In the annals of ruses used to provoke fear in the voting public about government…

British fiscal statement – continues the lie about austerity

The British Chancellor George Osborne told the British people during his fiscal presentation yesterday that the “The sun is starting to shine – and we are fixing the roof”, which was code for the age of austerity is over. The problem with that narrative is that the sun over Britain is pretty weak, has been shining since 2012 when the British government deferred its austerity push when the nascent economic recovery it inherited tanked after its first fiscal exercise in June 2010. The strategy then was clear – they kept the fiscal deficit at relatively high levels (even if some of the shifting of expenditures etc cause inequities and undermines the prosperity of certain cohorts). Those deficits have supported growth over the last several years. But growth has also come from the stimulus the government gave to the housing sector (not the construction of houses but the churning of existing stock) in the 2012 and 2013 Fiscal Statements (aka the ‘Budget’). That growth strategy is ephemeral because the household sector can only absorb so much extra debt given its already highly indebted state. Overall, the fiscal narrative in Britain put out by the Conservatives is a lie. They have not created a nation of “Makers” and growth has not come from austerity. If you want to see what austerity does just look across the Channel to Italy, France, and, of course Greece. The UK has not demonstrated that austerity is a stimulus to growth.

Most of the commentary about George Osborne’s Fiscal Statement has been about the fact that the fiscal strategy is designed not for the long-term benefit of the British economy and hence its people but rather has a 50 days time target – to shore up political support for the Conservatives at the upcoming general election in May. That appears to be true.

But the more compelling aspect of the exercise from my perspective is that it continues the fraud that austerity worked.

In a blog from last week (March 10, 2015) – Lacklustre British economy all down to Conservative incompetence – I documented how the current recovery in the British economy is the slowest in 300 years of economic cycles.

I further noted in relation to the self-proclaimed status of the British Chancellor as the champion of austerity, that a major reason that the British economy is showing any growth at all is because Osborne was unable to inflict as much policy austerity as he claimed he would have liked when he set out in the June 2010 Fiscal Statement.

The on-going and rising deficits have supported spending in the UK and given it some life. Please read my blog – Who are the British that are living within their means? – for more discussion on this point.

We have more data today to validate that point.

The problem, however, is that the growth is being motivated by unsustainable growth in private credit – again. And if the projected spending cuts in years two and three of the forward estimates come to fruition, Britain will quickly return to recession.

Remember the British Chancellor of the Exchequer George Osborne’s second fiscal statement on March 23, 2011. The economy was still being supported by the fiscal deficits that the previous government had allowed to grow in the face of the crisis, which emerged in late 2007, early 2008.

On that day, the Chancellor delivered his – Fiscal Statement – and early on in that Speech he said that he was introducing:

… a Budget that encourages enterprise. That supports exports, manufacturing and investment. That is based on robust independent figures. A Budget for making things not for making things up. Britain has a plan. And we’re sticking to it … So this is our plan for growth. We want the words: ‘Made in Britain’ ‘Created in Britain’ ‘Designed in Britain’ ‘Invented in Britain’ To drive our nation forward.

A Britain carried aloft by the march of the makers.

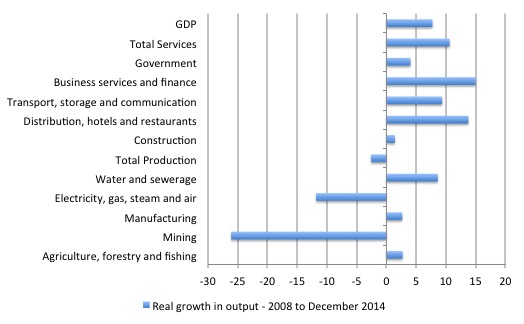

The following graph shows the total percentage change in each sector between the average of 2010 and the December-quarter 2014.

You can see that the ‘Makers’ are not marching much or for that matter making much with Total Production declining over the course of the Conservative government by 2.6 per cent while services have expanded by 10.6 per cent.

Taken from the previous peak, the construction and manufacturing sectors have still not recovered the ground lost during the downturn.

Within the services, it is Business Services and Finance that have led the way (15 per cent growth), reflecting the fact that when Osborne abandoned the austerity push in the 2012 Fiscal Statement as the British economy was going backwards again, the stimulus was largely given to the finance and real estate sectors.

It was clear that by 2013, the UK government had abandoned that strategy and instead were hoping that the housing sector would generate (temporary) growth. More about which later.

Please read my blog – The March of the Makers – out! – for more discussion on this point.

Sectoral Balances

The other missing reality compared to the Conservative narrative is the missing-in-action export led recovery.

