I am late today because I am writing this in London after travelling the last…

Some lessons from history for the design of a coronavirus fiscal intervention

This post continues my thinking and analysis of the issues relating to the design of a fiscal intervention by the Australian government to ameliorate the damaging consequences of the coronavirus dislocation. Today, I delve a little bit back in history to provide some perspective on the current fiscal considerations. Further, I consider some of the problems already emerging in the policy response. And finally, I consider the lessons of history provide an important guide to the sort of interventions that the Australian government might usefully deploy. While the analysis is focused on Australia at present, the principles developed are portable across national boundaries. And the underlying Modern Monetary Theory (MMT) understanding is applicable everywhere there is a monetary system. This series of blog posts are building up to the production of my 10-point or something plan to address the crisis.

Dealing with the Second World War

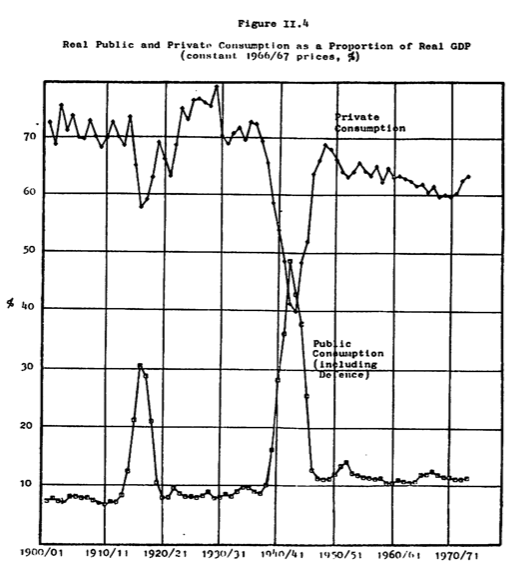

The following graphs show the dramatic shifts in public and private spending during the Second World War. They are taken from the excellent historical data provided by M.W. Butlin – A Preliminary Annual Database, 1900/01 to 1973/74.

By the early 1940s, as the war in the Pacific was in full swing, the Australian government shifted its total consumption expenditure (including defence) in real terms from just under 10 per cent of GDP to close to 50 per cent.

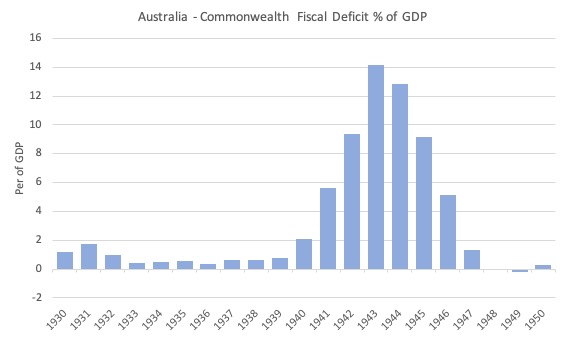

The next graph shows the shift in the Australian government fiscal balance between 1930 and 1950 (as a per cent of GDP). The fiscal injection reached a peak of 14.12 per cent in 1943 and was over 5 per cent of 6 years.

So it was a massive federal intervention that was deemed to be required as part of the war effort.

There was a dramatic shift in the manufacturing sector towards armaments production. Manufacturing employment surged by 10.1 per cent in 1940 and 10.7 per cent in 1941, mostly as a result of women entering the labour force.

This article from the National Archives – Secondary Industries – provides some background.

We learn that during the War, “there was another upsurge in manufacturing” and:

By 1943, the Commonwealth Government had established 47 munitions factories and establishments, and there were also 178 government-financed annexes attached to private firms and state workshops … In five years manufacturing employment, which included a significant proportion of female workers, rose by 25 per cent, with 753,000 employed in 1944. Two-thirds of civilian employees were engaged …

In this historical account from the Victorian government – Women’s work during World War II – we learn that:

During World War II, with the male workforce considerably depleted and ‘manpower’ critical to maintain wartime production, women took on a significant role. Wartime created opportunities not only for the development of local engineering prowess, but also provided new employment opportunities for women …

And this archive – Women at Work – reports that:

Women’s participation in the workforce increased by 31% between 1939 and 1943 as women found work in factories and farms and were able to take up positions in country areas as teachers and nurses.

The point is that in time of emergency, there is substantial capacity to shift resources around into areas previously considered unimaginable.

The women factory workers had never done that sort of work before yet productivity rose during that period.

Current fiscal intervention – so far

Consider the current fiscal intervention in relation to this historical data and also the GFC stimulus provided by the Federal government.

As an aside, I have no issue with using the term ‘stimulus’. Some think we should use more drastic terms commensurate with the severity of the problem.

The Government has so far announced two fiscal stimulus measures:

1. March 16, 2020 – $A17.6 billion

2. March 22, 2020 – $A66.0 billion

3. Total $A83.6 billion

4. In terms of the 2019 GDP, this amounts to 4.2 per cent.

5. The RBA also made $A90 billion available for SMSE loans at 0.25 per cent, and also cut the policy rate to 0.25 per cent. I will talk more about this later.

