Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – June 26, 2010 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

Assume inflation is stable, there is excess productive capacity, and the central bank maintains its current monetary policy setting. It is then true that if government spending increases by $X dollars and private investment and exports are unchanged then nominal income will continue growing until the sum of taxation revenue, import spending and household saving rises by $X dollars.

The answer is True.

This question relates to the concept of a spending multiplier and the relationship between spending injections and spending leakages.

We have made the question easy by assuming that only government spending changes (exogenously) in period one and then remains unchanged after that.

Aggregate demand drives output which then generates incomes (via payments to the productive inputs). Accordingly, what is spent will generate income in that period which is available for use. The uses are further consumption; paying taxes and/or buying imports.

We consider imports as a separate category (even though they reflect consumption, investment and government spending decisions) because they constitute spending which does not recycle back into the production process. They are thus considered to be “leakages” from the expenditure system.

So if for every dollar produced and paid out as income, if the economy imports around 20 cents in the dollar, then only 80 cents is available within the system for spending in subsequent periods excluding taxation considerations.

However there are two other “leakages” which arise from domestic sources – saving and taxation. Take taxation first. When income is produced, the households end up with less than they are paid out in gross terms because the government levies a tax. So the income concept available for subsequent spending is called disposable income (Yd).

To keep it simple, imagine a proportional tax of 20 cents in the dollar is levied, so if $100 of income is generated, $20 goes to taxation and Yd is $80 (what is left). So taxation (T) is a “leakage” from the expenditure system in the same way as imports are.

Finally consider saving. Consumers make decisions to spend a proportion of their disposable income. The amount of each dollar they spent at the margin (that is, how much of every extra dollar to they consume) is called the marginal propensity to consume. If that is 0.80 then they spent 80 cents in every dollar of disposable income.

So if total disposable income is $80 (after taxation of 20 cents in the dollar is collected) then consumption (C) will be 0.80 times $80 which is $64 and saving will be the residual – $26. Saving (S) is also a “leakage” from the expenditure system.

It is easy to see that for every $100 produced, the income that is generated and distributed results in $64 in consumption and $36 in leakages which do not cycle back into spending.

For income to remain at $100 in the next period the $36 has to be made up by what economists call “injections” which in these sorts of models comprise the sum of investment (I), government spending (G) and exports (X). The injections are seen as coming from “outside” the output-income generating process (they are called exogenous or autonomous expenditure variables).

For GDP to be stable injections have to equal leakages (this can be converted into growth terms to the same effect). The national accounting statements that we have discussed previous such that the government deficit (surplus) equals $-for-$ the non-government surplus (deficit) and those that decompose the non-government sector in the external and private domestic sectors is derived from these relationships.

So imagine there is a certain level of income being produced – its value is immaterial. Imagine that the central bank sees no inflation risk and so interest rates are stable as are exchange rates (these simplifications are to to eliminate unnecessary complexity).

The question then is: what would happen if government increased spending by, say, $100? This is the terrain of the multiplier. If aggregate demand increases drive higher output and income increases then the question is by how much?

The spending multiplier is defined as the change in real income that results from a dollar change in exogenous aggregate demand (so one of G, I or X). We could complicate this by having autonomous consumption as well but the principle is not altered.

So the starting point is to define the consumption relationship. The most simple is a proportional relationship to disposable income (Yd). So we might write it as C = c*Yd – where little c is the marginal propensity to consume (MPC) or the fraction of every dollar of disposable income consumed. We will use c = 0.8.

The * sign denotes multiplication. You can do this example in an spreadsheet if you like.

Our tax relationship is already defined above – so T = tY. The little t is the marginal tax rate which in this case is the proportional rate (assume it is 0.2). Note here taxes are taken out of total income (Y) which then defines disposable income.

So Yd = (1-t) times Y or Yd = (1-0.2)*Y = 0.8*Y

If imports (M) are 20 per cent of total income (Y) then the relationship is M = m*Y where little m is the marginal propensity to import or the economy will increase imports by 20 cents for every real GDP dollar produced.

If you understand all that then the explanation of the multiplier follows logically. Imagine that government spending went up by $100 and the change in real national income is $179. Then the multiplier is the ratio (denoted k) of the Change in Total Income to the Change in government spending.

Thus k = $179/$100 = 1.79.

This says that for every dollar the government spends total real GDP will rise by $1.79 after taking into account the leakages from taxation, saving and imports.

When we conduct this thought experiment we are assuming the other autonomous expenditure components (I and X) are unchanged.

But the important point is to understand why the process generates a multiplier value of 1.79.

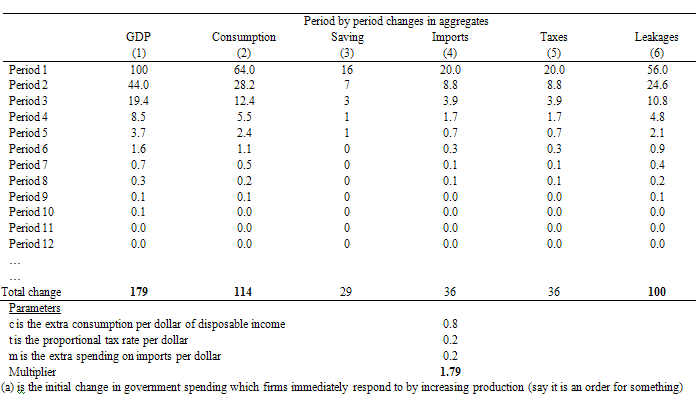

Here is a spreadsheet table I produced as a basis of the explanation. You might want to click it and then print it off if you are having trouble following the period by period flows.

