The other day I was asked whether I was happy that the US President was…

There is no credit risk for a sovereign government

Today I read a very interesting article in the Financial Times by a professional who works in the financial markets. It was in such contrast to the usual nonsense that I read that it made a special dent in my day. I also was informed that a leading US academic economist had recommended we read the same article. I found that a curious recommendation given that this economist is not exactly in the Modern Monetary Theory (MMT) camp. Indeed, if you examine the course material he inflicts on his macroeconomics classes you would reach the conclusion that his Department is another that should be boycotted by prospective students. Anyway, the FT article makes it very clear – there is no credit risk for a sovereign government – and that financial market investors who have bought into the neo-liberal spin that public debt default for such sovereign governments is nigh have made losses as a result.

This morning. a reader brought this tweet to my attention (thanks Dennis). It was published by UC Berkeley economist Brad DeLong.

I wondered why anyone would be reading DeLong’s twitter page but I suppose we all have different tastes.

I had already read the Financial Times article being linked which was written by Steven Major who is Global Head of Fixed Income Research at HSBC in London. I have had some correspondence with Steven in the last few years and he is clearly a thoughtful and insightful person. I will come to his narrative presently.

The first point that crossed my mind was what was going on in DeLong’s head. Last week, another reader (thanks Bernard) asked me to comment on the teaching material that DeLong prepares for his introductory macroeconomics course at Berkeley. The reader thought the material was problematic. He was right.

DeLong likes to think of himself alongside Krugman as part of the “Keynesian” army against all the neo-liberals. Both are in fact New Keynesians. In that sense, they are not very dissimilar to Mankiw and his gang. Interestingly, they appear to be continually trying to one-up Mankiw as part of some internecine struggle within the American economics academy. But from a Modern Monetary Theory (MMT) perspective, it is hard to tell their various narratives apart.

DeLong has long been a user of the Internet for teaching purposes. Here was his full Introductory Macroeconomics lectures at Berkeley in 1996. As far as I can work out this course follows an introductory course in microeconomics (Econ 100a). The macro course used Mankiw as the textbook – at least in the sections on fiscal policy.

The curriculum is stock standard mainstream and perpetuates all the misunderstandings about the way the monetary system operates that are still crippling the contemporary policy debate. I will leave it to your interest to delve into the lecture material to see how many errors in logic and understanding you can pick. The course is a scandal.

Interestingly, DeLong told his students at the beginning of the course that:

… I may be the best person at Berkeley to teach this course because of what I did in Washington. Most of my job there–as Deputy Assistant Secretary of the Treasury for Economic Policy–was the subject matter of this course: business cycles, inflation, effect of economic policies on the stability of the economy, determinants of long-run growth and income distribution, effect of economic policies on long-run growth, and on income distribution. What is for you the subject matter of a course was, for me, the principal component of my job for two and a half years.

Which just told me that the advice the US Government was getting in this crucial role was deeply flawed. Nothing has changed.

There is nothing in a text book like Mankiw which would allow a student to understand how the monetary system operates; how the central bank operates (Mankiw tells students they control the money supply – which is totally false); how government spending and taxation works (Mankiw thinks governments have to finance spending which causes interest rates to rise); how inflation is generated (Mankiw claims increasing money base is inflationary – like just look at the juxtaposition between the US Federal Reserve balance sheet and the US inflation rate!).

I could go on. It is a depressing prospect that we send our bright young hopes into classrooms only to be confronted by neo-liberal ideologues who tell the students that the only ideologues are socialists and then proceed to fill their minds with misrepresentations and outright lies.

Fast-track 14 years. Nothing much has changed even though the understanding that mainstream economics purports to provide students has been deeply cruelled by the current economic crisis. So the mainstream approach to macroeconomics has been totally discredited by this crisis. Students taught in this tradition will have no understanding of what caused the problem nor why the current policy approaches being advocated are so damaging.

Anyway, here is what DeLong thinks is acceptable material to provide his introductory macroeconomics students in their first lecture in macroeconomics.

In a post to his introductory economics students (August 12, 2010) – First Draft of August 30 Principles of Economics Lecture: Introduction to Macroeconomics – DeLong sought to outline what the terrain of macroeconomics is. He said it involved four topics: (a) depression economics – which is about demand failures; (b) inflation economics – which is about demand excesses; (c) deficit economics – which considers the breakdown in trust in the government and monetary system – which is about how governments break promises by running deficits that are too large or build up excessive national debt; and (d) growth economics.

This is not the way I teach macroeconomics and the treatment of the topics as outlined by DeLong is likely to be a confused cocktail of Keynesian notions and Monetarist notions in the way New Keynesians delight.

How much content has much to do with fiat monetary systems? Answer: there is very little applicable content.

For example, in his description of deficit economics, DeLong writes (and his students will then rote learn and etch the following into their naive minds forever):

The consequences of such breakdowns …[he is talking about inflationary spirals causing trust issues with the currency] … are the third part of the domain of macroeconomics, which deals with the case in which the macroeconomic market failure is one of promise-keeping on the part of the government. As the late Milton Friedman put it, for the government to spend is for the government to tax. Whenever the government spends, it is also promising explicitly or implicitly to tax somebody, either in the present or the future, either directly or indirectly, to pay for that purchase.

I would never tell a student such a story. How does DeLong explain the decades of consistent budget deficits that the US government (and most other governments ran in the Post Second World War period? And that was for the most part a period when currencies were convertible and so governments did have financial constraints.

Implicit in this citation of Friedman is the Barro Ricardian Equivalence nonsense. Accordingly, students are told that governments can net spend now if they issue debt but because the debt has to be paid back there is an implied tax rise which is known by households and firms and they accommodate that into their present spending decisions.

The reality is that governments do not usually retire their outstanding debt obligations (other than the trivial situation of paying back maturing obligations as new obligations are issued).

Please read my blog – Pushing the fantasy barrow – for more discussion on this point.

But the more important point is that students should understand very early in a macroeconomics course that a sovereign government is never revenue constrained because it is the monopoly issuer of the currency. That is a basic starting point in exploring the differences between spending and taxation decisions of a sovereign government and the spending and income-earning decisions/possibilities of the private sector entities (households and firms).

The two domains – government and non-government – are very different in this respect and any attempt to conflate them as if both are subject to budget constraints is wrong and starts the slippery slide down into the total mispresentation of how the macroeconomics system operates.

So DeLong’s students are already sliding down the chute into ignorance tainted by the implicit neo-liberal ideology that goes with this approach.

So a statement that “for the government to spend is for the government to tax” is without application in a modern monetary system where the national government is the monopoly issuer of the currency and floats it on international currency markets.

Such a government does not tax to raise revenue. Please read my blog – Functional finance and modern monetary theory – for more discussion on this point.

After duping the students with the Friedman line, DeLong goes to say the following:

The government can tax now to pay for spending later – and so run a budget surplus. The government can spend now and promise to tax later – and so run a budget deficit and increase the national debt. But what happens when the government runs up too great a debt and the political system tries to get the government to break its promise to tax? How to guard against such attempted promise-breaking by the government, and what happens when the government attempts such promise-breaking occurs is deficit economics. And once again it is not pretty: capital flight, disinvestment, stagflation, currency collapse, and hyperinflation.

Again, this is a total misrepresentation of the way the government and non-government sectors interact. A sovereign government does not have to run budget surpluses to spend later. Its capacity to spend now is never compromised in financial terms by its past net spending history unless the economy is already operating at full capacity in which case there is no further scope for aggregate demand growth.