6. March 23, 2020 – the Federal parliament approves a further $A40 billion as an unspecified fund to be used if and when needed at the Government’s discretion, given they have also suspended Parliament for around 5 months, allegedly to reduce the risk of coronavirus contraction. The Opposition Labor party thought it a good idea allowing the Government to have this spending approval without scrutiny. I would not have done that.

7. So the unspecified pool adds another 2 per cent of GDP to the stimulus.

Now think back to the GFC when the Opposition were in government and they were confronted with the impending collapse of the financial system after years of greed and excess and lack of prudential oversight.

Here is what it did:

1. October 2008 – $A10.4 billion.

- $A4.8 billion pre-Xmas pensioner payments

- $A3.9 billion family support

- $A1.5 billion first-home buyers grant tripled

- $A187 million training positions

2. February 2009 – $A42.0 billion (mostly infrastructure).

- $A26 billion for infrastructure

- $A2.7 billion small-business tax breaks

- $12.7 billion cash bonuses ($A950 for everyone earning less than $A80,000)

3. Total $A52.4 billion or 4.2 per cent of GDP.

4. The RBA also cut interest rates by 1 per cent to 3.25 per cent.

So, leaving aside the unspecified slush fund of $A40 billion, the current spending injection being proposed by the Australian government is equivalent in terms of proportion of GDP as the GFC response.

It is almost as though the Federal Treasury has some stimulus threshold beyond which they don’t want to go.

But, it will become clear that all of the unspecified slush fund of $A40 billion will be required and lots more if the nation is to get through the economic turmoil with a modicum of respectability.

The scale of the Federal government intervention is nowhere near what it executed during the Second World War yet I expect the ultimate shift in policy will have to be of similar magnitudes, albeit, perhaps, not for as long.

The virus will probably be corralled in a shorter time than it took to bring Japan to surrender.

Issues to consider

First, the Government is making out that the stimulus is, in fact, much larger than I have mentioned here, as a result of the $A90 billion that the RBA is making available to small and medium-sized businesses as loans at the current policy rate.

The problem with these types of measures, which are shared by quantitative easing (QE) policies is that they require firms and households to be prepared to borrow at a time when increased indebtedness is likely to be damaging without a solid sales and/or employment outlook.

I discussed the Household debt situation in Australia in this blog post (among others) – Household debt is part of a broader problem – be informed (November 22, 2017).

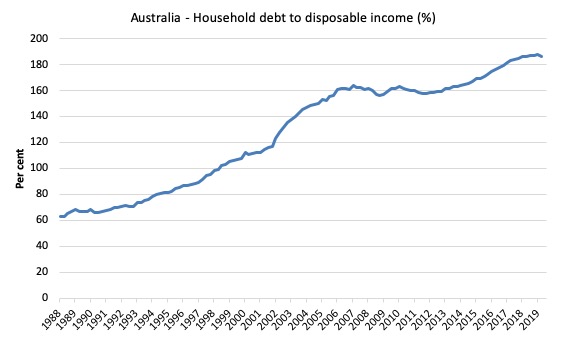

The most recent RBA data – Household Finances – Selected Ratios – E2 – shows that the ratio of household debt to annualised household disposable income is now at record levels – each month a new record is established.

The following graph shows the ratio from 1988 (the beginning of the series) to the June-quarter 2017.

In June 1988, the ratio was 63.2 per cent. It peaked at 171 per cent in the June-quarter 2007, just before the GFC emerged.

It stabilised for a while as the fear of unemployment and the economic slowdown curbed credit growth for a while. But that didn’t last.

Over the last two years it has accelerated considerably and in the September-quarter 2019, the ratio was 186.5 per cent, although in recent quarters we have seen a tapering, as economic conditions become less buoyant.

The position of Australian households, carrying record levels of debt, is made more precarious by the record low wages growth and the conduct of the private banks.

Please read my blog post – Australia’s household debt problem is not new – it is a neo-liberal product (February 22, 2017) – for more discussion on this point.

The problem is that in this environment, the consequences of the coronavirus disaster will only make the situation more precarious than it already was.

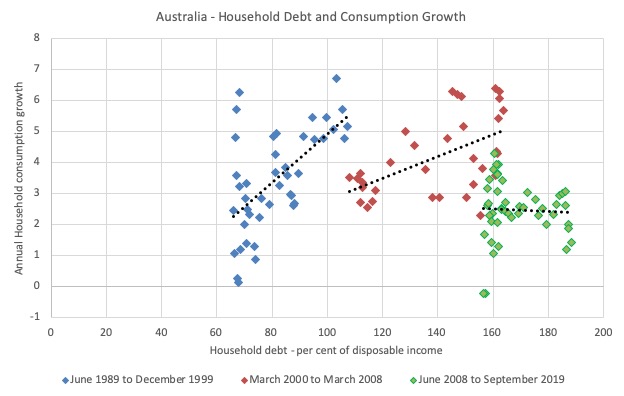

The next graph shows the way in which the evolution of the household debt ratio relates to the annual growth in household consumption expenditure.

The graph shows three distinct segments in the sample (which I confirmed using more sophisticated regime-switching analysis):

1. June-quarter 1989 to December-quarter 1999 – at which point the relationship started to shift outwards. At this point, the household debt ratio was 107.9.

