I started my undergraduate studies in economics in the late 1970s after starting out as…

Would someone please put something in the water supply

When I read the financial and economic news every day I sense a global madness has emerged. Global political processes are becoming distorted by the types of debates that the conservative media companies and the mainstream economists are driving. Every day a new whacko proposition is suggested or entertained by governments. Old hatreds are also resurfacing as our economies labour on (or not labour to be more accurate!) in the face of a major private spending collapse accompanied by inadequate government fiscal responses. The collateral damage of the deficit terrorism is increasing and spreading and still the major political parties in most countries slug it out as to which one will deliver the most fiscal austerity. Would someone please put something in the water supply so that we can refocus this debate onto what is important. That was the plan in the late 1960s to chill everyone out and distinguish the meaningful from the nonsense. Something has to restore our sense of priorities. The longer this madness goes on the worse it is going to get. There is no sensible solution that will come from following the present path.

The Austrian schoolers have probably gone broke!

To start out today, here is my interesting piece of economic data segment (I just invented that title).

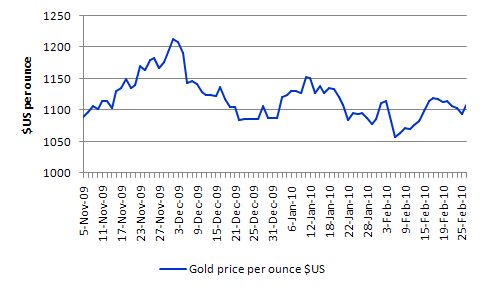

As the deficit-hysteria was mounting through the second-half of last year the gold-bugs and Austrian schoolers were all advising us to sell any US dollars we might have an invest in gold – a flight to security. Wasn’t it the case that with the “ballooning” and “unsustainable” budget deficits that the Obama Administration was running and the massive reserve buildup that the Federal Reserve had engineered, hyperinflation was just a matter of days away and sovereign default wasn’t much further away.

Gold, gold, gold.

Anyway, it seems that there is a flight to US dollars happening and the price of gold has been in decline

The following graph shows the daily price of gold since November last year up until the end of February 2010. You can get excellent data from the World Gold Council.

So you gold bugs, how many of you are now holding loss-making positions?

But moreover, the serious point is that none of the doom prophecies are showing up in the data. How long should we wait for the signs of hyperinflation, for the sky-rocketing interest rates, and the massive tax hikes – and ultimately, the collapse of government?

Surely those unsustainable fiscal positions should be starting to deliver the consequences the terrorists predict?

Of-course, even though Japan still defies them after nearly two decades of running “ballooning” deficits with deflation and zero interest rates and the World’s largest public debt to GDP ratio – Rogoff was still over there in the last week predicting insolvency.

Sure enough governments might start implementing mindless austerity programs – but these will be politically- rather than financially-driven. And my prediction is that they will make matters worse.

Which brings me to an interesting article in the UK Guardian from last Tuesday (March 2, 2010) – The state’s role in economic recovery

The state’s role in economic recovery

One Michael Meacher examined the The state’s role in economic recovery.

In relation to the upcoming British national election, he noted that:

Both the main political parties are focusing on one central issue (how far and how fast the budget deficit should be cut) when that is the wrong policy and the right policy is being rejected out of hand. At the same time, what should clearly be the central focus of this election doesn’t even get a serious mention.

Cutting public spending, whether drastically or sensitively and straight away or a bit later, is not the right policy when the “recovery” is so precarious, and particularly when the deep recession is mainly due, not to the bank bailouts, but to the collapse in private investment. That investment, especially in housing and private transport equipment (buses, trains, cars, etc), had already fallen spectacularly by 15% between the first quarter of 2007 and the second quarter of 2008, before the financial crash of September 2008. The banking failures, which then exacerbated the collapse in lending to businesses and homeowners from a healthy 20% a year growth at the start of 2007 to nil or negative two years later, compounded an already dramatic fall in private investment.

How many times have you read something like this in the last year? Not many I can guarantee.

The writer gets to the heart of the problem.

The real problem that exists is a major failure of aggregate demand in most nations. This has been driven by a collapse of private spending. So ladies and gentlemen when looking around for solutions two things are important to note.

First, an aggregate demand collapse needs more spending to enter the economy. Simple as that.

Second, if the private sector spending has collapsed – guess what? – there are only two other sectors left to fill the gap – the external sector and the government sector. Net exports in most countries are not going to rise to fill the gap. That would need massive structural changes in the economies which may be impossible but would certainly take years to implement.

So – guess what? – there is only one sector left. This sector has the capacity (if it issues its own currency and doesn’t peg it to someone else’s currency) to fill any size spending gap in its own currency. The budget deficit should be increased to fill that gap.

Discretionary policies have to be designed to ensure the non-cyclical component of the gap (properly measured) should be filled by long-term spending initiatives and the cyclical component of the gap should be filled by spending programs that can be easily scaled back when the cycle improves.

