These notes will serve as part of a briefing document that I will send off…

More misery and dysfunction coming for France – as the fiscal rules bite

For all those Europhile progressives who have held out that reform is the way to deal with the neoliberalism of the European Union and even, in some cases, claimed that the austerity mindset was over (once the fiscal rules enshrined in the Stability and Growth Pact were temporarily suspended during the pandemic), the behaviour of the French government should wake them out of their delusional reverie. The new Prime Minister addressed the National Assembly last week and outlined a new fiscal direction involving significant expenditure cuts and tax hikes. His plan will not satisfy the European Commission, however, who under the Excessive Deficit Protocol (EDP) have indicated they want a faster transition back to the fiscal rule thresholds (that is, even harsher austerity than Barnier is proposing). This policy shift is in the context of an elevated unemployment rate (which is rising) and an already significant output gap. The austerity is likely to push the unemployment rate towards 9 per cent (around) and will be a disaster for the prosperity of the French people who are still enduring the cost-of-living fallout from the pandemic and the Russian-Ukraine situation. Add in the possible impacts of the Middle East crisis and we have a failed state. Once again the fiscal rules defined within the EMU architecture are going to deliver shocking outcomes.

I last wrote about this topic in this blog post – The 20 EMU Member States are not currency issuers in the MMT sense (September 16, 2024) – in response to some commentators with MMT leanings claiming that the original architecture of the Economic and Monetary Union has been ‘changed’ in such a way that the original constraints on Member States no longer apply.

I argued that while the ECB continues to run its bond-buying programs, which effectively controls yield spreads for the 19 Member States of the Eurozone (Germany is the 20th and the benchmark asset upon which the spreads are expressed), the fact remains that the ECB demands conditionality.

Conditionality in the EU context means austerity.

The European Commission authorities have now ended the ‘general escape clause’ of the Stability and Growth Pact and are once again enforcing the Excessive Deficit procedure (EDP) and imposing austerity on several Member States.

The temporary relaxation of the SGP rules (via the general emergency clause) did not amount to a ‘change’ in the fiscal rules.

Indeed, the EDP has been strengthened this year.

The Member States still face credit risk on their debt, still use a foreign currency that is issued by the ECB and is beyond their legislative remit, and are still vulnerable to austerity impositions from the Commission and their technocrats.

And now we are seeing the austerity dialogue translating into actual policy shifts in France.

Last week (October 1, 2024), the new French Prime Minister Michel Barnier, who was foisted into the role by the President’s defiant disregard for the results of the recent election, gave his first speech to the French National Assembly.

The speech came at item 4 on the agenda – 4. Déclaration du Gouvernement et débat.

After some recognition for the shocking murder of the female student known as ‘Philippine’ in Bois de Boulogne a few weeks ago, Barnier turned to his brief.

He said to the astonishment of many Assembly members:

Contrairement aux termes de l’ordre de mission signé par le général de Gaulle, nous ne partons pas de « presque rien ». (Exclamations et applaudissements sur de nombreux bancs du groupe EPR.) Je pars, avec le Gouvernement, d’un vote populaire par lequel vous avez été élus, mesdames, messieurs les députés …

Paraphrasing – he claimed that the government was elected by popular vote – joke.

The transcript recorded “Rires et exclamations sur les bancs des groupes LFI-NFP, EcoS et GDR)” (laughter and exclamations from the benches of the LFI-NFP, EcoS and GDR).

The progressive members will bring a vote of no confidence in Barnier in the coming period.

He then turned to presenting “le Gouvernement notre feuille de route” (the government’s road map) which comprised “cinq grands chantiers” (five major projects).

I will just provide my translated version from here to save space.

The first of these major projects – predictably – was cutting public debt – he said there was a “sword of Damocles hanging over the Government” (to which someone cried out “It’s Macron”).

He said:

The real sword of Damocles is our colossal financial debt: €3,228 billion. If we are not careful, it will place our country on the brink of a precipice. This year, our public deficit, that of all public authorities, is expected to exceed 6% of GDP.

He invoked the grandchildren myth and said that “the burden of this debt – 51 billion euros – is the second largest item of government expenditure, behind education.”

He said they had to reduce debt to “regain the budgetary room to maneuver”.