2. March-quarter 2000 to March-quarter 2008 – taking us up to the GFC, at which point I detected further instability.

3. June-quarter 2008 to September-quarter 2019 (latest data).

And the dotted lines are the linear trends for each sub-sample derived from a simple regression equation.

The analysis is simple and illustrative. We should never infer too much from cross plots (correlation versus causation and all that) but the patterns are interesting.

As the household debt ratio rose in the late 1980s and into the 1990s, with the deregulation of the financial sector, growth in household consumption was stronger. Hence the upward sloping dotted line for the blue marker period.

In the second period, the relationship remains positive but it is weakening (flatter dotted line). So an increase in the household debt ratio is associated with a lower growth in household consumption than it would have in the earlier period.

Further, corporate debt remains at high levels, hovering around 2.8 times the total financial assets in the business sector. In the period before the GFC, the ratio peaked at 3.4 times.

With falling demand (sales) and a projected period of stagnation with commensurate loss of cash flow, it is highly unlikely that businesses will take on further debt, no matter how cheap it is.

And if they do it will because they are using the debt facility as a substitute for cash flow, which is a myopic strategy and will have negative long-run consequences for their viability.

Having said that, though, a credit line will help firms remain solvent if they have to roll-over existing debt obligations. In this case, they shift the obligation from existing creditors to the RBA.

Ultimately, the RBA can write of any loans it makes should that be deemed desirable.

I wrote about these considerations in this blog post (among others) – Fiscal stimulus disappears into saving – solution – bigger stimulus was needed in the first place (February 17, 2020).

The second problem with the current government aproach is that they are encouraging and allowing people to draw down their superannuation balances (up to $A10,000 per year for 2019-20 and 2020-21).

This option often comes up in public policy discussions and was last rehearsed as a solution to easing the housing affordability problem facing first-home buyers.

It would have been bad policy then and is a very bad policy choice now, in the context of the coronavirus crisis.

For the individuals, the draw down will reduce their future pension prospects and will be biased to those with those who in all likelihood already have balances at the lower end.

Younger people or those on low incomes will thus deplete their future pension balances quickly.

From the perspective of the superannuation funds, it will cause a liquidity rush (forced sale of assets) which will further damage their situation, given the recent short-run movements in the sharemarkets.

There is absolutely no reason to undermine the future to deal with the present crisis.

The Australian government has all the fiscal capacity it needs and should not compromise the future compounded growth of workers’ hard-earned savings.

Resource flexibility

I was talking with a person the other day who told me there ‘must’ be a recession because so many workers are not going to be able to work for a while – for example, cafes, hotels, entertainment, and other service jobs.

I have also seen others claiming that advocacy of a Job Guarantee right now is irresponsible because workers will have to be confined to their homes.

At present, only those with risk factors (either have the virus, are entering the nation from areas where there is high incidence, or a frail) are confined to their homes (or isolation centres).

Work is on-going and can be designed to be ‘safe’.

Think about the experience of the Second World War.

There is no shortage of productive jobs that can be done which would be ‘safe’ in this social distancing era but would provide valuable outputs to society.

The Victorian Government announced, for example, in their – Economic Survival Package To Support Businesses And Jobs (March 21, 2020) – that:

The Government will establish a $500 million Working for Victoria Fund in consultation with the Victorian Council of Social Services and Victorian Trades Hall Council. The fund will help workers who have lost their jobs find new opportunities, including work cleaning public infrastructure or delivering food – providing vital contributions to our state’s response to the pandemic and affording those Victorians security when its needed most.

So think about it.

Australia has just been ravaged by drought, bushfire and then flood – before the coronavirus hit.

There is so much depleted land, infrastructure and personal care services that are required arising not only from these natural disasters but also from years of austerity and outsources of public services.

There are tens of thousand of jobs that the Federal government could fund across the regional and urban space to help improve our society.

There will probably be a shortage of medical support staff. Thousands of jobs could be created to ease the load in the short-term on the depleted health care ranks.

The food harvest is facilitated in so small way by visiting ‘backpackers’.

For those workers in regional areas who are now unable to work because of the closures enforced by the government or by consumer boycots (not going out anymore), the Government could help shift workers into the food harvesting sector for the time being while border controls prevent people from visiting and working.

And if we are to protect our aged members of the population, then we could ensure they are secure in their homes with adequate food and other supplies, are able to maintain their gardens (if they have them), and attend to other needs.

Thousands of jobs could serve this function for the time being. There would be no reason for such a person to take the risk of venturing to the supermarket, for example.

And what about the claims that these shifts cannot be facilitated quickly enough to avoid mass unemployment?

Well, I think I could retrain as a hospital orderly, for example, in a matter of hours or a few days at most, if I was required to.

The women who entered the factories in 1939 had no prior background. But productivity rose quickly.

So I advocate major public sector job creation to help workers adjust to the loss of their current jobs (while the crisis persists) and to provide a productive workforce to enhance our social offerings in terms of infrastructure and services.

The number of jobs that could be created to absorb those losing their jobs elsewhere, which would add social value, is limited only by our imaginations.

And I have a pretty active imagination!

There is no financial constraint preventing the Government from taking on this role.

Conclusion

As I further develop the thinking towards my 10-point or something plan (where each post contains aspects of the final plan) I will consider the likely impacts on unemployment.