Talk of “credible exit plans” are meaningless if the government has properly implemented its fiscal intervention. Economic growth will return more quickly if it has and the cycle component of the deficit will disappear as the automatic stabilisers reverse the slide in revenue etc.

Trying to engineer “exit plans” with fiscal rules and other nonsensical contrivances only will make matters worse. The budget deficit is ultimately an endogenous balance which goes up and down with non-government spending.

The real problems should always command the spotlight – ensuring adequate employment growth to reduce unemployment, providing adequate housing and well-resourced schools and hospitals etc.

Governments should concentrate on those goals and ignore the budget numbers.

There is also a major banking crisis – certainly with zombie banks only surviving on government handouts. They all should be closed immediately – that is, nationalised. There should be no further socialisation of losses and privatisation of gains.

But the wherewithal to fix (that is, stabilise) the financial system exists and it is only a lack of political will that is failing at present.

Meacher agrees and says:

The obviously right response … in a deep recession is the stepping-up of public sector investment to compensate. A major public investment programme in job creation in house-building, infrastructure enhancement and the new green digital economy would provide a triple whammy to meet the current impasse. It would boost aggregate demand after private investment faded as the unsustainable housing and credit bubbles finally burst. It would go some way to filling the void left by the collapse of bank lending to businesses. And with house-building at its lowest ebb since the 1920s, it would give huge impetus to the provision of affordable social housing the lack of which, with 1.8m households currently on council waiting-lists, is by far the biggest unmet social need in Britain today.

He also rejects the arguments that “bond markets won’t stand for any further extension of the … budget deficit” and that the Government would “not be able to finance its debt” and that the nation “might even lose its prized triple A credit rating”.

He says the:

… opposite is true” and notes that what “has caused the recent unsteadiness in the financial markets is not the size of the deficit, but rather the government’s retrenchment from its (modest) reflation of the economy, which will make the downturn much more prolonged. An economy flat-lining on the bottom is what scares markets.

Real investors want burgeoining economies not depressed places with little income generation going on. That is the lesson that Argentina taught us after their default. The big organisations like the IMF and the usual array of mainstream economists (probably earning consulting fees from the creditor banks) claimed that the nation would be history and no-one would lend again.

As the government’s domestic oriented policy saw growth return, FDI returned. The finance minister of the time had one explanation: “greed, capital moves where it can make profit … it has no ideology at the end of the day” (or words to that effect).

Meacher then zeros in of the cause of the political malaise – and surprise surprise – it is the “neo-liberal agenda”:

… that private markets must be the exclusive mechanism for economic activity – remains dominant in both the main political parties.

What the crisis has taught us emphatically is that this ideological perspective does not translate into real outcomes that are sustainable and which distributes the benefits of economic activity broadly across people and regions.

Meacher says that the “neoliberal system is clearly broken” and refers to the dominance of the financialisation over real priorities.

The obsession with market fundamentalism, even though it has now been tested to destruction, has not given way to a needed rebalancing of the roles of the markets and the state. Privatisation, deregulation and labour market flexibility have run their course without producing stable growth or full employment. The grotesque ballooning of inequality has also generated a social recession, the stubborn persistence of poverty and unresolved and arguably deepening problems of an alienated sub-class.

To which I can hear the deficit terrorists crying “commie bastard”. However, Meacher is careful not to advocate nationalisation or central planning but outlines a return to closer regulation and attention to areas of market failure.

The point he makes about the “alienated sub-classes” resonates with another report that has just been released in the US and documents some of the broader, not-often spoken about, consequences of the unrelenting deficit terrorism.

More collateral damage from the deficit terrorists

The UK Guardian carried the story (March 4, 2010) that the – US facing surge in rightwing extremists and militias.

Apprarently:

The US is facing a surge in anti-government extremist groups and armed militias, driven by deepening hostility on the right to Barack Obama, anger over the economy, and the increasing propagation of conspiracy theories by parts of the mass media such as Fox News.

The Southern Poverty Law Centre (SPLC) has just released a report – Rage on the Right, which if even half accurate (and I don’t intend any slur here) is chilling evidence of the way in which deficit terrorism is creating wider damage than just the income and employment losses.

The SPLC say:

Hate groups stayed at record levels – almost 1,000 – despite the total collapse of the second largest neo-Nazi group in America. Furious anti-immigrant vigilante groups soared by nearly 80%, adding some 136 new groups during 2009. And, most remarkably of all, so-called “Patriot” groups – militias and other organizations that see the federal government as part of a plot to impose “one-world government” on liberty-loving Americans – came roaring back after years out of the limelight … The signs of growing radicalisation are everywhere. Armed men have come to Obama speeches bearing signs suggesting that the ‘tree of liberty’ needs to be ‘watered’ with ‘the blood of tyrants’. The Conservative Political Action Conference held this February was co-sponsored by groups like the John Birch Society, which believes President Eisenhower was a communist agent, and Oath Keepers, a patriot outfit formed last year that suggests, in thinly veiled language, that the government has secret plans to declare martial law and intern patriotic Americans in concentration camps.

