The other day I was asked whether I was happy that the US President was…

Ireland still located in the Irish Sea despite multibillion-euro austerity drive

I get several E-mails a month telling me to pull my head in that because, apparently, Ireland is clearly demonstrating my claims that fiscal austerity will kill growth and cause even higher unemployment is plainly wrong – “just look at the data” – is a regular claim by these phantom contact form types. Heroic indeed. They should have realised by now that I love to “look at the data” and are also circumspect about data that will be revised in the course of time. Last week (June 27, 2013), the Irish Central Statistics Office (CSO) released the March-quarter 2013 National Account estimates – GDP decreased 0.6% (Q1 2013 compared with Q1 2012) – which also revised the December-quarter real growth estimates down to show a contraction. That is three consecutive quarters of negative real GDP growth. That should demonstrate some 4.5 years into their fiscal austerity experiment that it isn’t working. Time for change. So, all you phantoms, save your comments until you have something to say that transcends your blind free market ideology. And perhaps, get a life.

The UK Guardian (June 27, 2013) came out with this headline after the Irish CSO has issued the latest data – Ireland falls back into recession despite multibillion-euro austerity drive.

There has been speculation that this was tongue-in-cheek. The text doesn’t suggest that. But let’s say it was – why would we be making a joke about a devastating tragedy?

Anyway, whatever.

Last week, the Irish saw the impacts of austerity and the selective bailouts in very clear lights.

First, the CSO revisions and updated data demonstrate that the fiscal strategy has failed badly and should be abandoned forthwith before it causes even more damage.

Second, as the Guardian article noted:

The blow comes as Ireland reels from the unfolding Anglo Irish Bank scandal, in which executives at the bailed-out bank were caught on tape joking about their multi-billion euro rescue in 2008 and, at one point, singing “Deutschland über Alles” as they quipped about German deposits shoring up the bank.

Jail time is warranted for many of those who creamed the system in this way.

I last wrote about the Irish situation in this blog – The Celtic poster child demonstrates the failure of austerity – when the September-quarter 2012 National Accounts data came out.

I noted that despite all those commentators who had seized on the slightest evidence of real GDP growth (or a falling unemployment rate) as a sign that austerity was finally going to deliver the miracle the EU, the ECB, the IMF and the Irish government has been telling the world about, that the reality was clear – Ireland is an example of how much damage fiscal austerity causes.

It was the first of the Euro nations to impose a fiscal austerity package. It is still not growing and private spending is collapsing.

With the CSO revisions to the December-quarter 2012 real growth estimates (a decline of 0.2 per cent) and the estimated contraction of 0.6 per cent in the first three months of 2013, it is hard to conclude anything else.

This is now 4.5 years of austerity with no sign of improvement and an economy that is now highly dysfunctional.

The most recent (March-quarter 2013) – National Accounts – data for Ireland issued last week (June 27, 2012) by Ireland’s Central Statistics Office continue to paint a very bleak picture.

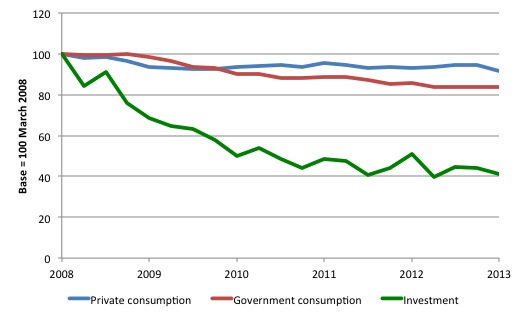

Consider the following graph which shows the evolution of personal consumption, government consumption and investment (indexed at 100 in the March 2008 quarter peak) to the June quarter 2012.

Investment now has an index number of 41 compared to 100 in the peak quarter March 2008. Both public and private spending have consistently headed in the same direction since fiscal austerity was imposed.

