The other day I was asked whether I was happy that the US President was…

The Celtic Tiger is not a good example

I am back from the US now and have been reading a lot about how Ireland is poised to show all of us deficit supporters the “what for”. The crazies (the Flat Earthers or deficit terrorists) are now starting to suggest that the recent Irish national accounts results for the first quarter 2010 are the sign that the austerity drive has made Ireland more competitive and that an export-led growth era is emerging. You always have to be careful when using official data to conclude anything. The reality is that the national accounts data show that the Irish economy is still declining domestically and this is causing the labour market to deteriorate even further. The growth that is being observed is generating income that is being expatriated to foreigners. So not only is the Irish economy sacrificing real goods and services to increase exports but then the benefits of that sacrifice are being sent abroad to foreigners. If that is an example of how austerity benefits the local population then it just shows how impoverished the conception held by the crazies is. Ireland remains a good example of what happens when you withdraw public spending support for an economy facing a major collapse in private spending.

The Irish Times reported on Saturday (July 3, 2010) that there were now “(h)opeful signs on the economy”. The article said:

THE ECONOMIC tide is slowly turning. For the first time in three years, there are now more reasons for hope than for despair.

This week a raft of indicators, when taken together, give grounds to believe that the foundations of a jobs-generating recovery are falling into place. By economists’ standard definition, the recession ended in the first three months of the year according to the CSO’s latest GDP data. There are tentative signs that consumers are spending again. Every measure of retail sales in April was up, albeit marginally, on the low points registered at the turn of the year. All the latest exports numbers – also available to April – show strong growth, and a weaker euro since then should provide some additional boost.

Ireland was the first of the EMU nations to embrace the austerity mantra – the first of the governments to openly engage in economic policy malpractice by abandoning their responsibilities to advance public purpose. The data supporting that claim is easily available (see below).

But the deficit terrorists are starting to claim victory as a result of the latest national accounts data. The Central Statistics Office for Ireland released the National Accountsdata for the first-quarter 2010.

The CSO said in their release that:

Initial estimates for the first quarter of 2010 show an increase, on a seasonally adjusted basis, of 2.7 per cent in GDP and a decline of 0.5 per cent in GNP compared with the previous quarter. In comparison with the corresponding quarter of 2009, GDP at constant prices was 0.7 per cent lower while GNP was 4.2 per cent lower.

The following graph shows quarterly growth rates in real Gross Domestic Product (GDP) and Gross National Product (GNP) from the first quarter 2007 to the June 2010 quarter. Clearly the GDP growth in the June 2010 quarter is what everybody is focusing on. The most recent quarter shows a 2.7 per growth although GNP continues to be negative.

Before I come back to analysing what is driving this result, you need to first understand the difference between GDP and GNP. Wikipedia is a reasonable place to start in this respect (but not always). A more thorough (very) understanding of these concepts is provided in the excellent publication from the Australian Bureau of Statistics – Australian National Accounts: Concepts, Sources and Methods, 2000

The two concepts are defined as such:

- Gross domestic product (GDP) is defined as the market value of all final goods and services produced in a country in any given period”.

- Gross National Product (GNP) is defined as the market value of all goods and services produced in any given period by labour and property supplied by the residents of a country.

The Irish CSO publication says that GNP = GDP + Net factor income from the rest of the world (NFI). NFI is defined as:

Net factor income from the rest of the world (NFI) is the difference between investment income (interest, profits etc.,) and labour income earned abroad by Irish resident persons and companies (inflows) and similar incomes earned in Ireland by non-residents (outflows). The data are taken from the Balance of Payments statistics. However the components of interest flows involving banks in this item in the national accounts are constructed on the basis of “pure” interest rates (that is exclusive of FISIM) whereas in the balance of payments the FISIM adjustment is not carried out. There is an equal and opposite adjustment then made to the imports and exports of services in the national accounts which is not made to these items in the balance of payments. The deflator used to generate the constant price figures is based on the implied quarterly price index for the exports of goods and services. In some years exceptional income payments have had to be deflated individually.

In this blog – The sick Celtic Tiger getting sicker – I argued that the so-called “Celtic Tiger” growth miracle was an illusion and was driven by major US corporations evading US tax liabilities by exploiting massive tax breaks supplied to them by the Irish government.

