I started my undergraduate studies in economics in the late 1970s after starting out as…

There are riots in the street but the IMF wants more unemployment

I am writing this on late Friday afternoon European time. Today has been very busy and so I don’t have a lot of time to write this blog. I had a birthday in my immediate family to deal with and so some special celebrations were in order. Then I had meetings with two government officials – one from the Flemish government and the other from the Dutch government – they travelled down to Maastricht for consultations. The topic was the Job Guarantee and how they could implement such a buffer stock employment scheme into their own policy thinking. I will write up some thoughts about this meeting next week. Then I had to wade through a new International Labour Organization (ILO) report – World of Work Report 2010 – which has estimated that high unemployment will persist for much longer than they had previously forecast. The talk is that the “product market” (real output) recession is now becoming an entrenched labour market recession. Meanwhile, I also read the latest IMF World Economic Outlook report and noticed they were advocating changes to macroeconomic policy positions across the advanced world that would by their own reckoning increase unemployment and prolong recovery. They are still appealing to the nonsensical idea that fiscal austerity is good for a nation. Their view now is nuanced but still a disgraceful mis-use of econometric modelling. So only a relatively short tour through this work today.

The IMF World Economic Outlook has a chapter entitled – Will It Hurt? Macroeconomic Effects of Fiscal Consolidation – which claims that:

Budget deficits and government debt soared during the Great Recession. In 2009, the budget deficit averaged about 9 percent of GDP in advanced economies, up from only 1 percent of GDP in 2007.1 By the end of 2010, government debt is expected to reach about 100 percent of GDP-its highest level in 50 years. Looking ahead, population aging could create even more serious problems for public finances. In response to these worrisome developments, virtually all advanced economies will face the challenge of fiscal consolidation.

The only things that are worrisome are not mentioned by the IMF in thus summary of the Great Repression. The skyrocketing unemployment, underemployment and hiddden unemployment accompanying the massive real income losses that the Great Recession brought to most nations are the worrisome features that should be focused on and which drive the fiscal parameters – rising deficits and debt.

The fiscal parameters are just like wind or heat measuring equipment in the sense they measure changes in real activity via the cyclical changes in tax receipts and welfare payments. They have not particular meaning in themselves when they are driven largely by the movements in these automatic stabilisers.

Further, if population ageing is a problem at all then it is a real resource problem – it is never going to be a financial problem for a national government. Please read my blogs – Democracy, accountability and more intergenerational nonsense and Another intergenerational report – another waste of time – for more discussion on this point.

The entire logic underpinning the population ageing is flawed. Financial commentators often suggest that budget surpluses in some way are equivalent to accumulation funds that a private citizen might enjoy. This has overtones of the regular US debate in relation to their Social Security Trust Fund.

This idea that accumulated surpluses allegedly “stored away” will help government deal with increased public expenditure demands that may accompany the ageing population lies at the heart of the intergenerational debate misconception. While it is moot that an ageing population will place disproportionate pressures on government expenditure in the future, it is clear that the concept of pressure is inapplicable because it assumes a financial constraint.

A sovereign government in a fiat monetary system is not financially constrained.

There will never be a squeeze on “taxpayers’ funds” because the taxpayers do not fund “anything”. The concept of the taxpayer funding government spending is misleading. Taxes are paid by debiting accounts of the member commercial banks accounts whereas spending occurs by crediting the same. The notion that “debited funds” have some further use is not applicable.

Further, the so-called government budget constraint is not a “bridge” that spans the generations in some restrictive manner. Each generation is free to select the tax burden it endures. Taxing and spending transfers real resources from the private to the public domain. Each generation is free to select how much they want to transfer via political decisions mediated through political processes.

When MMT argues that there is no financial constraint on federal government spending they are not, as if often erroneously claimed, saying that government should therefore not be concerned with the size of its deficit. We are not advocating unlimited deficits. Rather, the size of the deficit (surplus) will be market determined by the desired net saving of the non-government sector.

This may not coincide with full employment and so it is the responsibility of the government to ensure that its taxation/spending are at the right level to ensure that this equality occurs at full employment. Accordingly, if the goals of the economy are full employment with price level stability then the task is to make sure that government spending is exactly at the level that is neither inflationary or deflationary.

This insight puts the idea of sustainability of government finances into a different light. The emphasis on forward planning that has been at the heart of the ageing population debate is sound. We do need to meet the real challenges that will be posed by these demographic shifts.

However, all of these remedies which focus on “fiscal consolidation” miss the point overall. It is not a financial crisis that beckons but a real one. Are we really saying that there will not be enough real resources available to provide aged-care at an increasing level? That is never the statement made. The worry is always that public outlays will rise because more real resources will be required “in the public sector” than previously.

But as long as these real resources are available there will be no problem. In this context, the type of policy strategy that is being driven by these myths will probably undermine the future productivity and provision of real goods and services in the future.

It is clear that the goal should be to maintain efficient and effective medical care systems. Clearly the real health care system matters by which I mean the resources that are employed to deliver the health care services and the research that is done by universities and elsewhere to improve our future health prospects. So real facilities and real know how define the essence of an effective health care system.

Further, productivity growth comes from research and development and in Australia the private sector has an abysmal track record in this area. Typically they are parasites on the public research system which is concentrated in the universities and public research centres.

For all practical purposes there is no real investment that can be made today that will remain useful 50 years from now apart from education. Unfortunately, tackling the problems of the distant future in terms of current “monetary” considerations which have led to the conclusion that fiscal austerity is needed today to prepare us for the future will actually undermine our future.

The irony is that the pursuit of budget austerity leads governments to target public education almost universally as one of the first expenditures that are reduced.

Most importantly, maximising employment and output in each period is a necessary condition for long-term growth. The emphasis in mainstream integenerational debate that we have to lift labour force participation by older workers is sound but contrary to current government policies which reduces job opportunities for older male workers by refusing to deal with the rising unemployment.

Anything that has a positive impact on the dependency ratio is desirable and the best thing for that is ensuring that there is a job available for all those who desire to work.

Further encouraging increased casualisation and allowing underemployment to rise is not a sensible strategy for the future. The incentive to invest in one’s human capital is reduced if people expect to have part-time work opportunities increasingly made available to them.

But all these issues are really about political choices rather than government finances. The ability of government to provide necessary goods and services to the non-government sector, in particular, those goods that the private sector may under-provide is independent of government finance.

Any attempt to link the two via fiscal policy “discipline:, will not increase per capita GDP growth in the longer term. The reality is that fiscal drag that accompanies such “discipline” reduces growth in aggregate demand and private disposable incomes, which can be measured by the foregone output that results.

Clearly surpluses helps control inflation because they act as a deflationary force relying on sustained excess capacity and unemployment to keep prices under control. This type of fiscal “discipline” is also claimed to increase national savings but this equals reduced non-government savings, which arguably is the relevant measure to focus upon.

But the IMF chapter is seeking to investigate the following issue:

An important and timely question is, therefore, whether fiscal retrenchment will hurt economic performance.

In this context, they advance the so-called masterpiece of the deficit terrorists – the “expansionary fiscal contractions” hypothesis which claims that austerity improves real output growth in the short-term because it increases “household and business confidence” who are refusing to spend because they are scared of the deficits (allegedly higher tax burdens and higher interest rates).