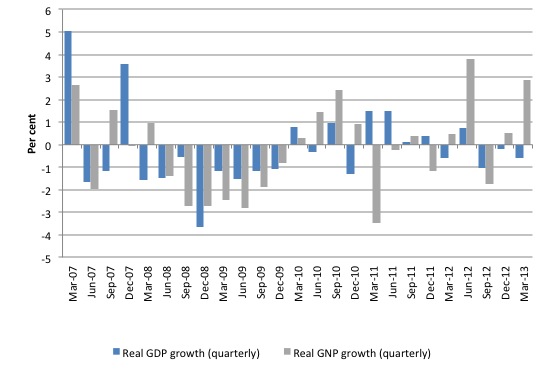

The following graph shows quarterly growth rates in real Gross Domestic Product (GDP) and Gross National Product (GNP) from the first quarter 2007 to the March-quarter 2013. Real GDP declined by 0.6 per cent in the first quarter of 2013 and after declining by 1 per cent in the September-quarter 2012 and 0.2 per cent in the December-quarter 2012 (seasonally adjusted).

So three consecutive quarters of negative real GDP growth.

However, real Gross National Product (GNP) grew by 2.9 per cent in the March-quarter 2013, an increase on the estimated 0.5 per cent growth in the December-quarter 2012.

What does that mean?

First, you need to first understand the difference between GDP and GNP. This is a particularly important point when it comes to understanding the Irish predicament (both before the crisis and now).

You can gain a thorough understanding of these concepts from this excellent publication from the Australian Bureau of Statistics – Australian National Accounts: Concepts, Sources and Methods, 2000

The two concepts are defined as such:

- Gross domestic product (GDP) is defined as the market value of all final goods and services produced in a country in any given period”.

- Gross National Product (GNP) is defined as the market value of all goods and services produced in any given period by labour and property supplied by the residents of a country.

The Irish CSO publication says that GNP = GDP + Net factor income from the rest of the world (NFI). NFI is defined as:

Net factor income from the rest of the world (NFI) is the difference between investment income (interest, profits etc.,) and labour income earned abroad by Irish resident persons and companies (inflows) and similar incomes earned in Ireland by non-residents (outflows). The data are taken from the Balance of Payments statistics. However the components of interest flows involving banks in this item in the national accounts are constructed on the basis of “pure” interest rates (that is exclusive of FISIM) whereas in the balance of payments the FISIM adjustment is not carried out. There is an equal and opposite adjustment then made to the imports and exports of services in the national accounts which is not made to these items in the balance of payments. The deflator used to generate the constant price figures is based on the implied quarterly price index for the exports of goods and services. In some years exceptional income payments have had to be deflated individually.

In this blog – The sick Celtic Tiger getting sicker – I argued that the so-called “Celtic Tiger” growth miracle was an illusion and was driven by major US corporations evading US tax liabilities by exploiting massive tax breaks supplied to them by the Irish government.

In a New York Times article (May 20, 2010) – Irish Miracle – or Mirage? – by Peter Boone and Simon Johnson, we read that:

… 20 percent of Irish gross domestic product is actually “profit transfers” that raise little tax for Ireland and are owned by foreign companies – the Irish miracle was a mirage driven by clever use of tax-haven rules and a huge credit boom that permitted real estate prices and construction to grow quickly before declining ever more rapidly. The biggest banks grew to have assets twice the size of official G.D.P. when they essentially failed in 2008.

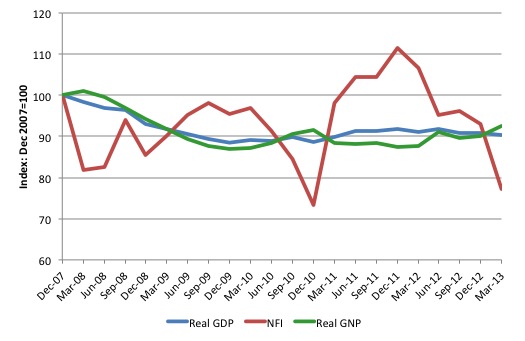

I indexed the national aggregates (GDP, GNP and NFI) at 100 at the GDP peak of the last cycle (December quarter 2007). As at the March-quarter 2013, the GDP index was 90.2, the GNP index was 92.6 and the NFI index was at 77.3 (but there was a sudden plunge in NFI in the March-quarter 2013, which makes the domestic economy look better than it actually is).

