I started my undergraduate studies in economics in the late 1970s after starting out as…

Balance sheet recessions and democracy

A regular reader sent me a recent financial market report written by Tokyo-based economist Richard Koo which raises some interesting issues about the association between prolonged recessions and democracy. Koo has achieved some notoriety in the last decade or more by coining the term “balance sheet recession” to describe what happened to Japan during its so-called “lost decade”. He also applies the analysis to the present global economic crisis. While he is not a modern monetary theorist, he recognises the need for considerable fiscal intervention and the futility of quantitative easing. So this blog is about all of that.

What is a balance sheet recession? I had previously read Koo’s 2003 book – Balance Sheet Recession: Japan’s Struggle with Uncharted Economics and its Global Implications – which was published by John Wiley & Sons.

The book sets out a theoretical explanation for the demise of Japan in the 1990s. At the time, there were two conflicting theories about why Japan went into economic decline in the 1990s. First, the neo-liberal supply-side argument claimed that Japanese institutions (banking, industry etc) were necrotic and required substantial microeconomic reform – privatisation, deregulation and elimination of bureaucratic interference.

Second, demand-side explanations argued that there was a need for expanded public works spending to overcome the severe spending gap that emerged from the rising saving desires of the private sector. Some demand-side theories were not opposed to the micro reform agenda proposed but said that the urgency was for fiscal and monetary expansion.

Koo’s balance sheet recession idea is somewhat different again. He argues that the structural rigidities in Japan, inasmuch as they exist, were present during the strong growth period and did not just emerge in the 1990s.

He prefers to focus on the debt build up that began in the 1970s and accelerated during the 1980s. The asset price boom that was fuelled by the debt accumulation (primarily tied to land) was ultimately terminated by contractionary Bank of Japan monetary policy. The subsequent crash in asset values and the resulting balance sheet adjustments that followed give rise to the term – “balance sheet recession”.

Koo says that during this process of balance sheet restructuring the priority is to pay off debt rather than pursue profit. In turn, this suppresses aggregate demand as investment plunges. The downturn reinforces the pessimism and credit-worthy borrowers dry up and bankruptcies rise. The circuit breaker has to be fiscal policy because the economy gets caught in a liquidity trap (which I explain below).

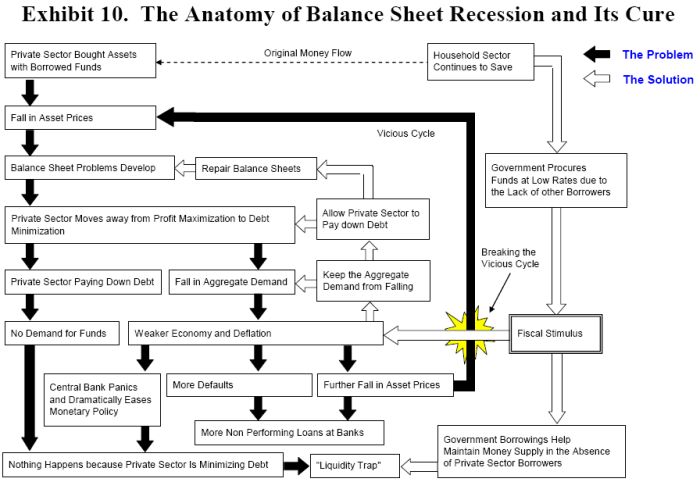

The following diagram is taken from his 2003 book. It is essentially an expanded circular flow model used in introductory text books to show the relationship between income and expenditure and output. The flow diagram captures the basis of his balance sheet recession concept.

So this is the sequence of events captured in the diagram:

- The private sector builds up massive debt levels to buy property and speculative assets.

- The asset prices rise as demand rises but then eventually the bubble bursts and the private sector is left with declining wealth but huge debt.

- The private sector then start restructuring their balance sheets – and stop borrowing – no matter how low interest rates go.

- All effort is devoted to paying back debt (de-leveraging) and households increase their saving and reduced spending because they become pessimistic about the future.

- A credit crunch emerges – not because there is enough funds but because banks cannot find credit-worthy borrowers to lend to.

- Attempts at pumping liquidity into the banks will fail because they are not reserve-constrained. They are not lending because no-one worthy wants to borrow.

- The faltering spending causes the macroeconomy to melt.