There is no doubt in my mind that people would prefer to continue working if that can be rendered safe.

The is no financial constraint preventing the government employing all the idle labour.

I have been doing some estimation of how much idle labour their might be in the medium-term.

And the estimates are shocking. Next time.

For now, I have a difficult decision to make – will I fly tomorrow. So far I have been avoiding flying over the last 10 days. But I have some issues to deal with interstate which requires my presence. The problem is both the virus susceptibility and the possibility that NSW and Victoria will close their borders while I am away and as a consequence I would have to spend 14 days in isolation at either end.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

I was one of those people you mention that said this is not a time to implement a Jobs Guarantee. Even though I am all for a JG- my federal government seems to have a difficult time doing anything in any short period of time besides blowing people up. So that is the reason I want them to just send out checks as soon as possible so people will be able to buy food and avoid being evicted in the short term. And they can’t even get that settled so far. Idiots.

I don’t know what measures the Australian government has taken, but here in Connecticut USA at least 50% of people are not supposed to go to work. Personally as a carpenter I am in a borderline area where emergency repairs would be allowed for me to do. Can still go to the grocery store, the gas station, the doctor and pharmacy, and the liquor store to buy beer thank God. People who can work from home and whose employers allow that can work so I imagine many of them will do that if they can. But many of them have children who would be in school and all the schools are closed. And many of the poorest depend on meals provided at the schools to feed their children and while some attempts have been made to try to assist with that, there is going to be a lot that don’t fair so well.

52 years old and never experienced anything like this in my life. I live in a city, walked to the pharmacy around 6 PM and the streets are eerily empty. Well Bill- and everyone else- I hope you stay well and be well. I’m not sure you could pay me enough to get on a plane though.

As virus cases rise I tend to suspect that we will move into more stringent stages of lockdown, which would end up crimping the variety of possible roles that could be performed while still observing curfew measures.

Just as as a short-term emergency measure (for some, maybe others could find it ongoing) should schools end up being closed to all but the children of those workers regarded as essential – why couldn’t keeping your children at home, keeping them safe and engaging them in incidental learning be a paid position? The Morrison government has no funding issue, only ideological ones.

Bill, graph missing…

“The next graph shows the way in which the evolution of the household debt ratio relates to the annual growth in household consumption expenditure.”

Hello Bill,

Thank you very much for your work and your books

Do you konow if it’s possible to find figures for Australian households on the balance between debt and assets as a percentage of GDP, as well as its evolution?

” I live in a city, walked to the pharmacy around 6 PM and the streets are eerily empty. ”

I live in a semi-rural area but my sister-in-law lives in Brisbane (my state capital) and works in the city CBD. She sent my wife some photos an hour ago, of the inner-city district at lunchtime – two-and-half million people in the place and not a soul to be seen on the streets in what is normally an insanely-packed crush of people. It’s like a ghost town.

One minor benefit of the UK govt funding response is that the standard set of BBC faces, eg Andrew Marr, no longer ask ‘how will the govt pay for it”.

Also a friend who had remained unconvinced by my presentation of MMT volunteered recently that given the UK govts manifest ability just to spend money and the absurdity of supposing there is some pot of unused cash that all the world’s govts could dip into that he would take a second look at MMT.

Take care if you decide to fly Bill. I’m sure you will anyway but I have been following this as closely as a layperson can and I strongly suspect that the pathogen has spread further through our community than we have been told.

Dr Norman Swan and the Chief Medical Officer were both interviewed last night and the admission was forthcoming that our testing regime is seriously inadequate. Testing is restricted very largely to those who have been abroad or who are known to have had close contact with those who have because there are not enough test kits available to test widely (Germany is testing as many people every few days as we have in total since it started). People presenting with symptoms consistent with this infection are being turned away from testing because they do not meet the strict criteria.

Community transmission is underway in Australia – this is a virtual certainty. But because we are not testing for it, we have no idea how far it has already spread. People become infectious for some time before they show symptoms.

Around 500 new confirmed cases in Australia in the past 24 hours. Again I must stress how restricted the testing availability is so there are certainly a lot more.

Well, I don’t know about the on-board recirculation of air on planes including the effect on viruses, but I do know that there is a large number of televisual aids which one could use, rather than run the risk of becoming infected with the Coronavirus.

Take care, Bill.

Bill,

I would also add that the extreme speed of one country getting the virus and the next one also contracting it is down to the humble aeroplane.

Dave.

As Quentin R already mentioned above the second graph is missing!

At 15’000 deaths from the virus worldwide we are now at about 2% of the casualities of the “normal” yearly flu. Or 1% of yearly deaths from tuberculosis which is as easily to catch as the Covid-19. Can anybody explain to me the relentless media coverage of the Covid-19 and the harsh measures taken by authorities worldwide? Has anybody ever heard about “population control”?

“I have also seen others claiming that advocacy of a Job Guarantee right now is irresponsible because workers will have to be confined to their homes.”

If you hire all the spare labour – including the laid off, the redundant and self-employed – then not only can you pay them via existing Payroll and Bank mechanisms, using existing software and financial system interfaces, *you can direct them to stay at home as their job*. On pain of not getting any money if necessary,

Those people that are desperate to be paid for doing nothing really can’t think out of the box can they.

