The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

Corporate profit greed is driving inflationary pressures

Despite all the hysteria about the current inflationary pressures and the reversion of central bank policy committees to the New Keynesian norm – interest rates have to rise to kill off inflation otherwise it becomes a self-fulfilling process where wage demands are made in ‘expectation’ of more inflation and firms (passively in their view) have to pass on the higher unit costs, I remain of the view that this period is transitory. That doesn’t win me any friends (other than my true friends). It also leads to another hysterical line of Twitter-type statements that the Modern Monetary Theory (MMT) have gone silent because they were wrong about fiscal deficits not causing inflation and are too ashamed to admit it. I haven’t gone silent. I have been continuous in my advocacy both privately and publicly. The rise in fiscal deficits during the pandemic and the central bank bond purchases have had little to do with this inflationary episode. Covid, sickness of workers, War, natural disasters (floods, fires) and noncompetitive cartels and energy markets are the reason for the inflation (variously in different countries) and interest rate increases won’t do much at all to target changes in those driving factors. New ECB research (released August 3, 2022) in their Economic Bulletin (Issue 5, 2022) – Wage share dynamics and second-round effects on inflation after energy price surges in the 1970s and today – reinforces my assessment of the situation.

The ECB research appeared as a ‘box’ in the latest Economic Bulletin and aimed at reviewing:

… wage share dynamics and potential second-round effects on inflation at times of energy price increases.

So, they want to explore what is going on with wage movements after a major imported raw material price shock has occurred.

The 1970s

In the 1970s, of course, a major energy price shock occurred when the OPEC cartel pushed up oil prices (massively) starting in October 1973 as the US provided military support to continue the illegal Israeli occupation of the Sinai Peninsula and the Golan Heights.

That set off the 1970s inflation as oil-dependent nations struggled to deal with the distributional dilemma as to who would bear the real income loss initiated by the imported raw material cost rise (which diverted national incomes to the foreign oil companies and producers).

At that time, trade unions were much stronger and had more ‘price-setting’ power – that is, they had the ability to impose major costs on firms who refused nominal wage demands that were designed to protect real wages.

Firms also had (and have more now) ‘price-setting’ power – that is, they had market power which enabled them to protect their real profit margins by passing on the rising unit costs from the wages growth onto final consumers.

Both sides of the conflict – labour and capital – were intent on protecting their real incomes and forcing the other side to take the loss embodied in the imported raw material rise.

And as a result, the initial price shocks triggered what I call a ‘propagating mechanism’ – the wage-price or price-wage spiral – which then ensured the inflationary pressures would continue and escalate into a full blown distributional battle of ‘mark-ups’.

It was also complicated by the second oil embargo in 1979 in relation to the Iran-Iraq war, which pushed another energy shock into the global economy.

But by this time, major substitutions were underway around the world that meant this shock was less damaging than the first.

Oil heating had been abandoned in many countries in favour of the cheaper gas and the big, gas-guzzling 6- and 8-cylinder cars were being replaced with better and more efficient, 4-cylinder cars that used less fuel per km.

If the distributional propagating mechanism had have been absent, then the 1970s inflation would have petered out fairly quickly.

The initial price rises in 1973 really only lasted for a few years, and were then resumed by the 1979 shock (the ‘second oil shock’).

But, by the early 1980s, oil prices were falling pretty quickly as OPEC increased supply and cheaper oil supplies from Mexico (for example) became available.

The current situation

The lack of the distributional propagating mechanism is why I consider the current situation is not akin to the 1970s.

And the ECB researchers agree with me.

The situation now is a little different because the energy shock to Europe is driven not only by the OPEC cartel but also by the impact of gas supply restrictions as a result of Europe’s (Germany) dependence on imported gas from Russia.

The euro area is a “net energy importing region” and at present it is facing a massive:

… deterioration in the terms of trade (the ratio of export prices to import prices), thereby eroding the income used to remunerate domestic factors of production.

So that much is similar to the 1970s.

