In the annals of ruses used to provoke fear in the voting public about government…

Australian Treasurer refuses to use his legislative power to rein in the rogue RBA

It has been quite the week in central banking terms in Australia. We had the Federal Greens economic justice spokesperson demanding that the Federal Treasurer use the powers he has under the Reserve Bank of Australia Act 1959 and order the RBA to lower interest rates. Then we had the Treasurer playing the ‘RBA is independent’ game, which depoliticises a major arm of economic policy, a (neoliberal) rort that ordinary people are finally starting to see through and rebel against in voting intention. Then an ABC journalist finally told his readers that the RBA was using a flawed theory (NAIRU) and was screwing mortgage holders relentlessly for no reason. Then the RBA Monetary Policy Board met yesterday and held the interest rate constant despite the US Federal Reserve lowering the US funds rate by a rather large 50 basis points last week and continued their pathetic narrative that inflation was too high and ‘sticky’. And then, today (September 25, 2024), the Australian Bureau of Statistics (ABS) released the latest – Monthly Consumer Price Index Indicator – for August 2024, which exposed the fallacy of the RBA’s narrative. The annual inflation rate is now at 2.7 per cent having dropped from 3.5 per cent in July and the current drivers have nothing to do with ‘excess demand (spending)’, which means the claims by the RBA that they have to keep a lid on spending – which really means they want unemployment to increase further – are plainly unjustifiable. As I said, quite a week in central banking. My position has been clear – the global factors that drove the inflationary pressures are resolving and that the outlook for inflation is for continued decline. This was never an ‘excess demand’ episode and there was no case for higher interest rates, even back in May 2022, when the RBA started hiking.

The latest monthly ABS CPI data shows for August 2024 that the annual results are:

- The All groups CPI measure rose 2.7 per cent over the 12 months (down from 3.5 in July).

- Food and non-alcoholic beverages 3.4 per cent (from 3.8).

- Clothing and footwear 1.7 per cent (1.9).

- Housing 2.6 per cent (4.0). Rents (6.8 per cent cf. 6.9 per cent).

- Furnishings and household equipment -0.9 per cent (-0.9).

- Health 5.3 per cent (5.3).

- Transport -1.1 per cent (3.4).

- Communications -0.2 per cent (1.9).

- Recreation and culture 2.5 per cent (from 1.1).

- Education 5.4 per cent (5.6).

- Insurance and financial services 6.2 per cent (6.4).

The ABS Media Release (August 28, 2024) – Monthly CPI indicator rose 2.7% in the year to August 2024 – noted that:

The monthly Consumer Price Index (CPI) indicator rose 2.7 per cent in the 12 months to August 2024 …

… the top contributors to the annual movement were Housing (+2.6 per cent), Food and non-alcoholic beverages (+3.4 per cent), and Alcohol and tobacco (+6.6 per cent). Partly offsetting the annual increase was Transport (-1.1 per cent). …

Falls in Automotive fuel and Electricity were significant moderators of annual inflation in August. Automotive fuel was 7.6 per cent lower than August 2023 after price falls in recent months. For Electricity, the combined impact of Commonwealth Energy Bill Relief Fund rebates and State Government rebates in Queensland, Western Australia and Tasmania, drove the largest annual fall in electricity prices on record of 17.9 per cent …

Commonwealth Government and State Government rebates led to a 14.6 per cent fall in electricity prices in the month of August, which followed a 6.4 per cent fall in July. Excluding the rebates, electricity prices would have risen 0.1 per cent in August and 0.9 per cent in July …

General Conclusions:

1. The CPI Indicator has been consistently falling since December 2022 and yet the RBA continued to hike rates six more times for the next 12 months (6 hikes at 0.25 points) ending on November 8, 2023.

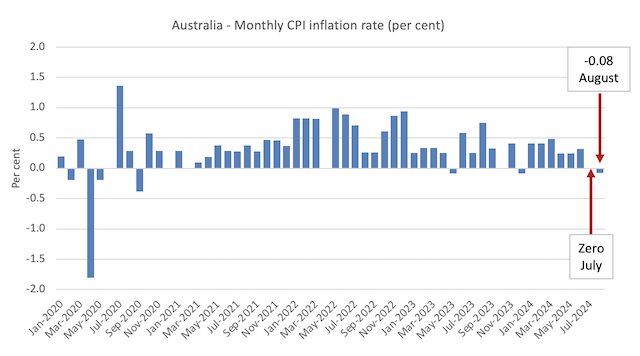

2. Think about this: the last two months the monthly inflation rate was zero in July and now minus 0.1 in August. Further, over the last quarter, if we annual that CPI change the inflation rate would be just 0.97 per cent. And if we annualise the most recent month the rate would be minus 0.96 per cent. In other words, while the RBA is claiming that the inflation rate is sticky, the reality is that we are now witnessing deflation (negative inflation).

