In the annals of ruses used to provoke fear in the voting public about government…

Once again the so-called technocracy that is the Eurozone looks like a farce

So last week, the Bank of Japan remained the last bank standing, the rest in the advanced world have largely lost the plot by thinking that raising interest rates significantly will reduce the global inflationary pressures that are being driven by on-going supply disruptions arising from the pandemic, the noncompetitive behaviour of the OPEC oil cartel and the Russian assault on Ukraine. The most recent central bank to buckle is the ECB, which last week raised interest rates by 50 basis point, apparently to fight inflation. But the ECB did it with a twist. On the one hand, the rate hike was very mainstream and based on the same defective reasoning that engulfs mainstream macroeconomics. But on the other hand, they introduced a new version of their government bond-buying programs, which the mainstream would call ‘money printing’ and inflationary. So, contradiction reigns supreme in the Eurozone and that is because of the dysfunctional monetary architecture that the neoliberals put in place in the 1990s. The only way the common currency can survive is if the ECB continues to fund Member State deficits, even if they play the charade that they are doing something different. Hilarious.

World price watch

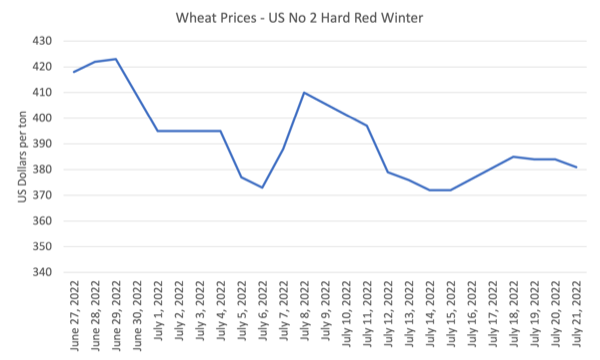

Data from the – International Grains Council – shows that global wheat prices are falling sharply since their peak at the end of June 2022.

The following graph shows the movement in the representative US No 2 Hard Red Winter wheat price since June 27, 2022.

A similar trajectory exists for Maize, Soyabeans and Rice in world markets.

I know that one swallow doesn’t make summer, but when I see commodity prices this I know that there is not likely to be a uniform and persistent inflationary period ahead.

What is going on?

The pandemic pushed up wheat prices because of the supply disruption, which was exacerbated by weather issues (bad drought in the US, for example).

Then Russia invades the Ukraine at the end of February, so the already elevated prices rise quickly because there was the fear that the global wheat supply would be significantly reduced (given Russia and Ukraine’s producer status – around 30 per cent of the world export market for wheat).

So consumer prices on food items started inflating because wheat prices (a major input) accelerated.

As the graph shows, there is now a serious reversal in wheat prices underway because North American production levels are up significantly and there appears to be serious desire between Russia and Turkey to free up supply that is currently being held in blockaded Ukrainian ports.

As to maize and soyabeans, their prices are falling because the weather patterns are improving (drought is over).

And, don’t forget, China seems to have abandoned their lockdown and supplies are flowing again.

What does that all mean?

The food inflation pressures are probably abating.

The ECB finds itself … well, remaining effectively compromised

The relevance of the first section on Wheat prices is to disabuse readers of the notion that prices are accelerating across the board and that drastic action is required from our economic policy authorities.

As each central bank rolls over and the collective of them (bar Bank of Japan) appears to be in a race to see who can increase rates the most in the shortest space of time, we should understand that at present there is no entrenched structural inflation in the system.

There have been no significant second round propagating responses from wages to the initial price hikes arising from the sources mentioned in the Introduction.

So if China’s factories get back to work and get goods onto ships anchored around Shanghai soon enough then a lot of price pressures will evaporate.

A good wheat harvest as the impacts of the American drought recedes see the wheat price fall sharply within the space of a few weeks.

On July 21, 2022, the ECB released a – Monetary Policy Statement – to announce and rationalise their decision to increase “three key ECB interest rates by 50 basic points”.

The decision aims to end the period of negative interest rates (nominal rates minus inflation) but I doubt that we have seen the end given the current inflationary trajectory.

In the same breath, they announced the new “Transmission Protection Instrument (TPI)”, which adds to the acronym soup mix that the ECB and the Euro bureaucrats in general love, but really amounts to more funding government deficits in the Eurozone.

That function has come in various guises the SMP, the APP, the PSPP, the PEPP and now the TPI.

