I grew up in a society where collective will was at the forefront and it…

Wage rises are required – real wages must grow in line with productivity

There was an interesting article in the UK Guardian last weekend (March 29, 2015) – Why falling inflation is a false pretext for keeping wages low – which examined wage trends in the UK and the validity of the argument that “Falling inflation now provides employers with a pretext for keeping wage settlements low”. Employer groups never support wage increases and are continually trying to suppress real wages growth below productivity growth so that they can enjoy a greater share of national income. As part of my research to discover the nature of the ideological shift accompanying the emergence of Monetarism as the dominant policy paradigm I have been examining wage distributions. This is part of a book I will complete next year (fingers crossed) on the demise of the political left. In this blog we examine the shifting relationship between labour productivity growth and real wages growth since 1960. The results are illuminating and open up a broad research front about which I will write more as time passes.

I have considered the shift in national income distribution in other previous blogs:

1. There is a class warfare and the workers are not winning.

2. Massive real wage cuts will not improve growth prospects.

3. The origins of the economic crisis.

4. Redistribution of national income to wages is essential.

5. Declining wage shares undermine growth.

Distributional shifts towards profits of the magnitude we have seen since the 1980s are damaging to economic growth and financial stability.

The wage share was constant for a long time during the Post Second World period and this constancy was so marked that Kaldor (the Cambridge economist) termed it one of the great “stylised” facts. So real wages grew in line with productivity growth which was the source of increasing living standards for workers.

The productivity growth provided the “room” in the distribution system for workers to enjoy a greater command over real production and thus higher living standards without threatening inflation.

Since the mid-1980s, the neo-liberal assault on workers’ rights (trade union attacks; deregulation; privatisation; persistently high unemployment) has seen this nexus between real wages and labour productivity growth broken. So while real wages have been stagnant or growing modestly, this growth has been dwarfed by labour productivity growth.

As a result, the wage shares in most nations have been falling. Where has the real income gone? To the profit share!

The declining wage share and the resulting credit binge in many nations were clearly causal in creating the global financial crisis. The mainstream economists believed that the markets were efficient and that there would be no problems with placing an increasing proportion of real income into the hands of the Casino economy.

The problem that arises is if the output per unit of labour input (labour productivity) is rising so strongly yet the capacity to purchase (the real wage) is lagging badly behind – how does economic growth which relies on growth in spending sustain itself? This is especially significant in the context of the increasing fiscal drag coming from the public surpluses or stifled deficits which squeezed purchasing power in the private sector since the late 1990s.

In the past, the dilemma of capitalism was that the firms had to keep real wages growing in line with productivity to ensure that the consumption goods produced were sold. But in the lead up to the crisis, capital found a new way to accomplish this which allowed them to suppress real wages growth and pocket increasing shares of the national income produced as profits. Along the way, this munificence also manifested as the ridiculous executive pay deals and Wall Street gambling that we read about constantly over the last decade or so and ultimately blew up in our faces.

The trick was found in the rise of “financial engineering” which pushed ever increasing debt onto the household sector. The capitalists found that they could sustain purchasing power and receive a bonus along the way in the form of interest payments. This seemed to be a much better strategy than paying higher real wages.

The household sector, already squeezed for liquidity by the move to build increasing federal surpluses were enticed by the lower interest rates and the vehement marketing strategies of the financial engineers.

The financial planning industry fell prey to the urgency of capital to push as much debt as possible to as many people as possible to ensure the “profit gap” grew and the output was sold. And greed got the better of the industry as they sought to broaden the debt base. Riskier loans were created and eventually the relationship between capacity to pay and the size of the loan was stretched beyond any reasonable limit. This is the origins of the sub-prime crisis.

So the dynamic that got us into the crisis is present again and with fiscal austerity emerging as the key policy direction the welfare of our economies is severely threatened. This is a dramatic failure of government oversight.

The UK Guardian article cited at the outset bears on this topic.

Larry Elliott, the journalist, notes that:

Earlier this year Shinzo Abe, Japan’s prime minister, told his country’s business elite that he wanted them to take a brave decision. He wanted them to raise wages.

