I have been a consistent critic of the way in which the British Labour Party,…

An MMT-Green New Deal and the financial markets – Part 2

This is Part 2 of the series I started earlier this week in – An MMT-Green New Deal and the financial markets – Part 1 (September 2, 2019). In the first part, I discussed Chapter 12 in John Maynard Keynes’ General Theory, published in 1936, where he outlined how the growth of financial markets was distorting investment choices and biasing them towards speculative wealth-shuffling exercises, which had the potential to destabilise prosperity generated by the real economy (production, employment, etc). His insights were very prescient given what has transpired since he wrote. He was dealing with what we would now consider to be a tiny problem given the expansion of the financial markets over the last three decades. In this part, I am briefly outlining what I think an MMT-Green New Deal agenda would encompass in the field of financial market changes. The MMT association is that such an understanding opens us up to appreciate a plethora of policy options that a strict sound finance regime rejects or neglects to mention. That policy proposals and reform agenda I outline here reflects my MMT understanding but also, importantly, my value set – what I think are important parameters for a futuristic progressive society. So we always have to separate the understanding part from the values part (although that is sometimes difficult to do). The point is that a person with a different value set who shared the MMT understanding could come up with a totally different agenda to deal with climate issues and the need for societal restructuring. You can see all the elements of my thinking on this topic under the category – Green New Deal – which also contains a long history (now) of relevant commentary. Most of my writing on the topic are about the societal aspects of the GND transformation rather than the specific climate issues. That is obviously because I am not a climate scientist. But as I signalled in Part 1, I am about to announce a coalition (in the coming week I hope) which does include climate science expertise to broaden the capacity of the MMT-GND agenda.

In its April 2006, Global Financial Stability Report, the IMF represented the orthodox position that the deregulation of financial markets was delivering massive benefits both in terms of efficient channelling of savings to best-practice ends and financial stability.

There was a plethora of academic papers all singing from the same hymn sheet.

Chapter II of that IMF report, entitled “The Influence of Credit Derivative and Structured Credit Markets on Financial Stability”, starts with this statement:

There is growing recognition that the dispersion of credit risk by banks to a broader and more diverse group of investors, rather than warehousing such risk on their balance sheets, has helped to make the banking and overall financial system more resilient … Over the last decade, new investors have entered the credit markets, including the credit risk transfer markets. These new participants, with differing risk management and investment objectives (including other banks seeking portfolio diversification), help to mitigate and absorb shocks to the financial system, which in the past affected primarily a few systemically important financial intermediaries. The improved resilience may be seen in fewer bank failures and more consistent credit provision. Consequently, the commercial banks, a core segment of the financial system, may be less vulnerable today to credit or economic shocks. At the same time, the transition from bank-dominated to more market-based financial systems presents new challenges and vulnerabilities. These new vulnerabilities need to be understood and considered in order to form a balanced assessment of the influence of credit derivative markets.

A few paragraphs later we read:

While the credit derivative markets raise some supervisory concerns, the information they provide is very useful for supervision

and market surveillance. First, by enhancing the transparency of the market’s collective view of credit risk, similar to bond markets before them, credit derivatives provide valuable information about broad credit conditions, and increasingly set the marginal price of credit. Therefore, such activity improves market discipline. Second, supervisors and other public authorities also may be able to use such market-based information to detect deteriorating credit quality, and to better monitor regulated institutions and other market participants. Finally, with the broadening of the product base (e.g., the development of mortgage and other asset-backed derivative instruments), these markets may also provide an early warning mechanism about economic stress in sectors beyond banking (e.g., the household sector).

So two hallmarks of a functional financial system – efficiency and stability.

This was the line increasingly pushed by the financial market lobby groups as the neoliberal era unfolded. It was also the line presented by the mainstream macroeconomists in the lead up to the GFC.

For example, the likes of Larry Summers, who is now busily trying to reinvent himself as some sort of wise man of economics, was prominent in pushing this viewpoint.

