The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

Those who invoke the ‘Truss Moment’ should look at what is happening in Japan

In the annals of ruses used to provoke fear in the voting public about government deficits, central bank currency issuance, and fiscal activism, the experience of Germany in the 1920s was a long-standing favourite, that could be wheeled out on demand and have immediate effect. Wheelbarrows full of money being pushed to the local bakery to buy the daily bread, etc. It was a very effective vehicle for advancing the interests of the ruling class because it created a political brake on government action to reduce poverty and maintain full employment. More recently, Zimbabwe became the vehicle. It was equally effective even though it, like the Weimar ruse, was largely based on fiction. Even more recently, we have a new ‘ruse on the block’, the so-called ‘Truss Moment’, which is particularly effective in the UK. The current Labour government is petrified to do anything that might resemble a Labour government because they have a deep-seated paranoid ideation that the ‘City’ is out to get them, and the ‘Truss Moment’ is used as the summary event that apparently justify that delusion. They might have looked to the East, to Japan, to see why the ‘Truss Moment’ was about something quite different to the popular narrative that accompanies the mention of the ill-fated few months in British politics.

Background

The economic and political debate in the UK has long been stifled by the unfortunate sell out by James Callaghan and Denis Healey in 1976 to the increasingly dominant Monetarist economics of Milton Friedman.

I have written extensively about that period – see – Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World (Pluto Books, September 2017) – for a summary account.

I did another interview with the Incite Institute recently, which is an interdisciplinary research center at Columbia University and is home to the – Columbia Center for Oral History Research – the oldest center devoted to oral history in the country.

It was my second contribution to their archive project centred on sketching what a Post Neoliberal world might look like and how we got to where we are.

It was a very interesting experience and in the second part we discussed in detail the way in which the progressive (including social democratic) elements effectively abandoned ship in the 1970s and started accepting some of the core economic ideas of Monetarism and the derivatives of that ideology that followed.

The idea that Denis Healey introduced into the British debate – that the British government had to borrow funds from the IMF to stay solvent was preposterous but was a very effective way of diverting blame for his preferred austerity shift to preserve the increasingly precarious relationship under the ‘Social Contract’ that the government had with the trade union movement.

The 1970s and 1980s was a period when social democratic politicians all fell into line with the Monetarist – fight inflation first – narrative.

In Europe, it was the ‘tournant de la rigueur’ (austerity turn) introduced by the French Socialist government of François Mitterrand in 1983 that effectively cancelled the commitment to the progressive – Programme commun – that is often cited as a demonstration of the limited capacity of governments to resist the global power of the financial markets.

The fact that it was progressive governments that instigated these events made it more emphatic – the Left essentially swallowed the fictions introduced by the Right and the corporate elites that governments were now powerless against the power of the financial markets.

The macroeconomic contest was essentially ceded to the conservatives and it has been that way since.

The modern British Labour Party – or at least the ‘elite’ political players in that party that dominate the government (after the purge of Jeremy Corbyn’s influence) – carry on the delusion that Denis Healey introduced into the Party and the public debate after he became infested with Monetarist ideas.

The ‘Truss Moment’ has been added to this catalogue of paranoid delusions and is used to justify the claim that governments must appease the financial markets or face currency destruction and rising bond yields.

Like its predecessors, there is no validity to the claims.

But the Left is so bereft that it cannot see through the smoke and mirrors.

And that is why the world is in the parlous state that it is – the contest of ideas is non-existent.

It is a case of rinse and repeat – except all is happening is lies and posturing is being recycled.

2026 Japanese election outcome – implications

I was reflecting on all this when I was analysing the results from the – 2026 Japanese general election – which was held on February 8, 2026.

As we now know, the recently installed Prime Minister in Japan, Ms Takaichi, took a gamble by dissolving the Diet in an attempt to regain seats lost in the 2025 general election.

She even took the risk of running an election in the depth of Winter, which is rare.

Her aim was to try to gain a majority in the Diet and produce a popular mandate for her policy shift towards larger fiscal deficits and easing monetary policy settings.

Her gamble paid off big time – the LDP gained an extra 125 seats to set a new Post WW2 record for the most seats won by a single party – 316 in the 465 seat Lower House.

It gave her a ‘supermajority’ in her own right and ended her reliance on having to govern with a coalition partner.

The progressive parties lost dramatically.

At the press conference announcing the dissolution of the Diet, Ms Takaichi promised to:

… break free from the excessive restraint of austerity-oriented economic and fiscal policy and fundamentally shift fiscal policy …

Among her expansionary policy positions, Ms Takaichi promised to suspend the destructive sales tax on food, which attracted massive criticism from mainstream economists, who claimed it would plunge Japan into a fiscal and currency crisis.

The new PM was also fighting an austerity vanguard in her own party – the old club of men who have demanded that fiscal policy be more constrained.

The election result puts a sock in their mouths!

