Well my holiday is over. Not that I had one! This morning we submitted the…

The last eruption of Mount Fuji was 305 years ago

Humans are very habitual. In Japan as elsewhere. It seems that a regular occurrence in Japan is that some career-minded economist comes out and predicts the end. The end can come in various projected forms. Hyperinflation, government bankruptcy, bond markets vaporising before our eyes, accelerating then exploding bond yields, Mount Fuji erupting and covering the plain beneath it with hot lava, etc. In fact, the eruption of Mount Fuji is the only probable event although even that has erupted only 16 times since 781 – the last eruption being 305 years ago. That august publication (not), the Wall Street Journal gave air to the latest fanatic in the article (May 27, 2013) – Tokyo Urged to Undertake Serious Fiscal Reforms. None of the predictions in that article match the chance that Mount Fuji might erupt tomorrow. In fact, none of the predictions have any chance of being realised. And so we wait the next habitual event in the Japanese calendar which will surely come in the form of some hero in a suit from one of the corrupt ratings agencies declaring that Japan’s sovereign credit rating is in danger or has been downgraded. Like a yo-yo, the rating goes up and down when the ratings agencies need a bit of publicity. Does anything happen much in Japan when the ratings change – nought! As with all these habitual breakouts of nonsense, it is as you were Japan. Keep pumping aggregate demand and things will be fine.

Around this time last year (April 13, 2012), the end was predicted by a senior Japanese economist. I considered his (non)-contribution to the debate in this blog – A fiscal collapse is imminent – when? – sometime! – for more discussion on this point.

This was an economist who in 2002 predicted that “the huge fiscal deficits and the government debt, which is building up at an explosive rate, are also extremely serious problems in the Japanese economy”.

Its been a long explosion, hasn’t it. Explosions usually happen pretty quickly. But in the case of the mainstream economic commentators on Japan, we will cut them some slack. After all the same comments were made in the early 1990s when the government was fighting the worst property collapse the nation had faced.

You might recall that the economist who made this prediction (a very prominent person in Japan) constructed an economy which “is comprised of infinitely many representative households, each of which lives forever”, that “the government neither invests nor consumes but uses the fiscal surplus collected from the people to redeem government bonds”. That is the sort of mental chess games that economists play – twiddling ridiculous models to get the results they desire.

Then they issue some press release and “brief” some journalist in the WSJ or other News Limited (or in Australia Fairfax) publication, who then dutifully repeats the press release as if it is news and never once is there are question asked whether any household can live forever!

But then it is a representative household, which tells us that the writer is fudging the aggregation problem and seeking to use optimising results from microeconomics to say something about macroeconomics when they know full well that the path between the two conceptual levels of analysis fails due to the impossibility of aggregation. So choose a “representative” household and assume they are like an actual individual household.

Anyway, this character was predicting a year ago that “prices of Japanese government bonds … will tumble before a fiscal collapse or the government’s default on its debt.”

No signs of that happening yet but be alert!

A year later, the next entrant to the future of horrors enters the starter’s gate and the Wall Street Journal offers full coverage.

It is also reported across the Murdoch empire as if it is a big breaking story. For example, The Australian (New Limited) our national daily chooses to reprint WSJ news on a regular basis – the “spreading-the-propaganda-while-minimising-staff” approach. This afternoon (May 28, 2013) an article appeared – Bank of Japan’s bond yield conundrum.

It told has that “Japan’s government debt market has sparked into life” and that “Alarm bells are ringing”. Has anyone heard them?

We better refresh our memory so we can prepare a disaster plan. Where I live at the moment in Darwin residents are urged to have a “cyclone kit” at the ready – with some food, water, a transistor radio and torches and other things just in case a cyclone hits during the wet season. We didn’t quite get around to putting one together this year but we will next (I suppose).

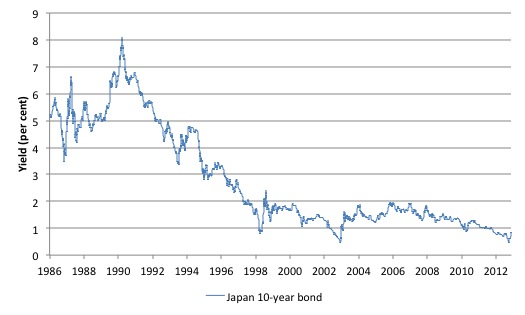

But here is the history of the Japanese 10-year bond yield since it was first issued on July 5, 1986 to yesterday (May 27, 2013). The daily data (all 10,048 observations) is available from the – Ministry of Finance).