I cited the work of Boone and Johnson who concluded that:

… 20 percent of Irish gross domestic product is actually “profit transfers” that raise little tax for Ireland and are owned by foreign companies – the Irish miracle was a mirage driven by clever use of tax-haven rules and a huge credit boom that permitted real estate prices and construction to grow quickly before declining ever more rapidly. The biggest banks grew to have assets twice the size of official G.D.P. when they essentially failed in 2008.

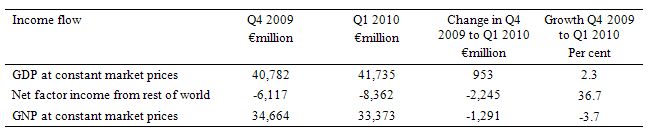

I created the following Table to show you the breakdown between these aggregates and their evolution between Q4 2009 and Q1 2010 for Ireland using the CSO National Accounts data.

So the growth in GDP has spawned a rapid fall in net NFI. What is the significance of this?

The recent growth is coming exclusively from exports (which is signalled by the GDP figure). However, the domestic economy is still declining with unemployment rising further.

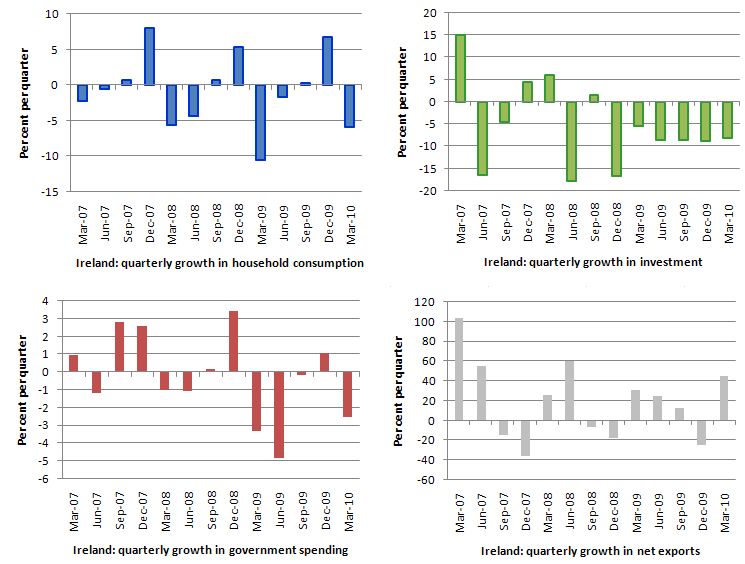

The following graph shows the quarterly growth in the major spending aggregates since the downturn took hold in Ireland (March quarter 2007). All domestic spending aggregates remain negative.

By excluding the expatriated profits of foreign multinationals, GNP provides a better picture of how the domestic economy is delivering welfare improvements to its residents. The fact is that Ireland continues to go backwards in this regard.

So they are exporting real goods and services which are a cost to the domestic economy (forgoing local use) to generate growth and the growth dividend is then being expatriated to foreigners as rising income.

The only conclusion you can draw at this stage is that the austerity package is further impoverishing the local residents and handing over increasing quantities of Ireland’s real resources to the benefit of foreigners. That doesn’t sound like a very attractive option to me.

In March 2005, the OECD Observer said this:

Ireland is another country where GDP has to be read with care. Ireland’s position has risen up the GDP per head rankings since 1999, and is now in the top five countries in the OECD … But does GDP per head accurately reflects Ireland’s actual wealth, since all that inward investment (and foreign labour) generates profits and other revenues, some of which inevitably flows back to the countries of origin?

Another measure, Gross National Income, accounts for these flows in and out of the country. For many countries, the flows tend to balance out, leaving little difference between GDP and GNI. But not so for Ireland, as outflows of profits and income, largely from global business giants located there, often exceed income flows back into the country. This means that in a GNI ranking, rather than being in the top five, Ireland drops to 17th. In other words, while Ireland produces a lot of income per inhabitant, GNI shows that less of it stays in the country than GDP might suggest.

