In the annals of ruses used to provoke fear in the voting public about government…

Federal Reserve Bank researchers openly acknowledge the inevitability of recession

It’s Wednesday, and so I have some shorter analysis on a range of matters today. First, some discussion of a technical paper from the US Federal Reserve researchers, which makes it clear they think that the interest rate hikes have a high probability of causing a recession. Second, we analyse some Russian data which suggests the sanctions are having the opposite effect to that intended. Third, I consider the stupidity of the new Australian government which is now falling into the ‘we have too much debt’ to even provide basic health care trap. And, I comment on a State Government that is now openly ignoring its professional health advice because the corporate sector told them to. And if all that wasn’t depressing enough, some music that focuses our attention of the vicissitudes of colonial might. All in a day.

No doubts about what the US Federal Reserve is up to

The US Federal Reserve Bank released a FEDS Note yesterday (July 12, 2022) – Monetary Policy, Inflation Outlook, and Recession Probabilities – which gave us more detailed insight into what they expect the consequences of their irresponsible interest rate hikes to be.

The discussion is somewhat technical but can be distilled as followed.

I wrote about inverted yields curves in these blog posts (which you can use as reference for this discussion):

1. Inverted yield curves signalling a total failure of the dominant mainstream macroeconomics (August 20, 2019).

2. When does no evidence mean no evidence? (November 10, 2010).

3. Time to outlaw the credit rating agencies (December 23, 2009).

4. Operation twist – then and now (March 31, 2010) – with a video.

Basically, the yield curve is a graphical depiction of the term-structure of risk-free interest rates and plots the maturity of the government bond on the horizontal axis against the respective yields (return) on the vertical axis. We can use the term maturity and term interchangeably.

The yield indicates the money that will be returned from the investment and is usually expressed in percentage terms (see above blog posts for more detail).

What determines the slope of the yield curve?

- Normal – Under normal circumstances, short-term bond rates are lower than long-term rates. The central bank attempts to keep short rates down to keep levels of activity as high as possible and bond investors desire premiums to protect them against inflation in longer-term

maturities. Combined, the yield curve is upward sloping. - Inverted – Sometimes, short-term rates are higher than long-term rates and we say the yield curve is inverted. The usual events which lead to an inverted yield curve are that the economy starts to overheat and expectations of rising inflation lead to higher bond yields being demanded. The central bank responds to building inflationary pressures by raising short-term interest rates sharply. Although bond yields rise, the significant tightening of monetary policy causes short-term interest rates to rise faster, resulting in an inversion of the yield curve. The higher interest rates may then lead to slower economic growth.

- Flat – A flat yield curve is seen most frequently in the transition from positive to inverted, or vice versa. As the yield curve flattens the yield spreads drop considerably. A yield spread is the difference between, say, the yield on a one year and a 10-year bond. What does this signal about the future performance of the economy? A flat yield curve can reflect a tightening monetary policy (short-term rates rise). Alternatively, it might depict a monetary easing after a recession (easing short-term rates) so the inverted yield curve will flatten out.

There are various theories about the yield curve and its dynamics. All share some common notions – in particular that the higher is expected inflation the steeper the yield curve will be other things equal.

The basic principle linking the shape of the yield curve to the economy’s prospects is explained as follows.

The short end of the yield curve reflects the interest rate set by the central bank.

The steepness of the yield curve then depends on the yield of the longer-term bonds, which are set by the market. But the short end of the curve is the primary determinant of its slope.

In other words, the curve steepens mainly because the central bank is lowering the official cash rate, and it flattens mainly because the central bank is raising the official cash rate.

Bond traders link the dynamics of the yield curve to their expectations of the future economic prospects. When the yield curve flattens it is usually accompanied by deflation or steady and low inflation and vice versa.

The Federal Reserve article notes that:

An inverted yield curve … is a powerful near-term predictor of recessions.

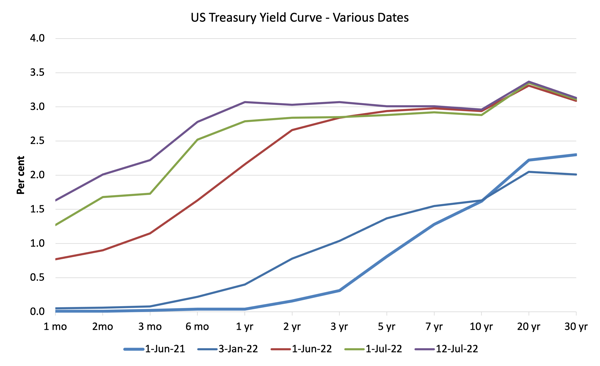

The following graph shows the US yield curve for various dates up until July 12, 2022.