That little upturn in the last week – see it! – is what they are all getting themselves in a lather about.

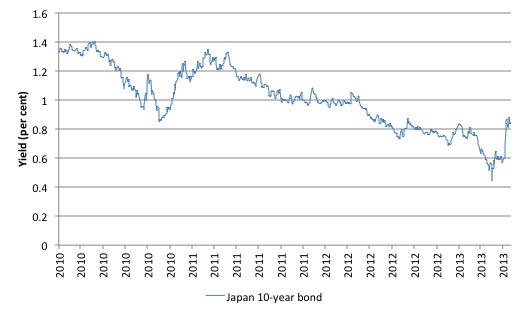

Here it is a little closer up, with yields from January 4, 2010 to yesterday. Ah yes, we can see it now. It looks terrifying. Sort of like what happened in August and October 2010. Anything could happen! Please.

Now back to the big story. The WSJ story tells us that “advisory panel to Japan’s finance minister” has urged the Japanese “advisory panel to Japan’s finance minister”.

I have not been able to access the original report so I have to take what the WSJ tells me, which will basically just be some form of press release anyway.

We learn that the Report thinks:

Fiscal reconstruction has become all the more important because of Prime Minister Shinzo Abe’s aggressive monetary and fiscal stimulus measures … [and] … that a loss of fiscal rectitude could send bond yields higher and undermine the efforts of the Bank of Japan to stimulate the economy.

Before we ask ourselves how that might happen read on.

Apparently, the bond markets are getting freaky because the Bank of Japan has “launched an aggressive bond-buying program in April”. This “initially pushed bond yields down. But uncertainty over the impact of buying on such a huge scale-up to 70% of newly issued debt-saw yields bounce back up”.

Or that the bond markets realised there was nothing in it and went back to where they were prior to the intervention.

The Chairperson of the advisory panel, one Prof. Hiroshi Yoshikawa from Tokyo University (Japanese students – avoid studying in this Department if you want to learn macroeconomics), was quoted as saying:

Any attempt to go ahead with more fiscal stimulus would be a contravention of the spirit of this report …

And lets hope the Government ignores the advice and defiles the spirit.

What is the Report worried about?

We read:

… such unusual policy measures cannot be continued indefinitely … Unless the government moves ahead with and makes progress in fiscal consolidation, the BOJ’s policy could be viewed as an act of debt financing by the central bank, causing bond yields to rise, and canceling out the effects of its monetary easing …

Well even in conventional macroeconomic models, what they term to be “central bank financing” reduces interest rates. Debt issuance, within these models increase interest rates. So one wonders what model framework they are operating in.

But not to be daunted, the Report is quoted as saying:

… even if the BOJ wants to reduce its government bond purchases, it won’t be able to do so unless there are alternative buyers of bonds in the market … Without private sector buyers, long-term interest rates could go up far beyond levels in line with economic growth rates …

Quiz question: How much, if any, of this analysis is valid. Option (a) none of it. Go to the top of the class.

The Report obviously doesn’t comprehend what it means for a central bank to be the monopoly supplier of bank reserves in this case denominated in Yen.

There was a reference to this capacity in a 2004 paper written by Ben Bernanke, Vincent Reinhart, and Brian Sack – Monetary Policy Alternatives at the Zero Bound: An Empirical Assessment.

The authors examine the future of monetary policy when short-term interest rates, the principle tool of monetary policy get close to zero (as they are now).

They discuss various strategies that a central bank can take to alter the composition of its balance sheet “in order to affect the relative supplies of securities held by the public.”

That is, the amount of bonds held by the non-government sector.

The authors noted that:

Perhaps the most extreme example of a policy keyed to the composition of the central bank’s balance sheet is the announcement of a ceiling on some longer-term yield, below the rate initially prevailing in the market. Such a policy would entail an essentially unlimited commitment to purchase the targeted security at the announced price.

And would completely control longer maturity yields – which means end of scary future a la the neo-liberal economists who seek public attention but cannot tell the same public the truth.

The above authors (Bernanke et al) also state (in a footnote on page 25) that:

In carrying out such a policy, the Fed would need to coordinate with the Treasury, to ensure that Treasury debt issuance policies did not offset the Fed’s actions.

