The other day I was asked whether I was happy that the US President was…

The case to defund the Fund

Imagine a patient that goes in for surgery to fix an in-grown toe-nail. She comes out in a wheelchair after the surgeon has trimmed a little more than expected from the toe. The result is she loses her whole leg in the operation. When challenged, the surgeon says that they underestimated how much damage would be caused when they starting trimming the toe-nail and realised too late that they had actually cut her leg off by mistake. The surgeon also admits that they had major differences of opinion with the other specialists involved in the assessment about the extent of the cutting required and the degree to which the surgery would deliver relief to the patient but chose not to disclose that to the patient before hand because they didn’t want to risk slowing down the rush to surgery. After all, surgeons know only one thing – cutting and stitching. The one-legged patient sues the surgeon under tort and the authorities prosecute under criminal law. The surgeon is found guilty of criminal malpractice and negligence, is ordered to pay out millions to the patient and is sent to prison. The reality of professional risk. While the analogy is not perfect it leads to this sort of question: Why should professional economists working for the IMF, the EC and the ECB be above the professional standards and accountability that apply throughout the professional world?

We learn from the following 2008 journal article – An Introduction to Medical Malpractice in the United States that:

The concept that every person who enters into a learned profession undertakes to bring to the exercise of a reasonable degree of care and skill dates back to the laws of ancient Rome and England … Under Roman law, medical malpractice was a recognized wrong. Around 1200 AD, Roman law was expanded and introduced to continental Europe. After the Norman conquest of 1066, English common law was developed, and during the reign of Richard Coeur de Lion at the close of the 12th century, records were kept in the Court of Common Law and the Plea Rolls. These records provide an unbroken line of medical malpractice decisions, all the way to modern times.

[Reference: Bal, B.S. (2009) ‘An Introduction to Medical Malpractice in the United States’, Clinical Orthopaedics and Related Research, 467(2), 339-347]

Further:

Writings on medical responsibility can be traced back to 2030 BC when the Code of Hammurabi provided that “If the doctor has treated a gentlemen with a lancet of bronze and has caused the gentleman to die, or has opened an abscess of the eye for a gentleman with a bronze lancet, and has caused the loss of the gentleman’s eye, one shall cut off his hands.

[Reference for quote within the quoted from the previously cited paper: Powis Smith JM. Origin & History of Hebrew Law. Chicago, IL: University of Chicago Press; 1931]

Tough medicine (excuse the pun).

Late yesterday (June 5, 2013), the IMF released a new Report – Greece: Ex Post Evaluation of Exceptional Access Under the 2010 Stand-By Arrangement. It was part of a suite of reports that the IMF released on its involvement in Greece. I will consider each as time passes.

The – Transcript of a Conference Call on Greece Article IV Consultation – accompanying the release of the Evaluation report was interesting. You sense the arrogance of the organisation in the way the head of IMF Greek Mission deals with the press.

He was asked “Is it true that the IMF admits mistakes on the Greek bailout?” To which he opened his reply with:

Sure. There is in this bundle of papers, there is a discussion of the past and, in the context of the Article IV Consultation, a full report … And, sure, in reviewing what we have done the whole time, there are certainly things we could have done differently. We already had that debate six months ago on these multipliers and that if we should do it again, we would not use the same multipliers.

Later it was suggested to him that “The report indicates that the Troika didn’t function very well in Greece” to which he replied:

I don’t see that at all. The report does not say that the Troika did not function very well. I think the report said that the Troika actually functioned surprisingly well …

Well this is what the report said about the Troika partners. Make up your own mind as to whether this says the Troika worked “surprisingly well”.

On Page 32, the IMF claimed that the EC was incompetent for the task at hand (Page 31):

… the EC tended to draw up policy positions by consensus, had enjoyed limited success with implementing conditionality under the Stability and Growth Pact, and had no experience with crisis management. The Fund’s program experience and ability to move rapidly in formulating policy recommendations were skills that the European institutions lacked.

There were also “marked differences of view within the Troika, particularly with regard to the growth projections” but these were covered up when dealing with the Greek authorities so as not to “risk slowing the program negotiations”.

So don’t tell the whole truth to the victims in case they flee the clutches. Democracy in action! This is standard IMF practice.

The Wall Street Journal article (June 5, 2013) – IMF to Admit Mistakes on Greece Bailout – was the first to flag the release of this report.

