The other day I was asked whether I was happy that the US President was…

Christmas is in decline in Greece

The alternative title for today could have been my award to the Euro elites for the title as Champions of Europe – for their consistent record-breaking feats – month after month – the unemployment rate rises. Eurostat reported on Monday (July 1, 2013) that – Euro area unemployment rate at 12.2% – up from 11.3 per cent in May 2012. That is an additional 1.4 million workers out of work in the 12 months. Unemployment is nearly reaching 20 million in the Eurozone. 3.5 million under 15s are now unemployed in the Eurozone (23.9 per cent up from 23 per cent in May 2012). Youth unemployment stands at 59.2 per cent in Greece, 56.5 per cent in Spain and 42.1 per cent in Portugal (and rising in all three nations). Talk about leaving a legacy for our grandchildren. Anyway. I thought I might just refresh my understanding of the Greek data today and ask some questions. What comes out is that Christmas is in decline in Greece – at least in a material sense. Which would be good if it was for the right reasons – that is, a renewed enlightenment towards non-material values. The problem is that it reflects a devastated economy being overseen by some bullies who not only fail in their own jobs but also want to make sure millions do not actually have jobs. The question (and there are a multitude of ways we could ask this) is Why?

A Reuters article this morning (July 3, 2013) – Eurozone issues ultimatum to Greece – reported how the Troika now are threatening Greece with reprisals if they don’t cut their net spending further. The question of how far can either side go arises. I notice new terminology creeping into this neo-liberal horror story. The latest is “mobility scheme” – which is a euphemism for sacking 12,500 workers within the next 12 months. Its just a mobility scheme. Dehumanising nomenclature for what I consider to be an assault on the well-being of Greek citizens.

So why?

Why is this happening?

Why would the workers go along with it?

Why would the pensioners go along with it?

Why would small business operators go along with it?

Who is actually gaining from this devastation? On the face of it there are millions of losers, so who are the winners?

The Reuters article reports that:

Greece has three days to reassure Europe and the IMF that it can deliver on conditions attached to its bailout in order to receive its next tranche of aid … The lenders are unhappy with progress Greece has made towards reforming its public sector … Athens has missed a June deadline to place 12,500 state workers into a “mobility scheme”, under which they are transferred or dismissed within a year …

Athens and the troika are at odds over an unpopular property tax and a sales tax for restaurants, while a shortfall of more than 1 billion euros has emerged at state-run health insurer EOPYY, meaning automatic spending cuts may have to be agreed to bring it back on an even keel.

Here is what the recent data from Greece is telling us. All data is from the – EL.STAT (Hellenic Statistical Authority).

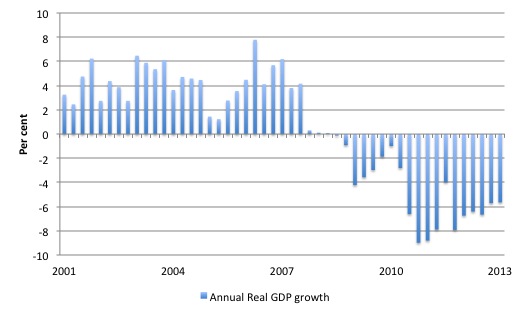

The first graph is the annual growth in real GDP since the March-quarter 2000. Real GDP is now at around the level that Greece produced at the beginning of 2000 and falling fast.

In other words, the economy is at the same size as it was overall when they entered the Eurozone. See later Graph for more information.

Greece has been in recession for 18 quarters (counting from the second negative growth outcome) and there is no sign of growth emerging.

It is now a staggering 31.8 per cent smaller than its peak in the September-quarter 2007.

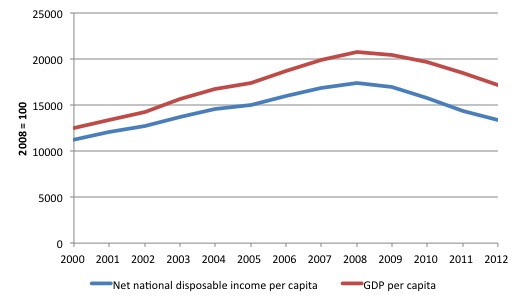

This translates into substantial declines in per capita GDP and net national disposable income per capita (see next graph).