So at the start of Period 1, the government increases spending by $100. The Table then traces out the changes that occur in the macroeconomic aggregates that follow this increase in spending (and “injection” of $100). The total change in real GDP (Column 1) will then tell us the multiplier value (although there is a simple formula that can compute it). The parameters which drive the individual flows are shown at the bottom of the table.

Note I have left out the full period adjustment – only showing up to Period 12. After that the adjustments are tiny until they peter out to zero.

Firms initially react to the $100 order from government at the beginning of the process of change. They increase output (assuming no change in inventories) and generate an extra $100 in income as a consequence which is the 100 change in GDP in Column [1].

The government taxes this income increase at 20 cents in the dollar (t = 0.20) and so disposable income only rises by $80 (Column 5).

There is a saying that one person’s income is another person’s expenditure and so the more the latter spends the more the former will receive and spend in turn – repeating the process.

Households spend 80 cents of every disposable dollar they receive which means that consumption rises by $64 in response to the rise in production/income. Households also save $16 of disposable income as a residual.

Imports also rise by $20 given that every dollar of GDP leads to a 20 cents increase imports (by assumption here) and this spending is lost from the spending stream in the next period.

So the initial rise in government spending has induced new consumption spending of $64. The workers who earned that income spend it and the production system responds. But remember $20 was lost from the spending stream so the second period spending increase is $44. Firms react and generate and extra $44 to meet the increase in aggregate demand.

And so the process continues with each period seeing a smaller and smaller induced spending effect (via consumption) because the leakages are draining the spending that gets recycled into increased production.

Eventually the process stops and income reaches its new “equilibrium” level in response to the step-increase of $100 in government spending. Note I haven’t show the total process in the Table and the final totals are the actual final totals.

If you check the total change in leakages (S + T + M) in Column (6) you see they equal $100 which matches the initial injection of government spending. The rule is that the multiplier process ends when the sum of the change in leakages matches the initial injection which started the process off.

You can also see that the initial injection of government spending ($100) stimulates an eventual rise in GDP of $179 (hence the multiplier of 1.79) and consumption has risen by 114, Saving by 29 and Imports by 36.

The following blog may be of further interest to you:

Question 2:

Bank reserves are maintained to ensure that all the cheques written every day clear when presented. If a bank doesn’t have enough reserves then cheques drawn against it will bounce.

The answer is False.

Banks can always get reserves from the central bank. So if they have extended loans to credit-worthy customers these loans are made independent of their reserve positions. Depending on the way the central bank accounts for commercial bank reserves, the latter will then seek funds to ensure they have the required reserves in the relevant accounting period.

They can borrow from each other in the interbank market but if the system overall is short of reserves these “horizontal” transactions will not add the required reserves. In these cases, the bank will sell bonds back to the central bank or borrow outright through the device called the “discount window”. There is typically a penalty for using this source of funds.

At the individual bank level, certainly the “price of reserves” will play some role in the credit department’s decision to loan funds. But the reserve position per se will not matter. So as long as the margin between the return on the loan and the rate they would have to borrow from the central bank through the discount window is sufficient, the bank will lend.

So the idea that reserve balances are required initially to “finance” bank balance sheet expansion via rising excess reserves is inapplicable. A bank’s ability to expand its balance sheet is not constrained by the quantity of reserves it holds or any fractional reserve requirements.

The bank expands its balance sheet by lending. Loans create deposits which are then backed by reserves after the fact. The process of extending loans (credit) which creates new bank liabilities is unrelated to the reserve position of the bank.

The major insight is that any balance sheet expansion which leaves a bank short of the required reserves may affect the return it can expect on the loan as a consequence of the “penalty” rate the central bank might exact through the discount window. But it will never impede the bank’s capacity to effect the loan in the first place.

So a cheque will only bounce if the account that the cheque is drawn on has insufficient funds and there is no overdraft arrangement in place. That process has nothing to do with banks running out of reserves.

The following blogs may be of further interest to you:

- Money multiplier and other myths

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

Question 3:

While a sovereign government is not revenue constrained and voluntarily constrains itself to borrow to cover its net spending position, it remains the case that by substituting its spending for the borrowed funds it reduces the private capacity to borrow and spend.

The answer is False.

It is clear that at any point in time, there are finite real resources available for production. New resources can be discovered, produced and the old stock spread better via education and productivity growth. The aim of production is to use these real resources to produce goods and services that people want either via private or public provision.

So by definition any sectoral claim (via spending) on the real resources reduces the availability for other users. There is always an opportunity cost involved in real terms when one component of spending increases relative to another.

However, the notion of opportunity cost relies on the assumption that all available resources are fully utilised.

