Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

The Weekend Quiz – November 19-20, 2022 – answers and discussion

Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

A currency-issuing government does not control the fiscal outcome.

The answer is True.

The non-government sector spending decisions ultimately determine the fiscal balance associated with any discretionary fiscal policy.

The fiscal balance has two conceptual components. First, the part that is associated with the chosen (discretionary) fiscal stance of the government independent of cyclical factors. So this component is chosen by the government.

Second, the cyclical component which refer to the automatic stabilisers that operate in a counter-cyclical fashion. When economic growth is strong, tax revenue improves given it is typically tied to income generation in some way. Further, most governments provide transfer payment relief to workers (unemployment benefits) and this decreases during growth.

In times of economic decline, the automatic stabilisers work in the opposite direction and push the fiscal balance towards deficit, into deficit, or into a larger deficit. These automatic movements in aggregate demand play an important counter-cyclical attenuating role. So when GDP is declining due to falling aggregate demand, the automatic stabilisers work to add demand (falling taxes and rising welfare payments).

When GDP growth is rising, the automatic stabilisers start to pull demand back as the economy adjusts (rising taxes and falling welfare payments).

The cyclical component is not insignificant and if the swings in private spending are significant then there will be significant swings in the fiscal balance.

The importance of this component is that the government cannot reliably target a particular deficit outcome with any certainty. This is why adherence to fiscal rules are fraught and normally lead to pro-cyclical fiscal policy which is usually undesirable, especially when the economy is in recession.

The fiscal outcome is thus considered to be endogenous – that is, it is determined by private spending (saving) decisions.

The government can set its discretionary net spending at some target to target a particular fiscal deficit outcome but it cannot control private spending fluctuations which will ultimately determine the final actual fiscal balance.

The following blog posts may be of further interest to you:

- Saturday Quiz – May 1, 2010 – answers and discussion

- Understanding central bank operations

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

- A modern monetary theory lullaby

- Saturday Quiz – April 24, 2010 – answers and discussion

- The dreaded NAIRU is still about!

- Structural deficits – the great con job!

- Structural deficits and automatic stabilisers

- Another economics department to close

Question 2:

If employment growth matches the pace of growth in the working age population (people above 15 years of age) then the economy will experience a constant unemployment rate as long as participation rates do not change.

The answer is True.

The Civilian Population is shorthand for the working age population and can be defined as all people between 15 and 65 years of age or persons above 15 years of age, depending on rules governing retirement. The working age population is then decomposed within the Labour Force Framework (used to collect and disseminate labour force data) into two categories: (a) the Labour Force; and (b) Not in the Labour Force. This demarcation is based on activity principles (willingness, availability and seeking work or being in work).

The participation rate is defined as the proportion of the working age population that is in the labour force. So if the working age population was 1000 and the participation rate was 65 per cent, then the labour force would be 650 persons. So the labour force can vary for two reasons: (a) growth in the working age population – demographic trends; and (b) changes in the participation rate.

The labour force is decomposed into employment and unemployment. To be employed you typically only have to work one hour in the survey week. To be unemployed you have to affirm that you are available, willing and seeking employment if you are not working one hour or more in the survey week. Otherwise, you will be classified as not being in the labour force.

So the hidden unemployed are those who give up looking for work (they become discouraged) yet are willing and available to work. They are classified by the statistician as being not in the labour force. But if they were offered a job today they would immediately accept it and so are in no functional way different from the unemployed.

When economic growth wanes, participation rates typically fall as the hidden unemployed exit the labour force. This cyclical phenomenon acts to reduce the official unemployment rate.

So clearly, the working age population is a much larger aggregate than the labour force and, in turn, employment. Clearly if the participation rate is constant then the labour force will grow at the same rate as the civilian population. And if employment grows at that rate too then while the gap between the labour force and employment will increase in absolute terms (which means that unemployment will be rising), that gap in percentage terms will be constant (that is the unemployment rate will be constant).

