These notes will serve as part of a briefing document that I will send off…

Eurozone anti-fragmentation confusion – its really simple – the ECB has to continue to fund deficits or kaput!

The French National Assembly results from the weekend are a good outcome. Not the best, but good, although the continued presence of the Right is disturbing. At least Macron’s group of Europhiles has lost its absolute majority with the new Left alliance becoming a viable opposition. The polarisation – with a surge from the Right and the strong performance of the real Left rather than the lite Socialist Party version – is indicative of what Europe has become – a fractured, divided, divergent set of nations and regions. If the Left had have seen the value in this unity ticket during the Presidential election things might have been different. But better late than ever. France will now find it hard pushing further neoliberal policies and there will be pressures on the government to defy the fiscal rules and redress some of the shocking deficiencies that the neoliberal period has created. But, those pressures are coming squarely up against the impending crisis facin gthe monetary union. All the economics talk in Europe at the moment is indicative of the plight that monetary union faces after papering over the cracks during the first two-and-a-half years of the pandemic. After years of holding the bond spreads down, with their asset purchasing programs, things are changing as the ECB is pressured to follow suit and hike interest rates and abandon their bond buying. If they do both things, then there will be a crisis quick smart because nations like Italy will face increasing yields on their borrowing which will run out of control. So, the solution – another ad hoc response – an “anti-fragmentation” tool. If it sounds like a joke that keeps on rolling, you would not be wrong. More paper, same cracks.

What is happening to bond spreads?

On March 24, 2020, the – DECISION (EU) 2020/440 OF THE EUROPEAN CENTRAL BANK – created an additional layer to their already large asset purchasing program – the “temporary pandemic emergency purchase programme” (PEPP).

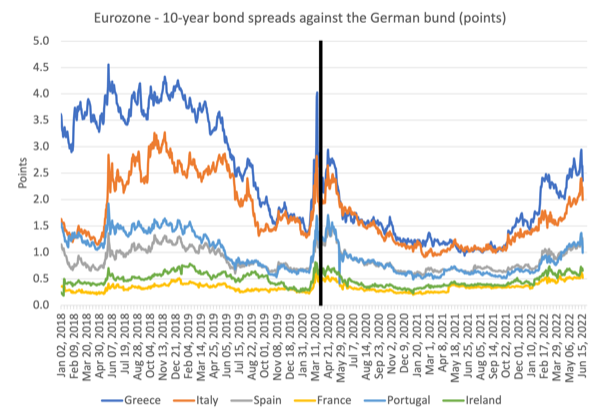

In the immediate period prior to that announcement and the implementation of further large public bond purchases, the bond spreads against the German bund benchmark were starting to rise quite sharply, particularly in Greece, Italy and Portugal, and less so in, say, France and Ireland.

This was in the face of growing alarm that the pandemic recession would be deep and costly to governments unable to issue their own currency.

Both the ECB and the European Commission acted in response to that alarm – the PEPP from the ECB and the relaxation of the fiscal rules from the Commission.

Both policy responses were in recognition that the mainstream architecture of the monetary union that they had created back in the 1990s would not be capable of withstanding another severe economic shock.

Only the large scale bond buying of the ECB during the GFC kept the union together for without it many nations, including Italy, Spain and Portugal would have definitely become insolvent.

Since then the various configurations of the asset buying programs have been funding the fiscal deficits of the Member States, although the ECB likes to play the charade that they are just maintaining liquidity conditions in money markets.

But those schemes were not large enough to cope with what was happening in February and March 2020 as a result of the pandemic.

Cue the PEPP (the date of introduction shown by the vertical black line in the following graph).

The following graph makes it clear what the impact of the PEPP was – it is unambiguous – the ECB pushed the yield spreads back down to low levels and took the fiscal pressure of the Member States.

The next graph shows the complete history of the Italian government 10-year bond spread against the German 10-year bund since the inception of the monetary union.

The near catastrophe in 2010-12 was averted by the ECB bond purchases and later in the period the PEPP reinforced the cheap funding mechanisms for the Italian government.

But the pressure is now rising.

Why is that happening and so suddenly?

It is because the ECB has been to-ing and fro-ing about their plan for so-called monetary ‘normalisation’ for some time, but then, out of the blue really, changed their strategy

They had been signalling since December 2021 that they would terminate the PEPP sometime in the first quarter of 2022.

On May 23, 2022, the ECB boss Madame Lagarde wrote in her – Blog post by Christine Lagarde, President of the ECB – that:

That has now been done.

The process continued with our announcement of an expected end date for net purchases under the asset purchase programme (APP). And as the inflation outlook has evolved, we have also adjusted our communication on the likely timing of interest rate lift-off, in line with our forward guidance.