Eurostat report that – National disposable income:

… is the sum of the disposable incomes of all resident institutional units/sectors.

Gross (or net) national disposable income measures the income available to the nation for final consumption and gross (or net) saving. It equals gross (or net) national income (at market prices) minus current transfers in cash (taxes on income and wealth, etc., social contributions, social benefits other than social transfers in kind, and other current transfers) payable to non-resident units, plus transfers receivable by resident units from the rest of the world.

In other words, national disposable income may be derived from national income by adding all current transfers in cash receivable by resident institutional units from non-resident units and subtracting all current transfers in cash payable by resident institutional units to non-resident units.

GDP per capita is down near the 2004 level and Net national disposable income is between the 2002 and 2003 levels.

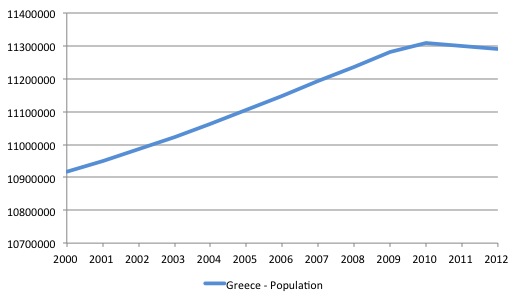

The situation would have been worse had not the population also declined over the last few years (see next graph). The estimated population in 2012 is now 15.5 per cent below the estimates for 2010. Austerity always looks better than it is (which translates to slightly less devastating than it is) because it leads to declines in population.

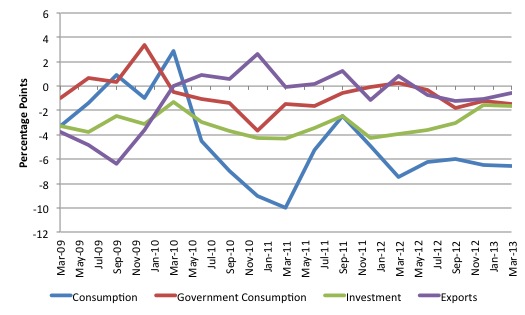

There is also not one single aggregate expenditure component adding to growth.

The next graph shows the contributions to annual real GDP growth from March 2009 to March 2013 for the major expenditure components.

Consider the narratives that have been spun by politicians drawing on mainstream macroeconomics to justify the austerity program.

The notion of Ricardian Equivalence, the modern version of which was developed by Robert Barro at Harvard. His predictions (or those of his followers) have been proven wrong so many times that it is difficult to keep count.

For non-economists – this piece of neo-liberal dogma says that the non-government sector (consumers explicitly) having internalised what they consider to be the government budget constraint (that eventually debt will have to be paid for with taxes) will negate any government spending increase whether the government “finances” its spending via taxes or borrowing. So if the government spends and borrows, consumers will anticipate higher future taxes and spend less now offsetting the stimulus.

Please read my blog – Ricardians in UK have a wonderful Xmas – for a detailed critique of this “theory”.

The data certainly doesn’t point to a recovery in private spending. The neo-liberals respond by saying that the public sector hasn’t cut enough yet. How far is enough one wonders.

I recall during the Thatcher years when I was studying in the UK that that the Monetarists kept responding to each successive release of higher unemployment data etc that the cuts and privatisation had not been severe enough yet. More was needed. Years passed and things continued to decline – but it was still the case that more cuts would be necessary.

The Troika are back with that argument again. Of-course, Greece will eventually grow again – as some entrepreneur seizes on some angle. It will be off a very low base but it will happen. The society will be transformed significantly with less public protections etc. But there will be growth. At that point expect to hear the neo-liberals claiming success.

But of-course, the growth will be despite the austerity not as a result of it.

Remember George Osborne’s – Mais Lecture – A New Economic Model – on February 24, 2010 where we learned that:

Those who recommend delay argue that when private demand is weak, cutting government spending too quickly risks undermining the recovery … [But] … why it is that private demand is weak.

Modern economics understands the importance of expectations and confidence. Businesses and individuals look to the future, and while they are not the perfectly rational creatures assumed by the theory of Ricardian equivalence, uncertainty over the future paths of tax rates and government spending does play an important role in their behaviour.