Nations are facing significant reductions in the real income they produce that can be distributed to their workers because an increasing share of that real income has to be paid to foreigners who want higher prices for the goods and services that they supply to the nations.

The ECB chooses to focus on the:

… wage share and inflation dynamics in the euro area after the energy price increase observed since the second quarter of 2021

The reason:

1. To see what the parallels and differences are between the 1970s inflation episode, which lasted into the early 1990s as a result of the wage-price propagation.

2. To see whether the euro area dynamics are similar to those in the US, which is experiencing the same imported raw material price rises (though tempered compared to Europe).

What is the wage share?

Please read this blog post – The Weekend Quiz – May 21-22, 2022 – answers and discussion (May 21, 2022) – and go to the answer for Question 2, for a full derivation of the wage share and its link to real wages, productivity and unit costs.

By way of summary:

1. The wage bill is a flow and is the product of total employment (L) and the average wage (W) prevailing at any point in time = W.L

2. The wage share is just the total labour costs expressed as a proportion of $GDP – (W.L)/$GDP in nominal terms, usually expressed as a percentage

3. Labour productivity (LP) is the units of real GDP produced per person employed per period = GDP/L.

4. The real wage is the nominal wage (W) deflated by the average price level (P) to express the purchasing power of the nominal wage – W/P.

5. Nominal GDP is $GDP and is real GDP valued at the price level = GDP.P

6. So the wage share is (W.L)/(GDP.P) which if you do some algebra that I don’t expect everyone to follow means that we can get an alternative expression for the wage share:

(W/P) divided by (GDP/L)

Don’t worry about the symbols – this just means that the wage share can also be expressed as the ratio of the real wage and labour productivity.

In other words, if the real wage grows faster or declines more slowly than labour productivity then the wage share rises and vice versa.

So we have a close link between the wage share, productivity and wage and price movements, which is the focus of the ECB research paper.

What is going on in Europe?

The ECB express it this way:

… the wage share rises when there is an increase in real consumer wages (measured by nominal wages per employed person divided by the private consumption deflator), a decline in labour productivity or a deterioration in the terms of trade (proxied by the GDP deflator-to-private consumption deflator ratio).

They note that if imported energy prices rise, the real wage is squeezed and:

… the impact of energy price hikes on the wage share crucially depends on the response of labour income. In turn, all other things being equal, the response of labour income to energy price hikes will affect unit labour costs and the GDP deflator.

That is the same dynamic I summarised in the early part of this post.