I discussed this sort of involvement in this blog post – Being shamed and disgraced is not enough (December 18, 2009).

Remember, Summers, Robert Rubin and Alan Greenspan were cast by the Time Magazine on February 15, 1999, as “The Committee to Save the World”. This was in relation to their resistance to regulating the Over-the-Counter derivatives market and the way they derailed the work of Brooksley Born, who was the head of the US federal Commodity Futures Trading Commission.

She resigned that position on June 1, 1999, after the US Congress legislated to prevent the Commission regulating derivatives trading.

The US Frontline Program ran a story – The Warning – which was a retrospective examination of the period.

Brooksley Born was asked in the program, who she was “trying to protect”.

She replied:

We’re trying to protect the money of the American public.

Her warnings of the danger of these unregulated markets “made her the enemy of a very, very large number of people” and finally, a legislature, captured by those same people, acted in violation of the best interests of the public to outlaw regulation, ending her ambition to reduce risk and provide greater safety for the savings of ordinary people.

And as a result of the lack of regulation and oversight, these markets grew quickly.

We also have the situation where because of excess risk-taking in financial markets (wealth shuffling casino behaviour), participants in the real economy (firms, etc) have to insure themselves against loss (hedge) arising from, say, exchange rate and/or interest rate risk.

That insurance, in turn, provides profit opportunities to the financial markets, when if they had not forced the need for insurance onto the real economy, there would have been losers to match the winners in the financial sector.

It becomes a self-fulfilling situation. The financial markets create excessive risk, and then offer derivative products and market expansion to exposed parties separate to the transactions hedging opportunities, which then expands the reach of the financial markets even further and elevates the risk.

We have dramatic developments in derivative markets in foreign exchange, local currency debt markets, which trade risk – Keynes’ ‘Pass the Parcel’ game (see An MMT-Green New Deal and the financial markets – Part 1 (September 2, 2019).

Many of these products (for example, forward contracts) are not traded in regulated exchanges but rather are bought and sold as over-the-counter (OTC) transactions.

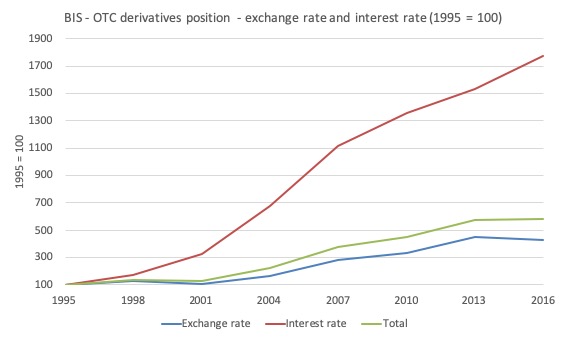

The Triennial Central Bank Survey of foreign exchange and OTC derivatives markets in 2016 provides data to track the developments in the OTC markets.

The two broad derivatives markets relate to foreign exchange trading and interest rates (local bonds) and since 1995, these markets have grown in volume by 429 per cent and 1,773 per cent respectively.

Overall (and recognising the exchange rate derivatives are around twice the volume), the overall OTC derivatives market has grown by 500 per cent. The following graph shows this history (using BIS Outstanding OTC derivatives datasets).

You can see that the trading slowed marginally during the crisis, but has since regained pace.

And as I demonstrated in Part 1, there is a disconnect between real GDP growth, which is an (imperfect) measure of overall material well-being and the growth of the financial markets.

