I have been a consistent critic of the way in which the British Labour Party,…

Lacklustre British economy all down to Conservative incompetence

Not much has really changed in Capitalism despite massive changes in technology, market reach, etc. The underlying behaviour is stable – chicanery, bleeding the state for all the advantages that capital can gain while berating workers (unions) and welfare recipients, rigging financial, share and product markets, lying about state finances to gain more access to public handouts, lobbying government to socialise risk and privatise profit, paying off politicians to engage in corrupt behaviour where conflicts of interest dominate, and more. I was reading about the famous – South Sea Company – today, which was a public-private partnership that began life in 1711. It was a total scam and had all of the elements noted above. Its collapse in 1720 on the back of corrupt and incompetent behaviour (GFC anyone?) caused one hell of a recession in the UK. The only thing it managed to do in any significant volume with its trade monopoly between the UK and South America was to buy and sell slaves and, even then, it messed that up financially – quite aside from the repugnance of the venture itself. Interestingly, its collapse led to the rise of the, then private Bank of England, becoming the Government’s banker, and ultimately, its dominant role as the central bank. What is the contemporary relevance of the South Sea Bubble and its collapse? There are many angles that resonate in the current debate, but the point today is that the current recovery in the UK is the slowest in 300 years – that is since the glacial recovery following the collapse of the South Sea Company. And George Osborne thinks he is a champion.

The other point that should be made in relation to the self-proclaimed champion status of the British Chancellor is that a major reason that the British economy is showing any growth at all is because Osborne was unable to inflict as much policy austerity as he claimed he would have liked.

The on-going and rising deficits have supported spending in the UK and given it some life. Please read my blog – Who are the British that are living within their means? – for more discussion on this point.

But back to the South Sea Bubble. David Blanchflower’s Op Ed in the Independent (August 3, 2014) – Britain has taken longer to recover from recession than at any time since the South Sea Bubble – provides the analysis for the claim made in the introduction.

He wrote:

I have to admit I was wrong in claiming that the recovery that has occurred under the Coalition is the slowest and worst in one hundred years. I should have said worst in 314 years. I severely understated how bad things have actually been.

Such modesty.

This paper from the Bank of England (it appeared in the Quarterly Bulletin, Fourth Quarter 2010) – The UK recession in context – what do three centuries of data tell us? – by the authors Sally Hills and Ryland Thomas examines the data since 1970 in some detail and is worth a read if you are historically motivated.

The database they rely on was produced by academics Stephen Broadberry, Bruce Campbell, Alexander Klein, Mark Overton and Bas van Leeuwen. It supported a 2011 paper – British Economic Growth, 1270-1870: An Output -based Approach. You can download the final data – HERE.

You can read the paper yourselves if you are interested in their methodology.

I augmented their dataset with another available from the Bank of England – Three Centuries of Data – which took me to 1947.

I then spliced in the current data set provided by the Office of National Statistics – National Accounts data back to 1948.

At each splice point, you just create and equivalence (set the values equal) and then convert the following data according to the ratio required to create that equivalence. It is easy to just convert everything into index number form, which is what I did.

So the UK economy – measured in real GDP terms – is now 441 times larger than it was in 1270.

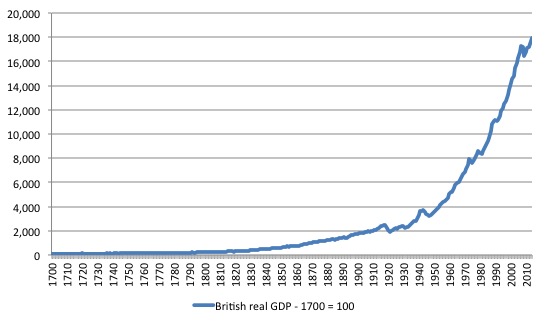

For interest, the following graph depicts the complete real GDP series from 1700 to 2014 (with the index = 100 at 1700). The take-off after the Industrial Revolution is quite remarkable as are the major recessions (that you see) after that period.

The graph back to 1270 is dead flat (relative) and not unlike the period 1700 to 1770 (or thereabouts).

The most recent recession was clearly fairly sizeable.