It is hilarious when you really understand what is going on.

In their Monetary Policy Statement they rehearsed the usual guff about interest rates and inflation.

1. “support the return of inflation to our medium-term target by strengthening the anchoring of inflation expectations …”

2. “ensuring that demand conditions adjust to deliver our inflation target in the medium term.” – which means reduce overall spending to match the diminished short-term supply disruptions.

Which means force people into income poverty so they stop spending by rendering them jobless.

3. “At our upcoming meetings, further normalisation of interest rates will be appropriate.”

Meanwhile ‘back at the real economy’, the most recent – industrial production data (released July 13, 2022) is showing that output growth has fallen France, Belgium and Germany (among other Eurozone Member States) and Europe’s manufacturing and export powerhouse, Germany, is now running trade deficits and its future looks grim, given its import-dependency on Russian energy and its failure to break away from diesel-based motor vehicles and move into EVs more quickly.

The ECB acknowledged that in its statement:

Economic activity is slowing. Russia’s unjustified aggression towards Ukraine is an ongoing drag on growth … Firms continue to face higher costs and disruptions in their supply chains, although there are tentative signs that some of the supply bottlenecks are easing. Taken together, these factors are significantly clouding the outlook for the second half of 2022 and beyond.

Read that carefully.

They are hiking rates when Europe’s economy is slowing and the inflation is due “disruptions in … supply chains”, which are “easing”.

The rate hikes won’t quicken that easing.

They won’t stop the War.

And they will, if anything accelerate the real output slowdown.

The ECB also acknowledge that supply disruptions are easing because the restrictions are easing.

But like all things to do with the European Union and the Eurozone, they cannot really hide from the dysfunctional monetary architecture.

In anticipation to what last week’s decision might bring, I wrote this blog post last month – Eurozone anti-fragmentation confusion – its really simple – the ECB has to continue to fund deficits or kaput! (June 20, 2022).

So now we know that the ‘anti-fragmentation’ tool is to be the – Transmission Protection Instrument (TPI).

As usual, the ECB dressed it up officially in this way:

The TPI will be an addition to our toolkit and can be activated to counter unwarranted, disorderly market dynamics that pose a serious threat to the transmission of monetary policy across the euro area. The scale of TPI purchases depends on the severity of the risks facing policy transmission. Purchases are not restricted ex ante. By safeguarding the transmission mechanism, the TPI will allow the Governing Council to more effectively deliver on its price stability mandate.

This is the same sort of justification that they came up with way back in May 2010 when they introduced the Securities Market Program (SMP), which saw them embark on the first of their large-scale government bond buying ventures at a time when it was likely Italy and other states would not be able to borrow sufficient to cover their expenses and their pre-existing debt obligations.

The interesting aspect of the TPI is not that it is unlimited but appears to be freed from guidelines operating on the previous bond-buying programs that required the ECB to broadly follow the capital key – that is, buy Member State debt in proportion with their contribution to the capital of the ECB.

Now the ECB is saying it can go for broke whenever.

The purpose, of course, is to maintain control over the bond spreads (against the lowest risk public asset the German bund).

If the ECB didn’t maintain that control, then the private markets would push the spreads up significantly and probably beyond the level that some Member States could afford to borrow and repay.

That means insolvency.

And that was the threat in 2010 and again in 2012 and ever since.

What the ECB is effectively doing by entering secondary bond markets and buying huge volumes of government debt is what any reasonable person would understand to be ‘funding’ government deficits through direct currency creation.

The mainstream call this ‘printing money’ which is a loaded term.

But don’t be fooled by all this talk about ‘smoothing’ “disorderly market dynamics” etc. The ECB is maintaining the power to negate the preferences of the bond investors by controlling government bond yields.

But the purpose is not to control the yields but to ensure that the bond investors who ‘make the market’ in the primary issuing phase of the debt process keep buying government debt (knowing they can offload it to the ECB in the secondary market).

So the ECB is really funding the Member States deficits.

The official statement says:

1. “Subject to fulfilling established criteria, the Eurosystem will be able to make secondary market purchases of securities issued in jurisdictions experiencing a deterioration in financing conditions not warranted by country-specific fundamentals” – the rub is to assess what is warranted or not.

2. The ECB will buy public debt from 1 to 10 years, but also says it can buy private debt (maybe to bailout some big company or bank)!