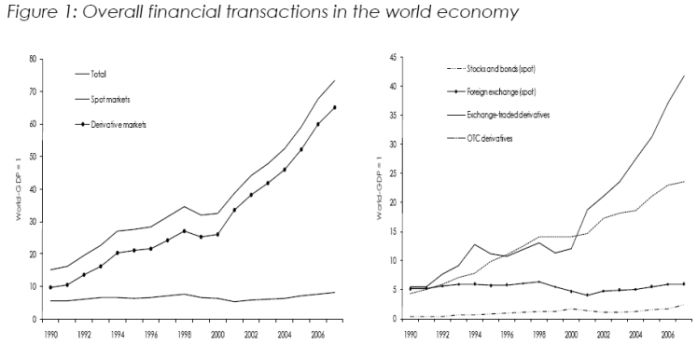

This was brought into relief by a study by working paper published in 2009 by WIFO (Austrian Institute for Economic Research) – A General Financial Transaction Tax: A Short Cut of the Pros, the Cons and a Proposal.

The following graph (reproduced Figure 1 in that publication) shows the explosion of global financial flows and derivative markets over spot markets (although the lines are a little hard to distinguish)

WIFO concluded:

1. “The volume of financial transactions in the global economy is 73.5 times higher than nominal world GDP, in 1990 this ratio amounted to “only” 15.3. Spot transactions of stocks, bonds and foreign exchange have expanded roughly in tandem with nominal world GDP. Hence, the overall increase in financial trading is exclusively due to the spectacular boom of the derivatives markets …”

2. “Futures and options trading on exchanges has expanded much stronger since 2000 than OTC transactions (the latter are the exclusive domain of professionals). In 2007, transaction volume of exchange-traded derivatives was 42.1 times higher than world GDP, the respective ratio of OTC transactions was 23.5% …”

In other words, most of the financial flows comprise wealth-shuffling speculation transactions which have nothing to do with the facilitation of trade in real goods and services across national boundaries.

This is the point that John Maynard Keynes understood well back in the 1930s. It was also the point of departure for Brooksley Born in her failed quest to regulate this growth before it turned nasty.

And turn nasty it did in 2008.

And the world is still not recovered from the bust and the legacy costs remain and will make the next crash even worse.

The Green New Deal requirements

So as part of a Green New Deal, which must aim to build a society based on equity and stability this paradigm of relatively unfettered financial excess has to end.

Most of the financial sector could be shut down with very little long-term damage to the rest of us.

What a progressive agenda needs to accomplish in the field of finance is the elimination of the divergence between speculation and the real fundamentals of the economy.

That divergence has elevated the risk of bubbles impacting negatively on the real economy and created a massive industry which has no productive role to play in the allocation of resources to useful ends.

Even basic commodities such as food have become objects of speculative profit-seeking, which in many situations, has denied people access to that food while making profits for the speculating investment institutions.

That paradigm has to end.

The question then is how that will happen.

What approaches should progressives take to bring speculative behaviour in financial markets into line with the real economy?

A popular progressive approach around the time the GFC was to advocate a global financial tax, sometimes called a Robin Hood tax.

This follows the idea that Keynes introduced in Chapter 12 of the General Theory (which I considered in part 1) that policy makers had to make it harder (more costly) for people to engage in these unproductive and potentially destabilising and destructive activities.

James Tobin built on the idea in the 1972 (then 1978) when he proposed a tax on foreign exchange and share transactions.

Tobin’s idea is the one people most associate with this sort of tax.

He first proposed it during a lecture at Princeton University in 1972 which was subsequently published in J. Tobin (1972) The New Economics: One Decade Older, Princeton University Press, 88-93.

It was later developed in his Presidential Address to the Eastern Economic Association in 1978 which was published as J. Tobin (1978) ‘A proposal for international monetary reform’, Eastern Economic Journal, 4.

I discussed the idea in detail in these blogs:

1. A global financial tax? (November 9, 2009).

2. Robin Hood was a thief not a saviour (April 1, 2010).

3. Progressives should move on from a reliance on ‘Robin Hood’ taxes (September 4, 2017).

My basic criticism of this proposals are:

1. It is usually constructed in the context of governments needed extra funding and that it would be better to tax the financial companies to reduce some of the incentive they have for accumulating large stocks of wealth and trading financial products across borders.

Clearly, an MMT understanding rejects that foundational premise outright.

