchasing yields will be set per auction, by indicating the yield spreads from the benchmark yields which the Bank determines separately.”

In a speech (November 14, 2016) to some ‘business leaders’ in Nagoya – Japan’s Economy and Monetary Policy – the Governor of the Bank of Japan, Haruhiko Kuroda reiterated the decision taken at the September Monetary Policy meeting that:

The new policy framework consists of two major components: the first is “yield curve control,” in which the Bank facilitates the formation of the yield curve that is deemed most appropriate with a view to maintaining the momentum toward achieving the price stability target of 2 percent …

On January 31, 2017, the Monetary Policy Committee of the Bank of Japan met and reaffirmed in the – Statement on Monetary Policy – that:

The Bank will purchase Japanese government bonds (JGBs) so that 10-year JGB yields will remain at around zero percent. With regard to the amount of JGBs to be purchased, the Bank will conduct purchases at more or less the current pace — an annual pace of increase in the amount outstanding of its JGB holdings of about 80 trillion yen — aiming to achieve the target level of the long-term interest rate specified by the guideline.

The Financial Markets Department of the Bank released its updated – Outline of Outright Purchases of Japanese Government Securities – which described how it would continue to conduct its “outright purchases of Japanese government securities”.

We read that:

1. The Bank would continue buying bonds across the full maturity range (2-year to 40-years).

2. They would be in the markets 8-10 business days per month but stands ready to change that frequency.

3. They plan to purchase “Approximately 8-12 trillion yen per month”

What does this all mean?

In this blog – Operation twist – then and now – I explained how the US Federal Reserve Bank in the 1961 began selling short-term government debt to drive down prices and drive up yields (to attract capital inflow) and buying long-term government debt to drive up prices and hence drive down yields (to encourage private investment).

Remember this was in the context of the fixed exchange rate system.

Operation Twist essentially flattened the yield curve, which in normal times would be upward sloping. It demonstrated categorically that the central bank was able to control all yields.

Mainstream economists have eschewed this sort of strategy and claim that the only way this could be successful would be if it ratified the market.

They claim that the central bank can only achieve this outcome if the targeted yields are consistent with what the bond markets want anyway.

That is, of course, a false claim.

In reality, the only consequence of a discrepancy between the targeted yields and the market expectations of future yields held by bond traders would be that the central bank would eventually own all of the bonds in the target range.

There would be no problem arising from that eventuality.

The bond traders might boycott the issues and force the central bank to take up all the volume on offer. So what? This doesn’t negate the effectiveness of the strategy it just means that the private buyers are missing out on a risk-free asset and have to put their funds elsewhere. Their loss!

Eventually, if the government bond was the preferred asset the bond traders would learn that the central bank was committed to the strategy and would realise that if they didn’t take up the issue the Bank would.

In 2004 paper published by the US Federal Reserve – Monetary Policy Alternatives at the Zero Bound: An Empirical Assessment – the authors concluded that:

If the Federal Reserve were willing to purchase an unlimited amount of a particular asset, say a Treasury security, at a fixed price, there is little doubt that it could establish that asset’s price. Presumably, this would be true even if the Federal Reserve’s commitment to purchase the long-lived asset was promised for a future date. Conceptually, it is useful to think of the Federal Reserve as providing investors in that security with a put option allowing them to sell back their holdings to the central bank at an established price. We can use our term-structure model to price that option.

There is no doubt about that.

The Bank of Japan’s current policy is demonstrating that it runs the show not the bond markets.

Here is the reality

1. The Japanese government can never run out of money (yen). It is impossible. Therefore it can never become bankrupt.

2. The Bank of Japan can maintain yields on JGBs at whatever level it chooses, at whatever maturity range it targets, and for as long as it likes. The bond market investors are incidental to that capacity and are supplicants rather than drivers.

3. The size of the Bank of Japan’s balance sheet (monetary base) has no relationship with the inflation rate.

4. If the Bid-to-Cover ratios at bond auctions fell to zero – that is, private bond dealers offered no bids for an auction – then the government could simply instruct the Bank of Japan to buy the issue. A simpler accounting device would be to stop issuing JGBs altogether and just instruct the Bank to credit relevant bank accounts to facilitate the spending desires of the Ministry of Finance.

5. If private investors choose to buy other assets once the risk in international markets subsides then the Japanese government (the consolidated central bank and treasury) could just buy more of its own debt – to near infinity. End of discussion.

