Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

The Weekend Quiz – January 12-13 – answers and discussion

Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

In a nation running an on-going external deficit, if the private domestic sector decides to increase the extent that it spends less than its overall income, then the national government has to increase its discretionary fiscal deficit in order to avoid rising employment losses.

The answer is True.

First, we must understand the linkages between the external and domestic situation.

To refresh your memory the sectoral balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

Expression (1) tells us that total income in the economy per period will be exactly equal to total spending from all sources of expenditure.

We also have to acknowledge that financial balances of the sectors are impacted by net government taxes (T) which includes all taxes and transfer and interest payments (the latter are not counted independently in the expenditure Expression (1)).

Further, as noted above the trade account is only one aspect of the financial flows between the domestic economy and the external sector. we have to include net external income flows (FNI).

Adding in the net external income flows (FNI) to Expression (2) for GDP we get the familiar gross national product or gross national income measure (GNP):

(2) GNP = C + I + G + (X – M) + FNI

To render this approach into the sectoral balances form, we subtract total taxes and transfers (T) from both sides of Expression (3) to get:

(3) GNP – T = C + I + G + (X – M) + FNI – T

Now we can collect the terms by arranging them according to the three sectoral balances:

(4) (GNP – C – T) – I = (G – T) + (X – M + FNI)

The the terms in Expression (4) are relatively easy to understand now.

The term (GNP – C – T) represents total income less the amount consumed less the amount paid to government in taxes (taking into account transfers coming the other way). In other words, it represents private domestic saving.

The left-hand side of Equation (4), (GNP – C – T) – I, thus is the overall saving of the private domestic sector, which is distinct from total household saving denoted by the term (GNP – C – T).

In other words, the left-hand side of Equation (4) is the private domestic financial balance and if it is positive then the sector is spending less than its total income and if it is negative the sector is spending more than it total income.

The term (G – T) is the government financial balance and is in deficit if government spending (G) is greater than government tax revenue minus transfers (T), and in surplus if the balance is negative.

Finally, the other right-hand side term (X – M + FNI) is the external financial balance, commonly known as the current account balance (CAD). It is in surplus if positive and deficit if negative.

In English we could say that:

The private financial balance equals the sum of the government financial balance plus the current account balance.

We can re-write Expression (6) in this way to get the sectoral balances equation:

(5) (S – I) = (G – T) + CAB

which is interpreted as meaning that government sector deficits (G – T > 0) and current account surpluses (CAB > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G – T < 0) and current account deficits (CAB < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

Expression (5) can also be written as:

(6) [(S – I) – CAB] = (G – T)

where the term on the left-hand side [(S – I) – CAB] is the non-government sector financial balance and is of equal and opposite sign to the government financial balance.

This is the familiar MMT statement that a government sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)) plus net income transfers.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

(S – I) denotes the relationship between private domestic income and spending. If S > I then, the private domestic sector is saving overall, which is different to saying the household sector is saving out of its disposable income.

When the private domestic sector seeks to increase the gap between S and I, they will reduce consumption or investment spending, which, in turn, directly reduces overall aggregate spending.

The normal inventory-cycle view of what happens next goes like this.

Output and employment are functions of aggregate spending. Firms form expectations of future aggregate demand and produce accordingly.

They are uncertain about the actual demand that will be realised as the output emerges from the production process.

The first signal firms get that household consumption is falling is in the unintended build-up of inventories. That signals to firms that they were overly optimistic about the level of demand in that particular period.

Once this realisation becomes consolidated, that is, firms generally realise they have over-produced, output starts to fall. Firms lay-off workers and the loss of income starts to multiply as those workers reduce their spending elsewhere.

At that point, the economy is heading for a recession.

There are only two ways out of this in order to avoid spiralling employment losses and both require an exogenous intervention to occur.

1. The fiscal deficit has to rise.

2. Net exports have to rise.

But we need to understand that at some steady state position (where changes in national income are zero), a change in one of the balances will force, via the resulting income changes, changes in the other two balances.