2. That a market-based solution – imposing a tax which affects the margin generated by transactions – will moderate behaviour.

In general, progressives seems to have been lured into this ‘market-style’ thinking. Everything has to be moderated through the price mechanism. This is a neoliberal framing.

Markets are constantly being corrupted by the wealthy and ‘rigged’ in their favour.

3. If the financial sector is largely unnecessary and potentially destructive why would we want to moderate its behaviour a little through a tax that is likely to be largely ineffective anyway?

A non-neoliberal framing is to reject the market logic and use regulate and the legislative capacity of the state to make illegal activities and functions that we deem to be unnecessary to the well-being of the people and which may potentially undermine our prosperity.

This is also my perspective on eliminating carbon-intensive industries – better to regulate them out of existence than try to play smart with carbon taxes or trading schemes.

In the short-term, though, a financial tax might be part of an adjustment period as the sector is downsized and eliminated.

Eliminating these sorts of activity will force most non-bank financial institutions out of business.

It will also significantly alter the scope for the commercial banks, which come under the aegis of the central banking acts.

The essential framing is to recognise, first, that commercial banks have a public as well as a private dimension.

Banks should operate to provide credit to clients after fully appraising their credit-worthiness. As part of that process, they seek funding through deposits and other means.

Many of the ‘other means’ involve participation in risky wholesale, global funding markets.

The only way these activities can be ‘safe’, meaning that the depositors funds are protected from market fluctuations, is for the currency-issuing government to offer insurance guarantees.

In addition, the central bank always has to ensure there are sufficient reserves in the system through loans and asset swaps, to maintain financial stability.

These essential government roles render commercial banking ‘public’ activities. The profit-seeking are the ‘private’ aspect.

The challenge then for a progressive government is, in the context of these public inputs into the security of the financial system, is to ensure that the banks do not adopt a ‘privatise the gains, socialise the losses’ mentality, which is sometimes referred to as the ‘too big to fail’ problem.

To satisfy that need, the government has to limit the behaviour of the banks on what we call the ‘asset’ side of their operations, rather than the ‘liability’ side.

Imposing reserve requirements on bank lending is an example of ‘liability-side’ regulation. As we saw in the period after deregulation, it is very hard to maintain discipline through these types of measures.

Asset-side regulations include:

1. Constraining what assets the banks can hold. For example, the geographic domain of the banking system would be defined by the currency area. Banks would be prohibited from creating assets through off-shore lending activity.

2. Ensuring all assets originated in the banks are kept on their balance sheets – so eliminating practices such as mortgage securitisation. This would eliminate the ‘Pass the Parcel’ mentality where the banks create assets they consider too risky to hold against their own capital and push onto (unsuspecting) buyers.

This would also eliminate the trend in the 1980s for commercial (deposit-taking) banks to set up subsidiary (finance) companies that were beyond the scope of prudential regulation and could shuffle assets for the head office bank at will.

3. The corollary of (2) is that banks would not be allowed to trade in the so-called secondary markets – buying and selling assets as speculative instruments. Speculative behaviour would be prohibited. This would reduce profit-seeking opportunity by the banks but ensure risk-analysis was more appropriately engaged.

4. Forcing minimum and meaningful capital requirements onto the banks – to ensure that probably losses are fully born by the shareholders of the bank rather than the public through government bailouts.

5. All financial instruments that are akin to credit default insurance would be prohibited. The government would be the only provider of financial security for the banking system under strict controls.

At some point, once we understand the impact of these changes and more on the limiting the scope of private banks, the question would arise as to whether a better way forward is possible.

The obvious preferred model is to bring all the risk and stability requirements wholly within the public sector – that is, national the retail banking system.

Then the publicly-owned financial institutions would be subjected to tight controls on management to ensure they functioned to provide credit where it was demanded and maintain an orderly payments system.

Overall, this new commercial banking environment would place specific obligations on the central bank.

