I am travelling today to Tokyo and have little time to write here. But with…

Australia GDP growth flat-lining

The Australian Bureau of Statistics released the March 2010 National Accounts data today and it revealed that the Australian economy has grown by 0.5 per cent only in the first quarter of 2010 and the trend is now dead flat. While the Australian economy sidestepped the global economic crisis with just one negative quarter of real GDP growth courtesy of the aggressive fiscal stimulus packages, private sector spending continues to subtract from growth. Private capital formation declined in the March quarter. The current performance of the Australian economy will make any not be sufficient inroads into the high rates of labour underutilisation that remain. The RBA claimed yesterday that economic growth is back around trend but the data shows that is far from the truth. Today’s data confirms that the fiscal contribution was the only reason Australia stayed out of official recession.

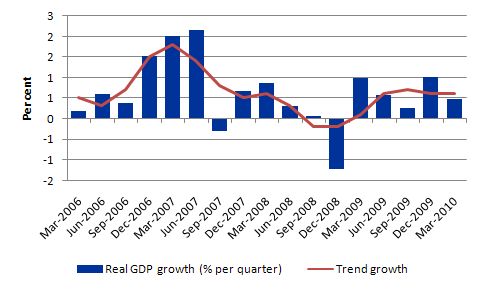

The following graph shows the quarterly percentage growth in real GDP from March 2006 to March 2010 (blue columns) and the ABS trend series (red line) superimposed to bring out the fact that the Australian economy is now flat-lining along at around 2 per cent growth per annum if not actually slowing a fraction. In the first 3 months of 2010, quarterly real GDP growth was back below trend.

The Sydney Morning Herald quoted a business economist as saying that:

… the weak private sector investment and housing investment had formed “a bit of an air pocket” in the economy. However, public spending and the household sector continue to expand. “Growth slowed but basically it is still really waiting for the business sector to really pick up momentum … And we’re also waiting for the housing recovery to come through”.

Today’s GDP results confirm what several other data series have been indicating in recent weeks – the Australian economy is going nowhere at present.

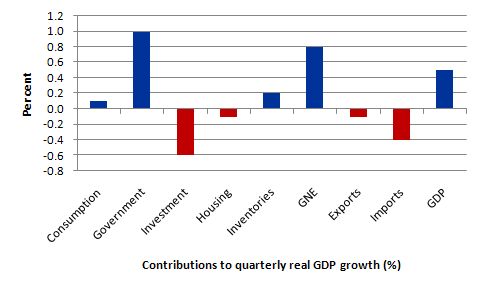

The next graph really shows you what is going on. It shows the percentage contributions to real GDP growth in the March 2010 quarter by aggregate spending type.

While GDP growth was 0.5 per cent in the March quarter, there was a weakening in private spending. The private sector contribution to growth his overall negative even though household consumption added 0.3 per cent to the bottom line. The graph below shows that residential investment in housing fell (contributing -0.1 to the GDP growth). Private investment fell in the quarter and contributed -0.6 per cent of the GDP growth. So no capacity building has been going on.

The other notable feature was the fall in exports (contributing -0.1 per cent of the GDP figture). The miners are arguing that the export sector is saving Australia at present. But the data is clear – exports subtracted from growth and net exports (taking into account imports) cut -0.5 per cent from GDP growth.

Public expenditure on infrastructure and buildings which was a central aspect of the second part of the fiscal stimulus package was the main positive contributor to GDP growth – adding 0.7 percentage points to the figure. If the deficit terrorists had have had their way, and forced a contraction in government spending then the Australian economy would have recorded negative growth in the March quarter 2010.

Interestingly, the ABS revised the December quarter growth rate upwards which further reinforces the contribution of the fiscal stimulus.

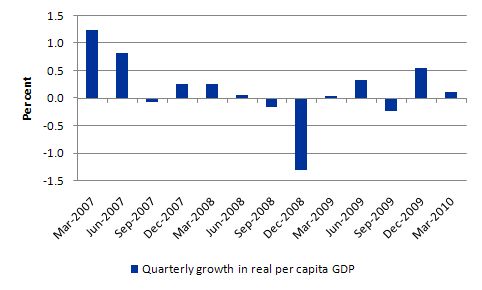

The following graph shows the quarterly percentage growth in real GDP per capita from March 2007 to March 2010. It grew by 0.1 per cent in the March quarter and confirms that improvement in real living standards is static at present.