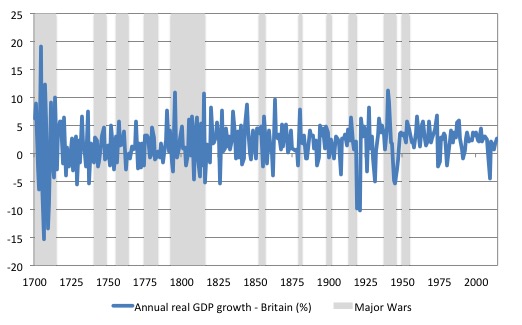

The next graph shows the annual real GDP growth for the UK from 1700 to 2014 (blue line) with the major war periods displayed in grey bars. Clearly war-time periods are associated with significant real GDP growth volatility.

David Blanchflower commented in the Op Ed cited above on a similar graph (I have updated his graph):

It shows that the UK economy has, almost always, bounced back rapidly from peacetime recessions, without a two-year flatlining period. Wars are different. Ryland Thomas from the Bank of England has kindly pointed out to me that over the last three hundred years you can find one peacetime episode where it does take output over seven years (on an annual basis) to recover to its pre-crisis peak. This is following the South Sea Bubble in 1720. Then the next one of comparable duration is Mr Osborne’s three hundred years later.

So that is the basis of the claim that the current recovery is the worst (peace-time) recovery in 300 years and the South Sea Bubble was a very large crash indeed.

After the collapse in 1720 (peak = 100), the British economy took until 1736 to catch up to the previous peak. As an aside, it plunged immediately back into recession again in 1737, which set it back for a futher 5 years.

We can look a little more closely at the quarterly data which is available from 1924 (so we leave out the 1920-24 recession).

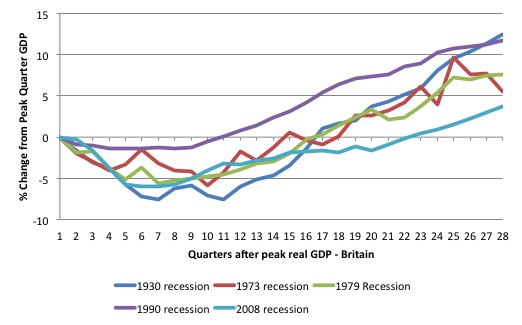

The following graph plots the percentage deviation from the peak in the quarters following the respective peaks before the major recessions in the C20th and C21st.

The 1930 Great Depression involved a larger negative deviation from the peak in the March-quarter 1930 (maximum deviation was -7.6 per cent recorded in the September-quarter 1932 before recovery slowly began).

But the recovery path in the current recession is clearly much slower than the four other major recessions. The maximum deviation in the current episode was 6 per cent (receorded in both the June- and September-quarters 2009).

You can also see that in the previous four episodes, the quarterly real GDP losses relative to the peak quarter ended well before the current episode. In the 1930 and 1979 recessions it took 16 quarters to stop the losses, in the 1973 recession it took 17 quarters, and in the 1990 recesssion it took just 10 quarters.

In the current recession it took 22 quarters and the rebound has been much more subdued.

Current UK growth performance

Stepping into the current period, Eurostat published the latest – National Accounts estimates – for the December-quarter 2014 last week (as noted in my discussion of Greece yesterday).

How did the UK fare relative to the rest of Europe?

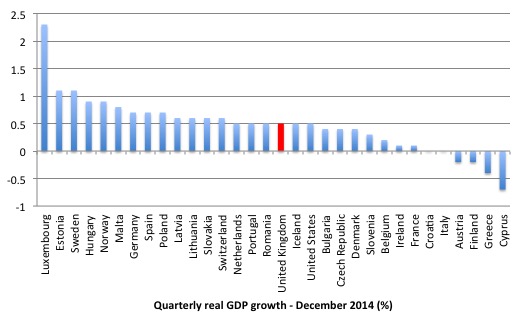

The following graph shows the real GDP growth in the December-quarter 2014 as published by Eurostat. The estimates for Luxembourg, Malta and Iceland are the third-quarter 2014 because no data was published for them for the December-quarter.

Grand old Britain is ranked in the middle of the field with Portugal, the Netherlands, Romania, Iceland, and the USA.

It cannot claim that it has to obey fiscal rules imposed by the European Commission because it has its own currency.

It cannot claim that the Eurozone is holding it back – the usual denial – because meany Eurozone nations are performing better than it.

That excuse came up again yesterday in the Guardian article (March 9, 2015) – UK uncertainties are real, but nothing saps confidence like the eurozone.