Export growth has been pathetic over the last 4 years even and net exports have been negative since 2012. The Office of Budget Responsibility in its – Economic and fiscal outlook – March 2015 – states that:

The current account deficit remains wide by historical standards. It increased to around 6 per cent of GDP in the third quarter of 2014, the second largest quarterly deficit in National Accounts data stretching back to 1955.

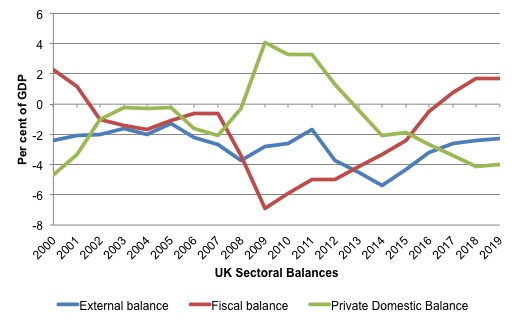

The following graph shows the sectoral balances from the financial years 2000-01 to 2019-20, with the estimates from 2014-15 being the OBR projections inherent in the current Fiscal Statement.

For a tutorial on the balances framework please read – Sectoral balances – Part 1 and Sectoral balances – Part 2 and Sectoral balances – Part 3.

You can see that during the crisis the rise in the fiscal deficit (red line) as a per cent of GDP supported to the conservative strategy of the private domestic sector which went into surplus – partly because investment spending fell but also because the household saving ratio rose.

The fiscal projections show that that external deficit will converge at around 2 per cent of GDP (currently close to 6 per cent) and as the fiscal position goes into projected surplus, the private dissaving (overall) accelerates.

In other words, the growth impetus into the future from now is increased private sector indebtedness. This trend began in 2013.

It makes a mockery of the claims in the June 2010 ‘Budget Report’ that:

Over the past decade, economic growth in the UK has been driven by the accumulation of unsustainable levels of private sector debt and rising public sector debt.

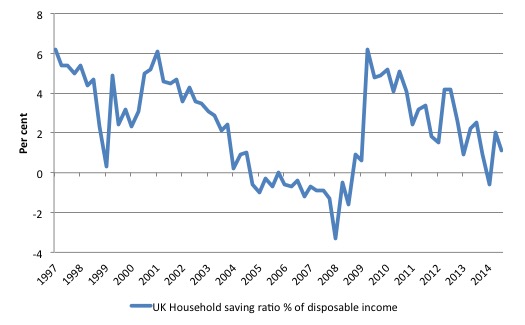

The following graph shows the Household saving ratio as a % of disposable income after adjusting for pension equity from the March-quarter 1997 to the September-quarter 2014.

The ratio is now heaving back into the territory that preceded the GFC when Britain was bingeing on private credit and driving housing prices up.

That strategy will prove to be unsustainable.

According to the most recent British ONS – House Price Index – housing price inflation was -0.9 per cent in 2011, then rose to 1.6 per cent in 2012 and 3.5 per cent in 2013.

This ONS graphic – Comparison of regional house price indices before and after the financial crisis shows what has been happening in 2014.

The false austerity narrative

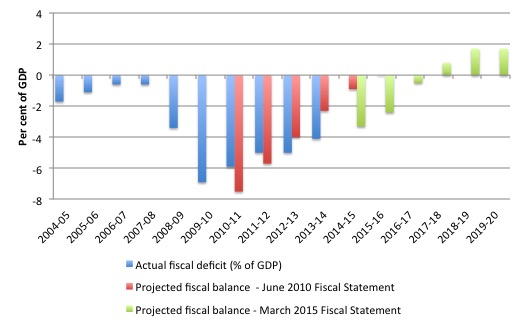

The following graph shows why the austerity narrative is a myth. The blue bars are the actual fiscal deficit as reported by the British – Office for National Statistics.

The red bars are the projected fiscal deficits that the newly elected Cameron government outlined in the – June 2010 Fiscal Statement.

The green bars are the projected fiscal deficits outlined in yesterday’s 2015 Fiscal Statement.

The planned austerity as at June 2010 which framed the Conservatives electoral appeal was by 2012-13 abandoned. You can see they were forecasting a balanced fiscal position by 2015-16 back then. The reality will be very different.

According to the projections in the June 2010 Fiscal Statement, the deficit should have been about £37 billion (see Page 72 of the 2010 fiscal documents). The current deficit is still around 4 per cent of GDP which is about £90 billion – that is £53 billion higher than it was projected to be about now.

That £53 billion is a large flow of spending that is supporting growth.