The important point is that the three sectors add to demand in their own ways. Total GDP and employment are dependent on aggregate demand. Variations in aggregate demand thus cause variations in output (GDP), incomes and employment. But a variation in spending in one sector can be made up via offsetting changes in the other sectors.

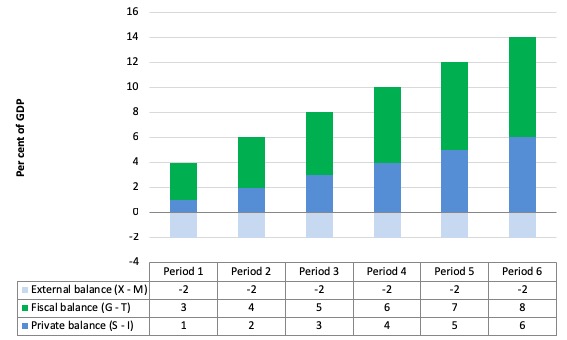

Consider the following graph, which shows a constant (on-going) external deficit of 2 per cent of GDP.

For the private domestic sector to save overall, the fiscal position has to be in deficit when there is an external deficit, irrespective of the size of the external deficit.

As we move from Period 1 to Period 6, the private domestic sector is achieving even greater overall saving and the fiscal deficit is rising as a consequence.

The fiscal deficit will rise without the government acting because of the automatic stabilisers – the slowdown in the economy from the withdrawal of private domestic spending will reduce tax revenue and increase welfare payments.

But that will typically not be sufficient to avoid employment losses.

So the government has to increase its discretionary net spending to ensure there is sufficient aggregate spending growth to keep pace with the rising private domestic sector spending withdrawal.

The following blogs may be of further interest to you:

- The full employment fiscal deficit condition (April 13, 2011).

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

- Saturday Quiz – May 22, 2010 – answers and discussion

Question 3:

The build-up of Chinese holdings of US government debt has allowed US citizens to enjoy a higher material standard of living at the expense of the residents of China.

The answer is True.

Note this is a question about macroeconomics and avoids dealing with questions about regions etc, which while very important, are abstracted from.

First, China can only do what the Americans and everyone else it trades with allow them to do. They cannot sell a penny’s worth of output in USD and therefore accumulate the USD which they then use to buy US treasury bonds if the US citizens didn’t buy their exports.

Presumably, people buy imported goods made in China instead of locally-made goods (which are more expensive) because they perceive it is their best interests to do so.

I find these ‘freedom’ campaigns curiously contradictory. They hate government involvement in the economy yet propose complex regulative structures (for example, tariffs) which would increase government control on resource allocation and, not to mention it, force citizens (against their will) to purchase goods and services they reject in an open comparison (on price and whatever other characteristics).

Many economists do not fully understand how to interpret the balance of payments in a fiat monetary system. For example, most will associate the rise in the current account deficit (exports less than imports plus net invisibles) with an outflow of capital. They then argue that the only way the US (if we use it as an example) can counter this is if US financial institutions borrow from abroad.

They then assume that this is a problem because it means, allegedly, that the US nation is “living beyond its means”. It it true that the higher the level of US foreign debt, the more its economy becomes linked to changing conditions in international credit markets. But the way this situation is usually constructed is dubious.

First, exports are a cost – a nation has to give something real to foreigners that it we could use domestically – so there is an opportunity cost involved in exports.

Second, imports are a benefit – they represent foreigners giving a nation something real that they could use themselves but which the local economy will benefit from having. The opportunity cost is all theirs!

So, on balance, if a nation can persuade foreigners to send more ships filled with things than it has to send in return (net export deficit) then that is a net benefit to the local economy. I am abstracting from all the arguments (valid mostly!) that says we cannot measure welfare in a material way. I know all the arguments that support that position and largely agree with them.

So how can we have a situation where foreigners are giving up more real things than they get from the local economy (in a macroeconomic sense)? The answer lies in the fact that the local nation’s current account deficit “finances” the desire of foreigners to accumulate net financial claims denominated in $AUDs. Think about that carefully. The standard conception is exactly the opposite – that the foreigners finance the local economy’s profligate spending patterns.