Which means that the two arms of government operate as a consolidated policy sector and target the same aim – maximisation of public purpose. This is unlike the way the government operates at present. For example, in Australia, the Treasury tell the government to engage in fiscal austerity, which kills growth and forces the central bank to then lower interest rates to salvage the situation.

But the relative effectiveness of the two arms of policy are different (fiscal policy is more effective) and so growth still suffers. The government strategy has the logical conclusion – that RBA rates go to zero and the economy enters recession – and then their tax base collapses (even more than now) and they fail to achieve their surplus anyway. Meanwhile hundreds of thousands of people have lost their jobs.

Mainstream economists have eschewed this sort of balance sheet strategy and claim that the only way this could be successful would be if it ratified what the market wanted anyway. That is, the only way the central bank could “enforce a ceiling on the yields of long-term Treasury securities” would be if the “targeted yields were broadly consistent with investor expectations about future values of the policy rate” (quote from paper).

The last conclusion is incorrect.

It comes from economists who mostly use “frictionless financial market” models where there is no time or transaction costs and everyone has perfect information and equal access. Clearly that sort of model has nothing to say about the real world we live in.

But more importantly, the only consequence of a discrepancy between the targeted yields and the market expectations of future yields (that is, the bond traders considered rates would rise eventually) would be that the “central bank would end up owning all or most of the targeted security.” (quote from paper).

My assessment of that outcome – excellent.

The bond traders might boycott the issues and “force” the central bank to take up all the volume on offer. So what? This doesn’t negate the effectiveness of the strategy it just means that the private buyers are missing out on a risk-free asset and have to put their funds elsewhere. Their loss!

Eventually, if the government bond was the preferred asset the bond traders would learn that the central bank was committed to the strategy and would realise that if they didn’t take up the issue the bank would. End of story – the rats would come marching into town piped in by the central bank resolve.

The authors also suggest that it is possible that:

… even if large purchases of, say, a long-dated Treasury security were able to affect the yield on that security, the possibility exists that the yield on that security might become “disconnected” from the rest of the term structure and from private rates, thus reducing the economic impact of the policy.

That is possible. The corporate rates which reflect risk as well as inflationary expectations might deviate.

The overall point is that when there are transaction costs and “financial markets are incomplete in important ways”, the central bank can influence “term, risk, and liquidity premiums – and thus overall yields.”

The authors note that historically the strategy has been successful in a number of countries and give examples. Among the examples, they consider the “historical episode” that became known as “Operation Twist”.

I considered the issue of how the central bank can control the bond yield curve at all maturities in this blog – Operation twist – then and now.

So there is never a situation where the bond markets can destroy a nation which has currency sovereignty. Never means NEVER.

The substantive issue in Japan’s case is that they are once again relying on Quantitative Easing to maintain growth and discussing the simultaneous introduction of fiscal austerity.

The problem is that QE will have no significant effect on growth. Please read my blog – Quantitative easing 101 – for more discussion on this point.

But attempting a fiscal contraction will just take the nation back to 1997, where these same debates were rehearsed then and led to tax hikes – and – a dive back into recession.

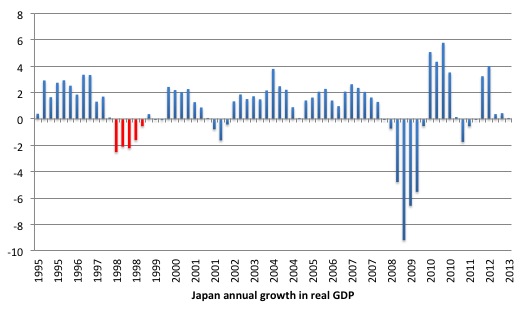

The following graph shows the annual rate of real growth in Japan from the March-quarter 1995 (at the onset of the asset price crash) through to the March-quarter 2013.

The property crash in th early 1990s caused a severe contraction in household consumption and private investment spending which culminated in a brief real contraction in 1994. Once the stimulus from the expanding budget deficit began to work real GDP growth regained momemtum.

By 1996, the same calls for austerity (fears about public debt ratio etc) that dominate the policy debate today were rampant in Japan and the government eventually bowed to political pressure and raised taxes in an attempt to reign in the budget deficit.