In these situations, if the government wants to expand the public command on real resources it would have to reduce the private use of those resources by increasing taxation.

But there is no such thing as national saving in the sense that budget surpluses provide a stock of “money” which the government can spend later. Households save by foregoing current consumption in the hope that by expanding their financial resources (via compounding) they will be able to consume greater amounts in the future. But the household has no choice – they are financially constrained and their spending choices in each period reflect that constraint.

When a government runs a surplus it is not “saving” anything. The surpluses go nowhere! They are just flows that are accounted for and the aggregate demand which is drained by the surpluses is lost in that period forever.

Some might say that sovereign funds do stockpile public saving. But the creation of the fund meant that there was no accounting surplus anyway. The government just chose to purchase speculative financial assets instead of building schools or hospitals or providing public sector employment.

Further, a sovereign fund does not increase the capacity of a sovereign government to spend in the future. Such a government issues the currency under monopoly conditions and can always spend.

You can also see very emotive language in DeLong’s notes to his students. What, for example, does “too great a debt” constitute? Is this a political statement reflecting an ideology or does DeLong has some financial formula to say that a sovereign government becomes incapable of servicing that debt after some point?

Answer: the former. There is no financial or economic logic in the statement that there is too much debt outstanding for a sovereign government. Governments just service debt by crediting bank accounts. They have an infinite financial capacity to do that.

So DeLong is actually teaching some bastardised course in Political Science here and only allowing the conservative side of the debate to be aired.

Finally, note the link between deficits and currency collapse and hyperinflation. Why not emphasise the importance of public deficits for sustaining employment and income growth and underwriting the desire of the private sector to save?

Of-course aggregate demand growth that outstrips the real capacity of the economy to absorb it will generate inflation. But any spending component – public, private or external – can drive spending over the acceptable nominal edge. Why force your students only to focus on public net spending in this context?

Which takes me back to the beginning. If DeLong thought the FT article by Steven Major was worth reading why hasn’t he immediately told his students that the stuff he is proposing to teach them in this introductory macroeconomics course is misleading and not worthy of their attention?

Is this another Economic Departments that should be blacklisted? I think so. Please add it to your list.

In my view, his students would be better off driving across the bay (from Berkeley) and going for a surf at – Fort Point or to Ocean Beach or North Ocean Beach or to South Ocean Beach – to start with. Then they could pack the Kombi and head down the coast to some of the magic breaks that are to be found in that part of the world.

But I do wonder what DeLong gleaned from Steven Major’s Financial Times article – ‘True sovereigns’ immune from eurozone contagion – which was published on August 16, 2010.

As an admin note, several readers wonder how they can get around the FT registration system that precludes you from reading to much on-line material for free. If you don’t have a subscription, here is how you can get unlimited content. I assume all billy blog readers are sophisticates and only use Firefox. First, go to Tools/Options/ and click on the Remove Individual Cookies link. This is how FT checks to see how many times you have accessed their pages. Second, put FT in the search box when the window comes up and delete all the cookies that are listed. Third, do a Google search for the article title. Fourth, click the Google search link and you should be sweet. It is a bit of messing around but free.

What is the point about a sovereign government than DeLong seems to miss in his course design? Well the FT article helps us understand the point very clearly.

In his FT article – ‘True sovereigns’ immune from eurozone contagion – HSBC economist Steven Major opens with the following statement:

There are plenty of doomsayers who think it is only a matter of time before the sovereign risk crisis spreads from the eurozone to other countries, including the US, UK and Japan.

This is not going to happen in my view. That is because the obsession with public debt ratios fails to distinguish between different levels of sovereignty. The US, UK and others can maintain high public debt ratios for longer, especially given the amount of deleveraging being carried out by the private sector.

Not all sovereigns are the same. The US, UK, Japan and Canada are examples of what I call “true sovereigns”. For these countries there is zero default risk. Investors should not worry about credit fundamentals, as they will always receive their coupons and original investment on redemption.

This is so contrary to what is being peddled each day in the financial press that a medal for bravery should be awarded. I just did that Steve(!)

MMT doesn’t different between degrees of sovereignty. But the point is taken. MMT differentiates between sovereign and non-sovereign governments.

Steven Major chooses to term a government in the former category a “true sovereign” because it:

… can issue freely in its own currency, has full taxing power over the population and ultimately, if required, can create more of its own money. None of this means that true sovereigns can afford to be profligate, far from it, but it does mean there is no externally imposed timetable on fiscal retrenchment.

I am 100 per cent in agreement with this construction.

Note that in saying a (true) sovereign government is never revenue constrained because it is the monopoly issuer of the currency one is not advocating reckless net spending by the same government.

A (true) sovereign government should define its sense of public purpose which in my view will always include full employment using technologies that are environmentally sustainable. Then its fiscal position should enable the economy to achieve levels of activity that are commensurate with this idea of public purpose.

It should definitely not allow nominal aggregate demand to outstrip the real capacity of the economy to absorb it. That would be reckless. But in the scale of recklessness, it would be less reckless than allowing 10 per cent of your willing labour force to remain unemployed and at least another 6 or 7 per cent more of your available workers to be idle in other ways.

So I do not use the term “true” sovereignty but I understand Major’s intent in introducing that to his audience.

He then said:

Investors in the “true sovereigns'” should worry about the level of interest rates and inflation, but not about credit risk. These factors, rather than the level of supply, will be the most critical in determining bond yields.

Market participants mixed up the different contributions to risk in government bond markets earlier this year when they started pricing in some element of default risk. Short sellers, sitting on significant losses, have been forced to cover their positions. The traders who thought 10-year US and UK government bonds were expensive in January when the yield was 4 per cent will not find them good value at close to 3 per cent.

So, no risk of insolvency should ever drive financial markets when dealing with the debt of a sovereign government. That is in contradistinction to the mania tha you hear and read each day from so-called informed commentators. That is all they focus on.

It is clear that bond investors can lose if there is inflation and/or unanticipated changes in interest rates. Bond traders are speculators after all. They thus have to price into their decisions the risk of price and yield movements.

But then we know that the central bank can effectively manage interest rates and, in doing so, condition differnt segments of the yield curve. In this way, the monetary authority can keep the risk elements attributable to interest rates that drive spreads between short- and long-rates low. That is, the central bank should be aiming to create a favourable investment climate to encourage productive capacity building.

In terms of inflation, MMT eschews the use of monetary policy and promotes functional finance principles. Inflation (unless it is cost-derived) arises from excessive growth in nominal aggregate demand. The most effective aggregate policy instrument for dealing with inflation is fiscal policy.

So by failing to understand the essentials of a fiat monetary system, many of the investors (the short-sellers) are now sitting on losses. If they understood the principles of MMT they would not have disadvanted their clients in this way. The fact they are now sitting on losses is a further empirical rejection of the mainstream macroeconomic depiction of the way the sytem works.

Then Steven Major notes that in the current environment:

… those who are worried about deflation and understand the different categories of risk will buy these bonds to maintain purchasing power. After all, investors have recently been gobbling up 10-year Japanese government bonds with a 1 per cent yield. They know that sovereign risk is zero so any amount of positive yield is attractive when inflation is negative.

There is a growing demand for sovereign government debt. This flies in the face of the rantings of Kotlikoff and Co who are claiming that governments are already insolvent.

A recent report in Australia showed that government debt returns outstripped the performance of the superannuation funds over the last decade.

Major then talks about the EMU governments and says:

By contrast, there is sovereign default risk in eurozone bonds. The countries that adopted the single currency immediately relinquished some policy sovereignty. But that only became crystal clear this year when Greece faced a liquidity crisis. This was caused by the market’s loss of confidence in the Hellenic Republic’s ability to pay bondholders as large redemptions?

