The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

Bank of England announces end to propping up corporate greed – sort of!

It’s Wednesday and overnight there has been a Twitter storm, which like most of these Tweet Crazes, is about nothing at all and only serves to embarrass the Tweeters, not that they are aware of the humiliation. I refer to the statements made overnight by the Bank of England boss who reiterated press releases the day before in saying the Bank would not continue to prop up pension funds who had mismanaged their assets. The Twitterati seemingly didn’t really get the point. And while we are on central banking, the former IMF chief economist Olivier Blanchard was interviewed in the last few days (I won’t link to it) claiming in relation to the US economy that “the path to avoiding a recession is narrow because the economy is still overheating”. He then concluded that the Federal Reserve Bank “is no longer behind the curve but still has work to do to deal with stubborn underlying inflation pressures”. He thought the Federal Reserve’s funds rate (its policy rate) would go higher than 5 per cent. Planet Not Earth. To keep us on the straight and narrow after those contributions to public discourse, we end today with some piano music. Always a good idea to stay calm and reflective.

The Bank of England in charge – and don’t doubt it

I wrote about the recent gyrations in Britain with the pension funds and the Bank of England in this blog post – The last week in Britain demonstrates key MMT propositions (September 29, 2022).

Twitter had gone berserk predicting the sterling was about to be destroyed and all sorts of commentators were out in force claiming fiscal deficits were causing the currency to collapse.

Some standard intervention from the Bank of England (buying up some bonds) saw the currency value return quickly to the level before the hoo-ha and peace resumed.

That intervention from the Bank proved that the central bank can always stabilise bond yields at whatever level it chooses and the ‘bond investors’ can do little to change that.

But the intervention didn’t fix the underlying problems facing the pension funds who had pursued greed over their main business – to provide stable flows of payments to retirees etc in a rather predictable manner.

That task is not that hard, as I explained in the blog post above.

The pension fund managers made it hard because they went off script and started to use various dubious methods to increase returns and putting their assets where they should not be put – presumably also to ensure they get massive management bonuses at the end of the year.

As one would reasonably expect, the greed got ahead of itself and the pension funds were forced into an unpalatable bond sell off which in a market where there was too much ‘supply’ and their solvency was threatened.

The Bank of England’s actions in bolstering the demand side of the bond market quote substantially the week before last temporarily provided the liquidity that the pension funds required, but did not solve the structural mismatch in assets and liabilities for the pension funds.

Then came yesterday in Britain.

Twitter went feral overnight, as it does regularly on most issues, after the governor Andrew Bailey told the BBC that (Source):

… a bond-buying scheme to stabilise pension funds must end on Friday … managers have got to make sure that their funds are resilient … You’ve got three days left now. You’ve got to get this done.

Predictably, the sterling fell in value (it will return don’t worry).

The pensions industry peak body, feeling like even more corporate welfare from the government (central bank division) was their due, pleaded with the Bank to continue buying up bonds.

Twitter went feral suggesting the Bank didn’t know what is was doing and that the governor was just a loose cannon mouthing off at will.

The day before (October 11, 2022), the Bank had issued a two press releases:

1. Bank of England widens gilt purchase operations to include index-linked gilts.

2. Temporary Purchases of Index-linked Gilts – Market Notice 11 October 2022.

I wonder how many of the Twitter catastrophe army had read them. Not many I posit to guess.

Bailey was just telling the BBC what these press releases outlined in great detail.

Whether you agree with the decision or not the discussion with the BBC was no idle piece of tongue slipping.

The reality is that the pension funds need to be reined in and forced to withdraw from their ‘greed’ positions and to get back to ensuring they have sufficient assets and commensurate returns to cover their liabilities.

If the Bank of England maintained what was effectively a bailout for these funds then you can guess what the funds would continue to do.

Yes – pursue greed and management excesses.

The Bank is also pushing the pension problem back on to the funds and also the political arm of government.

If they cannot retreat back into safe territory, then the funds will be on the brink.

No government is going to allow the pension system to collapse.

So whether it is Treasury action – nationalisation would be a good start after sacking the managers – or more central bank action under a different guise – just maintaining indefinite support to the pension funds was not sustainable.

My preference is for them to be nationalised and for them, under public ownership, to go back to core business.

US inflation trends

From the comments made by Olivier Blanchard one would think that inflation is accelerating.

We use the term ‘overheating’ to describe an economy where nominal demand pressures are outstripping supply, but with the inference that it is demand that is accelerating rather than supply contracting due to temporary constraints arising from Covid or War or cost pressures arising from OPEC decisions on oil prices.