The article said that the:

The International Monetary Fund is set to admit to major missteps over the past three years in its handling of the bailout of Greece, the first spark in a debt crisis that spread across Europe … the IMF said it badly underestimated the damage that its prescriptions of austerity would do to Greece’s economy, which has been mired in recession for years … The IMF said that it bent its own rules to make Greece’s burgeoning debt seem sustainable and that, in retrospect, the country failed on three of the four IMF criteria to qualify for assistance.

This admission follows the October 2012 revelation by the IMF that they had seriously underestimated the expenditure multipliers – see blog – The culpability lies elsewhere … always!.

I also considered the problem of poor IMF forecasting in this blog (among others) – Governments that deliberately undermine their economies.

The point is that while forecasting errors are a fact of life, the IMF and other major neo-liberal inspired organisations produce systematic errors – which mean they do not arise from the stochastic nature of the underlying forecasting process. It is easy to trace these systematic mistakes to the underlying ideological biases, which shape the way they create their economic models.

This was the IMF report on that disaster – Growth Forecast Errors and Fiscal Multipliers.

Remember what they said:

… recent efforts among wealthy countries to shrink their deficits – through tax hikes and spending cuts – have been causing far more economic damage than experts had assumed.

Why? They were surprised to find they had not only underestimated the size of the multiplier but also the sign of the impact. They assumed austerity would promote growth when in actual fact it destroyed growth.

For anyone with a semblance of understanding of macroeconomics who is not infested with the neo-liberal ideology, there was never a surprise that the multipliers were “larger” than the IMF predicted. The predictions were always too low and wrong. That is because the IMF uses a flawed macroeconomic approach.

The October 2012 IMF paper found:

… a significant negative relation between fiscal consolidation forecasts made in 2010 and subsequent growth forecast errors. In the baseline specification, the estimate … [implies] … that, for every additional percentage point of GDP of fiscal consolidation, GDP was about 1 percent lower than forecast.

In more accessible language, the larger was the planned fiscal consolidation at the start of 2010, the larger the actual decline in real GDP relative to what the IMF thought it would be.

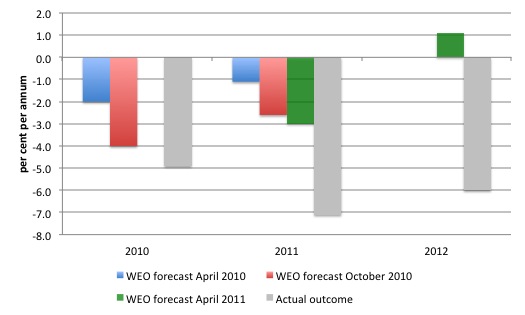

So for Greece, for example, in its – April 2010 WEO – the IMF predicted that Greece would experience a real GDP growth rate of minus 2 per cent in 2010 and -1.1 per cent in 2011.

Six months later, in the October 2010 WEO – it revised these forecasts to -4 per cent (2010) and -2.6 per cent in 2011.

By the – April 2011 WEO – we learn that the IMF thinks that the Greek economy will decline by 3 per cent in 2011 but return to a 1.1 per cent growth rate in 2012. Yes, you read that correctly.

The facts are very different (see Eurostat data).

The following graph shows the evolution of the IMFs forecasts against the reality (the missing columns relate to the moving nature of the forecast horizons).

The IMF underestimated the contraction by 2.9 per cent in 2010 (based on the April 2010 predictions); by 6 per cent in 2011 (based on April 2010 predictions); and by a staggering 7.1 per cent (based on their April 2011 predictions).

The errors were systematic in direction and very large.

What do the IMF think their results mean? They say:

Our results suggest that actual fiscal multipliers have been larger than forecasters assumed.

They guess that the average figure used in forecasts was a multiplier of 0.5. That means that for every $1 the government spends the economy will only grow by 50 cents. Where does the other 50 cents go given that $1 of spending adds that much to national income initially?

The answer is that the models assume that there is private sector crowding out and Ricardian effects which lead to an offset of 50 cents in other production that would otherwise have occurred if the government didn’t spend the $1.

However, the evidence supports the finding “that actual multipliers were substantially above 1 early in the crisis”. That is, the $1 of extra spending would multiply to be much more than $1 (crowding in) because of induced consumption spending and favourable investment response to the initial increases in output.

This means that for policy makers:

… it seems safe for the time being, when thinking about fiscal consolidation, to assume higher multipliers than before the crisis.

This admission features in the latest Report about Greece as well.