The following graph shows the evolution of these indexes between December quarter 2007 and the March-quarter 2013. It is not a model economy.

In relation to the rise in real GNP, the CSO told journalists that the “increase should be treated with caution as it represented profit inflows into Ireland from overseas subsidiaries of companies that had set up headquarters in the country” (Source).

In other words, we cannot interpret that as a bonus for the Irish people.

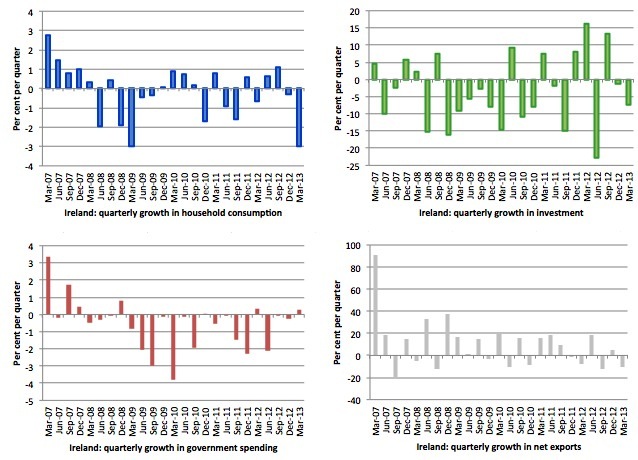

The following graph shows the quarterly growth in the major spending aggregates since the downturn took hold in Ireland (March quarter 2007).

The CSO reports (comparing the changes in the 12 months to March 2013) that:

On the expenditure side personal expenditure fell by 1.6 per cent and government expenditure declined by 1.8 per cent compared with Q1 2012. Capital investment decreased by 19.8 per cent (due to a large reduction in imported aeroplanes) while net exports fell by €300m in the first quarter of 2013 compared with the corresponding quarter of 2012.

On a quarter-by-quarter basis, personal consumption growth has declined for the last two quarters (plunging in the March-quarter 2013) and remains well below its pre-austerity levels. There is no revival evident in private consumption expenditure.

All those Ricardian Equivalence arguments that claimed there would be a surge of private consumption once the austerity was invoked would seem to be silent well and truly now.

Government spending growth has been aggressively negative although there was a slightly positive contribution in the March-2013 quarter.

Private investment (capital formation) fell dramatically in the June quarter due to the aviation investment. These special airline purchases of leasing companies which use Dublin as a tax haven always distort the aggregate national accounts data.

Investment expenditure is sensitive to these large lumpy items (especially in an economy the size of Ireland) but there is no sign of a major investment-led recovery about to swamp Ireland anytime soon.

Even net exports has been negative for two of the last three quarters. The volume of exports fell in the March-quarter 2013 (by 3.2 per cent), the third negative result in the last four quarters and the sixth in the last eight quarters.

The situation would have been worse had not imports slumped (on the back of declining national income). Imports have contracted for 7 of the last 8 quarters, a truly dismal sign.

The other “arm” of the fiscal contraction expansion argument used to justify the imposition of austerity – the domestic deflation leading to rising international competitiveness and an export-led recovery is also proving to have no merit.

Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

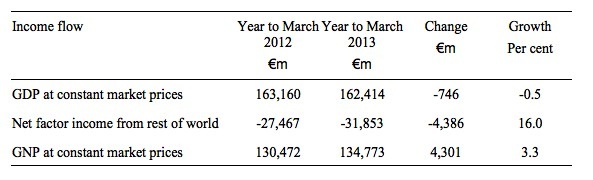

The following Table provides a longer view to see beyond the volatility of the sometimes large capital flows which occur given that there are some very large companies sheltering in the a relatively small nation.

The Table compares real GDP, NFI and GNP for the 12 months to March 2012 with the 12 months to March 2013.

Real GDP fell by 0.5 per cent over the last 12 months compared to the previous 12 month period, while real GNP grew by 3.3 per cent over the same period. Net factor income to foreigners grew by a staggering 16.0 per cent over the last 12 months compared to the previous 12 months.

Ireland’s growth strategy has been based on increasing exports of real goods and services which are a cost to the domestic economy (forgoing local use). Further, any growth dividend is being expatriated to foreigners as rising income.