Unless you subscribe to the extreme end of mainstream economics which espouses concepts such as 100 per cent crowding out via financial markets and/or Ricardian equivalence consumption effects, you will conclude that rising net public spending as percentage of GDP will add to aggregate demand and as long as the economy can produce more real goods and services in response, this increase in public demand will be met with increased public access to real goods and services.

If the economy is already at full capacity, then a rising public share of GDP must squeeze real usage by the non-government sector which might also drive inflation as the economy tries to siphon of the incompatible nominal demands on final real output.

However, the question is focusing on the concept of financial crowding out which is a centrepiece of mainstream macroeconomics textbooks. This concept has nothing to do with “real crowding out” of the type noted in the opening paragraphs.

The financial crowding out assertion is a central plank in the mainstream economics attack on government fiscal intervention. At the heart of this conception is the theory of loanable funds, which is a aggregate construction of the way financial markets are meant to work in mainstream macroeconomic thinking.

The original conception was designed to explain how aggregate demand could never fall short of aggregate supply because interest rate adjustments would always bring investment and saving into equality.

At the heart of this erroneous hypothesis is a flawed viewed of financial markets. The so-called loanable funds market is constructed by the mainstream economists as serving to mediate saving and investment via interest rate variations.

This is pre-Keynesian thinking and was a central part of the so-called classical model where perfectly flexible prices delivered self-adjusting, market-clearing aggregate markets at all times. If consumption fell, then saving would rise and this would not lead to an oversupply of goods because investment (capital goods production) would rise in proportion with saving. So while the composition of output might change (workers would be shifted between the consumption goods sector to the capital goods sector), a full employment equilibrium was always maintained as long as price flexibility was not impeded. The interest rate became the vehicle to mediate saving and investment to ensure that there was never any gluts.

So saving (supply of funds) is conceived of as a positive function of the real interest rate because rising rates increase the opportunity cost of current consumption and thus encourage saving. Investment (demand for funds) declines with the interest rate because the costs of funds to invest in (houses, factories, equipment etc) rises.

Changes in the interest rate thus create continuous equilibrium such that aggregate demand always equals aggregate supply and the composition of final demand (between consumption and investment) changes as interest rates adjust.

According to this theory, if there is a rising budget deficit then there is increased demand is placed on the scarce savings (via the alleged need to borrow by the government) and this pushes interest rates to “clear” the loanable funds market. This chokes off investment spending.

So allegedly, when the government borrows to “finance” its budget deficit, it crowds out private borrowers who are trying to finance investment.

The mainstream economists conceive of this as the government reducing national saving (by running a budget deficit) and pushing up interest rates which damage private investment.

The analysis relies on layers of myths which have permeated the public space to become almost self-evident truths. This trilogy of blogs will help you understand this if you are new to my blog – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3.

The basic flaws in the mainstream story are that governments just borrow back the net financial assets that they create when they spend. Its a wash! It is true that the private sector might wish to spread these financial assets across different portfolios. But then the implication is that the private spending component of total demand will rise and there will be a reduced need for net public spending.

Further, they assume that savings are finite and the government spending is financially constrained which means it has to seek “funding” in order to progress their fiscal plans. But government spending by stimulating income also stimulates saving.

Additionally, credit-worthy private borrowers can usually access credit from the banking system. Banks lend independent of their reserve position so government debt issuance does not impede this liquidity creation.

The following blogs may be of further interest to you:

- When a huge pack of lies is barely enough

- Saturday Quiz – April 17, 2010 – answers and discussion

- Building bank reserves will not expand credit

- a href=”https://billmitchell.org/blog/?p=6624″>Building bank reserves is not inflationary – for further discussion.

Question 4:

The crucial difference between a monetary system based on the gold standard world and a fiat currency monetary is:

The correct (best) answer is – that under the former system, the national government had to issue debt to cover spending above taxation.

Under the gold standard the paper money issued by a central bank was backed by gold. A currency’s value was expressed in terms of a specified unit of gold and there was convertibility which allowed a person to swap the paper money for the relevant amount of gold. A parity was fixed and central banks agreed to maintain the “mint price” of gold fixed by standing ready to buy or sell gold to meet any supply or demand imbalance.

Further, the central bank (or equivalent in those days) had to maintain stores of gold sufficient to back the circulating currency (at the agreed convertibility rate).

Gold was also considered to be the principle method of making international payments. Accordingly, as trade unfolded, imbalances in trade (imports and exports) arose and this necessitated that gold be transferred between nations to fund these imbalances. Trade deficit countries had to ship gold to trade surplus countries.

This inflow of gold would allow the governments in surplus nations to expand the money supply (issue more notes) because they now had more gold to back the currency. This expansion was in strict proportion to the set value of the local currency in terms of grains of gold. The rising money supply would push against the inflation barrier (given no increase in the real capacity of the economy) which would ultimately render exports less attractive to foreigners and the external deficit would decline.

From the perspective of an external deficit nation, the loss of gold reserves forced their government to withdraw paper currency which was deflationary – rising unemployment and falling output and prices. The latter improved the competitiveness of their economy which also helped resolve the trade imbalance. But it remains that the deficit nations were forced to bear rising unemployment and vice versa as the trade imbalances resolved.

