Today (January 22, 2026), the Australian Bureau of Statistics (ABS) released the latest labour force…

Falling unemployment is not necessarily good

I have been travelling for most of today and unable to write very much. But there were are few things I penned which might be of interest. I was sent a news report today which appeared in the local Fairfax press and related to yesterday’s ABS release of the detailed labour force estimates by region. This usually garners a lot of regional interest and the estimates are used by politicians, business groups etc to further their own vested interests. Rarely do any of the public statements that are made about this detailed data actually tell an accurate story. The news report in question was a classic case of this. What we should always understand is that the labour force framework is complicated and falling unemployment is not necessarily a good outcome.

Media lies … how not to misrepresent labour force data

The local Newcastle media is not shy in talking up the local economy and often quote business lobby groups and a local private research institute (which really just reflects the voice of business who provide them with contracted research opportunities). I am a regular commentator in the local media and typically present a very different view to that offered by the business interests which includes property developers who are intent on getting their hands on as much public space as they can for private gain.

I am often attacked by these interest for suggesting that their claims that the local economy is booming are overstated – to put it politely. My role as a truly independent academic researcher and commentator is to portray events and developments as accurately as I can without hyperbole. The vested interests, however, rarely like this level of scrutiny or truth.

Here is a classic case that followed the release of the ABS detailed regional labour force data yesterday (December 16, 2010).

It is highly likely the journalist who wrote this piece does not understand what he/she is dealing with when commenting on the labour force data. But that is no excuse for total misrepresentation and fabrication.

This morning (December 17, 2010), the Newcastle Herald (the local Fairfax press daily) provided the following report on the ABS data release:

HUNTER employment figures are soaring back to record levels in the lead up to Christmas, Australian Bureau of Statistics figures show.

The Hunter’s unemployment rate of 3.9 per cent for November is well below October’s recording of 5.3 per cent. The October figure was above the state average.

Hunter Business Chamber chief executive Peter Shinnick said it pleasing to have the Hunter’s rates below the NSW and national averages.

So the impression given is that the local economy is booming – jobs are growing, unemployment is falling and our region is doing better than the rest of the state.

Nothing could be further from the truth.

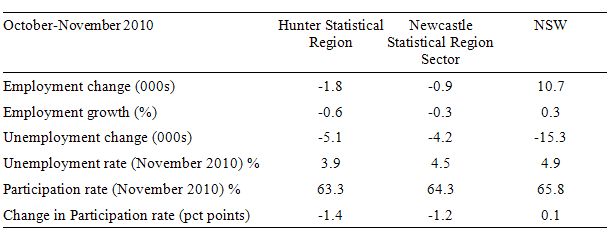

The following Table compares the main labour force aggregates for the Hunter and Newcastle regions and the state of NSW as at November 2010. The changes relate to the period October to November 2010. The figures are taken from the official data.

Employment fell in both the broad Hunter Statistical Region and the Newcastle Statistical Region Sector, which is the most densely populated part of the Hunter region (and where I live by the sea). However, in the state of NSW (in which the Hunter region is located) employment growth was positive.

So the local press lied when it said that Hunter employment figures soared. No – employment contracted sharply in November 2010.

In all regions noted in the Table unemployment fell. The official unemployment rate in the Hunter is indeed below the state average so there is the grain of truth in the news report.

But is a fall in the official unemployment an unambiguously good thing. It all depends. You can see that the participation rate for the state as a whole (NSW) rose in November 2010 so more people were looking for work in that month than in October 2010.

So the falling unemployment was a consequence of the relatively strong employment growth outstripping the growth in the labour force. That is a very good outcome although if the jobs were casualised and offering less hours than desired we would conclude otherwise. But at this level of aggregation things improved at the state-level.

But you cannot conclude the same for the Hunter (or Newcastle) regions. Participation rates fell sharply in November 2010 as workers reacted to the declining employment opportunities and left the active labour force.