These groups etc are thus no wallflowers and are not just a pack of guys who walk around with sheets covering them out in the bush playing with matches. Racially-motivated violence is rising as are attacks on government officials (including cops).

They also have significant political leverage on conservative politicians (are there any US politicians who are not conservative these days?) and have spokespersons in the national media such as that idiot Fox News presenter Glenn Beck who:

… re-popularized a key Patriot conspiracy theory – the charge that FEMA … [Federal Emergency Management Agency] … is secretly running concentration camps – before finally “debunking” it.

But by then the damage was done. There are a lot of unwell Americans over there who cannot tell what day it is!

As I catalogue the damage that the conservative movement and its media is creating you have to always bring the situation back to some perspective.

As I noted above in the discussion of the role of the state – the real problems of generating employment, reducting unemployment, providing adequate housing, well-resourced schools and hospitals etc – should always command the spotlight.

If the government concentrates on those goals and ignores the budget numbers then they will reduce the capacity of these hate groups and loony announcers to recruit the irrational. Everyone is better off then.

Iceland democracy survives despite its government

The Melbourne Age newspaper reported today (March 5, 2010) that the Icesave referendum to go ahead

The traitorous Iceland government has been trying to derail the referendum which was forced by the failure of the President to sign a bill which would have seen the government hand over 3.9 billion euros ($A5.9 billion) to Britain and the Netherlands.

How did this come about? Please read my blog – Iceland – another neo-liberal casuality – for a fairly detailed background on the controversy.

By way of summary, a privately-owned on-line bank, owned by Iceland capitalists, penetrated the UK and the Netherlands. The UK relaxed normal prudential control standards to let them trade. The bank offered ridiculously high (and unsustainable) returns on deposits to gouge depositors from other banks, while the regulators in the respective nations turned their backs.

After growing rapidly (by suckering in hundreds of thousands of depositors) they went broke in the financial crisis. The bank was thus a private (multinational) firm which went broke and that process is regulated through standard bankruptcy provisions.

The Iceland government had no legal or moral responsibility to do anything other than ensure its own citizens were protected which it did. It bore no legal or moral responsibility to the British and Dutch citizens who faced losing their saving.

The British and Dutch governments however did bear the responsibility to ensure the innocent depositors were protected. Accordingly, they intervened and paid out billions.

That should have been the end of it. It should have taught the British to regulate their financial sector more closely.

But the bullying Dutch and British governments decided to pressure the Iceland government, which represents a few hundred thousand people only, to pay the money back. How can you be made to pay money back when you were a party to the transaction?

The bullies threatened Iceland’s entry in to the Euro if they didn’t agree. The Iceland government officials who probably have been hanging out in Brussels enjoying the rich life than worrying about their own citizens panicked at the thought of not being admitted to the EMU (fancy worrying about that) and so agreed to the blackmail.

Come in President! The Prez then decides enough is enough – how can the citizens pay this debt when they were already being subjected to a harsh standard of living correction themselves as a result of the folly of their own capitalist greed coming unstuck. He showed leadership and loyalty to his people by vetoing the bill.

So on Tuesday the referendum will be held and around 75 per cent of the voters are predicted to reject the payback deal.

The bullies are now threatening to “block a $US2.1 billion ($A2.32 billion) International Monetary Fund rescue package for Reykjavik, sharpening Iceland’s recession”

Okay, the first thing Iceland should do is to default on all its non-Iceland currency debts. That would be my first advice. Or … renegotiate to re-structure them in its own currency. Then they better get used to fish!

Whichever way it goes it will be painful for this tiny country caught up in the neo-liberal feeding frenzy of the 1990s and beyond. That came unstuck and the real damage is being left for the ordinary folk to endure.

And I note … the government that is doing this to its own people is a “leftist government” – same as in Greece. What do we call progressive any more?

You can an E-mail to President Ólafur Ragnar Grímsson – forseti@forseti.is – in solidarity.

Rest and other things no longer permitted in Arizona

The following photo was taken from the New York Times article – Closing of Highway Rest Stops Stirs Anger in Arizona – and shows how absurd the emphasis on fiscal contraction has become in the US.

The state of Arizona has been selling buildings and making all sorts of other cuts but now the people have started to react because “the state took away their toilets”.

To cut costs, the government “decided to close 13 of the state’s 18 highway rest stops”.

Now I love to drive through Arizona – especially late in the afternoon while the sun is still out and it creates such beautiful patterns of light through the mesas and buttes that the highways wind through in certain areas. Driving through those gorges is a really lovely experience. But not if the bladder is full.

As an aside: along one stretch the journey through Arizona marks the end of Nevada (relief!) and the road to Utah (scary) so it might just feel good for those reasons!

