These notes will serve as part of a briefing document that I will send off…

RBA bows to financial market pressure and boost bank profits at the expense of low-income mortgage holders

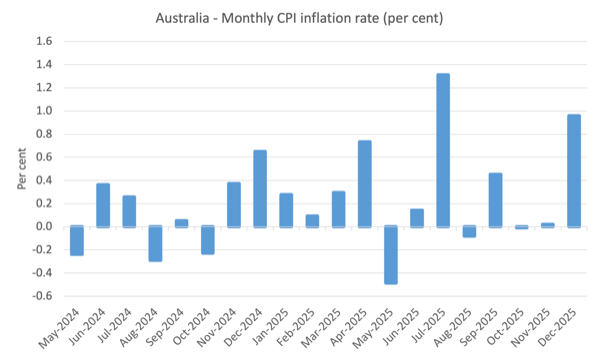

The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday and claimed that it was because the inflationary outlook was in danger of accelerating out of control as a result of excessive demand pressures. This followed last week’s CPI release which showed the December increase to be 0.96 points. When we examine that increase more closely, we find that 97.6 per cent of the December rise in the All Groups CPI was due to ‘Holiday travel and accommodation’ (most associated with Xmas and the one-off Ashes cricket series) – 70.9 per cent was due to International holiday travel and accommodation and 26.6 per cent due to Domestic holiday travel and accommodation. It is nigh on impossible to construct that as an economy that is ‘bursting at its seams’, notwithstanding all the lurid contributions from the RBA cheer squad in the media, who seem to spend their professional lives repeating press releases from organisations like the RBA, without giving them any due diligence. The reality is the RBA has bowed to pressure from the financial markets and rewarded the demands for higher rates from bank economists, who work for institutions that profit from such rises. Such is the state of macroeconomic policy in Australia.

Latest CPI data

Last week (January 28, 2026), the Australian Bureau of Statistics (ABS) published the latest – Consumer Price Index, Australia – for the month of December 2025.

For those who use this data regularly, the latest release is a disaster (temporary) because all the formatting and tables have changed.

Further the old quarterly series is being calculated on a difference basis as the monthly series takes precedence.

So it will take some time to get my underlying databases sorted out.

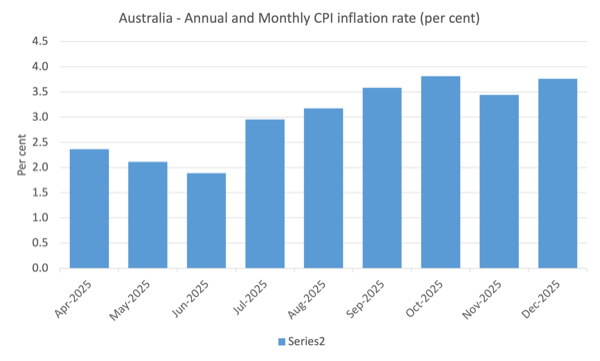

The latest release sent the commentators into conniptions given that it showed that the All Groups CPI rose 3.8 per cent in the 12 months to December 2025, up from 3.4 per cent for the 12 months to November 2025.

The bank economists who are now featured on major media outlets, without any warnings to listeners or viewers that they are not ‘independent commentators’ and that their organisations benefit from interest rate increases, were all baying at the moon for the RBA to respond to this disastrous CPI ‘print’ (as they call it) and push up rates at least a few times in the coming months.

The headlines in newspapers talked about the economy ‘busting at the seams’ and about to enter a dangerous period where inflation was running out of control and that we needed to ‘pull our belts in’.

They didn’t note that for the month of December, once seasonal factors are taken into account, the CPI increased by just 0.2 per cent, which if annualised is 2.4 per cent, and well within the so-called RBA targetting range.

There was hardly any rise in the trimmed mean measure (3.3 per cent from 3.2 per cent) – noise!

