I started my undergraduate studies in economics in the late 1970s after starting out as…

I agree with a mainstream economist

On the first day in her new job the IMF boss was interviewed by the in-house survey unit and asked to outline her agenda. She clearly thinks the IMF remains a centrepiece of the international monetary system. The evidence would suggest otherwise. The conduct of the IMF over its long history has not advanced prosperity and once the fixed-exchange rate system collapsed as unworkable the rationale for the IMF also disappeared. In trying to reinvent itself over the last 40 years, the IMF has become an exemplar of neo-liberal free market thinking and action and caused many of the larger crises that have evolved during this period. Its role in the current crisis exemplifies its culpability. It turns out that a leading mainstream economists also thinks it is time to shut the doors at 700 19th Street, N.W., Washington, D.C. 20431.

In reply to the question: “what are the biggest challenges facing the global economy?”, the new IMF boss’s first response was:

You have sovereign debt issues in most of the advanced countries. This is most acute in a monetary zone called the euro zone … but it’s not the only one. The sovereign debt issue is pretty much all over the place in the advanced economies, from Japan to the United States, and obviously epitomized in the European Union, and the euro zone in particular.

She then mentioned inflation threats and finally “unemployment rising, or not resolved, and not abating”.

She was then asked “What is the role of the IMF in helping its member countries tackle some of these challenges that you’ve mentioned?”

Her reply was that the IMF has to conduct “bilateral surveillance” of national outcomes and it “has the largest, biggest, and most powerful brain power assembled together under one roof” to conduct this surveillance.

Secondly, the IMF can provide “lending, supporting, and helping out countries that need a program because they are going through a difficult situation. It is a current account balance fix essentially”.

Third, it should make “recommendations” to specific organisations such as the Group of Twenty (G-20).

I have written several blogs about the IMF in the last few years, among them are:

- Life in the IMF fantasy world

- The IMF – incompetent, biased and culpable

- There are riots in the street but the IMF wants more unemployment

- The IMF continue to demonstrate their failings

- Are capital controls the answer?

- IMF agreements pro-cyclical in low income countries

- The IMF fall into a loanable funds black hole … again

There are two broad angles which we can criticise the IMF. First, it has outlived its role. Second, in trying to redefine its role it causes more trouble than it is worth.

In both respects, I find myself in agreement with arch mainstreamer Edmund Phelps (Columbia University). Along with Milton Friedman, Edmund Phelps was an early contributor to the “natural rate of unemployment” literature, which I have spent a career writing against.

According to this school of thought, there is no discretionary role for aggregate demand management (other than to control inflation via monetary policy) and only microeconomic changes can reduce the natural rate of unemployment.

So they claim that the only viable policy debate must be concentrated on deregulation, privatisation, and reductions in the provisions of the Welfare State with tight monetary and fiscal regimes instituted.

Of-course, the last two decades or more have been characterised by just that sort of policy – what we refer to as the neo-liberal era – and apart from high unemployment persisting and poverty at the lowest end not abating – the deregulated financial and labour markets set

In relation to the current crisis, Phelps wrote on November 2, 2009 – A fruitless clash of economic opposites – which focused on what he claims is the fallacy of the “Keynesians”:

… is their premise that all slumps, all of the time, are entirely the result of “co-ordination problems” – mis-expectations causing a deficiency of demand. Having modelled the effects of expectations decades ago, I know they have consequences. I agree that companies appeared to underestimate the cutbacks and price cuts of competitors on the way down. That excessive optimism signalled deficient demand for goods and labour. So any stimulus then may have had a Keynesian effect. By now, though, such optimism has surely been wrung out of the system. To pump up consumer or government demand would force interest rates up and asset prices down, possibly by enough to destroy more jobs than are created.

So from that you can conclude that Phelps has a thoroughly mainstream view of the relationship between government spending and interest rates such that when government spending rises the claims on a finite supply of savings (loanable funds doctrine) lead to rationing (via interest rates changes) so that other borrowers lose access to funds and their price goes up to others.

The alternative mainstream view that emerged out of Keynes thinks that money demand is motivated by transactions and the more transactions the more demand for money you would have. They also claim that the central bank controls the money supply (they believe in the money multiplier) and so if governments spend more, money demand rises, and for a given money supply there is an excess money demand. The only way this can be rationed is for interest rates to rise (and bond prices to fall).

