In the annals of ruses used to provoke fear in the voting public about government…

The ‘MMT is dead’ crowd are silent now the yen is appreciating

It’s Wednesday and I am mostly thinking about Japan today. In just over a week’s time, I will once again head to Japan to work at Kyoto University. I will be there for several weeks and will provide regular reports as I have in previous years of what is happening there. The LDP leadership struggle is certainly proving to be interesting and there is now a view emerging that the hoped for break out from the deflationary period has not happened and further fiscal expansion is necessary. This is at a time when the yen is appreciating and the authorities are worried it is making the external sector noncompetitive. That is, light years away from the predictions made by the ‘MMT is dead’ crowd when they saw the depreciating yen during 2022 and beyond. It just goes to show that trying to interpret the world from the ‘sound finance’ lens will generally lead to erroneous conclusions.

The yen

I don’t spend much time following Twitter exchanges and less now that it has become rather unhinged.

But I do notice some things.

The yen started depreciating in March 2022, right after the US Federal Reserve Bank started hiking the Federal Funds rate.

While the rest of the central banks around the world hiked interest rates to varying degrees, the Bank of Japan held its rate constant at minus 0.1 per cent.

They also maintained control of the bond markets through their Yield-Curve-Control (YCC) policy to keep government bond rates stable across the yield (maturity) curve.

Their justification for this policy stance was two-fold.

First, they adopted the view that the major factors driving the inflation were transitory and related to the supply side constraints that the pandemic caused, the Russian incursion into the Ukraine and then the OPEC+ oil price rises.

Second, they were actively trying to manage an escape from the deflationary cycle the nation had been trapped in for some years. In other words, they were happy to see inflation fall but wanted to stabilise it around 2 per cent.

The Bank’s strategy indicates that they remain within the mainstream paradigm, which considers that lower interest rates provide a stimulus.

And that, coupled with fiscal responsibility motives driving the sales tax increases, has kept a lid on domestic demand and prices, ultimately supporting trade surpluses, which have been returning.

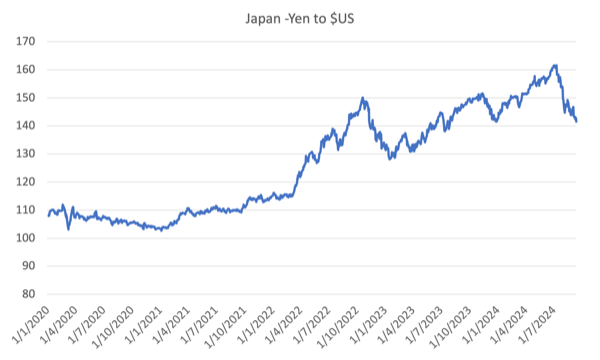

The yen continued to depreciate through to October 2022 and then reversed direction for several months into 2023 as the following graph shows.

Then a longer period of trend depreciation (that is weakening yen with occasional strengthening periods) came to a peak in July 2024.

Throughout this period, I observed the usual suspects crowing loudly on Twitter and elsewhere (if one can crow on social media platforms) about how the day of reckoning for Modern Monetary Theory (MMT) has arrived and the poster child Japan is now facing the reality of large, continuous deficits, significant outstanding public debt, and large bond-buying by the Bank of Japan.

Apparently, the depreciating exchange rate marked the beginning of the judgement period by financial markets and demonstrated their capacity to destroy a currency if the government was not compliant to the principles of sound finance.

The buy-in by others on social media of that view was substantial.

All sorts of gobs were talking big and pronouncing the end of MMT.

See, we told you so sort of stuff, you idiots.

I received many E-mails during that period about the apparent reckoning for MMT – none were complimentary and all just went into the delete bin without a reply from me.

The mainstream ‘experts’ thought they had finally found a new front upon which they can debunk MMT.

Apparently, the depreciation proves that Japan’s continuing fiscal deficits and the high public debt ratio are being rejected by the financial markets.

According to this narrative the Bank of Japan has no choice but to put a cap on bond yields and keep interest rates low or else the debt servicing will become impossible.