The RBA uses a range of measures to ascertain whether they believe there are persistent inflation threats.

Please read my blog post – Australian inflation trending down – lower oil prices and subdued economy (January 29, 2015) – for a detailed discussion about the use of the headline rate of inflation and other analytical inflation measures.

The trimmed mean measure is a measure of central tendency that is achieved not by excluding outliers, but by giving lower weighting to volatile elements.

The summary, seasonally-adjusted Consumer Price Index results for December 2025 are as follows:

| Component | Quarter % | Annual % |

| All groups CPI | 0.2 (last 0.2) | 3.7 (last 3.5) |

| Trimmed mean series | 0.2 (0.3) | 3.7 (3.5) |

| Weighted median series | 0.2 (0.3) | 3.6 (3.0) |

The following Table shows the rates of inflation (seasonally adjusted) for the major components of the CPI:

| Component | Current quarter % | Last 12 months % |

| All groups CPI | 0.2 (Last month 0.2) | 3.7 (Last month 3.5) |

| Food and non-alcoholic beverages | 0.2 (0.3) | 3.5 (3.3) |

| Alcohol and tobacco | 0.5 (0.6) | 4.8 (4.2) |

| Clothing and footwear | -0.9 (0.0) | 3.4 (4.6) |

| Housing | 0.1 (0.9) | 5.5 (5.2) |

| Furnishings, household equipment and services | 0.1 (-0.4) | 1.7 (1.4) |

| Health | 0.4 (-0.2) | 3.6 (3.6) |

| Transport | 0.3 (0.3) | 1.7 (2.7) |

| Communication | -0.1 (0.6) | 1.1 (1.3) |

| Recreation and culture | 0.4 (-0.7) | 4.3 (2.3) |

| Education | 0.4 (0.4) | 5.4 (5.4) |

| Insurance and financial services | 0.1 (0.3) | 2.5 (2.5) |

The ABS Media Release – CPI rose 3.8% in the year to December 2025 – noted that:

The largest contributor to annual inflation in December was Housing, up 5.5 per cent. This was followed by Food and non-alcoholic beverages, up 3.4 per cent, and Recreation and culture, which rose 4.4 per cent …

When prices for some items change significantly, measures of underlying inflation like the Trimmed mean can give more insights into how inflation is trending …

Trimmed mean inflation was 3.3 per cent in the 12 months to December 2025, up from 3.2 per cent in the 12 months to November 2025 …

Annual Goods inflation was 3.4 per cent in the 12 months to December, up from 3.3 per cent to November. The main contributor was Electricity, which rose 21.5 per cent in the 12 months to December.

Annual Services inflation was 4.1 per cent in the 12 months to December, up from 3.6 per cent to November. The main contributors were Domestic holiday travel and accommodation (+9.6 per cent) and Rents (+3.9 per cent) …

Annual Housing inflation was 5.5 per cent to December, driven by Electricity costs, which rose 21.5 per cent in the 12 months to December …

Annual inflation for Recreation and culture was 4.4 per cent to December, up from a 2.0 per cent rise to November.

Domestic holiday travel and accommodation prices rose 9.6 per cent in the 12 months to December, up from a 3.3 per cent rise in the 12 months to November.

In monthly terms, prices for Domestic holiday travel and accommodation rose by 8.2 per cent due to strong demand in the lead up to Christmas, the summer school holidays and major events such as the Ashes cricket test series.

The following graphs show the annual and monthly inflation rates (noting that the data series now begins at April 2024, given the change in ABS methodology.

The media went crazy when they saw the All Groups CPI rise by 0.96 per cent monthly rise for December 2025.

But a closer examination demonstrates there is no accelerating trend in inflation.