The public contraction on top of very fragile private sector spending – akin to the situation that most nations face today – caused a massive contraction in 1997 and 1998 – which increased the budget deficit (via the automatic stabilisers) and added to the public debt ratio (given both debt was rising and GDP was falling).

That was the situation that Moody’s then started to play games by downgrading the sovereign debt. Fortunately, the Japanese government did not take any notice of the agencies and realising the mistake of 1996-1997, expanded their net spending again. The renewed fiscal stimulus saw real GDP grow very strongly in the ensuing years despite the rating agencies decision.

The Japanese government never had any trouble finding buyers for the debt it was issuing, they held complete control over interest rates, inflation fell, unemployment remained relatively stable and real GDP growth was strong through the period of the downgrade.

The decision by Moody’s was rendered irrelevant by the Japanese government who just exercised the power they had as a sovereign issuer of the currency.

You might wonder what happened in 2002? The recession that occurred then in Japan was largely driven by an export collapse (remember the US went into recession during this period) and a tightening of net public spending. This then provoked a fall in private investment spending and a rising saving rate. It had nothing to do with the ratings decision.

Once exports recovered and public spending support resumed the economy then grew relatively strongly despite the lower sovereign debt ratings.

And then the 2007 crisis arrived.

Any attempt to engage in fiscal austerity now will take them back into recession.

As to the Japanese debt situation. Modern Monetary Theory (MMT) of-course considers the issuing of public debt to be a redundant artifact of the convertible currency era. The best thing that a sovereign government can do is consolidate its treasury and central banking operations (make them consistent in a policy sense) – which would make macroeconomic policy totally accountable to voters unlike today where the central bankers do not face election.

Then the treasury should net spend as required to ensure that the economy achieves and sustains full employment and price stability. This may under some circumstances (very strong external surpluses) require a budget surplus, but normally for most countries it will require continuous budget deficits of varying proportions of GDP as the saving desires of the private domestic sector varied over time.

The treasury should issue no debt at all. There is a weak case for the government issuing only short-term paper to allow the central bank to reach its target interest rate via liquidity management operations. But this case is made by those who argue that monetary policy should be used as a counter-stabilisation tool. I think monetary policy should be put to bed and all counter-stabilisation be performed via fiscal policy.

Further, the central bank can simply offer a return on reserves which negates the reason for issuing any debt.

There is no case for governments to issue any debt. This choice would introduce no increased inflation risk. The monetary operations that accompany fiscal policy changes have very little impact on increasing or decreasing the inflation risk of continuously running an economy close to full capacity. The risk is real and relates to the spending side not to the monetary operations that might accompany the spending.

At any rate, the risk can be managed.

Further, there is no financial reason for issuing the debt because the sovereign government retains monopoly control over the currency. The practice of debt-issuance is a hang-over from the gold standard era where governments had to “finance” their spending in order to retain control over the exchange rate.

The practice has lingered because it is now a convenient ideological cum political tool used by neo-liberals to limit the size of government and to give the corporate sector access to corporate welfare (the risk-free government debt) that they use to create profit.

If everyone knew that there was no functional (financial) reason for the government to issue debt and that it just transferred public funds into the hands of the speculators then I think attitudes might change.

Anyway, that is the preferred MMT policy option.

The reality is that that option is not taken advantage off (like some many lost opportunities available to a fiat currency-issuing government) and governments continue to issue debt and expose themselves to the bullying tactics of the bond markets.

Please read my blog – Who is in charge? – for more discussion on this point.

Conclusion

Lesson for today: as each habitual offering comes out from these Japanese economists and their mates in the press the best thing to do is move to the sport’s section and catch up on the latest cycling news.

Or, equally, watch a nice music video on YouTube. Relax and wonder why these idiots get media space.

Then start computing the probability that Mount Fuji will go off tomorrow. It is low but at least positive.

Modern Monetary Theory Event in Sydney, May 31, 2013

The Sydney University Political Economy Society in collaboration with the Columbia University Law School’s Modern Money and Public Purpose group is staging a special seminar – Macroeconomic policymaking for small, open economies: an Australian perspective – Friday May 31st, 2013 at the Lecture Theatre 123, School of IT, Sydney University.

For full details consult the – Event homePage.

I am one of three featured speakers and my confreres will be Dr Sean Carmody and Assoc Prof Peter Kriesler.

If you are in Sydney on Friday and have some time around lunchtime then you would be most welcome. See the link above for details of registration (free) etc.