A month or so later David Cameron followed suit. Addressing the chambers of commerce, the prime minister said it was time for Britain to have a pay rise. Two prime ministers, same message, one subtle difference: in Japan there is evidence that executives took notice of what Abe said, while in the UK we are still waiting for the long-anticipated pick up in pay.

His hypothesis is that in Japan they have a “corporatist model” which means that if the Governments speaks, business listen.

The UK went ‘individualistic’ in the Thatcher years and has lost that solidarity to pursue national interest in a collective fashion.

Larry Elliott says that the corporate sector in the UK believes that the stagnation in real wages and tendency to deflation (not yet realised) is temporary, and that once unemployment falls further, the tighter labour market will push wages growth up.

He contests that claim and argues that:

The relationship between unemployment and wage pressures appears to have changed, so that a much bigger drop in joblessness is needed to provide upward pressure on earnings.

One of the reasons for this is that with rising casualisation and underemployment, labour market wage pressure is no longer driven by unemployment or the lack of it alone.

I covered that argument in this blog – Why did unemployment and inflation fall in the 1990s? – where I reported on research we were doing to augment the Phillips curve (the relationship between unemployment and inflation) with the impact of underemployment.

This underemployment suppression effect is well entrenched in many nations now.

Larry Elliott quotes a recent study which concludes that:

Employers now call the shots not unions. “Once workers would have been looking for the first opportunity to press for higher wages; now employers are looking at pay rises as a last resort” …

He rejects the argument that “Falling inflation now provides employers with a pretext for keeping wage settlements low” as being dangerous and likely to “embed the idea that disinflationary pressures are stronger or longer lasting than previously imagined, that’s the start of a deflationary spiral right there”.

Which is the problem that Japan has become caught up in, given its extremely low wages growth over the last few decades.

And that is one reason why the Japanese PM is urging higher wage settlements.

Larry Elliott thinks the British government should push for:

… bigger increases in minimum wages; they could insist that those companies bidding for state contracts pay a living wage; they could make it easier for trade unions to organise and bargain collectively. Like Abe in Japan, they could tilt the playing field back in favour of labour.

That would require a major ideological shift!

Some historical evidence

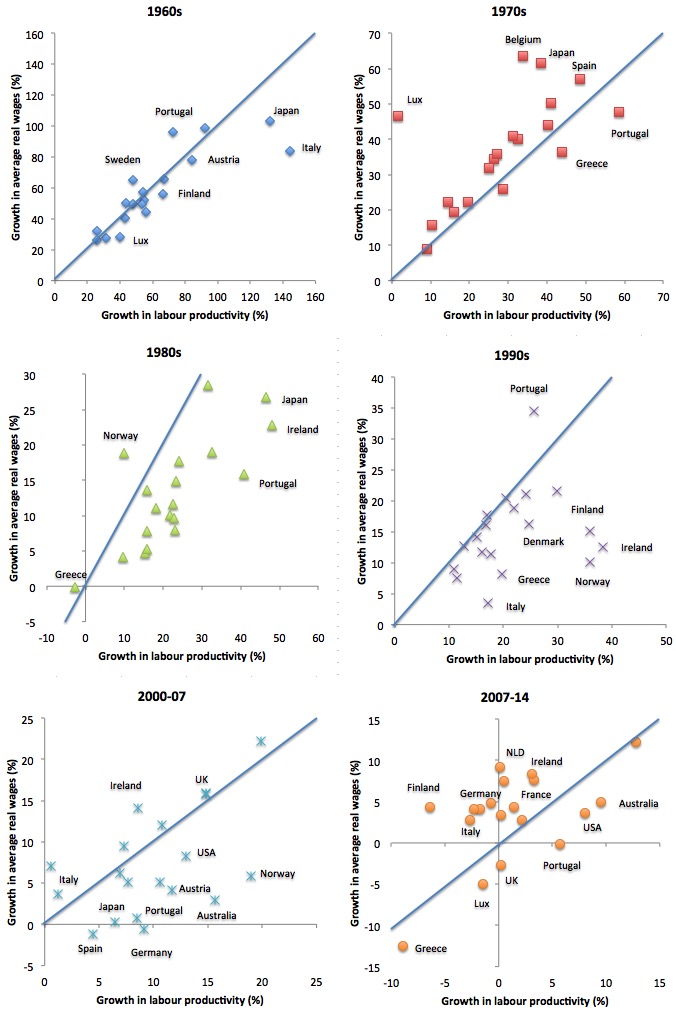

The following graph shows the growth in labour productivity (%) for various time periods since 1960 (using AMECO database) on the horizontal axis and the corresponding growth in average real wages (%).