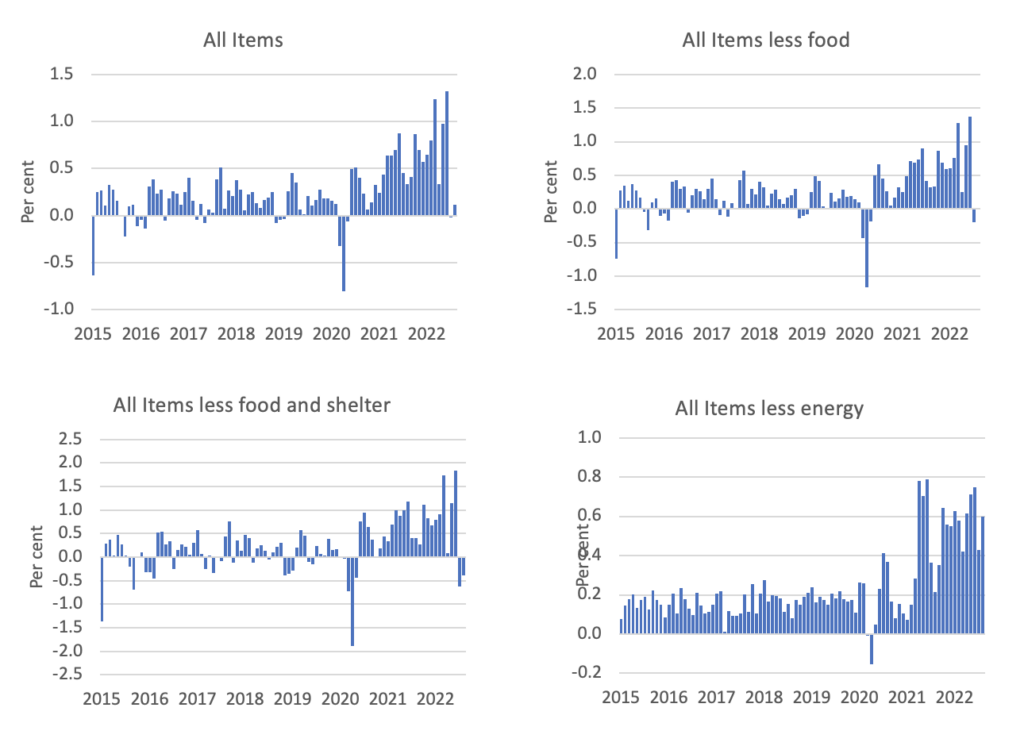

The first graph shows the monthly movements in the various versions of the US CPI from January 2015 to August 2022 (latest data).

It is obvious that it is energy prices that are driving the continued inflation.

The All Items CPI rose by 0.1 per cent in August 2022 after recording a zero rise in July 2022.

The ‘All items less food and shelter’ has fallen for two consecutive months.

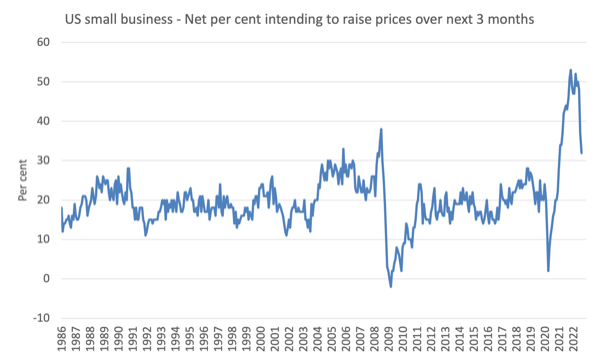

The following graph shows the ‘Net per cent (higher minus lower) during next three month of small business pricing plans.

The data is published by NFIB research which does extensive surveying of small businesses in the US.

If the ‘net per cent’ line is falling it means that less businesses are planning to raise prices in the next three months relative to those who are going to reduce them.

What the graph tells us is that the inflationary peak has probably passed and was due to transient factors, some of which are abating.

The NFIB research also shows that expected sales have been declining rather sharply, hardly a sign of an overheating economy.

Which challenges the credibility of commentators like Blanchard, who along with several of his cronies have created a renewed hysteria about inflation and pressured the Federal Reserve Bank to go feral.

Don’t be under any apprehension that this isn’t another play in the class struggle.

The rising interest rates, as I have explained previously, aid the big banks and the wealthy, which is one reason they are not a very efficient tool for bringing down aggregate spending anyway,

But at the same time, they hurt the lower-income workers who are trying to accumulate a modicum of wealth in the form of owner-occupied housing.

And if the Federal Reserve pushes rates up far enough, eventually, the economy will tank and unemployment will rise, further endangering the prosperity of the weak.

This data also tells me, again a point I have been making for the last year or so, that the central banks do not have the tools to deal with the specific pressures that are causing the inflation.