Labour market impact

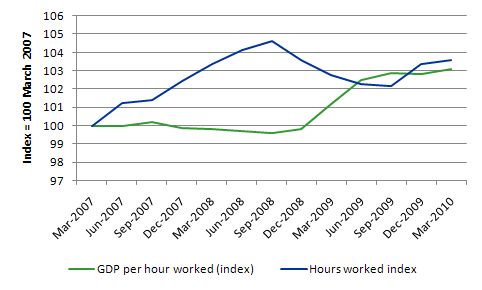

The following graph shows real GDP per hour worked and total hours worked indexes (March 2007 = 100) which provide some clue as to what is going on in the labour market. The economic growth is not driving strong growth in hours worked. Ordinarily this would mean that employment growth should be very flat and unemployment should rise given that the labour force is growing around 1.8 per cent per annum at present.

The reality is that unemployment is being kept down because productivity growth is fairly slow also and declined in the March 2010 quarter.

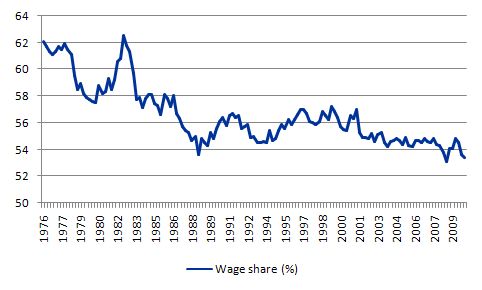

Wage share continues to fall

The wage share in factor income is tells us about the direction of real unit labour costs – that is, what each unit of output is costing per real unit of labour input.

The wage share can fall because the real wage is falling as a result of discretionary policies to deregulate the labour market and attack unions. But, equally, it can fall because the economy is booming and productivity growth is strong.

The latest estimates for the March quarter 2010, show the wage share fell again by 0.2 percentage points (from 53.6 to 53.4 per cent).

The following graph shows the evolution of the wage share in national income since March 1976. It shows the continuous redistribution of income from wages to profits which I document as one of the characteristics of the neo-liberal period that led to the current crisis. Please read the blog – The origins of the economic crisis – for more detail on this point.

In historical terms, this redistribution is very large and unprecedented – another atypical behaviour – which the neo-liberals have tried to condition us is just normal. This trend along with the rapid increase in household indebtedness and the obsessive pursuit of budget surpluses are all historically atypical behaviours – which have to be reversed if we are to avoid further crises of the type that has recently crippled the World economy.

I do not believe that the households can absorb the real output that is being produced by the economy under these distributional trends without having to continually increase their debt levels. Real wages growth has to come back into line with productivity growth to ensure sustainable growth is achieved and this means one thing – there has to be a rather significant shift in the wage share upwards.

The reality is that this can only be accomplished if real wages growth is allowed to track labour productivity growth. That will require a paradigm shift away from labour market deregulation, anti-labour legislation and trade union bashing.

I don’t see that happening any time soon and combined with our failure to take a serious position on financial market reform and our obsession with fiscal austerity – it is clear we are setting our economies up for the next crisis. Conservative ideology triumphing over good economics.

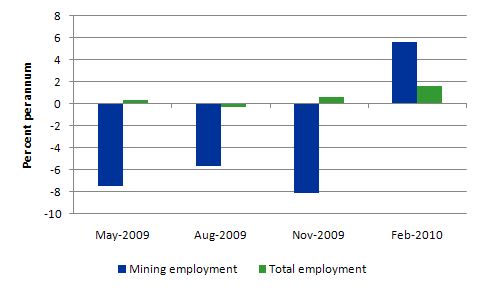

Did the Mining sector save Australia?

With the announcement by the Federal Government in the May budget that they are finally going to introduce a 40 per cent resource rent tax (on rents not profits!), the Mining lobby which is a particularly bullying and obnoxious lot have been running nationwide campaigns arguing that they will leave the country and that they saved us from recession.

The following graph is taken from the ABS Labour Force data by industry and shows annual employment growth for the last four quarters for the mining industry and for the nation as a whole. Draw your own conclusions. It isn’t rocket science.

The external outlook

Australia’s economic fortunes are increasingly tied to China’s growth path. There has been a lot of speculation that China is slowing and in the second-half of 2010 may be in trouble.

The latest data suggests that Chinese manufacturing growth has slowed in the last month in response to weakening domestic and external demand.

There is also speculation that the Chinese property market, which had driven growth via construction is now overheating and economists there are urging the government to raise interest rates to quell demand.

