Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – October 2, 2010 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

If there is more “money” in the economy its value declines.

The answer is Maybe.

The question is mostly false but there are situations (rare) where it could be true – so maybe.

The question requires you to: (a) understand the difference between bank reserves and the money supply; and (b) understand the Quantity Theory of Money.

The mainstream macroeconomics text book argument that increasing the money supply will cause inflation is based on the Quantity Theory of Money. First, expanding bank reserves will put more base money into the economy but not increase the aggregates that drive the alleged causality in the Quantity Theory of Money – that is, the various estimates of the “money supply”.

Second, even if the money supply is increasing, the economy may still adjust to that via output and income increases up to full capacity. Over time, as investment expands the productive capacity of the economy, aggregate demand growth can support the utilisation of that increased capacity without there being inflation.

In this situation, an increasing money supply (which is really not a very useful aggregate at all) which signals expanding credit will not be inflationary.

So the Maybe relates to the situation that might arise if nominal demand kept increasing beyond the capacity of the real economy to absorb it via increased production. Then you would get inflation and the “value” of the dollar would start to decline.

The Quantity Theory of Money which in symbols is MV = PQ but means that the money stock times the turnover per period (V) is equal to the price level (P) times real output (Q). The mainstream assume that V is fixed (despite empirically it moving all over the place) and Q is always at full employment as a result of market adjustments.

In applying this theory the mainstream deny the existence of unemployment. The more reasonable mainstream economists admit that short-run deviations in the predictions of the Quantity Theory of Money can occur but in the long-run all the frictions causing unemployment will disappear and the theory will apply.

In general, the Monetarists (the most recent group to revive the Quantity Theory of Money) claim that with V and Q fixed, then changes in M cause changes in P – which is the basic Monetarist claim that expanding the money supply is inflationary. They say that excess monetary growth creates a situation where too much money is chasing too few goods and the only adjustment that is possible is nominal (that is, inflation).

One of the contributions of Keynes was to show the Quantity Theory of Money could not be correct. He observed price level changes independent of monetary supply movements (and vice versa) which changed his own perception of the way the monetary system operated.

Further, with high rates of capacity and labour underutilisation at various times (including now) one can hardly seriously maintain the view that Q is fixed. There is always scope for real adjustments (that is, increasing output) to match nominal growth in aggregate demand. So if increased credit became available and borrowers used the deposits that were created by the loans to purchase goods and services, it is likely that firms with excess capacity will react to the increased nominal demand by increasing output.

The mainstream have related the current non-standard monetary policy efforts – the so-called quantitative easing – to the Quantity Theory of Money and predicted hyperinflation will arise.

So it is the modern belief in the Quantity Theory of Money is behind the hysteria about the level of bank reserves at present – it has to be inflationary they say because there is all this money lying around and it will flood the economy.

Textbook like that of Mankiw mislead their students into thinking that there is a direct relationship between the monetary base and the money supply. They claim that the central bank “controls the money supply by buying and selling government bonds in open-market operations” and that the private banks then create multiples of the base via credit-creation.

Students are familiar with the pages of textbook space wasted on explaining the erroneous concept of the money multiplier where a banks are alleged to “loan out some of its reserves and create money”. As I have indicated several times the depiction of the fractional reserve-money multiplier process in textbooks like Mankiw exemplifies the mainstream misunderstanding of banking operations. Please read my blog – Money multiplier and other myths – for more discussion on this point.

The idea that the monetary base (the sum of bank reserves and currency) leads to a change in the money supply via some multiple is not a valid representation of the way the monetary system operates even though it appears in all mainstream macroeconomics textbooks and is relentlessly rammed down the throats of unsuspecting economic students.

The money multiplier myth leads students to think that as the central bank can control the monetary base then it can control the money supply. Further, given that inflation is allegedly the result of the money supply growing too fast then the blame is sheeted home to the “government” (the central bank in this case).

The reality is that the central bank does not have the capacity to control the money supply. We have regularly traversed this point. In the world we live in, bank loans create deposits and are made without reference to the reserve positions of the banks. The bank then ensures its reserve positions are legally compliant as a separate process knowing that it can always get the reserves from the central bank.

The only way that the central bank can influence credit creation in this setting is via the price of the reserves it provides on demand to the commercial banks.

So when we talk about quantitative easing, we must first understand that it requires the short-term interest rate to be at zero or close to it. Otherwise, the central bank would not be able to maintain control of a positive interest rate target because the excess reserves would invoke a competitive process in the interbank market which would effectively drive the interest rate down.

Quantitative easing then involves the central bank buying assets from the private sector – government bonds and high quality corporate debt. So what the central bank is doing is swapping financial assets with the banks – they sell their financial assets and receive back in return extra reserves. So the central bank is buying one type of financial asset (private holdings of bonds, company paper) and exchanging it for another (reserve balances at the central bank). The net financial assets in the private sector are in fact unchanged although the portfolio composition of those assets is altered (maturity substitution) which changes yields and returns.

In terms of changing portfolio compositions, quantitative easing increases central bank demand for “long maturity” assets held in the private sector which reduces interest rates at the longer end of the yield curve. These are traditionally thought of as the investment rates. This might increase aggregate demand given the cost of investment funds is likely to drop. But on the other hand, the lower rates reduce the interest-income of savers who will reduce consumption (demand) accordingly.

How these opposing effects balance out is unclear but the evidence suggests there is not very much impact at all.

For the monetary aggregates (outside of base money) to increase, the banks would then have to increase their lending and create deposits. This is at the heart of the mainstream belief is that quantitative easing will stimulate the economy sufficiently to put a brake on the downward spiral of lost production and the increasing unemployment. The recent experience (and that of Japan in 2001) showed that quantitative easing does not succeed in doing this.