I would not call any of the EMU governments sovereign. They do not issue their own currencies nor do they float them on international markets.

Please read the following blogs – Euro zone’s self-imposed meltdown – A Greek tragedy … – España se está muriendo – Exiting the Euro? – Doomed from the start – Europe – bailout or exit? – EMU posturing provides no durable solution – for more discussion on the EMU.

But the point that Major is making is correct. An individual EMU government would not be able to save its own banking system without external help, for example.

The only reason that the situation has settled a little in the Eurozone is because the ECB are now playing fiscal policy games and buying government debt in the secondary markets – which means they are effectively providing the matching funds for the deficits of the EMU governments where the private bond investors are reluctant.

In this regard, Major notes that:

Receiving refinancing help from the eurozone and the International Monetary Fund dealt with the near-term concerns over ability to pay but did nothing to remove longer-term concerns over willingness to pay. That is true credit risk.

Yes, it is. Any of the EMU governments is at the risk of insolvency. But no sovereign government faces credit risk.

On that distinction, Major says that “Greece … cannot be compared with the UK position, for example”:

Indeed, it was extraordinary that market professionals made the mistake of comparing Greek and UK budget deficit and outstanding debt ratios. Understandable, perhaps, if you are a politician trying to win an election but not if your job is to invest in the bond markets.

Which when combined with all those loss-making short-positions tells you that there is no deep wisdom in the financial markets. Some traders and insiders know how the system operates but most do not.

The fact that risk on a wide variety of financial instruments became impossible to price in the lead up to the financial crisis tells you that financial markets are incapable of efficient self-regulation. Bond traders and other investors make monumental errors – in part, because they have bought the neo-liberal ideology about government solvency.

Finally, while Major thinks that the “sovereign crisis for the eurozone is not over and markets are likely to require a greater risk premium for some of the weaker members if economic conditions become more challenging”:

This is not the case for countries such as the US and UK. Yields there will be determined by the outlook for interest rates and inflation. The latter will be particularly important when policy rates are close to zero. Also, the fact that private sector borrowing has been contracting at a faster rate than budget deficits have been growing adds downward pressure to inflation.

Clearly this is consistent with the MMT position on the current state of play. The crucial point is that the public deficits have not been large enough to really underpin sustainable growth given the contraction of private spending (and borrowing). It was important for the private sector to find more sustainable long-run debt positions and thus increase saving.

But that required a commensurate increase in public net spending. The public deficits have helped the world economy to stabilise somewhat. But the detritus that remains in the form of persistently high unemployment just demonstrates the need for even larger fiscal stimulus to be introduced.

There is no solvency risk in expanding the public deficits nor is there any significant inflation risk at present (or in the foreseeable future). There is so much excess productive capacity to be absorbed back into effective use that aggregate demand growth is a long way from running up against the inflation barrier.

Anyway, it was nice to see the FT publish something that was sensible for a change.

Conclusion

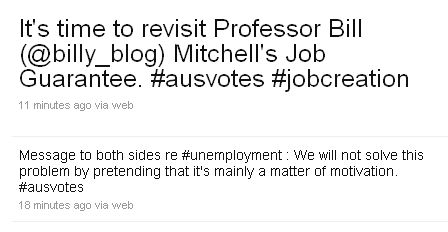

And while I am on the Twitter theme, these tweets came in this afternoon as a reaction to the announcement today of the Coalition’s jobs manifesto as part of the national election campaign. It is a non-jobs manifesto, in fact, but in this era of double speak surpluses and persistently high unemployment are good and creative fiscal leadership and full employment are bad. The latter are constructed as the hallmarks of fiscal irresponsibility. Strange world.

The tweets came from John Falzon who is CEO of the St Vincent de Paul Society in Australia and a very decent person to boot.

Total Aside – and sad

If you surf then there are hazards! They do not stop us however – Full Story.

That is enough for today!

The economics world will probably get around to the MMT way of thinking at some point (prob too late, and without Niall Ferguson and his ilk who will be left hanging from Nakatame Tower like Alan Rickman!), at which time they will treat it as a self-evident truth in full harry-hindsight manner. Nice to see the Major’s & Wolf’s and McCulley’s getting there, but would nice to see more, especially given how ridiculous the neos actually sound. You’d (probably not) be amazed at the blank looks I get when I discuss the insufficiency of the US stimulus, particularly in light of the fact that the growth revisions mean that the hole was deeper than thought in the first place! Or the conversations about hyperinflation where arguments spew forth by rote, not considered thought. Everyone still seems to think it’s a pure function of demand. Un…ahem….believable. Decomposing relationships in MMT framework is a wonderful key to reading markets, so thanks for the site once again, appreciate it man.

Steve Major deserves a huge thank you for pointing out the truth. He comes closer than almost anybody has yet come to explaining why those true sovereign bond yields remain stubbornly low, and why those governments have absolutely no trouble selling them! It would be interesting to see the reaction to Steve’s article on the part of so many of the “experts” who somehow fail to get the difference between true sovereigns (who have the absolute monopoly over the issuance of their own currency in a floating FX, non convertible, non gold standard world) and non true sovereigns (all of the EMU countries, for example).

Hats off to Steve

Instead of whining how bad courses neocons give and how terrible textbooks they use, you should write your own comprehensive textbook. 🙂

It would have much more impact than any blog. Could become an alternative to Mankiv & Co. Nobody is gonna teach economics from a blog. Please give us a textbook!

Piotrek, there are a lot of online universities nowadays, but you are right – Prof. Mitchell and the rest of the MMT-ers should put everything in one big, juicy textbook.

Bill,

I don’t know if you take requests, but if so I’d be interested in what your take on Koo is: http://krugman.blogs.nytimes.com/2010/08/17/notes-on-koo-wonkish/

You say that the Fed does not control money creation. Don’t they have a hand in it when they buy bonds held by the public (expansion) or sell bonds to the public (contraction)? They can perform these operations without deficit spending by the government, can’t they? What am I misunderstanding?

A quick question to anyone who cares to answer… I presume Pakistan is sovereign in its currency. Does that mean that calls for aid money are unwarranted, as the Pakistan government should be able to use government spending to help deal with the flood crisis?

“The government can tax now to pay for spending later – and so run a budget surplus. The government can spend now and promise to tax later”

Is the consequence of de Long’s argument that a nation can reduce possible production now to save it for the future?

I thought that it was Keynesian or what progressivs in economics did understand even before Keynes in the 1930s that a nation can’t save, it can only maximize its productive capacity if it wanted to give a better society to the future? That the only case for surplus taxation was to fend off inflation in a economy that was going full capacity. One maybe could argue in such a case that might be better to “deface” the surplus money that feeding financial speculative markets.

And this was irrespective if economists were of an MMT bent or not.

That the use of surplus funds was in no way different of the government “printing” money to spend, that the government can’t spend any funds in the future without considering the state of the economy and if would be inflating the money value.

Bill

Many thanks for an interesting article and comment on Steven Major’s contribution in the FT. Listening to George Osborne today, I suspect he will be able to talk the UK into a problem even when none exists! His brand of economics makes me shiver for the damage it can, and probably will do. If we don’t have a crisis, then he needs to make one, so he has a job!

“A quick question to anyone who cares to answer… I presume Pakistan is sovereign in its currency. Does that mean that calls for aid money are unwarranted, as the Pakistan government should be able to use government spending to help deal with the flood crisis?”

