The other day I was asked whether I was happy that the US President was…

The Celtic poster child demonstrates the failure of austerity

The IMF boss claimed yesterday that her organisation believed that austerity and growth “can be reconciled and should not be mutually exclusive” (see analysis in blog). She lied just like the IMF has been lying regularly since the crisis began. She also claimed that the IMF forecasts have been trending down. The fact is that they keep revising them down because they are continually wrong. They want to dress their austerity bullying up in a favourable light by claiming growth will be higher. The reality is always different and growth, quite predictably, comes in lower. Their poster child – Ireland – was the first nation to succumb to the austerity narrative. The latest national accounts from Ireland released last week continue to provide a bleak outlook on what is happening there. Austerity is killing the economy – slowly but surely. Joseph Stiglitz said that fiscal austerity is tantamount to economic suicide. Ireland is leading the way. Despite massive austerity, Ireland is still going backwards and people are becoming poorer. Claims that Ireland’s austerity approach provides a model for other nations to follow because it produces growth cannot be sustained from the data. Further, as I will show in another blog – the poor economic performance is making it impossible for Ireland to achieve the ridiculous fiscal benchmarks that the Troika have imposed on it. It is folly all round. Pity the workers and the common folk.

In seasonally adjusted terms, Gross domestic fixed capital formation (that is, investment) in Ireland was valued at 37,196 million Euros in 2007 in constant price terms. In 2011, it was 16,390 million Euros a decline of 56 per cent.

In 2007, Personal consumption by households was 85,936 million Euros in Ireland. By 2011 it had fallen 6.8 per cent to 80,056 million Euros.

Public consumption spending fell 13.9 per cent between 2007 and 2011. Real GDP fell 6.9 per cent, while real GNP fell 11.2 per cent.

Private consumption, government spending, private investment, real GDP has continued to fall in the first two quarters of 2012.

That is what fiscal austerity does.

Earlier this year, Joseph Stiglitz told an audience in Vienna, Austria that (Source):

I think Europe is headed to a suicide…There has never been any successful austerity program in any large country … Decreasing growth is causing the deficit, not the other way around. I think that austerity approach is going to lead to high levels of unemployment that will be politically unacceptable and make deficits get worse.

Compare that to the babble from the highly-paid IMF boss yesterday (September 24, 2012). In a speech to participants at the bastion of free market for others, government handouts for them – the Peterson Institute for International Economics – Promises to Keep: The Policy Actions Needed to Secure Global Recovery – the IMF boss said:

On the Fund’s part, we are favorably considering that this be done in as timely and flexible a manner as possible … above all, keeping the emphasis not just on austerity, but also on growth as we believe that the two can be reconciled and should not be mutually exclusive.

That is the new mantra – folks you can have everything – massive cuts in aggregate demand but economic growth at the same time – the fiscal contraction expansion.

Fiscal austerity and growth are impossible if the non-government sector reacts to the austerity by cutting their own spending. For too long the IMF and others have been trying to kid us that the opposite happens – that the private sector gets a burst of confidence as austerity is imposed because they hate deficits so much and go crazy spending up big even though unemployment is rising and businesses are folding on a daily basis.

The fiscal contraction expansion myth – dressed up sometimes as the “Ricardian Equivalence” theory – which underpins the stated claim that fiscal austerity will be good for growth because the private sector will be revitalised by the boost in confidence that comes from knowing that the budget deficit is being cut – denies basic human psychology.

It is obvious that spending growth is needed to restore overall economic growth in Europe and elsewhere. So the debate is about where that spending growth will come from.

At last count there were two broad macroeconomic sectors – the government and the non-government. The non-government sector can be decomposed into the private domestic sector and the external sector. The private domestic sector can be further decomposed into households who consume and firms who invest (in productive capital).

Macroeconomics is easy. There are two broad spending sectors and then some more detail.

So if the IMF proposed “reconciliation” between austerity and growth is to be realised then we should expect to find positive private domestic sector spending surges accompanying the fiscal cutbacks.

Remember this interview on the US NPR (April 30, 2012) – Austerity Measures Cost Some Politicians Their Jobs – with one John Peet, who is the Europe Editor of The Economist Magazine.