Their only avenue is rising interest rates, which they hope will kill of spending, destroy sales and jobs and force workers into penury and firms into conservative pricing policies.

In the short-term, this very blunt approach is not even very effective at dealing with spending because even the Federal Reserve is uncertain that the rising borrowing costs to firms from the rising rates are not passed on as even higher prices.

But it becomes even more ridiculous when we understand that the inflation sources are, in the main, not sensitive to rising interest rates anyway.

On May 12, 2022, just after the central bank increased rates by the largest amount in 22 years, the Federal Reserve boss spoke to the American Public Media program, Marketplace – Fed Chair Jerome Powell: “Whether we can execute a soft landing or not, it may actually depend on factors that we don’t control.

The title of the Interview tells all really.

Powell said:

What we can control is demand, we can’t really affect supply with our policies … And supply is a big part of the story here. But more than that, there are huge events, geopolitical events going on around the world, that are going to play a very important role in the economy in the next year or so. So the question whether we can execute a soft landing or not, it may actually depend on factors that we don’t control.

In other words, WTF!

As noted above, they cannot even control demand very closely.

He also claimed when asked about the prospects of recession and rising unemployment, that the “the one thing we really cannot do is to fail to restore price stability”.

So that comes ahead of peoples’ jobs.

So you can conclude that the US Federal Reserve is acting more like an agent for capital than being a responsible and accountable economic policy maker, the image that is portrayed by the likes of Blanchard.

Music – staying calm

This is what I have been listening to while working this morning.

I saw a movie last night – Man on Wire – which told the story of the French wire walker who walked between the twin towers of the World Trade centre while they were still erect.

It wasn’t much of a movie, the walker basically burned his friends who seemed devoted to his obsessive compulsion to show off at great heights.

But at one point, the background music was that of French composer and pianist – Erik Satie – who is a particular favourite of mine.

While the movie use the – Gymnopédies – written by from Erik Satie in 1888.

While appearing to be deceptively simple, are actually very complex pieces – getting the tempo correct and keeping it even – has teased me for some time. It is a very hard exercise.

It is very difficult to get the clear separation between the melody and the chordal accompaniment including getting the right pedal exactly coordinated with the bass notes.

That juxtaposition between sonic simplicity and technical complexity is why Erik Satie was a genius.

Here is the late Dutch pianist – Reinbert de Leeuw – who has made something of a career interpreting the work of Erik Satie, playing Gymnopédies 1 and 3.

Gymnopédies 1 shifts from D major to D minor, while Gymnopédies 3 is in A minor. Both are in 3/4 time.

Erik Satie also can be accorded the status of a post minimalist 100 years before its time. That is the way I see his compositions.

As an additional treat – here is the version by – Blood, Sweat and Tears – from their – Variations on a Theme by Erik Satie (1st and 2nd Movements) – which appeared on their second album from 1968.

Quite a contrast to the rest of that album.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Bill wrote:

“What we can control is demand, we can’t really affect supply with our policies … And supply is a big part of the story here. But more than that, there are huge events, geopolitical events going on around the world, that are going to play a very important role in the economy in the next year or so. So the question whether we can execute a soft landing or not, it may actually depend on factors that we don’t control.

In other words, WTF!

As noted above, they cannot even control demand very closely.”

If this is so then aren’t MMTers calling for more checks to feed money into the economy at the bottom so the rich can suck it up without the masses being crushed as a result?

If they (the Fed or the Gov.) can’t stop inflation, why not keep the masses from being damaged and make the rich richer at the same time?

Warren Mosler wrote last October, 8th, that “…rate hikes continue to contribute to a now rising federal deficit that is supporting growth, contrary to Fed expectations.(…)”.

So, we have one of two scenarios: or we got into a serious illiteracy problem at central banks, or the goal lies elsewhere.

Inflation is good for governments, as they collect more taxes (I’m talking from the eurozone, where taxes matters) and helps corrode the debt (the eurozone again).

I guess that it lies elsewhere (notwithstanding the nobel prize celebrating illiteracy).

Private pension industry not fit for purpose, as with, in the UK, the water, energy and rail companies. My goodness, that is far too radical, and obvious, a thought to be addressed by our media or politicians.

@Steve_American I don’t really understand who these MMTers are that you refer to or that paragraph, but my understanding of Prof. Mitchell’s stance (and mine) is that it isn’t good policy to impose austerity on (reduce the demand of) the poorer section of society in response to temporary inflationary supply restrictions. Moreover, (certainly in the UK) the full employment statistics are misleading because the number of working age adults who have left the workforce and/or stopped the hassle of registering at a Job centre, but might be enticed back with better pay/conditions, far exceeds those having to endure Job Centre hassle for the pittance of state welfare. We should know that money normally flows up in a capitalist society, but best to aim it first at those at the bottom who need it to go through their accounts the most.