This should come as no surprise at all if you understand Modern Monetary Theory (MMT).

The mainstream view is based on the erroneous belief that the banks need reserves before they can lend and that quantitative easing provides those reserves. That is a major misrepresentation of the way the banking system actually operates. But the mainstream position asserts (wrongly) that banks only lend if they have prior reserves.

The illusion is that a bank is an institution that accepts deposits to build up reserves and then on-lends them at a margin to make money. The conceptualisation suggests that if it doesn’t have adequate reserves then it cannot lend. So the presupposition is that by adding to bank reserves, quantitative easing will help lending.

But banks do not operate like this. Bank lending is not “reserve constrained”. Banks lend to any credit worthy customer they can find and then worry about their reserve positions afterwards. If they are short of reserves (their reserve accounts have to be in positive balance each day and in some countries central banks require certain ratios to be maintained) then they borrow from each other in the interbank market or, ultimately, they will borrow from the central bank through the so-called discount window. They are reluctant to use the latter facility because it carries a penalty (higher interest cost).

The point is that building bank reserves will not increase the bank’s capacity to lend. Loans create deposits which generate reserves.

The reason that the commercial banks are currently not lending much is because they are not convinced there are credit worthy customers on their doorstep. In the current climate the assessment of what is credit worthy has become very strict compared to the lax days as the top of the boom approached.

Those that claim that quantitative easing will expose the economy to uncontrollable inflation are just harking back to the old and flawed Quantity Theory of Money. This theory has no application in a modern monetary economy and proponents of it have to explain why economies with huge excess capacity to produce (idle capital and high proportions of unused labour) cannot expand production when the orders for goods and services increase. Should quantitative easing actually stimulate spending then the depressed economies will likely respond by increasing output not prices.

So the fact that large scale quantitative easing conducted by central banks in Japan in 2001 and now in the UK and the USA has not caused inflation does not provide a strong refutation of the mainstream Quantity Theory of Money because it has not impacted on the monetary aggregates.

The fact that is hasn’t is not surprising if you understand how the monetary system operates but it has certainly bedazzled the (easily dazzled) mainstream economists.

The following blogs may be of further interest to you:

- Money multiplier and other myths

- Islands in the sun

- Operation twist – then and now

- Quantitative easing 101

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

Question 2:

If national government public works expenditure funds the construction of a road and then the government tears the road up again and rebuilds it, there is no net gain in employment and national income the second time round.

The answer is False.

This question allows us to go back into J.M. Keynes’ The General Theory of Employment, Interest, and Money. Many mainstream economics characterise the Keynesian position on the use of public works as an expansionary employment measure as advocating useless work – digging holes and filling them up again. The critics focus on the seeming futility of that work to denigrate it and rarely examine the flow of funds and impacts on aggregate demand. They know that people will instinctively recoil from the idea if the nonsensical nature of the work is emphasised.

The critics actually fail in their stylisations of what Keynes actually said. They also fail to understand the nature of the policy recommendations that Keynes was advocating.

What Keynes demonstrated was that when private demand fails during a recession and the private sector will not buy any more goods and services, then government spending interventions were necessary. He said that while hiring people to dig holes only to fill them up again would work to stimulate demand, there were much more creative and useful things that the government could do.

Keynes maintained that in a crisis caused by inadequate private willingness or ability to buy goods and services, it was the role of government to generate demand. But, he argued, merely hiring people to dig holes, while better than nothing, is not a reasonable way to do it.

In Chapter 16 of The General Theory of Employment, Interest, and Money, Keynes wrote, in the book’s typically impenetrable style:

If – for whatever reason – the rate of interest cannot fall as fast as the marginal efficiency of capital would fall with a rate of accumulation corresponding to what the community would choose to save at a rate of interest equal to the marginal efficiency of capital in conditions of full employment, then even a diversion of the desire to hold wealth towards assets, which will in fact yield no economic fruits whatever, will increase economic well-being. In so far as millionaires find their satisfaction in building mighty mansions to contain their bodies when alive and pyramids to shelter them after death, or, repenting of their sins, erect cathedrals and endow monasteries or foreign missions, the day when abundance of capital will interfere with abundance of output may be postponed. “To dig holes in the ground,” paid for out of savings, will increase, not only employment, but the real national dividend of useful goods and services. It is not reasonable, however, that a sensible community should be content to remain dependent on such fortuitous and often wasteful mitigations when once we understand the influences upon which effective demand depends.

So while the narrative style is typical Keynes (I actually think the General Theory is a poorly written book) the message is clear. Keynes clearly understands that digging holes will stimulate aggregate demand when private investment has fallen but not increase “the real national dividend of useful goods and services”.

He also notes that once the public realise how employment is determined and the role that government can play in times of crisis they would expect government to use their net spending wisely to create useful outcomes.

Earlier, in Chapter 10 of the General Theory you read the following:

If the Treasury were to fill old bottles with banknotes, bury them at suitable depths in disused coalmines which are then filled up to the surface with town rubbish, and leave it to private enterprise on well-tried principles of laissez-faire to dig the notes up again (the right to do so being obtained, of course, by tendering for leases of the note-bearing territory), there need be no more unemployment and, with the help of the repercussions, the real income of the community, and its capital wealth also, would probably become a good deal greater than it actually is. It would, indeed, be more sensible to build houses and the like; but if there are political and practical difficulties in the way of this, the above would be better than nothing.

Again a similar theme. The government can stimulate demand in a number of ways when private spending collapses. But they should choose ways that will yield more “sensible” products such as housing. He notes too that politics might intervene in doing what is best. When that happens the sub-optimal but effective outcome would be suitable.