I will look forwward to seeing you.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

“Explosions usually happen pretty quickly.”

Depends how close you are to a black hole. Since these people keep talking about black holes perhaps they believe they are near them – hence why the explosion seems to take a long time from our viewpoint but is clearly very rapid from theirs.

@Neil

Thats quite good.

As one of those who sees explosions I can concur with that observation.

Japans problem is that it is a extreme entrepot economy.

Nuclear shutdown makes it a even more extreme and manic entrepot, desperate efforts to export to afford imports will only prolong the agony.

Imagine a world 70 years ago where two islands almost at the opposite side of the globe were dependent on a certain fuel (LNG in Qatar) for their very survival.

Absurd but true.

Globalization is on its lasts legs as countries no longer have any internal redundancy.

(this has happened many times before)

Countries with a economic structure and almost zero resource local hinterland such as Japan are toast.

We live in a world of the market state where only absurd non value adding trade dynamics sustains their decapitalized economic structure.

This is true for the mercantile market states with Japan as the prime example.

Nightmare managerial market states in Euroland or so called free /liberal market states in the Anglo world.

They have no core capital remaining.

Its over boys.

Neil, I don’t mean to be pedantic, but I think you have the black hole relationship reversed. If one is near or falling into the black hole it should seem to take forever due to the time dilation effect, but for those farther away it will appear to take place virtually instantly.

Bill,

The problem with this argument is that voters are often not well informed, especially about macro-economic policy. If we had a system that worked for public purpose, it would make sense to make it hard to change, because somebody would surely want to meddle with it for their own advantage.

Consider the automatic stabilisers – they work precisely because they are automatic. The ability of the present UK government to bring them into the policy sphere looks like a structural weakness.

Bill says, “Then the treasury should net spend as required to ensure that the economy achieves and sustains full employment and price stability. This may under some circumstances (very strong external surpluses) require a budget surplus, but normally for most countries it will require continuous budget deficits of varying proportions of GDP as the saving desires of the private domestic sector varied over time.”

The fact that “saving desires ….vary over time” does not actually explain why a deficit is needed nine years out of ten.

Take a simple example. If saving desires rise by $Xbn in even years and fall by $Xbn in odd years (and all else is equal / constant), then you’d need a deficit of $Xbn in even years and a surplus of $Xbn in odd years. That is, to repeat, that simple “variation” does not explain the need for a deficit 9 years out of 10.

I’ve actually explained the reason why a deficit is needed 9 years out of 10 on this blog before. Wasn’t anyone paying attention?:-)

Dnm,

I agree. Moreover, Bill is not correct to suggest that consolidating “treasury and central banking operations” would automatically “make macroeconomic policy totally accountable to voters”. That is, one could perfectly well have a “consolidated” system under which the decision as to how much “monetary plus fiscal stimulus” to apply was taken by some sort of independent committee of economists – like the Bank of England Monetary Policy Committee or the Office for Budget Responsibility. Indeed Positive Money and Richard Werner advocate such a system.

Of course politicians ultimately have the power to bash down the front door of a central bank and override decisions taken by committees therein. That’s what happens in Argentina, and look at the results. Or perhaps I’m exaggerating the irresponsibility of politicians???

“but I think you have the black hole relationship reversed.”

Tsk. That’s what you get by relying on ‘Andromeda’ for your theoretical physics. 🙂

Not that they should do anything differently, but given Japan’s demographics, isn’t it possible that the strong savings desire now, will be followed in the not distant future by retirees spending that money? If that causes inflation, the government can run a surplus by increases in taxes (hurt the people still working) or decreases in spending (hurts who more?).

Given where there population and age distribution are going, Japan is going to need technology to come to the rescue … not at all impossible.

Neil, you had it right the first time, Larry’s got it backwards.

Percentage capacity utilisation in the US economy from 88/89 to present) from Board of Governers of the Reserve System:-

88/89 90/91 94/95 2009 2012 2013

Total industry 85.2% 78.8% 85.0% 66.9% 77.7% 77.8%

Average 1972 – 2012 = 80.2%

So monetarism and neoliberalism get the economy running at 4/5 ths capacity and vastly increase inequality and poverty! “There are record numbers of Americans on food stamps today because there are record numbers of Americans in poverty (records begin in 1959.) As of 2011, there were 46.2 million men, women, and children living below the U.S. poverty line.” – The Atlantic.