This is particularly true when it comes to consumer spending and business investment … a credible fiscal consolidation plan will have a positive impact through greater certainty and confidence about the future.

Remember his boss, David Cameron who on January 27, 2011 in his – address – to the World Economic Forum in Davos, Switzerland, said:

Those who argue that dealing with our deficit and promoting growth are somehow alternatives are wrong. You cannot put off the first in order to promote the second.

Why doesn’t the press question these characters as to how there so-called authoritative assessments, which have guided policies for the last five or so years around the world (in the sense that they reflect the neo-liberal ideology), stack up against the data?

Why do they assume the people are so stupid? Why do the people keep voting for political parties who inflict pain on them – not by chance, but by orchestrated mayhem.

And remember the pontificating President of the European Council Herman Van Rompuy, who in a – Speech to the European Parliament – on March 13, 2012:

One front is fiscal consolidation. Another is the growth and employment agenda. Some claim that these two are contradictory. It is our job to make sure that they are not.

It would seem Van Rompuy failed to do his job. But he won’t be forced into penury as a result. It seems that Osborne and Cameron and all the rest of those who claimed that there could be fiscal contraction expansion got it wrong – badly.

Why haven’t the business sector taken them to task for wrecking countless firms?

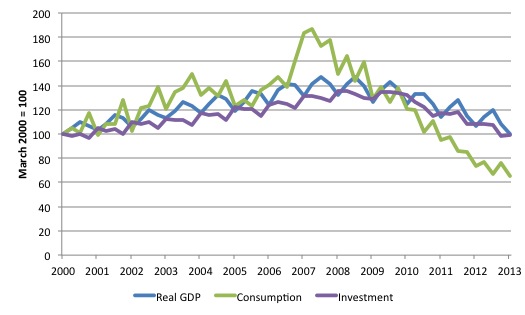

And the next graph shows real GDP, consumption and investment indexed to 100 at the March-quarter 2000. The serrated nature of the lines is because the data is not seasonally adjusted. But you can see the underlying movement very clearly.

Real GDP and real consumption (private and public) is now back to levels seen in the March-quarter 2000 and total investment (that is, building of productive capacity) is around 59 index points (that is around 40 per cent below the March-quarter 2000 level).

Consider what that implies for future growth in Greece. The massive attrition in productive capacity will make it very hard for the nation to achieve a return to prosperity in the coming decade.

The nation will encounter inflation bottlenecks earlier than otherwise and its productivity growth will be weaker than otherwise.

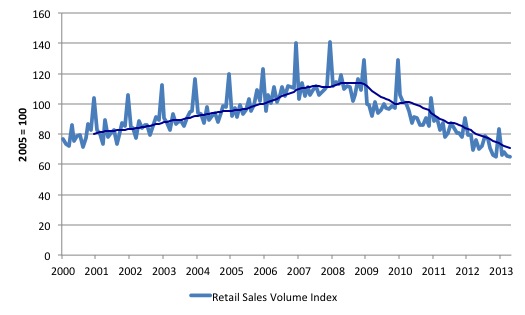

The next graph shows the Retail Sales Volume Index for Greece from January 2000 to April 2013 (Index = 100 in 2005). The data is from the EL.STAT (Hellenic Statistical Authority) – Volume Index in Retail Trade. The darker line is a 12-month moving average.

By April 2013, the index was down to 65 (2005 = 100) and is well below the value of 76 in January 2000, when the index starts.

Notice the seasonal spikes for the month of December which indicate the traditional boost to retail sales from the Xmas spending. Those spikes are now much less apparent.

Austerity is destroying seasonality!

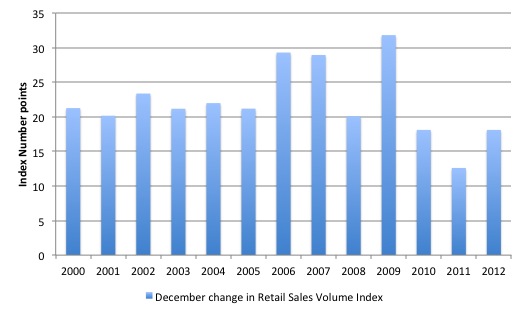

The following graph shows the change in the Retail Sales Volume Index each December from 2000 to 2012. I wonder what happened in 2009. Clearly the trend is down.