Please read the following blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – for further discussion.

Now consider the third surface graph which covers the period since the start of 2017 up to February 6, 2017 and compare it to the previous graph.

What you see is a slight steepening of the curve in the maturities below 10-years but also a rising level within that range. As at February 6, 2017, 6-year bonds and below were still trading at negative yields but the longer maturity bonds were now just in positive territory.

On February 2, 2017, 10-year yields were at their highest level since January 29, 2016. I will come back to that.

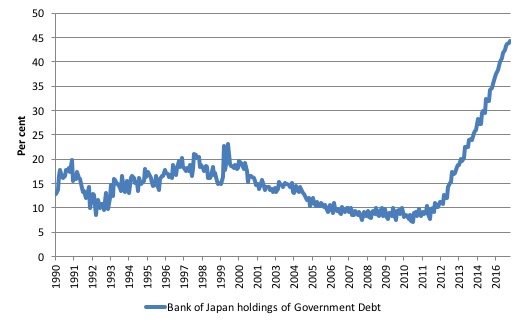

Increasing Bank of Japan holdings of Japanese government debt

The secondary JGBs market has been very thin since the QQE program began and the fact that sellers in that market are declining.

Why? Because as the auction yields have gone negative, current bond holders who purchased the debt instrument at positive yields, will worry about having funds (from sales) which are only going to attract negative returns (losses). The smart strategy in that case is to maintain long positions.

The following graph shows the proportion of total national government debt in Japan that is held by the Bank of Japan from January 1990 to September 2016.

In February 2011, the Bank of Japan held 7.1 per cent of all the outstanding JGBs (across most maturities). By September 2016, that ratio has risen to 44.2 per cent and will rise further as the QQE program continues.

Since the April 2013 announcement, the monetary base has risen from 1,495,975 trillion yen to 4,352,054 trillion yen (as at January 2017). Where is the accelerating inflation? Answer: in flawed Monetarist textbooks!

The monetary operations really just mean that the Japanese government is spending by using credits created by the Bank of Japan, whatever else the accounting structures might lead one to believe.

With inflation low (to zero), these dynamics surely put paid to the various myths that a currency-issuing government can run out of money and that central bank credits to facilitate government spending lead to hyperinflation.

Latest Bank of Japan monetary policy gymnastics

Why are yields rising in recent weeks?

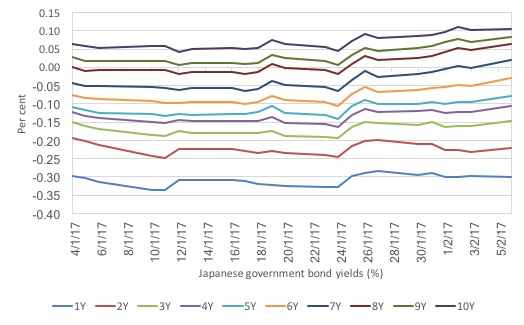

The following graph shows JGB yields from the beginning of 2017 to February 6, 2017 for maturities between 1-year and 10-year (inclusive).

What explains the apparent sudden and uniform (across the maturity range) shifts in yields on various days?

The answer is largely due to the variable conduct of the Bank of Japan.

For example, on January 25, 2017, after some days of robust Bank of Japan purchasing within this maturity range, the bond markets were anticipating that trend to continue.

The Bank had other ideas and didn’t participate as expected and so the yields rose across the board (see shift in direction after several days of declining yields).

My contacts in the Japanese bond markets told me last Thursday that despite the announced yield curve control they thought the Bank of Japan was easing that policy to allow yields to move higher.

But then, the suprises continued, and January 27, 2017, the Bank of Japan reentered the bond markets and substantially increased its purchases of JGBs in the 5-year to 10-year maturity range, which drove yields down again.

The 10-year bond yield fell from 0.09 to 0.08 on that day, quite a shift.

On February 3, things got more interesting.

The actions of the Bank on that day put it beyond doubt that the bond markets are powerless in the face of central bank action to control bond yields.

In early trading on that day, the Bank bought less bonds in the 5-year to 10-year range than was expected and as a consequence the 10-year bond yield rose as demand fell sharply in the market.