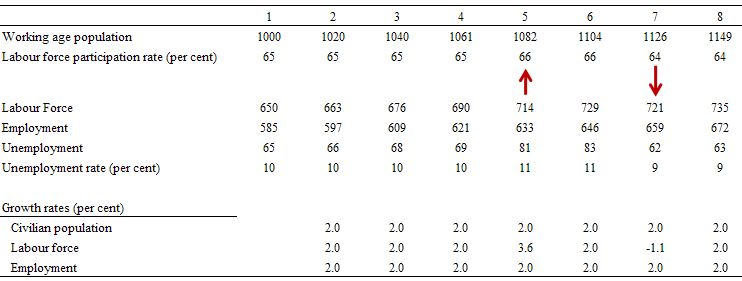

The following Table simulates a simple labour market for 8 periods. You can see for the first 4 periods, that unemployment rises steadily over time but the unemployment rate is constant. During this time span employment growth is equal to the growth in the underlying working age population and the participation rate doesn’t change. So the unemployment rate will be constant although more people will be unemployed.

In Period 5, the participation rate rises so that even though there is constant growth (2 per cent) in the working age population, the labour force growth rate rises to 3.6 per cent. Now unemployment jumps disproportionately because employment growth (2 per cent) is not keeping pace with the growth in new entrants to the labour force and as a consequence the unemployent rate rises to 11 per cent.

In Period 6, employment growth equals labour force growth (because the participation rate settles at the new level – 66 per cent) and the unemployment rate is constant.

In Period 7, the participation rate plunges to 64 per cent and the labour force contracts (as the higher proportion of the working age population are inactive – that is, not participating). As a consequence, unemployment falls dramatically as does the unemployment rate. But this is hardly a cause for celebration – the unemployed are now hidden by the statistician “outside the labour force”.

Understanding these aggregates is very important because as we often see when Labour Force data is released by national statisticians the public debate becomes distorted by the incorrect way in which employment growth is represented in the media.

In situations where employment growth keeps pace with the underlying population but the participation rate falls then the unemployment rate will also fall. By focusing on the link between the positive employment growth and the declining unemployment there is a tendency for the uninformed reader to conclude that the economy is in good shape. The reality, of-course, is very different.

The following blog posts may be of further interest to you:

Question 3:

In a fiat monetary system (for example, US or Australia) with an on-going external deficit and fiscal deficit that is smaller than the external sector, then the domestic private sector is in:

(a) Cannot tell without knowing the actual deficits as a percent of GDP.

(b) Surplus.

(c) Deficit.

The answer is Deficit.

This question is an application of the sectoral balances framework that can be derived from the National Accounts for any nation.

To refresh your memory the sectoral balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

Expression (1) tells us that total income in the economy per period will be exactly equal to total spending from all sources of expenditure.

We also have to acknowledge that financial balances of the sectors are impacted by net government taxes (T) which includes all taxes and transfer and interest payments (the latter are not counted independently in the expenditure Expression (1)).

Further, as noted above the trade account is only one aspect of the financial flows between the domestic economy and the external sector. we have to include net external income flows (FNI).

Adding in the net external income flows (FNI) to Expression (2) for GDP we get the familiar gross national product or gross national income measure (GNP):

(2) GNP = C + I + G + (X – M) + FNI

To render this approach into the sectoral balances form, we subtract total taxes and transfers (T) from both sides of Expression (3) to get:

(3) GNP – T = C + I + G + (X – M) + FNI – T

Now we can collect the terms by arranging them according to the three sectoral balances:

(4) (GNP – C – T) – I = (G – T) + (X – M + FNI)

The the terms in Expression (4) are relatively easy to understand now.

The term (GNP – C – T) represents total income less the amount consumed less the amount paid to government in taxes (taking into account transfers coming the other way). In other words, it represents private domestic saving.

The left-hand side of Equation (4), (GNP – C – T) – I, thus is the overall saving of the private domestic sector, which is distinct from total household saving denoted by the term (GNP – C – T).

In other words, the left-hand side of Equation (4) is the private domestic financial balance and if it is positive then the sector is spending less than its total income and if it is negative the sector is spending more than it total income.

The term (G – T) is the government financial balance and is in deficit if government spending (G) is greater than government tax revenue minus transfers (T), and in surplus if the balance is negative.