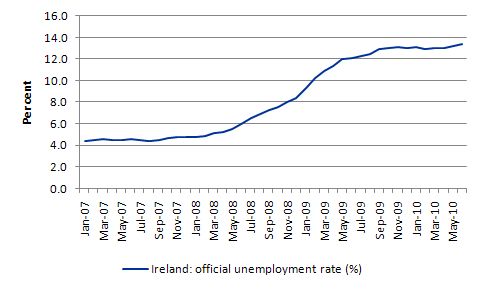

The reality is that the GDP growth has not impacted positively on Ireland’s labour market – which presumably matters more than whether the economy is producing net income for foreigners.

The following graph shows the evolution of the official (standardised) unemployment rate in Ireland taken from CSO labour force estimates from January 2007 to June 2010. You can see that in recent months the unemployment rate is rising again. This is also in the context (not shown) of a continuing plunge in participation rates. So not only is the economy failing to generate enough jobs to satisfy the available labour force, but it is also driving more and more workers into inactivity (not in the labour force).

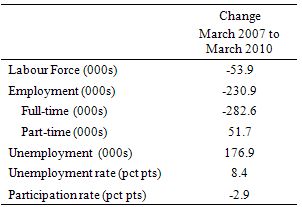

To see how much has been lost in Ireland, the following table shows the changes in the major labour market aggregates since Q1 2007 to Q1 2010. The job losses have been huge and are continuing in net terms.

In general, Ireland’s growth is coming as a result of the modest growth in the US economy in the recent quarters. There are over 600 American companies with major operations in Ireland. As the Euro depreciates Ireland’s exports (pharmaceuticals, software, food and services) are increasingly cheaper and more attractive to its two major trading partners Britain and the US.

That is what is driving its growth. But with the UK economy about to nosedive as a result of its very harsh budget cuts and the US economy slowing again, the Irish recovery will be stopped in its tracks. The lack of any spending recovery in the domestic components and the rising unemployment will take care of that.

US economy

So if Ireland is highly dependent on the US economy, what is happening there?

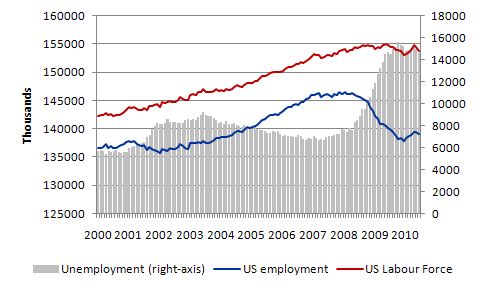

The latest labour market news from the US Bureau of Labor Statistics doesn’t bode well. The first graph shows the seasonally-adjusted labour force, employment (both left-axis in thousands) and total unemployment (right-axis) from January 2000 to June 2010. The gap between the labour force series (red line) and total employment (blue line) is official unemployment.

The severity of the recession as shown by first the slowing down on employment and the labour force (as participation rates fell) is very striking.

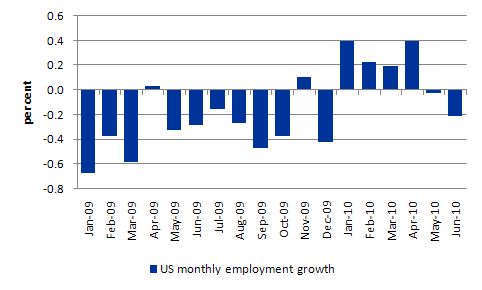

The next graph shows monthly employment growth (per cent) since January 2009. Over that period, the US labour market has shed a net 4.1 million jobs. In the last two months, the net job loss has been 336 thousand and the job losses gathered pace in the last month. If the job decline is not reversed in the coming month, then the double-dip option becomes the strongest contender.

But the situation is worse than depicted by these two graphs. You will note that the labour force growth rate has also slowed. The peak labour force participation rate in the previous growth cycle was 66.4 per cent (January 2007) and it now sits at 64.7 per cent after rising in early 2010 as workers were attracted by the positive employment growth. In the last month, participation fell by 0.3 per cent, which amounts to around 712 thousand workers less in the labour force in June 2010 than there would have been if the May 2010 participation rate had have held.

Those workers join the ranks of the discouraged or hidden unemployed and should reasonably be added back into the calculation to assess the true unemployment rate.