The straight blue line is the 45 degree line where labour productivity growth and real wages growth are equal. This is a special point in the graph because it marks the point where real unit labour costs (RULCs) and the wage share are constant.

To understand that point, here is a quick refresher.

Labour productivity (LP) is the amount of real GDP per person employed per period (it can be measured in hours worked or persons employed). Using the symbols already defined this can be written as:

LP = GDP/L

so it tells us what real output (GDP) each labour unit that is added to production produces on average.

The real wage is the purchasing power equivalent on the nominal wage that workers get paid each period. To compute the real wage at the macroeconomic level, we need to consider two variables: (a) the nominal wage (W) and the aggregate price level (P).

Workers do not determine the real wage. The nominal wage (W) is paid by employers to workers is determined in the labour market by the contract of employment between the worker and the employer.

The price level (P) is determined in the goods market by the interaction of total supply of output and aggregate demand for that output although there are complex models of firm price setting that use cost-plus mark-up formulas with demand just determining volume sold.

The point is that the real wage is the outcome of forces prevailing in two separate (though linked) areas of the economy and a worker cannot easily ‘cut’ his or her own real wage even if they accept work at a lower nominal wage.

The wage share is the share of GDP in nominal terms that the workers command. So it is defined as:

Wage share = (W.L)/P.GDP

W.L is total labour costs, and P.GDP is real GDP valued by the price level.

As I explain in this blog – Saturday Quiz – June 14, 2014 – answers and discussion – it is easy (for someone familiar with algebra) to rearrange the wage share expression in another way.

So Wage share = (W.L)/P.GDP is equivalent to (W/P)/(GDP/L)

that is, the real wage (W/P) divided by labour productivity (GDP/L).

That expression is also equivalent to RULCs.

RULCs are the ratio of real wages to labour productivity and if they are falling it means that productivity growth is rising faster than real wages and the economy is redistributing national income towards profits (usually).

The RULC measure is equivalent to the share of wages in national income. If it falls, workers have a lower share in GDP or National Income.

So in terms of the graph that follows, any observations below the 45 degree line indicate a falling wage share or RULCs and any observation above the 45 degree line indicate a rising wage share or RULCs.

This graph gives you a relative sense of what happened over the decades.

The neo-liberal period is touted as the exemplar of ‘efficiency’ but in general labour productivity growth fell (on average) and real wage suppression became more pronounced as the dominance of the ideology spread.

The ‘Keynesian’ period of the 1960s produced far more balanced and superior outcomes in almost every nation.

To see the graph in more detail I have produced the following decade by decade composite graph. The straight line is the 45 degree line, which looks different in each graph because the scales alter.

The trend over the decades has been obvious.

In the 1960s, with some exceptions, the wage shares were stable and real wages grew in proportion with labour productivity.

By the 1970s, the wage shares were increasing in most nations, but not alarmingly.

Then the neo-liberal attack on trade unions began in earnest and wage shares fell in most of the nations shown with large declines in some.

Labour productivity was no longer being passed on in the form of real wages growth and RULCs were falling sharply in some nations.

By the 1990s, this pattern was entrenched.

In the period before the GFC began, the suppression of real wages became more pronounced in many nations, particularly, Spain, Portugal, Germany, Australia, and Austria, while productivity growth was generally slower.

It is hard to blame trade unions and excessive wage demands for what happened in 2008.

In the period since the crisis, wage shares have risen slightly but that is a typical situation in a major recession because labour productivity slows more than real wage growth.

Greece and the UK (and Luxemburg) have cut real wages sharply in the period since the crisis.

Government conspiratorial attacks on workers

A related theme I have been examining is the extent to which we can document the conspiratorial attacks on workers by their governments.