This was even though the Bank had announced around 10.00 am that it was increasing its purchases within that range from 400 billion yen to 450 billion yen. The bond traders guessed wrongly that the purchase volumes would be even larger than that. They were wrong.

A few hours later (12:30 pm), the Bank indicated it was going to introduce a beefed up “fixed-rate bond purchase program” (signalled as an option in earlier releases outlining the operation of the QQE).

It hadn’t participated in the bond markets in this way since November 17, 2016.

Essentially it was telling the bond markets that it was going to buy unlimited quantities of bonds within certain maturity ranges so as to maintain complete control over the yields.

It was reasserting its intention to keep the 10-year bond yield around zero per cent

And as day follows night, the yields fell again.

Conclusion

Once you appreciate the fact that the central bank can control government bond yields at any level it chooses, the next step in the transition is to realise that such interventions are, in fact, redundant.

The best thing that a sovereign government can do is consolidate its treasury and central banking operations (make them consistent in a policy sense) – which would make macroeconomic policy totally accountable to voters unlike today where the central bankers do not face election.

Then the treasury should net spend as required to ensure that the economy achieves and sustains full employment and price stability. This may under some circumstances (very strong external surpluses) require a fiscal surplus, but normally for most countries it will require continuous fiscal deficits of varying proportions of GDP as the overall saving desires of the private domestic sector varied over time.

The treasury should issue no debt at all. Even those who argue that the government should issue short-term paper to allow the central bank to reach its target interest rate via liquidity management operations now realise that interest payments on excess reserves accomplishes the same end.

No increased inflation risk would be introduced by the government refraining from issuing debt to match any fiscal deficits it might be recording. The monetary operations that accompany fiscal policy changes have very little impact on increasing or decreasing the inflation risk of continuously running an economy close to full capacity. The risk is real but can be managed.

Further, there is no financial reason for issuing the debt because the sovereign government retains monopoly control over the currency. The practice of debt-issuance is a hang-over from the gold standard era where governments had to fund their spending in order to retain control over the exchange rate.

The practice has lingered because it is now a convenient ideological cum political tool used by neo-liberals to limit the size of government and to give the corporate sector access to corporate welfare (the risk-free government debt) that they use to create profit.

If everyone knew that there was no functional (financial) reason for the government to issue debt and that it just transferred public funds into the hands of the speculators then I think attitudes might change.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

Bill,

You seem to be implying that that relying on interest payments on excess reserves would be a cheaper way to control interest rates than issuing bonds. But is that really true? UIVMM only banks can receive interest on excess reserves, whereas anyone with money can buy government bonds. So what would cause the option with more competition to be less efficient?

Just after the first graph you wrote

“Well, the bond markets could stop buying bonds any time they choose to get off the corporate welfare bottle but the government of Japan would happily continue spending as much as it chose to. That is because it can always buy its own debt and even more clearly does even need to issue the debt in the first place.”

I believe there is a typo of a missing word – ‘not’

” ….. and even more clearly does NOT even need to issue the debt in the first place.”

@Aidan Stanger

Very good point you’re making. I’ll try to answer it:

1. MMT’ers usually recommend setting/leaving the overnight interest rate at zero. Hence, neither bond issues nor interest payments on excess reserves would be necessary. If we agree that a country with a nonconvertible currency should not use the interest rate instrument to “fine-tune” the economy then zero is its place to be. A positive overnight interest rate under such conditions would pose nothing other but a risk-free rent for rentiers.

2. If a positive overnight interest rate policy is still pursued then its management should not be done via the bond but via the interest on excess reserves method mostly for symbolic purposes. My understanding is that Bill wants to change the procedures so that it is finally clear that government budget deficits are not “funded” by bond issues. It’s about “lifting the curtain” and doing away with the misleading appearance of bond sales so as to finally end the whole hysteria about it.

3. Modern primary bond auctions are conducted behind closed doors anyway. Only certified banks are able to purchase them in the primary market. They afterwards decide whether and how much corporate welfare they’ll keep for themselves or they’ll sell to other banks, funds, individuals or the central bank in the secondary market. By contrast, paying excess reserves on benefits every bank with a clearing surplus. I guess that this is still less of a concentration of power and more competitive than the first approach. Either way, alternative financial institutions (i.e. public savings banks etc.)should provide safe saving instruments to individuals according to broader MMT-based reform approaches. The whole financial architecture needs to be overhauled either way.