The proponents of the gold standard focus on the way it prevents the government from issuing paper currency as a means of stimulating their economies. Under the gold standard, the government could not expand base money if the economy was in trade deficit. It was considered that the gold standard acted as a means to control the money supply and generate price levels in different trading countries which were consistent with trade balance. The domestic economy however was forced to make the adjustments to the trade imbalances.

Monetary policy became captive to the amount of gold that a country possessed (principally derived from trade). Variations in the gold production levels also influenced the price levels of countries.

After World War 2, the IMF was created to supercede the gold standard and the so-called gold exchange standard emerged. Convertibility to gold was abandoned and replaced by convertibility into the US dollar, reflecting the dominance of the US in world trade (and the fact that they won the war!). This new system was built on the agreement that the US government would convert a USD into gold at $USD35 per ounce of gold. This provided the nominal anchor for the exchange rate system.

The Bretton Woods System was introduced in 1946 and created the fixed exchange rates system. Governments could now sell gold to the United States treasury at the price of $USD35 per ounce. So now a country would build up US dollar reserves and if they were running a trade deficit they could swap their own currency for US dollars (drawing from their reserves) and then for their own currency and stimulate the economy (to increase imports and reduce the trade deficit).

The fixed exchange rate system however rendered fiscal policy relatively restricted because monetary policy had to target the exchange parity. If the exchange rate was under attack (perhaps because of a balance of payments deficit) which would manifest as an excess supply of the currency in the foreign exchange markets, then the central bank had to intervene and buy up the local currency with its reserves of foreign currency (principally $USDs).

This meant that the domestic economy would contract (as the money supply fell) and unemployment would rise. Further, the stock of $US dollar reserves held by any particular bank was finite and so countries with weak trading positions were always subject to a recessionary bias in order to defend the agreed exchange parities. The system was politically difficult to maintain because of the social instability arising from unemployment.

So if fiscal policy was used too aggressively to reduce unemployment, it would invoke a monetary contraction to defend the exchange rate as imports rose in response to the rising national income levels engendered by the fiscal expansion. Ultimately, the primacy of monetary policy ruled because countries were bound by the Bretton Woods agreement to maintain the exchange rate parities. They could revalue or devalue (once off realignments) but this was frowned upon and not common.

Whichever system we want to talk off – pure gold standard or USD-convertible system backed by gold – the constraints on government were obvious.

The gold standard as applied domestically meant that existing gold reserves controlled the domestic money supply. Given gold was in finite supply (and no new discoveries had been made for years), it was considered to provide a stable monetary system. But when the supply of gold changed (a new field discovered) then this would create inflation.

So gold reserves restricted the expansion of bank reserves and the supply of high powered money (government currency). The central bank thus could not expand their liabilities beyond their gold reserves. In operational terms this means that once the threshold was reached, then the monetary authority could not buy any government debt or provide loans to its member banks.

As a consequence, bank reserves were limited and if the public wanted to hold more currency then the reserves would contract. This state defined the money supply threshold.

The concept of (and the term) monetisation comes from this period. When the government acquired new gold (say by purchasing some from a gold mining firm) they could create new money. The process was that the government would order some gold and sign a cheque for the delivery. This cheque is deposited by the miner in their bank. The bank then would exchange this cheque with the central bank in return for added reserves. The central bank then accounts for this by reducing the government account at the bank. So the government’s loss is the commercial banks reserve gain.

The other implication of this system is that the national government can only increase the money supply by acquiring more gold. Any other expenditure that the government makes would have to be “financed” by taxation or by debt issuance. The government cannot just credit a commercial bank account under this system to expand its net spending independent of its source of finance.

As a consequence, whenever the government spent it would require offsetting revenue in the form of taxes or borrowed funds.

The move to fiat currencies fundamentally altered the way the monetary system operated even though the currency was still, say, the $AUD.

This system had two defining characteristics: (a) non-convertibility; and (b) flexible exchange rates.

First, under a fiat monetary system, “state money” has no intrinsic value. It is non-convertible. So for this otherwise “worthless” currency to be acceptable in exchange (buying and selling things) some motivation has to be introduced. That motivation emerges because the sovereign government has the capacity to require its use to relinquish private tax obligations to the state. Under the gold standard and its derivatives money was always welcome as a means of exchange because it was convertible to gold which had a known and fixed value by agreement. This is a fundamental change.

Second, given the relationship between the commodity backing (gold) and the ability to spend is abandoned and that the Government is the monopoly issuer of the fiat currency in use (defined by the tax obligation) then the spending by this government is revenue independent. It can spend however much it likes subject to there being real goods and services available for sale. This is a dramatic change.

Irrespective of whether the government has been spending more than revenue (taxation and bond sales) or less, on any particular day the government has the same capacity to spend as it did yesterday. There is no such concept of the government being “out of money” or not being able to afford to fund a program. How much the national government spends is entirely of its own choosing. There are no financial restrictions on this capacity.

This is not to say there are no restrictions on government spending. There clearly are – the quantity of real goods and services available for sale including all the unemployed labour. Further, it is important to understand that while the national government issuing a fiat currency is not financially constrained its spending decisions (and taxation and borrowing decisions) impact on interest rates, economic growth, private investment, and price level movements.