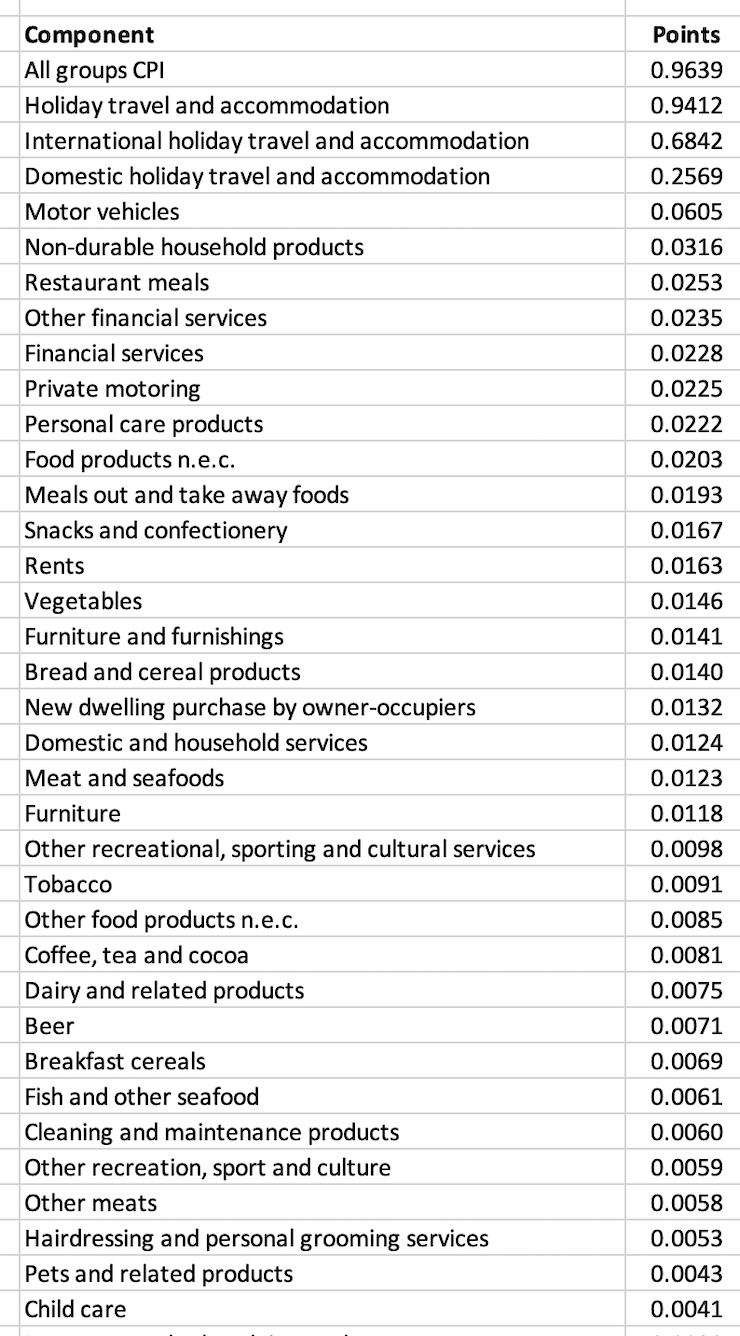

The following table shows the contributions of that 0.96 per cent overall rise by the top 35 contributing individual CPI components.

Observations:

1. The annual inflation rate rose slightly and was largely driven by one-off factors – electricity rebates ending and a major tourist boost because of the Ashes cricket series, which attracted a major increase in travel and price gouging from the airlines and hospitality providers.

2. 97.6 per cent of the December rise in the All Groups CPI was due to ‘Holiday travel and accommodation’.

3. 70.9 per cent was due to International holiday travel and accommodation and 26.6 per cent due to Domestic holiday travel and accommodation.

4. Most of that travel was associated with Xmas holidays (seasonal effect) and the irregular Ashes Cricket series, which attracts many tourists to Australia.

5. The electricity component has been driving inflation recently but that is all down to the fact that the Queensland and Western Australian governments have terminated their energy subsidies.