Under a tight asset-side regulation model, the central bank’s role with respect to private banks would be to fund them on demand to avoid disruption of the payments system.

It becomes a relatively simple activity – ensure there are sufficient reserves in the system available at whatever short-term interest rate is being maintained by monetary policy.

This would eliminate any need for interbank borrowing, where the private banks trade government funds to cover open payment positions. If the central bank simply ensured all funds were available at all times then the banks would take that option.

Given the preferred MMT monetary policy setting is to allow excess reserves and maintain zero short-term interest rates, this function becomes straightforward.

Further, as the preferred MMT position is for governments to avoid issuing any debt to the non-government sector, any interest-rate maintenance above zero would be accomplished by the central bank offering an appropriate return on excess reserves each day.

In 2009, Warren Mosler outlined this type of model in the context of the US – Proposals for the Banking System, Treasury, Fed, and FDIC.

However, the asset-side regulation model generalises to any currency system and is the only way to ensure long-term financial stability.

Other reforms which would be suggested for the financial markets:

1. No speculative trading in any food products (with exceptions):

- We should ban financial speculation on food prices (May 27, 2011).

- Food speculation should be (mostly) banned (January 18, 2012).

- Ending food price speculation – Part 1 (October 17, 2016).

- Ending food price speculation – Part 2 (October 18, 2016).

2. The use of capital controls on across border transactions:

- Why capital controls should be part of a progressive policy (July 6, 2016).

- Are capital controls the answer? (April 28, 2010).

Conclusion

I will return to this theme in a future blog post.

That analysis will cover transition arrangements as a Green New Deal scales down unproductive and destabilising activities in the financial markets.

Essentially, lawmakers must adopt the principle that activities will be regulated to ensure they meet the purpose of advancing the well-being of humanity rather than lining the pockets of a few.

And if such regulation is fraught, then legislation will render such activities that do not advance that criterion, illegal

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

Bill,

I don’t know how any others feel, but I didn’t see much about the Green part of the GND here.

Bill, you wrote, “Her warnings of the danger of these unregulated markets “made her the enemy of a very, very large number of people” and finally, a legislature, captured by those same people, acted in violation of the best interests of the public to outlaw *putting* her ambition to reduce risk and provide greater safety for the savings of ordinary people.”

It looks to me like the word ‘putting’ there is left over from an earlier draft of the sentence.

It might be better if it was deleted.

Steve-the-American,

‘Essentially, lawmakers must adopt the principle that activities will be regulated to ensure they meet the purpose of advancing the well-being of humanity rather than lining the pockets of a few.’

GND is surely an element in the ‘advancing the well-being of humanity.’

Steve, re the ‘missing’ GND part:

The point is readying the financial system to facilitate the massive investment required.

The amazing statistic (in Bill’s article) that financial derivatives trading amounts to more than 73 times nominal world GDP says it all. No doubt $100 trillion (?) is immediately released, if the mainly speculative element of that useless (from a public-good standpoint) massive derivative trading can be invested in the transition from filthy fossil.

As for a description of funding and building the actual necessary green infrastructure itself, and the transition of resources from fossil to green, I think Randall Wray at the Levy Institute has fleshed this out in considerable detail.

@Steve:

That might be becasuse:

“Most of my writing on the topic are about the societal aspects of the GND transformation rather than the specific climate issues. That is obviously because I am not a climate scientist. But as I signalled in Part 1, I am about to announce a coalition (in the coming week I hope) which does include climate science expertise to broaden the capacity of the MMT-GND agenda.”

Ultimately, Bill’s economics-based input serves mainly to counter the ever louder “who/how will you pay for that?!” cacophony of corporate owned conservative/neoliberal media and politicians. There is a plethora of sensible propositions that are propagandized out of existance on this basis.

Personally, I would more than welcome a new political norm in which markets solving the problems they themselves created stop being the default, no, the only option.

Cheers!