So the answer is false. As long as the road builder is paying on-going wages to construct, tear up and construct the road again then this will be beneficial for aggregate demand. The workers employed will spend a proportion of their weekly incomes on other goods and services which, in turn, provides wages to workers providing those outputs. They spend a proportion of this income and the “induced consumption” (induced from the initial spending on the road) multiplies throughout the economy.

This is the idea behind the expenditure multiplier.

The economy may not get much useful output from such a policy but aggregate demand would be stronger and employment higher as a consequence.

The following blogs may be of further interest to you:

Question 3:

If there was a fiscal rule imposed such that the national government had to balance its budget at all times then this would also eliminate the sensitivity of the budget outcome to the automatic stabilisers.

The answer is False.

The final budget outcome is the difference between total federal revenue and total federal outlays. So if total revenue is greater than outlays, the budget is in surplus and vice versa. It is a simple matter of accounting with no theory involved. However, the budget balance is used by all and sundry to indicate the fiscal stance of the government.

So if the budget is in surplus it is often concluded that the fiscal impact of government is contractionary (withdrawing net spending) and if the budget is in deficit we say the fiscal impact expansionary (adding net spending).

Further, a rising deficit (falling surplus) is often considered to be reflecting an expansionary policy stance and vice versa. What we know is that a rising deficit may, in fact, indicate a contractionary fiscal stance – which, in turn, creates such income losses that the automatic stabilisers start driving the budget back towards (or into) deficit.

So the complication is that we cannot conclude that changes in the fiscal impact reflect discretionary policy changes. The reason for this uncertainty clearly relates to the operation of the automatic stabilisers.

To see this, the most simple model of the budget balance we might think of can be written as:

Budget Balance = Revenue – Spending = (Tax Revenue + Other Revenue) – (Welfare Payments + Other Spending)

We know that Tax Revenue and Welfare Payments move inversely with respect to each other, with the latter rising when GDP growth falls and the former rises with GDP growth. These components of the budget balance are the so-called automatic stabilisers.

In other words, without any discretionary policy changes, the budget balance will vary over the course of the business cycle. When the economy is weak – tax revenue falls and welfare payments rise and so the budget balance moves towards deficit (or an increasing deficit). When the economy is stronger – tax revenue rises and welfare payments fall and the budget balance becomes increasingly positive. Automatic stabilisers attenuate the amplitude in the business cycle by expanding the budget in a recession and contracting it in a boom.

So just because the budget goes into deficit doesn’t allow us to conclude that the Government has suddenly become of an expansionary mind. In other words, the presence of automatic stabilisers make it hard to discern whether the fiscal policy stance (chosen by the government) is contractionary or expansionary at any particular point in time.

The first point to always be clear about then is that the budget balance is not determined by the government. Its discretionary policy stance certainly is an influence but the final outcome will reflect non-government spending decisions. In other words, the concept of a fiscal rule – where the government can set a desired balance (in the case of the question – zero) and achieve that at all times is fraught.

It is likely that in attempting to achieve a balanced budget the government will set its discretionary policy settings counter to the best interests of the economy – either too contractionary or too expansionary.

If there was a balanced budget fiscal rule and private spending fell dramatically then the automatic stabilisers would push the budget into the direction of deficit. The final outcome would depend on net exports and whether the private sector was saving overall or not. Assume, that net exports were in deficit (typical case) and private saving overall was positive. Then private spending declines.

In this case, the actual budget outcome would be a deficit equal to the sum of the other two balances.

Then in attempting to apply the fiscal rule, the discretionary component of the budget would have to contract. This contraction would further reduce aggregate demand and the automatic stabilisers (loss of tax revenue and increased welfare payments) would be working against the discretionary policy choice.

In that case, the application of the fiscal rule would be undermining production and employment and probably not succeeding in getting the budget into balance.

But every time a discretionary policy change was made the impact on aggregate demand and hence production would then trigger the automatic stabilisers via the income changes to work in the opposite direction to the discretionary policy shift.

You might like to read these blogs for further information:

Question 4:

The private domestic sector will always run a deficit (spend more than they earn) which is exactly equal to the external deficit, if the government balances its budget on average over the business cycle.

The answer is True.

This is a question about the sectoral balances – the government budget balance, the external balance and the private domestic balance – that have to always add to zero because they are derived as an accounting identity from the national accounts. The balances reflect the underlying economic behaviour in each sector which is interdependent – given this is a macroeconomic system we are considering.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I – S) + (X – M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

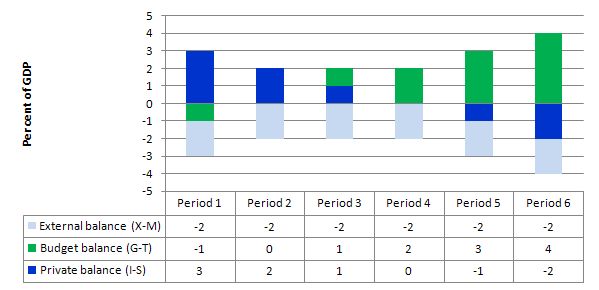

The following graph with accompanying data table lets you see the evolution of the balances expressed in terms of percent of GDP. I have held the external deficit constant at 2 per cent of GDP (which is artificial because as economic activity changes imports also rise and fall).

To aid interpretation remember that (I-S) > 0 means that the private domestic sector is spending more than they are earning; that (G-T) < 0 means that the government is running a surplus because T > G; and (X-M) < 0 means the external position is in deficit because imports are greater than exports.

If we assume these Periods are average positions over the course of each business cycle (that is, Period 1 is a separate business cycle to Period 2 etc).