The only conclusion you can draw at this stage is that the austerity package is further impoverishing the local residents and handing over increasing quantities of Ireland’s real resources to the benefit of foreigners. That doesn’t sound like a very attractive option to me.

The Irish Labour market

If we take the ILO Participation and Unemployment rates (Source) as a reference we can use the total working age population series (15 years and over) (Source) to derive what are ILO consistent estimates of the labour force, unemployment and employment. This allows us to gain deeper insights into the Irish data, which is rarely discussed in the mainstream media.

If we take the fourth-quarter 2007 as our benchmark quarter, given the participation rate peaked at 64.1 per cent, we can track what has happened in the labour market since then – a period which covers the descent into crisis and then the sustained austerity stance (beginning early 2009).

The following Table provides a comparison between the period from the December-quarter 2007 to the March-quarter 2013 (21 quarters) with the 21-quarter leading up to the December-quarter 2007 and demonstrates the stunning turnaround in the nation’s fortunes.

There has been a dramatic slowdown in total population growth since late 2007, a massive shrinkage in the Irish labour force and a large proportion of the jobs gains in the five-years or so leading up to the crisis are gone.

| Period | Working age Population (000s) | Labour Force (000s) | Employment (000s) | Unemployment (000s) |

| 2002Q3 – 2007Q4 | 434.2 | 412.0 | 378.8 | 33.2 |

| 2007Q4 – 2013Q1 | 50.8 | -122.0 | -305.2 | 183.2 |

The Central Statistics Office in Ireland estimates the standardised unemployment rate to be 13.7 per cent in May 2013. Critics of my position have suggested that the rate has fallen from its peak of 15.1 per cent in the March-quarter 2012, which illustrates that austerity is bringing the unemployment rate down.

Well it depends on how you measure things. There are shifts in a number of components that go to make up the official measure. Remember it is a ratio of those who are officially unemployed to the current official labour force. The unemployment rate can fall if the denominator falls less quickly than the pool of unemployed falls due to workers being counted as outside the official labour force.

What would drive that sort of outcome? Exactly what we are witnessing in Ireland since December 2007.

First, there has been a rapidly slowing population growth rate as more and more young Irish workers leave the nation in search of a better outcome.

Since mid-2009, net migration rates have been negative with a dramatic decline in the migration to Ireland and a rise in the migration from Ireland (Source)

In 2006, 83.6 per cent of the total out migration was from persons in the 15-44 year old cohort. There were 36 thousand leaving Ireland in total in that year.

By 2012, the proportion of 15-44 year olds was about the same 86.5 but the total out migration for all groups had risen to 87 thousand.

The main destination for Irish nationals is Australia.

Second, there has been a dramatic decline in the participation rate as workers give up looking for work and become discouraged (hidden unemployed) workers not counted in the official unemployment rate.

These are workers who would start work immediately should a job offer be available but fail activity tests (search) and are excluded from the ranks of the unemployed.

What impact has this effect had?

Ignoring the virtual zero population growth since the December-quarter 2007 (which if we took that into account would produce a much worse situation than follows), the drop in participation from 64.1 per cent to 59.8 per cent in the March-quarter 2013 (and it continues to fall), means that approximately 154 thousand persons have left the labour force as a result of the recession and become hidden unemployed.

These are not including those who have left the country. So the rise in official unemployment has been 183.2 thousand over the period but the rise in hidden unemployment has been not much less at 154.6 thousand (and rising).

That is a better measure of the extent of labour market failure. If we add the two groups together the unemployment rate would currently be around 19.5 per cent rather than 13.7 per cent, as officially measured.

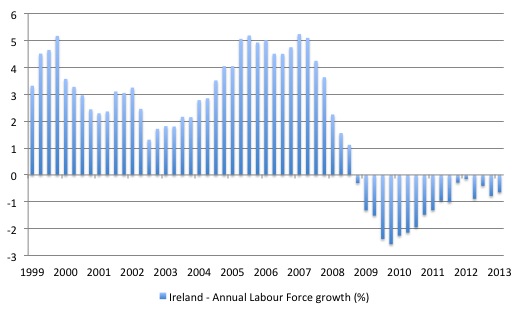

The following graph shows the annual growth in the Irish Labour Force since the March-quarter 1999. It includes the effects of a dramatically slower population rate since 2008 and a sharp (and on-going decline in the participation rate).