We should never fall prey to the argument that the government has to get revenue from taxation or borrowing to “finance” its spending under a fiat currency system. It had to do this under a gold standard (or derivative system) but not under a fiat currency system. Most commentators fail to understand this difference and still apply the economics they learned at university which is fundamentally based on the gold standard/fixed exchange rate system.

Third, in a fiat currency system the government does not need to finance spending in which case the issuing of debt by the monetary authority or the treasury has to serve other purposes. Accordingly, it serves a interest-maintenance function by providing investors with an interest-bearing asset that drains the excess reserves in the banking system that result from deficit spending. If these reserves were not drained (that is, if the government did not borrow) then the spending would still occur but the overnight interest rate would plunge (due to competition by banks to rid themselves of the non-profitable reserves) and this may not be consistent with the stated intention of the central bank to maintain a particular target interest rate.

Importantly, the source of funds that investors use to buy the bonds is derived from the net government spending anyway (that is, spending above taxation). The private sector cannot buy bonds in the fiat currency unless the government has spent the same previously. This is a fundamental departure from the gold standard mechanisms where borrowing was necessary to fund government spending given the fixed money supply (fixed by gold stocks). Taxation and borrowing were intrinsically tied to the government’s management of its gold reserves.

So in a fiat currency system, government borrowing doesn’t fund its spending. It merely stops interbank competition which allows the central bank to defend its target interest rate.

The flexible exchange rate system means that monetary policy is freed from defending some fixed parity and thus fiscal policy can solely target the spending gap to maintain high levels of employment. The foreign adjustment is then accomplished by the daily variations in the exchange rate.

The following blogs may be of further interest to you:

Question 5:

When the national government’s budget balance moves into deficit:

The answer is that you cannot conclude anything about the government’s policy intentions.

The actual budget deficit outcome that is reported in the press and by Treasury departments is not a pure measure of the fiscal policy stance adopted by the government at any point in time. As a result, a straightforward interpretation of the government’s discretionary fiscal intentions is not possible when using the actual reported budget deficit.

Economists conceptualise the actual budget outcome as being the sum of two components: (a) a discretionary component – that is, the actual fiscal stance intended by the government; and (b) a cyclical component reflecting the sensitivity of certain fiscal items (tax revenue based on activity and welfare payments to name the most sensitive) to changes in the level of activity.

The former component is now called the “structural deficit” and the latter component is sometimes referred to as the automatic stabilisers.

The structural deficit thus conceptually reflects the chosen (discretionary) fiscal stance of the government independent of cyclical factors.

The cyclical factors refer to the automatic stabilisers which operate in a counter-cyclical fashion. When economic growth is strong, tax revenue improves given it is typically tied to income generation in some way. Further, most governments provide transfer payment relief to workers (unemployment benefits) and this decreases during growth.

In times of economic decline, the automatic stabilisers work in the opposite direction and push the budget balance towards deficit, into deficit, or into a larger deficit. These automatic movements in aggregate demand play an important counter-cyclical attenuating role. So when GDP is declining due to falling aggregate demand, the automatic stabilisers work to add demand (falling taxes and rising welfare payments). When GDP growth is rising, the automatic stabilisers start to pull demand back as the economy adjusts (rising taxes and falling welfare payments).

The problem is then how to determine whether the chosen discretionary fiscal stance is adding to demand (expansionary) or reducing demand (contractionary). It is a problem because a government could be run a contractionary policy by choice but the automatic stabilisers are so strong that the budget goes into deficit which might lead people to think the “government” is expanding the economy.

So just because the budget goes into deficit doesn’t allow us to conclude that the Government has suddenly become of an expansionary mind. In other words, the presence of automatic stabilisers make it hard to discern whether the fiscal policy stance (chosen by the government) is contractionary or expansionary at any particular point in time.

To overcome this ambiguity, economists decided to measure the automatic stabiliser impact against some benchmark or “full capacity” or potential level of output, so that we can decompose the budget balance into that component which is due to specific discretionary fiscal policy choices made by the government and that which arises because the cycle takes the economy away from the potential level of output.

As a result, economists devised what used to be called the Full Employment or High Employment Budget. In more recent times, this concept is now called the Structural Balance. As I have noted in previous blogs, the change in nomenclature here is very telling because it occurred over the period that neo-liberal governments began to abandon their commitments to maintaining full employment and instead decided to use unemployment as a policy tool to discipline inflation.

The Full Employment Budget Balance was a hypothetical construction of the budget balance that would be realised if the economy was operating at potential or full employment. In other words, calibrating the budget position (and the underlying budget parameters) against some fixed point (full capacity) eliminated the cyclical component – the swings in activity around full employment.

This framework allowed economists to decompose the actual budget balance into (in modern terminology) the structural (discretionary) and cyclical budget balances with these unseen budget components being adjusted to what they would be at the potential or full capacity level of output.

The difference between the actual budget outcome and the structural component is then considered to be the cyclical budget outcome and it arises because the economy is deviating from its potential.

