Well my holiday is over. Not that I had one! This morning we submitted the…

Germany to play smokes and mirrors again

Germany is proposing some more smokes and mirrors so that it can maintain its position as the exemplar of fiscal responsibility by obeying its ‘Debt brake’ yet inject significant deficit spending into its recessed economy, which is starved of public infrastructure spending. They are proposing to set up new institutions which will be funded by government-guaranteed debt and spend billions into the economy while ensuring these transactions do not show up on the official fiscal books of the German government. The only financial constraint these new agencies will be bound by are the European Commission’s Stability and Growth Pact rules. But because the allowable spending difference between the ‘Debt brake’ and the SGP is huge (but still well below what is needed to redress the years of austerity and infrastructure degradation) and so will provide a much-needed stimulus to the ailing German economy. Meanwhile, the Germans will tell the world how thrifty they are and how they obey their own rules. And then they can say that all other Member States should also stick to the rules. Meanwhile, the smoke and mirrors are going hammer and tong to create spending growth that bears no resemblance to the allowable growth under the Debt brake. The Debt brake then is just a sham. The upside is that needed public spending will enter the economy which tells us that the Debt brake should never have been introduced in the first place. Such is life in the EU – a daily circus.

I have discussed the role of the German government-owned development bank – Kreditanstalt für Wiederaufbau (KfW) before:

1. The fiscal role of the KfW – Part 1 (December 3, 2013).

2. Germany fails to honour its part of the Greek bailout deal (July 24, 2017).

The first-cited blog post provides some history and background to the role that the KfW plays in the German economy after it was created in 1948 as a German vehicle to faciliate the infrastructure rebuilding under the Marshall Plan.

It is now one of the largest banks in Germany (taken its main business units into account) and pumps millions of Euros in the domestic economy and the export sector (via IPEX, its 100 per cent owned subsidiary).

It is a major reason why the public debt ratio in Germany is around 60 per cent rather than closer to 100 per cent.

It is a major reason why the federal fiscal deficit was able to be cut to the point of achieving surplus without scorching the German economy.

It is a classic story about smoke-and-mirrors accounting, German-style.

The Federal Government owns 80 per cent of a development bank while the States own the remaining 20 per cent. The national government uses it as a fiscal instrument.

Its chairman is the Federal Minister of Finance, Olaf Scholz and its Deputy-Chairman is Peter Altmaier, Minster of Economic Affairs and Energy.

It borrows in capital markets and all its debt is federal government-guaranteed, which reduces its funding costs relative to a private bank with no such guarantee. It is also exempt from paying company tax.

Taken together, it offers loans to developments at much lower rates than the commercial banks, although it is precluded by law from direct competition with the banks.

The KfW extends credit to the non-government sector, which, inasmuch as the liquidity enters the German economy, allows for a higher increase in aggregate spending without being recorded as ‘deficit spending’ in the the official government books, which are subject to the European Commission’s Stability and Growth Pact rules, and more recently to the ridiculous Debt Brake that is now embedded in the Basic Law (Constitution).

As a result, economic activity is higher than it would be without the KfW’s input and the fiscal deficit can be lower at each level of real GDP growth.

The KfW provides the German government with a vehicle to shift stimulus away from the fiscal books and onto the bank’s books.

Simple.

Whether you think that is controversial or not, in the light of all that has been going on in the Eurozone over the last decade or so, depends on your viewpoint.

I actually think it is a demonstration of scandalous hypocrisy given to the way Germany insisted on Greece being treated.

Public capital formation in the Eurozone

It has been clear for a long time that the Member States of the European Union has been starving their citizens of adequate investment in public infrastructure.

One of the ways the political costs of austerity can be minimised is by cutting capital expenditure because the negative consequences take years, in some cases, to manifest.

I wrote about this isssue in these blog posts (among others):

1. Massive Eurozone infrastructure deficit requires urgent redress (November 27, 2017).

2. The chickens are coming home to roost for Europe’s so-called powerhouse (August 10, 2017).

In the second of those blog posts, I noted that Germany has, particularly, trailed behind and major infrastructure such as the main bridge on the A40 autobahn crossing the Rhine river between Oberhausen and Duisberg had been deemed unfit for heavy vehicles and trucks had to detour some 30 kms to get across the river.

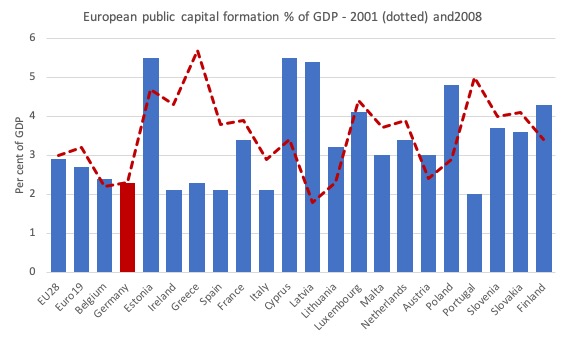

The following graph shows the public investment ratios in 2008 (blue columns) and 2001 (red dotted line) for the European aggregates and the 19 Member States of the Eurozone.