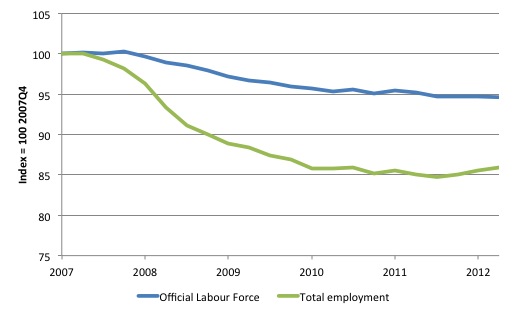

The next graph shows what has happened to the labour force and total employment (both indexed to 100 as at December-quarter 2007). The difference between the two lines is the growth in unemployment But, as noted above, this seriously underestimates the impact of the downturn and the subsequent fiscal austerity given the slump in population growth and the collapse in the participation rate.

So there is another “look at the data”! It isn’t rocket science.

Conclusion

In this blog from July 2010 – The Celtic Tiger is not a good example – I noted that Ireland’s growth was coming from the modest growth in the US economy. As the Euro depreciated against the US dollar, Ireland’s exports (pharmaceuticals, software, food and services) became increasingly cheaper and more attractive to its two major trading partners Britain and the US.

Exports were driving Ireland’s growth. I noted then that with the UK economy heading back into recession courtesy of its own government’s austerity mania, that the Irish recovery would soon come to an end.

That prediction continues to be validated by each subsequent data release (once the revisions come in).

Austerity begets austerity and trade is one way that the transmission occurs. There is nothing good that can be taken out of the latest Irish national accounts data.

It demonstrates the pernicious lie that the IMF, the OECD, the EU bosses and the Irish politicians are forcing on the Irish people.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

This morning, a business in Ballincollig (Cork) almost hired a part-time secretary. But of course some people still claim that austerity doesn’t work in Ireland. There is no stopping the left-wing propaganda spread on this blog.

Ireland’s growth strategy has been based on increasing exports of real goods and services which are a cost to the domestic economy (forgoing local use). Further, any growth dividend is being expatriated to foreigners as rising income.

This is the long-standing relationship between the west and many resource-rich less-developed nations. Now coming to a country near you! Experience shows that it is an indefinitely ‘sustainable’ economic model, as long as the local leaders/politicians are on board. I hope, for Ireland’s sake, that voters are not so numbed by the continuing waste and corruption that they let the situation continue.

Alex

Thanks. Nothing like a good belly laugh first thing in the morning.

In the 1930s the financial powers in charge of the globe crashed the monetary operating system.

The resources were available in the 30s but the money was not.

Deflation was used to centralize power , once power was further centralized they inflated.

Something similar is happening now but in a more slow motion fashion with perhaps the smaller peripheral EU preforming the role of the larger US of the 30s.

The power of the now not so hidden financial power can be seen in a Vincent Browne interview of the Irish CB gov 2 years ago when he referred to “The People” who had ultimate political power.

The idea is to crash the operating system of these Euro vassals ………this means real resources are not burned in these banking jurisdictions and thus get transferred to a more central area of banking operations for whatever dark purpose they have in mind for us.

Its quite clear to me – they wished to destroy us from the very beginning.

These market state events closely parallel the 17th century Cromwellian conquest & objective of transforming a mixed Gaelic / Norman tribal system into a more centralized nation /anti nation state system of banking control.

Now the nation state system is on the chopping block as these Doctor Frankenstein characters have a new creation which they wish to animate – the European managerial version of the global banking market state.

What Bill fails to see is that failure of a nation state is a dramatic success in their eyes.

People in Ireland have underwent two massive inflationary & deflationary shocks since entering the euro 9th circle which was also used to destroy a perhaps mythical culture created by a certain Anglo Irish sect in the 19th century.