Conclusion

While the answer to the question why are they doing this is complex, there is no complexity in explaining why the Greek economy is behaving in this way.

Modern Monetary Theory (MMT) is about the real world and starts with some basic macroeconomic principles like – spending equals income.

The basic macroeconomic rule – spending equals income – (the equivalent of gravity) is being ignored by governments who have been captured by the neo-liberal dogma that self-regulating private markets will deliver prosperity to all if only governments reduce regulation and run budget surpluses with low taxation.

There have been scores of mainstream economic lies that this crisis has exposed including deficits cause inflation; deficits cause interest rates to rise; there is a money multiplier; or the spending multiplier is well below one. Even the IMF has had to admit they lied about the latter in their earlier forecasts and “modelling”.

One of the most basic neo-liberal lies – that if governments cut their spending the private sector will fill the gap. Mainstream economic theory claims that that private spending is weak because we are scared of the future tax implications of the rising budget deficits.

The overwhelming evidence from research studies shows that firms will not invest while consumption is weak and households will not spend because they scared of becoming unemployed and are trying to reduce their bloated debt levels.

So understanding the data is simple. Understanding the motivation for the various players is not.

It is not easy to explain why the business sector is tolerating its own destruction and loss of profitable opportunities.

It is not easy understanding why workers haven’t revolted. They clearly do not understand the link between the Euro and the demise of their prosperity (given high levels of support for the monetary union remain). But why isn’t that message seeping out?

The media? The blogosphere is becoming an increasingly powerful communication force. There is plenty out there to link the Euro with the problem.

It is not easy to understand who exactly gains from all of this. Yes, the Brussels politicians are still enjoying a luxurious life. But they are mouthpieces for underlying elites.

Who are the elites and how are they gaining? That is a question I am writing a book about.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Remember George Osborne

These Oligarchical reps want to reduce local & national power in favour of transnational organizations which makes a mockery of their limited government dogma.

Its just that the “governance” they wish for is of a different character (even more centralized)

The Scots quite rightly wish to break from the original union which destroyed the periphery of this demonic construct in a further effort to centralize both at the start of its formation and now it seems near its end.

Remember Whitehall and the rest of the UK state apparatus was considered the most concentrated expression of power for quite some time.

However the Scots are likely to fall into the final City trap ……….The Euro.

They would be best advised to form closer links with Eurosceptical elements of Scandinavian society and avoid the “free trade” Marxist Tories like the plague as the era of long distance trans continental trade may be coming to a abrupt end soon ,chiefly as a result of their crazy ambition to control all life on earth.

Then again these oligarchs could succeed which will mean politics has no meaning anyway as we all enter the 9th circle of free banking hell.

Dear Bill

It is sometimes possible that private spending replaces government spending. It happens after every war. For instance, in the US, government spending was much lower in 1946 and 1947 than in 1944 and 1945, but there was no second depression.

Regards. James

Dear James Schipper (at 2013/07/03 at 21:16)

That is true but in that period employment was rising and governments were committing to full employment and social inclusion. And there was massive pent up demand following the rationing of the War.

A situation quite unlike what we face in many nations today.

best wishes

bill

When you refer to “business” not benefiting from austerity, I think it is crucial to differentiate different types of business. Creditors wanting to preserve the real value of government bonds are an interest group entirely at odds with businesses wanting to sell real goods and services. The monetary system is governed and designed by people who cherish the financial power of paper wealth. Austerity perfectly fits the role of maximizing the value of government bonds.

Perhaps the Greek people need to look to Haiti as an example of where they could be heading. Haiti paid massive compensation to France after Haiti became independent and it completely destroyed the country and they still haven’t recovered a century later.

Re post-war periods, governments tend to incur big debts during wars, which means that after wars, private sector net financial assets tend to be high, which presumably encourages spending.