The IMF conclude that:

:

Fiscal consolidation typically has a contractionary effect on output. A fiscal consolidation equal to 1 percent of GDP typically reduces GDP by about 0.5 percent within two years and raises the unemployment rate by about 0.3 percentage point. Domestic demand-consumption and investment-falls by about 1 percent …Reductions in interest rates usually support output during episodes of fiscal consolidation. Central banks offset some of the contractionary pressures by cutting policy interest rates, and longer-term rates also typically decline, cushioning the impact on consumption and investment. For each 1 percent of GDP of fiscal consolidation, interest rates usually fall by about 20 basis points after two years. The model simulations also imply that, if interest rates are near zero, the effects of fiscal consolidation are more costly in terms of lost output.

A decline in the real value of the domestic currency typically plays an important cushioning role by spurring net exports … [but] … this finding implies that fiscal contraction is likely to be more painful when many countries adjust at the same time …

So they agree that in the short-run that fiscal austerity damages economic activity and worsens unemployment. The offsets they model via monetary policy clearly are not available in the current situation in most countries – even if they were credible offsets (which I dispute).

They also claim that public spending cuts are less contractionary that tax adjustments but this is because “central banks usually provide substantially more stimulus following a spending-based contraction than following a tax-based contraction”. So even if that result is sound (and I do not think it is), it is largely irrelevant in the current situation because central banks have nowhere to move on interest rates.

The literature the IMF cite is very selective and supportive of the idea that fiscal austerity is good. For example, they cite a few examples of Alberto Alesina’s work.

In this blog – The deficit terrorists have found a new hero. Not! – I provide a thorough critique of Alesina’s work in this regard.

In all his work he assumes that households are alleged to have an advanced understanding of the way the economy works and the future fiscal policy settings. All the evidence from behavioural economics tells us they do not have that understanding nor behave in the “rational” way that is alleged in the the mainstream textbooks. Please read my recent blogs – Defunct but still dominant and dangerous and The myth of rational expectations – for more discussion of the extent of rationality of individuals and how mainstream economics is flawed.

But, further, if they did have such an understanding they would quickly scoff at Alesina and point out that governments do not have to raise taxes to “pay back deficits”. There is very little historical evidence to support the fact that governments behave like that. Governments rarely pay down outstanding debt and when they try that by running surpluses a recession soon follows pushing them back into deficit.

Our enlightened households would tell Alesina that the reality – rehearsed countless times in history – is that the reversal of the automatic stabilisers as growth emerges reduces the budget deficits and arrests the rise in the public debt to GDP ratio.

Even less enlightened households, particularly the Japanese, will know that Japan has experienced rising budget deficits (as a per cent of GDP), has the largest stock of public debt when compared to GDP, and has maintained low interest rates for two decades. When the government tried cutting the deficit in 1997 – using Alesina’s logic – the Japanese economy tanked. A renewed expansion of net public spending provided the growth spurt that they enjoyed in early 2000s.

Further, in the examples used by Alesina to make his case household and corporate debt levels were nothing like they are today. The imperative to save by households is now well embedded in their psyche and that better explains why the demand for credit remains weak and why economies are slowing as the fiscal stimulus packages are being withdrawn.

Third, none of these examples were coincident – that is, what a single country might be able to achieve with a supportive external demand environment cannot be applied to all countries cutting at the same time. You need world demand to stay strong to exploit your increased competitiveness. As I argued in this blog – Fiscal austerity – the newest fallacy of composition – it is flawed reasoning to think that if all nations deflate that there will be enough demand available to take advantage of the increased competitiveness.

Fourth, if all nations are deflating, the competitive gains of any single nation are likely to be small anyway.

Fifth, the neo-classical labour supply model that Alesina is using is without application. The macroeconomy is well “off” any possible labour supply frontier at present as a result of the very significant aggregate demand constraint being imposed on the labour market. The unemployment we are seeing is involuntary unemployment and “agents” are not on the “margin of their indifference between labour and leisure”. So all the alleged substitution and income effects that Alesina is hinting out would not work even if they ever worked. And … they do not. The neoclassical labour supply model has very little empirical support. People do not exhibit large reactions in their labour supply in relation to tax changes.

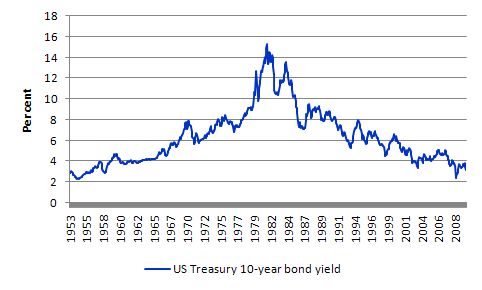

Sixth, implicit in Alesina’s claim is that US bond yields are higher than they would otherwise be because there is fear of future insolvency. The following chart makes a joke of that sort of claim.

You can access the data from the US Federal Reserve database. I am using their measure “Market yield on U.S. Treasury securities at 10-year constant maturity, quoted on investment basis” as a guide. The choice is not particularly important for this purpose.

Further, you can go here to see the results of the US bond auctions and you will see that there is no shortage of buyers for the debt. So if there was a widespread fear that the US government is about to default and so bond premiums are being squeezed up to reflect the rising risk you would also see it in the volume take up. No evidence at all.

The same sort of evidence applies to most major nations at present (it is just easy to get US data to show you this is the case).

Overall, there is no credibility gap being revealed by the bond trading data despite very significant rises in debt ratios and on-going budget deficits.

I know what the terrorists are now saying – it is only a matter of time! Sure and doom-merchants have been predicting the end of the world forever and the 2000k bugs were predicting it then and the terrorists were predicting the sky would fall in by the end of 2009 and … We can just let the “it is only a matter of time” brigade worry themselves sick and leave us in peace.

Seventh, none of the nations that Alesina examined had very low interest rates. In many of the cases he examined the monetary authority eased policy as fiscal policy was tightening which not only reduced borrowing costs but also eased the exchange rate.

The only nation in recent history that has followed Alesina’s preferred policy path is Japan in 1997. It has zero interest rates, low private demand growth and the Japanese government listened to the deficit terrorists then and a fiscal austerity was imposed. What happened? It is clear what happened as a result. It is well-known that the Japanese economy double-dipped and more hardship was caused.

So there is plenty of empirical evidence and a stack of theoretical argument that would dispute the major conclusion of the austerity proponents that are trying to foist the “expansionary fiscal contractions” hypothesis onto policy makers and the public. Recent evidence is compelling – Ireland, Britain etc. Japan in 1997, the major economies in 1937 … the reality is that fiscal austerity damages aggregate demand and reduces real output and employment growth.

The IMF’s main claim that they use to justify their claim that governments should invoke fiscal austerity to cut their budget deficits is that the output losses are worth it in the longer-term because:

… lower debt is likely to reduce real interest rates and the burden of interest payments, allowing for future cuts to distortionary taxes …

This result is derived from the IMF econometric model which is structured in such a way to get that conclusion. That is, the structure of the model assumes that nominal interest rates rise with increased deficits. Of-course, their model would fail badly to forecast Japanese economic outcomes since the 1990s. It would further be subject to significant forecasting errors at present where interest rates are low (short- and long-term) and bond yields are falling despite significant increases in public debt being issued.

The more realistic result is that by damaging demand in the short- to medium-term, fiscal austerity curtails investment which further erodes the long-term growth potential of the economy and stretches the recession out even longer. When growth resumes the trend capacity is lower than when the economy entered the downturn. This is called the hysteresis effect – that is, that growth is path-dependent and where the economy has been affects where it goes. Please read my blog – The Great Moderation myth – for more discussion on this point.

There is a credible body of research work that shows that these longer-term effects are substantial. The other longer-term problem is that workers who have been unemployed for a long time suffer a series of pathologies that undermine their position in the labour market. Please read my blog – The daily losses from unemployment – for more discussion on this point.