A very succinct, appraisal of what’s needed to move forward with any kind of progress; of course we must remove the main force opposing change! That’s going to be one huge political dueling match ahead though.

In preparing to make a comment, I highlighted the same line from Bill’s post that Simon Cohen used to address Steve’s concern about the missing “Green part.” Bill has discussed aspects of that crucial part in previous posts and here he indicates that he is “about to announce a coalition (in the coming week I hope) which does include climate science expertise to broaden the capacity of the MMT-GND agenda.” But to return to the line that caught the attention of Simon, me, and surely others, a call for politicians to put the interests of people and planet above the interest of “lining the pockets of the few,” just how to do that, how to change a value system ingrained in politicians (and often in the citizens who vote for them) by an economic system based upon, driven by, greed, is something about which no one seems to have a clue, much less a concrete proposal. There have been times in human history when massive and sudden changes for the better occurred in human hearts and minds–the Axial Age, the rise of Christianity and other world religions, the Enlightenment, etc. Rare as these rapid transformations may be, as little as even our best historians can convincingly explain them, it seems that we must put our hope in some such substantial step forward by the human spirit. There can be no fundamental restructuring of a socioeconomic order built upon greed until, as Albert Schweitzer observed in the aftermath of the First World War, the majority of men and women come to grasp the utter absurdity and insanity of such a system and seek a new foundation upon which to build their societies and economies. Has a better one been offered than that which Schweitzer distilled as the most elemental and universal human value: reverence for life? Desperately, we need a new politics predicated upon such a principle. In the chaos swirling around us, threatening to bury us, are there signs that something like this is struggling to be born? Might MMT, a mere economic lens, become, through the clarity it provides, a vehicle to help give birth to a new and better world…if only enough of us demand one? Sorry to preach, especially to some in the choir, but to this old clergyman, the future of our species (and many others) is now at stake as never before. We must rise to the occasion and think big, really big, or resign ourselves to the unthinkable.

J.D. Alt just said what I tried to say in less grandiose, and thus perhaps more effective, terms:

http://neweconomicperspectives.org/2019/09/awakening-the-investor-in-whole-society.html

Regulation of the financial industry as ensued after the Great Depression kept the excesses of speculation and financial engineering at bay for many decades. The Clinton administration’s watering down of these regulations created the environment for the malaise we have now.

However, the source of the disfunction at hand is the gross disparities in income and wealth distribution that have occurred, particularly in the last 50 years.

This has caused a massive surfeit in capital held in very few hands which sloshes around world financial markets.

I believe this surfeit of capital is the reason for historic low interest rates and rates of return evident across all markets.

Globalization has accentuated the concentration of income and wealth by destroying the livelihoods of workers in the West.

While reregulation of financial markets will go a long way to dealing with the problems, income and wealth disparities have to be tackled.

“The essential framing is to recognise, first, that commercial banks have a public as well as a private dimension.” bill

This is precisely where MMT advocates (and most everyone else) have it wrong. Banks should be 100% private with 100% voluntary depositors. Otherwise, we have welfare for the banks themselves and for the rich, the most so-called “worthy” of what is then, in essence, the public’s credit but for private gain.

Moreover, by limiting fiat use to a government-privileged usury cartel, aka “the banks”, we then have a single payment system (besides mere physical fiat, aka “cash”, coins and paper notes) that must work through the banks or not at all thereby rendering the economy hostage to private interests.

As for interest rates, the proper way to lower them is equal fiat distributions to all citizens – not special privileges for a usury cartel.

Just need to say how much I appreciate this blogpost. Loved the 2006 IMF quote. Didn’t know about Brooksley Born. Great to see a good argument against Tobin Tax – always had doubts but couldn’t work it out myself.

Well I think Henry Rech is right.

“So that’s the choice at your local political theatre. BAU promises a magical future, with some robots and drones thrown in. GND sets out energy goals that could only be possible in some sort of Marvel superhero movie.

People are lining up behind these simple narratives because the human brain can’t handle much complexity.