- With this private contraction (reducing debt, saving) the only way out of the “balance sheet recession” is via public sector deficit spending.

GDP growth in Japan has been very low for the last 15 years and neo-liberals argue that this is evidence that the deficits were wasteful. But Koo says that the only thing keeping the economy from falling into a deep depression was the deficits. His work categorically shows that when the neo-liberal lobby started to gain traction and government net spending was reduced the Japanese economy went backwards again. But interestingly, these attempted cut-backs only increased the deficits – via the automatic stabilisers!

But don’t get the idea that Koo is a Keynesian although both advocated using fiscal policy to stimulate aggregate demand. and to thus ensure that production capacity is fully utilised. The difference though is in how they understand a recession. In the General Theory, Keynes argued that recession originated from a decline in investment driven by pessimistic profit expectations by business. The pessimism promotes an saving and aggregate demand drops.

However, Koo sees the private sector using loose credit to underwrite expansion of spending which results in the increased precariousness of private balance sheets. The reaction to this credit binge is that the private sector starts to save more and will not borrow even though interest rates are low. So monetary policy will not stimulate investment.

Interestingly, Koo notes that:

Western academics like Paul Krugman advised the BOJ to administer quantitative easing to stop the deflation. Ultimately – and reluctantly – the BOJ took their advice, and in 2001 the Bank expanded bank reserves dramatically from ¥5 trillion to ¥30 trillion.

Nonetheless, both economic activity and asset prices continued to fall, and the inflation projected by Western academics never materialized.

American economist Paul Krugman has of late become the deficit guru (unfortunately). Recently, CNN, for example, ran a head-to-head with Krugman versus John Taylor, the increasingly asinine conservative macroeconomist from Stanford, who actually is blaming the crisis on government intervention (deficits!).

The problem is that Krugman has not always been a fiscal policy sort of a guy. During the Japanese “lost decade”, Koo notes, he dramatically failed to understand the nature of their problem and recommended a reliance on monetary policy.

In one of his New York Times columns (published October 31, 2008), Krugman noted that “the long-feared capitulation of American consumers has arrived”, referring to the sharp drop in real consumer spending in the US in the third quarter of 2008. In this article, Krugman more or less admits (by implication anyway) that he was wrong in his analysis of the Japanese problems in the 1990s. Of-course, he doesn’t actually admit it but you compare his earlier statements on Japan (which I note below) with this statement now and you get the picture.

In October 2008, Krugman says that “American consumers have long been living beyond their means” and while in the past “Americans saved about 10 percent of their income” this had of late become negative and “consumer debt has risen to 98 percent of G.D.P., twice its level a quarter-century ago”.

These trends were also apparent in Australia and the same arguments were used by the free market lobby to allay commentators like myself from pointing out the dangers of running fiscal surpluses and then relying on increasing levels of private debt to maintain growth – that is, the growing debt is building wealth. Even official documents from the central bank (RBA) in the late 1990s promoted this argument – don’t worry be happy!

It was always the case that the households and firms seek to stabilise their precarious balance sheets and seek saving.

Krugman notes that:

Sooner or later, then, consumers were going to have to pull in their belts. But the timing of the new sobriety is deeply unfortunate. One is tempted to echo St. Augustine’s plea: “Grant me chastity and continence, but not yet.” For consumers are cutting back just as the U.S. economy has fallen into a liquidity trap – a situation in which the Federal Reserve has lost its grip on the economy.

Essentially, he is outlining the paradox of thrift, which we teach our first-year macroeconomics students – that “individual virtue can be public vice” – that is, when consumers en masse try to save more everyone suffers because national income falls (as production levels react to the lower spending) and unemployment rises.

Krugman says:

The point is that if consumers cut their spending, and nothing else takes the place of that spending, the economy will slide into a recession, reducing everyone’s income. In fact, consumers’ income may actually fall more than their spending, so that their attempt to save more backfires …

This is the so-called paradox of thrift. That what applies at a micro level (ability to increase saving if one is disciplined enough) does not apply at the macro level (if everyone saves things go pear-shaped without other (government) intervention).

The general reasoning failure that occurs when one tries to apply logic that might operate at a micro level to the macro level is called the fallacy of composition. In fact, it is what led to the establishment of macroeconomics as a separate discipline. Prior to the Great Depression, macroeconomics was thought of as an aggregation of microeconomics. The neo-classical economists (who are the precursors to the modern neo-liberals) didn’t understand the fallacy of composition trap and advocated spending cuts and wage cuts at the height of the Depression.