3. There will be a “cumulative list of criteria to assess” which Member States will be protected this way – but the Member States must “pursue sound and sustainable fiscal and macroeconomic policies.”

4. The Member State must be compliant with:

(a) “with the EU fiscal framework: not being subject to an excessive deficit procedure”.

(b) “absence of severe macroeconomic imbalances”

(c) “fiscal sustainability: in ascertaining that the trajectory of public debt is sustainable”.

(d) “sound and sustainable macroeconomic policies”.

The TPI will augment both the PEPP and the Outright Monetary Transactions (OMT) programs.

Assessment of the ECB Hoopla

The policy announcements last week demonstrate how riven the ECB and the whole European policy machinery is with contradictions and false premises.

First, they continue the charade that they believe in the primacy of private market decision making.

Second, the rationale for the interest rate rises is that inflation is the result of excessive demand relative to the disrupted supply.

That is, entirely mainstream.

But then they know that if all they did was pursue the mainstream interest rate hikes, there would be widespread insolvencies across the southern Member States (first) – Italy would almost certainly go broke and Spain, Greece and Portugal would not be far behind, with France following next.

Cyprus etc would be in the mix too.

So in that respect they have to continue the very non-mainstream policy programs that see it exercising its direct capacity as the currency issuer and funding the Member State deficits.

The mainstream claim that is inflationary.

Contradiction then.

Third, they maintain the charade that they are operating within the rules of the Treaties that govern the conduct of the European Union and the common currency.

But, of course, they are not, because those rules specifically preclude the central bank from funding deficits.

Hence all the word gymnastics and disorderly monetary dynamics to make out that the bond-buying programs are just regular monetary policy moves to ensure they hit their interest rate target.

They know as well as I know that if they didn’t do that the common currency would be dead, and, quickly.

So the ECB is exhibiting its schizoid personality more clearly than ever.

It pretends to be a regular central bank but is in fact, by dint of the dysfunctional monetary architecture, a quasi fiscal authority.

Fourth, with Germany now in real trouble – export surpluses gone, a massive energy crisis imminent, its manufacturing strategy looking seriously defunct and wages growth relative flat – the control that the Bundesbank has had on the ECB Council looks to be waning.

The last thing the Germans wanted was for the PEPP to continue and a new, unrestrained (effectively) program in the guise of the TPI to be announced.

In the last weeks, we have read statements from German commentators claiming the rising bond spreads were good, because it would force some discipline on Italy.

They wanted Italy to suffer more pain than it already is enduring (almost to the point that its social stability is under threat) because, apparently, they were lazy and profligate.

The reason Italy is in a parlous state is really because it surrendered its currency sovereignty.

But the implications of the ECB decision last week was that it was not going to let Italy go to the bond market wolves.

The troubles that Germany now find themselves in – begging Spain etc to use less gas so it can use more, for example, – has clearly diminished its European bullying capacity.

For how long remains to be seen.

Fifth, it will be very hard under the current monetary policy settings (with rates rising) for the European Commission to revoke the special clause that suspended the Stability and Growth Pact and restore the Excessive Deficit Mechanism.

That is, they will find it hard now to start forcing damaging fiscal austerity onto Member States any time soon.

And the ECB will find it hard restricting the TPI to nations that are seemingly operating with the SGP.

That would be illogical.

During the GFC, they used the bond-buying program to keep Member States solvent while the Commission was simultaneously pushing damaging austerity onto nations.

But that mix is not viable now. The bond-buying programs, even though the eligibility criteria for the TPI talk about fiscal obedience, will continue because without it, nations go broke, such is the ridiculous architecture of the euro system.

Finally, the ECB is now the top rank – it rules the roost. It can decide more or less how much each Member State will spend and can pressure the states to modify fiscal policy or face the threat of no TPI participation.

The link between voters and their governments has been increasingly eroded since the common currency was created.

Now the breach is very stark and the so-called ‘democratic deficit’ is obvious.

Who would want to be part of that system?

Conclusion

Once again the so-called technocracy that is the Eurozone looks like a farce.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

The European Commission has just quietly removed sanctions on Russian food, fertiliser and oil plus Belarusian fertiliser, hidden in their latest sanctions package. This will boost supply and reduce food price inflation.

The blockade so called of Odessa is a red herring but the Turkish navy is demining the port and Russia has guaranteed safe passage for 120 days anyway.

This is how you deal with inflation not the stupid interest rates.