The news from Europe remains bleak. Here are some headlines that came in this morning via RSS:

- European Unemployment Unexpectedly Increases to 12-Year High

- Trichet Says ECB ‘Fiercely Independent,’ Stable Prices Mandate

- Trichet Says ECB Won’t Tolerate Budget Indiscipline Any Longer

- Bank of Italy: EU euro defense package can’t last

- ECB: Banks Will Suffer Considerable Loan Losses In 2010, 2011

- European Manufacturing Growth Slowed More Than Estimated in May

- Fitch downgrades Spain’s credit rating

- French New Car Sales Fall 12% in May, After 12 Monthly Gains

- Italian Unemployment Climbs as Recovery Fails to Create Jobs

So after nearly 3 years of economic turmoil, the European indicators remain mostly negative.

Conclusion

While the politics of the two fiscal stimulus packages have not been handled well by the Governemtn and there have clearly been some issues relating to waste and poor implementation, the point we should remember is that any large-scale stimulus interventions of the type taken – which in international terms was early and large relative to GDP – are very complicated and you can expect some administrative inefficiencies. Imagine if the private sector had to ramp up investment spending within a quarter or so with virtually zero administrative machinery or expericen – what do you think would be the outcome of those projects.

The neo-liberal era has been marked by a major reduction in Departmental capacity to design and implement fiscal policy – given the obsession with monetary policy and the major outsourcing of “fiscal-type” government services to the private sector. Many of the major Federal government policy departments are now just contract managers for outsourced service delivery. So with the voluntary reduction in fiscal capacity within the federal government over the last 20 years or more it is no surprise that the overall capacity of the government machine to implement efficiently and speedily complicated nation-wide infrastructure programs has been diminished.

This is a lesson for the future in my opinion. We can no longer deny that fiscal policy is required to address serious swings in private spending. Monetary policy has been proven to be ineffective in dealing with aggregate demand failures of the sort we have witnessed in the current crisis. In that context, governments must develop forward-looking capacity to ensure that it has project implementation skills when they are required.

It is clear that the fiscal stimulus packages were still driving economic growth in the March 2010 quarter. If the view of the deficit terrorists had have prevailed we would have been in a prolonged recession like the rest of the advanced world with all the concomitant costs extending into the labour market.

If we had have taken the Chicago school (or the Harvard school) line – and left the collapsing economy to the private market to sort imagine where we would be now.

Where I think the Government could have done a lot better is in the area of job creation. They should have concentrated the stimulus on efforts to provide public sector jobs to the most disadvantaged workers who bear the brunt of unemployment and underemployment. They are still idle and without sufficient income. It would have delivered much more to the economy than competing for tradespersons with other “private” demands for those services, however, weak they were at the outset of the crisis.

Any real GDP growth is good news. But the fact is that it is still insufficient to absorb the pool of underutilised labour.

The real threat facing Australia at present is the combination of a EMU meltdown and a slowing Chinese economy combined with the withdrawal of the fiscal stimulus. If the world double-dips and our government persists in its obsession to get back into surplus post-haste, the future is less than bright.

Digression: Local citizens’ action in Newcastle

The property developers that prey on all public space in Newcastle have long mounted a campaign to get the State Government to eliminate the rail line into the city so they can develop the land. This is the only viable transport link from the hinterland and allows people to get to the beaches and surf etc by public transport. The developers claim that a bus service can replace the rail.

A dedicated group of activists Save our Rail have struggled for a long-time to resist the campaign by the developers. The problem is that like all grass roots struggles they have no money and do not eat and drink with the policy makers in private clubs around the place.

Anyway this coming Thursday, June 3, 2010 from 17:00 to 18:00 – Save our Rail are organising a public rally in Civic Park opposite the Town Hall. At that time the “Fix our City” meeting is being held in the Town Hall. The Fix our City aka as Fuck our City is the monied organisation backing the developers.

The only way we will save the public rail transport into the city is to join struggles like this. I urge all locals who read my blog to attend the rally.

On a satirical note, those who arrive beforehand can see the separate DARC-BICS (Developers Against the Rail Corridor – Building in the Corridor Soon) property developer lobby group throw their support behind Fix Our City’s demands to cut the rail line. DARC-BICS’s rally will be held outside Town Hall from 4.30pm. Their spokesman stated: “We have waited far too long for the NSW government to remove this train line so that we can build on it”.

That is enough for today!

Hi Bill,

Good to read your post on today’s national accounts.

On the topic of the rail line, are you a user of it?

Dear Rationalist

I do use it to – mostly when I go to Sydney.

best wishes

bill

The labor government is no different than liberals. They are privatising rail and other assets in Queensland too. So, there is not much to choose from and I think it is futile to protest and waste your time.

The same is happening in US too. I don’t see much difference between Obama and Bush. If you wait for a few years you will discover Obama attacking another tiny country.

In this world, most people broadly speaking, fall under one of the two categories: prey or predator.