Bill,

Real wage increases in Japan are small to non existent regardless of BoJ action – this despite little immigration and a declining & ageing population what solutions can MMT offer?

Bill ( or someone else with the time),

Presumably, when the central bank desires to purchase bonds form the secondary market this will automatically force the price up as the market could withold sale until the price reached a certain point -what mechanism limits this withholding so that price levels don’t reach absurd levels of ‘free money’ to the corporates? Is it the bid ratio of NEW issues that affects this? I don’t quite get the full picture here-any help from those who do appreciated.

Simon Cohen, that’s a question I have also wondered about a lot. I will give you my guesses at the answer and hope that someone with more knowledge might correct them.

The Central Bank never really needs to buy bonds in the first place- when they do desire to buy bonds on the secondary market it is done in order to increase the amount of reserves in the banking system, with the idea that that will bring down the inter bank lending rates. So they don’t desire the “bonds” they desire the effect that swapping reserve balances for the bonds will have on an interest rate. Without Central Bank actions that keep that rate above zero that interest rate would usually start falling towards zero anyway. And since keeping the payments system operational is a prime directive of any central bank, the bank has a number of tools to increase the amount of reserves in the system, bond purchases are just one of these.

All that being said, I would have to agree that an offer to buy bonds by the central bank would constitute an increase in demand for those bonds that should raise their prices somewhat and create an opportunity for profit by current bond holders. I imagine the whole system constitutes a nice safe way for bond dealers to make nice profits.

Dear Jerry Brown- thanks for your response. As you rightly say, it is to do with reserve positions and the mirrored relationship between yield curves and interest rates which I understand (I think!).

I was just wondering to what extent the ‘corporate welfare’ operates and given the Central Banks desire to lower interst rates to what extent the sellers of bonds (banks and Corporations) can hold the CB ‘to hostage’and extract the most ‘free money’ out of them. I suppose this can be countered by the issuance of new bonds but those drain reserves so that again affects the target interest rate and yield curve.

Anyway, the question still is: to what extent can the bond holders maximise their ‘welfare’ through taking advantage of the CB desire to but their bonds? I suspet, also that most of that ‘welfare’ feeds back into more bond purchases!

Simon, I guess the answer to your question “to what extent can the bond holders maximize their ‘welfare’ through taking advantage of the CB desire to buy their bonds” would be- to the extent that the CB allows them to do that. And only to that extent. The CB can always just lower its discount rate to whatever level it wants to in order to lower the inter-bank lending rate. And obviously the CB can create whatever number of reserves it desires at will although I imagine the government would get interested quickly if it decided to distribute them in ways the government disapproved of.

MMT holds that government deficit spending (by a currency issuing government) always comes first and bond sales are better thought of as monetary policy actions to mop up the excess reserves caused by the government deficit spending ( if an interest rate above zero is desired by the central bank). It seems to me that the whole process of bond sales and purchases just serves to provide nice incomes to bond dealers for doing no useful work. And maybe it provides political cover (as in they can pretend they don’t have the money) for governments that do not wish to ensure the welfare of their populations through job programs and such.

“Well, the bond markets could stop buying bonds any time they choose to get off the corporate welfare bottle…”

I have never heard about bonds before 2016, much less the bond market. I certainly don’t want to pass up the chance to ask questions while we are on this subject. Can someone please see if I am correct below? I don’t want to go to the internet and get brainwashed by Neoliberal/Monetarist BS.

When some corporations/individual make giant profits, they may buy bonds. When they do, the money is taken out of the money supply for a set number of years to get a government money sum in the form of yield each year (then said corporation can probably buy bonds again after maturity). Because the money could have been invested to become someone’s income or to buy assets which also is someone’s income, we have a drain in money supply just to enrich corporations/wealthy individuals. Other firms are supposed to be given the profit money to grow their businesses and pay workers. Bond market is a place where firms/wealthy individual go to maximize profits by buying/selling bonds at their leisure to generate more money with their windfall/profits instead of taking risk and investing to make economy grow.

“So investors are only requiring a return of 0.574 per cent to invest in bonds that will mature in 40 years time. That is, they will take whatever corporate welfare is on offer. Mendicants!”

I have never invested. This statement means that investors would like to see 0.574 percent return per year rather than investing their profits/windfall fully? 0.574 percent return is almost nothing isn’t it, but if some firm invests 10 billion, they will get 57 million per year in corporate welfare!