Which brings me to the ILO Report – World of Work Report 2010 – which has estimated that high unemployment will persist for much longer than they had previously forecast.

The ILO say that despite some growth recovery:

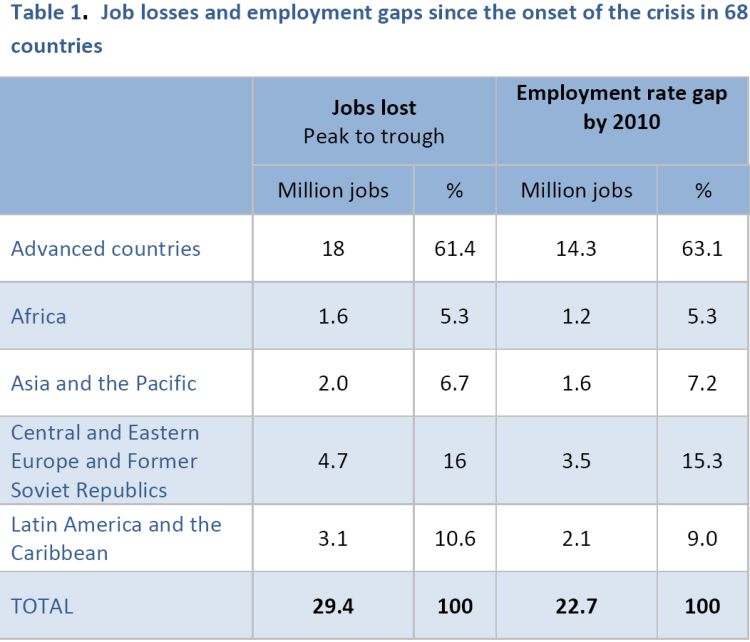

… new clouds have emerged on the employment horizon and the prospects have worsened significantly. In advanced economies, employment is expected to return to pre-crisis levels by 2015, instead of 2013 as expected in last year’s World of Work Report … In the case of emerging and developing countries, it is estimated that employment will reach pre crisis levels already this year – as predicted in last year’s Report. However, over 8 million jobs are still needed to meet the growing workforce in those countries (Table 1). In many other countries in which employment growth was positive at the end of 2009, more recent trends suggest a weakening of the job recovery or even a “double dip”.

The following Table is the Table 1 in the ILO report. It shows that the recovery has not been sufficient to make significant inroads into the labour market damage that has resulted from the aggregate demand collapse. Please read my blog – What causes mass unemployment? – for more discussion on why this situation occurs.

The costs of the extended slowdown are severe and dwarf all other economic costs.

The ILO say that:

The longer the labour market recession, the greater the difficulties for jobseekers to obtain new employment. In the 35 countries for which data exist, nearly 40 per cent of jobseekers have been without work for more than one year and therefore run significant risks of demoralisation, loss of self-esteem and mental health problems. Importantly, young people are disproportionately hit by unemployment and, when they find a job, it often tends to be precarious and does not match their skills. Because the labour market has been depressed for so long, many unemployed people are getting discouraged and leave the labour market altogether. Already, close to 4 million jobseekers had stopped looking for work by the end of 2009 in the countries for which information is available.

And the ILO is clear on why the outlook has deteriorated. They sheet the blame home directly to government:

The first reason behind the deteriorated outlook is that fiscal stimulus measures, which were critical in kick-starting a recovery, are being withdrawn.

This is an emerging theme in all countries that are engaging in fiscal withdrawal. The evidence is mounting that opposes the view that austerity is good. It is clearly bad and for obvious reasons. Employment growth depends on growth in spending. If a major contributor to spending growth (the public sector) is withdrawing but the other sector (private) is not picking up the slack then demand will fall and along with it real output and employment growth. It is not rocket science ladies and gentleman.

The ILO implicate a second factor:

A second, more fundamental factor is that the root causes of the crisis have not been properly tackled. The coexistence of debt-led growth in certain developed countries with export-led growth in large emerging economies has proved to be the Achilles’ heel of the world economy. Before the start of the financial crisis, real labour incomes grew less than justified by productivity gains, thereby leading to growing income inequalities. In certain advanced economies such as the US and several EU countries, this situation pushed households to borrow in order to fund their housing and consumption plans -which was possible because of a dysfunctional financial system. In other advanced economies like Germany and emerging countries such as China, growing inequalities translated into relatively modest domestic demand growth. But this was outweighed by higher exports to high-spending, debt-led economies. The private-debt bubble exploded with the onset of the global financial crisis and for a while was replaced with public debt as an engine of growth.

I traverse these themes in my blog – The origins of the economic crisis. For long-term stability there has to be a fundamental shift in the distribution of national income towards the workers – which will require real wages growing in line with labour productivity. To achieve that we will have to dismantle the neo-liberal machinery that has shifted national income shares dramatically to profits.

Further, fiscal deficits have to support non-government saving overall to allow economic growth to occur without relying on ever increasing private sector indebtedness.

But the ILO then advances its own neo-liberal approach:

However, there is a limit as to how much public debt can increase in order to stimulate the economy. For a sustainable exit from the crisis, it is therefore crucial to address both the income imbalances and the dysfunctional financial system.

The rise in public debt does not stimulate the economy. It is the increase in net public spending that provides the stimulus. The rise in public debt is a voluntary exercise – driven by mis-placed notions of fiscal discipline – which merely alters the asset portfolios of the non-government sector.

It has not been shown in any credible study that we are close to the limit that fiscal stimulus can provide. There is a limit – the availability of real resources. By the ILOs own reckoning the employment gaps (idle resources) are huge in most countries.

So the ILO has this schizophrenia – which has bedevilled its effectiveness for years – which allows it to mostly be the handmaiden of the IMF and the OECD. I would prefer the ILO to take a more courageous pro-worker stance given its origins and funding base.

The policy prescription the ILO proposes involves three planks. First, they want:

…. active labour market policies, work-sharing arrangements and targeted measures to support vulnerable groups, notably youth, are especially relevant in this respect.

Which is just the OECD employability model that attacks the supply side. These approaches do not produce very many jobs at all and tend to focus on the victim of the aggregate demand failure (the unemployed) rather than the cause (a lack of spending).

Second:

… ensuring a closer link between increases in labour incomes and productivity in surplus countries, unemployment would decline in these surplus countries but also in those facing acute deficit problems

This would be based on “income-led strategies” which “not only support aggregate demand, but also result in enlarged domestic markets and new business opportunities that can be seized by sustainable enterprises”.

I agree with this but extend it to say that public sector job creation also does this.

Third:

… financial reform … [because the] … volume of credit to the real economy has declined in advanced economies” and that “savings … [need to be ] … channelled to productive investment … [to make] … jobs … more stable.

I agree that far-reaching financial reform is needed. Please read the following blogs – Operational design arising from modern monetary theory and Asset bubbles and the conduct of banks for further discussion.

But there is no shortage of credit – just a shortage of willing and credit-worthy borrowers. Further growth in spending creates its own saving not the other way around.

Please read the following blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – for further discussion.

Finally, the ILO notes that the current debate about fiscal austerity has not addressed the issue of social cohesion. They say that:

… continued social cohesion cannot be taken for granted if the strategy became less inclusive. Already, there is growing evidence of a deteriorated social climate, especially in countries where job losses have been the highest … higher unemployment and growing income inequalities are key determinants of the deterioration in social climate indicators …

So they are not only estimating that the labour markets will not recover as quickly as the IMF etc are claiming but also that this sustained “labour market recession” will undermine social cohesion and the social fracturing will manifest in many destructive ways.