He promised to reduce the deficit in 2025 to 5 per cent of GDP and reach the 3 per cent threshold under the SGP by 2029.

It is moot whether the European Commission will accept that delay given they have demanded under the EDP that France achieve the 3 per cent threshold by 2027.

The projections this year are for the fiscal deficit to go beyond 6 per cent of GDP, despite the last government under former Finance Minister Bruno Le Maire promising it would be a 4.4 per cent, which temporarily placated the Commission technocrats.

The projected debt ratio is now 112 per cent of GDP and France pays more interest on its outstanding debt than Spain or Greece, which is no surprise given how austerity has ravaged those nations.

He said the only way they could do that was to “reduce spending” such that “two-thirds of the shift back to 5 per cent would come in that way”.

He is also committed to “hunting down duplication, inefficiencies, fraud, abuse of the system and unjustified rents” within the public sector.

AKA Austerity.

He also said that increased taxes would comprise the remaining third of the fiscal adjustment.

These would mostly come from highly profitable corporations and wealthy French taxpayers.

The other major projects related to addressing climate change, immigration (more prisons and police to keep the immigrants at bay), and security, in part, to appease the other members who should have been allowed to form the government if Macron had respected the voting outcomes.

But it was the claim that France has a “colossal fiscal deficit” that dominated his speech.

If you are wondering why the fiscal situation has arisen then it will not surprise you that the French government took what they called their “whatever it takes” approach to the recent crises – pandemic, yellow vests, and the inflation spike from the Russian situation.

The fiscal outlays in pursuing this approach were larger than the spending of other Eurozone nations.

In this article from the French research body – Observatoire français des conjonctures économiques – (May 24, 2024) – Les crises expliquent-elles la hausse de la dette publique en France? – we learn how the rise in public debt has occurred.

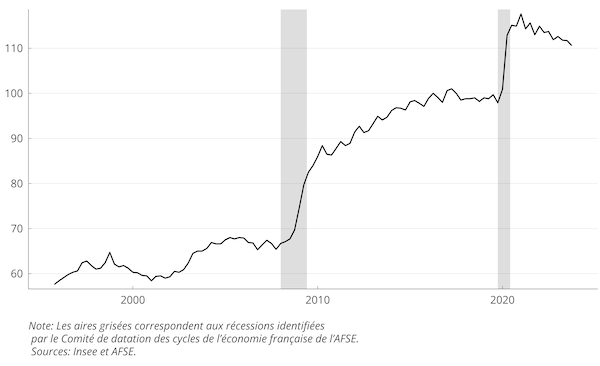

Their graph showing debt as a percent of GDP shows the impact of dealing with successive crises.

They conclude that:

1. Between 2016 and 2023, 52 per cent of the increase in public debt was not linked to permanent fiscal settings.

2. So while the debt ratio rose by 12.2 per cent of GDP over this period, 6.6 points of that were due to the crises.

3. However, they estimate that this proportion rises to 69 per cent if the “l’esnsemble du plan de relance” (entire recovery plan) is considered (that is, including the response to the Yellow Vests – the cheaper petrol subsidies etc).

4. Between 2007 and 2023, the response to the crises increased public debt by 44 per cent.

These were legitimate uses of fiscal policy to save the nation from catastrophe yet they end up violating the fiscal rules of the EMU and now require harsh cuts under the EDP.

What is the context that the French government is now being forced to make these cuts?

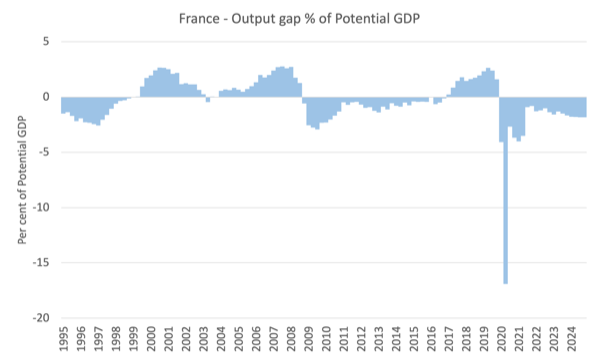

The next graph shows the output gap (from the OECD) as a per cent of potential GDP.

I consider the OECD series to understate the size of the output gap by some points (and certainly their methodology biases the outcome in favour of a zero output gap which constitutes full employment).