A quick search gave the impression that Pakistan has some sort of managed float, in principle Pakistan should be able to activate it’s domestic resources without any need of foreign currency. Pakistan is also a poor country and if it is dependent on mightier nations in some sense they could dictate how Pakistan shall manage its monetary policies. A brief search indicated that Pakistan have had current account surpluses for a while but have fairly big trade deficit.

The Kashmir earth quake did deteriorate Pakistans foreign affairs due to large need of imports of stuff it didn’t produced, tents, plastic and other stuff and services. Guess the current disaster might have similar effect and hard currencies buy on the global market would be needed.

The way I understand it is that when cities, states, and most private entities take out a loan, they have to make interest payments that pay back both interest and principal so there is no rollover risk at the end of the term of the loan.

Why is the federal gov’t different?

Better yet, what would the federal budget and economy look like if the federal gov’t had to make interest payments for both the interest and principal?

Fed Up,

Take US government as an example, principals and interests on treasury bonds are paid out. For T bonds held by Fed Reserve, the interest is actually rebated back to the US government. So in a hypothetical case of Fed Reserve holding ALL US government T bonds, the interest is zero.

So MMT is quite right that government deficits do not matter with respect to a true sovereign government that has no problem in productive capacities AND activities AND product diversity (i.e. no trade problem). I think the US of the 50/60s came closest.

While I am also not sure that deficits will result in desirable types of demands (thus distorting the productive activities), deficits are what we need now given the collapse in aggregate demands. Save the patient first.

A MUST READ!

A good take on Mainstream Economists and New Keynesian (Bastardised version of Keynes) written by Willem Buiter, the Chief Economist of Citigroup

“The unfortunate uselessness of most ‘state of the art’ academic monetary economics”

http://www.voxeu.org/index.php?q=node/3210

Quoting from this article;

“Most mainstream macroeconomic theoretical innovations since the 1970s (the New Classical rational expectations revolution associated with such names as Robert E. Lucas Jr., Edward Prescott, Thomas Sargent, Robert Barro etc, and the New Keynesian theorizing of Michael Woodford and many others) have turned out to be self-referential, inward-looking distractions at best. Research tended to be motivated by the internal logic, intellectual sunk capital and aesthetic puzzles of established research programmes rather than by a powerful desire to understand how the economy works”

“the manifest failure of the EMH in many key asset markets was obvious to virtually all those whose cognitive abilities had not been warped by a modern Anglo-American Ph.D. education. But most of the profession continued to swallow the EMH hook, line and sinker,”

“The conclusion, boys and girls, should be that trade – voluntary exchange – is the exception rather than the rule and that markets are inherently and hopelessly incomplete. “

Willem Buiter, the Chief Economist of Citigroup and was a member of the Bank of England wrote;

“Charles Goodhart, who was fortunate enough not to encounter complete markets macroeconomics and monetary economics during his impressionable, formative years, but only after he had acquired some intellectual immunity, once said of the Dynamic Stochastic General Equilibrium approach which for a while was the staple of central banks’ internal modelling: “It excludes everything I am interested in”. He was right. It excludes everything relevant to the pursuit of financial stability.

The Bank of England in 2007 faced the onset of the credit crunch with too much Robert Lucas, Michael Woodford and Robert Merton in its intellectual cupboard. A drastic but chaotic re-education took place and is continuing.

I believe that the Bank has by now shed the conventional wisdom of the typical macroeconomics training of the past few decades. In its place is an intellectual potpourri of factoids, partial theories, empirical regularities without firm theoretical foundations, hunches, intuitions and half-developed insights.”

Piotrek and rvm:

There is a textbook. It’s called “Full employment abandoned”.

A picture of is RIGHT THERE in the sidebar. Here’s the link if you still can’t find it.

http://books.google.com.au/books?id=caEl9oAI4XoC

Anas,

You may find the linked to paper of interest, as I used the Buiter paper you mention as one of the key themes. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1658234

Best,

Scott

chrismealy @2:39, Bill previously addressed this here and here, although not specifically this Krugman post. Krugman has left himself open on this one in stating that he does not understand Koo’s apparent claim that “interest rates literally make no difference whatsoever when you’re in a balance-sheet recession.” Seems to me that MMT’ers should jump on this opening.

Bill Said: Then they could pack the Kombi and head down the coast to some of the magic breaks that are to be found in that part of the world.

Plan your life arround the break Bill and everything will work out OK.

Very sad that one of our surfers was taken by a shark. All hungery sharks, no matter what type, are dangerous just like hungery people.

Been flat for a while on the Sunshine Coast so will go Scuba Diving instead this weekend.

Why do we let Australian State Governments (similar to USA states for you Yanks) borrow overseas money for infastructure when our own Soverign Gov could print and lend them the money?. This realy is confusing.

Better still get rid of the state gov all together as all they do is duplicate or overlap with Commonwealth Gov.

A comment on recent European bond sales:

“Sceptics, however, argue that main reason the bond sales succeeded is that banks and pension funds are able to buy the high-yielding bonds, and use them as collateral for borrowings from the European Central Bank (ECB). ”

Does this mean that the Eurozone countries do get some kind of “partial sovereign” status? I think it’s the case that ECB can’t buy bonds from Eurozone countries but if banks and pension funds can do as said here then there is a flow from ECB to the individual Eurozone countries. Well short of being able to print your own money (which would at least need a promise from ECB that they would do this forever with unlimited amounts).

Or is it just the same as any bond sale, except that the interest rate would be lower than it otherwise would be?

Thanks Steve for the paper,

I learned real economics more from people like you and Bill, more than all my formal Economics education at undergrad and graduate level.

Cheers

Anas

Anas Jalil, Willem Buiter is of the same gang. It is very strange to see him attacking his own friends and non-sense. As far as I can remember Bill had a tear-down of his Citi research some time ago. Just try a search.

Or maybe he sees that the world is changing and wants to be with winners?

Sergei,

But when a member of the same gang is starting to attacks each other, thus I am sure that the edifice of modern macro economics as what believed by the mainstream Economists would soon collapse . . .

MMT should position itself to replace the vacuum so that no more nonsense Voodoo Economics could infiltrate the young minds any longer.

Cheers

Anas

Sorry, not Steve,

Thanks Scott for the paper.

Cheers

Anas

Tom Hickey: thanks for the links!

In a world where MMT supplants the other schools of macroeconomic theory, what is the constraint on expansion of the varous sovereign governments? More employees, more entitlements, more resources…..

Almitra: In a world where MMT supplants the other schools of macroeconomic theory, what is the constraint on expansion of the varous sovereign governments? More employees, more entitlements, more resources…..

A principle contraint on government economic policy is price instability, which is relative to the availability of aggregate supply (real resources) to meet aggregate demand, one one hand, and, on the other, effective demand to purchase aggregate supply. The government as monopoly currency provider has the sole prerogative and corresponding sole responsibility to provide the correct amount of currency to balance spending power (nominal aggregate demand) and goods for sale (real output capacity). If the government issues in excess of the economy’s ability to produce, demand will rise relative to the goods and services available, and inflation will result. If the government falls short in maintaining this balance, recession and unemployment result, and if there is high private debt, the risk is debt-deflation and even depression.

MMT shows how to achieve and maintain full employment and price stability through functional finance, which relies chiefly on fiscal policy to adjust nominal aggregate demand relative to the ability of the economy to produce goods and services in response. Conversely, mainstream economics relies chiefly on interest rates, set by monetary policy, for the primary control mechanism in targeting inflation, and it uses employment as a tool rather than a target (ignoring the Fed’s mandate in the US).