Furthermore, Doesn’t the existence of bond/bond market further necessitate government deficit spending? Since money is constantly being taken out to buy bonds and so money supply gets smaller over time. In such a case, governments have more reason to step in to hire workers to drive demand up to fight unemployment. As Bill have pointed out, central banks control the interest rate, and so policies can be set to try and drive private investments-The focus should be policies to make people’s lives better.

I think I have read a piece by Bill saying that there is no point for bonds on the federal level. However, is there regulations to limit where the investment could go? It could go into building pipelines that our future citizens will not thank us for, or it could go into green energy. In that case, education, government regulation, and public expenditure to drive up demand may be more important than I thought in tackling climate change!

Hmm. Jerry, I think we are on the same page about bonds here. Can someone look at my comment above nonetheless?

Tom – as I understand it here in the UK-whenever the Government spends it is matched by bond sales that equal that expenditure, so as the money goes into reserves it goes out just after so that the same amount gets removed from the reserves to the Treasury account at the Bank of England, so it’s not taking money out of the system keeping it roughly the same as far as Government spending is concerned. As Bill says, it doesn’t need to do this but it creates the illusion that money comes from ‘rich’ people’ rather than the Government which is useful for preserving vested interests in society and conning the populace that there is ‘no money for things.’

I don’t fully understand how bonds of different maturity balance with Government spending and I suspect their are some heavy equations/formulas surrounding this.

In relation to the overall money supply, we know that this is largely based on bank loans where banks simultaneously create an asset (their loan) and a liability (to the borrower). The money comes form nowhere (keystrokes). Some estimate that 97% of the money in circulation is from this source (though what is Government spending and what bank mopney is hard to distinguish) and banks make a ‘mint’ of money from it especially credit used to support low wages and keep consumption going and banks have created masses of money via mortgages which has caused a 40 year housing bubble here in the UK with average credit card debt at about £12,000 (according to TUC recent figures based on ONS).

Of course , over time bank loans are paid bake (unless defaulted on!) so the money is then cancelled but the banks have made a load of interest in that time.

Others may be able to explain better than me or correct me if I’ve got it wrong!

Tom, the way I understand it, a (for instance) US Treasury bond does not actually remove spending power from the economy in any real way. Even though that is the rationale usually used to justify the issuance of bonds in the first place, (as opposed to the government just creating the money it uses to deficit spend).

If I personally purchased a bond for say $10,000, then yes I have that bond and not the $10,000 in a checking account. But I can sell that bond at any time if I wanted to spend that money immediately. I could also borrow against the value of that bond if for some reason I wanted to do that. The market for these bonds is extremely liquid.

Now I might be wrong here, but when say a bank buys a treasury bond, the entire value of that bond can be used as part of their capital reserve ratio which they can create loans against at multiples of. They can also use that bond at any time to borrow from the Fed if they wanted to. I imagine banks could even borrow in order to purchase the bond in the first place if they thought that would make profits for them.

So in my view, things like US Treasury bonds do not effectively limit spending and therefore have no real purpose except as welfare payments to bond purchasers who don’t want to risk their money in actual investments that might not pay off. Well maybe they serve a public purpose in allowing a safe savings vehicle for certain individuals and institutions, but that is not the reason given for their issuance, and other, better ways of savings could be devised if we thought that necessary.

Hi Simon and Jerry,

England thinks that it’s like a state government in the US in this sense. There were bunch of these propositions in California that we voted on about whether to issue bonds to build stuff. USA could just have federal government deficit spend and hire people to drive down unemployment, and it should be so much easier. Now I don’t even know how to track if our state gov has enough people buying bonds to even start the project.

I don’t think the maturity and government spending balance matters too much. Even when we take into account of the yield, the vast majority of money balance (between government spending and maturity) is still one to one because when bond matures, people/firms get the full amount back. For us MMT people, it’s even less of a deal since it doesn’t fund government spending.

Ugh average debt of 12,000. No wonder Steve Keen have raised the idea of debt jubilee. Right, I understand that banks have created most of the money supply. I don’t really understand the housing bubble (my parents never owned a house, we have been living poor for a very long time), but I guess my original point is that money will get concentrated to a few over time and they stash it as savings, resulting in lowered money supply, which will manifest unemployment, and government has to deficit spend to keep a healthy economy. I think you will agree with me.