In Period 1, there is an external deficit (2 per cent of GDP), a budget surplus of 1 per cent of GDP and the private sector is in deficit (I > S) to the tune of 3 per cent of GDP.

In Period 2, as the government budget enters balance (presumably the government increased spending or cut taxes or the automatic stabilisers were working), the private domestic deficit narrows and now equals the external deficit. This is the case that the question is referring to.

This provides another important rule with the deficit terrorists typically overlook – that if a nation records an average external deficit over the course of the business cycle (peak to peak) and you succeed in balancing the public budget then the private domestic sector will be in deficit equal to the external deficit. That means, the private sector is increasingly building debt to fund its “excess expenditure”. That conclusion is inevitable when you balance a budget with an external deficit. It could never be a viable fiscal rule.

In Periods 3 and 4, the budget deficit rises from balance to 1 to 2 per cent of GDP and the private domestic balance moves towards surplus. At the end of Period 4, the private sector is spending as much as they earning.

Periods 5 and 6 show the benefits of budget deficits when there is an external deficit. The private sector now is able to generate surpluses overall (that is, save as a sector) as a result of the public deficit.

So what is the economics that underpin these different situations?

If the nation is running an external deficit it means that the contribution to aggregate demand from the external sector is negative – that is net drain of spending – dragging output down.

The external deficit also means that foreigners are increasing financial claims denominated in the local currency. Given that exports represent a real cost and imports a real benefit, the motivation for a nation running a net exports surplus (the exporting nation in this case) must be to accumulate financial claims (assets) denominated in the currency of the nation running the external deficit.

A fiscal surplus also means the government is spending less than it is “earning” and that puts a drag on aggregate demand and constrains the ability of the economy to grow.

In these circumstances, for income to be stable, the private domestic sector has to spend more than they earn.

You can see this by going back to the aggregate demand relations above. For those who like simple algebra we can manipulate the aggregate demand model to see this more clearly.

Y = GDP = C + I + G + (X – M)

which says that the total national income (Y or GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

So if the G is spending less than it is “earning” and the external sector is adding less income (X) than it is absorbing spending (M), then the other spending components must be greater than total income.

Only when the government budget deficit supports aggregate demand at income levels which permit the private sector to save out of that income will the latter achieve its desired outcome. At this point, income and employment growth are maximised and private debt levels will be stable.

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 5 – Premium question:

This is the premium question for this week: Consumption adds to aggregate demand and imports drain aggregate demand. The marginal propensity to consume (MPC) is conceptually the extra consumption that is induced for every extra dollar of national income. The marginal propensity to import (MPM) is similarly the extra spending on imports that is induced for every extra dollar of national income. If the MPC and MPM both rise by 0.1 then the impact on aggregate demand for every new dollar of national income generated will be neutral.

The answer is False.

When there is an externally-motivated source of increased aggregate spending (say an injection of government spending or an autonomous increase in private investment), the economy will typically respond by increasing production which generates an equivalent increase in income. This situation relies on their being idle resources than can be brought into the production process and does not apply at full capacity.

So what is spent will generate income in that period which is available for use. The uses are further consumption; paying taxes and/or buying imports. We consider imports as a separate category (even though they reflect consumption, investment and government spending decisions) because they constitute spending which does not recycle back into the production process. They are thus considered to be “leakages” from the expenditure system.

So if for every dollar produced and paid out as income, if the economy imports around 20 cents in the dollar, then only 80 cents is available within the system for spending in subsequent periods excluding taxation considerations. We call this reaction the marginal propensity to import (MPM).

However there are two other “leakages” which arise from domestic sources – saving and taxation. Take taxation first. When income is produced, the households end up with less than they are paid out in gross terms because the government levies a tax. So the income concept available for subsequent spending is called disposable income (Yd).

To keep it simple, imagine a proportional tax of 20 cents in the dollar is levied, so if $100 of income is generated, $20 goes to taxation and Yd is $80 (what is left). So taxation (T) is a “leakage” from the expenditure system in the same way as imports are.

Finally consider saving. Consumers make decisions to spend a proportion of their disposable income. The amount of each dollar they spent at the margin (that is, how much of every extra dollar to they consume) is called the marginal propensity to consume (MPC). If that is 0.80 then they spent 80 cents in every dollar of disposable income.

So if total disposable income is $80 (after taxation of 20 cents in the dollar is collected) then consumption (C) will be 0.80 times $80 which is $64 and saving will be the residual – $26. Saving (S) is also a “leakage” from the expenditure system.

It is easy to see that for every $100 produced, the income that is generated and distributed results in $64 in consumption and $36 in leakages which do not cycle back into spending.

For income to remain at $100 in the next period the $36 has to be made up by what economists call “injections” which in these sorts of models comprise the sum of investment (I), government spending (G) and exports (X). The injections are seen as coming from “outside” the output-income generating process (they are called exogenous or autonomous expenditure variables).

Investment is dependent on expectations of future revenue and costs of borrowing. Government spending is clearly a reflection of policy choices available to government. Exports are determined by world incomes and real exchange rates etc.

For GDP to be stable injections have to equal leakages (this can be converted into growth terms to the same effect). The national accounting statements that we have discussed previous such that the government deficit (surplus) equals $-for-$ the non-government surplus (deficit) and those that decompose the non-government sector in the external and private domestic sectors is derived from these relationships.

So imagine there is a certain level of income being produced – its value is immaterial. Imagine that the central bank sees no inflation risk and so interest rates are stable as are exchange rates (these simplifications are to to eliminate unnecessary complexity).

The question then is: what would happen if government increased spending by, say, $100? In macroeconomics this question is answered by examining what it known as the expenditure multiplier. If aggregate demand increases drive higher output and income increases then the question is by how much?