3. If we look at the All Groups CPI excluding volatile items (which are items that fluctuate up and down regularly due to natural disasters, sudden events like OPEC price hikes, etc) then the monthly inflation rate was also minus 0.163 per cent in August – deflation.

4. Housing inflation fell dramatically but is being held up by the rent component, which is partly due to the RBA’s own rate hikes as landlords in a tight housing market just pass on the higher borrowing costs – so the so-called inflation-fighting rate hikes are actually driving inflation.

5. The electricity component is significantly lower after the introduction of the federal and state government rebates offsetting the profit-gouging in the energy sector. In other words, expansionary fiscal policy can be an effective tool in combatting inflation.

6. The other main cost pressure drivers are not sensitive to the RBA’s interest rate policy. Think about the large falls in transport costs – all down to international cartel gymnastics.

The next graph shows the monthly rate of inflation which fluctuates in line with special events or adjustments (such as, seasonal natural disasters, annual indexing arrangements etc).

There is no hint from this data that the inflation rate is accelerating or needs any special policy attention..

RBA Statement

The RBA Board yesterday (September 24, 2024) decided to leave its cash rate target unchanged at 4.25 per cent.

In its – Statement by the Reserve Bank Board: Monetary Policy Decision – the Board claimed:

… our current forecasts do not see inflation returning sustainably to target until 2026 …

This reflected a judgement that the economy’s capacity to meet demand was somewhat weaker than previously thought, evidenced by the persistence of inflation and ongoing strength in the labour market.

Wage pressures have eased somewhat …

Broader indicators suggest that labour market conditions remain tight, despite some signs of gradual easing. Over the three months to August, employment grew on average by 0.3 per cent per month. The unemployment rate remained at 4.2 per cent in August, up from the trough of 3.5 per cent in mid-2023 …

More broadly, there are uncertainties regarding the lags in the effects of monetary policy and how firms’ pricing decisions and wages will respond to the slower growth in the economy at a time of excess demand, and while conditions in the labour market remain tight.

They still think there is excess demand despite GDP growth (expenditure) falling to 0.2 per cent in the June-quarter – compared to the an underlying trend rate of around 3 per cent per annum – in other words, way below what the economy could achieve at full capacity.

The paranoia about a wages breakout is just a smokescreen.

Wages growth has been weak for years now despite the RBA’s claims that their private meetings with business leaders tell them there is a breakout coming.

When? Never!

This is a Board that has lost its grip on reality and just serves the vested interests of capital and those receiving massive income boosts from the interest rate hikes that have been a gift to those holding financial wealth.

And the ‘payees’ for those gifts have been the low-income mortgage holders who are not only being squeezed by the interest rate rises directly, but are also in the front-line of the job losses that the RBA is forcing on the economy.

Today’s inflation data demonstrates without doubt that CPI inflation is well within the RBA’s ‘targetting range’.

Now the bunk is that it is not “sustainably” within that range.

That is a new one.

While inflation was above 3 per cent the RBA had a simpler narrative – above is above.

Now it is within the range – we are hearing words like – ‘we can’t be sure it will remain there’.

So we have to scorch the economy some more and force more people out of work.

Which brings me to the Opinion piece by the ABC chief business correspondent yesterday (September 24, 2024) – RBA should stop relying on outdated theory about inflation and employment.

The said correspondent is usually conservative in his views – and I mostly disagree with his opinions and analysis.

This time, while there is much to disagree with, his basic message is something that I have been trying to get into the mainstream debate for years.

And that is the RBA obsession with getting the unemployment rate up to its estimate of the NAIRU (Non-Accelerating-Inflation-Rate-of-Unemployment), which is the mainstream concept of unemployment where inflation stabilises is simply voodoo in the extreme.

