Well my holiday is over. Not that I had one! This morning we submitted the…

The British government’s obsession with the fiscal rules is driving the economy towards recession

The UK economy is heading into a malaise. The latest news – UK construction activity in July falls at steepest rate since Covid (August 6, 2025) – and – UK services sector has biggest fall in orders for nearly three years (August 5, 2025) – confirms that there is a slowdown underway. That was prefaced by rising unemployment and falling overall GDP growth in previous data releases. However, when we examine statements coming from the Labour government, the Prime Minister is hinting that there might be tax rises in the Autumn Statement because a neoliberal oriented ‘think tank’ has told it that there is a £40 billion gap in the fiscal outcomes, which will breach the self-imposed limits specified in their fiscal rules. So the Government is contemplating more austerity and contractionary policy at a time when private spending is subdued and the economy is going backwards. It just demonstrates how the obsession with these fiscal rules grossly distorts fiscal decision making and focuses government eyes on all the wrong things. I am still amazed when I think how stupid we all have become for thinking that any of the stuff is acceptable.

So where are we at?

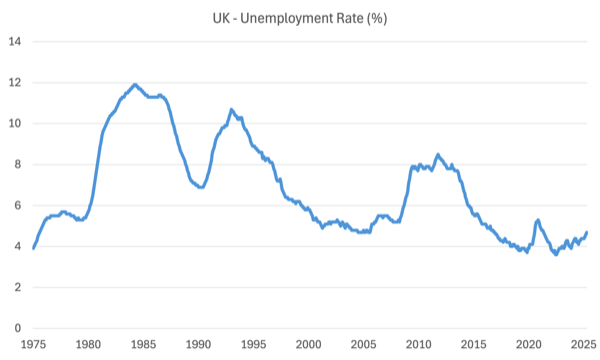

Here is the latest unemployment rate graph – it was 4.7 per cent and rising in the second quarter 2025.

According the latest Office of National Statistics bulletin (published July 17, 2025) – Labour market overview, UK: July 2025 – all the other labour market indicators are heading in the wrong direction.

1. “Estimates for payrolled employees in the UK fell by 135,000 (0.4%) between May 2024 and May 2025, and by 25,000 (0.1%) between April and May 2025.”

2. “Vacancies are down on the quarter and are below pre-pandemic levels”.

3. “Both regular and total nominal pay annual growth rates are down on the previous period.”

4. “The real annual growth rate for both regular and total (earnings) are down on the previous period.”

5. “The unemployment rate is up on the quarter and the year, and is above pre-pandemic rates. .”

6. “The economic inactivity rate is down on the quarter and down on the year, but is still above pre-pandemic rates.”

Then you add the survey evidence that (Source):

… total new work in the sector, which accounts for about 80% of the economy, eased to the slowest pace since November 2022.

And that (Source):

Activity in the UK construction sector fell last month at the sharpest rate since the height of the Covid pandemic amid a collapse in housebuilding, underscoring the challenge facing the government to meet its 1.5m new homes target.

And what do we get?

An economy heading towards recession.

So then what should the Prime Minister being thinking about?

Well, according to the latest interview – Starmer declines to rule out election pledge-breaking tax rises in budget after claim Treasury must fill £40bn deficit – as it happened (August 6, 2025) – his strategy appears to be to start conditioning the public for a tax rise:

Keir Starmer has defended the government’s handling of the economy, but declined to rule out tax rises in the autumn budget.

Which if a tax rise transpired would be exactly the opposite to what the Labour government should be doing given the circumstances.

The “£40bn deficit” reference is to a report that was issued yesterday from the National Institute of Economic and Social Research (NIESR), which used to be a stalwart research and policy development organisation with a Keynesian persuasion but now has become one of the mainstream organisations pushing the fiscal fictions of neoliberalism,

Sadly.

Anyway, in its – Report – the NIESR said that:

The UK economy enters the second half of 2025 still confronting weak growth and stubborn inflationary pressures … domestic challenges dominate the outlook. Chief among these is the government’s increasingly acute fiscal predicament. Simply put, the chancellor cannot simultaneously meet her fiscal rules, fulfil spending commitments, and uphold manifesto promises to avoid tax rises for working people. At least one of these will need to be dropped – she faces an impossible trilemma.

But they further noted that:

The government is no longer on track to meet its “stability rule”, with our forecast suggesting a current deficit of £41.2bn in the fiscal year 2029–30. With the autumn budget approaching, the chancellor faces unenviable decisions.

And:

1. Departmental budgets are already cut to the bone – “limiting scope for further cuts”.

2. “the poorest 10% of UK households face a further decline in their living standards this year.”