Jerry,

Even though it is extremely liquid, somebody has to have a particular bond on hand, so the money that was exchanged for that particular bond could always have gone to real investments. That means spending is limited by the amount of money that was exchanged for that particular bond.

I’m sorry I can’t really discuss reserves because I haven’t finished Wray’s book on banking =[. I do know how the accounts are set up because I watched Warren Mosler on youtube and he explained that bank reserve account = checking account of the bank at the FED and Treasury account = saving account of the bank at the FED. I actually don’t know how banks find reserves to satisfy reserve requirement and its embarrassing because I have the responsibility to read about it ^^.

Tom, as you know from MMT, a state government like California is not the currency issuer and actually does have to fund its spending projects. Bonds are one way California can do that. And those bonds may have the effect of reducing other people’s spending power, (while increasing California’s in the short term) especially depending on how the Fed rates them as collateral and how liquid the market on second hand California bonds is. There is always a real risk of default involved with a state government or corporate type bond that is not in any way comparable to default risk on a US government bond which is zero for all intents and purposes.

As far as the money being on hand to buy US gov debt, I believe that money is created by the US government spending in the first place, and if it is not on hand to buy the bonds that don’t need to be issued anyway, then who cares? If the US government wants to issue bonds it will and will have the Fed buy them, or it will just spend the US Dollars it wants to by just creating the US Dollars it wants to. It doesn’t need to pretend that it needs to borrow the currency it creates.

Hi Jerry,

Yes. I was just saying that England thinks its California, where we need to raise money by issuing bonds. My paragraph might have been poorly written so you misunderstood me. I meant to say England–at least the politicians–think that England is like one of the 50 states in the USA, where it needs to sell bonds to match funding.

My question/assessment about the bond market is that it will always decrease investment into real firms because it exists and it siphons money away. It doesn’t matter if the the bond changes hands between individuals or how quickly it does that because some money has been used to exchange for it in the FED. Some person has to have bought the bond and so they have decreased their account balance for a piece of paper that says they now have a govt bond. Am I just confused and got concerned over a non-issue?

I don’t know Tom, maybe the availability of perfectly safe government bonds reduces the incentives for people to risk their assets in investments in productive enterprises that would carry a risk of failure and default. That sounds reasonable to me. And it sounds like a reason not to issue the bonds in the first place if they aren’t needed. Sorry I misunderstood you.

And just so you realize, I am not an authorized, acknowledged describer of MMT. Just an avid follower trying to be helpful.

Yeah you are right. People can just sit on that money instead of investing it.

NP =] I’m learning myself as well.

I got involved with this issue over the question of U.S. E-series bonds during WWII, in the quiz a couple of weeks ago. The only way I can make sense of the situation is with these two points:

1) Selling government bonds removes money from the economy, but with a promise to replace that money in the future.

2) Through the magic of collateralized lending, any promise of money in the future can be turned into money right now by the banking system.

I may be wrong, this is the best I’ve got.

Mel -I think that is correct and that bonds are referred to as ‘near money’ in that they are assets that can be converted into cash readily (as long as you can sell them).

In the 19th Century, the bank of England did this with Bills of Exchange.

My reading of Bill on this is that bonds are bought with reserves and do not reduce the level of bank deposits at all. Thus bonds have little or no effect on real world demand: bonds do not “remove money from the economy”.

The “interesting” transaction happens when the government spends, creating a reserve deposit for a bank and a bank deposit of equal value for the recipient of the payment. That is, if the government pays you $100, the bank gets $100 in reserves for handling the payment. Of course, reserves seem to be money only in a loose sense …?

The government then swaps these new reserves for bonds, giving the bank a guaranteed income stream they can retain or sell on to third parties as they wish. In this way the reserves bonus is converted into a tradable commodity that the banks can leverage in the real (bank deposit) economy.

It is hard to see this two stage process as much more than an illusionist trick. If the government wished to be transparent about its operations, it could directly offer bonds when it spends should it wish to provide this corporate welfare or not offer bonds at all should it wish to equitably constrain the reserves system to its intended purpose of supporting inter-bank transactions.

A third possibility is to only give the bank the necessary fractional reserves to maintain its reserve position, thus ensuring there are no excess reserves in need of soaking up by bond issuance.

Of course, we would need to adjust accounting practices accordingly.