Irish people are suffering from the same cultural & economic Phenomena of the 17th century – a curious break in all things familiar which creates a disorientated populace ripe for the picking.

It was not a mistake.

The purpose of these strange and curious events is extraction.

Ireland much like the past is a major banking battleground for ideas.

We are a form of controlled experiment again as the economic & social data is quite good in Ireland.

For example economists can speculate about how many banking assets are lost to suicide and if certain policies have a worthwhile cost to benefit ratio.

dnm writes : “it is an indefinitely ‘sustainable’ economic model, as long as the local leaders/politicians are on board.”

I know you are being ironic. Nothing in the known universe is indefinitely sustainable.

Bill is quite right to point out that excess economic austerity damages the economy and that MMT principles and prescriptions would assist the matter. However, beyond that there is the issue of sustainability. Our ability to transition to a sustainable economy is being hampered by poor and wasteful use of current resources and capacity. There is also a lack of transition planning due to the belief that current BAU practices can continue for ever.

The economic and social malaise being manifested and expressed in places as diverse as Ireland, Greece, Egypt and Brazil (to name a few) is a compound brew of neoliberal capitalist economics and physical limits to growth being reached without appropriate action to transition to a stable, sustainable, renewable economy.

Nicole Fox talking in New Zealand with obvious parallels with the albeit much less isolated island of Ireland.

http://www.theautomaticearth.com/Finance/nicole-foss-new-zealand-and-the-end-of-economic-growth.html

If we could drag Ireland North to Icelands latitude or indeed down to South Georgia we may have some chance.

She speculates that the system will not be able to scale up – I am not so sure………as they wish to destroy the cash economy in Ireland which is the last remaining fully functional trade system.

A destruction of this will be seen as a success.

Destruction is a positive metric at the moment – they don’t want to create local buyers and sellers in Euro vassal states , everything must be under (external) corporate control as seen with the euro boys and girls banning turf cutting even – a fuel Ireland always turned to in bad times , they will not even allow us that cheap winter comfort.

The bastards in Europe are really trying to centralize at all costs and are becoming successful according to some of their demonic metrics.

Ikonoclast, when you talk about “physical limits to growth”, I think it is vital to differentiate between growth that is a manifestation of burning more of our limited natural resources and growth that is a manifestation of learning from our ever increasing body of knowledge and experience and so doing things smarter. The later type of growth really is without physical limit.

Dork of Cork, I don’t think there is anything more mysterious to the austerity plight than the simple wish to maintain the financial power of the credit bubble paper wealth that was built up prior to 2008. They just want to preserve that financial power in aspic even if that means utter waste and devastation.

Bill, what is to be made of the current “credit crunch” in China?

“Our ability to transition to a sustainable economy is being hampered by poor and wasteful use of current resources and capacity.”

Interesting point on trains that shows the issue. Companies that build trains are not receiving an income flow that reflects how good those trains are at lasting over time. The orders for trains are very lumpy and that makes it extremely difficult to run a company on normal terms. The risk premium is enormous and you have to be a vast organisation to absorb the ebb and flow of investment in rolling stock across the globe.

Yet we really need high quality efficient trains that have a very long lifespan.

Much of the move towards a throwaway culture can be attributed to the lack of value given to longevity in an item. It’s just not valued as it perhaps should be.

I wonder whether that sort of example calls into question the supposed efficiency of capitalist production.

Dear Bill

For a small country, emigration can give rise to a lower unemployment rate if it is mainly the unemployed who leave. Let’s assume that Ruritania has a labor force of 2 million, of whom 400,000 are unemployed. Its unemployment rate is therefore 20%. Now 200,000 of the 400,000 unemployed but none of the employed emigrate. As a result, the labor force is now 1.8 million, of whom 200,000 are unemployed. So, the unemployment rate in Ruritania falls from 20% to 11.1% without any additional jobs having been created. It seems that something like that happened in the Baltic Republics in recent years.

Regards. James

@Stone

Whats clear from the tapes (albeit in fragments) is the junior role of the Anglo Irish bank within the system.

The CB is their big sister which is seen willing to tolerate extraction via their double entry games up to a certain perhaps political point.

What worries the CB (like all CBs) is therefore what is the sustainable rate of extraction.