From a low of 25 million in poverty in 1970 to 1978 (the legacy of Keynesian policy as much of the improvement occurred in the 1960s) monetarism and neoliberalism have managed to put 46.2 million in poverty today. That is over twice the population of Australia or 14.7 % of the population of the US. Nearly 3 persons in every 20 are in poverty in the US. Great system…. NOT!

Ikonoclast, there has never been a truly Keyensian system operating after the war. It immediately became diluted and distorted almost as soon as his famous book was written, sometimes deliberately, sometimes accidentally. In the US, Keynesian policies were considered akin to communism, and Lorie Tarshis’ textbook, the best introduction to Keynes at the time, the early forties, was banned and removed from classrooms. Samuelson admits that he neoclassicized Keynes’ doctrines. Joan Robinson considered him a bastard Keynesian. Colander and Landreth, and Paul Davidson, have written about this period. And Bretton Woods wasn’t a Keynesian solution either. That was the work of Harry Dexter White. So, the upshot is, it seems to me, to be that Keynes can’t be blamed for the stagflation of the seventies.

Yes, Keynesian style macroeconomics can be given a lot of credit for the post war boom. There were other factors too. Keynesianism was a necessary but not sufficient condition. The monetarists and neoclassicals can take the credit for wrecking it.

I am always amazed that wage rises are solely blamed for inflation and yet price rises and profit rises are never mentioned as a cause of inflation. Worker wages are placed under strict controls but prices, profits, speculation, leveraging, debt creation and executive salaries are allowed to spiral up untouched. It’s a total double standard. Unemployment is used to discipline workers and the capitalists get to set at the high table with government to get all the laws and rules severely distorted in the favour of capital and bosses. The system is corrupt and morally evil.

deficit as a reflection of a savings desire is where MMT model fails

a bit like neo liberalism internally consistent but not a model of this reality

just like demand saving desires are only real when their effective

why do the poor desire so little savings

and the rich so much?

hand out universal welfare

fund and staff good quality health ,education ,mass transportation networks

and sustainable energy production

offer generous index linked pension bonds guaranteed by

government/ central bank

and watch the broad masses desire to save grow

Larry: No, Neil had it right at first. From distant observers, it seems to take forever for things to fall into black holes, which is why you can argue that black holes can’t really be observed. But if you yourself are falling in, you can cross the event horizon, get to a singularity in finite time from your perspective. One can say time moves a bit slower in any gravitational field, like on Earth as opposed to your space station condo.

Ikonoclast: Keynes coined the phrase “profit inflation”, in one of his earlier works IIRC, for this. His anti-inflation plans carefully took profiteering e.g. in wartime into account.

Some Guy, I would argue that you can’t observe black holes because light doesn’t escape from beyond the event horizon and they are, therefore, effectively invisible. Time slows down in an accelerating field. So, if you were traveling at the speed of light, time should stop – though this can’t happen because your mass would become infinite which is impossible. In your space condo, if it is geostationary, time on your condo compared to the ground would slow down because you are traveling faster than the point on the ground you are over and, thus, for your GPS to work, the satellite has to adjust its time settings in order to sync them with those on the ground.

Neil & Some Guy, I have just checked with Kim Thorpe’s Black Holes and Time Warps and we are all partly right and partly wrong. In terms of the object entering the black hole’s event horizon, time slows down and it seems to take an eternity to drop beyond the horizon. Once it crosses the horizon then it takes only a few moments of its time, which has slowed considerably, to drop into the hole itself. To an external observer, the object appears to be frozen at the horizon forever. Apologies for the confusion.

Typo: It is Kip Thorne’s Black Holes & Time Warps.

just a thought for a more MMT consistent analysis for the required level of a government deficit

than trying to guess aggregate saving desires

how about the level of deficit required to maintain spending power sufficient for full employment

and counteract the hoarding power of the rich

Bill

Completely agree with you. Another prone not to mince words: Prof Wray refers to authors of the WSJ article as ‘morons’.

So I’m puzzled by Marshall Auerbach’s recent blog entries on Japan (24 May, 30 May) at his blog macrobits.pinetreecapital.com. Not sure i get what he’s concerned about – isn’t the whole Japanese gov policy fiscally neutral (to maintain perceved fiscal discipline???) in any case?

Resp.