A liquidity trap is when monetary policy loses any effectiveness. That is, the central bank might try to reverse the spending decline by cutting interest rates. But when the economy is in a liquidity trap this strategy will fail because people do not want to borrow at all.

Krugman’s implied admission of error in the Japanese 1990s situation is found in his next statement:

For the fact is that we are in a liquidity trap right now: Fed policy has lost most of its traction. It’s true that Ben Bernanke hasn’t yet reduced interest rates all the way to zero, as the Japanese did in the 1990s. But it’s hard to believe that cutting the federal funds rate from 1 percent to nothing would have much positive effect on the economy. In particular, the financial crisis has made Fed policy largely irrelevant for much of the private sector: The Fed has been steadily cutting away, yet mortgage rates and the interest rates many businesses pay are higher than they were early this year.

… what the economy needs now is something to take the place of retrenching consumers. That means a major fiscal stimulus. And this time the stimulus should take the form of actual government spending rather than rebate checks that consumers probably wouldn’t spend.

However, if we go back to 1998 and read what Krugman had to say about Japan then you get realise that he didn’t have a clue about that country’s plight. I won’t summarise the article except he recognised that there was a spending gap in Japan and that low nominal interest rates were not providing a stimulus. He also indicated that fiscal policy would possibly work but “there is a government fiscal constraint” and the Japanese Government would only be wasting its spending.

He then said that monetary policy had been ineffective because:

… private actors view its … [Bank of Japan] … actions as temporary, because they believe that the central bank is committed to price stability as a long-run goal. And that is why monetary policy is ineffective! Japan has been unable to get its economy moving precisely because the market regards the central bank as being responsible, and expects it to rein in the money supply if the price level starts to rise.

The way to make monetary policy effective, then, is for the central bank to credibly promise to be irresponsible – to make a persuasive case that it will permit inflation to occur, thereby producing the negative real interest rates the economy needs.

This sounds funny as well as perverse. … [but] … the only way to expand the economy is to reduce the real interest rate; and the only way to do that is to create expectations of inflation.

So he was completely wrong in this diagnosis. The only thing that got Japan moving again in the early part of this Century was fiscal policy.

Koo provides the answer:

The reason why quantitative easing did not work in Japan is quite simple and has been frequently pointed out by BOJ officials and local market observers: there was no demand for funds in Japan’s private sector.

In order for funds supplied by the central bank to generate inflation, they must be borrowed and spent. That is the only way that money flows around the economy to increase demand. But during Japan’s long slump, businesses left with debt-ridden balance sheets after the bubble’s collapse were focused on restoring their financial health. Companies carrying excess debt refused to borrow even at zero interest rates. That is why neither zero interest rates nor

quantitative easing were able to stimulate the economy for the next 15 years.

Koo also takes aim at the IMF which was aghast at the Bank of Japan’s decision to end quantitative easing (as a futile exercise) in 2006. He says that:

The IMF – which was not alone in being unaware that Japan was in a balance sheet recession – opposed the BOJ’s decision to end quantitative easing. But when the Bank went through with its plan, nothing happened.

Many worried that long-term interest rates would skyrocket when the policy was discontinued. While long-term rates did arise 20-30bp in the immediate aftermath of the decision, they subsequently fell back to the previous 1.5-1.6% level, a record low in human history, and the collapse in JGB prices that so many had feared never happened.

So deficits do not drive up interest rates and, if appropriately scaled, also do not cause inflation. Koo makes this point very clearly in the following tract of his report:

Meanwhile, central bank monetization of government debt is not a sufficient condition for massive fiscal deficits to spark inflation. The sum of public and private sector demand must also substantially exceed the economy’s productive capacity.

In the US, however, private-sector demand has fallen sharply and the savings rate has risen dramatically in spite of zero interest rates. The resulting surplus of private-sector savings (ie, private savings in excess of private demand for funds) constitutes leakage to the economy’s income stream because of a lack of borrowers, producing a deflationary gap.

The resulting deflationary spiral is equal in magnitude to the excess savings of the private sector. The only way to stop it is for the government to borrow and spend the excess savings of the private sector, thereby returning the money to the income stream. That, in a word, is why the government must engage in fiscal stimulus to stabilize the economy during a balance sheet recession. Inflation will not result unless the government borrowing and spending are far in excess of the private savings surplus.