Neither view represents an accurate description of the way a fiat monetary system operates. Government spending creates new net financial assets (bank reserves) and increases income – which increases savings. If the government borrows to match its net spending it is just offering the holders of bank reserves (that the deficits created) an interest-bearing asset. But it is just borrowing the funds it created back. The issuing of public debt does not reduce the capacity of private agents to spend.

Further, the central bank does not control the money supply and monetary growth is endogenous and reflective of the demand for loans by consumers and firms. The central bank sets the interest rate and supply reserves to the banking system as required. Loans are never deposit-constrained – in fact, loans create deposits.

So Phelps’s representation of what is likely to happen when governments spend more is sadly astray and despite his 2006 Nobel Prize he should disqualify himself from the macroeconomic debate.

It is now July 2011 – 18 months on from when he wrote that article – and we cannot detect asset prices falling (bonds) nor interest rates rising. The reason is because the monetary system doesn’t operate in the way Phelps conceives it.

Please read my blog – Those bad Keynesians are to blame – for more discussion on Phelps.

I may write more on the recent Semiannual Monetary Policy Report to the U.S. House of Representatives, Committee on Financial Services on July 13, 2011 by US Federal Reserve boss Ben Bernanke.

But the question and answer section of the presentation was very interesting and bears on what I have just written.

For example:

Congressman Sean Duffy: We had talked about the QE2 with Dr. Paul. When – when you buy assets, where does that money come from?

Ben Bernanke: We create reserves in the banking system which are just held with the Fed. It does not go out into the public.

Congressman Sean Duffy: Does it come from tax dollars, though, to buy those assets?

Ben Bernanke: It does not.

Congressman Sean Duffy: Are you basically printing money to buy those assets?

Ben Bernanke: We’re not printing money. We’re creating reserves in the banking system.

We could quibble about some terminology here such as whether transactions that add to bank reserves “go out into the public”. Government spending adds to bank reserves and definitely goes out into the public. The reserve impact is after the demand boost has been registered by the economy. What he probably meant was that banks do not lend reserves and further that quantitative easing merely swaps financial assets within the federal reserve system.

There are other issues that we could raise but I refer you to Warren Mosler’s blog on this topic.

Anyway, back to Phelps. His recent article in Newsweek (July 10, 2011) – More Harm Than Good – is interesting and I find myself agreeing with the basic proposition – “How the IMF’s business model sabotages properly functioning capitalism”.

While I disagree with his motives for writing the article – which is to further deregulate the world economic system – the points he makes in relation to the IMF are in accord with my own thoughts.

The article notes that:

The International Monetary Fund’s new managing director, Christine Lagarde, has inherited an IMF that has outlived its purpose. It takes just a bit of history to explain why. The IMF was created under the 1944 Bretton Woods agreement, a plan to promote open markets through exchange rates tied to the U.S. dollar. If a country couldn’t cover its trade deficits, the IMF was to step in and lend it the needed dollars-on certain conditions. To ensure that the emergency loan would be repaid, and to clear the way for other financial institutions to make or renew longer-term loans in safety, the recipient nation had to adopt a program of strict austerity.

You may want to read the excellent book by Joseph Stiglitz (2002) Globalization and its Discontents (New York: W.W. Norton) on the history of the IMF’s austerity programs. You can find some information about the book HERE.

I could write a lot about the early history of the IMF but I have much time this afternoon.

The IMF was formed as an outcome of the Bretton Woods conference in 1944 as World War II was ending.

While that conference pitted the British (led by Keynes) and the US negotiators against each other – one side (British) being more liberal than the other in terms of organisation of the international monetary system – all sides accepted that there was a need to prevent a return to the closed financial markets and competitive exchange rate policies of the 1930s.

They agreed on a rules-based monetary system which essentially put in place the fixed exchange rate, US dollar convertibility system. The gold stocks were too unbalanced to allow a strict return to the Gold Standard so it was agreed to fix the parities against the US dollar which was then tied to gold.

The IMF was conceived differently by the British and the US. The former thought of it as a cooperative fund that could be used by the member states to maintain demand (and hence employment) when a crisis hit. So it would function like a “New Deal” organisation for all governments.

The US position was that the IMF should be a bank and thus should exercise due diligence to ensure debts were repaid. The transcripts of the conference show that the US were not really concerned about avoiding recessions and unemployment. They emphasised developmental loans based on strict conditions.