In fact, the local trade deficit allows the foreigners to accumulate these financial assets (claims on the local economy). The local economy gains in real terms – more ships full coming in than leave! – and foreigners achieve their desired financial portfolio. So in general that seems like a good outcome for all.

The problem is that if the foreigners change their desire to accumulate financial assets in the local currency then they will become unwilling to allow the “real terms of trade” (ships going and coming with real things) to remain in the local nation’s favour. Then the local economy has to adjust its export and import behaviour accordingly. If this transition is sudden then some disruptions can occur. In general, these adjustments are not sudden.

So if you understand this then you will be able to appreciate the following juxtaposition:

Neo-liberal myth: US consumers have to borrow $billions from foreigners to keep consuming.

MMT reality: US consumers are funding $billions in foreign savings (accumulation of $US-denominated financial assets by foreigners).

Here is a transactional account of how this works which starts off with a US citizen buying a Chinese product.

- US citizen buys a nice little Chinese car.

- If the US consumer pays cash, then his/her bank account is debited and the Chinese car dealer’s account is credited – this has the impact of increasing foreign savings of US dollar-denominated financial assets. Total deposits in the US banking system, so far, are unchanged.

- If the US consumer takes out a loan to buy the car, then his/her bank’s balance sheet now records the loan as an asset and creates a deposit (the loan) on the liability side. When the US consumer then hands the cheque over to the car dealer (representing the Chinese firm – ignore intervening transactions) the Chinese car company has a new asset (bank deposit) and my loan boosts overall bank deposits (loans create deposits). Foreign savings in US dollars rise by the amount of the loan.

- So the trade deficit (1 car in this case) results from the Chinese car firm’s desire to net save US dollar-denominated financial assets and sell goods and services to the US in order to get those assets – it is the only way they can accumulate financial assets in a foreign currency.

What if the Chinese car company then decided to buy US Government debt instead of holding the US dollar-denominated bank deposits?

Some more accounting transactions would occur.

- The Chinese company would put in an order for the bonds which would transfer the bank deposit into the hands of the central bank (Federal Reserve) who is selling the bond (ignore the specifics of which particular account in the Government is relevant) and in return hand over a bit of paper called a bond to the Chinese car maker’s lawyers or representative.

- The US Government’s foreign debt rises by that amount.

- But this merely means that the US Government promises, on maturity of the bond, to credit the Chinese car firm’s bank account (add reserves to the commercial bank the car firm deals with) with the face value of the bond plus interest and debit some account at the central bank (or whatever specific accounting structure deals with bond sales and purchases).

If you understand all of that then you will clearly understand that this merely amounts to substituting a non-interest bearing reserve balance for an interest-bearing Government bond. That transaction can never present any problems of solvency for a sovereign government.

The US consumers get all the real goods and services and the Chinese have bits of paper.

The following blogs may be of further interest to you:

- Modern monetary theory in an open economy

- Debt is not debt!

- The piper will call if surpluses are pursued …

Question 3:

Short-term interest rates are set by the central bank while the fiscal strategy manifests in tax and spending decisions by the government. Whereas the non-government sector cannot directly influence the interest rate target being set, it does, ultimately, determine the size of the fiscal deficit at any point in time.

The answer is True.

So the fundamental principles that arise in a fiat monetary system are as follows.

- The central bank sets the short-term interest rate based on its policy aspirations.

- Government spending is independent of borrowing which the latter best thought of as coming after spending.

- Government spending provides the net financial assets (bank reserves) which ultimately represent the funds used by the non-government agents to purchase the debt.

- Fiscal deficits put downward pressure on interest rates contrary to the myths that appear in macroeconomic textbooks about ‘crowding out’.

- The “penalty for not borrowing” is that the interest rate will fall to the bottom of the ‘corridor’ prevailing in the country which may be zero if the central bank does not offer a return on reserves.

- Government debt-issuance is better seen as a ‘monetary policy’ operation rather than being intrinsic to fiscal policy, although in a modern monetary paradigm the distinctions between monetary and fiscal policy as traditionally defined are moot.