So just like that the terrain had changed – no more PEPP, no more APP reinvestment, and interest rate hikes – in a highly uncertain environment where each of those policy changes is unlikely to address the root cause of the inflation but certain to cause chaos for Member State bond markets.

And the changes did!

The Governing Council meeting (June 9, 2022) produced this outcome – Monetary Policy Decisions – where the ECB basically reverted back to New Keynesian form.

The logic is simple as it is asinine.

Inflation rising -> hike interest rates -> cause unemployment and squeeze workers and business income -> create sufficient misery that they stop spending -> eventually scorch the inflation out of the system.

Then …

See what awful damage has been created and start blaming the unemployed for ‘wanting to live off welfare’.

Of course, if demand was the problem, that unemployment buffer stock would eventually achieve its goal of expunging inflation from the system.

But at great cost.

The problem is that such an approach will do little to arrest the current inflationary pressures because they are endemic to the supply-side of the economy.

It is destructive to inherit a dramatically constrained supply and then aim to reduce the previously ‘normal’ level of demand back to this temporary constrained level of supply.

When the transitory inflationary factors evaporate, then you are left with a trail of destruction of insolvent firms, impoverished workers, house mortgage foreclosures, increased suicides and worse.

In one swoop, the Governing Council:

1. “decided to end net asset purchases under its asset purchase programme (APP) as of 1 July 2022” – they will “continuing reinvesting” for a while as bonds held mature but the size of the pool will shrink.

2. will “reinvest the principal payments from maturing securities purchased under the programme until at least the end of 2024” – but no new purchases.

3. will “raise the key ECB interest rates by 25 basis points at its July monetary policy meeting” and “expects to raise the key ECB interest rates again in September.”

Of course, they knew full well that these changes would set the cats off in the bond markets.

So, as usual, the tough talk was followed by more realistic talk:

In the event of renewed market fragmentation related to the pandemic, PEPP reinvestments can be adjusted flexibly across time, asset classes and jurisdictions at any time. This could include purchasing bonds issued by the Hellenic Republic over and above rollovers of redemptions in order to avoid an interruption of purchases in that jurisdiction, which could impair the transmission of monetary policy to the Greek economy while it is still recovering from the fallout from the pandemic. Net purchases under the PEPP could also be resumed, if necessary, to counter negative shocks related to the pandemic.

Stay tuned for some new asset purchasing program to add to the alphabet soup of programs.

Quite simply, the ECB cannot allow the trends in the graphs above to continue.

It has to intervene, or else the bond markets will drive nations like Italy to the brink of insolvency with a deepening crisis along the way.

So now we have an abandoned PEPP policy bar reinvestment which allows for flexibility – meaning they will do what is required independent of the signals.

The problem is that the current rate of redemptions is too low in volume (perhaps around 20 billion euros per month) to allow the ECB to take on the bond markets.

Increasing flexibility in the bonds they reinvest in will give them more scope.

Cue the ‘anti-fragmentation’ instrument

The latest ad hoc response to the cracks reappearing is the statement by the ECB that it was going to create a new monetary policy tool to ensure there is no – wait for it – “fragmentation” across the union.

They are referring this new tool as an “anti-fragmentation instrument”.

Since the GFC, when it introduced the Securities Markets Program (SMP) in May 2010, the ECB has been the quasi fiscal authority, effectively funding fiscal deficits across the 19-Member State bloc through its asset purchasing programs,

Now it is going to take responsibility for the so-called ‘convergence’ that has evaded the European Commission since the common currency was introduced.

In a Speech on June 14, 2022 – Commencement speech by Isabel Schnabel, Member of the Executive Board of the ECB, to the graduates of the Master Program in Money, Banking, Finance and Insurance of the Panthéon-Sorbonne University – Executive Board member Isabel Schabel said that:

1. “In the spring of 2020, concerns about some countries’ perceived lack of fiscal space to deal with the pandemic led to a sharp divergence of financing conditions across euro area economies”.

2. “the vulnerability to such fragmentation risks will only disappear with fundamental changes to the euro area’s institutional architecture.”

She went on to define “bond market fragmentation” as a state where bond yields among separate units within a monetary union diverge from economic fundamentals to the point that the “wedge between the risk-free rate and national borrowing conditions”

leads to “financial instability”.

3. “Put simply, fragmentation reflects a sudden break in the relationship between sovereign yields and fundamentals, giving rise to non-linear and destabilising dynamics.”

I will write more about this topic in coming weeks as the discussion within the ECB moves forward and we get more detail.