The IMF basically played that role during the Bretton Woods era (so the US won the debate) and provided “structural adjustment loans” to countries in need of funds to resolve balance of payments difficulties. The SAPs as they became known were usually relatively harsh programs and emphasised export-led growth, privatisation and deregulation.

In other words, the self-regulating private market emphasis. Stiglitz’s book is harshly critical of this ideological bias in relation to poverty reduction.

In recent years, as an aside, the IMF re-badged the SAPs under their “Poverty Reduction Strategy Initiative” – without any real change in substance.

The IMF was central to the fixed exchange rate system. It managed the system of parities and maintained pressure on member states to provide full convertibility of their currencies and to trade freely at the current parities.

Nations would buy and sell US dollars when they had trade deficits/surpluses to ensure the financial effects of those trade “imbalances” were neutralised and the parities retained.

The IMF would then loan nations funds when their foreign reserves were exhausted. In extreme cases, the IMF could approve a change in the par value of the currency (that is, its exchange rate) – but only if the IMF considered the balance of payments in that nation to be in “fundamental disequilibrium”. Then they would also insist on structural changes which usually damaged the local economy.

The whole monetary system was biased again nations that ran current account deficits. They were always facing domestic deflation as the central banks had to withdraw local currency (by selling foreign currency – usually US dollars) to maintain the agreed parity.

The system clearly broke down because it was politically unsustainable – current account deficit nations effectively rejected persistent unemployment and sluggish growth as the only option being presented to them.

Please read my blog – Gold standard and fixed exchange rates – myths that still prevail – for more discussion on this point.

The system collapsed in 1971 once the US was faced with massive external deficits and currencies then floated (more or less).

The Phelps article says that with the collapse of the Bretton Woods system in 1971:

… economists imagined at first that a new era of freely floating exchange rates would keep imports and exports roughly in balance, thus eliminating large trade deficits and the need to borrow abroad to cover them … When the pretense that a country was creditworthy became impossible to sustain, the IMF was wheeled in to do the dirty work and make the country safe to lend to again-until the next crisis.

We could dispute some of this history but the point is clear. The neo-liberal period has worked against the poorest nations.

And the IMF has contributed to the persistence of that poverty.

The Phelps article then concludes:

The Greek debacle and the North African drama raise existential questions about the IMF. Responsible governments have no business borrowing vast sums from abroad, rather than from domestic sources. That’s what tinpot regimes do. And lending even more to borrowers who can’t pay what they already owe? That’s what loan sharks and mafiosi do.

The IMF’s business model sabotages properly functioning capitalism, victimizing ordinary people while benefiting the elites. Do we need international agencies to enable irresponsible-verging on immoral-borrowing and lending? Instead of dreaming up too-clever-by-half schemes to stumble through crises after they happen, why not just stop imprudent banks from accommodating foreign borrowing by feckless governments? After all, it’s French and German taxpayers who are on the hook-not just the Greeks and the Irish.

The IMF approach undermines the capacity of nations to maximise their domestic potential and properly regulate capitalist firms. That is not the same thing that Phelps and his co-author are saying but it amounts to the same conclusion – the IMF is a damaging organisation.

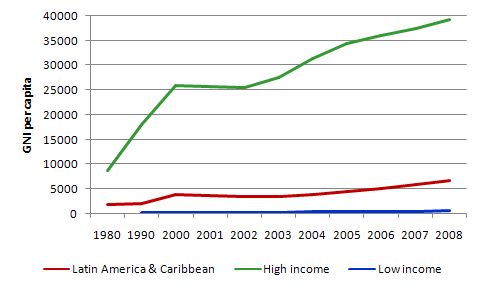

In closing, I republish this graph which I produced for this blog – IMF agreements pro-cyclical in low income countries in October 2009. It uses data from the World Development Indicators, provided by the World Bank. It shows Gross National Income per capita, which, in material terms is an indicator of increasing welfare.

The overwhelming evidence is that the IMF SAPs increase poverty and hardship rather than the other way around. Latin America and Sub-Saharan Africa (which dominates the low income countries) were the regions that bore the brunt of the IMF structural adjustment programs (SAPs) since the 1980s.

While the high income countries enjoyed strong per capita income growth over the period shown (since 1980), Latin America (and the Caribbean) has experienced modest growth and the low income countries actually became poorer between 1980 and 2006.