Accordingly, debt has no correspondence with any need to fund government spending. Debt might also be issued if the government wants the private sector to have less liquid purchasing power.

The central bank may agree to pay the short-term interest rate to banks who hold excess overnight reserves. This would eliminate the need by the commercial banks to access the interbank market to get rid of any excess reserves and would allow the central bank to maintain its target interest rate swapping government debt for bank reserves.

So the private domestic sector cannot directly influence the central bank’s capacity to set interest rates. Clearly the central bank considers developments in the private domestic sector but that is a different matter.

However, the private domestic sector does, ultimately, determine the fiscal balance associated with fiscal policy.

The fiscal balance has two conceptual components. First, the part that is associated with the chosen (discretionary) fiscal stance of the government independent of cyclical factors. So this component is chosen by the government.

Second, the cyclical component which refer to the automatic stabilisers that operate in a counter-cyclical fashion. When economic growth is strong, tax revenue improves given it is typically tied to income generation in some way. Further, most governments provide transfer payment relief to workers (unemployment benefits) and this decreases during growth.

In times of economic decline, the automatic stabilisers work in the opposite direction and push the fiscal balance towards deficit, into deficit, or into a larger deficit. These automatic movements in aggregate demand play an important counter-cyclical attenuating role. So when GDP is declining due to falling aggregate demand, the automatic stabilisers work to add demand (falling taxes and rising welfare payments).

When GDP growth is rising, the automatic stabilisers start to pull demand back as the economy adjusts (rising taxes and falling welfare payments).

The cyclical component is not insignificant and if the swings in private spending are significant then there will be significant swings in the fiscal balance.

The importance of this component is that the government cannot reliably target a particular deficit outcome with any certainty.

This is why adherence to fiscal rules are fraught and normally lead to pro-cyclical fiscal policy which is usually undesirable, especially when the economy is in recession.

While the short-term interest rate is exogenously set by the central bank, economists consider the fiscal outcome to be endogenous – that is, it is determined by private spending (saving) decisions.

The government can set its discretionary net spending at some target to target a particular fiscal deficit outcome but it cannot control private spending fluctuations which will ultimately determine the final actual fiscal balance.

The following blogs may be of further interest to you:

- Saturday Quiz – May 1, 2010 – answers and discussion

- Understanding central bank operations

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

- A modern monetary theory lullaby

- Saturday Quiz – April 24, 2010 – answers and discussion

- The dreaded NAIRU is still about!

- Structural deficits – the great con job!

- Structural deficits and automatic stabilisers

- Another economics department to close

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

The answers said I got question 1 wrong. I got hung up about ‘discretionary’ increases in government spending as opposed to increased spending due to automatic stabilizers. Point being that government spending has to, and is going to rise, and tax collections will decrease .

In one sense, I can see that all government spending is ‘discretionary’ to a certain extent. But that is not how the term is usually used on this blog or in economics.

So the answers tells us that “The fiscal deficit will rise without the government acting because of the automatic stabilizers – the slowdown in the economy from the withdrawal of private domestic spending will reduce tax revenue and increase welfare payments.”

And then- “But that will typically not be sufficient to avoid employment losses.”

I guess that is true or ‘typical’ most of the time- but is it necessarily true all of the time? I’m giving myself half-credit on my answer for that reason. Nope- I just gave myself full credit 🙂

As always- Thank you for the Quiz!

Jerry-yes, the word ‘discretionary’ here implies the existence of ‘non-discretionary’ which are the legally binding laws that are the welfare system and this is assumed to be in existence although welfare systems have started to look more and more discretionary in that they are getting curtailed and shorn down!

In the U.K the Department for Work and Pensions is constantly fighting legal challenges because of this and often losing them (the Government seems to have infinite amounts of money to pay Barristers for this purpose!).

There are still libertarians out there and Thatcherites who think the welfare state should be rolled back a lot further so that market forces prevail even more -but we know what the result of that would be: 19th Century v. 2.0