Whats surprising (or not) about Ireland is that there is no political extraction limit.

Also the Bank of Ireland is referred to as simply “The Bank” which gives a indication of where the true national power resides.

The political parties now in power would be closer to this Bank rather then the state which never really existed in Ireland.

Besides the local power structure the really big boys arrived in 2009 ……..this was the really big bank.

Ireland has always been more of a giant estate then a functional state.

( it is quite rightly not referred to as a republic during council meetings)

However at least prior to the Euro there was a more fluid money supply where internal goods were cheap relative to cash flow in rural areas (although not in urban areas)

http://www.youtube.com/watch?v=6Fz67YCIz1o

The entire society is in flux.The above town was always a very rough place during the fair but there was no murders that I can remember.

A young eastern European mother and little daughter was murdered in the place last month with a Ambulance paramedic also assaulted recently.

Domestic murder and especially hard drugs was almost unknown in Ireland until the CB and their sisters scaled up operations in the 1960s

Local rednecks have left the building and external workers are filling the void much like what happened to England after Suez.

The fat controllers can increase the rate of profit until a wider system collapse occurs where you get a total collapse of trust at even local trade & social relationships.

The population is not declining …………less energy is running through more and more (external) workers who have now reached child bearing age.

Them there are the facts I am afraid.

You do get gaps in the age structure / profile with for example 18 ~ year olds at a 30 + year low in the country but that will soon change as non native Irish kids mature.

In that sense its a Malthusian perti dish of the classic British variety.

If the irish labor force was the same today as in 2008, unemployment rate would be around 20%. The drop is a result of emigration and discouraged people leaving the labor force.

More explanations and a graph here : http://rwer.wordpress.com/2013/04/17/if-the-irish-labor-force-had-not-declined-so-much-irish-unemployment-might-have-been-20/

@ikonoclast

By ‘indefinitely’ I didn’t mean forever. It’s far from my field of expertise, but I reckon that at least in the LDCs, the political will exists as long as there are resources to be exploited, and far longer than the lifetime of individual administrations, or even states (see Conflict minerals. Hopefully, Ireland, being a democracy, is in a slightly better position.

“Free market?” It’s doubtful that banking could even exist to any large extent in a true free market of private money creation.

Ikonclast: The malaise is solely due to neo-liberal policies and has nothing whatever to do with ‘physical limits to growth’. Just as the ‘numbers’ do not support neo-liberalism, they do not support physical limits to growth. I have a technical background and I believe there are no physical reasons we could not give every inhabitant of this planet a comfortable life, and quite a few more besides. I will give you one example. There is no limit to the quantity of inexpensive energy that can be produced safely and cleanly by nuclear fission of uranium and thorium, with no negative impact on the environment. This requires no miraculous scientific breakthroughs or new Physics, it only requires the will to do so. For the worlds impoverished billions I hope that we will exercise that will. Looking at China there is good reason for optimism.

Whats most striking in my opinion is the neo – liberal sustainable energy Ireland organizations energy consumption predictions and its manifest total failure.

Not only that but German and other car /credit organizations are allowed to provide credit for useless Audis and some such when energy is needed for real work elsewhere and this is somehow never questioned.

Energy Forecasts for Ireland to 2020

2009 REPORT (December) was published over 2 years into the crisis…………

It used 2008 energy stats as its baseline

With a total primary energy requirement of 16,356 KTOE in that year of which 8,964 KTOE was oil

Wait for it

Its prediction for Y2012 ……..

TPER : 15,561 ktoe

oil : 8,181 ktoe

So a substantial fall was planned for.

The reality of 2012

TPER : 13,189 Ktoe

oil : 5,984 Ktoe

Needless to say a immediate near total ban on private car sales should have been brought in during 2008 and the surplus not given on external interest pushed into tram line fixed capital construction.

We now have a useless credit hyperinflated stock of cars which cannot be used at anything near the max at this energy density.

This story is as big if not bigger then the house boom stuff although both are linked via the burbs

800,000 private cars in Y1990.

1.8 million today.

A real country under such war time cuts in primary inputs would not allow a bunch of new cars to swan around wasting now precious fuel rations.