The two trends are not unrelated. The SAPs are responsible for transferring income from resource wealth from low income to high income countries.

This sort of data confirms to me that the IMF has outlived its usefulness if it ever had any.

Conclusion

A new paradigm for economic and social development in less developing countries is needed. An international organisation that helps nations who are struggling with currency sovereignty is needed.

These nations may have ceded their sovereignty by entering currency zones; by dollarising their currencies; by running currency boards; and similar arrangements clearly are not sovereign and face the same constraints that a country suffered during the gold standard era.

My advice to them would be to implement a plan to remove themselves from these arrangements as quickly as possible. The responsible conduct of the IMF and other agencies would be to help them achieve currency sovereignty as soon as possible.

Further, where imported food dependence exist – then the role of the international agencies should be to buy the local currency to ensure the exchange rate does not price the poor out of food. This is a simple solution which is preferable to to forcing these nations to run austerity campaigns just to keep their exchange rate higher.

But that sort of role is far removed from that currently played or envisaged by the IMF.

Saturday Quiz

The Saturday Quiz will be back sometime tomorrow – even harder than last week!

That is enough for today!

Well, to make any sense from the graph above it should be drawn in the log scale. Otherwise it looks idealogical 🙂

A very perceptive blog but as far as I recall the Keynes Plan involved the use of banking principles with the emphasis on creditor adjustment whereas the White plan was based on the use of a stabilsation fund which failed to make use of banking principles and the burden of adjustment was placed on the debtor.

Dear Bill

Suppose that all countries had their own currency, that there were no fixed exchange rates and no cross-border capital flows, then there still could be balance-of payment problems because many countries have very one-sided exports. Suppose that 80% of Ruritania’s exports consist of coffee. If there is a sudden sharp fall in the price of coffee, then Ruritania will experience balance-of payment problems. For such a country, an organization like the IMF could be useful. It could provide loans to Ruritania, which Ruritania could pay back when the price of coffee rises again.

In my view, the principal cause of balance-of payment problems are cross-border capital flows. If capital could not cross borders, the balance of payment and the balance of trade would be practical synonymous, except for countries that receive a lot of remittances from their emigrants. Cross-border flows are especially destabilizing when inflation rates differ between countries because inflation rates have a bearing on interest rates and difference in short-term interest rates between countries can determine cross-border capital flows.

This world would be a stabler place if capital could not flow freely between countries. The recent economic problems of Iceland, Ireland, Spain and Portugal would not have occurred if capital did not cross borders. We should restore national capitalism, by which I mean that people can invest essentially only in their own country and lend only to their compatriots. Keep immigrants out and keep your troops and capital at home, that is my motto.

Have a good weekend. James

What do you make of Paul Davidson’ s plan for a reformed international monetary system, as presented here:

http://bus.utk.edu/econweb/november%20newsschool.pdf

Is this consistent with MMT?

“Keep immigrants out and keep your troops and capital at home, that is my motto.”

That’s a fairly ugly doctrine, tbh. I can agree troops should be kept at home, except for UN-peacekeeping missions. I can also agree that cross-border lending should be harder than it is today. What i cannot agree to is your statement on immigrants. It is ugly and inhumane. Why would you want to do that anyway?

Dear Lord Keynes (at 2011/07/16 at 1:24)

I do not support Paul’s call to return to Keynes’ original plan. I discuss that in this blog – An international currency? Hopefully not!

best wishes

bill

James Schipper says: ” We should restore national capitalism, by which I mean that people can invest essentially only in their own country and lend only to their compatriots.”

James there is a problem I can see with your idea. A country like Australia would never have the financial or real resources to develop its minerals if we did not have outside capital. The reason it is important for Australia to develop its mineral resources to meet real world demand is simple. If say, as example, China or the USA needs real resources and Australia has them but wont or can’t develop and supply them then China or USA will simply take them. I believe that 22 million Australian’s are not going to tell 1.4 Billion Chinese what they can and can’t have and how the Chinese should live. The only way for a small population to stay safe is to have two things. One is the ability to develop its own resources. Two is to have agreements to supply real resources with several super powers who would fight each other if any of them tried to take Australia’s resources by force. ( look at Oil producers and their protectors for a real life example)

I wouldn’t try interrupting the supply of real resources China needs. Worth noting there are about 800,000 Chinese people working in Africa.