Finally, the other right-hand side term (X – M + FNI) is the external financial balance, commonly known as the current account balance (CAD). It is in surplus if positive and deficit if negative.

In English we could say that:

The private financial balance equals the sum of the government financial balance plus the current account balance.

We can re-write Expression (6) in this way to get the sectoral balances equation:

(5) (S – I) = (G – T) + CAB

which is interpreted as meaning that government sector deficits (G – T > 0) and current account surpluses (CAB > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G – T < 0) and current account deficits (CAB < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

Expression (5) can also be written as:

(6) [(S – I) – CAB] = (G – T)

where the term on the left-hand side [(S – I) – CAB] is the non-government sector financial balance and is of equal and opposite sign to the government financial balance.

This is the familiar MMT statement that a government sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)) plus net income transfers.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

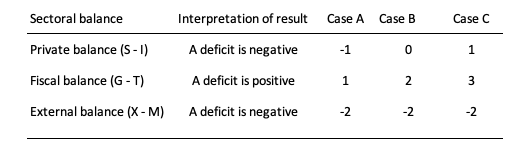

To help us answer the specific question posed, we can identify three states all involving public and external deficits:

- Case A: Fiscal deficit (G – T) < Current Account balance (X – M) deficit.

- Case B: Fiscal deficit (G – T) = Current Account balance (X – M) deficit.

- Case C: Fiscal deficit (G – T) > Current Account balance (X – M) deficit.

The following Table shows these three cases expressing the balances as percentages of GDP. Case A shows the situation where the external deficit exceeds the public deficit and the private domestic sector is in deficit. In this case, there can be no overall private sector de-leveraging.

With the external balance set at a 2 per cent of GDP, as the fiscal position moves into larger deficit, the private domestic balance approaches balance (Case B). Case B also does not permit the private sector to save overall.

Once the fiscal deficit is large enough (3 per cent of GDP) to offset the demand-draining external deficit (2 per cent of GDP), the private domestic sector can save overall (Case C).

In this situation, the fiscal deficits are supporting aggregate spending which allows income growth to be sufficient to generate savings greater than investment in the private domestic sector but have to be able to offset the demand-draining impacts of the external deficits to provide sufficient income growth for the private domestic sector to save overall.

For the domestic private sector (households and firms) to reduce their overall levels of debt they have to net save overall. The behavioural implications of this accounting result would manifest as reduced consumption or investment, which, in turn, would reduce overall aggregate demand.

The normal inventory-cycle view of what happens next goes like this. Output and employment are functions of aggregate spending. Firms form expectations of future aggregate demand and produce accordingly. They are uncertain about the actual demand that will be realised as the output emerges from the production process.

The first signal firms get that household consumption is falling is in the unintended build-up of inventories. That signals to firms that they were overly optimistic about the level of demand in that particular period.

Once this realisation becomes consolidated, that is, firms generally realise they have over-produced, output starts to fall. Firms lay-off workers and the loss of income starts to multiply as those workers reduce their spending elsewhere.

At that point, the economy is heading for a recession.

So the only way to avoid these spiralling employment losses would be for an exogenous intervention to occur. Given the question assumes on-going external deficits, the implication is that the exogenous intervention would come from an expanding public deficit. Clearly, if the external sector improved the expansion could come from net exports.

It is possible that at the same time that the households and firms are reducing their consumption in an attempt to lift the saving ratio, net exports boom. A net exports boom adds to aggregate demand (the spending injection via exports is greater than the spending leakage via imports).

So it is possible that the public fiscal balance could actually go towards surplus and the private domestic sector increase its saving ratio if net exports were strong enough.

The important point is that the three sectors add to demand in their own ways. Total GDP and employment are dependent on aggregate demand. Variations in aggregate demand thus cause variations in output (GDP), incomes and employment. But a variation in spending in one sector can be made up via offsetting changes in the other sectors.

The following blog posts may be of further interest to you:

- Private deleveraging requires fiscal support

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

- Saturday Quiz – May 22, 2010 – answers and discussion

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

This Post Has 0 Comments