1. Germany’s general government sector is in the lower group of nations in this regard.

2. The impacts of austerity in many nations (Ireland, Greece, Spain, France, Italy, Malta, Netherlands, Portugal, Slovenia and Slovakia is apparent. These nations have inflicted long-term damage on their economies by failing to maintain the share of public investment in GDP.

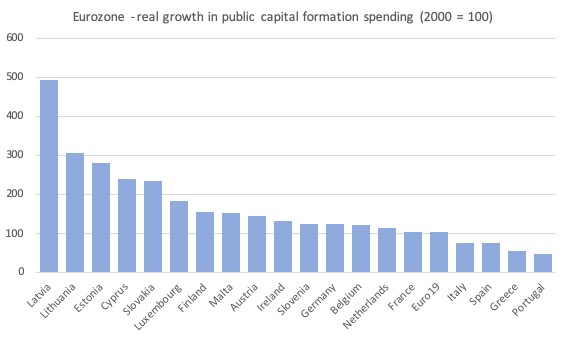

The next graph shows the real growth in public capital formation since the inception of the common currency (2000) in index number points with 2000=100.

Across the 19 Member State Eurozone, there has only been 2.5 per cent real increase in public infrastructure spending since 2000. Values below 100 indicate a real decline. For example, Portugal has endured a 53 per cent decline in real public capital formation.

The German debt brake

In 2009, the German parliament approved the introduction of the so-called Schuldenbremse (or ‘Debt Brake’), which was embedded into Germany’s constitution – the Basic Law.

Article 109, Paragraph 3 reads:

Die Haushalte von Bund und Ländern sind grundsätzlich ohne Einnahmen aus Krediten auszugleichen. Bund und Länder können Regelungen zur im Auf- und Abschwung symmetrischen Berücksichtigung der Auswirkungen einer von der Normallage abweichenden konjunkturellen Entwicklung sowie eine Ausnahmeregelung für Naturkatastrophen oder außergewöhnliche Notsituationen, die sich der Kontrolle des Staates entziehen und die staatliche Finanzlage erheblich beeinträchtigen, vorsehen. Für die Ausnahmeregelung ist eine entsprechende Tilgungsregelung vorzusehen. Die nähere Ausgestaltung regelt für den Haushalt des Bundes Artikel 115 mit der Maßgabe, dass Satz 1 entsprochen ist, wenn die Einnahmen aus Krediten 0,35 vom Hundert im Verhältnis zum nominalen Bruttoinlandsprodukt nicht überschreiten. Die nähere Ausgestaltung für die Haushalte der Länder regeln diese im Rahmen ihrer verfassungsrechtlichen Kompetenzen mit der Maßgabe, dass Satz 1 nur dann entsprochen ist, wenn keine Einnahmen aus Krediten zugelassen werden.

In English, paraphrasing, we see:

1. The budgets of the Federation and the Länder shall, in principle, be balanced without revenue from credits.

2. The Federal fiscal balance (adjusted for the economic cycle – that is, the ‘structural’ deficit cannot exceed 0.35 per cent of GDP.

3. The 16 Länder (states) will be required to balance their fiscal positions by 2020 and structural deficits are then prohibited.

You can imagine how inflexible this makes public spending in Germany.

Their debt brake is much more extreme than the current fiscal rules enforced by the European Commission.

On June 30, 2012, the so-called ‘fiscal compact’ was added to the Stability and Growth Pact.

The fiscal compact contained (Source):

1. “a fiscal rule which requires that the general government budget be balanced or in surplus”.

2. “The fiscal rule is considered to be respected if the annual structural balance meets the country-specific medium-term objective and does not exceed a deficit (in structural terms) of 0.5% of GDP.”

3. “If the government debt ratio is significantly below 60% of GDP and risks to long-term fiscal sustainability are low, the medium-term objective can be set as low as a structural deficit of at most 1% of GDP.”

4. “A country may temporarily deviate from its medium-term objective or adjustment path towards it only in exceptional circumstances”.

So what the German government was saying to the world is that their approach to fiscal policy, which they made part of the constitutional (to overcome shifts in behaviour due to political flavours changing) is significantly more strict than that enshrined in the European Union’s legal structure.

Some claim to virtue.

Germany’s latest scam

Given that context, it was interesting to read the Reuters news report (September 9, 2019) – EXCLUSIVE-Germany considers ‘shadow budget’ to circumvent national debt rules – sources – which indicated that the German government was in the process of setting up some new public bodies as a way of getting around the constitutional restrictions they created by legislating for a ‘Debt Brake’.