Country boarders wont mean squat anyway if a mass migration is caused by a natural or man-made human catastrophe.

The best way to preserve a great life style is try and make sure everyone in the world has one.

You getting a slice of this swell Bill or is it a bit oversized for your home break? We are hoping it makes it to the Sunshine Coast.

Cheers Punchy

Dear Harpe

Immigration is really off-topic, but I’ll answer you anyway. International migration is always an attempt to use foreigners to solve problems. In theory, there can be situations where cross-border migration is beneficial to the emigrant-exporting country as well as to the immigrant-receiving country, but in practice this rarely occurs. Let me give you two examples. In the Canadian province of Saskachewan, about half of the doctors are now from South Africa. Is that good for the people of Saskachewan? Most certainly it is. Is that good for the people of South Africa? Most certainly it is not. Mexico has exported 20% of its population to the US. Is that good for Mexico? It probably is. Is it also good for the US? Most likely it is not, and certainly not for low-skilled Americans, who are the ones competing with all these Mexicans.

It is a mistake to compare international migration with international trade. In trade there is symmetry, in migration there is not. Trade means: we like to have some of what you produce and in return you can get some of what we produce. No such symmetry exists in international migration. One country can export its unskilled masses to another, or one country can deprive another of its skilled minority, the so-called brain drain.

Suppose that there are 3,5 million doctors in the world, one for each 2000 humans. That is a sub-optimal ratio. Would every country in the world obtain an optimal doctor/patient ratio if doctors had total freedom to cross borders? Of course not! If anthing, it would create disincentives to train doctors. Rich countries could decide to train fewer doctors than they need to maintain an optimal doctor/patient ratio because it is cheaper to let foreigners bear the costs of training doctors. I read once that 60% of Ghanians and Jamaicans with medical degrees are working abroad. Isn’t that wonderful! I’m sure that the average Ghanian and Jamaican is delighted about that. Without international migration, each country would have a stronger incentive to train its own labor force, and poor countries would no longer need to fear the brain drain.

In reality, no-one really believes in total freedom of cross-border migration. There is a story about President Carter. He was once lecturing a Chinese leader about the lack of freedom of emigration in China. The Chinese looked at Carter and asked: “Mr President, how many Chinese would you like? 10 million? 20 million? 50 million?” Carter changed the topic. There are 60 million people in Britain and 1.2 billion in India. If only 5% of Indians settled in Britain, that would double the population there. How many Britons would want that? Australia has 20 million people and Indonesia 240 million. How many Austrtalians would like only 10% of Indonesians to settle in Australia? Let’s not play hypocritical games. If every country were free, prosperous and secure, then maybe we could have a world in which freedom of cross-border is practiced, but not before then.

If you are a realistic socialist in a rich country, then you should recognize that the worst objective enemies of workers in high-wage countries are the workers in low-wage countries. The more of them migrate to high-wage countries, the more wages in rich countries will fall. Immigration is a class issue. Mass immigration is always bad for the masses in rich countries, but it can be quite beneficial to the capitalist minority. Limited but skilled immigration is bad for the masses in poor countries. Leftists who support large-scale immigration have not understood the economics, but they are guided by political correctness.

Regards. James

Dear Punchy

I don’t see why a countrie like Australia needs foreign investment to develop its resources. Fewer than 5% of the Australian labor force is in in the primary sector. Let’s assume that the primary sector is 5 times more capital-intensive than the average, then 25% of productive capital in Australia would be in the primary sector. Why can’t Australians finance that themselves?

Regards. James

Bill

In that 2009 article you state:

“The US Government can never become bankrupt in terms of transactions made in US dollars. That is impossible unless they get a mad desire, for political reasons, to start defaulting on obligations denominated in their own currency. That is so far-fetched to be impossible.”

Do you now feel that credited the US democratic process with more rationality than it deserves? 😉

Schipper:

Wow, what an extensive answer. It doesn’t have to be that complicated, though.

“If you are a realistic socialist in a rich country, then you should recognize that the worst objective enemies of workers in high-wage countries are the workers in low-wage countries.”

Which isn’t true. The enemy you’re talking about is unemployment and “too” open borders for capital and goods. Workers in all countries share a cause, that is to get their fair place in society.