Anyway, the government of Arizona is now squeezing the bladders of it citizens in a mindless move to save money. Apparently, this trend is generalising throughout the US.

A spokesperson for the Arizona Transportation Department said:

People think “You just go in and change the toilet paper, don’t you?” … The answer is, no, we have to maintain the water quality, we have do maintenance to the buildings and so on. Some of those places in the middle of nowhere are like their own little cities.

Yes, we can relate to that – it is called basic sanitation in the advanced world.

When the deficit-terrorists (including Hillary Clinton) claim that the current state of US government finances is a threat to national security – it seems that health dangers as faeces and other things pile up on the country’s roadsides will be more of a national disaster than a few numbers on a spreadsheet somewhere in Washington.

While the US Constitution forces states to balance their budgets, no such rule applies at the federal level – yet! A simple expansionary move would be for US government to provide each state with a per capita allowance to keep their toilets and other essential infrastructure open. That would be a good basis for another round of stimulus which should accompany the introduction of a Job Guarantee.

[Correction: a reader kindly noted that the US Constitution does not force the states to balance budgets rather they chose to do that via their own statutes. So they could alter the statutes presumably. It just makes the story worse].

The reference to “other things” in the title of this sub-section is because parents are probably letting their children read my blog and we have to keep it clean! Unlike the roadways of America – the richest nation in the World.

But Germany wants more toilets

The Sydney Morning Herald carried the story today (March 5, 2010) – Cash for Corfu – Greece told to sell a few islands. This is now being widely reported around the World.

Two of Angela Merkel’s parliamentary members have the solution to the Eurozone problems. The SMH said:

They’ve offered some unsolicited financial advice to their counterparts in Greece: sell off uninhabited islands and other properties to ease the debt crisis that has plunged the common currency into the doldrums and sent financial markets worldwide into jittery states of apprehension.

But it doesn’t stop there. The Greeks are being advised to “offload the ancient Acorpolis. For a fair sum, of course.”

One of the German politicians (touted in the press as a “finance policy expert” – yeh, right) was quoted as saying:

Those in insolvency have to sell everything they have to pay their creditors … Greece owns buildings, companies and uninhabited islands, which could all be used for debt redemption …

The other politician said (charmingly I am sure, not!):

Sell your islands, you bankrupt Greeks! And sell the Acropolis too!

That is generally what happens when a non-government entity that is revenue-constrained becomes insolvent although it is usually the case that the richer the non-government entity the more asset-rich their family trusts or their wives/husbands become just before they file for bankrupcty.

But the revenue-constrained status of a non-government entity is not a voluntary position – it is the product of the currency system. Citizens and firms use the currency that the authorities issue.

Now the government can also be revenue-constrained in the same way and can therefore become insolvent in the currency of use. But, unlike the non-government entity, this status is entirely voluntary for the government. They can choose to adopt these constraints if they want. Equally, they can choose not to adopt them.

For a fiat currency-issuing government there is never a solvency question. They never have to have “asset sales” to pay back their debts. In fact, they never even have to go into debt if they didn’t want to.

Greece is in the category of countries that have voluntarily chosen to constrain their monetary and fiscal policy capacity and expose the nation to insolvency and default on sovereign debt.

However, before they start carving up their land mass which the Germans were not able to dominate when they last invaded (they needed the Italians to help them!) and/or selling their ancient archaeological relics, the Greeks might like to consider the second option.

That is, blow out the Euro and re-issue the drachma – convert all the Euro debts in drachma (at the threat of default) – have a few advertising campaigns promoting Corfu as a desirable tourist destination (to get some US dollars or Euro!) – prevent any IMF officials from entering the country – and bunker down for the adjustment process. And, I forgot – tell the Germans to take a long walk (along a short-pier).

Meanwhile, as the Greek government embarks on a unsustainable austerity program the unionists invaded the “finance ministry and prevented staff entering the building” while wider strike action was mooted.

So they are not very happy and I expect this unrest to generalise and render the austerity campaign of the government impossible to implement. They are entering a vicious circle of austerity, rising budget deficits (via the automatic stabilisers), more cries for austerity, wider spreads on their bonds relative to Germany etc, rising budget deficits as the deflation worsens the real economy and … crash bang … it just gets ugly.

The problem in the Eurozone is structural and lies at the heart of their ill-conceived monetary union. They will just lurch from one crisis to another now that the current crisis has exposed the flaws in their system that were apparent from the outset to those who (a) understood how monetary systems operate; and (b) didn’t have their Brussel-Frankfurt thug ideological blinkers on. Please read my blog – Euro zone’s self-imposed meltdown – for more discussion on this point.