The topic of the segment was the “backlash against austerity measures” in Europe and he was asked whether there was “any country that seems to be leading the way out of here”, to which he replied:

… And of the countries that were in trouble, I would say Ireland looks as if it’s the best at the moment because Ireland has implemented very heavy austerity programs, but is now beginning to grow again. So there are some examples …

To which I would reply – Ireland is an example of how much damage fiscal austerity causes. It was the first of the Euro nations to impose a fiscal austerity package. It is still not growing and private spending is collapsing.

The most recent (June quarter 2012) – National Accounts – data for Ireland issued last week (September 20, 2012) by Ireland’s Central Statistics Office tell a very bleak story.

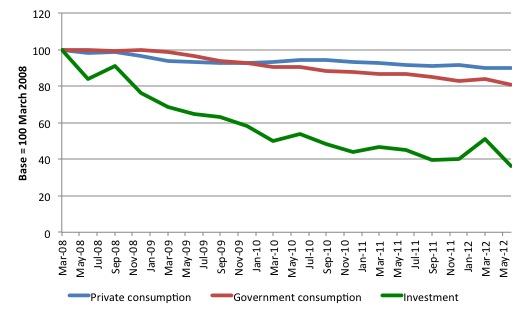

Consider the following graph which shows the evolution of personal consumption, government consumption and investment (indexed at 100 in the March 2008 quarter peak) to the June quarter 2012.

Investment now has an index number of 36 compared to 100 in the peak quarter March 2008. Both public and private spending have consistently headed in the same direction since fiscal austerity was imposed.

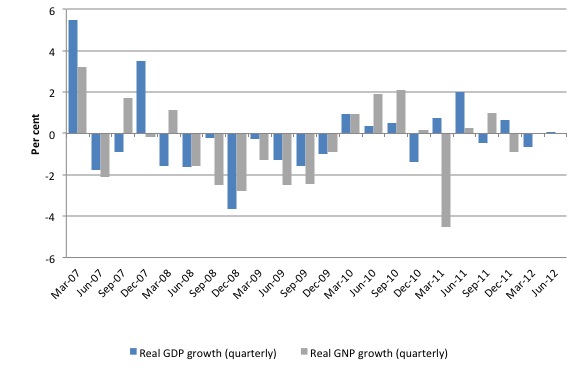

The following graph shows quarterly growth rates in real Gross Domestic Product (GDP) and Gross National Product (GNP) from the first quarter 2007 to the June 2012 quarter. Real GDP declined by 0.7 per cent in the first quarter of 2012 and showed zero growth in the second quarter (seasonally adjusted). Real GNP declined by 0.1 per cent in the first quarter of 2012 but grew by 4.3 per cent in the June quarter.

So real GDP is flat and hasn’t grown at all since austerity was imposed but real GNP rose in the June quarter. What does that mean?

First, you need to first understand the difference between GDP and GNP. This is a particularly important point when it comes to understanding the Irish predicament (both before the crisis and now).

You can gain a thorough understanding of these concepts from this excellent publication from the Australian Bureau of Statistics – Australian National Accounts: Concepts, Sources and Methods, 2000

The two concepts are defined as such:

- Gross domestic product (GDP) is defined as the market value of all final goods and services produced in a country in any given period”.

- Gross National Product (GNP) is defined as the market value of all goods and services produced in any given period by labour and property supplied by the residents of a country.

The Irish CSO publication says that GNP = GDP + Net factor income from the rest of the world (NFI). NFI is defined as:

Net factor income from the rest of the world (NFI) is the difference between investment income (interest, profits etc.,) and labour income earned abroad by Irish resident persons and companies (inflows) and similar incomes earned in Ireland by non-residents (outflows). The data are taken from the Balance of Payments statistics. However the components of interest flows involving banks in this item in the national accounts are constructed on the basis of “pure” interest rates (that is exclusive of FISIM) whereas in the balance of payments the FISIM adjustment is not carried out. There is an equal and opposite adjustment then made to the imports and exports of services in the national accounts which is not made to these items in the balance of payments. The deflator used to generate the constant price figures is based on the implied quarterly price index for the exports of goods and services. In some years exceptional income payments have had to be deflated individually.