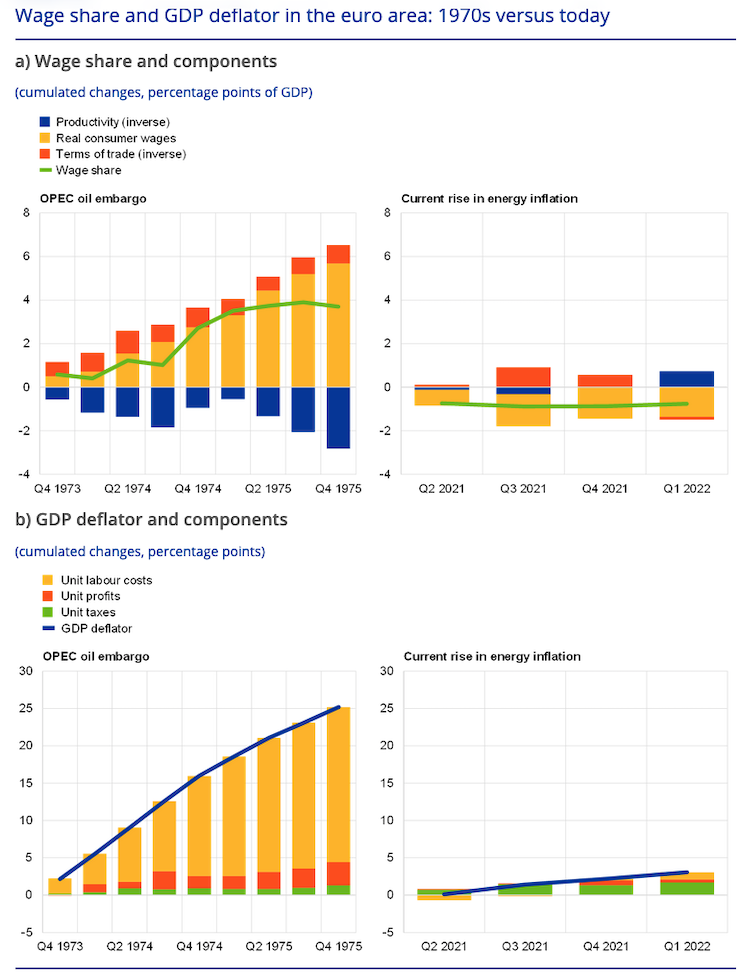

The ECB conclusion:

The recent deterioration in the terms of trade has had limited implications for labour income and the GDP deflator relative to the experience in the 1970s.

First, the initial income loss this time “was only about a third of the drop triggered by the OPEC oil embargo between the fourth quarter of 1973 and the third quarter of 1974.”

Second, “real consumer wages declined after the recent rise in energy inflation, while they strongly increased in the 1970s.”

The result – “a slight decline in the wage share, in contrast to a sizeable increase after the OPEC oil embargo”.

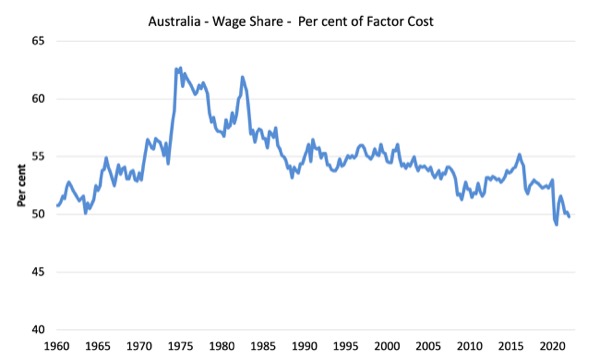

The same dynamic is playing out in Australia and I have produced these wage share and profit share graphs before (when I last analysed the national accounts release in June).

The declining share of wages historically is a product of neoliberalism.

But the point is that Australian workers are seeing further wage share falls in the recent energy crisis (motivated by different factors to some extent than the European situation) as opposed to what happened in the 1970s when unions could defend the real wage and extract a greater share of productivity growth.

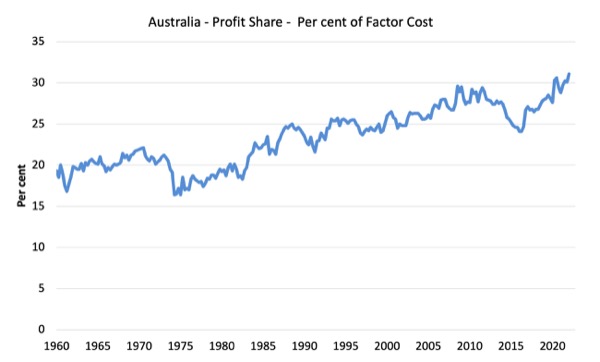

And look at the profit share – rising!

In Australia, we have a major gas crisis with shortfalls in domestic gas supply and huge increases in the local price.

How can that be given we produce more gas than we can ever consume?

Simple.

Foreign-owned gas companies (90 per cent control over domestic gas) with huge tax breaks from the government have sent all their uncontracted gas off to the rest of the world, exploiting the massive price rises as a result of a shortage of Russian gas supply.

The result?

Huge increase in their profit margins and profits and a shortage of local gas supply leading to a hike in local gas prices.

The circumstances are a little different to Europe but the dynamic is the same.

Workers are paying the price of this inflationary episode and business profits are booming.

That should be a wake-up call for our governments to really regulate the capitalists.