But even with those biases, the current output gap is significant.

I should also add that the potential GDP series shows a significant flattening since the GFC, which means that the French economy has less capacity to produce GDP growth and that means there has been a deterioration in the relationship between labour force aggregates and the national accounts aggregates.

It means that a slower actual GDP growth will produce smaller output gaps yet be associated with a larger problem.

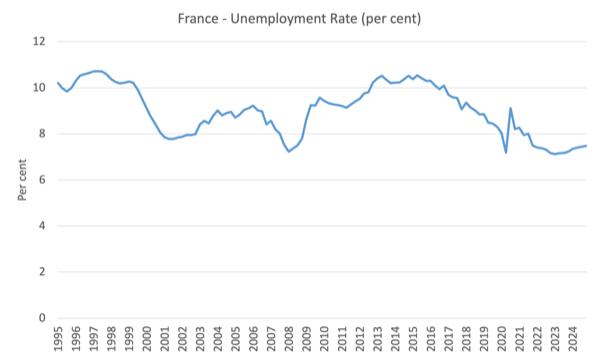

The next graph shows the evolution of the unemployment rate since 1995.

It is currently at 7.4 per cent and rising.

These aggregates will deteriorate further with this renewed austerity push by the Government under pressure from the European Commission.

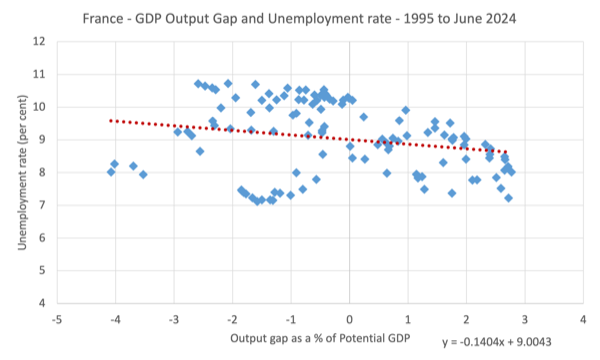

The next graph shows the relationship between the output gap (horizontal axis) and the unemployment rate (vertical axis).

I left out the observation for the June-quarter 2020 when the output gap was estimated to be 16.92 per cent – it would have skewed the graph.

The red dotted line shows a simple linear regression linking the two aggregates (and the equation shown defines that dotted line).

This table shows the estimated unemployment rate for different assumptions about the output gap (using the equation generated in the last graph).

| Output Gap (%) | Unemployment Rate (%) |

| -2.00 | 9.29 |

| -2.25 | 9.32 |

| -2.50 | 9.36 |

| -2.75 | 9.39 |

| -3.00 | 9.43 |

The current output gap is -1.86 per cent.

So even if the output gap increases by less than 1 point, the unemployment rate will rise to over 9 per cent as an approximation.

Conclusion

The problem facing the French government is that the austerity they are planning to inflict on the nation is incompatible with the other challenges that Barnier outlined in his speech, especially dealing with decarbonisation and climate issues.

But moreover, the French case demonstrates the dysfunctional nature of the fiscal rules that define the architecture of the common currency.

A government is caught in a bind – it has to bail the economy out during crises, but in doing so it realises that it must pay the piper with harsh austerity as a consequence.

The Eurozone is trapped in this perpetual cycle of one step forward, several steps back all the time purely as a result of the rules that are not fit for purpose.

Nothing much has changed in the last 24 odd years of operation.

And the progressives who think there is reform hope are sorry to say hopelessly wrong.

Yes, the ECB is still buying the debt and keeping Member State governments above water.

But the conditionality and the rest of the fiscal rules architecture still exerts influence and undermines prosperity.

What a miserable place Europe has become under the current political class.

Eventually, it is hoped, the citizens rise up and abandon this miserable system.

At least the French have done that in the past.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

The trouble with France is that De Gaulle is not around.

Increased spending will increase, not reduce, our ecological footprint.

Increased spending will improve efficiency—spending will reduce the (CO2) cost of every unit of energy produced.

But improvements in the efficiency of resource usage lead to higher, not lower, *total* resource usage (Jevons).

Spending on a “green transition” will accelerate the ecocide.

Isn’t that what taxes are for? More resources must be bought into state use which must use the same responsibly.

I want everyone to be have free healthcare, education, shelter, food & water.