The Report claims that the Stand-By Arrangement (SBA) – which was the Troika bailout and imposed conditionality – achieved some “notable successes” – itemised as:

Strong fiscal consolidation was achieved and the pension system was put on a viable footing. Greece remained in the euro area, which was its stated political preference. Spillovers that might have had a severe effect on the global economy were relatively well-contained …

From any assessment of relative value, these “successes” pale into a second-order smallness when we consider the “notable failures”.

1. “Market confidence was not restored”

2. “the banking system lost 30 percent of its deposits”

3. “the economy encountered a much- deeper-than-expected recession with exceptionally high unemployment”.

4. “Public debt remained too high and eventually had to be restructured, with collateral damage for bank balance sheets that were also weakened by the recession”.

5. “Competitiveness improved somewhat on the back of falling wages, but … productivity gains proved elusive”.

So huge real damage with no end in sight for some political and ideological gains. Not much of a balance there. The IMF typically counts success in ways that most of us would discount. They also downplay their failures which are typically the things that we find most important – employment, income growth, public services etc.

Even on their own obsessive criteria – appeasing bond markets, reducing public debt and competitiveness – the intervention has failed.

The Evaluation Report admits that the rhetoric being pumped out by the IMF over the last three years about the “sustainability” of the Greek public debt levels was not supportable by the evidence.

The WSJ article reports that:

Over the last three years, a number of senior IMF figures, including the current managing director Christine Lagarde, have repeatedly said that the country’s debt level was “sustainable”-likely to be repaid in full and on time.

Juxtapose that with the admissions in the Report that the IMF modified their own rules in an ad hoc manner to ensure they could fast-track the austerity program.

We read that:

… uncertainties were so significant that staff was unable to vouch that public debt was sustainable with high probability.

So why did Christine Lagarde and other senior IMF officials attempt to mislead the public debate on this question?

Perhaps because they were protecting the big monied interests in France and Germany. That can be gleaned from statements in the Report which say that:

… moving ahead with the Greek program gave the euro area time to build a firewall to protect other vulnerable members and averted potentially severe effects on the global economy.

Despite causing massive losses for the Greek economy.

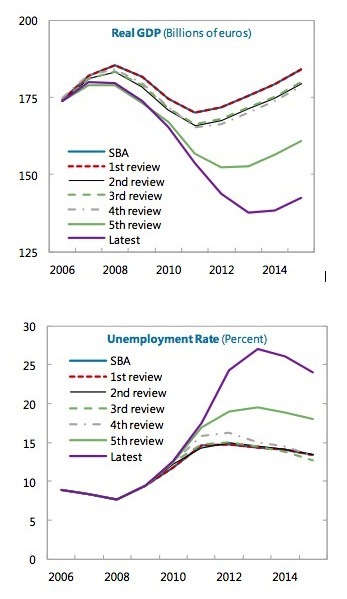

The following graph is distilled from the graphs on Page 13 of the Report and show the real GDP and unemployment rate mistakes that the IMF made in forecasting the impacts of the austerity program.

The different reviews follow the chronology of the intervention and you can see they were playing catch up. They claimed growth would resume (as noted above) in 2010. They still claim it will resume this year – time is runnning out.

For example, they originally had forecast the unemployment rate to peak at 15 per cent. It is now above 27 percent with no ceiling in sight. Greek youth unemployment is now around 64 per cent.

Overall, that is a mistake of around 500 thousand people who the IMF claimed would be in work that are now unemployed.

That is a huge mistake and way outside any reasonable professional error bands.

The other point that amuses me is that the IMF believes that under the austerity program “debt will come down to 124 per cent by 2020”. Yet at the same time they claim that growth will strengthen in 2014. What does that imply about their previous exhortations of the work of those Excel spreadsheet champions Rogoff and Reinhart who claimed (or allowed to be claimed) that there was a 90 per cent threshold, which once passed would lead to negative growth.

Even as late as January 8, 2013, the IMF were pushing this line. See, for example – High Government Debt Threatens Growth Prospects.

The conclusion is obvious – flawed frameworks lead to mistakes.

The IMF ask whether the fiscal adjustment should have been more gradual? They conclude:

It is difficult to argue that adjustment should have been attempted more slowly …

But that is conditioned by their obsession with getting the budget deficit down not any concern for growth or unemployment damage which they failed to even remotely get right.

What is the cost of these errors in lost national income and destroyed personal lives? Silence.

They claim that a “flatter adjustment path would have required more than €110 billion in financing”, which if the politicians had have really cared about the people (especially those being financially ruined) would have been easily within the infinite financial resources of the ECB. The IMF incompetence did not even have to be involved.

They also ask whether it was reasonable to consider that the economic downturn would have been larger than expected.