Ian Verrender says that the monetary policy logic at the moment is:

In short, the RBA would like more Australians to lose their jobs.

Why?

The current RBA governor told the press in June that:

Conditions in the labour market eased further over the past month but remain tighter than is consistent with sustained full employment and inflation at target.

Which was more or less repeated in yesterday’s statement by the Board.

Ian Verrender says this is a “little gem of central bank doublespeak”, which in “plain English” can be read as “More people lost their jobs in the past month but not enough to ensure we have full employment and to keep inflation in check.”

His article then critiques that viewpoint which he believes is out of date – I would add – never was!

He also notes that:

Astoundingly, no-one can actually tell you what the NAIRU is. That’s because they simply don’t know. For years, any time the jobless rate dropped to within earshot of 5 per cent, red lights would begin flashing.

The RBA is suggesting 4.3 per cent unemployment based on its forecasts. But in the years leading up to the pandemic, it became rubbery as inflation receded to dangerously low levels even though jobs numbers were incredibly strong. Again, the theory just didn’t hold.

I have been trying to make this point my whole academic career.

The estimates of the NAIRU are meaningless and provide no guide to policy.

Further, Ian Verrender is the first journalist to articulate what I have been writing about and telling interviewers for several years:

Just look at what happened in the past two years. Wage rises in the past two years didn’t cover price rises, resulting in a loss of real income for households.

That has been weighing heavily on economic growth as household consumption has slumped.

Inflation is on the wane. So, clearly, by definition, the current level of unemployment is already helping reduce inflation.

That’s the key to understanding the RBA’s failure – a deliberate failure to act in the public interest.

As I have noted often:

1. The NAIRU concept is that inflation will accelerate if the unemployment rate is below the NAIRU and start falling if the unemployment rate is above the NAIRU.

2. The unemployment rate was relatively stable around 3.7 or about for some quarters in recent times (despite rising a bit in recent months) while inflation rose, peaked (December 2022) and then steadily fell to its 2.7 per cent figure released today.

3. The RBA keeps claiming the NAIRU is 4.25 per cent – which they revised downward from 4.5 per cent last year – without telling us why.

4. So according to the RBA estimate of the NAIRU and the theoretical logic which they claim drives their interest rate setting, the inflation rate should have been accelerating throughout 2023 and for most of 2024.

5. But it was falling so the unemployment rate could not have been below the NAIRU (if you believe in that nonsense).

Ian Verrender finally has seen that (in the quote above).

It is amazing that it has taking so long for the mainstream journalists to twig to the RBA caprice.

Come in Greens

The Greens, who I have referred to as ‘neoliberals on bikes’ in the past, because they usually articulate mainstream economics policies and framing, came into focus this week when they demanded the Federal Treasurer intervene and use his powers under the – Reserve Bank Act 1959 – to order the RBA to cut rates (see ABC story (September 22, 2024) – Greens demand hostile takeover of RBA in exchange for passing board reforms in likely death knell for treasurer’s bill).

Under Section 11(4) of the Act, we find that if there are “Differences of Opinion with Government on questions of policy” and a specified process of negotiation is followed:

The Treasurer may then submit a recommendation to the Governor‑General, and the Governor‑General, acting with the advice of the Federal Executive Council, may, by order, determine the policy to be adopted by the Bank.

In other words, the Act puts the elected Treasurer as the ultimate authority over monetary policy settings and can intervene any time he/she wants to set interest rates.

So while the Treasurer recently tried to change the RBA Act to remove that power but was forced by the weight of public opinion to renege, the Greens are now calling on him to use it given the intransigence of the rogue central bank.

The Treasurer, of course, played the ‘RBA is independent’ card which is a neoliberal ruse to depoliticise economic policy so he can shift the blame for the rising unemployment onto the unelected and unaccountable RBA Board.

He called the Greens’ proposal – the “nuclear option” and inferred that the currency would collapse if he intervened as his legislative power would allow him to.

The usual central bank ‘credibility as an inflation fighter’ argument was repeated ad nauseum, which protects the RBA Board from public scrutiny.

The mainstream media tried to associate the Green’s demand with ‘Trumpism’ who decried the depoliticisation of policy in the USA.

That slur misses the point – we elect governments to implement policy in our best interest.

We don’t elect the central bank policy board nor can we vote it out if we are unhappy.

Trump is correct – having a major macroeconomic policy lever – outside of the accountability ring is not democratically sound.