So if the economy is operating below capacity then tax revenue would be below its potential level and welfare spending would be above. In other words, the budget balance would be smaller at potential output relative to its current value if the economy was operating below full capacity. The adjustments would work in reverse should the economy be operating above full capacity.

If the budget is in deficit when computed at the “full employment” or potential output level, then we call this a structural deficit and it means that the overall impact of discretionary fiscal policy is expansionary irrespective of what the actual budget outcome is presently. If it is in surplus, then we have a structural surplus and it means that the overall impact of discretionary fiscal policy is contractionary irrespective of what the actual budget outcome is presently.

So you could have a downturn which drives the budget into a deficit but the underlying structural position could be contractionary (that is, a surplus). And vice versa.

The question then relates to how the “potential” or benchmark level of output is to be measured. The calculation of the structural deficit spawned a bit of an industry among the profession raising lots of complex issues relating to adjustments for inflation, terms of trade effects, changes in interest rates and more.

Much of the debate centred on how to compute the unobserved full employment point in the economy. There were a plethora of methods used in the period of true full employment in the 1960s.

As the neo-liberal resurgence gained traction in the 1970s and beyond and governments abandoned their commitment to full employment , the concept of the Non-Accelerating Inflation Rate of Unemployment (the NAIRU) entered the debate – see my blogs – The dreaded NAIRU is still about and Redefing full employment … again!.

The NAIRU became a central plank in the front-line attack on the use of discretionary fiscal policy by governments. It was argued, erroneously, that full employment did not mean the state where there were enough jobs to satisfy the preferences of the available workforce. Instead full employment occurred when the unemployment rate was at the level where inflation was stable.

The estimated NAIRU (it is not observed) became the standard measure of full capacity utilisation. If the economy is running an unemployment equal to the estimated NAIRU then mainstream economists concluded that the economy is at full capacity. Of-course, they kept changing their estimates of the NAIRU which were in turn accompanied by huge standard errors. These error bands in the estimates meant their calculated NAIRUs might vary between 3 and 13 per cent in some studies which made the concept useless for policy purposes.

Typically, the NAIRU estimates are much higher than any acceptable level of full employment and therefore full capacity. The change of the the name from Full Employment Budget Balance to Structural Balance was to avoid the connotations of the past where full capacity arose when there were enough jobs for all those who wanted to work at the current wage levels.

Now you will only read about structural balances which are benchmarked using the NAIRU or some derivation of it – which is, in turn, estimated using very spurious models. This allows them to compute the tax and spending that would occur at this so-called full employment point. But it severely underestimates the tax revenue and overestimates the spending because typically the estimated NAIRU always exceeds a reasonable (non-neo-liberal) definition of full employment.

So the estimates of structural deficits provided by all the international agencies and treasuries etc all conclude that the structural balance is more in deficit (less in surplus) than it actually is – that is, bias the representation of fiscal expansion upwards.

As a result, they systematically understate the degree of discretionary contraction coming from fiscal policy.

The only qualification is if the NAIRU measurement actually represented full employment. Then this source of bias would disappear.

Why all this matters is because, as an example, the Australian government thinks we are close to full employment now (according to Treasury NAIRU estimates) when there is 5.2 per cent unemployment and 7.5 per cent underemployment (and about 1.5 per cent of hidden unemployment). As a result of them thinking this, they consider the structural deficit estimates are indicating too much fiscal expansion is still in the system and so they are cutting back.

Whereas, if we computed the correct structural balance it is likely that the Federal budget deficit even though it expanded in both discretionary and cyclical terms during the crisis is still too contractionary.

The following blogs may be of further interest to you:

You’ve used the following boiler plate sentence in several recent posts. For the life of me, I can’t figure out what it means:

“So now a country would build up US dollar reserves and if they were running a trade deficit they could swap their own currency for US dollars (drawing from their reserves) and then for their own currency and stimulate the economy (to increase imports and reduce the trade deficit).”

I second that Anon.

And I still question the best answer to Q4. In the explanation today, you mention unemployment several times as a problem that can occur under a gold standard. Why is it issueing debt is the most crucial difference?

A third that. I’ve tried to parse that particular sentence a number of times without any luck!

Ken

«Given gold was in finite supply (and no new discoveries had been made for years), it was considered to provide a stable monetary system. But when the supply of gold changed (a new field discovered) then this would create inflation.»

But the main difference between a real and fiat money system is of course distributional, while even you make mostly only arguments on *aggregates*. Then the distributional issue also impacts incentives for the aggregate level, but indirectly (but perhaps no less importantly).

The point is very simple: assume that the “real” economy is growing by 5% a year, and that the supply of numeraire, e.g. gold, is constant. Over a year that numeraire has increased in “real” value by 5%, because the same quantity of numeraire can now buy 5% more “real” goods or services (in other words, 5% deflation has occurred). Therefore there has been a distributional impact in favour of property holders (in general, not just those holding numeraire).

Put another way, growth in the real economy results in rents via capital gains to property owners, if the stock of numeraire is constant.

The consequence is that only suckers would then invest and work to create growth in “real” output, as that ends up captured in whole or part by capital gains for property owners; holding numeraire or other property would allow participating partially or wholly in any “real” growth, without effort or risk (except the risk of a contraction in “real” output), and the more numeraire or property, the bigger the gain.