How many opportunities must the ECB present for the masses to understand what’s really going on? While ever the MSM don’t delve into the actualities and the great unwashed continue to swallow the lie that it is all too complicated and nothing for them to bother about (at least while they remain distracted by the noise of their daily lives) it will be a long time before calling out of the emperor’s new clothes will cut through. There are none so blind as those who will not see. How many decades now? But each crisis heaped upon crisis helps get us that bit closer.

Can’t wait for exposure of the lie to be mainstream when the powers that be will be caught between declaring their ignorance or a cover up. Not sure we’ll have a livable planet by then or time to turn things around.

How many more tools and a soup of acronyms ECB has to invent to keep this dysfunctional union going? The whole edifice of the monetary union is built on shaky foundations. Most of the euro zone countries are condemned to long growth and high unemployment. Acknowledging the design flaws of the monetary union and giving its member a more discretion in the use of fiscal policy should the way forwards not a new soup of acronyms which do not address the core problems of this dysfunctional union.

“Who would want to be part of that system?”

Those who benefit from it…

As we all know, raising the price of money is an inflationary pressure.

In the 1970s, raising the price of money didn’t quell inflation per si.

The crisis spawned by the Volcker shock repressed inflation – with a colossal price paid by the lower 99% of the population.

But, inflation never trouble the top 1% of the population: if they loose money with inflation, the governments are keen on “printing” more money for them.

That’s inflationary too, but eventually, prices stabilize and, in the end, the 1% have gotten richer and the 99% have gotten poorer.

The ECB is not worried about inflation either. They’re worried about the FED’s rates hikes and the ensuing capital flight to the US, lured by the yields of bonds and even bank deposits (do you remember the last time you seen an interest gain in your account?).

In parallel to that, they are facing parity of the euro with the US dollar, which is a blow on the competitiveness of eurozone exports, mainly the Germans.

Meanwhile, China, Russia and others are promoting a new reserve currency, which threatens to turn the dollar and the euro into rubble (not yet very visible here, but just wait for the recession).

The eurozone states will do nothing to fight all that with fiscal policy.

It’s up to the ECB and the monetary policy (it was in 2012 and still is in 2022).

And the ECB has only a hammer to fight the vandals already climbing the fortress walls – interest rates.

It’ll be a blood bath.

‘The ECB is really funding the Member States deficits.’ Yes, and providing risk-free profit for bond dealers. If only this corporate welfare was better understood by ‘the masses.’

“Who would want to be part of that system?”

Well, Croatia from 1 January 2023…

The ruling class with capital want to be part of the system. They lead the population by the nose to get there and hand pick faces at election time to achieve their goals. The geopolitical map demands it.

As for the central banks hiking. Now that the central banks have become the trade unions of the bond holders and rent seekers. They hike to protect their trade union membership.

a) During growth periods they hike in tandem with the growth as that is their belief system. On the delusion they’ll see a US economy with 5% interest rates and the economy is stable and growing with full employment.

b) They hike to pop bubbles. They are in the business of bubble popping because option a) never works making them spend long times with low interest rates. That increases speculation in assets.

They are caught in this loop of rinse and repeat and forever increasing their balance sheet over time. Create unemployment both ways regardless of what they do.

Allow their trade union membership to entrench their power over democracy during every rinse and repeat cycle. As assets get transferred into fewer hands every time and picked up on the cheap as main street struggle to pay their debts. Once the asset swap is complete on the cheap they’ll pump the assets up again. Allowing the rent seekers to extract more and more rent in the future.

Nothing will change unless the geopolitical map changes.

That’s the driving force behind it. It demands that power is concentrated in this way if they are going to take on both Russia and China in the future. They see real raw power in fewer hands and more authoritarian, as the key to unlock the real resources in Russia and China. That the West can then own from which to extract rent.

@Korual re: ‘The blockade so called of Odessa is a red herring but the Turkish navy is demining the port and Russia has guaranteed safe passage for 120 days anyway.’ Nice bit of optimism thrown in with your red herring (untruth) of red herrings.

The TPI is already known, colloquially, as “Totally Protect Italy”.

Anybody who still think central banks control economies by projecting “credibility” probably needs to cut back on whatever they are smoking.

When they set up the EU they didn’t want this thriving, open, democratic, entity, that would create full employment.

They wanted the real power that stretched from London to the East to be as undemocratic as possible Where real power was in a few hands that never had to face the ballot box. Introduced an economic system that made sure all member states could be kept in line. Wheeled out faces at election time that represented that real power and their geopolitical goals.