People who are lucky enough can choose to be a member of any one of these two categories.

Cheers,

Sriram

This is the last of the Food for Thought comments on Imperfection. (So cheer up!)

The final source of imperfection to be discussed is dispersion or non-concentration. Simply is the scatter of parts that form a unit of occurrence that leads to a mismatch of contact per part and a spread of non-simultaneous contacts across parts. Other approaches of analysis have been offered, such as search theory, see survey of Pissarides (2000), Diamond (1984), Howitt (1986) and Farmer (2010). They find multiple positions in a continuum of equilibria (indeterminancy of solution). Here,in this analysis, I use queueing theory, see Gross and Harris (1998) and spectral theory, see Kuttler (2010) to present and specify the presentation. The purpose is still to show how reality affects the Keynesian concept of effective equilibrium stasis.

The properties of dispersion of parts are rank of queue and phase of spectrum. Parts, as explained in previous comments, are formed as trials of occurrence drive towards completion a unit of occurrence. As the completion process approaches its limit, parts converge to a degree of concentration, one of the sources of unit perfection. The convergence is limited by complexity since the forces of completion adjustment get entangled, inducing an entropy of reduction. (No more in this comment!). Parts queue in order to reach a contact with other parts along the path of completion and they have a rank of wait (storage) as they get “bumped” up the ladder of the queue until served. This is a vertical generation process, reflecting a matching technology. The rank of a part rises in the queue (the queue is shortened for a part) as a prior reaches contact and shifts (interval) with other parts along the path of unit completion. The mismatch of wait, for a part with a higher rank, and the unit dispersion are reduced or concentration increases and parts converge.

On the other hand, the spectrum of parts consists of phase intervals (distances) among parts. Each phase interval increases as the queue of parts is shortened. This is an horizontal allocation process, reflecting a spectral transformation function that depends on the phase interval. The phase interval of the spectrum rises and the dispersion increases and parts diverge horizontally. Thus, a rise in the rank queue per part implies a reduction in dispersion and a rise in the phase interval of the spectrum across parts implies an increase in dispersion. In order to assure the stability of the process, we can close the “square” of nonlinear dialectics of interdependent properties of parts. When the queue is shortened (as the rank of the part rises), the phase interval increases and when the phase interval decreases the queue line is lengthened (and the rank is reduced).

At a given level of completion, the unit occurrence has a mix of rank of queue per part and phase of spectrum across parts which corresponds to a degree of dispersion. We can specify the above, with a simple model of dispersion based a) on a matching technology per part as the square root of the wait period subject to a Poisson generation process of the number of contacts in the wait period. Furthermore, the model is based on b) a spectral transformation of the phase interval as the squared interval (distance) across parts subject to an exponential distribution of the intervals.

Under this source of imperfection, unit operation and behavior and its variation feedback is bounded by mismatches between parties in market trades and non-simultaneous transactions that require the holding of liquid assets. Furthermore, there are multiple positions of equilibria rather than a unique equilibrium that clears markets. Spreads of completed transactions are persistent. This describes another form of a Keynesian concept of equilibrium that corresponds to an effective stasis that could differ from the Pareto optimum general equilibrium position.

The sources of imperfection can be combined in a model of the mode of operation, behavior and feedback that is consistent with the effective equilibrium concept of Keynes.

Dear Bill,

Very good point about the trend for fiscal capacity being outsourced by most governments. This another form of externality imposed upon the community as a private gain is enforced upon services that the society has to pay. The same applies for offshore activities that replace domestic production of goods and services reducing the employment of home resources and returns them for consumption.

Given that we live in an increasingly interconnected world, do you think that developments in Europe are responsible for Australia’s lack of growth. Idon’t know how much Aus exports to Europe and other regions which practice fiscal austerity, and therefor have reduced demand for goods and services.

The UK has this problem, in that, 50% of goods and services are exported to Europe, yet there seems to be insufficient demand there.

I have a specific question to ask you, Bill, or your contributors:

In a previouse comment, someone replied to me about Inflation being a problem for nations which rely on Imports where that nations currency falls in value. I have heard, rightly or wrongly, that this is called ‘Imported Inflation’. If this is the case, does MMT have a description of the degree of potential exposure a nation has to imported inflation. For example, is it related to the Balance of Trade, or is it related to the ‘gross’ level of imports.

I am interested because of the level of public debt that the UK has, and to what extent this represents a threat of inflation due to imports. From reading, Bill, your other blogs I know that public deficit, itself, is not inherantly inflationary, but Britain being a physically small country which has to import food might put it at risk. I am interested in what steps our government could take to mitigate those risks by ‘improving’ our balance of trade.