It is not yet inverted as the shorter rates are still lower than the longer rates.

But the dynamic is certainly heading in the inverted direction.

The Federal Reserve article prefers to look at a different indicator (derived from the yield curve) – the so-called “nominal near-term forward spread (NTFS), given by the difference between the six-quarter-ahead forward Treasury yield and the current three-month Treasury bill rate”.

They say that movements in this statistic can help predict recessions – because it is:

… an informative gauge of market-participants’ expectations about future near-term monetary policy actions, such as the raising and lowering of the federal funds rate by the Federal Reserve. Thus, it carries information about current and near-term real interest rates, future expected inflation, and the interest rate forward risk premium (or term premium), which in turn are linked to expectations of future business cycle outcomes.

The forward rate is a measure of the expectations of the market participants of what is likely to be the interest rate situation at that maturity.

So changes in this forward spread are meant to reflect by changes in the market participant’s expectations for the trajectory of interest rates set by monetary policy over the next 6 quarters.

So a rising NTFS suggests that the market is expecting rates to be higher in the period ahead and vice versa.

A negative NTFS suggests that market participants think monetary policy is going to ease and vice versa.

This, in turn, suggests the investors think a recession is nigh, which will force the central bank to cut interest rates.

So when the NTFS is low, there is a chance of a recession emerging.

That is the theory at least.

The article itself is very technical so I won’t summarise that part.

The results of their statistical work are as follows:

1. “While the NTFS is currently positive, market participants anticipate further monetary policy tightening in the upcoming months.”

2. “If such interest rates hikes indeed materialize, they could result in a lower NTFS and thus an increase in recession probabilities. ”

3. The data shows that “the NTFS does not currently forecast a recession”.

4. “Going forward, however, the model expects monetary policy to become more restrictive, and thus it estimates a higher likelihood of a downturn.”

5. “In our baseline case, we forecast increasing real rates, a narrowing policy gap, and a 35% recession probability by the end of 2023.”

6. If the Federal Reserve tightens more than expected at present, then they predict this will be “at the cost of a higher downside risk for economic activity, as the one-year ahead recession probability approaches 60% by the end of 2023”.

So the number crunchers in the Federal Reserve Bank are in no doubt as to what the Monetary Policy Committee is up to.

It is clear they know that the monetary policy changes are likely to force the US economy into recession with rising unemployment and poverty rates.

It seems unconscionable that such a policy stance would be taken when there is no certainty that the policy levers actually can influence the inflationary pressures other than oil prices (which will be responsive to demand shifts).

Central banks are falling back into form.

It is a form that is destructive of prosperity.

Sanctions against Russia – recent evidence

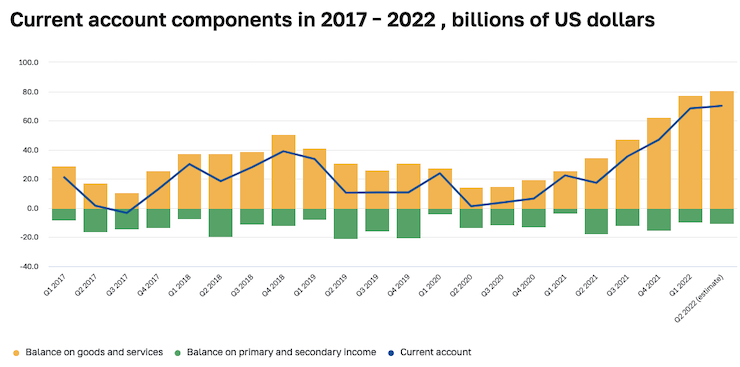

On July 11, 2022, the Russian Central Bank released its latest – Balance of Payments data – which shows:

… widening of surplus in the balance on goods and services as a result of significant growth in exports driven by favorable market environment and a decline in imports …

The December-quarter 2021 current account surplus was $US41 billion and the June-quarter 2022 estimate is now $US70.1 billion.

A hefty increase.

Between the first-quarter and the second-quarter 2022 there was a small increase in the current account surplus ($US68.4 billion to $US701.1 billion) driven by a fall in exports ($US166.4 billion to $US153.1 billion) being more than offset by a fall in imports ($US88.7 billion to $US72.3 billion).

However, in the 12 months to the June-quarter 2022, the current account surplus rose from $US17.3 billion to $US70.1 – with exports up from $US127.9 billion to $US153.1 billion and imports down from $US93.2 billion to $US72.3 billion.

This chart is taken from their data release.