These are the reasons they list for their errors:

1. “The fiscal multipliers were too low” – as above.

2. “the deeper-than-expected contraction was not purely due to the fiscal shock” – this is a very curious argument and reveals how little these characters really understand about the way people react to falling national income and rising unemployment.

They claim that:

Part of the contraction in activity was not directly related to the fiscal adjustment, but rather reflected the absence of a pick-up in private sector growth due to the boost to productivity and improvements in the investment climate that the program hoped would result from structural reforms. Confidence was also badly affected by domestic social and political turmoil and talk of a Greek exit from the euro by European policy-makers. On the other hand, the offset to the fiscal contraction from higher private sector growth that was assumed during the program period appears to have been optimistic …

This goes to the heart of the Ricardian-type ideology that drives the IMF forecasting models. They expected the private sector – heavily indebted and facing massive cuts to their pensions, wages, and other conditions of work and life – were so intimidated by the budget deficits (the so-called future tax liability effect) that on the announcement by the Troika that wholesale slaughter of living standards would bring the deficits down, these private agents would spend like crazy.

Psychology 101 escapes these morons.

3. “In any event, a deep recession was unavoidable” because “Greece lost market access in the first half of 2010 with a fiscal deficit so large and amortization obligations so onerous that it is difficult to see how a severe economic contraction could have been avoided”.

It is easy to see how it could have been avoided. With the lack of a credible federal fiscal authority, the ECB could have simply announced that it would fund all relevant deficits aimed at filling the output gap caused by the collapse in private spending. QED. The crisis would have been a blip in history and the tax revenue growth on the back of the recoveries would have reduced the cyclical deficits.

Macroeconomics 101 escapes these morons.

They then talk about how “Structural reforms were critical to improving competitiveness” and conclude that there was limited progress on the “competitive-promoting reforms” (privatisation wasn’t as easy as they thought, people resisted the savage cuts, etc).

These all “militated against realization of the productivity gains that had been hoped for in the program”.

I considered the issue of competitiveness gains in this blog – It’s all been for nothing – that is, if we ignore the millions of jobs lost etc.

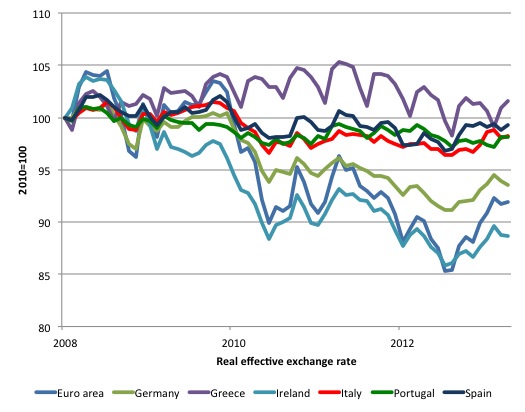

I showed (using BIS data on real effective exchange rates – the standard measure on international competitiveness – that despite the savaging of wages and conditions in Greece, its international competitiveness has deteriorated since 2008.

I produced this graph, which shows movements in real effective exchange rates since January 2008 until April 2013 for selected Eurozone nations and the Euro area overall.

Following the crisis, the general tendency has been for real effective exchange rates to decline. However, the real effective exchange rate for Greece was higher in April 2013 (Index value = 101.6) than in January 2008 (Index value = 100) as the crisis was developing.

By comparison, the real effective exchange rate for Germany is now at 93.5. For the euro area overall the index is now at 91.9. Of the peripheral nations, only Ireland has seen a substantial drop in its real effective exchange rate (now at 88.7).

The rest of the so-called PIIGS have seen their real effective exchange rate fall only marginally during the austerity period. the index values as at April 2013 were staying 99.3, Portugal 98.2, and Italy 98.2.

So it is hard to square that against IMF claims that Greece is on the right path as a result of the devastating cuts to costs (and incomes).

Conclusion

The IMF Report makes a sound case for all contributing governments to immediately announce that they are defunding the fund – that is, withdraw all financial support for this malicious and incompetent agency. The world would definitely be a better place without the IMF.

In my view, the way they have conducted themselves in this matter (not to mention the years of pernicious Structural Adjustment Programs that they have forced on some of the poorest nations) would leave them open for criminal and civil claims for malpractice if there were equivalent rules governing the economics profession that prevail in almost every other professional activity.

The logic of their incompetence is stunning. First, they demand a massive fiscal contraction and grossly underestimate the negative consequences.