The election result thus means that there is unambiguous public support for the government to use its fiscal capacity to stimulate large-scale investment projects and provide cost-of-living relief to struggling households.

Of interest, is the fact that the narrative that Ms Takaichi has promoted – shifting focus away from the obsession with achieving a primary fiscal surplus, towards using fiscal policy to stimulate investment and break Japan out of the secular stagnation that has bedevilled it since the 1990s – is a major shift and goes directly against the mainstream economists construction of reality.

While the fiscal expansion she proposed and will now be able to implement (21.3 trillion yen) is an improvement on the position held by the Ishiba government, the scale of the problems facing the nation are so large that her initial proposal is underwhelming, notwithstanding the fact that it is like a seismic shift in economic thinking in Japan.

I expect the government, now it has such an overwhelming position of dominance in the Diet, to add to that initial fiscal expansion with more measures to stimulate new investment and diversify the assistance to households.

The government is becoming increasingly aware that a large shock is required to break the stagnation mindset.

Corporations have to be given an incentive to stop hoarding retained earnings and instead invest them in new, clean technologies.

They also have to see that their current reliance on non-regular (low pay casualised work) should be replaced by offering higher wages and more secure employment again.

That will help households to break out of their own pessimism which is characterised by high saving and subdued consumption spending patterns.

Ms Takaichi is talking about pushing the Japanese economy up against the inflation ceiling (a so-called ‘high pressure’ economy) while disregarding the primary fiscal balance.

The shift in fiscal policy narrative is also being accompanied by a shift in the way monetary policy should operate.

The new PM has made no secret of the fact that she wants the Bank of Japan to adopt a broader approach emphasising both price stability and stronger economic growth, which means that the Bank’s current mindset towards increasing interest rates and ‘normalising’ its monetary policy settings (including selling its extensive stock of government debt) will come under political pressure.

There was an interesting article in yesterday’s The Japan Times (February 11, 2026) = Ruling bloc’s election victory may affect BOJ monetary policy – which discussed ways in which this political influence may manifest.

Ms Takaichi is being advised to pressure the Bank of Japan into abandoning any further interest rate increases.

She is already on the public record as saying:

Raising interest rates now would be stupid …

The article recounts how the newly elected government can now appoint “BOJ policymakers, which reflect the thinking of the government.”

Two members of the BOJ’s policy board are soon to be replaced.

Ms Takaichi has already made new appointments of “people opposing rate hikes to government posts” and it is expected that she will appoint “people in favor of monetary easing” as the positions become due at the Bank of Japan.

Who said central banks were ‘independent’ of the political process?

All of this is anathema to the mainstream economics debate and the sort of narratives that the financial markets like to publicly promote, even though, behind the scenes, the big investment banks are out to get the fiscal largesse for themselves.

And if you think about it makes the rather modest fiscal proposals advanced by Liz Truss and her ‘four week Chancellor Akwasi Kwarteng in September 2022 look rather wan.

Wan is an understatement.

The ‘Truss Moment’ and Japan

So why haven’t the financial markets launched against Ms Takaichi’s much more outlandish (in mainstream terms) proposed fiscal (and monetary) shift?

Liz Truss’s brief occupation of the Prime Ministerial position in Britain in 2022 demonstrated what happens when a person assumes the highest office without any confidence in a continued occupancy.

Her policy approach was really just more-of-the-same in a long-line of ‘trickle-down’ economics that began its British life with Margaret Thatcher’s postulation that a ‘social market economy’ would be achieved by providing more largesse to the wealthy who through supply and demand forces (the ‘market) would ensure the benefits permeated the entire social structure down to the weakest citizens.

The path to achieve this end required widespread deregulation, privatisation, outsourcing and above all, large tax cuts to the highest income earners.

The policies that have been advocated by both sides of British politics since – in one way or another – a consistent with that ideological perspective.

The fact is that there has never been any evidential support for these types of policies.

Indeed the economic performance of the US and UK economies as a result of Thatcher’s policies and those of Ronald Reagan who espoused the same nonsense were poor by historical standards.

I remember Monetarists in academic departments I was working in or studying in as a postgraduate student at the time claiming that the reason the policies were failing was because the Thatcher and Reagan didn’t go hard enough.

But these ‘hyperinflation’, ‘debt chaos’, ‘insolvency’ claims are regularly repeated by characters who appear to have attention deficit disorders – always wanting to be in the media pontificating about how they know better.

I have written extensively about how ‘leading’ US economists were very vocal during the 1990s about how Japan would run out of yen because the financial markets would never tolerate the high deficits and expanding public debt.

They were uniformly wrong about everything.

Anyway, Truss was another of these supply-siders who hadn’t caught up with reality.

In her ‘Oral statement to Parliament’ on September 8, 2022 – PM Liz Truss’s opening speech on the energy policy debate – Truss outlined her ‘economic plan’ to reduce regulation, particularly in the energy sector to give “investors the confidence to back gas as part of our transition to net zero”.