Sadly, it hasn’t led to much policy action.

And the central banks are taking the running in that area and worsening the plight of workers while transferring billions into bank profits.

If you were buying shares – banks and energy companies!

The ECB research notes that while the wage share has declined in Europe, profits margins (over unit costs) are rising:

These dynamics reverberated in the profile of the GDP deflator, which grew moderately and through different channels in the recent period (mainly through unit profits and taxes, rather than unit labour costs) compared with the 1970s.

This excellent graph (produced by the ECB in their Bulletin Box) takes some study but captures the essence of their research.

Is the US any different at present?

The ECB show that:

Wage share dynamics in the United States are similar to those in the euro area today, but these differed markedly in the 1970s.

In other words, similar story with some differences.

1. Smaller real income loss now relative to the 1970s.

2. Wage share declined in the US in the 1970s.

3. Profit margin push played “a significant role in both episodes” (1970s and now) in the US.

They conclude:

Overall, the US experience shows that the GDP deflator may increase considerably as a result of energy price shocks, despite limited wage indexation mechanisms and, especially today, low net energy dependency and strong monetary policy credibility.

Which means that the US corporations were able to continue pushing prices up after the initial shock as a strategy to gain more real income for themselves rather than as a retaliation response for major wage push from workers.

Which means that the US product market is relatively uncompetitive and corporations have excessive market power and abuse it when they can.

This is a similar story to Australia now.

The ECB verify their results using statistical modelling which shows that:

Second-round effects played a major role in the transmission of oil supply shocks to inflation in the 1970s and 1980s, but these have been largely absent on average in the period since the euro was launched.

That is, there has been no propagating mechanisms to drive any imported raw material price shocks into an extended inflationary episode.

Conclusion

Unlike the 1970s, where the focus became ‘excessive trade union power’ and was used as a justification for hammering unions through a variety of anti-union regulations and laws, the current episode is highlighting the destructive market power that corporations have and their profit greed at a time when workers are suffering real income losses and worsening standards of living.

The response of central banks to exacerbate that suffering is criminal in my view.

Unless society comes to terms with this and demands from our governments that they take action against corporations and restrict their market power the situation will continue.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

I Could be wrong, but I think another thing it shows is just how bad infrastructure and supply chains actually have been over the years. Fine when dealing with low growth rates that financial capitalism has produced under neoliberalism. Get really strong growth and really strong world demand and it falls apart. I think overall they know this and why they can’t wait to create unemployment in the way of interest rate hikes and kill off demand before it engulfs the system. They know what level of GDP they can deal with.

China seems to be the only place that can turn the tap on when desired. Deal with very large growth rates and move real and human resources around to where they are required. They are set up very differently.

Thatcherism proved it when the UK tried to move real and human resources around from mining and ship building and low end manufacturing. In to services and high end manufacturing it was a complete disaster.

After nearly 50 years of financial capitalism the ability to do it has become even worse, as governments had no choice but to leave the heavy lifting to the free market tooth fairy. The private sectors performance at trying to fix the infrastructure and supply side was abysmal. Financial capitalism clearly doesn’t allow real and human resources to be moved around effectively. I think this needs to be studied and clearly understood before the introduction of a job guarentee or a green new deal.

China simply doesn’t care. It builds the infrastructure and the supply side first and then generates the demand and could flip to a war economy with ease. Financial capitalism in comparison is like turning the titanic. If China builds too much infrastructure it simply knocks it down and uses those real resources on something else. They know in all cases it creates jobs and the government doesn’t need to worry about a profit or loss balance sheet in the way the privatised public sector does with financial capitalism.

It is what the war in Ukraine is all about. It is a battle between two different types of capitalism. Which one will prevail. Financial capitalism based on colonial rent seeking which in true Orwellian fashion is called a liberal democracy based on the US based order. Or Autocratic industrial capitalism that believes in being a sovereign nation state.