“The more of them migrate to high-wage countries, the more wages in rich countries will fall.”

Not necessarily. That all depends on how immigration is handled. If there is a social wage policy as well as a job-guarantee, it is not at all likely that that would be the path in the long run.

“Immigration is a class issue. Mass immigration is always bad for the masses in rich countries, but it can be quite beneficial to the capitalist minority. Limited but skilled immigration is bad for the masses in poor countries.”

All migration is a human rights issue. As a socialist, i do not believe in controlling people’s whereabouts. Mass immigration is a problem, if it causes unemployment. Like i already said, that isn’t necessary what happens at all. The capitalist minority will do what it can and try to lower wages however it can, whether there is immigration or not.

“Leftists who support large-scale immigration have not understood the economics, but they are guided by political correctness.”

It is not a matter of political correctness, it is a matter of the rights of man. Also, it seems you haven’t understood the economics behind it. Just like there isn’t a fixed number of funds, there isn’t a fixed number of jobs. Immigration in a full employment country can be quite good economically, if the right measures are only taken to invite these immigrants into the local society.

“The best way to preserve a great life style is try and make sure everyone in the world has one.”

Exactly. The opposite is also true. The best way to make sure your lifestyle deteriorates is to make sure someone elses does. Greece, Portugal and Ireland in forced austerity are great examples of this, the rest of the EU forces misery upon them, which in turn will show up as reduced solidarity between the countries in the EU, which in turn will lead to friction and, in really bad cases, war. The European theater of WW2 is a great example of that happening.

Can someone please explain to me, in an mmt context, in the current debt ceiling “crises”, what would happen if the debt ceiling were not raised.

If as I understand correctly, Treasuries function solely to drain reserves from the banking system in order to target the yeild structure of interest rates.

With no new Treasuries, it seems to me that the gubmint could continue to send out all payments and reserves would build up in the banking system which would then be deposited at the Fed to earn what? Oh yeah, interest. So what? Reserves on deposit at the Fed have already risen from zero to $1.6 Trillion in the past two years.

Anyone who must have Treauries could still buy rollover bonds at auction. If they need more they’d have to get ’em on the open market which arguably would bid up the price and bid down the yield. That’s good for borrowers, bad for savers. Seems like you’d lose control of your term yield structure, but only until the Fed figures out that it needs to start paying interest on term deposits in addition to reserves. Otherwise, so what?

What exactly am I missing here?

Thanks,

Joe

You aren’t missing much if anything, Joe. What is important is that the government keep spending, paying bills as usual, obeying Congessional spending authorizations. There are several tricks the US government might use, e.g. jumbo coins, to keep spending within the baroque present legal strictures. Arguably the US government could be forced to use them because of the US Constitution preventing defaults. Of course the debt ceiling forcing a default on either bonds or say Social Security, would be catastrophic. If there is no default, how the NFA are distributed in terms of bonds or reserves is secondary, of microscopic importance in comparison to default or the deranged economy-wrecking spending cuts that Congress and the President are hell-bent on inflicting.

Due to a human nature nothing good comes out of mass immigrations. There seems to be sizeable minority (maybe 20%?) in every country that is hostile to immigrants. It comes from our basic tribalistic instincts, and cannot be wished away. That alone is good reason to oppose immigration: we are all, in the aggregate, happier that way.

@HarPe

“… the rest of the EU forces misery upon them, which in turn will show up as reduced solidarity between the countries in the EU, which in turn will lead to friction and, in really bad cases, war.”

It’s even simpler than that. If Germany forces misery on Greece, they will stop buying German cars and washing machines, which won’t do the German economy any good. The Germans are trying to have their cake and eat it. Telling them that in a politically-acceptable way is the heart of the current problem.

Dear Harpe

I consider myself a socialist, although I’m not a believer in “public ownership of the means of production, distribution and exchange”. However, my socialism ends at the border. The essential socialist virtue is solidarity between those who have more and those who have less. This can only be done within a sovereign state and between people who are fairly close to each other. The British NHS is an example of that. It was designed to provide free health care for the people(s) of the UK, not for all of mankind. To quote Wouter Bos, former leader of the Dutch Labor party: (1) “The welfare state is a national, not a global arrangement” and: (2) “People who want to practice solidarity with everybody end up practicing solidarity with nobody”. Sensible words.