But things are not always straightforward. Maybe the German plan has some merit. Further analysis is required. So I fired up my GIS software and …

GIS analysis – my current EMU solution

My advanced GIS analysis of European cartography tells me that the island marked A on the map below certainly looks to be part of Germany and so it only reasonable that they get it back again. How terrible for them that they have been deprived of it for so long in their history. So kommen Sie griechische bastards … Seite ist es vorbei! [editor’s note: So come you Greek bastards … hand it over!].

But I have an even better suggestion. Melbourne (my home town) in Victoria, Australia is the second-largest Greek speaking city in the World outside of Athens. So I suggest the EMU bureaucrats hand over the whole of the Greek peninsula and all its islands to Germany, and put all the citizens there on a boat and ship them to Melbourne where they will be able to eat Greek food, talk about Greece, dance to Zorba the Greek, and otherwise enjoy Greek culture. Then the Germans will enjoy some sun in peace without all those Greek-speaking Latins in their midst and … lady and gentleman bureaucrats in Brussels – your Euro crisis is over.

Only problem is that all the Greeks will be arrested by our paranoid government here and detained on Christmas Island as criminals such is the Australian Government’s to refugees who arrive here in boats. However, the plan breaks down further because Christmas Island island isn’t large enough to detain them all on.

We will need an austerity package somewhere in all of this but at this stage I cannot exactly see how it will help bring my otherwise ingenious solution to the fruition it deserves.

But on reflection I realise where the fiscal austerity package can still be implemented. If my plan is implemented then the health budget in EMU nations will escalate violently out of control as the skin cancer rate among Germans accelerates. Yes, the Eurozone is not indistinguishable from Germany – the other hangers-on are riff-raff of various tongues who don’t really matter.

So I have all angles covered at present except the size of Christmas Island. Any advice gratefully received. And I promise I didn’t drink any water today!

Conclusion

As I noted the other day … we will need a few more crises to start to really turn the ideological debate around so that the true role of the state can be seen in a more clearer way and our national priorities turn away from irrelevant things like numbers of bits of paper (deficits to GDP ratios etc) and towards the things that matter – jobs, incomes, and inclusion.

Hopefully, Greece will still have its borders intact so that its citizens can once again enjoy a holiday in their isles without having to speak German.

The weekend ahead …

Tomorrow will be another Saturday Quiz – look out for it some time. Whenever it appears it will be designed to inflict torture – given austerity is all the go these days.

Sunday, will be my new format – the answers and discussion to the Quiz and another surprise (for me)! More on that when the time comes.

Anyway, that is enough for today!

Interesting stuff as always, Bill. With regard to that first article from the Guardian newspaper, Michael Meacher is a Member of Parliament for the Labour Party and a former minister in the Labour Government. One wonders whether he pursued the same rational line when he was actually in a position to have some positive influence. Who knows.

If anyone wants to enter a bear pit they can read the reader comments below that article, which are full of predictions of national insolvency and other such hysteria. However, if you look closely, you will find a few comments from your’s truly (same ID as I use here so it is easy to find me) trying to pour some water on the flames.

It looks like the deficit is going to be a significant factor in the upcoming UK General Election. While the Conservative Party has had to soften its “slash and burn the deficit NOW” line recently, due to a negative public reaction, there is still next to zero understanding of the issue in the public debate (as you would expect given the iron grip the deficit crazies have on the mainstream media and political establishment).

You’ve got the wrong graph. You’re showing the 3 month gold price, not the one from the start of last year.

Dear Aidan

Thank for your vigilence – it was the right graph – showing the peak then the fall – I just wrote it up wrongly.

best wishes

bill

This paper claims that there was precious little stimulus in the US in 2009 because the stimulus coming from the Federal govt was cancelled out by the drop in spending by state governments.

http://www.voxeu.org/index.php?q=node/4707

If this is correct then the scale of incompetence of those supposedly running the US economy can now only be described as TOTALLY BREATHTAKING!

It is a strange/interesting time we live. The austerity hawks “wisdom” isn’t new they had the same position in the 30s. The odd conclusion was/is that a country can be so poor that it can afford to let its citizen’s work, only rich nations can afford to let its citizen’s work.

March 1930 Heinrich Brüning (doctor national economy) was appointed to lead the government in Germany. Brüning’s ardent austerity measures paralyzed the German economy and resulted in skyrocketing unemployment. Companies did go bankrupt, heavy industry and building sector was almost entirely paralyzed, 1932 there was almost 6 million unemployed and at least a million more that slip of the system. By 1932 communes, city’s and even federal states did go bankrupt and put under federal administration.

Not until the ardent austerity man Brüning did attack East Elbian estates did Hindenburg act, Hindenburg himself a owner of East Elbian estates. Then the stage was set for the most notorious politician of the 20 century.

For long time one believed that Brüning was forever dead, but some doctor Frankenstein in Frankfurt have obviously succeeded in the resuscitation of Brüning. They seem to believe that engaging the citizens of EU in productive labor is at serious threat to their beloved Euro.