3. The Government will have to breach “its fiscal rules – risking higher borrowing costs or even market instability” or increase taxes and cut spending

Put all the pieces together:

1. Economy is starting to tank and unemployment is rising.

2. The government is being urged to implement even more major fiscal austerity.

2. Which will make the already significantly disadvantaged even more worse off than before.

This is modern Britain – a nation that has allowed ideology to run rampant.

But ask the question: Why do the pieces have to fall in that way?

Answer: Because the Labour government has put itself in voluntary fiscal straitjacket called its fiscal rules, which were never fit for purpose, given the circumstances and are a completely confected artefact of modern neoliberalism that serves the interests of the top end of town at the expense of everyone else.

It gets worse.

The most recent ONS bulletin – Public sector finances, UK: June 2025 – released July 22, 2025 – shows that:

1. Central government borrowing is rising – “the second-highest June borrowing since monthly records began in 1993”.

2. “The interest payable on central government debt was £16.4 billion in June 2025, largely because the interest payable on index-linked gilts rises and falls with the Retail Prices Index; this was £8.4 billion more than in June 2024 and the second-highest June central government interest payable since monthly records began in 1997, after that of June 2022.”

3. “The current budget deficit in the financial year to June 2025 was £44.5 billion; this was £6.5 billion more than in the same three-month period of 2024 and the third-highest April to June current budget deficit since monthly records began, after those of 2020 and 2021.”

So you get the picture?

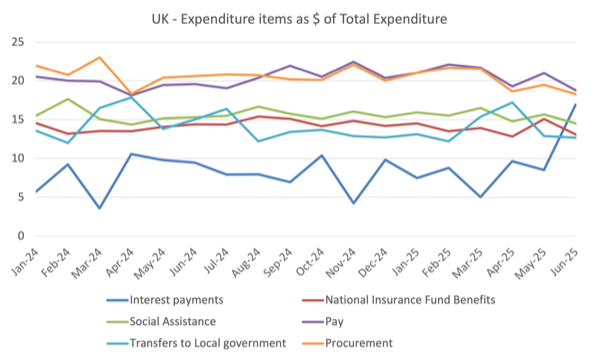

A deeper analysis of the expenditure movements is quite interesting.

Using the ONS dataset – Public sector finances summary tables: Appendix M (published July 22, 2025) we find that interest payments have skyrocketed as noted above.

The following graph shows the main components of central government expenditure as a proportion of total current expenditure from January 2024 to June 2025.

Interest payments have risen from 5.7 per cent to 16.9 per cent while all the other major components have lost share in total current expenditure – as the cuts have proceeded.

So even total current expenditure has risen by 23.3 per cent over that time, interest payments have risen by 264 per cent.

Another thing to note is that nominal net investment expenditure by the central government has fallen by 67.7 per cent since January last year.

The three things that you can glean from these developments are:

1. There is widespread austerity being imposed on public sector including local government.

2. The Labour government is undermining the already depleted public infrastructure by cutting its capital spending as part of its ‘invisible’ austerity.

I use that term ‘invisible’ because governments typically implement austerity by large cuts to capital projects because the public are less conscious of the implications.

It takes some time before the bridges and sewers collapse and roads wear out etc.

Eventually though the investment required to fix the damage when it does start to manifest far outweigh any on-going maintenance and improvement outlays.

Neoliberal myopia.

3. The massive increase in expenditure on interest payments are going to the wealthy including speculators at the expense of the poorest people in Britain.

Then think about this.

As noted above, the ONS tell us that the skyrocketing interest payments are “largely because the interest payable on index-linked gilts rises”.

What are these debt instruments?

Index-linked Gilts – “differ from conventional gilts in that both the semi-annual coupon payments and the principal payment are adjusted in line with movements in the General Index of Retail Prices in the UK (also known as the RPI).”

The British Treasury released a – Economic Progress Report – in May 1981, which sought to justify its decision to issue this type of asset (first issue was March 27, 1981).

In that Report the Treasury argued that while the indexed gilts would be “marketable” (that is, could be bought and sold in secondary markets) the ownership of those assets was:

… restricted essentially to pension funds, and to life insurance companies and friendly societies in respect of their UK pension business only. An institution wishing to purchase the stock must sign a statutory declaration to the effect that it is an eligible holder within the terms of

the prospectus. The stock may only be bought and sold by eligible holders.

I won’t go into the reasons they gave for these restrictions.

Suffice to say the restrictions were removed in March 1982 just a year after the Treasury had argued vehemently for the restrictions.

The Treasury also said that “indexed borrowing imposes discipline, in that it becomes less easy for Government to inflate as a way of resolving immediate difficulties.”

Which is one of the major reasons they keep issuing these totally unnecessary instruments.

They are one of several voluntarily imposed fiscal constraints that make it harder for government to operate.

Who owns these financial instruments?

Data from the UK Debt Management Office – Distribution of gilt holdings – shows that as at August 6, 2025

1. Total Amount Outstanding (including inflation uplift for index-linked gilts) = £2,761.80 billion nominal for the Gilt market.