The relative roles of government and the private sector are a political choice rather than an economic one. However, economic analysis can show how to achieve an efficient and effective balance between the two based on agreed upon criteria. These criteria are not only economic but also normative. For example, the definition of “public purpose” is normative, and views about this differ along the political spectrum from right to left.

The economic criteria can be justified rationally based on macroeconomic analysis. For example, MMT points to the economic inefficiency of unemployment in addition to the ineffectiveness in meeting public purpose of permitting unnecessary levels of unemployment. This foregone opportunity represents the largest economic loss to an economy, much greater than inflation, and the resource degradation is never recaptured. This is especially true of human resources, the most valuable resources a country has. Squandering them is wasteful and irresponsible, as well as morally repugnant owing to the far-reaching consequences on people’s lives.

“Squandering them is wasteful and irresponsible, as well as morally repugnant owing to the far-reaching consequences on people’s lives.”

It’s also bad free market economics. If there are more jobs, ideas and businesses than there are people to work in them then prices will adjust until some of those jobs, ideas and businesses disappear through price pressure. But you simply can’t do it the other way around without employing Euthanasia or concentration camps.

Therefore it makes sense to ensure that there is always an adequate supply of jobs, ideas and businesses in an economy.

Thank you Tom Hickey for your response to my question on expansion of sovereign governments in a world where MMT is the generally accepted macroeconomic theory.

I like how your answer is focussed on the economics. I do not doubt that if the task of allocating resources were assigned to a rational and objective party, that the expansion that I fear would be constrained.

How do we get to system where a rational and objective party is in control?

How do we get to system where a rational and objective party is in control?

In the US, as I expect is the same in most places, the problem is twofold, ignorance and corruption. On one hand, eradicating the widespread ignorance at all levels is also very difficult because it is being perpetuated by people who are heavily invested in its continuance. ON the other hand, getting the money out of politics and closing the revolving door is a prerequisite to significant and lasting change, otherwise the same battles will be fought on a regular basis and those doing the corrupting will have the preponderance of the ammo and firepower.

So I think that absent campaign finance and lobbying reform, which is very difficult, the only other possibility is a massive system failure that wakes people up to what is happening. But the result is iffy. The US got an FDR, while Germany got a Hitler and Italy a Mussolini. The radical transformation that is called for in extremis is difficult to predict and go a variety of ways, not all salutary. The job of MMT proponent is to make sure that there is viable alternative ready at hand, should this eventuality come to pass, lest a pseudo-solution even worse than the current failed case be picked up instead.

I’m not optimistic that positive change is going to happen smoothly, barring a miracle or two. But the moral obligation of those who are convinced that they have better options is to push them hard and hope for the best. Encouragingly, there are some cracks appearing in the monolith as more voices are raised, significant voices sign on, and others start to think that they may be left behind when the worm turns.

That’s what it is really significant when someone like Stephan Major stands up and says, “You folks have it all wrong.” FT is a very influential publication internationally. What appears there gets noticed. Martin Wolf has already started to talk about the sectoral balance approach, too. This may catch on in the UK first, since Wynne Godley was one of the “six wise men” at Treasury there, whereas he is not as well known in the US. Plus, the UK has already installed a conservative government that is inevitably headed for a crack up if it pursues austerity as announced.

And the most recent report of unemployment claims in the US suggests that the situation is worsening. That is a political tinderbox that politicians are going to have to address at their peril. All the talk about green shoots seems hollow in light of the giant hail storms that are apparently fast approaching on the horizon.

“There is no credit risk for a sovereign government”!?

What about Argentina’s default in 2001 on $132 Billion worth of public debt (to mention one sovereign default in recent history)? There have been numerous sovereign debt defaults in history (partial or out right).

I would suggest reading an execellent study by Reinhart and Rogoff, “This Time is Different”. I would note that the evidence in this study weighs rather heavily against the publication by Brad Delong, and much of the content of this particular blog.

I would also note, where some commententers have referenced Keynes, that he was ultimately not an advocate of deficit spending (When Keynes’ “Treatise on Money” was criticised, Keynes asserted that this work no longer reflected his thinking), and advocated forced saving, rather than deficit spending, in order to pay for Britain’s part in World War II.

Åndrew, see Yeva Nersisyan, The Myths about Government Debt as Told by Carmen Reinhart and Kenneth Rogoff, and the follow up, More Reasons to Doubt Rogoff and Reinhart.

During WWII, there was not only forced saving, but also goods rationing, a command economy, government-administered industrial policy, wage, price and profit controls and a variety of sundry means to deal with an extraordinary situation created by a quick ramp up of production and supply bottlenecks owing to the war effort. Hardly a case to cite as precedent for economists’ thinking.

Thank you again, Tom Hickey, for your willingness to dialogue.

You and I share the opinion that political campaign financing is a fulcrum. As a citizen of Manitoba, I decided to take a four week hiatus from my business to prove that Manitoba’s “No corporate or union donation” law could work. It did. Quite the contrast with the U.S. Supreme Court ruling whereby Corporations are now persons who may contribute without limit.

You mention lobbying. Perhaps you share my concern that the general public knows not about lobbying; that it is not the overt lobbying that puts the system at risk, but moreso the ocean of connivance amongst the priveleged few that sets the system towards a path with no good end.

You seem as well to be on the same path as me with your suggestion that it wil take a major breakdown to open minds to new ways of relating to each other. So how does MMT after the major breakdown deal with our same shortcomings that brought us to this brink?

Andrew H:

“There is no credit risk for a sovereign government”!?

Quite True. There has never been, in the history of humanity, a default by a floating, non-convertible fiat currency issuing government., which is what is meant by (monetarily) sovereign government. Of course you might think that “this time is different” – but the bond markets certainly don’t think so, and lap up US and Japanese debt. The refs that Tom provided explain in more detail.

Almitra, I think we can probably agree that a combination of ignorance, sometimes willful and sometimes not, connivance, and corruption have led to the establishment of privilege that favors wealthy and powerful interest groups. The antidote to this is political activism and voter education of remedies and alternatives.

After understanding MMT principles, one discovers that most of the people who are politically active and trying to change this rotten situation are woefully ignorant of the basic principles of economics; hence, they often work against themselves unwittingly by buying into the false ideas that are responsible for the conditions they are attempting to correct, thereby reinforcing their opponents’s point of view instead of providing a viable alternative. Like the rest of the pubic, politicians, and most mainstream economists, for example, they are victims of the government-finance-is like-household-finance false analogy that makes it seem as if all governments are revenue constrained and have to fund themselves with taxes or finance themselves with debt. MMT shows how this is false in the case of monetary sovereign governments that are sole providers of a nonconvertible floating rate currency, like the US, Canada, the UK, and Japan – but not the Eurozone. So comparisons of monetary sovereigns with Greece are misguided. Similarly, with countries that operate on a peg/currency board. So, for instance, comparing the US with Argentina at the time of its default is without basis.

A primary purpose of Bill’s work is to provide a general understanding of MMT and how MMT principles illuminate public policy options in a way that make it possible to accomplish public purpose by achieving full employment/full capacity utilization along with price stability. He does this by explaining the fundamental MMT principles of Chartalism, the vertical-horizontal relationship of government and nongovernment in money creation, central banking and commercial banking, national accounting principles, functional finance, Minsky’s financial instability hypothesis, Fisher’s debt-deflation theory of depressions, sectoral balances, and stock-flow consistent macro models, as well as policy proposals such as the job guarantee and reform of the global financial system. It is all in the archives, with links on the right. Bill also provided a lot of cross links, so one post leads to several others. There are several other MMT-based blogs, and well as a plethora of papers, and a few books.