It wasn’t the Government saying that this time but a British business executive.

Greece should be worried about the Eurozone and its ridiculous constraints but the British economy is able to chart its own course.

It can stimulate domestic demand to the limit of available real resources should its export markets falter (which they have despite the substantial depreciation in the pound since the recession).

So the lacklustre performance is all down to the failure of the British conservative government to manage the economy properly.

It talked it into submission early in its tenure with all the rubbish about public deficits and debt explosions and cannot find its way to increase the discretionary deficit such that growth accelerates and becomes less reliant on further private debt accumulation, which was the problem in the first place.

Conclusion

We will give the last word to David Blanchflower from his Independent Op Ed:

No other Chancellor since records were kept has been so incompetent in extending a recession for so long. It isn’t that the depth of the shock was unprecedented. So the triumphalism over restoring output to its starting level is totally misplaced, especially given that the economy was growing along the typical growth path of 20th-century recoveries when the Coalition inherited it in 2010. I do recall saying in June 2010 “this Budget will kill the recovery stone dead”. And it did. Not since the South Sea Bubble in 1720 has Britain seen such a prolonged recovery.

But the other important point that Blanchflower doesn’t acknowledge (and implicitly denies) is that the only reason there has been any recovery at all is because the British government has not been able to implement the fiscal austerity that it preached in June 2010 just after it was elected.

Had their initial plans been realised, then the fiscal position would have killed the recovery stone dead.

The recovery has been, in fact, a weak Keynesian-style one. It would have been much better if they hadn’t tried to cut the fiscal deficit at all. Then the UK would have enjoyed a much more robust return to economic growth.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

It’s lacklustre for sure, but it has been employment rich – at least in terms of keeping people off the statistics list.

The UK didn’t get an unemployment blow out, the participation rate barely changed and the employment level has never been higher – thanks to high net immigration and extended participation of the elderly.

So it’s been ‘good enough’ for the majority of people, which is all you need to get elected. Hence why the pretenders to the throne is busy aping the same nonsense Cameron and Osborne put out.

There are still over four million people without work that want it, but they are a small enough and fragmented enough set of people that they can be ignored, if not vilified.

There’s a definite air of resigned depression around at the moment. Whether that is a function of the state of things or a very grey and dreary winter we shall see.

Kunstler’s Klusterfuck blog today resonates with appropriate derision on the economist’s blind march towards destruction.

http://kunstler.com/clusterfuck-nation/truthinesslessness/?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+clusterfucknation+%28Clusterfuck+Nation%29

“The whole Zirp and QE game can be boiled down to a basic wish to get something for nothing, that is, prosperity where nothing of value is created”

It reinforces your view that the ruling class is incompetent, venal and destructive. Not just the conservatives either.

Bill, Three Centuries of Data and the ONS link take one to the same Excel spreadsheet, from 1948 to 2014.

If O&C win the next election, O has promised to implement the austerity plans that he has been unable to so far. That won’t just kill the recovery, it may also kill various public institutions and services stone dead. This is the most dangerous government I have seen in a long while — they are worse than Thatcher.

Warner of the Telegraph contends that British productivity is not just lacklustre; it is a national disgrace.

http://www.telegraph.co.uk/finance/economics/11452004/British-productivity-is-a-national-disgrace.html.

Dear Larry (at 2015/03/10 at 20:31)

Thanks for the scrutiny. Fixed now.

best wishes

bill

The conservatives also helped worsen the early 80s recession with monetarist policies that failed and the early 90s where they pegged the pound to the DM and ran up a land price bubble.

All around, not too competent.

The major govt ran big deficits in the mid 90s after the smaller ERM recession.

“””Osborne was unable to inflict as much policy austerity as he claimed he would have liked.”””

Would be interesting to see an interview with Osborne where he says ‘how’ this austerity is supposed to induce growth. Why (using hard data) it would work. Its a monumental fail that he’s allowed to get away with this in 2015.

http://www.independent.co.uk/news/uk/home-news/britains-divided-decade-the-rich-are-64-richer-than-before-the-recessionwhile-the-poor-are-57-poorer-10097038.html

I notice Warner skips over the issue of near infinite cheap labour and the demand suppressing nature of the flexible labour market and onto the usual right wing hobby horse of exports.