Ensuring that the distributional impact of the monetary system strongly favours rentier owners of financial or real capital seems a bad idea to me, but of course looks like a wonderful idea to masses of really dumb and greedy middle class owners of retirement accounts and “real” property, who have enthusiastically voted for the past 30 years for policies aimed at higher property prices and lower wages hoping to ride into a luxurious retirement supported by massive capital gains.

And who have (indirectly) supported whichever monetary theory bullsh*t helped along their “f*ck you, I got mine” dream of easily becoming wealthy rentiers.

«you mention unemployment several times as a problem that can occur under a gold standard»

Not quite; unemployment can happen in theory under any monetary regime.

The difference between a gold backed and a fiat monetary regime, as the blogger has explained many times in detail, is as to how easily the government can help restore full employment in some cases.

Assuming that the unemployment is caused by a private demand gap, this can be compensated for by increasing public demand; financing this with gold backed money requires borrowing gold to pay for the spending in excess of taxation, with fiat money it only requires central bank accounting adjustments.

In theory the government could just transfer (via a tax increase) gold from large gold holders who are not spending it to itself and then spend it, but this way to increase the government spending power is simply much less politically desirable than just creating new equivalent fiat numeraire. It is also to some extent more economically desirable as it works around better some friction and rigidities in both the real and financial economy.

Fourth that.

Will attempt to parse it.

A country will build up US dollar reserves. When they run a trade deficit, it leads to a loss of reserves. A capital inflow can lead to increase in reserves so there is a dollar reserve gain and one can say that its like a swap.

There seems to be some kind of swap here as well. The central bank purchasing government debt and creating reserves maybe?This increases the money supply and simulates the economy ?

Hardest to parse.

My ideas and knowledge about the fixed exchange rate regime is different however. France lost a lot of gold to Germany in the 1800s to compensate for the loss of a war but the French economy grew instead of suffering a deep recession.

The policy of the government and the central bank was not to reduce currency but to reduce demand. The causality is not currency reducing demand but fiscal+monetary policy reducing demand. The central bank’s monetary policy targets may have been

r = f(M)

i.e, bank rate is a function of the “supply of money” but its just that the culprit was the policy and not currency. Central banks cannot control the money supply. They may attempt to but they have attempted this even in the fiat currency regimes. Even in that case r = f(M).

Ramanan,

“Central banks cannot control the money supply.”

I think you’re roughly right, and this is what I find disconcerting about descriptions of the gold system.

I think your r = f(M) is closer to the truth.

And therefore the difference between gold/fixed rate regimes and fiat regimes is a lot less than is usually described.

In other words, r = f(M) holds in fiat and non-fiat.

The only way fiat supersedes this function is via zero natural rate implementation.

Therefore, the unique message of MMT depends on ZNR implementation.

Anon,

I couldn’t catch your points on ZNR vs fixed in the other post as well – what’s the connection ?

Ramanan:

If you’re talking about the Franco-Prussian war – the French also lost the Alsace and Lorraine regions, which had a considerable amount of real resources (although the newly unified German state granted most favored trade status to France, so maybe trade impact on France was not so severe).

Anyway, perhaps finally getting rid of the monarchy (another gold drain, perhaps?) helped France’s economy more than losing some gold (which basically allowed Germany to invest – who were they going to buy from, the Russians?). The late 1800s were a very productive/technologically advancing time worldwide.

I don’t know how the monetary system worked out in France then, but with the Paris Commune and other revolutionary movements, I imagine the authorities “relaxed” their standards a bit.

Someone may complain that since the M in “r=f(M)” is for one country, how can different countries have different interest rates ? Wouldn’t the world “move funds” heavily in countries which has a higher interest rate ?

There are many assumptions made in such an argument such as the assumption that financial institutions have a huge amount of funds available to earn more because of the differential and that banks are unregulated and can lend to financial institutions to make this arbitrage. I guess they were better regulated in those times. Its possible that banks lending charges are high enough for the trade to not make sense. There are other hidden assumption as well such as institutions are indifferent to lending to different governments etc. Those who invest without borrowing are limited by their (income – expenditure).

Central banks in a fixed exchange rate regime can set their interest rates. If they suspect a lot of foreign funds in the pipeline, they can react accordingly. Its when they are worried about losses, that they may start reacting in crazy ways and hike rates.

pebird,

My knowledge of history is bad. I don’t know where I read about the gold loss, so can’t say more on that.

What I am trying to say is that the description of the gold standard period is almost the same as for fiat currency. By some act of the unknown, banks may have exchanged currency at the rate fixed by countries and the IMF. The dynamics is the same as fiat currency floating regime, except that the exchange rate doesn’t move (atleast till some country revalues’ her currency).

btw, saw what happened in the Germany-England match ? Sufficient reason for the UK to not join the Euro Zone !

The individual banks and the banking system are two separate entities. There is a highly flexible payments clearing systems within the Federal Reserve’s structure. But that doesn’t mean the bankers will always be able to clear their checks, though it is true as you say legal reserves don’t guarantee that checks will clear or bounce.