This leads to the conclusion that MMT is wrong because there is a financial market constraint on how far fiscal authorities can go.

As we explain in our new book – Modern Monetary Theory: Bill and Warren’s Excellent Adventure – the currency trajectory was driven mostly by the trade account.

An MMT understanding would clearly lead to an expectation that the yen would have depreciated because of the differential between the Japanese interest rates and those available elsewhere has risen, which has encouraged an outflow of investments from yen. Further the swings in the trade balance as world events change has been influential.

The depreciation provides no ‘test’ of the validity of MMT as a superior lens to understand the way the fiat monetary system works.

Now, what is the story since August?

Well the Twitter heroes have gone silent about their claimed link between the yen exchange parity and MMT.

Of course they have.

There was a story in the Japan Times yesterday (September 17, 2024) – Japan set to hold rates steady as yen rallies and LDP candidates stump (you need to be a subscriber to read it) – which suggests that the Bank of Japan will not be hiking rates at its meeting later this week.

The heroes also claimed that the Bank of Japan would have to keep pushing rates up consistently after their first hike in March 2024 to avoid further depreciation and currency Armageddon.

But the authorities are now worried that the yen’s appreciation is excessive and undermining its trading position through the terms of trade.

The point is that the Japanese experience demonstrates how ridiculous these pronouncements (‘MMT is dead’) really are.

Unlike central bankers elsewhere who had drummed up the inflation bogey as justification for hiking rates, the Bank of Japan officials saw a ‘virtuous cycle between wages and prices’ emerging which would underpin a normalisation of the inflation rate at around 2 per cent.

But they considered the outlook to be uncertain and thus made it clear that they would ‘patiently continue with monetary easing under the framework of yield curve control, aiming to support Japan’s economic activity and thereby facilitate a favorable environment for wage increases’ according to the Bank of Japan governor Ueda Kazuo who gave a speech on November 6, 2023 in Nagoya to business leaders – Japan’s Economy and Monetary Policy.

The Bank’s decision-making is ruled by what it thinks will happen to wages each year as a result of the so-called ‘spring wage offensive’ or Shuntō, which is conducted in February and March each year.

In 2023, the average annual wage outcome from the spring wage offensive was 3.8 per cent, which delivered very small real purchasing power increases to workers, given the inflation rate of around 3.3 per cent.

The March estimate for the 2024 round was 5.28 per cent at a time when inflation had continued to fall.

The wage outcomes for 2024 will thus see workers enjoy a significant real wage increase in Japan.

However, the real gains were too little too late to save Fumio Kishida’s Prime Minister ship, especially with other scandals continuing to run.

In part, this is why he announced he would not run for re-election as the LDP leader (and hence Prime Minister).

The Bank of Japan has long indicated that when it was clearer that the period of suppressed Shuntō wage outcomes was coming to an end, then they would start to increase interest rates.

And that is what they did.

The Bank hoped that the wage movements are indicative of a shift in mindset in Japan from a deflationary bias to a more normalised environment where consumer demand can drive economic growth via stronger wage contributions.

The minimal rate rise was in no way a sign that the Bank was giving in to financial market pressure or was finally falling into line with the rest of the central banks.

However, the Shuntō results really are about the wage negotiations between the trade unions and the large employers.

They take some months to filter down to the smaller firms in Japan, which dominate.

And the evidence that we now have available is that the real wage boosts that were hoped for across the board have not eventuated.

And without those boosts to the real purchasing power, Japanese consumers have declined to expand their spending and that has put a brake on any hoped for expansion of the Japanese growth rate.

The most recent data is more hopeful on the household consumption front as real wages seem to be showing positive signs.

And the debates among the LDP leadership contenders includes talk of resisting any further tightening of interest rates.

This is especially the view from one of the favourites, Sanae Takaichi.

She has:

… also indicated that she will be rolling out policies that include aggressive fiscal spending financed by the sale of government bonds, which would make it tough for the BOJ to raise rates.

I can also announce that MMT is alive and well.