The Reuters report told us:

1. “Germany is considering setting up independent public agencies that could take on new debt to invest in the country’s flagging economy, without falling foul of strict national spending rules”.

2. “The creation of new investment agencies would let Germany take advantage of historically low borrowing costs to spend more on infrastructure and climate protection, over and above debt limits enshrined in the constitution”.

Here is some arithmetic:

1. In 2018, Germany’s GDP was recorded at 3,344,370 million euro.

2. Under the Basic Law (the Debt Brake) it would have been allowed a maximum fiscal deficit equal to 11,705.3 million euro (0.35 per cent of GDP).

3. With growth this year, a figure around 12 billion euros is the ballpark maximum.

4. It is estimated that given current debt stocks and the growth outlook, “Berlin only has the scope to increase new debt by 5 billion next year”.

Even the KfW has estimated that Germany has an infrastructure backlog of around 138 billion euros given the austerity record that has accumulated from the past in reduced rates of growth in public capital formation expenditure.

So with Germany heading for recession and its own constitutional constraints (self-imposed) allowing maximum public investment spending that is miniscule in scale compared to the need, the Government clearly has a problem.

It cannot back down and abandon the Debt Brake even though it should and should never have legislated for it in the first place.

That would be seen as giving into reality, something the German government is ill-equipped to do.

So as an alternative, they can play more ‘smokes-and-mirrors’.

How?

Set up some new “public investment agencies” which have ‘books’ that are not recorded as part of the government’s fiscal books under German law.

So despite taking on a significant hike in debt and providing fiscal stimulus (deficit spending) through the new agency, the German government will officially be able to say it is obeying the constitutional ‘Debt brake’ requirements.

Meanwhile, the overall ‘government’ deficit rises well beyond the ‘Debt brake’ rule and provides positive stimulus to the ailing German economy and all the nudge-nudge-wink-wink behaviour gets lost.

Now before we get too carried away, the fact remains that these new ‘agencies’ will still be bound by the European Commission’s fiscal rules.

But because the Debt brake rule is much harsher than the Stability and Growth Pact rules (and that alone should tell you how ridiculous this all is), the new agency and the German government will be able to:

… take on new debt worth up to 35 billion euros a year, rather than the 5 billion allowed under its own constitutionally enshrined debt brake.

A Government spoeksperson said that:

We should be able to resist criticism about using accounting tricks – the task is worth it.

So why not abandon the Debt brake rule?

Well, according to a German economics professor quoted by Reuters:

Germans like their rules and they like to interpret them very narrowly …

Which should, further, give you a feel for how ridiculous all this German behaviour has become within a ridiculous overall environment (the EU) that is biased to austerity anyway.

And, if that wasn’t enough – the German government is considering creating a ‘private’ foundation which the Government would fund (outside of its Debt brake accounting) and which would be outside the EU Stability and Pact rules.

Conclusion

What we learn from all this, once again, is that the EU rules and all the posturing in Germany about fiscal rectitude is a sham and is used variably to suit the situation.

But when a less important nation, in the overall EU mix, tries the same thing or just happens to need fiscal support, the rules become iron-clad and are enforced with a brutally that one can only guess is the work of sociopaths.

Modern day EU.

And the Remainers in Britain want to desperately be part of it so, presumably, they can be part of “Protecting our European Way of Life”, which is the new title given by incoming EC President Ursula von der Leyen to the vice-president responsible for migration and skilled labour in her new commission.

But then aren’t they all meant to be cosmopolitans? The Cosmo that stops at the border!

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

So, would this new foundation provide a model that other austerity-hit member states could copy, without getting reprimanded by the EU high command?

Dear dnm (at 2019/09/12 at 8:42 pm)

Yes, the smoke-and-mirrors can work elsewhere. But one of the ways they pull this off is because they benefit from German government debt ratings and make tidy profits via negative yielding long-term bond issues.

I doubt, for example, Italy, could fund such off-balance sheet agencies as easily.

But the principle is established.

best wishes

bill

Very interesting.

Als this cliffhanger made me uniquely curious: “the German government is considering creating a ‘private’ foundation which the Government would fund (outside of its Debt brake accounting) and which would be outside the EU Stability and Pact rules”

Dear Willem (at 2019/09/12 at 9:00 pm)

On September 9, 2019, the German Minister for Economic Affairs and Energy, Peter Altmaier “floated the idea of creating a non-profit climate foundation into which Berlin could initially inject 5 billion euros.

The foundation would issue interest-free loans for climate protection projects – up to a maximum of 50 billion euros – with the aim of reducing German carbon emissions …

That’s roughly the amount needed to finance the additional climate protection measures the government is considering, and which Berlin aims to present on Sept. 20.