It means that a rogue RBA Board, bullied by the RBA insiders who are obsessed with flawed concepts such as the NAIRU, which is inflicting massive damage on low income Australians and overseeing and facilitating one of the large income redistributions from poor to rich in our history, is beyond our reach.

The Greens’ spokesperson summarised it as:

They’re not infallible high priests of the economy and should not be immune to criticism …

Conclusion

Indeed.

I was asked by a journalist what I would do about all this and I replied that I would merge the RBA with the Treasury and take policy back into the political arena so that the citizens can exercise their judgements accordingly.

The journalist thought I was mad.

There is no real need for a central bank structured as it currently is and having a stack of unelected Board members running policy decisions.

That is a topic for another day.

As I said, quite a week in central banking.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

When you say rogue bank, I believe you mean the RBA is not following the Australian People’s interest, the People who elected the government supposedly in power.

And, of course, the supposed government doens’t seem very woried that its central bank is following somebody else’s agenda.

So, who is that somebody else?

If we look carefully, that agenda is not very different from the ECB’s, the Fed’s, or the UK’s central bank, just to mention a few.

So, we have here a very different kind of government, one that we didn’t vote for, one we don’t even know who they are.

Yet, it’s very real.

And while we ammuse ourselves electing useless people for government, the real government keeps working on something…

The trouble is, the real government is the wall street casino.

Their business is gambling.

They don’t care about the Australian People, or the American People, or the European people.

The only way to make money out of money in the western world in 2024 is by gambling.

Everything else was destroyed.

And when there’s nothing else to gamble, they will use our lifes to gamble.

Look carefull again and you’ll see that already happening.

If nothing else, I am pleased that the “NAIRU Fairy” is being exposed for the chimera it has always been and likewise the fundamentally undemocratic nature of “independent” central banks, which by design are unaccountable aristocratic institutions inimical to labour.

Bill, the treasurer in a real labour government would be knocking down your door begging you to be his/her chief advisor. Sadly we have a Labor government (no u).

A couple of points:

There is no such thing as “depoliticising” monetary policy. Whether decisions are made by the executive branch of the government or by a so-called independent party, there are winners and losers and therefore political.

I’m glad you pointed out that the RBA is suddenly worried about underlying inflation when it had no such concerns before. It’s exactly what I thought.

It’s also worth mentioning (until we’re all blue in the face) that the RBA Act says:

“It is the duty of the Reserve Bank Board, within the limits of its powers, to ensure that the monetary and banking policy of the Bank is directed to the greatest advantage of the people of Australia and that the powers of the Bank … are exercised in such a manner as, in the opinion of the Reserve Bank Board, will best contribute to:

(a) the stability of the currency of Australia ;

(b) the maintenance of full employment in Australia ; and

(c) the economic prosperity and welfare of the people of Australia .”

No mention of inflation targeting. And in 1959 when the Act came into effect, full employment meant exactly that.

Rogue indeed.

I never imagined the day when you would agree with Donald Trump on anything, so I am shocked. But your recommendation to merge an ostensible arm of government viz., RBA into Treasury is to be applauded and should be executed with haste.

By the way, the Teals in Kooyong are now fully aware of you and your role in MMT. They were surprised when I informed them that you were the architect; and it seems that numerous constituents had apprised them of MMT but you had been overlooked. And the good things is: they are listening.

Dear Bill,

I wonder if you noticed the recent article on The Conversation on this topic:

https://theconversation.com/why-is-the-reserve-bank-independent-from-government-and-why-does-it-matter-239717

Sadly, the author is not very well informed:

“However, the Greens’ attempt to use an interest rate cut as a negotiating chip ironically reinforces the importance of central bank independence. Were governments to take direct control of setting interest rates, we might expect monetary policy to be influenced by short-term electoral concerns, rather than the long-term health of the economy. ”

Just imagine, the RBA might actually do something the public wanted! The horror!

Dear D. Milburn (at 2024/09/27 at 9/55 am)

I also like to play golf! (-:

Thanks for the intelligence w.r.t Kooyong Teals. I was hoping they would be at my book launch the other day but there was no contact.

best wishes

bill

With a US regional hegemony pulling all levers (neoliberal paradigm) , I don’t expect any politician to deliver (doing their job) what should be done to rein in any western central bank.