The expenditure multiplier is defined as the change in real income that results from a dollar change in exogenous aggregate demand (so one of G, I or X). We could complicate this by having autonomous consumption as well but the principle is not altered.

Consumption and Saving

So the starting point is to define the consumption relationship. The most simple is a proportional relationship to disposable income (Yd). So we might write it as C = c*Yd – where little c is the marginal propensity to consume (MPC) or the fraction of every dollar of disposable income consumed. We will use c = 0.8.

The * sign denotes multiplication. You can do this example in an spreadsheet if you like.

Taxes

Our tax relationship is already defined above – so T = tY. The little t is the marginal tax rate which in this case is the proportional rate (assume it is 0.2). Note here taxes are taken out of total income (Y) which then defines disposable income.

So Yd = (1-t) times Y or Yd = (1-0.2)*Y = 0.8*Y

Imports

If imports (M) are 20 per cent of total income (Y) then the relationship is M = m*Y where little m is the marginal propensity to import or the economy will increase imports by 20 cents for every real GDP dollar produced.

Multiplier

If you understand all that then the explanation of the multiplier follows logically. Imagine that government spending went up by $100 and the change in real national income is $179. Then the multiplier is the ratio (denoted k) of the

Change in Total Income to the Change in government spending.

Thus k = $179/$100 = 1.79.

This says that for every dollar the government spends total real GDP will rise by $1.79 after taking into account the leakages from taxation, saving and imports.

When we conduct this thought experiment we are assuming the other autonomous expenditure components (I and X) are unchanged.

But the important point is to understand why the process generates a multiplier value of 1.79.

The formula for the spending multiplier is given as:

k = 1/(1 – c*(1-t) + m)

where c is the MPC, t is the tax rate so c(1-t) is the extra spending per dollar of disposable income and m is the MPM. The * denotes multiplication as before.

This formula is derived as follows:

The national income identity outlined in Question 4 is:

GDP = Y = C + I + G + (X – M)

A simple model of these expenditure components taking the information above is:

GDP = Y = c*Yd + I + G + X – m*Y

Yd = (1 – t)*Y

We consider (in this model for simplicity) that the expenditure components I, G and X are autonomous and do not depend on the level of income (GDP) in any particular period. So we can aggregate them as all autonomous expenditure A.

Thus:

GDP = Y = c*(1- t)*Y -m*Y + A

While I am not trying to test one’s ability to do algebra, and in that sense the answer can be worked out conceptually, to get the multiplier formula we re-arrange the previous equation as follows:

Y – c*(1-t)*Y + m*Y – A

Then collect the like terms and simplify:

Y[1-c*(1-t) + m] = A

So a change in A will generate a change in Y according to the this formula:

Change in Y = k = 1/(1 -c*(1-t) + m)*Change in A

or if k = 1/(1 -c*(1-t) + m)

Change in Y = k*Change in A.

]

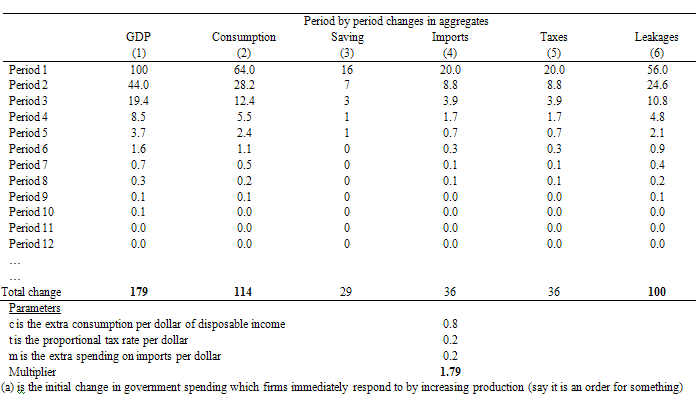

In the current example, the following spreadsheet table explains what is going on in terms of the economics.

So at the start of Period 1, the government increases spending by $100. The Table then traces out the changes that occur in the macroeconomic aggregates that follow this increase in spending (and “injection” of $100). The total change in real GDP (Column 1) will then tell us the multiplier value (although there is a simple formula that can compute it). The parameters which drive the individual flows are shown at the bottom of the table.

Note I have left out the full period adjustment – only showing up to Period 12. After that the adjustments are tiny until they peter out to zero.

Firms initially react to the $100 order from government at the beginning of the process of change. They increase output (assuming no change in inventories) and generate an extra $100 in income as a consequence which is the 100 change in GDP in Column [1].

The government taxes this income increase at 20 cents in the dollar (t = 0.20) and so disposable income only rises by $80 (Column 5).

There is a saying that one person’s income is another person’s expenditure and so the more the latter spends the more the former will receive and spend in turn – repeating the process.

Households spend 80 cents of every disposable dollar they receive which means that consumption rises by $64 in response to the rise in production/income. Households also save $16 of disposable income as a residual.

Imports also rise by $20 given that every dollar of GDP leads to a 20 cents increase imports (by assumption here) and this spending is lost from the spending stream in the next period.

So the initial rise in government spending has induced new consumption spending of $64. The workers who earned that income spend it and the production system responds. But remember $20 was lost from the spending stream so

the second period spending increase is $44. Firms react and generate and extra $44 to meet the increase in aggregate demand.

And so the process continues with each period seeing a smaller and smaller induced spending effect (via consumption) because the leakages are draining the spending that gets recycled into increased production.

Eventually the process stops and income reaches its new “equilibrium” level in response to the step-increase of $100 in government spending. Note I haven’t show the total process in the Table and the final totals are the actual final totals.