And the real unfolding drama – the collapse of a global civilization founded on a highly material culture created by cheap energy – is not a narrative we want to tell ourselves or our children.”

From: The Consciousness of Sheep.

Bill wrote:-

“What a progressive agenda needs to accomplish in the field of finance is the elimination of the divergence between speculation and the real fundamentals of the economy.

That divergence has elevated the risk of bubbles impacting negatively on the real economy and created a massive industry which has no productive role to play in the allocation of resources to useful ends”.

Absolutely!

I would add one further dimension to this analysis. Namely, the underlying *reason* why that divergence has been relentlessly driven forward by financial-market participants and been facilitated by the thwarting of regulatory intervention on the part of their co-conspirators (Summers in particular).

IMO it’s a very simple one – unbridled personal greed on a major scale, unconstrained by any concern whatsoever for the well-being of society. It’s the motivation of brigands, pirates or of any other kinds of predators and plunderers.

Human nature being what it is, it’s a sad fact that presented with the same opportunity (ie to help oneself to what would previously have seemed unimaginably huge gain at no personal risk) most of us would behave the same way. The temptation is virtually irresistible.

How utterly asinine, then (leaving any question of personal probity on the part of a public servant aside) that they were not denied that opportunity! What other behaviour was to be expected would follow than that which manifested itself? At the cost – to one degree or another – of all of the rest of us, while they were permitted to go merrily on doing more of the same? It’s enough to make a cat laugh.

@ Carol Wilcox

“… Didn’t know about Brooksley Born”.

That disgraceful episode has been copiously documented on the Web and in the media.

Shortly afterwards he was appointed President of Harvard University. Make of that what you will.

The Green New Deal is technically and financially do-able. The only roadblock is political but given survival of the biosphere in its current form is at stake then how long can that roadblock remain?

In Australia, Beyond Zero Emissions released a report – ‘Stationary Energy Plan’ (2010) with rigorous, peer-reviewed research demonstrating that powering Australia with clean renewable energy is technically feasible and affordable, will improve reliability and can be completed within a decade. We could have done it by now!

The plan detailed the technologies and costs to upgrade the Australian electricity grid to clean renewable energy. It showed that within 10 years solar and wind (including concentrated solar thermal power and storage) could meet over 90% of energy needs, and the extra cost to households would be only $8 per week.

Since 2010 the cost of renewables has plummeted, technology has advanced, and renewables are being installed at record rates.

Other organisations such as Repower Australia have since released a similar roadmap – ‘A Plan to Repower Australia’ that demonstrates the technical and economic efficacy of a 100% renewable energy powered economy for Australia in the timescale remaining if implementation begins very soon. Backup power in the form of pumped hydro and battery banks as well as energy conservation and load management are all factored in.

Most nations of the world can do the same if they cast of the political and neoliberal economic roadblocks.

Those nations with high population densities and long cold winters and with more limited renewable energy availability during this season will also have the option of importing hydrogen in either liquefied form by LHG ship or as ammonia depending on how the different technologies evolve. Ideally hydrogen would be produced in those regions with ample renewable energy capacity utilizing the excess peak electricity generated that would otherwise need to be offline in a 100% renewable and therefore highly variable electricity generation system – thus performing an important load levelling role.

Long distance international electrical grid interconnections are another option. Next generation nuclear power such as those based on the inherently failsafe liquid fluoride thorium reactor could also be part of the solution for some countries but would also present a serious nuclear weapon proliferation hazard.

We have had enough of the climate change denialists and their successors the renewable energy denialists.

Links to the reports:

Beyond Zero Emissions report – ‘Stationary Energy Plan’ (2010)

https://bze.org.au/research/renewable-energy-plan/

Repower Australia – ‘A Plan to Repower Australia’

https://www.solarcitizens.org.au/a_plan_to_repower_australia

Postkey – That’s from an article by Andrew Nikiforuk in The Tyee or an abridgment and commentary by fjwhite in Citizen Action Monitor as well as The Consciousness of Sheep

It’s Collapse Porn. Some people get off on it mightily. I don’t. Collapse porn addiction is a very widespread and serious problem.