The combination of negative employment growth and falling participation are the two signs of a failing (weakening) labour market. While some commentators saw the fall in the unemployment rate as a good thing, the reality is that it signals the falling participation rates. The official unemployment rate would have edged up a little if participation rates had not have fallen between May and June 2010.

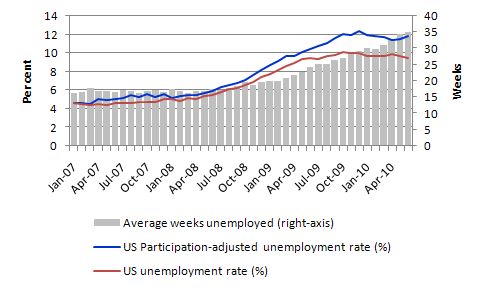

But as the next graph depicts, if we were to consider what the unemployment rate would have been if the participation rate had remained at the peak value in January 2007 (66.4 per cent) – that is, considering the job loss but also the labour force withdrawal – then, the adjusted unemployment rate would be much worse.

The adjusted unemployment rate (blue line) is computed by estimating what the labour force would have been in each period show if the participation rate was constant at its peak level. The extra workers are then added to the unemployment pool and a new rate calculated using the new labour force as the denominator. Remember the official unemployment rate is the number of unemployed as a percentage of the labour force.

In June 2010, the official unemployment rate is estimated to be 9.5 per cent, wherease the adjusted figure is 11.8 per cent. The difference is due to participation effects and represents a rough measure of the change in discouraged workers over the time period.

The other point to note is that the official rate has declined in recent months whereas the adjusted rate is increasing. This means that the participation losses are continuing.

Also plotted on the graph (right-axis) in grey bars is the average duration of unemployment (weeks). You can see that the participation rate effects took some time before the plunge began and this coincided with the spiking upwards of average duration. In January 2007, average duration of unemployment was 16.54 weeks and by June 2010 it had risen to 35.7 weeks. It will continue to rise over the coming year or two even if the weak growth persists.

Neo-liberal austerity solution: all new workers just volunteer!

The story in yesterday’s UK Guardian (July 4, 2010) – Police recruits ‘should work for free’ – tells you how bad things are getting. Apparently:

Chief constables are planning to introduce a national scheme that would see people wanting to become police officers working for free before they can join the force.

The move is part of their response to the large budget cuts they will have to make as part of the government’s slashing of public spending.

The Association of Chief Police Officers has asked the National Policing Improvement Agency for guidance on a scheme to be introduced across all 43 forces, senior sources have confirmed.

While the circumstances were less dire, the last conservative Australian government (1996-2007), which ran increasing budget surpluses over their period of tenure while high rates of labour underutilisation persisted, promoted volunteerism relentlessly. They tried to convince the population that scrapping paid work (particularly in the public sector) and replacing the essential functions with volunteer labour was a demonstration of the virtue of the community.

The sad thing was that the voters believed them.

I hate volunteerism – when it undermines paid work!

Conclusion

From an Modern Monetary Theory (MMT) perspective, the austerity push is draining the domestic capacity of the Irish economy to engender growth.

There is no growth in the labour market coming from the export drive and the latter is dependent on the British and the US economies for any sustainability.

But I would not be holding Ireland out as an example of a succesful outcome for austerity. Things are very dire there indeed.

The problem is that the Irish government has no real options while they remain constrained by the Maastricht Treaty and their lack of sovereignty.

That is enough for today!

“I hate volunteerism – when it undermines paid work!”

Yes, but ‘paid work’ with a minimum wage on a job Guarantee introduces a dead zone into the system, just above the level of the minimum wage, where private companies cannot operate at a profit due to crowding out by the public sector Job Guarantee programme.

You could turn volunteerism to your advantage by making all public sector ‘optional’ jobs volunteer positions and then giving everybody who works (volunteer or not) a universal pension that is effectively the minimum wage.

Then if you scrap the minimum wage, the private sector jobs market becomes a pure market where all marginal rates of pay are actually worth doing – since they just add to the universal pension amount received from the state.

The state then pays the universal pension to workers and pensioners and guarantees that everybody not required by the private sector can be usefully employed in the public sector on a ‘volunteer’ programme. Those who don’t want to work, or refuse to work get nothing.