We are observing increased labour unrest – strikes, marches etc in many European nations now. In these situations, workplace actions (sabotage, go-slow etc) also usually rise as an expression of worker dissatisfaction.

In 2001 in Argentina, as the crisis deepened there were fatal street riots which ultimately led to the government changing policy tack altogether and rejecting its neo-liberal approach that had nearly destroyed it.

It is time that such policy reversals started occurring everywhere to ensure that the “labour market recession” ends quickly. It will get very ugly if it doesn’t.

Conclusion

The IMF position is just what you expect from them. It is without credibility.

I have run out of time.

Saturday Quiz

The Saturday Quiz will be back sometime tomorrow. If I get the time I plan a premium question 5 to trip up the smarties who are claiming it is getting too easy for them. We will see about that!

That is enough for today!

“Each generation is free to select how much they want to transfer via political decisions mediated through political processes.”

Isn’t it true that interest payments on public debt represent a contractual transfer from the public to the private sphere at future times which those future citizens have little or no say over, unless they wish to repudiate the debt and end the transfers (highly unlikely)? Thus your statement glosses over a restriction past generations place on future ones, even if typically in aggregate it doesn’t amount to very much.

@Burk ~ As with all other federal government spending, future interest payments will be created with simple keystrokes. No money need be set aside to provide for these keystrokes. They are just made, and the money is there.

The build up of money in the non-goverment sector (the flip side of the acumulated deficit spending) is a legacy passed on to the next generation. That is a corupting, messed up legacy in my (minority of one) opinion.

Burk, tax this “contractual transfer from the public to the private sphere”.

Can the next generation do it?

Make that a minority of two, stone.

MMT seems to do fine as far as fixing the current malaise, but how to stop the stimulus of gov’t-enabled full employment from being simply drained off (upwards) again doesn’t seem to be a part of that answer. Eventually, couldn’t non-gov’t entities aquire enough money to in effect compromise the gov’t’s monopoly-issuer status?

To be fair, this is not a problem that MMT introduces into the economy, and perhaps it is not an economic problem per se (ie, perhaps this is a political problem of inappropriate tax policy), but its result would certainly become an economic problem.

[It seems to me that this is perhaps one of the things Marx was getting at, but I don’t find public ownership to be a very satisfying answer to it.]

The idea of accumulated surpluses that make a fund for future pensioners is basically ridicules in a fiat money system and probably even in other monetary systems. When these funds is going to be used a sensible government have to do the same considerations as if they have “printed” new money, how will it affect the economy, will there be inflation etc.

The idea of how pension systems are considered is also flawed, people dot realize what they are doing. The reality is that people is making a contract with the children or even the once not born yet. The pensioners can only get the welfare they need from the then active generations production. So the fellow is aging and retire then he is showing the youngsters in the active generation a piece of paper “look here young fellow this is a contract that entitles me to get a piece of your production”, the young fellow “I know nothing about that contract”, the retire: “well I made this deal with you before you where born”.

Focussing on just one aspect ‘accumulation of financial assets’ to the exclusion of everything else doesn’t help anybody. It’s not a problem if the system is designed correctly.

The majority want to get rich and famous. An economy that denies either of those things will not last as the Soviet block has proved – unless you are in favour of dictatorships.

There should be neither tyranny of the few, nor tyranny of the masses (which always ends up being tyranny of the few anyway as Bob Crow proves).

For me the state’s job is to put the control rods into the reactor of capitalism – an acceptable standard of living for all citizens in an average situation with work guaranteed where required, a fair distribution of taxation, a set of levies and regulations on clear market externalities, and possibly a set of incentive payments to deal with any clear market failures.

Benedict@Large – a minority of two is much less lonely than a minority of one! “Eventually, couldn’t non-gov’t entities aquire enough money to in effect compromise the gov’t’s monopoly-issuer status? “- To my mind non-gov’t entities have already aquired enough money to capture the goverments and use them to direct more financial power to the oligarchy. Tony Blair took out a £3M personal morgage when in office, then received >£20M from Landsdowne Partners and JP Morgan straight after leaving office. O’Bama got much of his campaign funds from Goldman Sachs. Basically if politicians start off decent, the speculators just budget a bit extra for the cost of capturing and corrupting them. The practice of letting savings acumulate ad infinatum will leave our descendents with a rich world (consiting entirely of the FIRE sector and state administrators) living parasitically off the rest of the world. More likely it will end up leaving our descendants ruled by China. China may be doing good in Africa but in Tibet and Uigistan they seem tyranical. I think we owe it to the next generation to adopt a sustainable, just, global economic system.

stone: “The build up of money in the non-goverment sector (the flip side of the acumulated deficit spending) is a legacy passed on to the next generation. That is a corupting, messed up legacy in my (minority of one) opinion.”

Even the Bible does not say that money is corrupting, it says that the “love of money is the root of all evil”. There is nothing noble about barter.

/L: “So the fellow is aging and retire then he is showing the youngsters in the active generation a piece of paper “look here young fellow this is a contract that entitles me to get a piece of your production”, the young fellow “I know nothing about that contract”, the retire: “well I made this deal with you before you where born”.

Well, yes, maybe we should not allow gov’ts, corporations, and other institutions to enter into contracts.

Min “Even the Bible does not say that money is corrupting, it says that the “love of money is the root of all evil”. There is nothing noble about barter.”

Min- I’m not saying we should abandon money, I’m just saying we should have a non-expanding currency.

Stone

I find your comments about savings to have some merit. I’ve argued before that we have given our finances over to the savers and let them rule the world. Why should anyone be guaranteed a 7% return on their savings, 6%, or any percent? The rest of the working people must sacrifice something so that these savers get their cut. Just like everything else in our system, the net savers are always offset by some net borrowers.

Where we have to work is in undermining a couple of very strong human desires which have emerged into what many to believe are economic laws.

These ideas are 1) Saving (money) is virtuous. This gives people the notion that we can ALL be net savers (within the private sector) AND run no budget deficits 2) Being a net exporter is virtuous (look at those Germans!!) and the best way to have low unemployment. This gets back to the put your nose to the grindstone, hard work is good for you argument. This is not an endorsement of slothful behavior but we must remember who it is that is usually the loudest in endorsing the hard work (of OTHERS)……….. those who are simply collecting bond interest!

Greg-I think the crucial thing is for saving to be for personal lifecycle financing rather than a dynastic compounded exponential wealth building end in its self. I don’t see how it can be sane for the global stock of savings to increase (in real terms) year on year, decade on decade. My impression is that it makes sense to have a system where it is normal for people to save to cover their old age or future unemployment or children’s university or whatever. The bulk of the money in the non-goverment sector now gets concentrated with elite speculators who use the money to appropriate more money from manipulating money (the more money there is the more scope there is to do that)- all that does is to create economic volatility and a wholely artifactual industry of financial engineering that diverts real tallent, effort and resources from worthwhile endeavours.

“The build-of money” – what about the build-up of people, real assets and productive capacity. Money is just a symbolic representation of the real economy.

The question isn’t the build-up of money, it is the distribution of that money so that the population has access to the real output of their own work.

A non-expanding currency would be completely non-functional – credit would require negative interest rates and we fall into the fallacy that the representation of value “stores” value, instead of providing access to value.

stone: “I’m not saying we should abandon money, I’m just saying we should have a non-expanding currency.”