Who are the experts cited in the article?

Tad Patzek, professor of petroleum and chemical engineering in Texas.

And Nate Hagens, “a former Wall Street wolf” who is approvingly quoted with the absurd lie on the GND “They are both energy blind. Neither BAU [Business as Usual] nor GND [Green New Deal], for instance, understand that energy flows underpin economic flows.”

An example of the coincidence of self-styled ultra-Green collapse porn productions and the output of Wall Street and fossil fuel industries?

Give me the Koch Brothers, Trump and their BAU over this.

The Consciousness of Sheep?

As for those who insist that only they are enlightened and belittle other people as sheep-

“Niemand ist mehr Sklave, als der sich für frei hält, ohne es zu sein.”

None are more hopelessly enslaved than those who falsely believe they are free

– Goethe

Play the man, not the ball?

Postkey quotes (from something or other}:

“GND sets out energy goals that could only be possible in some sort of Marvel superhero movie”.

Utter nonsense. But is it your view?

[Danny Price from Frontier Economics also views the ‘opportunity cost’ of resource transfer to GND as unacceptable. So in his view we continue with the “invisible hand” model of resource allocation, whether the planet burns or not…..]

Prof. Mark Blyth has a new video out. Titled, “So can we have it all?” It’s dated 7/16/2019.

[Quote] McMaster Humanities

Published on Jul 16, 2019

This lecture is part of the McMaster Department of Philosophy’s Summer School in Capitalism, democratic solidarity, and Institutional design. [/Quote]

He says quite a lot about MMT. Like, he says that after Brexit the UK will see food prices rise because the Pound will fall. He doesn’t say one way or the other if this will stabilize {which would mean the there would be no inflation, because inflation must be ‘on-going’} or if it would not stabilize and there would be inflation. This is to our Bill a huge difference. He says that because the dollar is the world’s reserve currency the US can do much more deficit spending by taking advantage of what MMT allows, but doesn’t say that Canada, Australia, etc. can. He never mentions Japan which our Bill says has been deficit spending for 20 to 30 years and not seen a fall in the yen.

I have a lot of trouble following it on the 1st watch. It seems like he uses many words and phrases that an economics student will know, but I don’t .

I’ll not include a link, because Bill doesn’t like links. At least to those who aren’t MMTers.

I’m sure you can find it easy enough if you want to listen to a 1 hr. talk by Mark to see what this currently popular contrarian economist is saying to his followers.

PS.

Prof. Blyth is even talking about a Job Guarantee but with a different name.

In the US with a wage of $5 over the current $7.35/hr. But he doesn’t mention ‘benefits’.

“Utter nonsense.”

ex cathedra statements don’t count.

Postkey,

I included the Danny Price proposition as an example of utter nonsense

Obviously the resources and know how exist, to transit from filthy fossil to green.

No ‘Marvel comic’ required.

“Obviously the resources and know how exist, to transit from filthy fossil to green. ”

Why don’t you go to The Consciousness of Sheep at facebook and explain to him where he has ‘gone wrong’?

Posrkey,

I was hoping you would understand MMT sufficiently well by now to be able to explain the error in that article yourself.

Wile I don’t like wasting my time on orthodox neoliberal economists, like Price, who think fiat money is a real resource, I may look at the face book page.

@Steve_American:

Sorry if I am wrong, but your comment seems to express the old paradigm which views limited human economy being located in limitless nature. Meaning, that the economic situation is always the consequence of the situation in nature, not the other way round.

I think this view is outdated today. Now nature is as much a consequence of economy as economy is a consequence of nature. It means that in order to discuss the world dynamics the environmentalists have to discuss the social and economic issues on the level of the empirical social scientists. I would advocate for human geography.