In the subsequent ‘mini-budget’ delivered by the haphazard Chancellor Kwasi Kwarteng on September 23, 2022, they proposed a “real, Tory budget” (in the words of the Daily Mail, which would have delivered the largest tax cuts to the top end in 50 years (1972).

What happened next?

Well, the financial markets decided to make some money and sterling fell sharply against the US dollar and long-term government bond yields rose sharply, almost immediately after the mini-statement was delivered.

All sorts of horrendous headlines appeared – ‘worse crisis since Suez’ etc.

What is not often made clear in the media is that the Bank of England raised rates modestly the day before the mini-statement was delivered, which clearly disappointed all the short-sellers that had bet on even higher rates.

The IMF claimed that the fiscal proposals would jeopardise the Bank of England’s anti-inflation campaign, even though the rate hikes were unnecessary given the nature of the inflationary episode.

Rate hikes did not make people better from Covid, nor did they stop Putin!

Anyway, the Truss failure is the new reference point that opponents of fiscal interventions are using as if the behaviour of the financial markets can be used as a unbiased arbiter in whether fiscal policy is sound or otherwise.

A moment’s reflection would make clear that the sort of policies that Truss/Kwarteng proposed were favourable to the financial market elites, rather than threatening.

Which suggests that the motivation of the short-sellers who pushed the currency down really had nothing to do with a negative assessment of the policy stance.

The reality is that the ‘Truss Moment’ demonstrated the fact that the financial markets will always prey on weak governments.

The speculators knew that Truss had a precarious hold on power and would shift position quickly if challenged to entrench her position.

Under those circumstances, the financial markets have the capacity to wreak havoc.

If Truss had been more secure in her Premiership and stood up to the short sellers, in the way the Bank of Japan and the Cabinet Office in Japan does, then the markets would not have been able to create the chaos they did.

The intervention of the ‘markets’ was all about profits rather than an assessment of whether the fiscal policy was appropriate or not.

As it happens, the mini-statement was ridiculous, but that is another matter all together.

Anyway, the ‘Truss Moment’ has become one of those ruses that is based on fiction but is a powerful meme.

Even progressives repeat the fiction.

Conclusion

Those who invoke the ‘Truss Moment’ as something which carries weight should reflect on what is happening in Japan at present.

Japan now has a confident Prime Minister, with a sound electoral backing, who is not scared to challenge the mainstream narratives (like the obsession with primary fiscal surpluses), and who will probably stack the Bank of Japan with like-minded souls.

As a consequence, the financial markets know the scope they have to undermine that narrative through short-selling trades and the like is extremely limited to non-existent.

The ‘Truss Moment’ said nothing about fiscal policy and everything about political weakness.

Reminder – London event

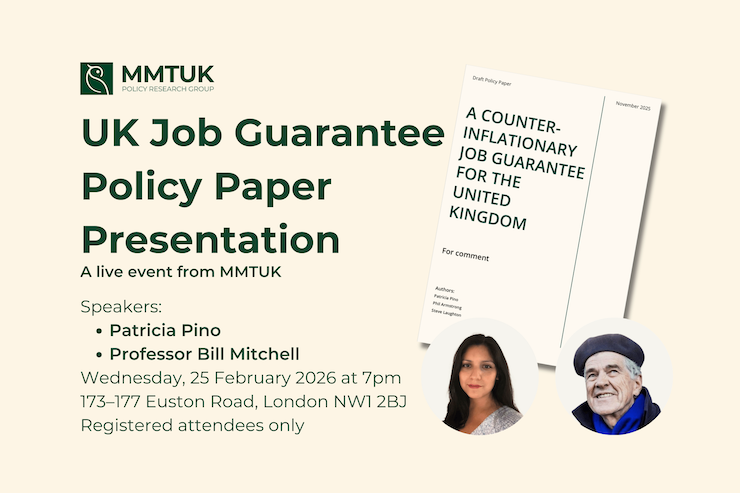

I will be speaking at the launch of the new Modern Monetary Theory (MMT) focused group in the UK – MMTUK Policy Research Group – on February 25, 2026 in inner London.

The event is open to the public but the capacity of the venue is very limited.

If you are in London and would like to attend please follow this – LINK.

Given the capacity size of the venue, please do not register for a ticket if you are at all uncertain of your intention to intend

The event details are:

MMTUK Launch Event: A Job Guarantee for Britain

Start: Wednesday, February 25, 2026 19:00

Location: Friends Meeting House, 173-177 Euston Road, London, NW1 2BJ GB

Host Contact Info: contact@mmtuk.org

The venue is right opposite Euston Station, on Euston Road.

That is enough for today!

(c) Copyright 2026 William Mitchell. All Rights Reserved.

This Post Has 0 Comments