On the gold standard (the US had a bimetallic standard before 1873, gold and silver), the US had a non-expanding currency for about 20 years. This was the period of the Long Depression, a deflationary time when farmers lost their farms to the banks because the prices of their crops kept going down, and they were unable to repay their loans (along with usurious interest). This was the background for William Jennings Bryan’s famous “Cross of Gold” speech. In the 1890s new discoveries of gold increased the US money supply (as well as money around the world) ushering in the boom time of the Gay Nineties. It was the non-expanding currency that was the problem, not the other way around.

min and pebird, the terrible problem in the 1930s was because money was hoarded by those few wealthy investors who had managed to sidestep the 1929 crash. Because the money was too concentrated, there were no customers able to pay for any goods or services so there was unemployment and a deflationary spiral. The problem was a money distribution problem. The MMT solution would be to use fiscal stimulus to get money into the hands of potential customers. That would also be my solution. The difference is that I would balance that fiscal stimulus money with money taxed off the few wealthy investors. Doing that would not reduce the price farmers could get for their crops. It might cause a drop in the price of farmland and other assets owned by the most wealthy. That might enable tenant farmers to buy their own farms. The whole cross of gold pro-expanding currency mellarcy comes about because people won’t face up to the need to remove money from the wealthy. A few extremely wealthy people do recognise that it is vital that money is handed back from them to the poorest. Bill Gates and Warren Buffet are giving all their wealth back to the very poorest in the world after all. My impression is that as a society we need to all recognise the same thing. The continuous deficit set up we have is not leading to people retaining the fruit of their labours or any such thing- it is artificially pumping up the wealth of the very wealthiest. It is vital to keep in mind that only the most organised and advanced nations can adeptly manage an expanding currency. Most of the world’s population live in countries that do not. Money is a zero sum game. The benefits that accrue to the world’s wealthiest are at the expense of the third world poor.

Stone,

Consider: We are using Free Floating, Non-Convertable (FFNC) currencies. Once you convert over to FFNC (US 1971), all stock measures of ‘money’ become useless, absurd really. Under FFNC the only useful measures of just about anything important are all flows from then on…we just have to put in govt policymakers who know how to create the flows that get the most out of this FFNC arrangement for all of society.

Resp,

stone:

There is something you seem to be continuously forgetting.

Some investments fail. Bill advocates interest rates of zero and no bonds. This means savers will have no choice but to invest their money or watch it get eaten by low but steady inflation. Any time you invest you risk losing your money. Over time your loses will be greater than your gains (unless you have a dynasty of brilliant investors) and you or your kids will need to earn an honest living again.

In order to keep getting income you would have to own a company or land or whatever. If someone manages to create a company that lasts a thousand years and avoids antitrust suits, I think they deserve a bit of renumeration just for the sheer improbability of it. This really only leaves owning land as a source of infinite easy money. I’m not really sure what can be done about that – but that’s not exactly a uniquely MMT created problem.

In other words, nothing lasts forever. MMT makes that even less likely by removing several methods of earning by doing nothing.

Stone,

Bill Gates and Warren Buffet are seeking to win Nobel Prizes and to have their names go down in the history books in a much better light than many think they actually deserve.

If either of them were so concerned with the welfare of their fellow human beings they would not have amassed their fortunes in the first place.

Alan Dunn- Warren Buffet has said himself that it is entirely crazy that people such as himself get anything like as much money as he has. Some of Warren Buffet’s fortune is due to his aptitude at recognising undervalued companies and what the real economy needs to be done- in that regard he has been doing a vital job for the real economy. In effect he has been doing competantly what soviet central planners did incompetantly. However much of Warren Buffet’s fortune is due to overal asset price inflation as an artifact of the expanding currency system. I don’t imagine Warren Buffet is any better or worse a person that say Bill who does this blog. You say “If either of them were so concerned with the welfare of their fellow human beings they would not have amassed their fortunes in the first place.”- is there any evidence that Warren Buffet has done any nefarious deeds to amass his fortune- I had the impression that he just did a basic job very well and the fortune amassed itsself. I think it is important that financial power is in the hands of people who are competant at allocating resources for the real economy and Warren Buffet was (the growth of financial services has now engulfed Berkshire Hathaway too).

I think capatilism can do good but it needs to have something to push against in order to be kept on the right track. A non-expanding currency maintains the scarcity value of money for investment and so restrains capitalism to serve the real economy. Redistributative taxes are absolutely essential to keep money in the hands of potential customers.

Grigory Graborenko: the near miraculous fact is that asset price volatility allows money to be accumulated purely from handling financial products. If you have say an absurdly overinflated stockmarket where stock prices are out of all proportion to underlying earnings- then elite speculators can harvest money simply from the random volatility of the prices. What they do is employ high frequency trading using the most advanced computors in the world that can identify when prices are about to rise or fall and then make trades on a milli-second timeframe. Basically they are able to “buy low- sell high” more than the bulk of the market is able to. They need a pool of “dumb money” to feed of. The ideal “dumb money” is index-tracker funds (such as the Vanguard funds and ETFs held by retail investors or for pensions). The $2T in such tracker funds just lumbers along following the traps set by the high frequency traders in order to feed off the tracker funds. In this way high frequency trading outfits such as Goldman Sachs and Rennasscience Technologies have been able to have 100s of consecutive days of winning trades often appropriating >$100M per day. There are thousands of people with phds in maths who are employed fine tuning the algorithms so as to more efficiently do this. The first customers for any advance in computor software or hardware are always the ultra low latency trading platforms. The computors are co-located with the NYSE computors so that the optical cables are as short as possible so as to conduct trades in the time it takes light to travel 10metres rather than 10km. Basically in the future the whole apperatus will be view by historians a bit like we view the Easter Island Heads or

Grigory Graborenko: My above comment was in reply to your point

“Some investments fail. Bill advocates interest rates of zero and no bonds. This means savers will have no choice but to invest their money or watch it get eaten by low but steady inflation. Any time you invest you risk losing your money. Over time your loses will be greater than your gains (unless you have a dynasty of brilliant investors).”

Further to what I said above- the constant pumping in of money for investment artificially pushes up asset prices year after year decade after decade. Since the collapse of Bretton Woods and the wholesale adoption of expanding currencies the USA real economy has had minimal real growth but asset (eg stock market) prices have inflated massively. That has created a massive transfer of wealth to those who were holding assets at the start of the process. It is basically a ponzi structure where currency expansion leads to transfer of wealth to those who started off the most wealthy. From what I can see the “natural order” is very much for wealth to concentrate (because wealth provides the resources to protect wealth) and expanding currencies greatly exascerbate that process. You seem to think that somehow someone investing leads to wealth getting spread out to everyone else. That seems to me a perfect inversion of reality. In history it sadly tends to only be violent conflicts that widely redistribute wealth. The post second world war “golden age” came about because the horrors of war also spread out much of the wealth. There were also massive taxes levelled at the most wealthy so as to pay off the costs of post war reconstruction. I just wish that we could now face up to reality and tax adequately so as to create an equitable stable functional capitalism before it is too late.

Matt Franko you said “Consider: We are using Free Floating, Non-Convertable (FFNC) currencies. Once you convert over to FFNC (US 1971), all stock measures of ‘money’ become useless, absurd really. Under FFNC the only useful measures of just about anything important are all flows from then on…we just have to put in govt policymakers who know how to create the flows that get the most out of this FFNC arrangement for all of society.”

-The sad fact is that here in the UK since adopting a FFNC currency, much of our economy has been given over to managing the ever accumulating stock of money that you seem to claim is just an inconsequental abstract concept that can be ignored. For a start if the stock of money meant nothing to anyone then it would not be contested to tax it away and so we would not be having this discussion (because the ONLY distinction I have with the MMT position is that I am saying wealth should be taxed to balance government spending).