Sometimes I think the Europeans are just irredeemably nihilistic and self-destructively perverse. They have convinced themselves that growth itself is evil, and so they are happy to have little of it. And they hate their children, because children remind them of things like hope and life and the future, concepts that don’t conform to the European post-apocalyptic mindset.

Not really so much in general, but a certain tradition. A crazy sickness unto death, a positive fascination in Vienna, and just being unto nothingness. Not so different from mainstream neocon thought in the States.

@SteveK9:” There is no limit to the quantity of inexpensive energy that can be produced safely and cleanly by nuclear fission of uranium and thorium, with no negative impact on the environment. ”

By “no limit”, I take it you mean that continued exponential growth of energy usage is feasible, given a source such as thorium fission. I urge you to read this:

http://physics.ucsd.edu/do-the-math/2011/07/galactic-scale-energy/

by another physicist, Tom Murphy. At 2.3% pa growth in energy usage, the Earth becomes hotter than the sun within 1400 years. Kinda toasty..

@ParadigmShift, I think the crucial thing is to not conflate energy consumption and economic activity. Doing things more efficiently could mean using less energy to get more benefit. Think about computers and Moore’s Law. DNA sequencing is getting more efficient with an even shorter doubling time than Moore’s Law.

As an example of potential economic growth – think of the sea fish stocks around the UK -they are desperately degraded and yield <50% of the catch yielded (sustainably) 100years ago. Potentially the sea environment could be regenerated and the seas could be teaming with fish AND fishing could be a recreational/tourist activity. Instead of dredging up the seafloor with grossly destructive trawlers, tourists might pay a fortune to sustainably go spearfishing or whatever. So a massive amount of economic growth might be realized simply by us being less stupid. I think we should at least aspire to become less and less stupid and aspiring to economic growth might be no different from aspiring to becoming less and less stupid – basically just learning from experience.

“At 2.3% pa growth in energy usage, the Earth becomes hotter than the sun within 1400 years”

Yes. Premature extrapolation. The chief weapon of charlatans everywhere (alongside ignoring the problems with exponentials at the other extreme).

I generally recommend they see a doctor. These days they have tablets that help with that sort of problem.

M1 money supply surging in Ireland and gone past 100 billion for first time.

http://www.cso.ie/px/pxeirestat/Statire/SelectVarVal/Define.asp?maintable=FIM06

This could be because of external factors ……..perhaps the so called ” The Gathering” introducing direct exchange into the country.

Recently Noticed increased car traffic in certain areas and some tourist areas buzzing a bit.

@stone: Yes, clearly there is some scope for reducing the energy intensity of GDP, particularly in developed countries. And there are many things we could be doing a lot smarter than we currently are, but powerful people stand to gain (in the short term, which is all they seem to care about) from the apparently suicidal behaviour of our civilisation, and unless that calculus changes, and I see no reason why it should after 5,000 years of civilised human history, I’m not hopeful that things will improve.

I think a more fundamental question is why we are still collectively held hostage to the imperative of GDP growth, when it is well established that GDP is a highly imperfect indicator of human happiness, and is becoming increasingly representative of what Herman Daly terms “illth”, rather than wealth. Our politicians have abdicated their social responsibilities, content to measure their success by the growth of a number that is a poor reflection of the health of society, masking all manner of social ills.

@ParadigmShift

I think Ireland has the lowest energy consumption relative to GDP in Europe.

So that has clearly not helped our situation although GDP is inflated by multinational operations.

No the crisis is one of local production vs outside oil / gas / capital inflows which overpower domestic systems.

When the consumer credit disappears from these countries they are left with stranded capital investments in a sea of concrete.

Neo liberal agencies such as the IEA energy policy advice has been a total disaster in this regard.

They tend to concentrate on further efficiency improvements……….this new surplus is then invested into more grot and not core capital investments such as capital intensive Nuclear or even coal plants.

It is no accident that Spain & Italy dumped Nuclear back in 1986.

It had nothing to do with Chernobyl really.

That was a timely excuse.

The budding EMU would not tolerate investments that would increase national redundancy from outside oil & gas shocks.