Just as an aside, the US constitution does not require states to balance their budgets. State governments are more or less sovereign in this regard — each state can tax and spend as it likes. State governments, on their own, started to pass balanced budget laws and amendments in the 1970s. Today I believe there is only one or two states without some form of a balanced budget requirement.

As you know, the big problem with these balanced budget requirements is that they are highly pro-cyclical. Obviously in times of recession states are forced to cut back expenditures and raise taxes. On the upside, most of the states have ‘kicker’ provisions in their balanced budget laws, which essentially forbid states from running surpluses. If a state with a kicker provision goes into surplus, they are required by law to rebate the surplus to the taxpayers. Of course, what most states end up doing instead is spending more money before their budget goes into surplus in the first place.

“The real problem that exists is a major failure of aggregate demand in most nations. This has been driven by a collapse of private spending.”

This may be true, but it doesn’t really address the cause of the problem – why is there a shortfall in aggregate demand? Why are people wanting to save and not spend now?

Is it possible that a large component of aggregate demand in the previous state of the world was derived from the continued buildup in private sector debt which was sustained by generally rising asset prices. When those asset prices gains stalled or even went into reverse, that component of demand was no longer sustainable.

Dear Gamma

I have written a lot about the unsustainable nature of the spending backed by ever increasing private debt levels. So I clearly agree. That is all the more reason why permanent deficits will have to be a feature of the future to provide the income growth consistent with a more stable saving pattern in the non-government sector. Unless of-course net export swings come and “save the day” – which is impossible for all nations taken together.

best wishes

bill

Dear DS

Thanks for the information on the US Constitution. Somehow I had it in my head that it was set in stone from the outset. It just makes the current situation even more parlous – they actually have a choice!

best wishes

bill

Bill, I have noticed that you have made reference a couple of times to the idea that government surpluses have been associated with the large build-up in private debt worldwide.

Have you written more extensively on this topic? Do you suggest that government surpluses have somehow caused or perhaps enabled or encouraged this buildup? That a budget surplus “crowds in” private savers to holding private debt due to an absence of government issued money or bonds?

This is kind of the flip-side of the “crowding out” out argument.

Hello Bill,

Your graph of gold shows the recent decline but there is no denying that since the start of the last decade gold has been on quite a bull run. A big part of this seems to be due to the general decline of the dollar, which leads me to my question. If one country takes on a natural rate of zero policy but others don’t, wouldn’t the ZIRP currency decline with respect to others because market participants would borrow in it to fund a carry trade? This happened to the yen and seems to be happening to the dollar since the crisis too. If this country was the USA, wouldn’t this then lead to an inflationary spike in commodity prices because commodities are priced in dollars? So my question is, how would you envisage a world shifting to a MMT-informed state from the one we are in now while minimising unwanted economic shocks? Would it be necessary for all countries to go to zero simultaneously?

Bill, you may be interested to know that your favourite economist is at it again in the UK Guardian:

http://www.guardian.co.uk/commentisfree/2010/mar/05/japan-economic-crisis

Best Regards

Bill: Really enjoyed today’s blog. Your comments re Germany and Greece were hilarious! Had a good laugh! Thanks for that.

Gamma: If you’re up to an in-depth explanation you might take a look at Scott Fullwiler’s post at http://neweconomicperspectives.blogspot.com/2009/07/sector-financial-balances-model-of_26.html.

Love your piece about Germany and Greece. I’m living in Germany being a “literal” Austrian. (Always embarrassing to have to say “I’m Austrian” in some sort of discussions.) That said the discussion here is heated and it’s mainly due to the fact the Germans imposed on themselves through various governments (left and right) permanent austerity. The German economic dogmas are simple: first and foremost we must maintain our position as export world champion. And second without the hardest currency in the world we’re done. These dogmas are enforced by politicians with the help of some economists (Hans-Werner Sinn et al.) Other economists like Heiner Flassbeck are crowded out. The result is obvious: the periphery of Europe is now an export colony of Germany.

BTW: The German translation should be: “Komm du griechischer Bastard … gibt es zurück! (Your sentence is meaningless 😉

Last Mile Update: MMT gets some cred. Jamie Galbraith publicly on board.

http://www.thenation.com/doc/20100322/galbraith

Thanks for that link, Tom.

folix22, after awhile, I thought I was reading Bill or Randy Wray. Galbraith really delivers a broadside to the Establishment and deficit terrorists. It’s a must-read and pass-it-on.

“Real investors want burgeoining economies not depressed places with little income generation going on.”

It has been interesting to watch the U. S. stock markets lately. Interestingly, they don’t like unemployment now. (Those pricks usually love it.) If even Wall Street gets it, why doesn’t Congress? 🙁

“[Correction: a reader kindly noted that the US Constitution does not force the states to balance budgets rather they chose to do that via their own statutes. So they could alter the statutes presumably. It just makes the story worse].”