In conclusion, I do not believe that there is such a right as the right to immigrate. Ultimately, there are no human rights, only the rights of citizens. Nobody has any rights simply because he is a human being, just as no child will receive parental care and love simply because it is a child. The rights that we enjoy we enjoy as citizens of a certain state, not as members of the human species.

None of the above is to suggest that we should be totally indifferent to people outside our borders, but there is a difference between occasional help or relief and the institutionalized solidarity of the welfare state, just as there is a difference between helping out the neigbor’s children every so often and raising one’s own children on a daily basis.

Cheers. James

@Hepionkeppi:

“Due to a human nature nothing good comes out of mass immigrations. There seems to be sizeable minority (maybe 20%?) in every country that is hostile to immigrants. It comes from our basic tribalistic instincts, and cannot be wished away. That alone is good reason to oppose immigration: we are all, in the aggregate, happier that way.”

Due to human nature, migration and interbreeding is gainful for society as a whole. I, for one, am very happy about the gains we’ve had, thanks to migration. But then, i’m not blind. I guess those 20% are. And frankly, i don’t give a shit. If they want to be unhappy about migration for no reason, let them. It’s not my problem and certainly not society’s as a whole, to keep a minority happy by reducing future prospects for the nation as a whole.

@James:

“I consider myself a socialist, although I’m not a believer in “public ownership of the means of production, distribution and exchange”. However, my socialism ends at the border. The essential socialist virtue is solidarity between those who have more and those who have less.”

Socialism doesn’t end at borders, lest it become social fascism. Solidarity or no, socialism for me is promoting equality above all. I mean, I can’t say i feel solidarity with the rich, neither do i expect them to feel solidarity with anything else than their wallet. I can’t say i feel solidarity with the middle class as a whole, for many of them care only about money. I can’t say i feel solidarity with white trash people. I can’t say i feel solidarity with any of those idiots who vote for conservative parties and think things will get better. But i feel they (and i) should all be treated equally, no matter what. Also different ethnic groups. It shouldn’t make a difference who someone is, they should still be treated with respect and they should still be given the same opportunities and care that the rest of society gets.

“This can only be done within a sovereign state and between people who are fairly close to each other. The British NHS is an example of that. It was designed to provide free health care for the people(s) of the UK, not for all of mankind.”

I am a decentralist, so i agree that politics should be done at a rather local level and that economies shouldn’t be too large, lest they become politically uncontrollable for the people and become like the US. That doesn’t mean i’m a nationalist and it doesn’t mean i want less migration. Hell, i’ll probably live in half a dozen places before i die. I don’t get your point about the NHS. Who has said it is to provide health-care to all of mankind? I certainly haven’t.

“To quote Wouter Bos, former leader of the Dutch Labor party: (1) “The welfare state is a national, not a global arrangement” and: (2) “People who want to practice solidarity with everybody end up practicing solidarity with nobody”. Sensible words.”

Agreed. I agree that we should not send troops around that much. I also agree a lot of the global work we do today is counterproductive and stupid. That doesn’t change the fact that we can let people in, without damaging our own society.

“In conclusion, I do not believe that there is such a right as the right to immigrate. Ultimately, there are no human rights, only the rights of citizens. Nobody has any rights simply because he is a human being, just as no child will receive parental care and love simply because it is a child. The rights that we enjoy we enjoy as citizens of a certain state, not as members of the human species.”

Within the borders of the nation i live in, i’d rather human rights be of value, citizen or no. Within the borders of the nation i live in, people have certain rights, just because they’re human beings. I do not expect people to be treated the same everywhere, but i’d be terrified if the nation i live in would not accept human rights.

People should have the right to move as they please, as long as it doesn’t become a problem. Obviously, a country of 3 million cannot receive 3 million more in a short time-span, but they should take as many as they can or want. Now, some people don’t want immigrants, but they will mostly be out-voted by more sensible people who can appreciate the gains of immigration.

“None of the above is to suggest that we should be totally indifferent to people outside our borders, but there is a difference between occasional help or relief and the institutionalized solidarity of the welfare state, just as there is a difference between helping out the neigbor’s children every so often and raising one’s own children on a daily basis.”

As long as there is no immediate reason to stop people from coming, i don’t see why we should. They come to our place to build a new life. If we welcome them, we all become richer. If we don’t, obviously we all become poorer and society as a whole degenerates.