You say “we just have to put in govt policymakers who know how to create the flows that get the most out of this FFNC arrangement for all of society”- Expanding the currency provides no additional capacity to provide “flows” that could benefit the poorest. All that expanding the currency means is NOT removing wealth from the rich so as to balance government spending.

I have never come accross any coherant MMT argument describing how taxing wealth impairs the global economy and so justifying expanding the currencies so as to accomodate “leakage to savings”.

stone: “However much of Warren Buffet’s fortune is due to overal asset price inflation as an artifact of the expanding currency system.”

I am not an economist, but I think that that is an illusion. Much of the **nominal** value of Buffet’s fortune is the result of inflation, but in general inflation favors debtors, and with his vast fortune Buffet is largely a creditor. In general, deflation favors creditors. Sorry, I do not have a reference — I do a lot of online exploration of economic topics, but do not keep records –, but not too long ago I saw something about the result of historical periods of deflation on the rich. True, their nominal fortunes decreased, but their purchasing power increased, in real terms.

You want to tax the rich. Some people call inflation a tax, that’s metaphorical. However, high inflation is worse for the haves than the have nots. (And moderate inflation is a general boon.)

Min- like you I am just a lay person with a (recent in my case) interest about economics. My understanding was that the expanding currencies have created much greater asset (stock market, real estate etc) price inflation than they have consumer price inflation. That means that if you bought some assets back in 1964 when Warren Buffet started off then sold them now you would be able to by much more consumer goods now than you could have done with the original money back in 1964. It is the ratio of asset price inflation to consumer price inflation that causes expanding currencies to enrich the rich at the expense of the poor.

@ stone

You may be right that asset inflation in real terms has been greater since 1971 than in general, I do not know. However, that does not mean that a fiat currency is the reason. I do know that the introduction of fiat currencies in the American colonies starting in the 1690s, up until 1764, made the creditors howl. The colony legislatures, however, were controlled by the debtor class. Finally the British gov’t heeded the creditors and passed legislation saying that people did not have to accept “colonial scrip” as legal tender. That legislation, along with the Stamp Act and the Intolerable Acts, was part of the cause of the Revolution. In general, fiat currency tends to inflation, which tends to favor debtors, rather than the rich.

Min, I agree that consumer price and wage inflation does not favour the wealthy. I still get the idea that an expanding currency can favour the wealthy so long as asset price inflation sufficiently outweighs wage inflation. I don’t think the early fiat currencies were closely managed so as to cause asset price and not wage inflation such as is the case now. My take on it was that nowadays the most wealthy do not use cash as a store of value for anything but a small proportion of their wealth. Instead they store value in assets such as real estate, stocks and farmland. Its worth a look on the web about asset management if like me that whole world is unfamiliar. I found the information about the Wellcome Trust a very clear description of how wealth is managed by the elite. http://www.wellcome.ac.uk/investments/index.htm

Alan Dunn says:

Sunday, October 3, 2010 at 11:12

“Bill Gates and Warren Buffet are seeking to win Nobel Prizes and to have their names go down in the history books in a much better light than many think they actually deserve. If either of them were so concerned with the welfare of their fellow human beings they would not have amassed their fortunes in the first place.”

Very harsh.

Both Gates and Buffet are among two of the world’s most generous philanthopists and were recently travelling Asia looking for partners to join them in giving their billions away for worthy causes.

I have no patience for those who have amassed fortunes through devious means but there is a lot of money to be made out of mispricing, arbitrage and inefficiency. I don’t think you can demean anyone who has put their own capital at stake to make a profit and like Stone, I see no evidence that these guys have rorted the system or ripped off their fellow man.

Socialism and equality is fine but it should not put reward in the hands of the lazy and stupid or those not prepared to work hard for advancement.

stone says:

Sunday, October 3, 2010 at 19:55

“The $2T in such tracker funds just lumbers along following the traps set by the high frequency traders in order to feed off the tracker funds. In this way high frequency trading outfits such as Goldman Sachs and Rennasscience Technologies have been able to have 100s of consecutive days of winning trades often appropriating >$100M per day. There are thousands of people with phds in maths who are employed fine tuning the algorithms so as to more efficiently do this. The first customers for any advance in computor software or hardware are always the ultra low latency trading platforms. The computors are co-located with the NYSE computors so that the optical cables are as short as possible so as to conduct trades in the time it takes light to travel 10metres rather than 10km.”

umm, that’s not quite right. For a start the bulk of GS’s $100mm+ days are not derived from platforms. Secondly, GS does not have a data centre co-located with the NYSE’s computers. Not sure where you got that info from.

One of the main benefits of the program trading platform is that re-weightings can be crossed with house trades which effectively allows the bank to deal on its own side of the market. This is a huge benefit if you run a large house account and have lots of customer orders.

In addition, a low-latency trading platform allows you to very quickly arb the SP500 and Dow futures vs their component stocks. Since the many sub indicies and ETF’s that have sprouted up, the technologically advanced banks like GS have been able to arb the ETF’s as they know exactly how these will reweight during a volatile market. The result is called “hedge slippage” and hurts the ETF’s tracking ratio.

Stone,

Appreciate the exchange.

“For a start if the stock of money meant nothing to anyone then it would not be contested to tax it away and so we would not be having this discussion”

I submit it is not the stock of money, it is the net decreased flow of incomes that (at least here in US) the income and payroll taxes effect that motivate ‘tea parties” and the general contempt for taxes by the middle to lower income households. We in US are currently grossly over-taxed. Govt representatives can quickly remedy this.

Resp,

Stone and friend,

Excesses of financial manipulation you fear so much in an MMT system, are already rampant in the current system. Logically you can only be fearful MMT would make matters worse.

You must consider MMT proponents (e.g. Bill) propose a number of measures to minimise manipulative financial distortions.

1) Removal of the central bank to eliminate ridiculous market distorting activities a la QE.

2) Severe restriction of speculative derivative activities. Excepting those that provide utility to the productive economy. e.g. airlines hedging future fuel costs.

3) All loans to be 100% asset backed. Eliminating at a stroke 100:1 currency trading accounts and their repulsive ilk.

4) A National bank or regional public owned banks to offer a competetive alternative to private banks.

5) Full employment and JG also reduces the power of large corporations to indulge in institutional wage blackmail.

How could this possibly be worse than than the cack handed system we already have. Cash savings in the private domain will always look for the best return, same as ever. The best we can do as a society is to direct these capital saving into productive investment. That’s certainly not what we see today.

Personally, I would go much further than Bill. Spiltting giant private banks. Single purpose banking, public owned exchanges with compulsory participation, strict control of non-productive asset classes, no bank casino operations, full reserve banking etc. I’d give savers 2 choices. Find a productive investment or expect zero returns. That’s the true spirit of capitalism.

Human nature will not change so we have to assume people will try to game any system. As most of the problems are caused by highly leveraged financial institutions and the ultra wealthy. Let’s keep the weedling swines in a well designed cage. You wouldn’t put criminals straight back on the streets with a fresh supply of crowbars.

Many of your fears and arguments are moot to the MMT vs Existing System argument. The solutions to many of your fears lie in the choice of financial regulation. The regulatory choices are often agnostic ideas to MMT’ers.

AW,

respectfully, what about the liars and swines in the cash economy who rort the system. Taxi drivers, newsagencies, tradesmen etc. Anyone why does business for cash is ripping us all off and placing a greater onus of tax upon the masses.