On March 6, 1984, the UK National Coal Board, which managed all the British coal mines, announced it would close 20 ember mines as part of its plan to rationalise the public subsidies to the mining sector. 20,000 jobs were to go in this move.

The leader of the National Union of Miners (NUM), Arthur Scargill immediately challenged the government by saying that their true aim was to close 70 mines, which would decimate employment, and, clearly, weaken the union.

The Tory government and the NCB Chairman Ian McGregor (a Thatcher appointment) denied Scargill’s claim and assused him of misleading the workers and the public.

The facts belied the honesty of the Government’s and its appointed henchman. Last year, the British National Archives released cabinet documents relating to this period, which clearly showed that the Government was planning to close the 5 mines all along and cut 64,000 jobs overall.

It also wanted the discussion about job losses and mine closures to be kept totally secret. A key document informing a meeting meeting attended by just seven people (including Thatcher, McGregor, the Chancellor, Employment and Energy Secretaries), began with the following statement:

It was agreed that no record of this meeting should be circulated.

Another document tightly circulated one week later among the same cast said that “there should be”:

… nothing in writing which clarifies the understandings about strategy which exist between Mr MacGregor and the secretary of state for energy.

It was a conspiracy to undermine the working class in Britain and destroy the unions.

The BBC radio journalist who covered the story at the time commented when the archives were opened that “If this document had ever emerged during the strike it would have been devastating for the credibility of Margaret Thatcher”. Why? Because she lied about the intentions of the Government and its part in leading the conspiracy.

You can refresh your memories of that particular piece of bastardry by reading this BBC exploration of the Archives release (January 3, 2014) – Cabinet papers reveal ‘secret coal pits closure plan’

Conclusion

The Japanese Prime Minister is clearly on the right track. A fundamental shift in our attitudes to national income distribution is required to allow consumption growth to be driven by real wages growth and to stay in line with productivity growth (so that inflation is kept in check).

That ideological shift is one part of an overall shift in economic policy thinking that is required to allow economies to grow again in a stable fashion without the extreme income inequality that is now entrenched.

Otherwise, a new crisis will emerge – and given the existing private debt levels, the next crisis will be worse than the GFC.

What are the chances of that sort of shift in thinking? Not great at the moment. The policy making circles are thick with neo-liberal Groupthink aka arrogant blindness.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Dear Bill

If wage growth falls behind productivity growth, employment can remain strong if there is a boom in the export sector. That is what has happened in Germany and some other European countries. The fall in domestic demand due to wage restraint was compensated by an increase in demand from the foreign sector. Needless to say, such a policy can only be practiced by some countries since it is a policy of exporting unemployment.

Regards. James

Bill –

I don’t think I’ve ever before disagreed more completely with what you’ve written!

More government spending can produce sufficient growth however low the wage share is. And there are two extremely good reasons why the past situation of a high wage share at the expense of the profit share is undesirable:

• A higher proportion of the value is now the intellectual property. Because of this there’s a much higher concentration of profits in the top 1% of companies, so thhe same overall wage share would be a much higher burden on the other businesses now than it was then.

• The low profit share and high wage share combination was conclusively proven to be undesirable by the events of the 1970s, as it left very little room to absorb external price shocks, and therefore led to very high inflation.

And what do you think the Thatcher government should’ve done about the NUM? They were striking in an attempt to force the government to waste resources keeping lossmaking coal mines open! And considering they’d already brought down the Heath government, surely the Thatcher government’s sneakiness was entirely justified? Don’t unions that make conspiratorial attacks on their own country’s governments deserve to be destroyed?

Bill, Same ballpark….different slant….

President Obama/Council of Economic Advisers:

According to Webster’s–a lie is a statement that is not in conformity with truth, or fact, specifically…..

We can’t seem to give up the lie in America that “the market can provide anybody wanting a job, with a job”–in spite of it being patently false, and it becomes a fraud-given the Republican agenda….

For instance, with this belief, singularly, driving our job creation policies in America-only ONCE since WW II has this resulted in an unemployment rate below 3%–in 1953—and a truism under this policy is that if the market fails-the jobless are out of luck [with 2008-9 as Exhibit One]!