Altmaier said any government borrowing or lending through such a non-profit foundation would not violate the federal government’s self-imposed balanced budget goal – or the more formal debt brake – because the foundation would be private.”

Source: http://news.trust.org/item/20190909134128-csy5m

That is all I know at present but I am investigating.

best wishes

bill

“So despite taking on a significant hike in debt and providing fiscal stimulus (deficit spending) through the new agency”

Bill, I couldn’t understand the dynamics. Deficit spending must be registered in the books of the Treasury or Central Bank, doesn’t it? Even if they are deficit spending to an agency.

So how can agencies be used to hide deficit spending? I’m losing something here

Thanks, Bill. That is just brilliant. Essentially every euronation it seems could capitalize a private bank-like structure, that can create 10 times that capital in euros to stimulate investment and demand.

The German hypocrisy is staggering indeed, though.

My belief is that China does off balance sheet fiscal policy by having government banks make loans to private sector entities. If the loan can’t be paid back it gets written off by the bank. I’m not entirely sure of this. If at some point Bill would write about China, as another commenter has recently requested, it would be most interesting.

“Well, according to a German economics professor quoted by Reuters:

‘ Germans like their rules and they like to interpret them very narrowly …'”

The most painful feature of this horrendous charade is having to witness the spectacle of an entire nation indulging in a collective act of denial.

This cannot bode well, either for their own future or anyone else’s.

3.3 million million is, in shorter terms, 3.3 trillion, as a million million = a trillion, much smaller than Deutsche Bank’s entire debt. Or, in scientific notation, 3.3 x 10 to the 12th. I think this is right.

I see the ECB are up to their usual tricks again with the interest rate and QE.

The opposite will happen to what they say will happen. It is hilarious they call it a stimulus as they remove all that interest income from the economy.

It is the reason they have suffered from deflation all these years yet they call it a stimulus and that they are trying to inflate.

Nothing but a bunch of charlitans.

I think the ECB’s profits are distributed among the central banks of the member states. So the interests the banks pay presumably end up as “income” for the respective governments.

That said, it’s an absurdly idiotic system. No way to just direct spending where it needs to be, instead creating front organisations, run by administrators, just to obscure what little extra public spending goes on.

“the German government is considering creating a ‘private’ foundation which the Government would fund (outside of its Debt brake accounting) and which would be outside the EU Stability and Pact rules”

Portugal was doing this, first thing to be shot down by Troika

Bill, is there a German MMT economist I can recommend to my Germany LVT colleague? I sent him this this blog. He responded “Even the conservative economic research institutes are criticising the German government for this policy. But we are ruled by a hoard [sic] of Neandertal men.”

Most interesting. It is very reminescent of Off Balance Sheet accounting of the banks in the GFC of 2008. The amount of money created by this hokuspokus is meager, the notorious German austerity will not even cover costs of intrastructure basic renewal. This will just be Italian breakfast in a possible deeper recession (so basically nothing).

Thanks for this most interesting spot on insight!

I would like to add the expression of deep astonishment about the brazenness in declaring a public enterprise private. This is all but private and in-the-plain cheating. Can you trust these guys? Not really. My rotten govt. They also want to collect small investors money to the tune of 50 billions, offering preferred status of 2% interest. This is just generous, isn´t it?

These people are unbelievable!

Germany to the rest of the Euro zone — do as we say, not as we do …

Hi, can eurozone governments deficit spend the same way as the US and UK, by crediting bank accounts or reserves? I understand there is a limit as to how much each eurozone member deficit can be. Is it up to each individual eurozone member to make sure it stays within the limits of the deficit spending rules? Or does the ECB have to provide this defecit spending to each member state directly? What would stop say France from crediting much more reserves than it does currently? Is there any literature that explains how individual eurozone member states credit reserves and manage their spending limits?

Thank you

@ John,

No one else has replied, so I will.

Nations in the eurozone must sell new bonds to borrow euros BEFORE they can deficit spend.

nations like the US, Japan, & Canada can deficit spend BEFORE they sell the bonds. Their CB can buy their bonds, and they could with changes in the laws just spend currency into their nations.

The ECB does not help nations in the eurozone out, well it is against the rules. However, now the ECB will break the rules and buy some of the bonds that each nation has *already* sold to help stabilize the bond market, IIRC. And remember, I’m no expert.

@robertH:

Not all of the country… only most.

It happens to be the most comforting and flattering lie the German soul could be told:

“you are responsible and thrifty and the others are lazy and suffer for it”

A story that feeds both our “Hochmut” AND “Schadenfreude” at the same time is simply too enticing to ressist 🙁

Cheers!

DNM:

What is proposed is not far off what Varoufakis and Galbraith and Holland proposed at a European level through the EBRD (in their Modest Proposal)! But they were a darn site more transparent and wrote in the spirit of European solidarity — which obviously is not what the KfW off-book approach is about.