Armed with this knowledge anyone can understand what’s gone wrong and what needs to be done to repair it. Now it is up to concerned citizens to get up to speed on the alternatives to the status quo and get the word out widely. This is already happening, of course, and the process is picking up speed lately. JOseph Stiglitz has just posited that the world needs a new economic paradigm because the old one has failed. OUr task is to make MMT that paradigm in that is based on operational reality rather than myth, and it was the myths that are taking down the old paradigm based on neoliberalism that has been dominante since the 1970’s.

Tom Hickey, you are an eloquent advocate for MMT. But I am not yet sold on the idea that implementation of MMT is a solution. Based on what I have seen so far, to me it is another step down a dead end road.

I agree that sovereign governments could theoretically achieve full employment for their citizens through the third way of funding the system (print money instead of issuing bonds or taxing). While I have not done enough homework on MMT to understand how it achieves price stability, I accept that given an objective and rational hand at the helm, this too is possible with MMT.

But I still need to see some intellectual underpinning of MMT that addresses my concern that there would be no effective constraint on a sovereign government that implements MMT. So far, I see no point in your eloquence that forestalls a trend in a MMT world whereby we all end up either on the government payroll or collecting entitlement payments from the government. Or is that the goal?

Fair enough questions, Almitra, and questions that MMT economists have addressed. Bill Mitchell/Joan Muysken have published a book on it. See the right column on this page. There are many professional articles and blog posts, too. See, for example, the archive of CofFEE under links in the right column and check out the blog archive and use the search box. The best comprehensive source written for non-economists is L. Randall Wary, Understanding Modern Money: The Key to Achieving Full Employment and Price Stability (1998).

The overall goal of MMT is to enable government to meet public purpose and the private sector to supply the economy with products and services that customers demand, while achieving full employment and price stability. One chief objective is to eliminate the foregone opportunity and degradation of resources through attempting to achieve a balance of inflation and employment under NAIRU, with monetary policy that uses unemployment as a tool instead of a target.

Why do you think that MMT leads to a situation where “we all end up either on the government payroll or collecting entitlement payments from the government”? MMT is about eliminating the buffer of unemployed that NAIRU uses to control inflation at tremendous cost through interest rates – except interest rates don’t control inflation anyway. That is one of the myths that needs to be punctured.

Like Almitra above, I worry about the political naivete of the MMT bloc. I fully accept that their economics is sound, but I am

concerned about the political controllers of any JG scheme for example. Are we really sure that they are going to be of any

higher quality than the crooks and fraudsters that run the American corporations such as Jack de Coster, Stephen Friedman,

Angelo Mozillo, Chuck Prince, et cetera ?

I like the goal of eliminating the buffer of unemployment. Print money, and put the unemployed to work. Voila. Unemployment solved.

Except that the need for a buffer has not been addressed. So layoffs ensue. Solution: Print more money. Put the newly unemployed to work. Voila. Unemployment solved. And so on.

Where is the constraint? No more unemployed to put onto the government payroll?

paul e., MMT cannot solve a country’s political problems. As an macroeconomic theory based on operational reality, and it proposes policy options based on operational reality rather than myth as it currently the case.

As I said, previously, the sine qua non of policial reform in the US at any rate is getting the money out of politics and closing the revolving door. At present the state has been captured by wealth.

If there should be a collapse, then all all things are possible, but the outcome could just as likely be a Hitler or Mussolini as another FDR.

Almitra, I previously directed you to places that MMT’ers have addressed these issues. If you are interested in the MMT response, please check out the abundant literature.

cop out

Sorry, Almitra, I didn’t mean to brush you off. But I don’t have time to lead through MMT. Maybe someone else will jump in.

@Almitra: “Except that the need for a buffer has not been addressed.”

There are two main things causing the need for a buffer: real-world economic ups and downs are the proximate one, and MMT is not going to solve that. It isn’t magic. By the way, I thought it was interesting on looking at one of Bill’s papers that he was influenced by Benjamin Graham’s work, Storage and Stability.

The ultimate cause of unemployment, people looking for money-paid work, is taxation, which causes the demand for money. If you have an idea of how to get rid of taxation, you should look into the problem of conquering death too. 🙂 Since government causes unemployment, it is its responsibility to eliminate it.

As the MMTers explain, the JG would have deflationary effects. The thing is, once you have a JG, in conditions like now, the private economy would instantly perk up with the increased demand, private employment would soar and things would get rosier. That’s what happened in the 1933-37 USA’s first New Deal. Eventually, people would leave their JGs for higher paying private sector jobs, or not being impoverished debt peons that the neolibs want, they could start their own businesses. Leaving the JG lowers the deficit; that’s the deflationary part. So the “So layoffs ensue. ” wouldn’t happen. The high-growth pro-full employment years from the war to ca 1980 did not cause a creeping Sovietization of the economy. The Job Guarantee program is its own constraint; it’s designed to be self-destructive.

****

@Paul E., the last time we had things like a JG in the USA, they were run by people like Harold Ickes and Harry Hopkins; exceedingly competent people who got things done. You are right that businesspeople might not necessarily be the best to run such programs, but since there would be no scope for personal enrichment, the kind of crooks you fear would have little attraction to the job.

There are still such people around. As Randall Wray notes at http://neweconomicperspectives.blogspot.com/2010/07/towards-libertarianaustrian-modern.html#comments

“Put this guy in the cabinet, allocate $60B to the program, and we’d have full employment in 2 weeks.”

referring to http://www.newdeal20.org/2010/07/30/a-diy-modern-day-wpa-program-16284/#comment-7912

Here is how a sovereign government can default on its debt (just a possibility):

Let us say I buy 30 year bonds of a sovereign country X today – in 2010 and expiring in 2040. In 2025, the nation decides it doesn’t like currency fluctuations and decides to fix its currency using some sort of institutional arrangement. Around 2039 the nation starts running into problems with the external sector. Near the expiry in 2040, there is a speculative attack on the currency. Paying bond holders will lead to more capital flight. The government decides to default 🙂

The government decides to default

Ramanan, As I understand it, MMT’ers have always held that a monetarily sovereign government with a fiat currency can decide politically to default, but there is no financial necessity to do so. A political decision to default might be wise or unwise in light of circumstances and consequences, but a monetary sovereign with a nonconvertible floating rate currency is never forced financially to default, since it funds itself with currency issuance. There are people on the right talking about a US default for political reasons right now. In fact, conservative Bruce Bartlett felt he had to address how foolish this would be in Contemptible Advocates of Debt Default.

The ultimate MMT answer is no bonds. Then there is no problem of default, it being a pseudo-problem anyway for monetary sovereigns with fiat currencies. Why pay a subsidy for a parking place and create an illusion which gives bond markets the illusion of power.

Ramanan:

Aren’t the conditions for a no-default sovereign: 1) fiat currency, 2) issues government debt in its own currency, 3) freely floats its exchange rate?

Take away any one of those and you have possibility for default.

pebird,

Yes of course.

What I was trying to say was that as of 2010 – borrowing words from JMK – we simply do not know 🙂

What I was trying to say was that as of 2010 – borrowing words from JMK – we simply do not know

George Soros comes up with a variant of the uncertainly principle in his theory of reflexivity, broadly speaking, the notion that feedback changes ideas and behavior. Virtually all economic reasoning is based to some degree on ceteris paribus owing to difficulties modeling complexity. But all things seldom remain equal. Therefore, economic reasoning produces conclusions that only claim to be true “in principle” because it is impossible in most cases to to predict what will happen in practice.