6. Taken the travel and electricity out of the December CPI result, we get an annual inflation rate of 3 per cent, down from the peak of 3.1 per cent in October.

7. If we were to project into the future, it is hard to see any new threatening inflationary tendencies in this data.

But the RBA sees the data differently as it dances with its own shadow.

RBA response

On February 3, 2025, the RBA hiked the interest rate by 0.25 points to 3.85 per cent after the ‘financial markets’ put it under massive pressure to do so.

In the – Statemeny by the Monetary Policy Board: Monetary Policy Decision (issued February 3, 2026) – the RBA said:

While inflation has fallen substantially since its peak in 2022, it picked up materially in the second half of 2025.

Hello!

The graphs above don’t accord with the claim that CPI inflation “picked up materially in the second half of 2025”.

It was mostly benign until December, when a major international sporting event combined with price gouging from travel providers (airlines etc) drove a once-off escalation.

The RBA continued:

While part of the pick-up in inflation is assessed to reflect temporary factors, it is evident that private demand is growing more quickly than expected, capacity pressures are greater than previously assessed and labour market conditions are a little tight.

As noted above “part of the pick-up in inflation” (holiday travel) accounted for 97.6 per cent of the December increase.

Part-of or most-of.

If there are ‘capacity pressures’ then they are not visible in the December data.

The RBA also claimed that:

Various indicators suggest that labour market conditions remain a little tight and that they have stabilised in recent months, in line with the pick-up in momentum in economic activity. The unemployment rate has been a little lower than expected and measures of labour underutilisation remain at low rates.

This is pushing the English language to the extremes of absurdity.

In December 2025, there were 646,600 persons officially unemployed in Australia – that is, 4.1 per cent of the labour force.

Adding to that is the fact that 5.7 per cent of the employed labour force are underemployed and on average desire an additional 14 odd hours extra work per week.

Taken together, the broad labour underutilisation rate (sum of unemployment and underemployment) is 9.8 per cent.

Overall, there are 1,501.8 thousand people either unemployed or underemployed and who want to work more.

The employment-to-population ratio and the participation rate are also falling.

What possible meaning of the RBA term “low rates” could apply to this data.

The only meaning that we can attach to the RBA assessment is that it is jumping at the NAIRU shadow.

Their estimate of the NAIRU (the mythical unemployment rate that is associated with stable inflation) is somewhere between 4.25 and 4.5 per cent, even though they are unable to back that up with any sensible analysis.

The current official unemployment rate is 4.1 per cent.

In other words, the RBA continues to desire a higher unemployment rate for reasons that escape any logic, given that wage pressures are declining and were never threatening anyway.

In fact in the most recent data available, real wages fell by 0.6 per cent.

The RBA is a lackey to the financial markets

The financial markets took a hit when the RBA reduced rates somewhat in 2025.

They have been very noisy about the ‘need’ (alleged) for interest rate rises.

Of course, their financial market bets and bank margins depended on the RBA doing their work for them.

Which it did.

And demonstrated just how compromised that institution has become.

There is a sort of ‘inner circle’ echo chamber in Sydney surrounding the RBA offices – and officials and bank economists and traders all interact – talking with each other.

It doesn’t take much for that sort of social interaction combined with an overwhelming acceptance of (erroneous) New Keynesian thinking for the RBA to completely lose touch with reality and just become an agent for the speculators in the financial markets.

Last Tuesday’s decision is certainly consistent with that assessment.

Conclusion

The problem is that the low-income mortgage holders who the RBA punishes when interest rate rises are unlikely to be the people indulging in the international travel boom that drove the December CPI figure.

But the RBA has never cared about the distributional consequences of its decisions, which shift real income into the hands of those with extensive financial assets (when rates rise) at the expense of low-income mortgage holders who are always hanging on by the skin of their teeth.

That is enough for today!

(c) Copyright 2026 William Mitchell. All Rights Reserved.

This Post Has 0 Comments