They never explain why foreign demand is so much better than domestic demand, nor where it will come from given that external demand rises only with world income. The External Sector is treated like some Deus Ex Machina by this philosophy.

Yet you can improve domestic demand simply by making sure that everybody has a job and an income.

You have policy control over domestic demand. None at all over external demand.

The UK problem is primarily a dependency on cheap labour and immigration (aka stealing skills and investment from other countries), rather than forcing the system to deal with expensive labour and invest to replace it with robotics – with the slack taken up by a Job Guarantee.

Conservatives promised to balance budged by the end of their term. They failed.

Conservatives promise to balance budged by the end of next government term, if they win elections.

Are we witnessing a pattern emerge here? Every election cycle they promise to balance budged and fail, so the aim to balance budget is transferred to the next government. This gives sufficient political cover to implement budget cuts from here to eternity. If the electorate does not support shrinking of the state in this manner, doesn’t this run against very idea of the democracy?

Neil, they don’t understand accounting

Imports = Exports

Me thinks the demon bank goes back a bit further.

To the introduction of orange capitalism a few decades before.

I have a Irish view of banking unions and in particular the British prototype.

Apparent failure is in fact a wild success.

Famine increases wealth concentration and is not a mistake.

Webster Tarpley view of England is closer to the mark although I disagree in some respects.

Its however certainly the Venice of the north and its been that way since Henry VIii

Small and insignificant on the surface yet all European trade pivots on its London fulcrum.

The current England has little or no connection to the distributed power system of the period between the 2 usury eras some 500 to 800 years ago now.

Its a island built on a grand illusion.

Ballot democracy holds little value within a centralised state system of concentration,

Bill is wildly incorrect.

Its not the poor feeble state losing to vested interests.

This is the Venetian view of the state as a quasi religious entity.

The state is the bank and the bank is the state.

The oligarchs work hand in glove with the British state and have done so since at least the enclosure period.

«the British economy is able to chart its own course. It can stimulate domestic demand to the limit of available real resources should its export markets falter (which they have despite the substantial depreciation in the pound since the recession).»

That “the limit of available real resources” is the big deal of course. Some MMT proponents or supporters seem to give the impression that periods in which the economy is performing well below the “the limit of available real resources” are common and that the reason in that case is simply lack of liquidity that constrains spending needlessly.

Perhaps in the past, when central banks deliberately suppressed liquidity to keep wages from growing, but recent “balance sheet” recessions are a different thing, as they happen as “available real resources” have been destroyed by bad industrial or financial decisions causing insolvencies. Pettis has written quite a bit about that not so uncommon case.

Even more importantly there are deep crises in which the main issue for a country is not lack of liquidity or even the destruction of capital but there is an import constraint, where real resources are not available because foreign vendors don’t accept the promises to pay from that country.

For now the “recovery” as it were in the UK is fueled by imports of “real resources” and foreign vendors still accept the promises to pay by UK buyers.

Overall the “growth strategy” in many countries (importers or exporters) in the past 30 years has been “vendor financing” (what some people cleverly misrepresent as a “savings glut”). For Greece “vendor financing” has ended, and for the UK “vendor financing” is still booming. We’ll see how that ends…

«Yet you can improve domestic demand simply by making sure that everybody has a job and an income.»

That works splendidly well if domestic supply goes up in the same amount; as our blogger says, “to the limit of available real resources”.

Indeed lucky is the country that has everything in overabundance and does not need to import food, oil, durable goods, raw materials, electronic components, etc… 🙂

The tragedy here is the failure of the Labour Party to get this message across to the UK voters. The shadow Chancellor, Ed Balls, is still talking about a version of “austerity lite”. No wonder the Party’s traditional supporters are notable by their absence

@Michael

Labour has simply been exposed as yet another bankers party.

In Ireland we had a Fabian socialist broadcaster who tress passed on property.

His argument for its seizure by the Bank of Ireland was that it was plush !!!!

At least live on TV there was no legal nuance.

Simply because the banking system engages in a deflationary seizure of assets policy it can be justified in stealing anything and everything.

These false socialists then use to working class mob as a tool against independent capital.

Whenever things goes tits up for banks they always revert to fascist Cromwellian like police states.

Its always predictable,

Only parties worth voting for are parties who challenge their monopoly of credit.

Most certainly that is not the labour party , the hint is in the name you see.