You may believe that all wealthy people are tax cheats but the simple fact is that they pay many multiples more in tax than the average earner in our progressive tax system. Add in the extra GST, land tax and other indirect taxes as a result of higher consumption.

It is very easy to bash bankers and banks, but superfunds and mums and dads (albeit the wealthier ones) benefit directly from their success.

If you really want equality then lobby to impose a 50% inheritence tax.

I am concerned that if we adopted your many suggestions then civil liberties would be curtailed, the consumer would have less choice because of a highly regulated market and we would move swiftly from a democracy towards that very ugly C word.

Ray, what you were saying about index arbitrage was what I was also trying to say (but in a much less expert way)- basically after money “leaks to savings” as Greg would put it, it then “leaks” to the low latency traders via the methods you so clearly describe. About the collocated computers at the NYSE, I heard that on a BBC radio program and then asked an investment banker (who I know through rock climbing!) who said it was true. I’ll try and dig out a link about it. The Goldman Sachs trading platform is called sigmaX is it?- The basic point is that “leakage to savings” ends up being leakage to a very elite group.

Stone,

indeed the very smart cookies now arb the ETFs similarly to index arb (ie. reweight the ETF vs their components faster than the ETF manager). I kind of think this is getting below the belt and is turning the normal ebb and flow of the market into just another opportunity in volatility so agree with you on that point.

I can also understand the distaste this type of thing leaves in the mouths of non-market people and agree the lengths some will go to make money is getting out of control (in other ways to that experienced during the GFC). The ‘flash crash’ earlier this year is evidence of this. Months later and there still isn’t a definitive cause of the 1000 point intra-session decline. Frightening.

Ray what I read somewhere was that the flash crash in May was a way to exploit automatic “stop loss” selling- ie what every trader needs is for the rest of the market to sell low and buy high and the flash crash tricked much of the market into doing that. Has that now been ruled out?

Do you agree with my general idea that if the market was very much “undervalued” ie with a P/E <10, then earnings rather than volatility would be what governed market practice? My thought was that in such a situation the "very smart cookies" would no longer be those harvesting stochastic volatility and instead would be those analysing the fundamentals of the underlying real economy. My impression was that the only genuinely viable form of market regulation is to have a non-expanding currency and redistributative taxation so as keep money for investment scarce and the market "undervalued".

I have zero experience of finance- I just think it is important for lay people such as myself to try and get some insight into what goes on. In the UK we are told that the "financial services industry" is the one thing of value we as a nation offer the rest of the world (even pharmacuticals and university education for foreign students are now being scaled back). To my mind our "financial services industry" looks a bit like Somalia's "shipping services industry"- ie pirates 🙂 .

Andrew Wilkins: I’m sorry if I gave the impression that I supported the current system. I support a non-expanding currency with plenty of fiscal stimulus and redistributative taxation such as a wealth tax and inheritance tax. My issues with MMT are with the parts of it that are THE SAME as the current system ie continuous deficit spending so as to finance “leakage to savings”.

I still consider it entirely forlorn to hope to have the global stock of money in savings and investments to increase year on year decade on decade and not to have a deranged, overgrown and damaging financial services industry.

MMTers make vague claims that they would have the power and insight to hold back such an unstoppable tide. Typically one of your measures is a flat contradiction of one of Bills. You say: “All loans to be 100% asset backed.” Bill said no loans should be asset backed and all loans should only be on the basis of projected cash flow. Personally I think Bill’s rule would make more sense in an expanding currency because in a credit fueled asset price bubble asset based loans feed the bubble as a feedback into asset prices. My general point is that all those hopelessly inadequate rules are not needed is you have a non-expanding currency with plenty of fiscal stimulus and redistributative taxation

wow, if Gates and Buffet really cared about philanthropy and poor people they would simple write a check to Red Cross, Caritas and similar organisations. Instead of that they want to pull together some assets, start a hedge fund, make money and spend some speculative profits on apparently noble and god-blessed things.

Ray, you should really take off your rose glasses. Or you should describe the difference between Gates/Buffest and Peter Peterson. Both are foundations.

Sergei, I thought Warren Buffet was in the process of giving away all of his money. My understanding was that it was quite hard to liquidate and give away $40B as fast as he is doing so. If he were to have overnight sold $40B of Berkshire Hathaway stock and given it over in one piece, my (very limited ) understanding was that that would have caused much waste and economic hiatus. I don’t think that he any more than me thinks that it makes him an especially good person to be giving away $40B anymore than someone else who had done useful work for 60 years that had left them penniless because unlike Warren Buffets work it didn’t happen to pay well.

stone, Buffet and Gates have a private bank or some similar structure taking care of their wealth, etc. It is a huge but rather invisible industry doing this task for super and just wealthy. Give-away of assets is an incredibly simple thing – one call to Buffet’s manager in his bank where he will have to name the beneficiary and the amount. All this mass-media nonsense is, as was mentioned above, only to get Nobel prize which none of them clearly deserves.

Sergei, I genuinely thought that Buffet’s wealth is in the form of shares in Berkshire Hathaway. Are you sure that the private bank you mention (that I don’t know about) isn’t just a transitionary holding point between selling stock and funding grants with the money. You seem to be saying that Warren Buffet just sits back and has a manager do all the asset allocation that made the fortune. If that were so then that shadowy “manager” you allude to would be the household name rather than Warren Buffet. From what you are saying it comes across that you haven’t got your head around what giving $40B to people who earn <2$ per day amounts to. I don't see how it can but entail a lot of organization and planning. The Chinese are giving away far more to Africa than Buffet and Gates in the form of road and railway projects but they have a huge communist? state to administer it. I really don't understand why Warren Buffet gets ill feeling from people on here. Personally I think that having Buffet and Gates being philanthropists is one extra bit of waste from our messed up economic system. Bill Gates is excellent at software and Buffet at resource allocation. In a sane world they would be able to do that without being lumbered with 10's of billions of dollars that they then have to give away to people who would not be needing give aways were it not for the failings of the economic system. None of that reflects badly in my eyes on Gates and Buffet. To my eyes that reflects badly on economists and those who implement their recommendations.

Ray- about Goldman Sachs having access to co-located computers for ultra low latency trading -There is something about it in

http://advancedtrading.com/algorithms/showArticle.jhtml?articleID=218401501#undefined

they say : Much has been made of the 32MB of Goldman Sachs’ proprietary algorithmic trading code (“trading secrets”) allegedly stolen by Sergey Aleynikov,……….To realize any real benefit from implementing these strategies, a trading firm must have a real-time, colocated, high-frequency trading platform-one where data is collected and orders are created and routed to execution venues in sub-millisecond times.

see also

http://zerohedge.blogspot.com/2009/07/goldmans-4-billion-high-frequency.html

I originally heard about the colocation on the BBC Radio4 “in business” program I thought.

stone, unfortunately private banking is a business which by definition is not a household business. They are paid to be silent, keep private secrets and stay below the radar.

And there are plenty of non-profit organisations with existing infrastructure, recognizable name, distribution networks, knowledge, experience etc which can put money at work right away. One does not need a new “foundation” in order to help people if he/she wants to.

Sergei, I just had a particularly ineffectual web search to try and check whether $40B would be a shock to the system for existing “third world poverty” NGOs. Oxfam seems to get less than £500M per year. The Wellcome Trust is a big funder for research into tropical diseases but their total spend is only £700M per year. I get the impression that the Buffet/ Gates money is orders of magnitude out of scale for existing NGOs. I’m happy to be shown otherwise. The Buffet money is already being spent and I have heard complaints that it is being spent wastefully fast which is opposite to your complaint. I agree in principle that personal foundations can be just an ego thing though.

stone says:

Monday, October 4, 2010 at 19:24

“Ray what I read somewhere was that the flash crash in May was a way to exploit automatic “stop loss” selling- Has that now been ruled out?