Second, these negative consequences undermine the tax base even further and in response the IMF claim that the “fiscal targets became even more ambitious once the downturn exceeded expectations. In addition, the starting point moved.”

Third, response – cut even harder. Unemployment shoots above the forecasted 15 per cent and is still climbing towards 30 per cent or more.

Fourth, the IMF do not revise their forecasts until 18 months of data comes in – thereby entrenching the downturn.

Unbelievable incompetence and worse.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Strikes me as more like the engineering profession than the medical profession. The engineers get an iron ring made from the wreckage of a failed bridge as a constant reminder of the consequences of their mistakes, which may also lead to civil and criminal penalties.

What, if anything, is an economist?

Is Economics really a science at all? It has the trappings of one – the intellectual rigor, the elegant mathematical precision, the emphasis on large empirical data sets. But its practitioners give us little reason to believe that they are deploying any of these things with a scientific outlook. (Present company excepted, of course). Testing theory and hypothesis against empirical results is science. Building models for their own sake or for what is believed to be some pleasing aesthetic experience is intellectual self-gratification.

Much of the Economics profession is guilty of this – most of it, to all appearances. I agree with Jamie Galbraith – we should leave this particular kennel to Lassie and start over:

“As I have documented-and only in part- there is a considerable, rich, promising body of economics, theory and evidence, entirely suited to the study of the real economy and its enormous problems. This work is significant in ways in which the entire corpus of mainstream economics-including recent fashions like the new “behavioral economics”- simply is not. But where is it inside the economics profession? Essentially, nowhere.

“It is therefore pointless to continue with conversations centered on the conventional economics. The urgent need is instead to expand the academic space and the public visibility of ongoing work that is of actual value when faced with the many deep problems of economic life in our time. It is to make possible careers in those areas, and for people with those perspectives, that have been proven worthy by events. This is-obviously-not a matter to be entrusted to the economics departments themselves. It is an imperative, instead, for university administrators, for funding agencies, for foundations, and for students and perhaps their parents. The point is not to argue endlessly with Tweedledum and Tweedledee. The point is to move past them toward the garden that must be out there, *that in fact is out there*, somewhere.”

http://www.nea.org/assets/docs/HE/TA09EconomistGalbraith.pdf

Mark Blyth was interviewed by Aditya Chakrabortty of the Guardian some time ago, and Blyth made some interesting comments about what he would say to members of the present government or someone who advocates austerity. But he also made a few brief comments about the IMF. In brief, he said that it was impossible to change the entire orientation of such a large organization overnight and that what we are seeing, not in his words but which expresses his ideas, is the IMF moving say two steps forward and one backwards in a kind of incremental shift. He never made any indication that he believed them to be incompetent. For those unfamiliar with Blyth’s work, his most recent book is Austerity: A very Dangerous Idea, which came out this year.

Dale, thanks for that link. It says a lot that needs to be shouted about the state of economics eg,

“”desire for an all-encompassing, intellectually elegant approach that also gave economists a chance to show off their mathematical prowess.” Exactly so. It was in part about elegance-and in part about showing off. It was not about … the economy. It was not a discussion of problems, risks, dangers, and policies.”

I think MMT also needs to be more vigilant about the potential political consequences of what MMT proposes (eg increasing the stock of risk free financial assets). Theory disconnected from the real world may be pure; but it is pure nonsense.

I guess the IMF is all about maintaining the value of risk free financial assets -ensuring that if you have money in the bank, that money will maintain all of its power. An economic depression and mass unemployment are obviously disasters UNLESS your prime concern is ensuring that money maintains all of its power.

“Is Economics really a science at all?” – Dale.

Economics is really a very difficult multi-disciplinary undertaking. In fact, the subject is properly Political Economy, not economics. Politics and Economics are inseparable. Indeed politics plus economics equals a new emergent complex (Political Economy) that is greater than the sum of the parts.

To study Political Economy properly you must study;

(a) History (in all its forms Social, Military, Diplomatic, Government, Law, Science, Technological etc.)

(b) Economic History;

(c) Political Science;

(d) Militarism, strategy, grand strategy, geostrategy;

(e) Governance and Law;

(f) Sociology;

(g) Science (including environmental);

(h) Mathematics;

(i) Physics; and

(j) Philosophy.

This is just to name the main ones. Political Economy is basically everything humans do, outside perhaps of dreams, all that touches on it and all that it influences. This is why it’s such a tough subject. It is also fully involved with and complicated by ideologies, religions, self-interest and every belief (no matter how absurd) under the sun.

It’s little wonder that is an endless work.