«the failure of the Labour Party to get this message across to the UK voters»

Of please, to repeat the obvious: for various reasons, including spontaneous gerrymandering due to suburbunization, most of UK voters are in “safe” seats of either major party and what message they get is irrelevant.

The only UK voters that matter are those in marginal seats, and who are swing voters, that is bribable.

Those UK voters that matter are usually middle income and upper, middle aged and older, property owning women, and what they want has been the same for decades: large tax-free property price increases, higher property rents, lower wages and lower benefits for men especially if young and from the north.

That is the policy that George Osborne has describe as his version of austerity, “My approach is to be fiscally conservative but monetarily active”.

I’ll repost here an excellent summary of what politics in the UK and Australia has been for decades:

http://en.wikipedia.org/wiki/Homes_for_votes_scandal

«a political scandal in the United Kingdom which involved the selling off of council housing to potential Conservative voters»

«Eight wards were selected as ‘key wards’ – in public it was claimed that these wards were subject to particular ‘stress factors’ leading to a decline in the population of Westminster. In reality, secret documents showed that the wards most subject to these stress factors were rather different, and that the eight wards chosen had been the most marginal in the City Council elections of 1986.»

«In services as disparate as street cleaning, pavement repair and environmental improvements, marginal wards were given priority while safely Labour and safely Conservative parts of the city were neglected.»

and the results was:

«In 1990, the Conservatives were re-elected by a landslide victory in Westminster, increasing their majority from 4 to 38. They won all but one of the wards targeted by Building Stable Communities policy. Porter stood down as Leader of the Council in 1991, and served as Lord Mayor of Westminster in 1991-2.»

“That works splendidly well if domestic supply goes up in the same amount;”

It works ‘splendidly well’ regardless – unless you subscribe to the idea that you need to keep a section of the population in penury so that others can live high on the hog.

It doesn’t matter whether the supply that goes up comes from a domestic or foreign source. Given the scrabble for export demand generated by neo-liberal thinking there will be plenty of takers.

Always remember that your currency is ‘foreign currency’ to another state, and the neo-liberals are desperate to earn it and hoard it for its own sake.

The persistent viewpoint of a single state when assessing economies leads to a load of bad thinking. No more so than the obsession with imports and exports. Switch the viewpoint to a whole world view and stimulation of real activity wherever it happens to be leads to less artificial anxiety.

Our new treasury Secretary has stated that he disagrees with the IMF that austerity does not work in some cases. He feels the austerity policies in Britain have worked well. Perhaps he has some totally different data? Or is it that he doesn’t work with data? (I think he spoke publicly at some venue).

«Switch the viewpoint to a whole world view and stimulation of real activity wherever it happens to be leads to less artificial anxiety.x

Obviously the whole world has no import or export constraints, and it is a splendid idea that «Given the scrabble for export demand generated by neo-liberal thinking» there is no effective import constraint for individual countries either, as foreign suppliers of commodities, services and manufactures are so generous, thanks to «neo-liberal thinking», despite there being ungrateful people like me who are appalled by neo-liberal thinking :-).

When I was pointing out that:

«Overall the “growth strategy” in many countries (importers or exporters) in the past 30 years has been “vendor financing”»

I was not aware of the marvellous idea that very generous exporters don’t impose an import constraint on demand in importer countries. Which largely amounts to saying that “vendor financing” can be expected to continue forever. Perhaps someone should tell Varoufakis, as he would be immensely relieved :-). Even better, someone should remind the countries that used to finance Greece’s imports :-).

Neil: The persistent viewpoint of a single state when assessing economies leads to a load of bad thinking.

Not to disagree with your thinking, your conclusions, which are MMT’s – I don’t – but this characterization of sources of bad thinking isn’t the best.

For Lerner used the “persistent viewpoint of a single state when assessing economies” and with him, I find this viewpoint easy to understand and generalize to the whole world and explain. From this viewpoint, the common mainstream error is not “single state thinking” but the opposite – global thinking done very badly. Just as badly as the mainstream thinks about single states. 🙂

Blissex: Some MMT proponents or supporters seem to give the impression that periods in which the economy is performing well below the “the limit of available real resources” are common

“They” – which includes really all MMT proponents or supporters, and many others besides, give this impression because such periods are very common. Reading billyblog should convince anyone that these periods are in fact the rule, not the exception in modern capitalist economies. For neoclassical econ is little more than the absurd claim that economies usually operate at the limit of available real resources.