Both world wars and the American civil war were fought over the same thing and competing economic models. The bankers and financial capitalism were knee deep in all of it. You could list any war in the last 100 years and what you will find is a country trying to keep financial capitalism at bay and away from its borders and to protect its right to be a sovereign nation state. It that sense most of Europe has already been conquered and not only completely defeated but now fights on the side of American and British bankers.

Which is quite ironic, as what is American independence day all about. What were the Americans trying to free themselves from. Only then to fully embrace and then represent and become the face of what they fought against themselves. The complete and utter evil and poison of the British merchant banker.

COP 26 in Glasgow was hand delivered to the world, by the hand picked faces, as financial capitalism solution to the climate crises. The very model that caused it in the first place.

Just look at the state of it. What a complete and utter war mongering mess they are in. Fiddling carbon offsets and counting them 3 times to try and show they are compliant. Counting measures that were installed in their buildings in the 1920’s as offsets. The financial sector knee deep in all of it.

When clearly a more Autocratic industrial capitalism approach is needed. Autocratic in the sense that both banks and big business need to be forced out of the way and more government planning needs to take place. If the private sectors recent performances under financial capitalism is anything to go by. We are in big trouble and won’t move in time to avoid the iceberg. Clearly, a more Chinese centric approach is needed.

Stable prices can only come about when workers won’t ask for more money because they are frightened for their jobs, and firms won’t ask for more money because they are frightened for their market share.

There is insufficient market competition at present for markets to do their job, and too much of a desire for cash cows to fund pensions for the private economy to do any substantive investment.

There is a way to break this logjam, and it isn’t by paying pension funds more free money on ‘safe government assets’.

It’s time for the state to invest in competitors as investor of last resort.

“Clearly, a more Chinese centric approach is needed.”

It’s been tried and it failed – it was called the Soviet Union.

China began to progress once it allowed Western capital in, bringing Western technology and Western markets and allowed its private sector to flourish.

Western capital exploited cheap Chinese labour at the expense of labour in the West.

(Now the West is having to deal with the consequent economic, political and social problems.)

And I am not saying unfettered markets should reign.

And of course the autocratic Russian and Chinese systems have as their foundation, a kleptocracy.

Can inflation be deflationary?

Price-profits spiral is the outcome of

the neoliberal no-government mantra.

Better yet: government is now a function of the FIRE sector. They are in charge and the blokes we cast our votes for are their employees.

Funny how some of these employees dare to say that MMT as failed, in the aftermath of the Sri Lanka’s bankrupcy. As if Sri Lanka, bound by IMF shackles, was free to implement anything vaguely related to MMT.

Yanis Varoufakis talks to Lars P Syll on the irrelevance of mainstream economics.

https://larspsyll.wordpress.com/2022/08/03/yanis-varoufakis-on-the-irrelevance-of-mainstream-economics/

What Bill has been saying for decades. The Priesthood and who they represent. Like any Priesthood will fight against any change and accuse people of being witches. Those and only those who can read the ancient text will be allowed to enter.

It is all geopolitical driven. Economics has been hijacked by money and the groupthink behind that money. Just like with economics the money is now attacking many other different subjects in Western Universities. Infiltrated by the same groupthink that is behind the money that has destroyed the economics profession. Why they never tax their earnings and Offshoring exploded, that is their fighting fund to change society to how our leaders believe it should be.

You have to hand it to them. They had a plan and over the last 50 years carried out that plan. When you look at the left, the natural defence against that plan it has completely surrendered and been completely defeated. Infiltrated by liberalism and money and the same groupthink.

Why voters who want change, cling to anything that resembles any kind of change, like Trump and Le Pen. The left have to find a way to make a comeback and free themselves from this infestation, or there is a very good chance the breeze of history will start playing old songs of fascism on those wind chimes.

The left have to split and form their own political parties, or the geopolitics will never change. If the geopolitics doesn’t change nothing will change. The Priesthood are fighting hard to ensure the status quo remains. Fascism is standing in the wings ready to take advantage and getting louder by the day. As it is now normal in Florida to March in protest and wave the Swastika.