“Can anybody explain to me the relentless media coverage of the Covid-19”

If you can keep the rate of change below the ICU capacity of a nation then you can hold the death rate at about 0.9% of cases. Once you run out of ICU that leaps up to 3-4% of cases.

Show me a political regime in the world that can withstand that sort of death rate in their population?

The people that have to die will die unless we get a vaccine in place. It’s just a question of over what period of time you want them to die in. If we can stretch that out to three years or so, we might just be able to save some people.

There seems to be rather chaotic issues regarding supermarket delivery systems here in the UK at present leading to contradictory advice: Social distance/stay at home to ‘go out to the shops if you can’t get a delivery slot.’

There are 100’s of thousands of people trying to sign on to benefits at present with the site crashing regularly (I’m told). Yet there is a desperate need for more delivery drivers and food pickers for supermarkets. At present I can’t get further deliver slots for my 88 year old mum.

Why do we have a group of major supermarket chains operating in an uncoordinated way at this stage in the events (two weeks behind Italy?)?

People leaving their former jobs in the service industries could be ideally sent to deal with the delivery and food picker bottleneck so that all vulnerable people and maybe a lot more of the general population can get delivery slots.

it’s seems this will now take a further week to clarify. At present the supermarkets are still trying to co-ordinate with the Department of Work and Pensions who is vulnerable.

is this the consequence of decades of neo-liberalism, so that Government simply can’t get this together anymore? The operation is vast, sure, but in comparison to WW2 we have massive technological resources to effect things very quickly.

Meanwhile, our tousled hair ‘Schlemiel’ puts on a bleary -eyed face of faux gravity-his facial muscles must be hurting a lot by now!

‘Non Economist’ @21:17, Yes, there are some who say all the stuff we are doing to try to slow this down and remain able to provide adequate health care to all those who need it is just silly and stupid and a waste. I’ve argued with a bunch of them myself with little effect so I’m not going to waste time with you either on this subject. People don’t like their friends and family dying- that’s why we are doing this. Even an economist could understand that.

Non Economist, If you want to spend some time reading you can look at this link which spells it out pretty clearly

https://medium.com/@tomaspueyo/coronavirus-the-hammer-and-the-dance-be9337092b56

By my calculations, the Australian government was about 1 week too late to react. The consequence of this is that the peak number of cases will be about 4-5 times larger.

Simple maths really…

one week ago we had ~440 cases

now we have ~2100

next week we’ll have ~10000

the week after it will be ~48000

What happens in three weeks depends on how seriously people implement social isolation now.

Every interaction you avoid now can stop 100 people getting infected in 3 weeks – that is 1 life saved (assuming 1% mortality)

People need to stop focusing on money, and the government needs to do the best it can to change our thinking to be about saving lives. Ironically, handing out money to people might do that.

Also, the supermarket limits on #goods per purchase is disastrous – because people will congregate at the shops more frequently and spread the virus!

A better approach is to divide population into say 7 groups, and then each group gets to go to the shop on just one day, and they receive a fixed bundle of food/supplies to last a week, and they can shop for discretionary foods if they want. This means you stop the spread over the whole population from the shops.

Bill, my advice would be strongly to not fly. Surely there are video alternatives that would suit the occasion, such as Zoom and Skype. You do not want this or to put yourself in a position where you might get it. I realize that you are pretty fit, but do you really want to play dice with this thing?

> Can anybody explain to me the relentless media coverage of the Covid-19 and the harsh measures taken by authorities worldwide?

Overflowing ICUs, as Wilson said, which means regular problems like heart attacks, hypoglycemia, aneurysms and so on may not be treated. And you might as well stop doing chemotherapy and organ transplants if you still have the space, because recipients won’t have the time to replenish their immune systems.

Either way, the economy goes tits up as enough people avoid doing normal things while others happily spread the virus.

Whether it will end when capacity ramps up, if it will phased and how, and other questions remain open, but there’s time to think about it.

Non economist: A good percentage of those getting Covid-19, even those who are relatively young, are only making it through the infection with the support of ventilator equipment and the staff needed to support that technology. That equipment and staff is in short supply, a real resource constraint!

The reason the elderly are more likely to die, is that they don’t tend to tolerate mechanical ventilation well, and may die just from complications related to being on a ventilator.

Countries that have higher death rates tend to have fewer of the critical resources they need to treat people, combined with rapidly spreading infection.

Dear Bill,

Take this flight and be safe. There are presently about 400’000 Covid-19 infected people worldwide. In the flu season of 2017-18 there were up to 58 million infected people in the US alone. You still could go to your local pub and to your local barber. No shops were closed and there was no public hysteria fanned by the media. Chances are higher that you may get killed by hand lagguage falling from your overhead compartment than by Covid-19.

I am hopeful that those near and dear to Non Economist will be able to avoid “population control.” I’m also guessing he/she doesn’t really have any death by luggage statistics. Show us your data!