If you check the total change in leakages (S + T + M) in Column (6) you see they equal $100 which matches the initial injection of government spending. The rule is that the multiplier process ends when the sum of the change in leakages matches the initial injection which started the process off.

You can also see that the initial injection of government spending ($100) stimulates an eventual rise in GDP of $179 (hence the multiplier of 1.79) and consumption has risen by 114, Saving by 29 and Imports by 36.

In this case the change in the budget position would be (100-36) = $64 which has allowed private saving to rise. The implied current account deficit (with X fixed) would have increased a bit. A full model would introduce exchange rate effects. In this case, the exchange rate would likely fall a little (under the assumption of no change in autonomous X) which would stimulate X and reduce M a bit which would “crowd in” further income growth.

Further, inasmuch some imported inflation occurred (a tiny amount if any) then real interest rates would rise and might further stimulate output via investment. These additional effects are possible but probably fairly small in magnitude.

In general, the multiplier is larger the smaller the leakages. So the lower is the import leakage per dollar and the lower the taxation rate the larger the multiplier and the

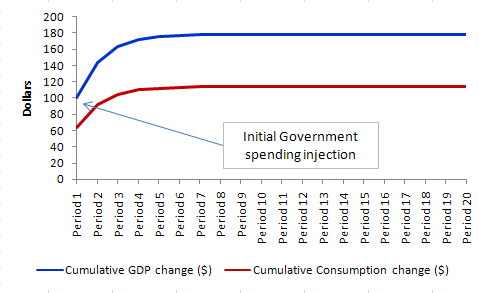

The following graph shows you the income and induced consumption adjustment path. The initial injection stimulates a lot of activity which then induces further consumption but in smaller and smaller amounts as the leakages impact in each period.

This type of approach also tells you that if the government was to cut taxes such that the households received the equivalent of $100 in extra disposable income the final multiplier would be lower because households will initially seek to save a proportion of the initial bonus. In other words, the first round injection would be less than the $100 and then the subsequent multiplier rounds would be smaller and the process would exhaust itself more quickly.

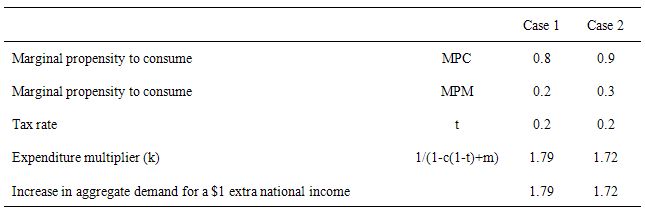

Now consider the two situations outlined in the question which are represented in the following Table.

You can see that when the MPC and the MPM both rise by 0.1 the expenditure multiplier falls from 1.79 (given starting values) to 1.72.

The reason? The fall in the MPM increases the drain on aggregate spending for every dollar of new national income by 10 cents. The rise in the MPC by 0.1 increases the induced consumption component by 10 per cent of every dollar of disposable income generated.

Given that the disposable income is less than total income (because of the positive tax rate), the increased import drain on spending is higher than the extra spending coming from the increased consumption and so the overall net impact of an extra dollar of national income falls.

The following blog may be of further interest to you:

Regarding the third question, the government of British Columbia, Canada (where I live) indeed passed a law requiring balanced budgets in 2000 or 2001. In late 2008 the government had to declare a “fiscal emergency to legalize what they said, prior to the 2009 election, would be a four hundred million dollar deficit.

After the election, which the governing “Liberal” party won, they had to admit that the actual deficit would be over a billion dollars, and was actually, depending on whether you used honest accounting methods or not, two or three billion.

They then brought in a “Harmonised sales tax” (which they had said in the runup to the election was “not on their radar”) mere weeks after re-election partly because the Federal government bribed them with an offer of a billion and a half dollars which they used to “reduce” (disguise, lie about) the official “deficit”. This tax had the effect of taking billions of dollars of the tax “burden” from the big mineral, timber, and oil exporters and placing it on the middle and lower classes.

They are now the least popular government in British Columbia’s history, mainly I think because they had become so arrogant that they did not bother to drum up a plausible lie before the election, so the populace has at last woken up to the realization that they are liars and robber barons. But it’s nearly three years to the next election.

Until people wake up the the scam that “neo liberal economics” are fleecing them with I am afraid that this will continue. The only hope I see is that people like you will start to be heard and actually listened to as the old “neo-liberal” ideologies drive us toward ruination. Keep up the good work. Please.

Hi Prof. Bill,

In the answer to question 5: Case 2 should be computed with MPM=0.1 (MPM falls by 0.1 as per your question),

therefore k=2.63. Am I wrong?

Regards.

Hi Bill, Got Question 4 wrong embarrasingly.

Sorry about the paraphrasing but it’s the only way I can get it.

Are the conclusions below correct particularly my understanding of ‘I’ being private wealth spent in the real economy?

1 GDP C + G + I + (X-M) Sources

2 GDP C + S + T Households

3 G + I + (X-M) = S + T

4 (G-T) = (S-I) + (M-X)

Govt sector Non Govt sector

Ignoring external sector

5 G-T = S-I

Budget deficit Net savings

From 5 If you reduce the budget deficit, private debt will increase unless

you can cause private wealth to be invested in the real economy.

From 1 GDP will not be maintained at its current level if Govt spending is

reduced unless private consumption, or private wealth invested in the real economy ,or the

difference between exports and imports, increases

From 2 GDP will not be maintained at its current level if Taxation is

increased unless private consumption increases or private debt increases (net savings fall)

From 1,2 & 5 The priority of Govt should be to pursue tax and spending policies

(that may mean a deficit) that maintains GDP and stabilizes private debt

From 4 At the very least it will need to run a budget deficit to fund any excess of

(imports – exports) if GDP is to be maintained

Thanks

Bill, question 4 “The private domestic sector will always run a deficit (spend more than they earn) which is exactly equal to the external deficit, if the government balances its budget on average over the business cycle.”