The ONS tell us that:

From April to December 2014, the central government net cash requirement (CGNCR) was £87.1 billion; an increase of £18.9 billion compared with the same period in 2013/14.

That is an expansionary fiscal move.

The self-employed trend

Then there is the employment story.

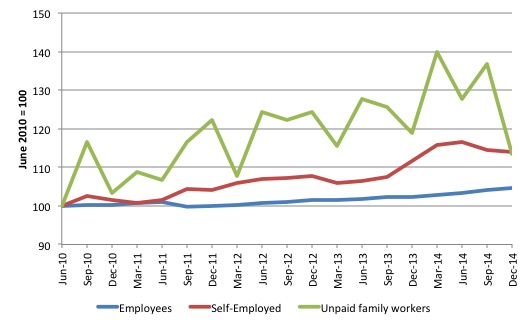

The following graph shows the growth in employment since the June-quarter 2010 (just after the Conservatives were elected) until the December-quarter 2014.

Total growth employees has been a miserly 5.8 per cent overall while the growth in self-employed and unpaid family workers has been 14 and 13.3 per cent, respectively.

The majority of the self-employed are working part-time. Many of these jobs are low pay and insecure. This is not a robust labour market despite the number of jobs that have been ‘created’ since the Tories took over.

Conclusion

I have not had time yet to fully consider all the nuances of the Fiscal Statement and the related research. I will over time have more to say.

But the overwhelming message is that the British government has been lying about its self-declared austerity champion status. It kept running deficits and then brought in spurious initiatives (like the Funding for Lending in 2012 and the 2013 housing subsidies) which allowed the economy to return to some modest growth.

That strategy is unsustainable and if you examine the projections for the next three years you will see that if the Government really does engage in a substantial fiscal shift to cut the deficit, the return to recession will come sooner rather than later.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Surprise,surprise! The British Chancellor and the British PM tell lies. In case anyone has not noticed, politics has always been engaged (at an organised level) in lying, evasion, distortion, manipulation and spin. it is in the nature of the political animal to do so, and it is driven by ideology.

The lying fiends. Watching bbc works it amazes me how simple the economic discussions are. It’s all about Janet Yellen removing the word “patient” in regards to interest rates. They won’t talk about anything at all relating to reality. It’s bizarre the world we live In and the sever lack of understanding if economics tgat mainstream media is willing to share. It’s propaganda at the highest level. I’m still not sure if it’s deliberate or just groupthink that’s out of control. *sigh* at humans collective stupidity.

Thanks as always for your blog bill.

When you have the Shadow Secretary for Work and Pensions (Rachel Reeves) stating “We are not the party of people on benefits. We don’t want to be seen, and we’re not, the party to represent those who are out of work.”

This from a Labour MP who supposedly represents Leeds West constituency which contains two of the poorest and most deprived wards in the whole of Leeds with ‘significantly poorer outcomes’ according to Leeds Council research.

That this individual hasn’t been hauled over the coals for this comment, has retained her ministerial position and will be reelected in May by the very same people she has just said she doesn’t represent.

Is it any wonder nothing changes?

I agree with Neil Wilson. What we get from UK politicians of all political persuasions on austerity and related subjects is such an unmitigated load of garbage that I cannot be bothered listening to it. But congratulations to Bill for going thru the details.

These politicians would not be able to get away with this garbage so easily, if it wasn’t for the hordes of economists who support their statements. Just as we speak of the MSM, I think we need to popularise the MSE – the MainStreamEconomists. These are the “economists” who appear in the MSM and mouth the same old rubbish about “balanced budgets, returning to surplus, retiring debt”, etc.

Jobless data sure looks like they were implementing maximum austerity that did not result in rising unemployment rates until 1.5 years before election: http://www.bbc.com/news/10604117

And they talk a lot about austerity, while at the same time keeping budget deficits second highest in Europe, over twice the average it seems: https://rwer.files.wordpress.com/2015/03/deficit.png

“I documented how the current recovery in the British economy is the slowest in 300 years of economic cycles.”

And yet, according to L.H..

“But, on the same basis, the recent recovery has actually been slightly faster than during Thatcher’s hey-day.”

http://www.telegraph.co.uk/finance/comment/liamhalligan/8672677/Why-Chancellor-George-Osborne-must-not-flinch-from-carrying-out-his-austerity-plan.html

Then came the ‘austerity’ measures?

” . . . reflecting the fact that when Osborne abandoned the austerity push in the 2012 Fiscal Statement as the British economy was going backwards again, the stimulus was largely given to the finance and real estate sectors.”

And G.O. had a ‘stroke of luck’?