If you start from the viewpoint that of course they know MMT and how different monetary systems work. History is littered with examples that they do. Then it is obvious that geopolitics drives everything. The Euro was clearly designed like Sterling in the British Empire and the French CAC in Africa. It is a colonial currency made for colonialism hitched on the back of free trade, private shareholders and austerity. Today’s version of the gold standard.

Countries within the EU are about as democratic as they were during the Roman empire. Brussels is the new Rome.

Wherever you decide to go on holiday visit a museum and you will find coinage. Of those who ruled the waves. Greek, Viking, Roman, Portuguese, Dutch, French and British.

Study how they used these coins. Exactly like Warren says they did, to get conquered nations to work for them and steal their real resources from which to extract rent. Whilst protecting the most profitable trade routes.

The Euro is no different. The coin is the geopolitical tool from which you can steal another nations real resources but you need real power and a debtors prison to make it work.

The ECB is the trade union of the bond holders and the rent seekers. That look after their trade union membership. NATO fits it like a glove and has been specifically designed to do so. Treaties, charters, no difference, they are the same thing delivering the same message.

Because of MMT, when I visit a museum I go straight to the coinage section. Look at the different coinage and the dates. Then challenge myself to try and piece together the history of the island I’m on or country I’m in. Then I go back to the start of the museum and walk through it to see if I am right.

So ECB have increased interest rate py 50 basis points, to 0.0 %.

If I don’t remember wrong, this site was a critic of the negative interest regime?

It do seems by ECB and others reasoning that imported inflation due to disturbed supply/production, mainly Covid should be meet with lower purchasing power in line whit the new supply side volume.

” . . . the ECB has

70:57 been a disaster from day one it’s

70:59 created asset bubbles banking crises

71:02 massive recessions vast unemployment

71:04 large youth unemployment in Spain and

71:07 Greece left right and center but it’s a

71:10 fair it’s a fair Central Bank it

71:12 wouldn’t be it wouldn’t be enough it

71:15 would it would be unfair just to create

71:17 these massive economic pandemonium’s

71:20 in Ireland Portugal Spain and Greece and

71:22 not in Germany . . . right now it’s Germany’s

71:25 turn because the ECB is now creating and

71:27 property bubble in Germany has been

71:29 since 2009 while it’s killing the

71:33 community banks the good banks they’re

71:35 all forced now to lend for property

71:37 speculation so check me out in five

71:39 years time the property bubble will

71:42 burst and the tired German banking

71:44 system will be bust and the ECB will be

71:47 responsible . . . “

Germans are already preparing to sue the ECB on the new anti-fragmentation tool

Its open-ended nature & skew towards weaker countries makes it prone to be labeled as direct debt financing (illegal under EU laws)

A prime example of how poor is the current Eurozone’s architecture.

If the ECB’s Transmission Protection Instrument (TPI) was primarily created to help support the weak Italian economy and is in defiance of the Bundesbank apparatchiks view that the ECB should not buy/write off the debt of member states, then it appears that someone in Italy’s government must have threatened to leave the Eurozone and/or the EU? Both Britain and Italy being the founding members of the European Union of Nations would be a good outcome at some time.

Germany will do OK in the transition away from Russian oil and gas which will send a lot of ECB created money to the German and other European construction and manufacturing industries, the big German defence spending increase will also be good for German industry and Germany will be a big player in supplying the well engineered bits needed for the new renewable energy powered and energy efficient national economies of the world. Similarly South Korea, Japan, China and in parts the US will all gain lots of orders from the global energy transition away from fossil fuels.

Meanwhile in corporate captured Oz, Milton Friedman’s Monetarism again appears to be the economic roadmap as dictated by the commercial banks surrogates in the Departments of the Treasury, Finance and the RBA, as the brand new Labor federal government talks endlessly about reducing the AU$1 trillion budget black hole left to them by the previous conservative LNP federal government.

Clearly the bankers like the current rorts of $40+ billion p.a. in superannuation fund management fees, probably over twice that in mortgage repayments per year, their share of the truly huge profits from the dig it up and flog it quick industry, the privatised price gouging energy and power companies and so forth, WHILE NOTHING MORE IS TO BE WASTED ON THE PEASANTS or on combatting global warming as that’s less profitable.

The ECB are still better economic managers than the wizards of Oz.