The tax credit system in the UK attempts to do this, but via a complex means testing system and unfair withdrawal mechanism that hits the low end with marginal rates approaching 70%. This along with the minimum wage restriction and the lack of a guaranteed job means that it doesn’t really work effectively during a private sector recession.

The minimum wage is so pathetically low that I cannot imagine how it could negatively impact upon employment levels.

To talk of offering anything less or even near the current minimum is a disgrace and those in question should perhaps question the viability of their businesses rather than removing one of the very few protections afforded to the most vulnerable people of our society.

More precarious working arrangements is the problem not a solution.

The ny times has a great article on the wonderfulness of Austerity and its effects on the people of ireland a week ago.

http://delusionaleconomics.blogspot.com/2010/06/ireland-where-do-we-start.html

Ireland is the “pack leader” on European Austerity, lets hope the greeks , italians, spanish and british are prepared for these awesome outcomes.

For an explaination of how I feel about it please read.

http://delusionaleconomics.blogspot.com/2010/07/wasted-oppurtunities.html

Hi Neil,

I’m pretty sure Bill has a blog somewhere about the “myth of crowding out”. You may be able to find it if you do a search.

Regards,

Senexx

Neil . . . if it truly does happen that the JG wage has been set such that businesses can’t profitably hire, then you can simply lower the JG wage (though some in the JG camp could make the argument that perhaps it is the private business models themselves that are the problem–in a rich country, if you can’t be profitable without paying such low wages, are you actually a viable business? It’s a question that might be worth asking in some situations, and a JG policy would enable such a debate since there would now be an alternative). Like Alan, I have a hard time believing that this would happen with the current level of minimum wage in most countries, but (as Senexx noted) “where to set the JG wage” is something that’s been discussed from the very beginning in the JG literature.

A great post,

Is it right to say that GNP (= GNI \”gross national income\”?) is:

private consumption + gross investment + government spending + (exports − imports) + net factor income from abroad

Is this right?

Why can you get good statistics on GNP for all countries?

Neil assumes (as is common practice amongst JG advocates) that JG jobs are all in the public sector. If temporary and not desperately productive jobs are feasible in the public sector for those who cannot find normal or unsubsidised work, why not also in the private sector?

Short term subsidised private sector work is part of the so called New Deal system in the U.K. and was part of Argentina’s Jefes program.

Ralph . . . Randy Wray has often discussed creating JG jobs via non-profits. In fact, I think that would be one of the key routes of implementing the program in the US. There are many, many non-profits already working on job creation for the low or unskilled, and this could help leverage their efforts. There are countless ways of implementing a JG, in fact. The important points are to keep to the basic principles of financing at the national level, providing jobs to anyone willing/able to work at the announced wage, and so forth. Beyond those, I have no problem envisioning any number of different types of JG policies.

At least the volunteer recruits will have a real incentive for learning a tried and true income supplement: graft and corruption.

Then, when once trained, they can be hired into the private security forces of the financiers.

What is the saying, bad values drives out good?

You guys have come across the Guaranteed Minimum Income work, have you? State pays everyone (on the same basis as the UK Child Benefit) a guaranteed minimum income equivalent to, say, current adult UK income support plus some quantity of average UK Housing Benefit as an automatic entitlement at the age of 17/18 – no means testing.

All income over and above the GMI is taxed on a progressive basis, with maybe a £10,000 p.a. tax-free minimum, thus incentivizing everyone working in the ‘black/grey’ economy to report all earnings for tax purposes, since NI contributions would also be incentivized in some fashion. This inverts the rationale of many tax/benefits systems, which effectively punish poverty and honesty and releases millions of underpaid workers to find full-/part-time employed labour if it suited them or start their own businesses if they want.

Government tax receipts would balloon because workers were being rewarded for honesty and this system gets connected to a progressive immigration system whereby everyone who applies gets a work visa (given that the EC is going to need some extra 50 million migrant workers by 2035 to maintain current standards of living), staggered over time. all migrant workers ineligible to claim GMI for a stated period (five years plus UK residency?) but incentivized again to report work to ‘earn’ progressive stages of financially-justified citizenship.