This is a problem is in most disciplines, which is the reason for the meta-disciplinary approach and general system theory, for example. A good example of this approach is found in the work of Gerald Celente’s trend analysis, in which everything is taken into consideration. This is the type of thinking used by intelligence services, some think tanks, and the Pentagon. I don’t know of anyone other than Celente doing this on a popular basis. While I don’t agree with his ideology and I suspect his economic understanding is weak, the trends model is sound, and he has often produced better results than the disciplinary thinkers and media pundits. I don’t subscribe to his trend report but from what I can tell of his TV appearances, he is pretty monolithic and is dogmatic about this conclusions, whereas the more sophisticated producers of this type of intelligence are more nuanced and talk in terms of probable outcomes given different plausible scenarios. But that’s not as “sexy” and wouldn’t sell well to the public, which likes “straight” answers.

Economic data and theoretical reasoning are not determinative of outcomes in the real world. For example, people and countries are constantly making choices for a variety of reasons and one choice precludes other. This is how trend analysis looks at it. Once a decision to cross the Rubicon is taken one’s future options are determined in all areas of life affected by that political decision, as will as the options of others. Julius Caesar set a ball in motion that shaped subsequent Western civilization. Those who are experienced in trend analysis learn from experience to see where things are likely headed, based on big choices as well as a lot of similar small choices in a number of apparently unrelated areas.

I think what you are saying Ramanan, is that any economic analysis, such as MMT, is only a guide, no matter how true to operational reality it may be, because a lot of other factors are involved. I agree, and I don’t think that any thinking person believes that the future is predictable with a high degree of certainty because of this.

But I don’t know that is helps to try and come up with counter-examples that can be imagined as thought-experiments. For example, even the staunchest free-marketers agreed that rationing materials was necessary during WWII. Trend analysis would have picked that up, but few free market economists saw it coming, I am willing to bet. That hardly shows that they changed their ideology or that rationing should be the order of the day under normal conditions. But it does show that rationing does have a place under certain circumstances. Political default probably falls in that category.

Some Guy: “The Job Guarantee program is its own constraint; it’s designed to be self-destructive.”

Thank you for your willingness to educate me on MMT. I now better understand an aspect of MMT that had not come to my attention. Am I correct that MMt includes provision for workfare (although the terminology is different)?

I can see lots of benefits to workfare, MMT or no.

This education has somewhat lessened my apprehensions about living in a MMT world. But concerns remain.

I can see how sovereign governments could print money without selling bonds or taxing in order to fund workfare, and that this would not necessarily be inflationary.

The problem I see is that the printing of money would not be restricted to the funding of workfare; it would be used to buy the next vote at the next election; or to reward the oligarchies that dominate certain market sectors. What is the retraint on these uses for the new money?

Ramanan, see Michael Pettis, The last chance to avoid a global trade war. As Pettis observes, this is a political constraint. He and others like Andy Xie have been warning about this developing trend, which, of course, is essentially economic, but since it is not being addressed economically, it will be handled politically, most likely in a heavy-handed way that will have “anticipated” consequences – as if the consequences of previous trade wars were unknown.

@Almitra,

“I like the goal of eliminating the buffer of unemployment…..Except that the need for a buffer has not been addressed”

Perhaps a nuance, but consider that unemployed people are not the buffer stock. The way I interpret, the people in the JG would be the buffer stock.

Bill once gave a talk where he said he got the idea of a JG as a buffer stock for labor from studying the wool industry in Australia. In bumper years, the govt would buy surplus wool (supporting prices) and put it in warehouses as a buffer stock. It would then follow that you could do the same with human “resources” ie people. In times when there was a surplus of labor, the govt could provide for a JG so as to maintain/preserve the human “resources”, just as in the case for wool.

The govt didnt just incinerate the wool in bumper years, they preserved it in good shape for perhaps future years when there could be shortages of wool, there has to be a preserved/maintained resource for there to be a buffer stock…to set up a system that lets people who get thrown out of their jobs go unemployed is effectively destroying the human “resources”…similar to a policy of incinerating the wool, imo.

Resp,

Thanks Tom. The FT link looks nice. Will read it in detail.

Tom,

Very nice article by Pettis. I think I agree with him mostly.

Its not politics – its game theory 😉 You may be interested in the following from a paper from Philip Arestis and Elias Karakitsos

link_http://www.landecon.cam.ac.uk/research/reuag/ccepp/publications/WP03-05.pdf

Ramanan:

Yes, we do not know. But such an action would necessarily mean that MMT principles would no longer apply operationally (although we would be more able to predict the disasters to follow than those not informed by MMT).

It seems to me to be a subtle way of saying “well, if we go on the gold standard, MMT would not be applicable”. Well, duh – true – but what is the point?

MMT is many things (in my amateur humble view) – an economic analytic framework, an operational description of fiat currency monetary mechanisms, a framework that can be used to develop political and policy proposals.

Some people don’t like the political proposals, so they think up some wild idea and say that this “invalidates” MMT. Some don’t like the unconventional view of monetary operations, so they drill into some micro view of when spending and lending occurs (I fell for that theme), to demonstrate MMT inaccurately depicts reality.

I agree with Tom, that MMT is a guide (I wouldn’t say “only”, in today’s jungle a good guide has high value), and that it so inverts conventional thinking that it is also a powerful intellectual tool when trying to convince others.

But these “thought experiments” seem to me to be political dodges attempting to subvert the meaning of MMT in the guise of a criticism.

I agree we don’t know about the future – I didn’t know there was a debate about the issue.

P.S. Tom, thanks for the Pettis link reminder – I need to put him on an RSS feed, he doesn’t post daily, I forget to look.

P.P.S Ramanan, thanks for game theory link – I might be mistaken here, but I’ve always viewed game theory as an attempt to bridge micro and macro via some very sophisticated modeling and very speculative assumptions. I wish I were better at math.

As I briefly expressed earlier on this string, I fear that MMT is another step down a dead end road.

Noone who comments on this site has addressed my question: what is the constraint on using the printing of money to further abuse a financial system that is trending towards more and more trouble?

MMT removes one more element of discipline from the system.

It will have appeal for the elites as they seek to extend the time when the status quo can be perpetuated.

It will not succeed in the long run. There is probably another layer or two of discipline removal that will be used after MMT is seen as not a long term answer.

pebird, put up a Google alert for Michael Pettis in addition to following his site. Same with Andy Xie (pronounced like “shed” without the “d”) if you are interested in China. Their stuff is irregular and shows up in various venues. You can choose email or RSS for Google alerts.

Ramanan, I agree that game theory fits, but politics forces the options rather than what either player (government) would prefer doing independently of it. For example, US has preferred playing Stackelberg-follower relative to China by choice, given its business and financial interests, but political reaction is forcing it to play Stackelberg-leader, as job leakage trumps when unemployment is high and the public, rightly or wrongly, thinks that their jobs being shipped to China. However, as Andy Xie suggests, it may be more complicated than that, since it may be dampening stimulus through this leakage.

Even though traditional US policy prefers free trade and free markets in principle, the government may be forced to adopt a protectionist policy it doesn’t want to stay in power by winning competitive elections. Neither political party has wide latitude here, and there could even be “bipartisan” support for a policy that is anathema to the GOP and conservatives. US voters are becoming angrier, and they have both parties in their sights.

How American Stimulus Creates Jobs In China Rather Than America

pebird,

Not saying it invalidates or anything.

I do not know game theory but the basic ideas seem nice. I am merely pointing out to complex decisions indviduals and sectors of the economy take and how it in turn effects future decisions.