So to reverse engineer this-let’s take two circumstances….every politician since the beginning of the republic has promised good jobs for everyone, if elected…i.e., it is a given that “work” is a high priority for Americans-indeed, 86% of Americans believe “anybody wanting to work should be able to find a job.”

Secondly, our current method for job creation is incapable of creating enough jobs……even at the “official” rate of 5.5%, we still have almost 9 million jobless as we inch downward [and given “automation”, alone, fewer and fewer jobs are being created going forward]-the question is: What steps do we need to take to meet the will of the American people?

It is a “What works?” question….

Obviously there are other influences that come into play-but the only question, here, is:

With Jobs the #1 priority for Americans, and our current method for job creation incapable of creating enough jobs- How do we fix this?

And the irony is that we have a “legal” fix that makes America truly “exceptional”–nowhere else in the OECD do they have this law, and 10% UE is common in the Eurozone, 25% in Greece and Spain-specifically, 15 U.S. Code § 3101 with a “legal authorization” to limit our UE rate to “3%”, tomorrow–i.e., at no time should our UE rate in America exceed 3%–

Unemployment is a NO ONE WINS, the jobless lose, civility loses, and the market loses….but, aside from the persistence of Congressman Conyers-i.e., deficit-neutral HR 1000, etc.-this obvious solution to our unemployment crisis might as well not exist….

Ref: FULL EMPLOYMENT IS A PRO-MARKET CONCEPT, and THE NEIGHBOR-TO-NEIGHBOR JOB CREATION ACT [hereafter NTN], Amazon

Jim Green, Democrat opponent to Lamar Smith, 2000

James Schipper –

I suggest that your view fails at the macroeconomic level (where this post is pitched). I have reason to think export-led growth = import-led recession, sometimes with exactness (can you find a fair counter-example pair of economies?). If so, what you propose is a zero-sum game (at best). I’m firmly with Dr M that the benefits of productivity should be distributed (equitably?) *within* the economy that produces them.

Aidan Stanger –

I think you’re forgetting that organised labour was a response, and what has been can be again. There may be a window of opportunity to choose how better to handle it, and enable it to evolve in useful ways. eg I understand the German model did and does function better than most.

Dr M –

Productivity is I think a key issue for the 21stC, so I’m grateful for the opportunity to comment. The “raw” Okun plots I’ve seen (incl yours for Australia) indicate that the normal long-term increase in GDP is around 1 pc pa (at const employment). Those same plots indicate that the direct effect of this is 2-3 pc pa unemployment (at const GDP). To the extent that GDP reflects productivity, this suggests that persistent increase in unemployment can only be avoided by “sufficient” continued investment in real wealth-creation (ie new stuff); whether by public or private sector is debatable but o/t here. I think the data you present are consistent with a scenario of progressive shrinkage of the wage-share from around 1980, coupled with underinvestment (lag ~10 years?), systematically reducing opportunities for productivity growth; ie that “the economy” has “managed” this productivity dynamic largely by suppressing it. We shouldn’t re-invent the wheel, but we cannot un-invent it; this trend must falsify ideas of economic equilibrium, so needs exposure.

“The low profit share and high wage share combination was conclusively proven to be undesirable by the events of the 1970s, as it left very little room to absorb external price shocks, and therefore led to very high inflation.”

In the UK perhaps. I don’t think it has to be like this. Bill just wants wages to grow with productivity to keep the wage share constant. I think (Bill?)

Anyway, I would have capital and wage shares, but also consider the monopoly (capital) share, like revenues from land rent, which has risen. So you can use LVT to cut income taxes and give a citizens income to increase labour share and reduce monopoly part of the capital share.

“A higher proportion of the value is now the intellectual property. Because of this there’s a much higher concentration of profits in the top 1% of companies, so thhe same overall wage share would be a much higher burden on the other businesses now than it was then.”