Government saves substantial amounts of money as well, by e.g. getting rid of employment department ‘fraud’ investigators necessitated by means-testing (fraud section in the UK costs 10 times what it ‘saves’ the taxpayer); getting rid of useless and unworkable Child Support Agency; getting rid of symbolic Borders Agency, which in reality is nothing more than a private security force dedicated to terrifying low-wage workers on behalf of UK corporations.

Sounds too good to be true? Well, it does have some disadvantages – government can’t use the low-paid as scapegoats any more or talk about welfare scroungers (strictly the non-bank ones); government can’t make meaningless gestures towards prudence/austerity by punishing the most vulnerable and pretending that we’re ‘all in the same boat’ when they and their banker friends are in the QE2 and we’re stuffed in the life-boat; government can’t point the finger at ‘illegal immigrants’ (Boo! Hiss!) to cover up for their own cretinous and destructive amorality….. so it’ll never be implemented.

Ralph, you misred me. What I’m suggesting is that all work is effectively subsidised – otherwise wherever the subsidy ends you will get a ‘gap’ that the private sector cannot bridge – due to cost base crowding out. This is a problem we already see in the retail arena where ‘charity shops’ – that receive rate subsidies and tax breaks can outcompete the pure play private sector shop next door.

Then the jobs market returns to a pure market where there is no minimum wage, and yes the private sector can compete with the public sector for ‘volunteers’ (ie jobs where the marginal wage is zero).

The problem I see with ‘Job guarantee’ is the non-compete issue – something the public sector is woefully bad at. I’ve seen them put private sector companies out of business dozens of times, not to mention discouraging people from starting up. Anything that involves a ‘Wisdom of Solomon’ decision by some public servant isn’t going to work. It needs to be an automatic function of the system design.

No, the acid test for any job guarantee is whether a purely private sector funded organisation and purely public sector funded organisation can set up the same operation next to each other doing the same thing and their cost bases are identical.

“if it truly does happen that the JG wage has been set such that businesses can’t profitably hire, then you can simply lower the JG wage (though some in the JG camp could make the argument that perhaps it is the private business models themselves that are the problem-in a rich country, if you can’t be profitable without paying such low wages, are you actually a viable business?”

You could argue that, or you could take the approach that *all* jobs are effectively subsided to the minimum standards and the nature of the taxation system recovers from the top end (if required to manage aggregate demand). The rising tide then raises all boats.

At the moment all private sector jobs below (using the British min-wage figure) £12K per annum profit per employee can’t exist because the minimum income from work is effectively privatised. If the minimum income is completely nationalised and minimum wage dropped then some of those jobs can exist, which helps provide some of the work for the currently unemployed and the public sector job guarantee programme could be smaller. I think this is similar to what Ralph is suggesting with subsidised private sector jobs.

Neil: You say “At the moment all private sector jobs below (using the British min-wage figure) £12K per annum profit per employee can’t exist..” You are thinking along similar lines as me.

That is, I think there are a very large number of potential jobs out there (public and private sector): jobs which employers think yield less the minimum wage by way of output, and which they therefore don’t bring into existence. These can be brought into existence if employers (public and private sector) can hire anyone anytime at a heavily subsidised rate, but on various conditions: conditions aimed at tricking employers into only claiming the subsidy only in respect of genuinely not very productive types of work.

I’ve set out my ideas here: http://mpra.ub.uni-muenchen.de/19094/

I’ve also set up a Blogger site for any comments. URL is just above the “Introduction” to the paper. Comments welcome.

“In general, Ireland’s growth is coming as a result of the modest growth in the US economy in the recent quarters. There are over 600 American companies with major operations in Ireland. As the Euro depreciates Ireland’s exports (pharmaceuticals, software, food and services) are increasingly cheaper and more attractive to its two major trading partners Britain and the US.”

I live in the USA. I’m sick of everyone else thinking/wanting the USA to be the “importer of last resort”.

What happens if the USA tries to run a trade deficit of $300 to $600 billion a year, the private sector (mostly the lower and middle class) smartens up and does not go further into debt, and the electorate finally elects some people who will refuse to go further into gov’t debt?

Fed Up – who says imports are a negative? Put in perspective, placing full employment first does guarantee that imports are a benefit. Furthermore, national currency “deficit” is simply the increase in a nation’s currency supply required to supply a growing economy. We should all be so lucky, every year.