Not advocating gold standard either. The “rules of the game” did not apply in the gold standard era.

The reason I brought that up was it seemed like what Pettis is arguing. One need not “apply” it to do any calculation. However I have been writing about coordinated fiscal expansion and ways to do international trade and paras I quoted look nice to me. Imagine one nation alone expands fiscally – that leads to higher demand and higher trade deficits as well which it may not want. etc. The US may want to export more and reduce its trade deficits and in case that scenario happens, others may go into fiscal contraction (so that they import less) and it will be damaging for their citizens. And one can keep adding to this story ad infinitum.

Almitra: what is the constraint on using the printing of money to further abuse a financial system that is trending towards more and more trouble?

What do you mean by “printing money”? That is ordinarily used as a term for cb monetary operations, and MMT eschews using cb monetary ops in favor of using fiscal policy instead. Fiscal policy is under the control of elected representatives that have to stand for re-election periodically. That is the discipline.

What do you see as the problem stemming from adopting MMT, which is simply recognition of the existing operational reality of the present monetary system? What would make operating a complex economic on the basis of myths be better?

Ramanan: And one can keep adding to this story ad infinitum.

And the world goes around. The problem of internal and external adjustment will not begin to be solved until globalization is put on an income-demand footing, which would tend to bring trade into balance as well as promote wholesome distributional effects increasing general welfare. Globalization based on growth models and financialization promote rent-seeking) and this is always going to lead to dislocations and malinvestment internally and externally. Ground rules and incentives need to change.

Almitra: Noone who comments on this site has addressed my question: what is the constraint on using the printing of money to further abuse a financial system that is trending towards more and more MMT removes one more element of discipline from the system.

What are the current constraints? The only constraints ever are political. If you have a gold based system, what prevents the government from stealing and melting down the gold? Nothing. ANY monetary system can be abused.

MMT advocates UNDERSTANDING how the system really works and moving policy forward to maximizes its effect. Right now we have policy based upon falshoods which lead to bad policy. Relying on falshoods as constraints only means you are actviely choosing bad policy by actively denying how the system really works.

Almitra: Noone who comments on this site has addressed my question: what is the constraint on using the printing of money to further abuse a financial system that is trending towards more and more trouble?

What are the constraints to ruin the world today? None. You can not blame physics because it tells how to build a nuclear bomb. So if you do not trust your government then elect a better one.

MMT is a theory only with regards to its advice on how to mitigate adverse effects of government money, globalisation, etc., ie. the forces that are here with us and can not be rolled back.

Some Guy Says:

August 24th, 2010 at 3:31 pm

@Almitra: I’m just learning this stuff myself. Glad to help. I’ve taught formally enough to know that the only way to really learn a subject is to teach it.

Here is Bill on the difference between the Job Guarantee and workfare:

“Many people think that the JG is just Work-for-the-Dole in another guise. The JG is, categorically, not a more elaborate form of Workfare. Workfare does not provide secure employment with conditions consistent with norms established in the community with respect to non-wage benefits and the like. Workfare does not ensure stable living incomes are provided to the workers. Workfare is a program, where the State extracts a contribution from the unemployed for their welfare payments. The State, however, takes no responsibility for the failure of the economy to generate enough jobs. In the JG, the state assumes this responsibility and pays workers award conditions for their work.

Under the JG workers could remain employed for as long as they wanted the work. There would be no compulsion on them to seek private work. They could also choose full-time hours or any fraction thereof.” https://billmitchell.org/blog/?p=1541 & https://billmitchell.org/blog/?p=11127

On can distinguish between MMT, the academic theory, which can be true or false (If Bill ever puts this on a quiz, I pick true ) and (natural) policy recommendations flowing from it. The Job Guarantee is in between, as it is an obvious benefit of real understanding of 21st century modern money. Mass unemployment is only politically possible if enough people are convinced it is God’s / the market’s will. The general theory seeks to understand modern money, and as Keynes said, modern money is (at least) 4,000 years old.

The problem I see is that the printing of money would not be restricted to the funding of workfare; it would be used to buy the next vote at the next election; or to reward the oligarchies that dominate certain market sectors. What is the restraint on these uses for the new money?

Well, the current system of bond issuance, purportedly to raise funds, in reality to maintain interest rates, is not so different from the zero interest rate, “print money” deficit spending that MMT points to as probably superior. Lower the interest rate and the maturity enough and for all practical purposes we are in the preferred regime. So we have the same problems of vote-buying and oligarchy rewarding now.

Right now we have people running things who simply don’t know what they are doing, along with most academic & popular commenters. And this got worse, as monetary policy was enshrined over fiscal in the last thirty years. If enough people understood MMT, and if the zero interest rate, no bonds proposal was enacted, not the least benefit would be increased clarity of who benefits from the government’s economic policy. Over the last 30 years, there was a high correlation between increasingly ridiculous and UNTRUE academic economic theories and increasingly destructive government policy. MMTniks hope to preserve the correlation, but use a TRUE theory.

On the question of whether it will further abuse a financial system that is trending towards more and more trouble – MMT owes much to Hyman Minsky, who was the teacher of Randall Wray, one of the big cheeses of MMT, and the Minsky Financial Fragility hypothesis. See, e.g. this post providing proposals, noting that

“The fact that financial markets operate in a pro-cyclical manner means that financial regulation should lean against the wind – that is, provide counter-cyclical capacity to the economy. In this way, the need for significant fiscal responses is reduced.”

https://billmitchell.org/blog/?p=10866

When they need to be bailed out, the financial oligarchs are happy to say things consistent with MMT. But when the “lesser people” need something, they revert to neoliberal puritans. Again, systematic understanding wrought by wider and better exposition of MMT and consistent policy should rein the oligarchs in.

Some Guy: “… systematic understanding wrought by wider and better exposition of MMT and consistent policy should rein the oligarchs in.”

As I understand your argument, you suggest that when the (voting?) public come to understand the principles that MMT explain, the (voting?) public will reward judicious applicatoin of these principles by the policy makers and punish abusive application of these principles.

Perhaps by extension we would posit that should this educated electorate find that their rewards and punishments admninistered at the ballot box for how the policy makers act is not sufficient to induce reform, then the (rioting?) public with understanding of the principles that MMT explain would prove sufficient.

Your argument, if I have understood it correctly, is based on the principle that we get objective and rational policies when we have an objective and rational (i.e. – no longer ignorant) public. Educaton of the public becomes the key.

No wonder you guys are so patient with me.

I like the ideal that this expresses: democracy is rule by the people, so best the people rule while in a state of knowledge rather than in a state of ignorance.

Before I take this further, I best check back: have I got this right so far?

@Almitra

I do understand your point. Lenin was also desperate about The People. They simply didn’t get it. Now is the electorate in the US enlightened? Nope. Does the majority understand what we’re talking about? Nope. What is to be done about this scandal? Nothing. We should just keep on babbling. Why? Because you can screw The People once, twice, three-times but eventually they will line up in front of your mansion and ask you the questions we were babbling about. Ask Erich Honecker: “The wall will still exist in 50 and in 100 years when the reasons for its existence are not yet resolved.” (Berlin 19. Januar 1989)

Elizabeth Warren – http://www.youtube.com/watch?v=o2kfAr2h5NE&feature=grec_index

Agree 100%. It’s very frustrating to keep hearing Delong, Krugman, Stiglitz, etc. endlessly telling us they’re Keynesian. Public control of the money supply is a necessary 1st step toward true democracy. Main stream economics is not a science – it’s a grouping of charlatans.

Jim

commentsongpe.wordpress.com