However that is a mis-leading question from the standpoint of the entire system. If the banking system can always get reserves for their expanding loans-deposits (these come into being simultaneously)), the monetary authorities could never “tighten”. The constraint would be an absence of creditworthy borrowers, & under-performing investments, where the bankers couldn’t maintain their margins (a self-correcting economy). While economists generally agree that reserve requirements aren’t “binding”, the evidence clearly demonstrates otherwise.

The liquidity preference curve is a false doctrine anyway. There is no liqudity trap with ZIRP, because the money supply can never be managed by any attempt to control the cost of credit. That’s what the Treas. – Fed. Res. Accord of Mar. 1951 was all about. The effect of tying open market policy to a fed Funds rate is to supply additional (and excessive (costless), legal reserves) to the banking system when loan demand increases.

It is a fact. Greenspan never “tightened” monetary policy whatsoever, & Bernanke never “loosened” monetary policy (until he collapsed the economy, a la Lehman Brothers).

A more accurate version of “r=f(M)” in the gold-standard is

Δr = – constant1 x Δg x p_g

So the central bank reacts by hiking rates if there is a loss of gold Δg. (p_g = price of gold in the local currency, x = multiplication symbol)

No targeting of the monetary base.

The government may react as well. That will be described as

ΔG = + constant2 x Δg x p_g

Not sure about the Bretton-Woods which is slightly different.

The fact the central banks target the interbank rates was first written by Sir Dennis Holme Robertson in 1922 in his book called Money. After, but not in the General Theory Keynes also stated it explicitly (it seems). (I haven’t read Keynes)

«If the banking system can always get reserves for their expanding loans-deposits (these come into being simultaneously)), the monetary authorities could never “tighten”.»

This to seems like a confusion between central bank reserve requirements and prudential capital requirements, two completely different things (often confused as central bank reserves can count as prudential capital). The great 1995 credit bubble was in part started and fueled by crass reductions in the USA (and Japanese) prudential capital requirements.

«The constraint would be an absence of creditworthy borrowers, & under-performing investments,»

Both constraints can be made very very very elastic with a bit of cooperation and positive thinking from accountants, who usually know which side their bread is (well) buttered on.

«just creating new equivalent fiat numeraire. It is also to some extent more economically desirable»

Oops, I wrote this carelessly: here “It” should have been “The latter” (“creating new equivalent fiat numeraire”).

In regard to the difference between hard currency and fiat currency, perhaps someone might wish to comment on this passage from “A History of American Currency” by Sumner.

“Evidently in a natural state of things there would be some things in each country (those for whose production that country has the best advantages) which would be lower in price, would be given in larger quantity for a given quantity of the precious metals, in that country than in others. The movement of metal from country to country would in that case be very slight, but whenever the average of prices in one country rose above the average in others, an outflow of specie would bring them down to the level, and whenever they fell below the average, an influx would raise them. Some argue that high prices make prosperity: others that low prices make prosperity. High and low prices are only relative terms, and in fact have no meaning when we embrace the production of the world. The true place for prices in each country to occupy is in their due relation to the general average the world over, for then each country gets the utmost possible gain from its relative advantage in those things which it can produce best. The movement of specie would therefore be, if the whole world used the metals and regulated prices by them without interference, as regular, as self-controlled, and as beneficent as the movement of the tides. This, too, is the grand fundamental reason why inconvertible paper is a suicidal folly in the country which adopts it.”

Not exactly a fan of fiat currency. 😉

“confusion between central bank reserve requirements and prudential capital requirement” Isn’t that an oxymoron? There is the prudential reserve Euro-dollar market?

“A bank’s ability to expand its balance sheet is not constrained by the quantity of reserves it holds or any fractional reserve requirements” Verifiably not:

(at the height of the Doc.com stock market bubble), Greenspan initiated a “tight” monetary policy (for 31 out of 34 months). A “tight” money policy is one where the rate-of-change in monetary flows (our means-of-payment money times its transactions rate of turnover) is no greater than 2-3% above the rate-of-change in the real output of goods & services.

Greenspan then wildly reversed his “tight” money policy (at that point Greenspan was well behind the employment curve), and reverted to a very “easy” monetary policy — for 41 consecutive months (despite 17 raises in the FFR-every single rate increase was “behind the curve”).

Then, as soon as Bernanke was appointed to the Chairman of the Federal Reserve, he initiated a “tight” money policy, for 29 consecutive months (out of a possible 29, or at first, sufficient to wring inflation out of the economy, but persisting until the economy collapsed). And for the last 19 successive months (since Aug 2008), the FED has been on a monetary binge (ending at April’s month-end & now reversing).

Did you catch it??? Nobody got it. Greenspan didn’t start “easing” on January 3, 2000, when the FFR was first lowered by 1/2, to 6%. Greenspan didn’t change from a “tight” monetary policy, to an “easier” monetary policy, until after 11 reductions in the FFR, ending just before the reduction on November 6, 2002 @ 1 & 1/4%.

I.e., Greenspan was responsible for both high employment (June 2003, @ 6.3%), and high inflation). And Bernanke’s then responsible for 10.1% unemployment.

It is thus an incontrovertible fact that the banks, and the banking system, are both constrained by legal reserves