The U. S. Constitution prohibits states from issuing their own currency or bills of credit. (The California IOUs may well have been unconstitutional.) If you have any suggestions about how states can handle this mess with insufficient Federal help, that would be nice. 🙂

“Bill, you may be interested to know that your favourite economist is at it again in the UK Guardian:

http://www.guardian.co.uk/commentisfree/2010/mar/05/japan-economic-crisis

Best Regards”

I have often wondered though, why despite all the deficit spending for so many years, Japan simply failed to make a full recovery. Perhaps I missed something?

Andy Xie argues that stimulus spending simply isn’t enough

http://www.creditwritedowns.com/2010/03/the-mindset-will-not-change-a-depressionary-relapse-may-be-coming.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+creditwritedowns+%28Credit+Writedowns%29

Werner: The cause of Japan’s recession and the lessons for the world

The following taken from

http://www.abc.net.au/news/stories/2010/03/05/2837171.htm?site=thedrum

In November 1997 the then Treasurer, Peter Costello, shocked some people when he announced he’d signed off on the sale of $2 billion worth of Australian bullion. On the day he announced the sale the price was around $US306.00 an ounce. At the time, according to Mr Costello, gold “no longer plays a significant role in the international financial system”.

Joseph Stiglitz piles on. Not exactly MMT, but useful nonetheless.

The Dangers of Deficit Reduction

Thanks for that /L.

I will probably have to read it twice to fully absorb it.

Dear Bill,

Ypour blog although funny was not enjoyable since my wife is from Arizona and I know the scenery you talk about but I am also Greek and the Germans owe Greece in war and forced loan reparations around 100 billion euros at last count!! So lets cancel out debt and there is some left over for Greece. The point is that we do not want any part of Germany which we find ugly. Maybe they can hand over some of their politicians to use them in amusement parks. As for the rest of the Germans they can visit and enjoy Greeek hositality as long as they aplologize for the atrocities committed by their forefathers.

Dear Panayotis,

Although I understand your grievances in regard to Germany very well I think it’s not really a smart move by Greek politicians and citizens to come up with “outstanding” German WW2 reparations now. I live in Germany, I’m an Austrian (and YES we also had our fair share in WW2 atrocities – Amon Göth: Death is a Master from Vienna) and all I can say right now is, that I’m stunned how shallow this “common” European Union seems to be. There’s one problem and immediately national egoism and idiocy is on top of the agenda again.

German politicians pontificating Greece to sell islands and real estate (Acropolis) to raise money. The German media painting a picture of a population idling in the sun and sipping Ouzo all day long. On the other hand the Greek suddenly waking up to history and seeing Wehrmacht helmets all over the place. So let’s face it: this is only an economic problem, which can be sorted out in a civilized manner, and not the replay of WW2. The sentiment of both parties is simply ridiculous!

Now I hope for your understanding but I blame the Greek politicians in the first place. Why? Because they immediately gave in to the wishes of the EU and ECB and are now at their will. What would I’ve done if my name is Papandreou? First and foremost: You can’t seriously bargain if you can’t walk away from negotiations. Thus the Greek should have created a viable scenario to leave the EMU plus should have started to talk to the IMF (just to make the point).

Things would look very different given a better bargaining position of Greece. I’m positive that Germany, France and the ECB would think twice about pressuring Greece into meaningless and harmful action facing above consequences.

In the neo-liberal paradigm people is unemployed, there is debts and so on because people have low morale, not the right incentives its never an issue about technicalities, how the economic structure functions and if it have errors.

Dear Panayotis and Stephan

The fact that the past history is now being dredged is interesting (and depressing) but demonstrates why the EMU choice of nations was a disaster. For a common currency area to be effective for all the member regions you have to have the capacity to make fiscal redistributions in the face of asymmetric shocks. This implies a certain common common purpose and shared goals etc. The fact that the EMU by design excluded this has much to do with the sorts of hatred, suspicions etc that the current German-Greek dialogue is rehearsing. The whole EMU structure has an underlying narrative that Germany is not to be trusted and requires a political arrangement to avoid them going off on again!

While that may be true or false, they should have stopped with the political arrangement and not taken the paranoia into a common currency area.

By the way, we have a history of the same sorts of debates in Australia about the Japanese – given their atrocious behaviour in the Pacific region during WW2. My father’s generation would say never trust them etc. All the old enmities used to be played out even though they have been our largest trading partner. But my generation thankfully realises that today’s Japanese have nothing much to do with what happened – except historical association – and it is better to leave it all behind – as allow it to serve as a reminder to both nations of what humans are capable of under certain circumstances.

On Stephen’s point about bargaining power – totally agree – the Greeks – given the implications for the rest of the Eurozone certainly could have had the upper-hand but then lost it as soon as they agreed to austerity.

best wishes

bill

One technical flaw with the EMU/€ is that the country with the highest inflation will get the lowest real interest rate and vice versa.