First, you see that Koo is no modern monetary theorist given he believes in a government budget constraint (GBC) – automatically associated deficit spending with borrowing (even when he is talking about economies with near zero interest rates and therefore no need to borrow to maintain interest rate targets).

Second, he clearly understands the relationship between nominal spending and real capacity in relation to an analysis of inflation. When the former exceeds the latter you start to get the threat of inflation.

Third, rising private saving creates a spending gap that will be deflationary – that is, cause output and employment to fall.

Fourth, the only show in left in town is for the government to spend and “finance the saving intentions”. You will note he doesn’t express it like I do. That is because he is a deficit-dove in this regard and via the GBC he thinks the government is borrowing the funds from the savings and then spending them to keep money returning back into the income-generation stream.

This is backwards reasoning. The money that the private sector uses to buy the bonds comes from the government net spending (deficits). The same deficits provide the funds to ensure that the private saving desires can be realised. If the deficit did not expand to meet these desires then, as above, the paradox of thrift, would drive income (and output) down and a crisis would emerge.

Fifth, once again he realises that inflation will not arise unless the deficits exceed the private saving desires. That is, nominal spending exceeds the real capacity of the economy to produce.

A related point is that made by various economists including progressives that in a balance sheet recession the problem is too much debt. Accordingly, so the logic goes, the last thing the government should be doing is increasing public debt.

So private and public debt are somehow merged as equivalents. You might appreciate by now that this logic is just plainly false. The debt that a household, which uses the currency, carries is a burden on its future capacity to consume because it has to be funded in some manner. The debt that a government holds does not constrain its capacity to spend in the future. There is never a solvency issue with sovereign government debt.

This is not to say that I advocate rising public debt levels. In fact, I would issue very little public debt and keep the rates at the short-end of the yield curve close to zero in perpetuity. I would then make all the spending adjustments necessary to keep nominal demand in line with real capacity via fiscal policy.

Democracy and deficits

What I found interesting in the report that the reader sent me (written by Koo) was the discussion about democracy. Koo says:

The examples of Japan, the US and Europe show that it is difficult for governments to spend that much during peacetime. If anything, the risk is that fiscal outlays will be insufficient to offset the private savings surplus.

In democracies, there is an extremely high risk that governments will not be able to provide the necessary fiscal stimulus for the necessary duration because of concerns about the size of the budget deficit and criticism from proponents of fiscal consolidation. Japan fell into this trap in 1997, triggering a deflationary spiral and five consecutive quarters of negative growth.

In other words, the political process undermines the capacity of sovereign governments to deliver full employment. So where do these concerns that he mentions come from? The media and the public debate that it spawns. It is obvious that when you wheel the neo-liberal line out day after day and tell everyone their children are going to be so far in hock that the sky will fall in and they will live in penury because of the deficits today that some traction will occur.

In the true full employment decades after the Second World War, this hysteria was more controlled and governments (even though they were constrained by the currency system – gold standard etc) were able to achieve their policy goals of high employment and income growth.

The problem is no so much democracy – which I admit is a very hazy concept – but the lack of it, which is reflected in the highly concentrated media industry which largely reflects a conservative anti-government bias.

I went hunting for acceptable data which might “measure” democracy. There is an industry among some political science researchers on this topic. Unfortunately it seems to be very neo-liberal in its application. Cuba is not democratic at all but the USA gets the top mark! So I haven’t got very far in this little research effort – I was planning to examine the hypothesis in a formal way (econometrics) but I don’t trust the “democracy” data and it is peripheral to my research interests anyway.

Conclusion

There is much in Koo’s analysis that I disagree with. Most of these disputed points arise from his erroneous assumption that the government needs to finance its spending. It clearly doesn’t need to do that if it is the monopoly issuer of the currency.

But his understanding of the spending gap and the role played by fiscal policy in a severe downturn is clearly something I agree with.

Krugman also doesnt know the modern monetary interpretation of current account deficit. His book on International Economics talks of how the US owes so much to ROW because of imports.