I quite enjoyed Man on Wire, a few years ago.

@Steve_Americian My basic understanding of MMT is that the problem you allude to, i.e. that the rich will get richer by the poor spending government handouts, would be solved in part by appropriate taxation measures. This was partially the case in pre Regan USA. I do recall meeting a traveller from the USA in Norway who was crowing that Amazon or Google paid no tax in certain states. How wonderful he proclaimed! As an Australian I said that I thought the better thing would be for them to pay tax so that all people of the state could have access to decent healthcare and education. The Norwegian guide certainly agreed!

Patrick and Econewbie, I know that MTers don’t want austerity of interest rate increases, but what do they actually want? Yes, they want to tax the rich more, but also say that is a separate issue. Also, just taxing the rich now doesn’t help thee masses pay higher prices for everything.

What the masses need now is more income. A temporary UBI would begin faster that beginning the JGP, and faster is much better.

I suppose a UBI would cause inflation to rise faster, but why is that a more terrible thing than the masses being crushed? Especially pooper homeowners who will lose their homes.

@Steve

Not sure why a UBI is so much quicker to turn on (and off!) than a JG.

Here’s a basic job design that probably beats any UBI on this score. Line up for 8 hours and get a $120 payment at the end of the day. If you really object to this job, reflect on your support for UBI.

Regarding mortgage defaults, why doesn’t the Fed buy up all distressed home mortgages and work out terms with the residents to transition to unencumbered title. If a bank gets too many defaults, cancel their license. They only have one job, to reliably determine the credit worthiness of borrowers.

@Steve_Americian My limited understanding of using the Central Banks to determine the direction of the economy is akin to driving a car using only the handbrake. Politicians have copped out but they should be using the rest of the tools, like gears, accelerators , foot brakes and steering wheel to guide the economy where it should go. I thought the thing about MMT is not that it prescribes this or that, but allows a view of the policy space currently obscured by simplistic or incorrect notions. Just today we have one of the deputy BBA governors I think discussion how the usual formula the RBA uses to set rates is obviously not working at the moment. Seems it may have been luck it seemed to have worked until now?

Gymnopedies by Satie is the perfect music to play as we watch The Guardian, Starmer and -sadly- even Corbyn going ballistic about Truss’ spending plans. Who are the economists advising these people? Why can’t they focus on the regressive nature of her tax cut proposals and forget about Ricardian equivalence?

@Steve_American If we are at full employment level, then what would a Job Guarantee scheme do? I’d say that depends on the wage level set compared to existing minimum wages. If it provides a living wage above that currently on offer, which for many families in the UK is already topped up by grudging government support and/or charity food banks, then it forces firms to share a little more of their profit (and maybe for the corporates to pay less in dividends to the pension funds which are not fit for purpose anyway). Some firms that rely on paying poverty wages might go out of business, but the jobs would transfer: either to a JG job or with such as our social care companies, the government should step in and run them as non-profit. A JG might also tackle pockets of unemployment left by industries abandoning certain areas. Money would get into the pockets of those who need it in a much less inflationary and fairer way than UBI. There are also lots of simple ways of giving more targeted support, increase free school meals including in school holidays, encourage some redirection of the workforce into insulating homes rather than serving coffee, reduce dental fees, target cheaper public transport for those who need it rather than comfortable over 60s. Use progressive taxation rather than interest rates to dampen demand. Use regulation rather than interest rates to tackle our distorted housing sector where private developers refuse to build affordable housing and individuals and companies can buy up multiple homes for rental extraction. We need house prices to fall. If that leaves some in negative equity for a while, that’s rather better for them than an increase in mortgage interest (as well as negative equity).

@ Everyone, I said a temporary UBI to get checks out in 1 week. IMHO, AFAIK, no US Gov. program has every got going in less than 3 months. As soon as the JGP is in place we can convert to that.

We have sent checks out in the past. A promise to do it for a while a will be believed by voters, while a promise to start a JGP will not be understood or believed. It is 4 weeks to the election in which the Dems must hold the House and win +2 or 3 more Senate seats. We don’t have time to teach the nation about a MMT type JGP. Also, it would be chaos to just start paying people in the JGP $15/hr. when the min. wage is $7.25. You all have not thought this through like I have.

.

@Steve_American I understand the politics of throwing a quick pre-election bribe the electorates way. I also understand that getting elected politicians to deliver on progressive policies will only come about with slow but determined work on education and getting the message through (providing alternatives to the orthodoxy of academia and the media), grassroots/local organisation and events/upheaval, and older generations dying and being replaced by a more receptive generation. Some might say that there isn’t time to wait that passively to save ourselves and our environment from being decimated, and I have some sympathy with that view.