In this blog – The sick Celtic Tiger getting sicker – I argued that the so-called “Celtic Tiger” growth miracle was an illusion and was driven by major US corporations evading US tax liabilities by exploiting massive tax breaks supplied to them by the Irish government.

In a New York Times article (May 20, 2010) – Irish Miracle – or Mirage? – by Peter Boone and Simon Johnson, we read that:

… 20 percent of Irish gross domestic product is actually “profit transfers” that raise little tax for Ireland and are owned by foreign companies – the Irish miracle was a mirage driven by clever use of tax-haven rules and a huge credit boom that permitted real estate prices and construction to grow quickly before declining ever more rapidly. The biggest banks grew to have assets twice the size of official G.D.P. when they essentially failed in 2008.

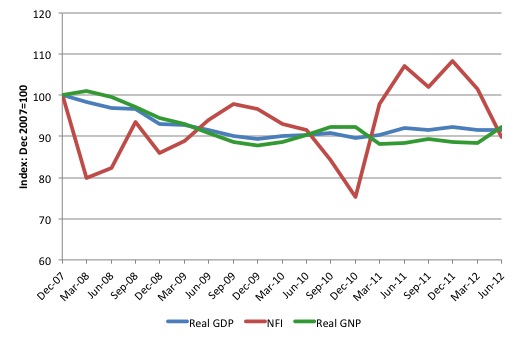

I indexed the national aggregates (GDP, GNP and NFI) at 100 at the GDP peak of the last cycle (December quarter 2007). As at the June 2012 quarter, the GDP index was 91.6, the GNP index was 92.3 and the NFI index was at 89.8 (but there was a sudden plunge in NFI in the June quarter which makes the domestic economy look better than it actually is).

The following graph shows the evolution of these indexes between December quarter 2007 and the June quarter 2012. It is not a model economy.

In relation to the rise in real GNP, the CSO told journalists that the “increase should be treated with caution as it represented profit inflows into Ireland from overseas subsidiaries of companies that had set up headquarters in the country” (Source).

In other words, we cannot interpret that as a bonus for the Irish people.

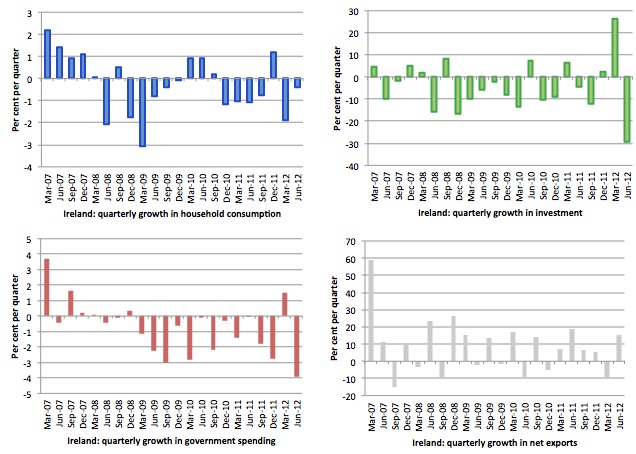

The following graph shows the quarterly growth in the major spending aggregates since the downturn took hold in Ireland (March quarter 2007).

Personal consumption growth has declined for the last two quarters and remains well below its pre-austerity levels. There is no revival evident in private consumption expenditure.

Government spending growth is aggressively negative.

Private investment (capital formation) fell dramatically in the June quarter. The CSO explained the positive spike in the first-quarter 2012 and the reversal in the June-quarter in this way:

A decrease in investment in airplanes of approximately €1bn between Q1 2012 and Q2 2012 contributed significantly to the overall decline in capital formation of 29.4 per cent.

So the first-quarter result was not representative of any positive trend and should be considered an biased result as a result of special airline purchases of leasing companies which use Dublin as a tax haven.

The only positive contributor to growth was net exports but even then we have to be somewhat circumspect. The volume of exports fell in the June quarter (by 0.5 per cent), which is only the second negative quarter result since December 2008. The slowdown in exports reflects declining economic performance in Europe and Britain.

Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

But it gets worse. Imports declined by 5.2 per cent in the June quarter, which is the largest quarterly contraction in imports ever recorded in the national accounts for Ireland. That contraction is a reflection of the poor state of the Irish economy.

But taken together, the decline in exports was swamped by a greater decline in imports and so the contribution of net exports to growth was positive. The drain from imports contracted more than the loss of income from the contraction in exports. It doesn’t paint a positive picture.

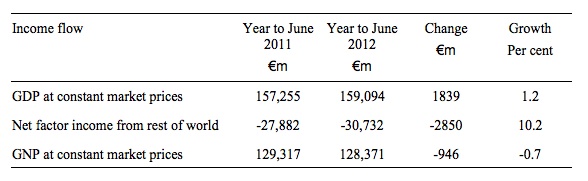

The following Table provides a longer view to see beyond the volatility of the sometimes large capital flows which occur given that there are some very large companies sheltering in the a relatively small nation.

The Table compares real GDP, NFI and GNP for the 12 months to June 2012 with the 12 months to June 2011. While real GDP did grow by 1.2 per cent over the last 12 months compared to the previous 12 month period, real GNP contracted by 0.7 per cent over the same period. Net factor income to foreigners grew by a staggering 10.2 per cent over the last 12 months compared to the previous 12 months.

The data puts the “trade recovery” into perspective. The growth over the last 12 months came from exports (which is signalled by the GDP figure). However, the domestic economy continued to decline and unemployment rose further (as indicated by the GNP figure).

By excluding the expatriated profits of foreign multinationals, GNP provides a better picture of how the domestic economy is delivering welfare improvements to its residents. The fact is that Ireland continues to go backwards in this regard.

As its major trading partners are implementing austerity and going backwards, exports will probably not be able to maintain positive growth overall.

So Ireland’s growth strategy has been based on increasing exports of real goods and services which are a cost to the domestic economy (forgoing local use). Further, any growth dividend is being largely expatriated to foreigners as rising income.

The only conclusion you can draw at this stage is that the austerity package is further impoverishing the local residents and handing over increasing quantities of Ireland’s real resources to the benefit of foreigners. That doesn’t sound like a very attractive option to me.

Conclusion

In this blog from July 2010 – The Celtic Tiger is not a good example – I noted that Ireland’s growth was coming from the modest growth in the US economy. As the Euro depreciated against the US dollar, Ireland’s exports (pharmaceuticals, software, food and services) became increasingly cheaper and more attractive to its two major trading partners Britain and the US.

Exports were driving Ireland’s growth. I noted then that with the UK economy heading back into recession courtesy of its own government’s austerity mania, that the Irish recovery would soon come to an end.

That prediction has been validated by the data.

Austerity begets austerity and trade is one way that the transmission occurs. There is nothing good that can be taken out of the latest Irish national accounts data.

It demonstrates the pernicious lie that the IMF, the OECD, the EU bosses and the Irish politicians are forcing on the Irish people.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

@Bill .

I think the Commission are more open about some of the objectives which is held withen their economic adjustment programme for Ireland reports (Spring & Summer 2012).

In a almost matter of fact manner they state money must be taken off people to make private banks profitable…..as it is a fully privatised money system with full control of all money and credit it is a logical consequence don’t you think ?

To be honest I find Isvan & Sven somewhat refreshing……they are hit men for the banks and know it….like good reservoir dogs they just get on with the programme.

This kind of stuff has been done before (Romania ?) – it is not a glitch in the system , it is the system.

Irelands role in Europe has always been as a conduit for the core and its banks , in the past they needed a market for their goods such as cars and they even went so far as giving us fiscal money for roads and then sitting back and watching our happy banks create a credit hyperinflation so we could buy them.

Now the core needs oil – so they must destroy Irish domestic demand while still leaving us enough hard currency so the upper middle class withen Ireland can continue to buy their goods which will reduce the shock to the cores still beating Black heart.

The French during the 60s & &70s accession rightly treated us with some disdain ( as a colony of the city) – they were correct of course.

PS Speaking as a person living withen this vacuum flask economy of slowly decaying heat energy I find the domestic demand figures (current) seem to most accurately describe the entropy.