– the flip side of government deficits providing private domestic sectors with extra goodies from abroad must be an equivalent loss by trading partners in less well run poorer countries. I find the apparent lack of facing up to that on here very hard to stomache. I really hope I have got the wrong end of the stick about how expanding currencies work- but it comes across as very nasty at the moment.

Hi Bill

Not sure if my previous post got through. Might be a good thing if it didn’t but…..

Re Question 4

Would it be fair to describe ‘I’ as any increase in the amount of private wealth invested in the real economy during the year ?

Thanks

Bill when you say “The illusion is that a bank is an institution that accepts deposits to build up reserves and then on-lends them at a margin to make money. The conceptualisation suggests that if it doesn’t have adequate reserves then it cannot lend. So the presupposition is that by adding to bank reserves, quantitative easing will help lending.” It made me think about the UK bank Northern Rock. They lent to credit worthy borrowers using rolled over short term loans from interbank lending. They went bust as soon as the interbank lending dried up and they had to use the more expensive discount window penalty rate money from the central bank. Doesn’t that show a very strong dependency of lending to reserves in private banks? The point you make that bank lending also requires credit worthy customers is also very true. My understanding was that banks consider day traders to be very credit worthy. In that way QE was able to reinflate stock prices after the 2008 crash by providing a massive injection of reserves that were lent (and are still being lent) to leveraged day traders in stocks etc. It would be far to expensive for banks to just lend to daytraders from the discount window central bank money so they would not have been funding the stock market inflation were it not for QE.

Stone,

Here in US, prior to the collapse of the commercial paper market, it was estimated that that sort of funding was supplying a regular 1.5+ Trillion in credit to the US economy by late 2008, this was also known by some as the “shadow banking system”. When the US govt negligently let Lehman Bros. go to bankruptcy, this market completely disappeared and near instantaneously removed a major source of credit to the US economy with the resultant fall in output and employment.

When the Fed put together the first QE progam, this is where they got the number for the amount of assets (MBS) to buy. They ignorantly thought all they would have to do is buy 1.5T of assets and increase system reserves by this same amount, and then the banks would have an additional 1.5T to “lend out” and the banks would just swoop in to take over this credit market share from the now defunct commercial paper market; they would get recovery and help out their cronies at the same time, brilliant they thought! ….as often with the best laid plans, this did not happen obviously as US bank credit has actually fallen since the start of the 1.5T QE.

Now instead of hiring Prof. Mitchell here to explain economic reality to them, they are sitting around and scratching their heads as to why their scheme did not work. This is a quote from Fed Vice Chairman Donald Kohn in March 2010, near the end of their QE program when they had already purchased over 1.25T:

“The huge quantity of bank reserves that were created has been seen largely as a byproduct of the purchases that would be unlikely to have a significant independent effect on financial markets and the economy. This view is not consistent with the simple models in many textbooks or the monetarist tradition in monetary policy, which emphasizes a line of causation from reserves to the money supply to economic activity and inflation. . . . We will need to watch and study this channel carefully.”

No kidding! Well now they are commisioning investigations (instead of reading BillyBlog for free) and Warren Mosler has cited a subsequent Fed study titled “Money, Reserves, and the Transmission of Monetary Policy: Does the Money Multiplier Exist?” (you can google) that does much to discredit the “multiplier” and the de facto defunct “Quantity Theory” of money.

Any recovery in US economy, output, equity prices has been a direct result of flows via both non-discretionary automatic stabilizers and discretionary stimulus programs enacted in early FY2009 as fiscal policy that has created record smashing deficits well in excess of 1.2T for now two fiscal years in a row, going on the third. The problem has been that much of the flow of net financial assets that has been created by these huge fiscal deficits has indeed ended up disproportionately in the wrong hands and is being provided in an inequitable fashion….the right people in govt could correct this problem in short order.

Resp,

“If there is more “money” in the economy its value declines.”

Define money. Is it currency plus the demand deposits from debt based on the currency?

“In this situation, an increasing money supply (which is really not a very useful aggregate at all) which signals expanding credit will not be inflationary.”

Why does an increasing money supply signal expanding credit???

Hello,

Can someone help to refute Say’s law?

I keep having arguments will Austrians who claim that Keynes never refuted it.

Does anyone have good links debunking Say’s law??

Please note that in my jet-lagged state I had altered the Premium question in my answers but forgot to change the wording in the actual question. I have now made the two consistent (that is, have changed the question to read as I intended). Many apologies – I am a little more awake and alive in the northern hemisphere now!

Andrew, Nick Rowe has some. I’m not sure he addresses gold though.

“This provides another important rule with the deficit terorists typically overlook – that if a nation records an average external deficit over the course of the business cycle (peak to peak) and you succeed in balancing the public budget then the private domestic sector will be in deficit equal to the external deficit. That means, the private sector is increasingly building debt to fund its “excess expenditure”.

This question may reflect my economic ignorance, but I don’t understand why a private domestic sector deficit necessarily implies an increasingly indebted domestic private sector. There seem to be buried assumptions regarding private sector behaviour there. Surely the ability of a govt to run a surplus is not dependent on the ability and willingness of the domestic private sector to borrow? Or is the latter simply an enabler of the former, rather than a sine qua non?