2. Of that 24.3 per cent are index-linked – some £670,987 billion.

As at the third-quarter 2024 (latest data) – Distribution of gilt holdings – on ownership shows that of that outstanding gilt liability:

1. 30.5 per cent was owed to monetary financial institutions.

2. 21.1 per cent to insurance companies and insurance funds.

3. 15.9 per cent to other financial institutions.

4. 32.1 per cent to overseas holdings.

So not only is the British government compromising the major policy departments (and service scope and standards) which has a detrimental impact on ordinary British people, but it continues to issue assets to “overseas holdings” that enrich the wealthy who are not even in the country.

And meanwhile, they have significantly cut overseas aid which has helped the least advantaged in other countries.

It is a toxic mix.

And why?

Central to the why is the ridiculous obsession with the fiscal rules.

Conclusion

My assessment remains the same: in trying to meet the parameters of the self-imposed fiscal rules, the British government will undermine the real economy and inflict hardship on the least advantaged citizens.

I agree with the NIESR that the government cannot meet the fiscal rules unless it inflicts further significant austerity and drives the economy into recession.

Even then, the recession will reduce tax revenue and increase some elements of expenditure, which will make it hard to get within the fiscal rules boundaries.

And all for?

Nothing of consequence.

That is enough for today!

(c) Copyright 2025 William Mitchell. All Rights Reserved.

Dreams of the long lost empire do not add up with reality.

May, Johnsson, Truss, Sunak, Starmer are expressions of a “dead-end” no one can fix.

Just the management of decline.

The elites always think big and so someone thought of turning Russia into a vassal state and plunder its resources. Hail the emperor!

Someone ought to tell them that it’s just plain stupid.

Napoleon couldn’t do it and neither did hitler.

So, why do “we” think little Starmer can do it?

He and the pantomines on each side of the pond don’t even know what they got themselves into.

But then, they are just puppets, right?

Maybe we should beggin by knowing who are the masters.

Thanks Professor Mitchell. Yet again I have to turn to a blog by an Australian to see a proper analysis while the British media can’t get beyond ‘the NIESR said ..’. I guess it’s no surprise that the current Labour Government is still acting as Thatcher’s did in March 1982. With regard to, ‘It takes some time before the bridges and sewers collapse and roads wear out etc.’ the UK may be a little behind Germany and Italy in respect of decrepit bridges, but our private water companies response to infrastructure needs has long been to pump excess shit straight into our rivers and lakes. As for our potholed roads, the answer is clearly to acquiese to the car manufacturers and finance companies wish for people to indebt but otherwise insulate themselves in monster vehicles completely unsuited to UK road infrastructure.

Assuming the government followed their fiscal rules, I just wondered how long it would take for the allowable government spending to be impossible

Debt servicing costs are 16%

Boe Lowering the bank rate, 30 yr Treasury yield has only go up, debt servicing costs are 16%

Inflation is still high

Britain imports 40% of its energy & food.

We can’t lower bank rate that much more than Fed otherwise we’ll get import led inflation.

Or carry out yield curve control and push down borrowing costs, foreigners will dump £ making vital imports more expensive. British already has the most expensive energy in the world due to netzero.expensice housing too.

Britain pays out on ‘triple lock ‘ Guarante on pensions. Increasing social insurance benefits going to natives & immigrants. huge foreign aid commitments.

Britain doesn’t have sufficient resource space to meet all of it current spending obligations and is at its inflation spending limit.

I don’t supprt Increasing taxes.but it still needs massive restructuring & cuts in spending ( including the Treasury Boe indemnity cost)

The government also insists on paying £35 billion to Mauritius for some reason.

@Fred

If the ‘cost’ of higher gov investment is a depreciation (supposed depreciation, since no one can predict the exchange rate effects), its more worth it than trying to attract inflows through higher rates. Depreciation itself is a real purchasing power cut (and hence a spending cut) which allows for more policy autonomy.

What kind of spending you want to cut? Military is a pretty good one, but it must be cut in a way employment and output of other sectors aren’t affected.

> Britain pays out on ‘triple lock ‘ Guarante on pensions. Increasing social insurance benefits going to natives & immigrants. huge foreign aid commitments.

Yet has any of that resulted in higher inflation, no. British Pound is still a very privileged currency in the global hierarchy and doesn’t experience capital outflows whenever Fed raises rates like many third world nations do.

I think one shouldn’t be stuck in TINA mindset. Take bold policies to increase spending, even at the cost of depreciation. Unemployment and austerity breeds reactionary politics. If the left wing parties (e.g. Corbyn and Sultana’s new party) cannot increase spending and get past the neoliberal sound finance mindset, it’ll bring in reactionaries into power in the future. The reactionaries, instead of fixing anything economically, will do culture wars nonsense.