Without a public “deficit” [expanding currency supply], how can a private sector accumulate and save currency? With an expanding currency supply, the natural outcome is more private savings.

All that is simply the minimum bookkeeping baseline. How to distribute private incomes & aggregate demand is a political decision that can only occur past that necessary but not sufficient baseline condition.

roger erickson’s post said: “Fed Up – who says imports are a negative?”

If they are paid for with debt, I do.

And, “Without a public “deficit” [expanding currency supply],”

That is one of the problems, most of the public (gov’t) deficit is debt with very little currency.

Can you see the time differences between earning and spending debt can create? How about what assumptions are “entities” making when they take on debt?

Wow. People arguing against the minimum wage. How far we have come (not)? So. Businesses are free to stop supplying the market when the price they can get is below “the costs of production”, but somehow, this floor for labor should be, in theory, “zero”? Maybe we should encourage a policy whereby workers supply bids for the privilege of having any work, and actually PAY for the opportunity to bow and scrape for their employers.

I wonder what the multiplier for that spending is.

Ireland’s domestic, non guest, economy was pumped up by years of mal-investment. Cheap credit, available at a phone call if you were borrowing millions at a time, has flowed from “banks”. These banks were out of all control, so much so that the precise extent is criminal and will be hidden in shadows for a long time to come. They, deliberately, because it was their job, “Boom”ed the economy into a bubble. All public bodies, including the regulators, were in favour. That was their actual task even if their titular duty was the opposite!

Now they have been caught out. The economy is returning to beyond the “normal” situation, as it overshoots in correction. The real economy has a capacity much reduced by the fruits of the mal-investment and the deficit reduction and the interest now payable on the borrowings caused by a desire to pay off the money pumped into the economy. People are afraid and are spending less and this will continue until they are convinced that the economy, which means different things to each of them, starts to recover. So, no recovery until there is a recovery……. a deflationary spiral is very likely.

No recovery will be sustained for any length of time, until the effect of that bubble of credit, DEBT, is wiped from the economy. The larger the bubble, the longer it will take and the worse the news will be.

John Cloke, above, is correct.

But that does not mean it will be implemented. Governments are about social control and many of the participants want to give things to voters, as it is our system. Therefore, they want certain anomalies to exist, else they will be less able to get into power. There is an international co-ordinated approach to a globally effective, more formally aligned, government. Alignments will take decades and a crisis is useful.

The pumping of the Irish economy with credit may even have been deliberate.

Just be aware that everything in the msm is suspect. The depression will get worse. Responses of crowds are being staged.

Volunteerism is actually very dangerous to our models of social control, which depend upon debt and then a formal economy from which taxes flow. How subversive of sheriff Howard!

Individuals and their families are controlled by having to earn cash, living in boxes of ticky-tacky, paying off mortgages and assembling the family only an hour before bed time, an hour after arising and at week ends.

So much for “Look at the lillies of the field and the birds in the air; they toil not neither do they spin”!

The depression may enable us to remake our societies, so that the economy is not the dominant activity!!!!!!! That would naturally curb the power of government and corporation and enhance the individual?

Terribly naif …….

Bill, I love your work, but it makes me cringe each time I see ‘Flat Earthers’. I understand how you are trying to discredit myths, but you are perpetuating a myth yourself. Virtually all educated people in the Middle Ages knew the Earth is spherical. The approximate cirumference of the Earth was calculated by the Greeks in the third century BCE and that knowledge was never lost. http://en.wikipedia.org/wiki/Myth_of_the_Flat_Earth

I’d like your opinion on government sanctioned discrimination against workers under 21. We are not eligible for minimum wage, so no employers pay it! Is there any sensible basis for it? The work we do is identical to someone over 21 and the jobs which rely on minimum wage do not require experience or anything that age benefits. Any claims that young workers are unreliable, inefficient etc are just cherry picked. If unreliability is observed, it is the effect not the cause of paying a single figure an hour!

I suppose I would be classed as a flat earther.