The left and greens need to split away and form a brand new political party and heal their divisions to tap into the legitimate grievances of the voters disenfranchised, marginalised, impoverished, and dispossessed by the 40-year-long neoliberal class war waged from above. Give voters a very different option than Le Pen and Trump and the geopolitical globalists.

Build their grassroots and base from there.

Henry,

It’s been tried and didn’t fail. It was a fantastic success.

https://billmitchell.org/blog/?p=37930

There is a 432-page Report in the historical archives that shows you exactly how to do it. Central planning – the 2 words that sends shivers down the free market tooth fairy spine.

Rather than allowing voters to simply run to the far right for any kind of change. These voters should be given a true left wing/ Green choice.

Just like Trump, Le Pen and Farage do with the Conservatives. This new true left wing/ Green breakaway political party will be able to hold the centrist, neoliberal, globalists, to account. Keep the fascists at arms length.

Build it and they will come.

Otherwise, I dread to think where we are heading or fail to see another way out of this mess.

Henry: “And I am not saying unfettered markets should reign”

Yes, we have to be clear about the advantages of markets. Some markets work very well, but others, especially factor markets like land and labour, need correction by government.

Derek,

“…..there is a very good chance the breeze of history will start playing old songs of fascism on those wind chimes. ”

Forget the wind chimes, there are symphonies of fascism playing in Russia and China.

(I’m sort of over Varoufakis, but in the video you linked above, he is at his brilliant best.)

Bill, and others here, why no discussion of the impacts of the fact that: fifty years ago fossil fuel depletion was not an issue, whereas today prices are too low for producers to invest in ever harder to get reserves? Gail Tverberg offers research suggesting prices cannot be simultaneously high enough for oil producers (such as Russia and Saudi Arabia) to ramp up production and remain low enough for consumers around the world to buy the goods and services that they are accustomed to buying.

“We are now in a period of price conflict, [driven by] oil and other energy prices [which] have remained too low for producers since at least mid-2014. At the same time, depletion of fossil fuels has led to higher costs of extraction. Often, the tax needs of governments of oil exporting countries are higher as well, leading to even higher required prices for producers if they are to continue to produce oil and raise their production. Thus, producers truly require higher prices.”

https://ourfiniteworld.com/2022/07/28/the-worlds-self-organizing-economy-can-be-expected-to-act-strangely-as-energy-supplies-deplete/

Derek,

“It’s been tried and didn’t fail. It was a fantastic success.”

So why did the Soviet Union fail is now a fascist state?

Why did the Chinese adopt capitalist reforms as has every other socialist state (except perhaps North Korea)?

Sounds like bill was on the money with his long covid predictions:

https://twitter.com/kathrynsbach/status/1554986303682379777?s=21&t=KbdoRgxHus-js6WREIgZEA

There are people who are very conveniently obsessed with Russia and China, but say nothing about the obvious attacks the European Union/ Euro represents on national democracies…

They also say nothing about the West-NATO war crimes…

So but so convenient…

Tina’s Nemesis,

I accept the diagnosis of the problem.

I just don’t accept the recommended treatment.

It ends with

“Nevertheless, high and persistent inflation increases the risk of second-round effects materialising via higher wages and profit margins.”

Just so people remember paying people to live through the effects is bad, okay? Don’t worry about it.

Henry,

“Forget the wind chimes, there are symphonies of fascism playing in Russia and China.”

Nomenclature aside (fascism is a specific thing), that is their problem; we manage to live just fine with the ones on the side of “good”, whatever that is. And also don’t ask how they got there. What is relevant here is that we will be fine with it infecting Europe, and maybe the US if less theocratic, as long as capital roams free. Bill, Mosler, Keen and all the rest can write plain as day how we can improve the economy for everyone, but just like their predecessors, it’s easily shouted down with incoherent common sense garbage.