So the fall in unemployment in the face of the falling employment is an artefact of the rate of labour force exit being larger than the drop in employment. Taken together that is an appalling outcome.

What would have happened to the unemployment rate if the participation rate in the Hunter region had not fallen so much?

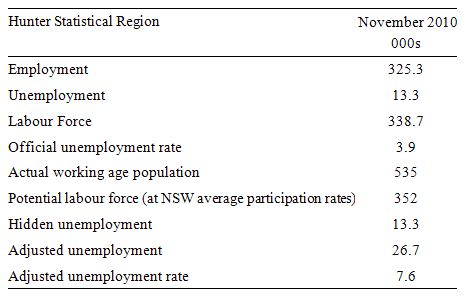

The following table shows the results of taking into account the fact that the participation rate fell dramatically in November 2010 in the Hunter Statistical Region (1.4 percentage points).

The data for Employment, Unemployment, the Labour Force and the Official unemployment rate are derived directly from the ABS data.

We know that the working age population (above 15 years of age) is 535 thousand because the participation rate in November 2010 was 63.3 per cent.

If we take the NSW (state-wide) average participation rate which was 2.5 percentage points higher than that for the Hunter region in November 2010 (that is, 65.8 per cent) and compute what the labour force would have been we get a potential labour force in November 2010 of 353 thousand as opposed to 339 thousand.

So around 13.3 thousand Hunter workers have left the workforce because of the shrinking job opportunities (we term this hidden unemployment).

If we added the discouraged workers to the actual unemployment you can see that it doubles to 26.7 thousand.

If we then re-computed the unemployment rate by dividing the adjusted unemployment into the potential labour force (that is, adding the hidden unemployed to the numerator and the denominator) we get an adjusted unemployment rate for the Hunter region in November 2010 of 7.6 per cent.

That is a very different story to the 3.9 per cent that the official data yields.

Reality: not as rosy as the press and the business community want us to believe. I expect more E-mail, telephone and other criticism for my comments today in the media about this in the coming days.

RBA to ease Basel III requirements on banks – read: socialisation

The Reserve Bank of Australia released a media release today (December 17, 2010) discussing its response to the Basel III requirements.

The media release – Australian Implementation of Global Liquidity Standards – was in response to yesterday’s announcement by the the Basel Committee on Banking Supervision (Basel Committee) – Basel III rules text and results of the quantitative impact study issued by the Basel Committee.

I will analyse the new rules in more detail next week.

But the RBA has reacted to the new Basel III “standard for liquidity risk” which it says:

… aims to ensure that banking institutions have sufficient high-quality liquid assets to survive an acute stress scenario lasting for one month.

This standard will not come in operation until January 1, 2015. Given the way the policy makers have become obsessed with fiscal consolidation the next big stress on banks may well come before that date anyway.

But the new Liquidity Coverage Ratio (LCR) will require that the vast proportion of high-quality liquid assets will have to be “holdings of government debt”.

Please read my blog – Bond markets require larger budget deficits – for more discussion on the implications of this new requirement.

The RBA has recognised that the pursuit of fiscal austerity by governments will compromise the ability of the banks to build up enough public debt holdings. It further notes that a “second level of eligible liquid assets that includes certain non-bank corporate debt is also in short supply in Australia”.

Given this reality, Basel III will allow for “alternative treatments for the holding of liquid assets” which might include banks establishing “contractual committed liquidity facilities provided by their central bank, subject to an appropriate fee, with such facilities counting towards the LCR requirement”.

You get the picture. The central bank can provide the required capital on a fee-for-service basis.

Today, the RBA (in tandem with the Australian Prudential Regulation Authority) agreed to establish:

… a committed secured liquidity facility with the RBA, sufficient in size to cover any shortfall between the ADI’s holdings of high-quality liquid assets and the LCR requirement. Qualifying collateral for the facility will comprise all assets eligible for repurchase transactions with the RBA under normal market operations. In return for the committed facility, the RBA will charge a market-based commitment fee.