But only in the sense that I think overall government spending should be reduced. Not really for reasons of crowding out, not really for lower taxes in the long run (I think taxes are still too low in general), but because there is much that is inept and wasteful about the spending. If it was wasteful in employing a lot of low-medium paid people, I wouldn’t mind so much. The view I have, though, is that it is wasteful in lining the pockets of the already comfortably well off who don’t make good use of it in the local economy – they hoard or export their government largesse.

Some example – legal and accounting services, IT procurement, Quangos, websites, increments for doing the same job (on top of cost of living adjustments that only go up), decentralisation, paying Johnny Rotten for all the buildings that they rent from him, expenses that only the public sector are entitled to claim (some that only politicians are entitled to claim). Yes, some of this is private sector bitterness, but some of it is not. I’m prepared to stump up my taxes, but I expect them to be well, or at least equitably spent. At its heart, the current system is corrupt and feeding the maw doesn’t diminish it.

Dear yoganmahew

1. So the private sector doesn’t engage in this sort of waste and special dealing?

2. The government never spends your taxes – you are mistaken. They do not need your taxes to spend. Please read – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3 – to learn more.

best wishes

bill

Bill,

“1. So the private sector doesn’t engage in this sort of waste and special dealing?”

It does undoubtedly, but if it does it too much then the business will cease to exist. The public sector doesn’t do that, since as you have eloquently pointed out they have infinite funding, so the entropy of human inefficiency is never destroyed. It just builds up.

The UK NHS is a case in point (as I suppose is NASA in the UK) It has a vast budget, almost limitless fundings and yet the outputs aren’t very efficiently produced – due to entropy in the systems. (Although I am British and the NHS is one of our greatest social inventions of which we should be rightly proud.)

And of course, two wrongs don’t make a right 🙂

My personal view is that government should take the same ‘bubble up’ approach to business as it should do with employment. The focus should be on making sure new businesses start up and keep going, and that old ones with too much entropy die quickly. The current focus on ‘inward investment’ and pandering to ‘large international businesses’ with endless corporate welfare is ridiculous. The smaller businesses are much more likely to stay in the country and will, in aggregate, employ more people at a higher return to the country.

Dear Bill,

Thanks for the response.

1. The private sector does of course waste money in extraordinary fashion. Many of the companies I worked for in the past engaged in the most astonishing flights of fancy. The corporate oversight on big spend was almost non-existent, but the stationery cupboards had a key… However, just because the private sector is venal, opaque and inefficient, there’s no reason why the public sector should be too.

2. Well, perhaps.

a) Ireland does not have a floating exchange rate, locked as it is into the euro.

b) Ireland does not have its own currency to fiat adjust; it is essentially on the gold standard of the euro.

c) 20% of Irish GDP is NFI – it flows out of the economy – have a look at transfer pricing with regard to Ireland. The problem with the Irish economy as currently structured is that it is incapable of directing its own destiny. It is reliant on capital flows. Deficit spending in Ireland flows out of the country as pretty much all consumer goods are imported. In creating the conditions for successful deficit spending, Ireland is in the position of the lost tourist “well, I wouldn’t start from here”.

d) In recent year, spending by private citizens has not been constrained in any meaningful way. There were no credit limits, no leverage limits and the banks imported capital to lend out at 100+% LTV for any purpose a consumer wanted. They even advertised this (“you can use your home improvement loan for anything you want”). The result was a huge credit splurge. The government gained huge transaction tax revenue on the back of this, particularly in property transactions. The ending of the boom has seen the state try to fill the gap through borrowing created by the ending of the credit boom (with the banks busted). The budget deficit is now a third of income (spending 60 bn, income 40 bn).

e) Two years ago, the state had a choice – it could save the banks or the economy. It chose the banks. Upwards of 40% of peak GDP will be spent on the banks with nothing to show for it. Despite the constraints of the euro, it would have been possible for the state to spend this money on the economy rather than gifting it to foreign bondholders of the banks. They chose not to.

f) The deficit last year was 14.5% of GDP. It will probably hit 16% this year once the bank ‘investments’ are acknowledged as bailouts. The ‘austerity’ that is happening is a slow return to trend economy size (i.e. one that is not a property bubble). I don’t see a way of avoiding this without creating another equally damaging bubble. In any case, the consumer in Ireland is indebted well beyond their ability to borrow as bubble-era salaries crater.

Best regards,

YM.