From that perspective, a return to a multi-polar world where external threats turn project unthinkable v2 into some new compromise doesn’t sound too bad. A new social democracy would still be bad, but, who knows, maybe some country will manage to use MMT for real sociol-economic progress that tears down the old thoughts. Or the CCP is actually serious about very slowly figuring it out – too much?

Not that anything will happen, but a man can dream. The alternative is complete apathy.

You can’t differentiate between planning in a mixed economy and planning in a pure communist state Henry. Forever comparing Apple’s with Oranges which is very quickly becoming your speciality.

https://michael-hudson.com/2022/05/the-destiny-of-civilization/

Derek,

For me, socialism has a particular meaning. For me, a mixed economy is not a socialist state. Every state whether neoliberal capitalist or pure socialist requires planning at some level. I have no problem with planning.

Socialism, as far as I am concerned, is just a form of capitalism, but the state has replaced the individual. But not only that, in extremis, the state has monopoly political, economic and social power which in reality, as history has shown, has been exercised with wanton brutality and which inevitably has evolved into fascism.

Marxist dialectical “science” tells us it is inevitable that capitalism will give way to socialism. So you should inevitably get your wish. But remember also that Marxist dialectical “science” tells us that socialism is also a transitory state. So enjoy it while you can.

Marxist dialectical “science” tells that society progresses so as to resolve the contradictions that pertain to that society. The fundamental factor is the production relations in society. As far as I understand, Marx forgot one thing. He forgot human nature. Yes, the relations of production in human society are important, but the overriding factor is human nature.

Why the secondary school lecture on Animal Farm Henry ?

You could replace the word socialism in your lecture with any ideology and guess what Henry the overriding factor is human nature. Not so profound when you are not 12 is it.

” I have no problem with planning. ”

Ah good, we finally got there then after a few 180’s and a complete 360 and looking at a few apples and oranges as per usual.

You could have simply said ” I have no problem with planning. ” from the very start Henry and then went onto explain why you think the ideology you vote for are better at planning than anybody else. Explained why you think it is better than the 432-page Report in the historical archives. Then of course for once offered up a solution.

You know, at least attempt to put some weight behind your arguments, instead of just arguing for arguments sake and always coming full circle.

Derek,

“You know, at least attempt to put some weight behind your arguments…”

Firstly, this is not really the place to make fulsome replies. In any event, you won’t convince me and I won’t convince you. 🙂

Secondly, there’s planning and then there’s planning. I studied socialist planning at university – it didn’t inspire me a great deal.

Thirdly, Animal Farm is not Marxist dialectical science.

Sound familiar…

“..one of the most importnat proofs..they showed..if we say our outside senses -a little 4% box – is all there is of the human mind, they literally proved that, that system would collapse in air, that if we modelled life as the brain, the living brain as its system without connected to another system, that system would eventually not know what is true and false, and would start to decay, so this is setting a tone for where we’re at today. That system does not understand one critical thing, which is what it means to be alive, and this is where A.I. starts.

This 4% system can only model the physical body, the moment you have a brain in that body, that system falls apart, because they recognise that the moment you’re thinking you’re changing everything in the environment..so basically man’s best so far in sciences technology has given us a 4% approximation and causal description of nature, including human nature and it works totally awesome, along as we’re not thinking; so they’ve modelled the world of the physical dead, which is a start but we’re a living system.

So the moment you having something living, there a forces driving that, that have nothing to do with what they’ve been able to model with their outside senses. So as i say, wind does not blow the human hand to the buy button, there are more forces, 96% of something is out there that we don’t know about, so to think we’re going to build markets on 4% that doesn’t understand what it means to be alive is absurd. You know, and in the absence of not understanding being alive we’ve dictated what this has become.”

Heidi Dangelmaier,

Driving financial growth and human evolution beyond man-made tools,

Women 4 solutions,

January 30, 2020

“Which means that the US corporations were able to continue pushing prices up after the initial shock as a strategy to gain more real income for themselves rather than as a retaliation response for major wage push from workers.”

So, the ‘capitalists’ were not maximising profits?