Given the asymptomatic nature of many infections and the complete lack of even randomized testing in most areas, no one really has any idea, especially in an earlier stage country like Australia, how many people are already infected. The trends are already clear though, to anyone who is paying attention to patterns in other countries. Also, this thing has a much higher risk than the flu, most especially where treatment isn’t available- up to 6% mortality if you look at places where people kept going to pubs and bars (i.e., Italy). In this case, avoiding the news isn’t your friend.

Bill – If you have to go no matter what that’s one thing, but it sounds like you have a choice. If the worst consequence you have is that you’ll be stuck somewhere for 14 days, I’d say be stuck at home. If you need technical assistance with remote technologies on either end, I and many others would be glad to assist.

The essential point in Bill’s post, a familiar one, comes near the end of his JG proposal: “There is no financial constraint preventing the Government from taking on this role.” Those of us who have learned to see through the “MMT lens” know that there is also no financial constraint preventing currency-sovereign governments from doing EVERYTHING ELSE they need to do to control and curb this pandemic. Every human need that such governments can meet can be met by wise and responsible use of fiat money, which can also flow via foreign aid into countries not currency-sovereign. There need be no social or personal financial crisis to aggravate this health-care crisis. Surely we need all the appropriate medical equipment, supplies, and personnel we can muster, but we also need to increase exponentially the “MMT lenses” which allow people to see how fiat money can enable us to cope with this crucible and emerge on its far side more intelligent, more informed, more humane. May each of us who participate on this blog follow Bill’s leadership in doing our utmost to so clarify public and political vision. Unlike the other essential resources we need right now to surmount this pandemic, these “MMT lenses” are freely and immediately distributable in unlimited supply.

1. A new meme is being pushed in a coordinated way by neoliberals including the person in White House that “the lockdown is worse than the epidemics”. This supports the idea that it is the neoliberalism as the system what is dying. Basically the economy has been reduced to only supplying the essentials, satisfying the true needs of the people. Maybe this is good? All the moronic rugby shows, real estate auctions, circular air and sea travel to nowhere, gatherings to worship celebrities or just plainly get drunk in a crowd are not essential and have stopped. But the neoliberal system cannot function without overconsumption and it is crashing. This is how much the so-called “service economy” is worth. It may be time to realise that we don’t need 50% of the stuff we are buying and this wasteful “middle-class” activity is destroying the planet. But the crash also demonstrates the old Keynesian point that the system is demand- not supply-driven.

2. The neoliberal economy is based on the principle of profit maximisation and has no inbuilt redundancy despite being inherently wasteful. That’s why the health care system crashes when a slightly higher number of seriously ill people show up. The same about Centrelink website, etc. From the system engineering point of view (please note that I studied this under the communist regime so I know all bad things), redundancy is one of key parameters determining the robustness of the system. Why do cats sleep 16h a day? Because they have evolved to be so efficient hunters that 8h of activity is enough but if they have to and there is not enough food, they can hunt for 16h and sleep for 8h. But if there is a 5% spike in the demand for toilet paper, the system goes into meltdown. Maybe we should learn from cats not from Milton Friedman or Friedrich Hayek about what’s efficient allocation of resources?

3. Right now it’s not time for the implementation of Job Guarantee. The economic activity should be frozen to increase social distancing and people who lost jobs should just be given enough money to sustain the minimum level of consumption. Now it is time to plan and organise hundreds of thousand Job Guarantee jobs to be made available in 3-6 months time. The main problem here is that states are not monetary sovereign yet the federal government has no physical capacity to organise things. The relationship between the federal government and states has to be re-engineered as the implementation of Job Guarantee needs to be performed at the state level while it can only be paid by the federal Treasury.

Sacking incompetent clown Morrison and replacing him with a sane person is long overdue. I don’t believe the Liberals cannot find someone who is just a normal person. At least NSW Premier Gladys Berejiklian and Victorian Daniel Andrews are competent managers and in my view can be trusted. We don’t need more rugby stadiums. We do need environemental regeneration after the bushfires and more social housing. This has to be planned at the federal level. Whether this happens I am doubtful but at least we should try.

Meanwhile, Social Europe is discussing… fiscal discipline. Sold old.

Glad Bill and Fazi showed up once, so I don’t have to tear my hair out.

UK Govt is tonight looking 250000 unpaid volunteers to act as ancillary resources for the NHS.

A good candidate for the JG perhaps?

Bill,

There is always facilities such as ‘Zoom’ which allows for conference calls? This is used by Rivera Sun to get conference meetings in New Mexico, I believe.

Dave Kelley.

point 1,

anyone that thinks the banking system measures were about credit flow are kidding themselves.

the back story is, that the government appears to be trying to match the liquidity provisioning with where it sees the risks emerging on the yield curve.

this was about stopping any insolvency risk in the banking system.

and im not sure they have got it right.

if you are going to .25 at the short end , why not go negative at some point given the volatility in the markets, and any degree in the confidence measure is out the window.

point 2,

the government as bill has rightly pointed out , is being too cute by half with how its going about the stimulus.

just about every business in this country has an abn number. the government knows them and they know the government. so why on earth would you create a situation where the government has to try and build a relationship with a million unemployed people very quickly , when they could have provided the cash flow provisioning for business’s to keep business going in terms of cash flow even if they have to go to hibernation for a while.

its more expensive sure , but we have a debacle on our hands right now,

old habits die hard , it smells of penny pinching.