Modern Monetary Theory: Bill and Warren’s Excellent Adventure

We did an Australian launch last week in Melbourne with host ABC finance reporter Alan Kohler.

A video will be available of that launch soon.

You can order the book globally from the publishers page for €14.00 (VAT included) – HERE.

Australian purchasers can get a copy for $A29.99 from – Readings Books – either at their Hawthorn or Carlton shop or through their on-line store.

Music – Nostalgia (Tezeta)

This is what I have been listening to while working this morning.

Here is the ‘father of Ethio-jazz’ – Mulatu Astatke – who is one of the great vibraphone players (not to mention his skills in conga drums, percussion and organ).

He is not a big name in Western jazz but to me, he has been a real pioneer and I love the sequence of his albums from early Latin elements (picked up while studying in the US) to his later work fusing pure African influences using Ethiopian instrumentation (such as the chordophone or Krar).

In that later case, the standard pentatonic scale (the Krar is tuned to it) was a perfect way to integrate more Western instruments into his style of jazz.

This song – Tezeta (Nostalgia) – is from the 1972 release – Ethiopian Modern Instrumental Hits (released Amha Records).

Amha Records – fled Ethiopia in 1975 after the military junta took over.

It was re-released on the 1998 volume – Éthiopiques 4: Ethio Jazz & Musique Instrumentale 1969-1974 – (Buda records), which featured the music of Mulatu Astatke.

This CD is still available.

Very mellow.

You can learn about the – Tizita – musical form in Ethiopia, which Westerners think of as blues music.

The form uses the – Qenet – pentatonic scale

Here is an interesting bio from 2018 – The father of Ethiopian jazz, Mulatu Astatke, remains a musician in motion.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

There’s similar head scratching going on about the movements of the Norwegian Krone.

It’s going down, when the Wise Ones think it should be going up. A whole article in The Economist puzzling over the situation (“Norway’s weak currency presents a mystery”).

Yet they are still handing over a load of Krone to the Oil Fund who then sells that Krone for FX to buy foreign investments. So perhaps stop doing that if imports are getting too expensive?

Trivial to explain from the MMT viewpoint.

Macroeconomics in mainstream outlets follows the trend of the general news. They keep telling you that the truth is what they are saying and you are suposed to believe it without questioning.

And, when they feel its hard to believe in their “truth”, they will bombard you with experts, so that you wont even dare to refute the obvious lies.

What about the common argument that japan has kept tax rate so low because of the high household savings?

Don’t forget that the Japanese households have very high savings rates. Rates of 30 to 40 % of income for the working age households. The Japanese save, they don’t spend. Japan’s debt; at 260% of GDP, is being saved mostly by its own households, in their own government’s securities. They are doing so because they see their parents and grandparents struggling financially as the live longer into old age.

In that MMT has a descriptive (double entry bookkeeping) constant basis and a variable prescriptive (what do I want to do, now that I know how fiat money functions, to improve the lives of the many or provide socialism for the wealthy few?) overlay, it is the melding of those two aspects by the socially conscious champions of MMT displaying their/our biases that enables much of the confused opprobrium against MMT by the theological orthodoxy on the neoliberal right.

We’ve gone from a Keynesian anything we can do we can afford world to a Friedman-Thatcher-Reaganite inverted economic world of what we (say we) can’t afford we can’t (won’t) do. All that inverse thinking, while dropping the gold standard for fiat currencies which can demonstrably show that Keynes was correct, has controlled the narrative. The ability to manufacture consent for the present orthodox view, that the neoliberal project drove, has been a masterful propaganda exercise in support of capital against the working class. All achieved via the almost complete indoctrination of the economics “profession”. Truly a conspiracy against the lay public.

Is the imperative for the existence of inflation an artefact of the need for continuous growth as per capitalism? A ZIRP would seem to support a zero inflation rate policy as all that interest payments are is a de facto private tax of rentiers that feed off the productive activities of society.

And now The Fed cut interest rates, it was clear from the start Japan should’ve waited it out.