Total Irish domestic demand (current)

Y2007 Q1 : 43,003 Million

Y2007 Q2 : 42,115 Million

Y2012 Q1 : 30 ,915 million

Y2012 Q2 : 29,947 million

You have to get your head around the fact that withen the Euro we are worth more dead then alive.

http://www.youtube.com/watch?v=B3sZy7IVRiw

PS

The last time total quarterly domestic demand was in the 29,000s was in the Year 2003

Back then stuff was a bit cheaper I gather and the population of the Irish state was far lower at 3.979 million rather then 4.484 million of 2011.

Simply put – there has been no interest in the physical economy of Peripheral Europe since 1986 /87 ~

All pretence died after that time.

Now it is a means of debt extraction.

Push us into massive current account surplus so that the UK and France can remain in Defecit…and thats it really.

You can see this in this headline…..a country that has experinced a 25% + drop in oil consumption cannot subsidise public transport.

At least when Cuba was cut off from the Soviet they could get on with their own business , this Soviet is a much nastier beast….they want it all.

http://www.rte.ie/news/2012/0924/transport-increase.html

Dear Bill,

we can never win the argument against Austerity, and here’s why:

Agricultural Austerity

Well, it’s been a harsh winter and the seeds you planted in the fall are showing up as little plants yes, but you’re a little bit scared that the plants won’t grow properly.

So you call the IMF and ask for help.

They tell you it was the best idea you ever had to call them. Because what you need is not simple growth: It’s sustainable growth by structural reform, and yes, you’re lucky, they are the experts of structural reform.

So the IMF gets hired and you will meet them next morning on the field.

Next morning you find the IMF has come as a crowd of people all wearing big black boots. They tell you not to worry and could you please step back for a moment. Then they start to trample down all the small plants standing in the field.

You start yelling at them: “What the hell are you doing, you’ve ruined me by killing all my plants !”

They tell you: “Not all of them, be sure: Austerity always works !”

And it’s true: Now that after the intervention of the IMF you’ve lost almost all hope it shows some plants survived even the trampling.

In the end you can harvest enough crop to fill a small basket.

IMF congratulates you: “Don’t you feel the brightness of the future now that you have the basis for sustainable growth ? Would you ever have experienced this delicious feeling if we hadn’t trampled down your plants ?”

And you know they are right: It’s been a tough time yes, and never mind all the money you’d have made without the trampling: The future is all yours now.

IMF is right: Austerity always works.

Erik

The True enemy of Ireland lies withen.

As I said these guys such as Sven & Isvan are mere hit men, with the IMF boys flesh creeping Monetary Catechism preached by our very own Donal Donovan far more spiritually disturbing.

I imagine In a previous existence that guy would have become a Archbishop or something.

The IMF doctrine is not meant to be taken scientifically seriously of course – it is a mere method of extraction.

Beginning in the late 60s /70s a certain very nasty Guinness Peat aviation crowd began to make serious money in the new European monetary envoirment of that time.

With guys like Roy Jenkins (A true friend of both the EEC & the IMF) destroying British Aerospace & boffin culture and transferring the surplus to the rentiers in this sector.

By 1986/ 7 (The Big bang / EMU period) this very nasty GPA crowd began to move into the Ryanair wage arbitration space.

This is one of the most important Oligarchical electrons which orbits the failed Irish state.

Low cost air operations was very important to the new found “wealth” of post 1987 Ireland.

For a moment in Time Ireland was no longer a Island – WE WERE TRUELY PART OF EUROPE NOW.

But people did not understand what Ryanair and companies which copied this low wage model (Irish Ferries etc) actually did to Ireland on a macro scale.

In these very energy intensive operations they had to reduce the labour cost so as to redirect more surplus towards fuel waste.

This appeared to be spectacular successful…..other companies from all Industrial spheres followed this model including domestic construction where they went so far as bringing in Turkish workers to build a new Cork road.

Less wage money demand required more bank credit to keep the ship upright……but this credit was directed towards malinvestment as there was no rational underlying demand.

Finally of course the Bubble collapsed.

With Dublin airport & Ireland registering the largest falls of air passenger demand in Europe.