Bill: while I think I follow most of your reasoning, I’m still not quite sure why you don’t like the idea of Government borrowing. As I understand the monetary theory perspective, I don’t see that it makes any real difference either way whether the Government simply credits reserve accounts or issues debt. Since the Government is not revenue constrained, it’s not as though servicing the debt is a problem. To the extent that debt issuance creates any pressure on interest rates, this can be addressed through central bank market operations. Is your concern simply that presenting Government spending as something that must be “financed” by borrowing reinforces a misconception that Government spending is constrained, or is there an economic difference that you see at play?

Dear Sean

I don’t really care whether government borrows or not. I figure that the Treasury officials that manage the who debt process would be better employed elsewhere – researching cures for cancer or something else. In a technical sense crediting reserve accounts and issuing debt is equivalent although spending a $ on interest-servicing versus a $ on hospital improvement is not equivalent. Clearly that non-equivalence is not an issue if the economy has excess capacity but if (as if!) we ever get back to full employment then the government does have to consider its nominal net injection and at that point compositional issues become more of an issue. So then we have to consider who benefits from the bond issues (as a source of private wealth) versus who benefits (public wealth) from better public schools and hospitals.

Given that bond issues are really about monetary policy my preference for no debt reflects my fiscal policy bias. I don’t think debt issuance puts any pressure on interest rates given that the central bank can determine whatever rate they like. In that regard, I would just keep the short rates at zero and release a significant portion of RBA staff to do research and/or run a Job Guarantee scheme. They would serve the community better in those alternative roles. So I would take monetary policy out of the counter-stabilisation tool kit and just use fiscal policy which is more effective.

In this respect, while I didn’t write about it this blog, I disagree entirely with Koo’s depiction of the upturn – where he considers monetary policy becomes effective again and fiscal policy crowds out. This (erroneous) view is driven by the funding assumptions (that is, the GBC is an ex ante financial constraint) which are clearly false. Fiscal policy is effective up and down the cycle whereas I doubt monetary policy is all that effective any time. Certainly, not in the typical range of interest rate adjustments.

So I guess my view just reflects the KISS principle. Keep things transparent and force the private futures traders etc to get their own risk-free (or low risk) benchmark asset and get them off the corporate welfare train which government bonds provide them – the guaranteed annuity!

best wishes

bill

Bill your idea of having interest rates at zero seems to make sense in the present context. However the whole world private sector has too much debt causing the recession and has reduced demand. The present monetary policy really cannot do much because a monetary policy cannot increase the private sector asset value (It just exchanges one asset for another). As you have pointed out on various occasions, loans create deposits and banks look for reserves later and hence billions of dollars of reserves cannot do much. But let us consider a hypothetical world where the private sector has saved enough – wouldnt the availability of cheap credit bad for the economy ? I understand fiscal policy can take care of this and is more powerful but fiscal policies have to change gradually and maybe monetary policy can do something here. For example, people would get really angry on a tax rate increase.

I know I’m kind of late, but here is a question, anyway. 🙂

“A credit crunch emerges – not because there is enough funds but because banks cannot find credit-worthy borrowers to lend to.”

I’m having a problem with the term, “credit-worthy”. Does it not have a systemic aspect in addition to the personal one? That is, aren’t many people less credit worthy during a severe recession because it limits their prospects of getting money? OTOH, if enough of them were granted the credit they desire, could there not be a virtuous feedback cycle, where the money created by lending to them increases their prospects?

And, as always, what about the social aspects of credit worthiness? Red-lining and other racially motivated practices aside, what about micro-credit? Does a recession make it less of a good idea?

dear Min

I totally agree with your perspective. The term is general to describe either banks not wanting to lend to someone (summarised as not being credit-worthy but could easily be a screen for prejudice etc) and/or people not wishing to borrow who would be deemed by the banks to be credit-worthy but are behaving in a risk averse fashion.

I hope that clarifies that.

best wishes

bill

Much grass, sennor Bill. 🙂

That’s odd!

My understanding is that democracy biases a government to deficits;

voters want more government spending

and lower taxes.

Look at California! Perhaps if they seceded or created their own money the inbuilt Cali-deficit wouldn’t be an issue.

Balance sheet recessions and democracy

So due to democratic constraints of not voting for politicians that promote spending (due to the debt phantom) the necessary fiscal spending does not come to relieve the balance sheet recession.

This then leaves the only avenue for government spending being the involvement in a war that has popular democratic support. It seems even in times of austerity, government spending can always be found for war making.

This then gets the fiscal stimulus out there but in the most undesirable way.