Bill,

The basic difficulty is that nobody wants to cross the Rubicon and say that maybe Greece would be better off outside the euro. The European Commission certainly isn’t going to openly push Greece into dumping the Euro. Especially not if the Greek political class continue to say they want to keep it. That would be a completely suicidal institutional move for the Commission. That kind of impulse really has to come from the politicians. But if leaving the euro is (for now) an unthinkable option (for the political decision makers anyhow) then that leaves Greece short of euros. They can’t borrow on the open market, so they need funds from other EU countries. And those funds come with strings attached. Nobody wants to write a blank cheque, and least of all to Greece. One can argue the details of the “programme”, but a lot of this discussion comes down to credibility. Let’s recall how we got here. Greece manipulated debt and deficit figures to get into the euro. The record of management of EU grants (Structural and Cohesion Funds) is awful. Greece’s tax system is like something out of a parody. And foot dragging on agreed measures has been of mythic proportion. Greece is not trusted, bottom line. Given those starting points, the answer to “what do we do with Greece?” is maybe a little less straighforward. Can’t leave the euro. Can’t borrow openly. Other countries are reluctant to lend – because they are cash strapped themselves, and don’t want to spend good money after bad. Given the political and institutional constraints, I really don’t think it is all that surprising we have ended up exactly where we are – up a creek without much of a paddle.

@ Bill & Schipper

Also, consumption was heavily rationed in the US during the war, and money that would have been used for consumption during the war had been redirected to various war bond programs, including importantly easy access to such bonds for small-time savers (including children). Once the war was over, there was not only a mass of pent-up demand, but also a huge wealth of savings available to finance this demand. The result was predictable. The US economy boomed.

Both Bill and Benedict properly mention the reasons the US did not devolve into depression following WWII.

Not mentioned, was the persistent worry among DC elites, that the end of the war would precipitate a return

of the Great Depression.

This occurred precisely because, prevalent economic dogma, at the time, had no coherent, relevant explanation

for the cause(s) of the depression, and could not explain why the post war period was not only different, but

would lead to a boom.

So, DC caved into massive armaments expenditures, the Cold War(engendered by Churchill), and the Military-Industrial complex.

Likewise, DC and contemporary economic thought, could not grasp the importance of the shift from animal drawn tillage to IC engine powered tillage. They could not grasp the import of 100,000,000 acres formerly given to fodder production, at the time transitioning into grain / dairy production.

INDY

“Who are the elites and how are they gaining? That is a question I am writing a book about.”

Bill, are you able to tell us more about this up-coming book?

It seems that we have nothing to look forward to except depression/deflation/stagflation, according to the income=spending principle. I have to look no further than my own wallet to see the truth of this.

What I find more difficult to understand is that is also true for companies, corporations, nations. Ultimately their incomes must fall as spending diminishes. Share and bond values and dividends will also fall, whilst bond yields climb skywards.

At present this confrontation with strangled fundamentals seems to be an outcome that is only deferred by injection of massive amounts of cheap QE money into the markets, but sooner or later the shrinking reality of the real economy will burst that bubble and precipitate another, far worse crisis. It’s like force feeding the patient whilst applying a gastric band. Shit that has nowhere else to go will uncontrollably go everywhere.

What am I missing, or are the neo-liberals really that spitefully and suicidally thick? When you ask ‘who benefits?’, who could possibly benefit from the world becoming a catastrophically unpleasant place for almost anyone, which is the certain outcome of a major global collapse? It seems to me that no elite will be anything like as safe and comfortable as they are now. OK, I know – wait for your book. Please write faster.

As usual Professor, an excellent summary of the socio-economic mess that Greece is.

.

It seems to me that there is no one asking the powers in charge, let alone demanding proof that austerity is the cure it is claimed to be.

Perhaps I’m mistaken and if so, please correct me.

.

I don’t know of any empirically testable model that confirms the claims of austerians. In addition to that, I don’t know of an empirically testable real world economy that proves the austerian claims.

About US after the war, another concern of the elites was Soviets economic growth during the 30s and its strength in war time production and show of force. Putting people in the west back in unemployment might make people think that the commie system wasn’t that bad after all.

Today there is no competing system forcing the elites to show some restraint in their contempt for the masses. Likewise there is no agitators that canvass people that there is alternatives. The propaganda for TINA is massive in mainstream media and Public Service big news and debate programs. And the “left” in form of European social democracy and Labour is whole hearted in the austerity camp.