“One economist, Alan Clarke at Scotiabank, says the compensation payments have been more successful at stimulating the U.K. economy than quantitative easing. U.K. lenders have already paid £11.5 billion ($18.7 billion) to millions of customers, and have set aside another £7.3 billion for future payments.

But the payments are not just creating one-off windfalls: the PPI industry is also creating much-needed employment.

As we report over on WSJ.com, claims have been coming in at such a clip that it’s created tens of thousands of new jobs to handle them.”

http://blogs.wsj.com/moneybeat/2013/10/04/how-a-banking-scandal-is-bolstering-britains-economy/

To add to Neil’s statement about Rachel Reeves, I have been told by more than one of her constituents how good she is. And about why she hasn’t been sacked or had the whip, I read the other day a comment from one of Miliband’s worker bees that he is experiencing mental conflicts about which path to go down. There are not only conflicts within the Labour Party, they also exist within his own mind. Add to that a neoclassically minded Shadow Chancellor and you have a recipe for confusion and uncertainty.

Having said that, he did well in responding to the budget statement. And in his comments, he mentioned, and physically pointed to, a table in the published budget that wasn’t even alluded to by Osborne in his speech about the further cuts that had the jaws of the front bench dropping. It was obvious that none of them had read the Budget statement itself and, moreover, hadn’t been adequately informed about what was in it.

Bill,

The latest budget included 1st time buyer discounts (as they are buying at the highest prices) & top ups to their tax free deposit building accounts – the help to buy continues apace!

“And G.O. had a ‘stroke of luck’?”

Quite a few. London Olympics, Royal Weddings, Lots of baby boomers cashing in their final salary pensions. Quite a lot of early retirements

And the biggest one of all was this strange unwritten agreement across the UK economy not to let people become unemployed. Whether that is a result of labour protection legislation or some sense of solidarity is difficult to tell, but essentially it meant that unemployment benefit was privatised and we saw the impact in the productivity figures.

Help to sell not to buy 😉

http://markwadsworth.blogspot.co.uk/2015/03/that-was-then-this-is-now.html?m=1

More stupidity.

“the stimulus was largely given to the finance and real estate sectors.”

I believe this is known as “rebalancing the economy” (towards FIRE and higher rents and land prices.)

I have no formal economics training, but have been educating myself in MMT. I find parallels in this blog to my country, NZ’. Here my take.

We too have a government hell bent on achieving surpluses. Despite this, current predictions for this financial year suggest they will produce a deficit of about $500M. Our growth rate is an impressive 3%, mostly generated on the back of activity occurring in Christchurch, where the city that was devastated by earthquakes 4 years ago is being reconstructed.

Our Current account is currently running a deficit to end of Dec 2014 of 7.8 Billion (3/3% GDP). I believe this means that the Private Sector will run a deficit of about 7 billion this year, presumably by willingly expanding private debt on back of all the “good” news above.

The political discourse and the media commentary could be transported from NZ to UK without changing a word.

For year 2014 IEA

UK electricity consumption down 5 %

Nat gas consumption down 8.5%

Huge electricity surpluses flowing from France ( electricity consumption -6.1%)

No need to invest (add costs) when the eurozone keeps on giving.

But we are seeing obvious signals of massive thermodynamic decline which is exposing the inherent waste of capitalistic production in especially vivid colours.

I am no economist and still struggling to work out how the overall false deficit generates ‘a large flow of spending that is supporting growth’ according to this extensive research in Billy’s ‘Modern Monetary Theory … macroeconomic reality’. All we are most certain of, is that the past and current financial – markets, business communities and banks are generally always happy to foot the bill for even excessive government spending (albeit for some few major taxpayers).

Where the false economy arises in my opinion, when there exists a failure of these major tax-evading corporations to not pay their fair share, the government then pursues the poorest in society whilst supporting the wealthiest – distributing national wealth heinously scrupulous. Moreover, when the government is only repaying the interest rates on their loans, the debt in itself cannot reduce. We must blame the government for selling off its real wealth and assets to foreign business corporations over the last five decades that austerity has has continually kept small business and people in poverty. Britain now thrives on what other than international trade and temporary business incentives to keep interest loan repayments afloat?. One of the biggest areas of government spending is on its security forces to protect their military defences, MPS and the Queen.

The only way out of this mess is to have a revolution or vote for the fringe parties who at least do not fabricate the truth of the deficit and make the poorest suffer. More cuts to welfare is not acceptable and forces people further into poverty, so does employing too many ‘middle management’ in the NHS where administration costs exceed the wages of many decent nurses for instance.