What is the causal link that connects depletion of private sector NFA to increased private sector debt? I’ve long accepted this link as plausible, under certain circumstances, but I don’t see how there is a necessary connection. (Takes seat at back of class)

ParadigmShift,

Good question. Attempting to answer a few things. A sector has an income and expenditure. If the sector has income higher than expenditure, it is running a surplus. So one can think of the household sector running a surplus during an accounting period and saving it by various means – such as increases in bank deposits, purchases of equities etc. It can also repay some of the loans and one has to be careful here because interest payments are supposed to be counted in expenditures whereas paying down debt is for the principal.

If the household sector is running deficit, it has to finance this deficit and this is done by borrowing. There are some complications here. One may think of a situation in which the household sector sells some of its financial assets instead of borrowing. So one has to be careful about these things.

If one talks of only the private sector or two sectors – households+producers and banks, then one can talk of the first sector being in deficit and borrowing from the second sector to finance this deficit. (Assume no sale of financial securities such as bonds/equities from the first sector to the second)

Your point about “enabler” is also interesting. The causality is in both directions. A government may start running a fiscal policy which ends up causing a surplus and forcing the private sector to borrow. One can also think of the private sector borrowing by itself and the increased demand created leading to a government surplus. Neither can go on forever.

Matt Franko: Cheers for the info about QE. What I still don’t get is how you lump together “recovery in US economy, output, equity prices”. My understanding was that all of the recovery in equity prices is due to money put in as day trading- that is money that does not care at all about the fiscal spending or the general economic state. That day trading money is in the equity markets purely to harvest money from volatility. I thought that the day trading money was totally dependent on cheap bank supplied leverage due to QE. In that way QE is useless for helping the real economy but absolutely perfect for pumping up equity prices. That is why Goldman Sachs are clamoring for more QE.

You seem to be saying that it is just an oversight that money goes directly into pumping up asset prices rather than into helping consumers spend. Governments feel that what they do is ever so important so they want to maximise the scope they have to spend without the currency value slipping and so giving them less scope to spend etc. To my mind that inevitably means that they try and direct money to the most wealthy. It takes a lot of unemployed fruit pickers getting fruit picking jobs to match one £20B hedge fund moving to Switzerland as they are always threatening to do. That is why I kind of doubt what Bill says about job creation schemes being the way to increase GDP. In a short term financial sense it seems to me not surprising that so many people get viewed as disposable in the quest for getting GDP to a level that will allow for nuclear bombs or even some benign pet scheme. I kind of think that we are on a road to a nightmare if we try and follow what will maximise our national wealth because that inevitably means creating gross problems both at home and across the world.

Ramanan

Thanks for your reply, what you have said makes perfect sense. It seems to me that, just as a household with savings can spend in excess of its income without having to borrow, a sector with net savings (positive NFA) should be able to spend in excess of its income without having to borrow.

Is this analogy flawed? I’m having a hard time seeing why.

What is the mechanism that FORCES the private sector to borrow if it is in deficit? I think there’s an additonal layer of complexity here that I haven’t really seen fleshed out.

The other issue I’m wrestling with is that it is often implied that the deficit sector must fund it’s deficit by borrowing from the surplus sector (e.g US trade deficit funded by Chinese “savings”), whereas this doesn’t seem to be the case, since the private sector largely borrows from itself. But perhaps I’m misinterpreting what I’ve read.

Paradigm Shift: From what I can see. If the USA stopped expanding its currency, balanced the budget by having an inheritance tax and a wealth tax and all USA citizens and companies developed an aversion to borrowing, then there would be no unstoppable force making the USA non-government borrow. There wouldn’t be until no one in the USA had any net worth which is extremely far from being the case. There could be a sell off of assets and reduction in savings to pay for the taxes which would cover the trade deficit to China until the wealth of US people was entirely gone.

Paradigm Shift, I realize I was in a muddle thinking that the external deficit might not mean borrowing was required. I suppose the only way non-government borrowing could be avoided would by drawing on savings saved before the period that the government is balancing the budget. Individuals could sell assets so as to exchange assets for other peoples savings in order to pay the taxes but overall prior savings would be the only net source for paying the tax. Basically if non-Chinese citizens were to continue getting more real stuff from China then we would have to work out what we could do for them in return.

@Andrew

Brad DeLong has an excellent discussion of Say’s Law and its correction by John Stuart Mill: http://delong.typepad.com/sdj/2010/03/more-from-the-history-of-economic-thought-john-stuart-mill-contra-says-law-1844.html

🙂

ParadigmShift,

Oh I see your point. I’d say that for the case of the US, all the sectors played the part in getting to the crisis. The US government went into a surplus in the late 90s and early 2000s because of capital gains taxes due to the equity markets boom. Of course the US government should have not become happy with its surplus. The private sector remained in deficit in the 00s because of the private sector’s own volition – increased borrowing plus speculating on housing. But the government should have been active at the same time and taken note of unsustainable processes that were building up.

Also, I think its important to always keep the banking sector unconsolidated. Its impossible to construct a sound theory where the banking sector is consolidated as the great Circuitist Augusto Graziani showed long back. Of course, once you know how to keep track, you can then consolidate the private sector as one.

For the general points you may be looking for, you may consult this nice article by Claudio Dos Santos and Antonio Macedo e Silva Revisiting “New Cambridge”: the three financial balances in a general stock-flow consistent applied modeling strategy

Ramanan

Thanks very much for that link. It’s exactly what I’ve been looking for! I’ll spend a few days digesting it. Agree totally about keeping the banking sector unconsolidated within the private sector.

Stone, thanks for your comments too. You’re right about the distribution of NFA being important. If a small oligarchy has all the private sector NFA and no-one else has any, the dynamics will surely be different than if NFA is evenly distributed. It seems to me that the SFB model is a little too gross/aggregated to draw firmly deterministic conclusions about debt dynamics, but I need to ponder this some more.