I’m no expert on this bit wonder how trade/payment balance impact when there is an common currency area. Sovereign nations hardly have any issue with trade balances internally. I believe now France try to beggar thy neighbour by raising VAT and lowering employment taxes.

At the first meeting 2008 the countries met and agreed to make stimulus of 1.5% of GDP, then everybody went home and engages in creative bookkeeping to reduce the amount to hardly nothing. Here in Sweden our treasury minister is so proud that the stimulus he claim to have made in no way encourage import. That is after almost two decades of continuing big trade surpluses. The international crises did hit the export sector hard but the import did fall with almost the same share and trade surplus is hardly affected.

When the crisis hit the world our central bank was in the process to raise interest rates to peak level, when the figures come out for last quarter export they smash it down, probably to get the currency down, a bit below the euro rates. It did make the crown dive below the dollar relative the Euro. For years the relationship between the crown vs dollar and Euro vs dollar have followed the same path.

In EU the largest foreign trade is internally, it will of course be very difficult to recover if everybody shall engage in beggar thy neighbour policy’s.

Dear Bill and Stephan,

1. I agree with regard what the Government should have done. I sent email comments and talked to politicians with high posts with the Government and tried to persuade them. I did not because they are afraid.

2. I do not agree about the war reparations. Germany has the means to pay and must pay after so many years. Furthermore, they forced an occupation loan (gold reserves etc.) which is now worth tens of billions of euros. Furthermore, they recently demanded Greek people to suffer from the austerity program in order to save the euro and German banks. This is not only the Government but the German people in a number of pols expressed no desire to help the Greek people. They should negotiate cancelation schedule of debts. I personally have nothing against the German people although they burned the village of my grandparents. During my teaching, research and business years I have met many Germans and I have good personal relations. However, reparations when you need the money for your people is only fair to ask! Where is the solidarity promised by the EU? Personally I do not have a problem due to the investment fund I own and run. However, many people in Greece are in great difficulty and I care for them.

Dear Bill, Eric P., Scott F., et all,

I recently read with interest your 8 month old graphical exposition of MMT propositions using the so called static “Crugman Cross”, pesented in billyblog (July 2009) and other blogs in neweconomicperspectives.blogspot.com of that period. Assuming they remain as they were, I have some observations to make.

1. The Private Financial Balance(PFB) and the Fiscal Policy Financial Balance(FPFB) schedules are shown following Krugman as straight lines reflecting only the slope term with arbitrary intercept terms (shifts) and no curvature terms.

2. In the billyblog exposition the (PFB) schedule is supposed to shift because of a variation in savings preference(behavior) forced from private debt and in the presentation by Scott from leverage preference variation(behavior). Instead I propose that the shift is related to changes in the technical convention state from innovation (organization) embedded in discretionary shifts in private investment and financial projects at every level of GNP. These are collateral effects(externalities) and they could be associated with “animal spirits” and/or in my framework from complexity entropy of excessive behavior(including speculation). Preference variation is endogenous behavior and should be expressed along the schedules and not as shifts of them. The intersections of the schedules are points of equilibrium stasis and no behavior can change them.

3. The (FPFB) in the billyblog exposition is shifted correctly by discretionary policy but should incorporate a collateral effect (externality) from a change in the state of uncertainty(non-risk) which comes from the liquidity posture offered with the discretionary policy (voluntary) shift at every level of GNP. Thus (FPFB) shifts by more than the discretionary stimulus term. Notice that the these intercept effects or externalities on the schedules are required to mantain the price deflator fixed for each level of GNP related in the static graph. (I had presented these points in several comments of previous blogs but I have received no response for discussion).

4. The (PFB) schedule has a curvature term because at higher GNP, private credit and interest rates are higher and the marginal propensity to save is higher so GNP change along this schedule decellerates. Thus, it has a concave curvature. (This does not mean that interest rates are determined by the schedules which can very well decrease as credit and fiscal debt compete in financing spending).

5. The (FPFB) schedule has a curvature term because at higher levels of GNP, it has higher marginal tax rates and since the schedule is inverse it has a convex curvature and the GNP change along this schedule accelerates.

6. NFA is lower at full employment than the standard case. The shift in (PFB) schedule is more and the (FPFB)schedule is less than otherwise.

7. There are lag in effects for the curvature and shift terms. The curvature term of (FPFB) schedule is slower than the (PFB) schedule assuming that the tax period is longer than the credit market adjustment. The (PFB) schedule shift is more gradual as innovation is slower than the liquidity effect upon the (FPFB) schedule. So and maybe the NFA level at full employment increases at an accelerating rate.

8. Notice that I have not included any reaction effects from surprise impact, shortfall/exclusion from inerti(hysteresis,fluctuation) and illusion(delay.disruption), and kaleidic effects discussed in my framework but cannot be handled by the static “Krugman Cross”. Any comments? I am trying to understand MMT and maybe help because it has many useful and practical(ex post) prescriptions in a world that suffers from neoclassical and neoliberal orthodoxy!