Do you agree with my general idea that if the market was very much “undervalued” ie with a P/E <10, then earnings rather than volatility would be what governed market practice? My thought was that in such a situation the "very smart cookies" would no longer be those harvesting stochastic volatility and instead would be those analysing the fundamentals of the underlying real economy. My impression was that the only genuinely viable form of market regulation is to have a non-expanding currency and redistributative taxation so as keep money for investment scarce and the market "undervalued".

Stone, in response.

1. The cause hasn't been determined 'exactly'. Indeed the NYSE invalidated certain trades which prompted some stocks to sell off above a threshold % (in itself this was a disaster because imagine if you bought one of those stocks vs sold another you'd then have only one leg remaining). There have been thoughts that the flash crash was caused by too many autotrading platforms re-weighting ETF's and too little market depth on the day. There was even a line of thought that someone had keyed in and extra couple of zeroes inadvertently (I personally consider this b/s as all trading platforms have certain operator key tolerance checks).

2. Interesting view. The SP is trading collectively at about 13x current earnings vs around 17.5 on historical average so already stocks are considered 'cheap'. Are they trading with less or more volatility than historically? More, certainly. Therefore, there is another factor in the mix other than simple intrinsic value. Perhaps investors are writing down enterprise value of many stocks (the profit that a company's branding can generate). To this end many of the US banks are trading well below book value which implies that regulation is removing much of their earning capacity or that BV (assets – liabilities) is wrong because they need to write down their asset book more (loans assets need more haircutting). Even if PE's were at 9, this is just a number that is used to validate bullishness or bearishness and suggests that enterprise value is cyclically lower. If you thought companies would make smaller and smaller profits in the future then you could be a speculative sell at a PE of 9 to buy back at 5. I personally think that much of the deleveraging that has occurred out of derivative products as a result of the GFC has been re-applied back to more traditional market trading methods (including day trading based on technical/momentum algorithms but employing new trading patform technology). Who wouldn't want a means of capturing small arbitrage profits and building a same-side order book rather than having to risk your capital with market views every time you trade.

The fact is that when you get a bunch of basically stupid and financially-inept US lawmakers like Pelosi and Frank trying to introduce regulation broadly across the entire industry it doesn't take much thought power to stay one step ahead of them. If they had any sense they would simply pay whatever it took and hire some of the smartest HF and bank guys/gals to join their side and work through fixing the system. If you want to build a better safe then you want to be hiring the best thief as a consultant.

The UK is mistaken for believing it has value as a financial services hub. Remember Ireland's boasts a few years back how it was creating favourable infrastructure and taxation for this exact same purpose…the rest is history.

In reality, financial services can be offered anywhere. You could in theory build a financial services hub at the centre of the earth and out-communicate everyone else on average. With today's technology there really is near-nil value for a financial services firm in being located in a major city (other than for traditional banking services).

Ray, I take what you are saying about how trading insiders are needed for drawing up regulation. I have no knowledge about the subject at all but still have opinions :). My general take on things is that a back to basics view of what the stock market is for is also needed. In the UK we seem to have got into the trap of viewing it as “the best way to get tax money to spend on the sure start program” as my MP put it. The real function must be to allocate resources for the real economy. I think the structure of the stockmarket needs to be dictated by those that run companies that need equity funding rather than by those who trade equities. The kind of thing that springs to mind to me (as an ignorant lay person) would be to have a (large say 3%) charge on every trade and that charge paid to the company being traded. Also to have market making provided by the companies listed on the exchange with a bid/ask spread always provided at no more than the trade charge. I’d also ban index trackers because they are totally counter to the whole “wisdom of crowds” function of the market and only exist as a pool of “dumb money” to be exploited. I’d say that each company has to always have precisely 1,000,000,000 shares in each listed company with all profits paid as dividends rather than share buy backs and all employees shares provided by buying shares from the market to give to employees rather than just issuing more. I’m wittering about a subject that I know nothing about but I’d really like to hear the views of those that do.

@ stone

Thanks. 🙂 But I do not see from your reply how a fiat currency favors the rich.

stone says:

Tuesday, October 5, 2010 at 1:25

“My general take on things is that a back to basics view of what the stock market is for is also needed.”

I think most people would agree with this and your opinions do have basis (regardless of your claims to know little on the matter 😉

The problem with taxing transfers of assets (ie. stamp duties) is that there may be no intrinsic value in the exchange to start with. For example, if I have $100 of cash sitting in a bank account and decide I want to become a shareholder in a transport company then I can only buy $97 of shares (due to your tax). I then need to decide whether the 3% haircut is worth taking the risk to redirect my capital into this business. Likewise if a million people suddenly have the same interest then the company stands to make more money market-making their own stock then actually producing widgets which would not be good for the economy.

One of the beauties of the open market is the ability for people and companies to very quickly redirect the focus of their capital. If say oil prices rise to $100+ levels then investors and companies and quickly redirect capital towards developing solar, wind, hydro etc which is a good think for mankind.

In its early format, the stockmarket was nothing more than a bunch of farmers, commodity producers and consumers meeting at the town square and exchanging goods for currency or bartering but I am sure there were arbitrageurs who communicated with nearby villages and bought/sold the inefficiencies of the markets. In itself this seems a healthy practice and would help prevent the poor and disadvantaged from being ripped off (as much).

The real problem with the stockmarket as I see it is the ‘grey market’. If every trade and over-the-counter derivative was cleared on an exchange I think we would be 90% of the way to fixing the problems that most people see with the markets.

The grey market is a system by which banks can cross ownership of equities, commodities and other securities which have a demonstrable price AWAY from the exchange (at least initially when it is traded). As you can imagine, if a large volume of flow is dealt off-market or OTC then it is not scrutinised by regulators and few might know of the positional pressures building within the market.

If I could regulate one thing it would be the requirement to clear all derivatives on-market so that at least regulators and the general public can gain transparency. Taxing flow I believe is just another inefficiency in the movement of capital and I think an inheritence tax would probably redistribute wealth better (not that I’m in favour of this).

Stone,

I did have an extra coffee yesterday and scanned through some of the messages. I hear the concern on excess savings, that’s why I am very keen to tightly regulate the financial system so investments are put into productive enteprise and not wasted on asset bubbles. A good public pension scheme could also soak up excess saving. A well designed public pension scheme could take in excess savings and payout pensions proportional to inputs. As we have a fiat currency, payouts would be public spending and inputs a form of taxation.

Ray,

I am all for free markets. I am extremely supportive of small and medium businesses being given an opportunity to compete. I do wish to rein in excessively large corporations which threaten our personal liberty (also inefficient monopolies e.g. Microsoft). If the Government is deficit spending I would like the major chunk of the spending to go to private sector contracts.

I believe the private sector is efficient in most endeavours. I am also sensible to recognise where the public sector does some things better than a free market. (e.g. Social housing, large road building programmes etc). There are many threats to our personal liberty from the ultra wealthy in a free market environment. Slave trades and indebted peasantry spring to mind. Personally I find the unregulated financial sector provides extremely poor social utility. I should try to stop calling them names though.

I support more aggressive redistibution of wealth through progressive taxation. I am nowhere near aupportive of a command economy or an authoritarian communist state. It is possible to be left wing and support “free” markets. Accepting there is no such thing as free markets, there are only degrees of regulation. I support regulation that provides useful and widespread social utility.