Aiden Stanger

The top companies in the world are: Exxon, Apple, Google, Wal-Mart, Microsoft, General Electric, Johnson & Johnson, IBM, Chevron, Pfizer, Shell, Toyota, Samsung, HSBC. How important is intellectual property to these businesses? Exxon, Chevron and Shell get their value by digging it out of the ground. Wal-Mart, General Electric and Johnson & Johnson maintain their value by market power. HSBC take advantage of their transnational financial sector status to leverage multi time-zone competence in renting money to the world. HSBC make money by rent and arbitrage, therefore they do not create value.

This leaves Apple, Google, Microsoft, General Electric, IBM, Pfizer, Toyota and Samsung. What these companies all have in common is technology investment by government. They have all taken advantage of massive amounts of government technology research. The amount of government research used in Apple products has been covered ad nauseam so let’s take another example.

Google is as good an example as any. The internet was developed by Darpa. The WWW was developed at Cern. HTML, the web server and the browser were all developed at Cern. The first search engine was developed in a British university. The research behind Google’s initial algorithm was funded by a research grant. Google keep their algorithm secret because it is not covered by intellectual property law. The law in the USA considers algorithms to be mathematics and in the US mathematics is legally a natural law. The logic of US law is that the laws of thermodynamics cannot be covered by intellectual property and neither can any mathematical logic. Google bought a huge number of patents on the open market but it uses these patents to gain market power. If anyone sues them over patents then there is an immediate countersuit. Google’s money making strategy is to grab as much data as it can and then process it in secret.

I can tell you a similar story for every company in the list. They all rely on government research to survive. Intellectual property laws have precisely the opposite effect to the one described by your post. Intellectual property laws are historic accidents with no underlying logic. They do not protect creators of technology. Intellectual property laws strengthen the market power of those who can afford to do business while carrying the inefficient, unproductive and expensive costs of legal staff. This situation creates a first mover disadvantage for technologists in the private sector. Most technology is created by governments and then given to the private sector. As technology is a common good, the benefits should not accrue to a wealthy elite.

I agree with Bill’s analysis. I would go further and argue that something needs to be done about the question of who owns the means of production. Bill would probably answer that he is looking at realistic solutions for the short to mid-term and he might be right. The question of who owns the means of production is still considered completely off-limits under current ideology. However, in the long run this question will still have to be addressed.

The real and final contradictions of capitalism are linked. One, the capitalist system by its internal logic is committed to endless growth. After each crisis, it grows to new heights. Competing capitals (companies, firms, conglomerates, transnationals) must grow or be supplanted by capitals which will grow. Two, a system predicated on endless growth cannot continue in a finite environment (the earth’s biosphere). A levelling to a more or less steady-state or oscillating plateau is required or else overshoot and collapse will occur.

The elite (who are the oligarchs and their elite managers, econocrats and technocrats) control the bulk of the decisions about production because they essentially own and control the productive apparatus. The elite are insulated from the common human pain and the environmental negative externality damage of their decisions. Only the disempowered people feel that pain and damage immediately. The elite, insulated from this pain and damage in their financially and physically protected enclaves of great wealth, are free and indeed attracted and induced to inflict ever worsening human pain and environmental damage. They don’t see it, they don’t feel it and when they do they ignore or deny it. Only worker democratic control of the means of production can deliver production decisions which balance economic, social and environmental requirements.

“A fundamental shift in our attitudes to national income distribution is required to allow consumption growth to be driven by real wages growth and to stay in line with productivity growth (so that inflation is kept in check)”.

How to bring this about is surely a key question.

I would like to see governments legislate to enforce this as I doubt if it would happen otherwise. Visionary thinkers could make it happen.

Peter Shaw –

I’m not forgetting that at all. But when a union is totally unreasonable, I don’t think it can be redeemed. And if you think it can, I’d like to know how!

Bob –

No, not just in the UK, but throughout the world. Everywhere had high inflation in the 1970s and it resulted in the widespread abandonment of Keynesian economics.

Nope. Not in all countries.

I distinctly remember some oily shaped fluid rising in price during that time period.

In all western countries. If you think you have a counterexample, tell us!

The rising oil price was the cause of the problem. There was at that time a high dependence on oil, and the jump in oil prices was the main external price shock I was referring to. With a lower wage share and a higher profit share, the economy could have absorbed the shock far more easily and avoided the high inflation.