scot morrison will be in front of a microphone with a change plans by the end of this week i reckon , if he is smart about it

this might be hugely politically incorrect, but,

but i think we need to be creative with how we tackle the trajectory of the virus,

we need to turbo charge the psycological momentum to try and neutralise the momentum the virus has.

i dont think the pm and prof murphy pleading with people to behave, and tightening restrictions is going to impact until the numbers get larger.

the paradox here is , the amount of behavioural change required will only occur when its start getting real for most people and the numbers are much larger , by which time it may be too late to change the trajectory without a military kurfew.

so the government should step in right now and promise a financial reward for every australian if the nation achieves a specified goal in terms of the virus’s growth .

the difference between 70% compliance and 80% compliance is scary, and we need to use incentives to nudge the problem in the right direction

as crass as it is , money is a great motivator.

also get the bookmakers involved in framing a market for various outcomes. the law of large numbers says, having a smaller group of all be it very clever people making educated guesses about the future , may not be is a good as adding to the mix a much much larger group of people may be making less educated guesses about the future, but putting their money where their mouth is so to speak.

may be the data guys can correlate the two ideas

Dear Mahaish,

1. The banks should be prepared to smoothly operate in zombie mode with negative equity with the RBA continually providing equity. If this happens they should be nationalised. From what I know their foreign position is hedged.

2. On the propaganda front disseminating true stories from Italy and Spain (and soon NYC) will convince everyone. Like the image of a dying man on the street. This will convince the most hardcore party goers. Please read what Morawiecki and Duda are doing in Poland. It is true that it is easier from them as a lot of people in Poland often travel to Italy and they know the places in Northern Italy. (The distance is like from Sydney to Adelaide).

sorry RBA providing liquidity

just watched the pm’ s press conf,

he was asked about the uk approach,

answer- apparently we would have to create a separate payment system to do it the way the poms have done it,

is this a crock of ………

busineses have abns and bank accounts

any thoughts anyone

Here in New Zealand we are in lockdown at 11.59 tonight. Only essential industries can operate eg Dr, pharmacies, supermarkets, hospitals and Bunnings! (and Mitre10! but only for essential building things). Everybody is required to stay home for a month at least. The Govt has instigated a large rescue passage but our dopey Finance Minister has said he will borrow it…. The Govt has hinted that if necessary a State of Emergency will be declared. Interestingly it has been described as being ‘like wartime’ so if they spend like war time then may be this neoliberal nonsense will end.

Well the Government has been declared a State of Emergency here in New Zealand. We have had it before in 2011 when we had the Christchurch earthquake.

@mahaish…

“just watched the pm’ s press conf,

he was asked about the uk approach,

answer- apparently we would have to create a separate payment system to do it the way the poms have done it,

is this a crock of ………

busineses have abns and bank accounts

any thoughts anyone”

Does the federal government not have the power to simply credit every bank account in Australia? With absolutely huge numbers joining the ranks of the unemployed each day, the welfare system has less than zero chance of coping if it has to register and process every individual in the normal manner.

If the process of getting money to people who need it is not dramatically speeded up, it won;t be long before order breaks down, with gangs roaming the streets and desperate people willing to do anything to survive (and of course, spreading the virus further afield).

Since the system cannot possibly cope with what is shaping up to be a Great Depression-level event, is it possible to simply bypass it and credit every bank account in the country? Who cares if some money accidentally goes to dead people or to millionaires, the money is infinitely replaceable.

albo has come out and said we need a wage subsidy,

the media didnt question morrison on his payment system comment,

i cant see the problem, the data and systems are there, or am i missing something

so what do the professional economists on this forum think

neil,

i think the problem with the jobs gaurantee right now is the implimentation given the large numbers.

wouldnt it be quicker for the government to get a busineses bank details assuming they dont already have it, the busineses payroll report, and an agreement that the current payroll will be maintained.

in oz upto a million people out of work, no matter how good the government is they just wont be able re allocate people quick enough.

less keystrokes and logistics with paying the business payroll me thinks

Dear Mahaish,

I am responding in my capacity as a software engineer. They can’t just credit the accounts if there is no such facility even if it is a few lines of SQL code. This thing has to be legally approved, designed, implemented and tested. I don’t even know who writes the code for ATO or the Treasury, probably some is written in-house, some outsourced. You can ask people there, I stay away from Canberra unless our systems malfunction, please don’t ask which systems… nothing to do with the finance.

@Adam K

Do you mean the Australian government has no ability to pay into any and all accounts in the country? As I understand, they have no problem doing the reverse through the ATO.

You know – I actually can’t remember what happened in 2008/2009.

I remember we all received $900 from the government as stimulus but I don’t recall it arriving as a cheque in the mail. Then again maybe it did – I just can’t remember.

They have the ability if they tell someone to implement such functionality. How do they know who is employed where and how much these people earn? This would require linking data which is distributed across several systems and may be not up to date. As I said someone has to make a decision then someone else design, implement test, etc. This takes time. Payroll tax is levied by states. The stimulus has to be administrated at the federal level. As I said I have no idea how these systems are designed and implemented. but this is not trivial.