So the central bank provides the reserves if banks are short (for a fee) and now they have agreed to provide the required liquidity if the banks are short.

Sounds like the government should just nationalise the banks and be done with it.

Escape into hard commodities

With the Eurozone crisis spreading (to Spain now), the European Central Bank announced yesterday (December 16, 2010) that it would almost double its capital base.

A friend wrote to me overnight saying that the Euro was sinking and he was fleeing into the safe haven of hard commodities, a common reaction when a currency looks set to fail or hyper-inflate.

I imagined him stockpiling gold or silver or some other precious metal.

I was wrong – he bought a Harley! I laughed.

It just shows how bad the Euro is going – very clever people (financially) are buying boat anchors as a safe haven!

Context statement – I rode Triumphs and Ducatis!

Conclusion

I have had a very disjointed week with travel to various places and lots of non-writing commitments. Things return to relative normality next week.

Saturday Quiz

The Saturday Quiz will be back some time tomorrow – with some tricks to tease you with (hopefully).

That is enough (well … all I can write) for today!

I haven’t read it all yet Bill but I know the feeling, my local regional market was claiming 4.1% Unemployment January 2009, the March Small Area Labour Market data came out – which is as close as I could get to January – in March and said 5.7% Unemployment. It is out again, presumably from the same data you’re quoting and it is now 6.7%. And I can certainly state given the time of year, the amount of ‘festive seasonal’ work is near enough to nil. You would expect the opposite. So I expect the next lot of figures to be just as high or even higher.

“With the Eurozone crisis spreading (to Spain now), the European Central Bank announced yesterday (December 16, 2010) that it would almost double its capital base.”

A tip from the inside is that Belgium is getting a lot of scrutiny up and down. I kind of like the PIIGS acronym but how do we fit Belgium in?

I just did the Sat quiz and scored 2 out of 5 and after the 3rd look still have no idea where I went wrong. I must be exhibiting too many neo-liberal tendancies and in desperate need of a labotomy.

Ray –

Belgium is one of the BAFFLING economies which (along with the PIGS) joined the Euro in the first round.

So’s Ireland, even though lately they’ve been acting like they belong in with the PIGS.

I thought Ireland WAS one of the PIIGS – Portugal, Ireland, Italy, Greece, Spain. Did I have that wrong?

They were originally PIGS, not PIIGS!

Relabeling them PIIGS so that Ireland can join them is a bad idea – partly because the source of Ireland’s financial problems is completely different, and partly because BAFFLING becomes difficult to pronounce if you take the I out.

Always been PIIGS to me and Krugman tried to make them GIPSI once and Prof. Mitchell repeated it at least once. As long as they’re all part of the Eurozone, the root cause is ultimately the same.

The description of the position the countries are in would probably be accurate if we include Hungary and Turkey 😉

Senexx says:

Saturday, December 18, 2010 at 18:45

“Always been PIIGS to me and Krugman tried to make them GIPSI once and Prof. Mitchell repeated it at least once. As long as they’re all part of the Eurozone, the root cause is ultimately the same.”

GIPSI is equally derogatory and somewhat ironic given the disdain that most Europeans afford those poor sods of the same name.

What is truly laughable is that if you really include all the rotters in the same acronym then you get PIIIGGS. Iceland and Great Britain.

Just shows that you can put lipstick on a pig but at the end of the day it is still a pig. lol

That’s beyond the Palin, Ray.

Also you can’t consider Great Britain in the same boat. Whilst everything it is doing is wrong, they’re not part of the European Monetary Union. GB is still sovereign in its own currency. Admittedly nor is Iceland a part of the EMU but Iceland’s problem was debt in foreign currency which makes it near analogous to the European Monetary Union problems and it has been given favoured status to be one of the next member states.

Interesting commment on an IMF simulation using their standard models which comes to the conclusion that lifting the labour share fixes financial crises faster:

http://fistfulofeuros.net/afoe/economics-and-demography/sunshine-at-the-imf-of-all-places/