Ireland Air passenger growth 2009 & 2010 : – 12.1%

There has been no recovery , there can be no recovery withen the eurozone for Ireland

Because money supply is not intrinsic to Greece or Ireland the Euro market state must try to shut these frostbitten fingers and toes off from the core to keep its body temperature up.

If Ireland ever prints Punts ( I now doubt it will ever happen) the waste withen these oligarchical frameworks will be shown up for what they are – extractors of domestic demand with a total collapse of the air routes in & out of Ireland.

As these guys hold the regins of domestic power its looking unlikely until we get a larger breakdown crisis.

Dear Bill,

Apart from your excellent book I find your blogs a little bit depressing . I wonder if you can give some examples by looking on a bright side. What is about writing a blog about Iceland? They have had excellent performance in the last three years but it would be interesting to see what is your view.

Best regards

Alex

Schiggorat: Instead of Iceland, better yet, China, which will likely become the most important economy in the world in the next couple of decades. Arguably the most important to Australia now.

It all seems to be about protecting the real returns of sovereign debt holders. What are they? Royalty? Literally? And with sovereign debt the default risk is near zero (zero if the government is monetarily sovereign) so what do sovereign debt holders care about a deflationary Depression (except to desire it) since it increases their real yields?

The US has a Constitutional Amendment (the 14th) saying it must pay its debt! Who the heck made sure that got put in there?! Luckily the US is monetarily sovereign but still …

Let’s eliminate sovereign borrowing and fund all deficits with pure “money printing”. And let’s bailout the population and eliminate all privileges for the banks. How long shall we tolerate such parasites?

Austerity is a component, not a project.

SteveK9 – China,our example,our salvation,really?

I am Australian and the current suckhole attitude to China in my country makes me want to retch.

As sickening as this wretched attitude is it is also destined for a fall. China is a fascist state with massive population,social and environmental problems.And typical of a fascist state they are working up a nationalistic head of steam partly to gain resources they are not entitled to but also as a necessary diversion for a restive population.

Podargus: Did I say China was your salvation? No. I suggested that it is an interesting country to understand, and for this blog, from the point of view of its monetary system. Is this difficult? I guess so, it’s not very transparent. Is it worth understanding? I think so, given its importance today and in the future. I’m no Australian, so my knowledge is superficial, but I understood that China was a large (the largest) resource market for Australia, and therefore important. Not true?

You obviously feel a lot of emotion regarding this topic, to read as much into my little note as you did.

Nationalism is the common antidote to free market excess. Think nationalism as x+ and free market as x-, community as y+ and individualism as y-. We are in the lower left hand quadrant and belong in the upper right. The trick is to transition gently. In the old days, children were taught civics and attaining the American Dream of the middle class community.

@ F. Beard

As usual, you are expressing my views.

When diluting currencies, we rather hand the money to the population with the obligation to pay down their debt (lucky are those without debt). This will break the banking communities’ ability to continue blackmailing all of us. In addition, this will increase transparency and can easily be subjected to a democratic process.

What does austerity do?

It is always nice to read about austerity whereas we are not even closed to real austerity that would include a reduction of government debt. But to simply reduce the yearly deficit to a more reasonable level does not really constitute austerity but represents simply a battle cry by politician to make us believe that they act responsibly.

As long as politicians/governments are not able to live within their means, the situation is simply unsustainable and comparable to a ponzi scheme. But hey, Greece is supposed to not only live within their means in the coming years but reduce their government’s debt level. How exactly will they do that without producing a revolution of some kind. I simply do not know.

Maybe you’d get a better hearing if you didn’t say that the IMF lies.

Doesn’t this mean deliberate deception as opposed to just getting it wrong because they’ve been seriously misled by the economics profession?

Isn’t the IMF incompetent because it is staffed by economists trained by the economists you believe are incompetent and are guided by the textbooks that you believe are uninformative as to monetary and fiscal policy?

Hence the IMF isn’t lying, they just have no idea what they’re doing. For example, the IMF completely misdiagnosed the causes of the Asian financial crisis in 97-98 and advised Indonesia to cut government expenditure and other idiotic ideas, while Malaysia ignored the IMF and imposed capital controls and fared much better.