Liberal senator Eric Abetz implying that we cannot give a UK-style wage subsidy because we might run out of money: “What you have to have here is a cool head, practical head and ensure that there will be money to go around at the end of this as well.”

Even in a time of crisis without precedent, our policy-makers (I’ve stopped calling them leaders) continue to run with the myth that a sovereign currency-issuer can run out of it’s own currency of issue.

“How do they know who is employed where and how much these people earn? ”

In this situation without historical precedent, I would answer that question with “who cares?”

Apologies, that is not meant to be an offensive remark aimed at you.

The issue is this: we are seeing an almost apocalyptic-size tsunami of people suddenly losing means to stay alive – literally. The number of people who are suddenly utterly dependent on government to be able to put food in their stomachs – literally – is exploding beyond anything ever seen before in a shorter time than ever seen before.

The system of knowing who is who and what their employment circumstances are before registering them on the system to receive financial aid (survival, no less) simply has no way to cope with this – none. It could take six months to sort out who actually needs money and who does not – can a million or so people wait that long to eat?

The unbelieveabley bad situation is that because of measures needed to slow the pathogen, we cannot even go around handing out food to gatherings of people. So funds must be transferred to households to enable them to put food on the table – now.

Perhaps it’s because the sun is still shining, there is no radioactive mushroom cloud towing over an incinerated landscape and everything looks just like it did a month ago that we are slow to realise the scale of the unfolding catastrophe.

As I said earlier, so what if some money inadvertently goes to people who don’t need it – we can sort that out later.

WONDERFUL FANTASTIC GOOD NEWS.

There was a really great “town hall” interview on Fox News at the White House during the last 2 hours.

PRESIDENT TRUMP is the hero savour of the world.

He completely REJECTS lockdowns as a strategy for dealing with COVID-19.

He will put America back to work before Easter.

He has a very confident and clear understanding of Herd Immunity.

The rest of the world will probably follow his lead sooner or later.

The only question now is how quickly life can get back to normal.

Several months should be enough providing politicians stop listening to panicky medics.

Leftwinghillbillyprospector

Wednesday, March 25, 2020 at 16:15 ,

My sentiments exactly expressed.

Cheers Jerry – it really is almost incomprehensible what is occurring. Though I guess it had to happen sooner or later.

Really, if money starts flooding into the bank accounts of households across the nations – I can’t see that leading to an outbreak of galloping consumer demand-driven inflation any time soon.

Centrelink is supposed to handle requests for Newstart payments or whatever. But running of their computer system has been outsourced. There was an article in the Guardian saying that the companies involved are Concentrix Services, Datacom Connect and Serco Citizen Services.

There is no redundancy and no flexibility. Apparently they have allocated more hardware. The systems will at some point catch up.

I would not ask for help another outsourcing company, Wagner Group. They would fix everything immediately and they have global deployment capabilities but once they are in, they are in. It took us 47 years to expel them from Poland.

“Centrelink is supposed to handle requests for Newstart payments or whatever. But running of their computer system has been outsourced. ”

In that case, government may need to simply tear up the rules and bypass their own welfare system because it has no ability to handle this situation – it’s like taking a billy cart into a tank battle.

I’ll wait for Bill or someone with more knowledge than myself to shed light on whether there are any real, physical impedements to sovereign government doing this but the time for them to keep acting like stunned mullet is over.

One thing at least – I’ll bet that at the other end of this, governments manage to find unlimited funding for vaccine and disease prevention research.

It seems to me we all already have an extremely productive and useful new job: stay home in social isolation. Why is it so difficult to see this as a productive activity?? We have just moved into the era of full employment. So yes, the job guarantee has emerged as an MMT reality, not as something that needs to be critically progressed towards. If the jobs guarantee came and knocked on our doors one day, would we really know it??

Small typo “The food harvest is facilitated in so small way by visiting ‘backpackers’.”

Here in the UK it was reported yesterday that the airlines’ heart-rending plea for massive financial support has been turned down by the Chancellor, who has told them to seek it from other, private, sources instead such as shareholders. One wonders if he might have had Richard Branson in mind, who might be presumed – justifiably or not I don’t know – to own enough personal wealth to support his airline Virgin out of his own pocket (and who protested vociferously against the UK govt’s bailing-out of FlyBe which was “justified” on grounds of its being the provider of important links to remote/inaccessible places).

I must say I can’t see any obvious reason why this industry’s bosses and owners think it’s entitled to demand privileged financial assistance when others are not.

But that was of course what the banks were given after the GFC. Into the bargain the banks’ high-ranking employees were accorded de facto immunity against prosecution for what were prima facie criminal offences, (Which contrasts starkly with the treatment recently meted-out to Harvey Weinstein for criminal offences of another ilk. That sexual misdemeanours should in today’s world be thought deserving of draconian punishment while financial malfeasance is (effectively) exonerated ought to tell us that our moral values have become totally corrupted – by the financial interests).

I was under the impression that there were too many airlines in the world. Why not let those that are doomed to fail – fail? Isn’t that what’s supposed to happen under capitalism? Then the govt ought to buy at fire-sale prices those that are long-term viable (and/or provide a needed service on social grounds – with a route-by-route operating subsidy where merited) and run them (at arm’s length) as publicly-owned corporations.