But I don’t want everyone to spend everything they have on luxury goods.

And one must also take income/wealth inequality into account. Not every French person consumes the same amount and has same footprint. The top 1% in the first world have massive carbon footprints. Oxfam had a great paper on this ‘Carbon inequality in 2030’.

Then there is completely wasteful spending (public and private), like cryptocurrency mining or America’s many foreign military bases.

“The US military emits more than entire industrialised nations like Portugal and Denmark”

There are many tiers. Black Americans, despite being the poorest in the American class system are (in most cases) way better off than people in the third world. Obviously there are purchasing power differences (labour costs and all) but even still.

Ever since the pandemic revealed how so-called experts could so confidently, so arrogantly, get so many things wrong, and then suddenly tell a new story and then another new story as if their old stories had never had been told, and then viciously attack and attempt to censor other so-called experts, equally credentialed, who had different stories they wanted to tell–ever since this embarrassing and disconcerting debacle, much of the public has had zero confidence in so-called experts and their so-called expertise. They have for legitimate reasons come to wonder whether ANY body of group-thinking experts, including not only epidemiologists but also climate scientists, really know what they’re talking about. So if the climate scientists are right about global warming (something I had little doubt about pre-pandemic), if shaken public confidence in them has been caused in large part by the pandemic expertise debacle, and if this shaken confidence continues to block bold remedial action at the political level, then this new disease will indirectly turn out to be the deadliest ever to emerge in tragic, unnecessarily shortened human history. By the way, has anyone of note grappled with the impact of all of this on the perceived credibility of MMT experts, on the level of post-pandemic public confidence in their pronouncements?

The household fallacy abounds

He said:

The real sword of Damocles is our colossal financial debt: €3,228 billion. If we are not careful, it will place our country on the brink of a precipice. This year, our public deficit, that of all public authorities, is expected to exceed 6% of GDP.

He invoked the grandchildren myth and said that “the burden of this debt – 51 billion euros – is the second largest item of government expenditure, behind education.”

He said they had to reduce debt to “regain the budgetary room to maneuver”.

Newton, you’d almost have the impression they were making it up as they went along. God forbid! I do think perspective is everything and with science and most other disciplines, the predominant tendency is to deconstruct and organise into smaller entities with the obvious risk of losing the bigger picture. The classic right -v- left hemispherical conundrum.

What’s remarkable is when the fallacy of their position is exposed there is no reflection on the errors of their rationale, no apology or clarification – just a shrug of the shoulders and back to Groundhog Day. What a mess the mainstream commentators and politicians have found themselves in over money creation. Something as simple and obvious they’ve denied all their lives – then suddenly the ‘fiscal rules’ could and must be bent. Oh aye!

Nothing makes sense anymore. We’re so far up Shit Creek and still paddling like mad. We’re fast running out of essential natural resources – clean water and fresh air – that literally nothing else matters, but we’re still revving the engine of the Great War Machine to stimulate growth and save jobs and make money and secure more oil. And to kill.

I fear we have lost any hope of reigning in our excesses and preventing mass suicide by stupidity, dishonesty, greed and selfishness. In the absence of punitive divine intervention of a biblical scale as promised in Revelations, there’s only really Dante to look forward to. I hope Old Nick has a reliable gas supply…

Some 3,000 years ago money was invented in the bronze age. They also invented debt forgiveness this has been hidden and forgotten.

Europe is becoming a dysfunctional rump state (union).

It’s ridiculous war support against Russia is crippling it. Because it is a puppet for US security (under NATO).

The UK is drenched in neoliberalism while it just voted in another buffoon (sorry I have no nicer description.

The west is in decline, I see no bright future, just social chaos and intensive polarisation from arguing about beliefs rather than matters proven with evidence like climate change and not being incinerated like Japan was.

What will France have, just another revolution? Resulting in more social chaos.

Mr Marx is proving how vile capitalism can be, when its deregulated or pivoted for the advantage of the deluded and greedy elites, its happening again, imho. Over reaction? I dont think so, democracy doesnt seem to pamper to the demands of voters, it pampers to lobby groups (class donors). Imho.

Should we revolt? I dont think so, that is chaos and calamity, unless its an educational revolution based on reality like MMT can teach. But I bet the elites will want that nipped in the bud too.