But effectively, without really having a clear definition of what actually constitutes fragmentation (is it levels of the spreads, the pace of change or variance of them, etc), they are acknowledging what everyone knows but rarely wishes to acknowledge.

The architecture of the monetary union is dysfunctional and no amount of papering over will solve that.

That needs root-and-branch reform – that is Treaty Change – which is going to be impossible in the direction that is needed – including scrapping the euro.

The ECB knows what it has to do and continue to do – fund the fiscal deficits irrespective of what smokescreen it erects to call it something different.

Otherwise, kaput!

There are those who think the rising bond yields in Italy are good for the economy – Yes, they exist

I saw lots of people in the financial markets applauding the rising spreads and telling the ECB to keep out and just hike rates (rewarding their bets).

One of their arguments is that the ECB’s spread control traps Member States in state of “perpetual ECB dependence”.

That is correct.

But without their own currencies, that dependence is the only thing that keeps the Member States solvent.

Without it, they go broke.

The problem is the basic architecture of the union and arguing about the form of paper that covers the cracks misses the point.

Another high profile character (background Goldman) wrote this Tweet on June 10, 2022, claiming that the rising spreads would fast-track structural reform in Italy.

He clearly doesn’t read the literature very closely.

Mario Draghi opened an ECB conference on October 18, 2017 with these remarks (Source):

ECB research finds no convincing evidence that high interest rates lead to more reforms, if one controls for the business cycle and other factors. In fact, the opposite is more likely to be true: lower rates tend to promote reforms, since they lead to a better macroeconomic environment.

He was referring to this ECB research paper some years ago (June, 2017) – When do countries implement structural reforms? – which concluded that:

1. “structural reforms implementation, in particular on labour markets, is more likely during (deep) recessions and when unemployment rates are high.”

2. Importantly, “Turning to monetary policy, contrary to the frequent claim, low interest rates tend to promote rather than discourage structural reforms.”

Got it!

Conclusion

All this amounts to is that the ECB remains caught between a rock and a hard place.

Whatever it chooses to call its policy intervention, the substance of it will have to be a continuation of its government bond buying activities.

For without that funding of the deficits, the Member States will be vulnerable to insolvency and the shifts towards that state would be sudden once the horse started bolting.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Central bankers are ‘next level’ psychopathic. Trapped in neoliberal groupthink bubbles and concerned with protecting the profits of the elite capital class over well being of our societies. It’s down right scary.

The Eu should stop being a vassal of the US !

Where lies the european industrial power?

In the car industry, in Germany and France, with spilover effects to neighbours, but shrinking at great speed (in Britain, Italy, Sweden, Chequia, Spain, the local car industries disapeared all together or are in foreign hands).

We needed to expand railroads, but done the opposite, because the Germans wanted to sell their cars and cars need roads. And so we built roads, and more roads, many of them in parallel to other roads.

This industry is doomed by the proclaimed ban on motor cars, in 13 years time.

The end of the motor car will get here sooner, as the petrol prices will keep escalating: besides the shortage, the war, the supply chain disruptions, we have the simple fact that refining capacity is waning all over the west (nobody will invest in reffineries, when there’s an end schedulled for the business, and they are closing, one by one).

And so, the EU geniuses are dreaming about EVs, hidrogen, teslas and the like, but none of them is a solution to what lies ahead.

People will be forced to give up their cars (many of them not even fully paid for). This will give rise to a massive waste problem (millions of cars littering the streets) and people with have little options to go to work, to do whatever they do right now.

That’s because EVs are very expensive, and they have very limited autonomy.

They are a luxury (only for the rich) and they can’t take you far (in Portugal, the Teslas owners that went on holidays in June, are making huge queues in service stations to charge the batteries of their cars: I wonder what it will be like in July and August…).

And what is the geniuses’ solution? Finance.

Banks will help you to buy the EV you can afford.

What’s finance?

Exploitation, renting and colonization.

That’s what brought us here.

Bill is completely right. The euro is the result of an original sin which can never be redeemed. The whole architecture is flawed. The sooner it will be scrapped the faster countries like Italy go back to economic growth. It helps German mercantilism by boosting its exports. It serves no economic except some ego boost to the European elite who care least for the welfare of their citizens.

The EU is falling apart ! Sanctions are hastening its downfall and the neocons and neoliberals controlling the show need to be kicked out sooner rather than later!

I don’t see why the euro can’t be reformed into a functioning currency Union. At some point even MMT needs to look at how to manage decentralised finance system like the EUs collection of states with central banks and the ECB as last resort. I disagree with breaking up the eurozone into national economies as it just kicks off European nation state competition again. Why are we not working on designing a solution that keeps the Union? There is nothing in MMT says it can’t be done.