And here is the exchange rate evolution for 2022 (from January 3 to July 13, 2022).

Prior to the invasion, the exchange rate was steady with 1 USD buying around 75 to 76 roubles.

Then the sanctions hit and the rouble depreciated sharply against the US dollar – but only for 3 weeks or so from early March.

Since then it has appreciated strongly and is now selling at 1 USD for 58 roubles.

No currency collapse going on.

I have not had time to dig further into the micro details of the Russian economy as yet.

But these aggregates tell me that if the sanctions were designed to damage the Russian economy by choking off its external sector and dumping its currency, then the opposite has happened and that could be interpreted as failure.

Labor Governments in Australia losing the plot – again

On May 21, 2022, we finally got rid of the worst government in our history – the conservative coalition, which had become a climate change denying, do nothing government.

Hopes were somewhat elevated that things might be different.

But everytime the Treasurer talks now, we hear “we were left with a trillion dollars of debt”.

The Prime Minister also claims, whenever he is asked something – “we were left with a trillion dollars of debt”.

They are also pulling the stunt as they cut essential health care spending – on provision of RAP tests for low-income groups, the abandonment of isolation payments for people with Covid, the cessation of telehealth assistance to allow people (especially low-income workers) to access speedy health care, and more – that these were the policies of the previous government and “we were left with a trillion dollars of debt” so we cannot afford these things any longer.

Around 60 people die each day from Covid in Australia and our health system is starting to collapse.

Ambulances are ramping and red alerts are being announced (this is when an ambulance service cannot get a patient to hospital in time).

Infection rates are rising fast.

Death rates are rising fast.

Other health care needs are being abandoned because the hospitals are being overrun with Covid patients.

Long Covid statistics indicate an increasing number of people are finding they can no longer work.

Testing is being cut back.

And so on.

I had to turn the radio off this morning when the Treasurer was being asked to justify the cuts to these health care measures when Covid infections and deaths are rising massively.

He said – “we were left with a trillion dollars of debt and cannot afford these measures any longer”.

The statement is false.

There are no shortage of, for example, rapid antigen test kits for sale. So there is no real resource constraint.

The Australian government can buy whatever is for sale in Australian dollars whenever it wants. There is no concept applicable that says it can or cannot afford something.

Either something is available for sale in AUD or not.

They then claim that because RATs are cheaper now (down from $A24 or so to $A8) that the need to subsidise them is no longer there.

Tell that to a minimum wage worker who is on the borderline of poverty with basic food and other essentials rising in prices.

By abandoning these workers to the market the result will be – no tests!

No tests – means workers will go to work with Covid.

And that becomes even more likely as the isolation payment is also going to be terminated.

More people going to work with Covid – more workers sick – more people ultimately unable to work – and we will endure on-going shortages, late deliveries, food constraints etc.

Short-termism at its worst.

Then think about the announcement by the Victorian State Labor government yesterday.

Up until now, I have supported their handling of the pandemic with lockdowns when necessary etc.

They have also continually said they will take the advice of the health professionals, particularly the Chief Public Health Officer.

That Officer has become particularly alarmed at the hospital and ambulance situation in Victoria recently and indicated to the Health Minister that the government should reintroduce mask wearing mandates in indoor settings given the rapid rise in infection rates and sickness.

Yesterday, the Minister announced that (paraphrasing):

After consulting business, we have decided to ignore the health advice from the health care professionals and not mandate mask wearing or allow workers to work from home where possible.

Two points:

1. The government goes to election in November and is obviously fearful of a backlash if a simple mask mandate for indoors is reinstated.

2. They are prioritising the greed of the corporate sector over the quality of public health care.

This is the first time a government in Australia has blatantly announced it is ignored the best health advice available.

At a time, when the deaths are rising and thousands are becoming sick, it is a disgrace.

They deserve to lose office for this.

Music – The Capital Sessions 1973

This is what I have been listening to while working this morning.

Here is Bob Marley and the Wailers at the peak of their skills.

This Billboard story tells us about the release – Bob Marley and The Wailers’ ‘Capitol Session ’73’: How the Lost Footage Came to Light.

1973 was the year the band, in this format, released their first studio album – Catch a Fire (released April 13 on Island Records).

After that release – Bunny Wailer (Livingstone) – one of the original Wailers with Marley and Peter Tosh, left the trio to begin a solo career.

The trio concept of – The Wailers – was giving way to having Bob Marley out front of a band.

This song was the title track of their first album – Catch a Fire. While it tells the story of slavery, which was a significant and depressing part of Jamaican history, the themes resonate today given the vestiges of colonialism and exploitation remain a major constraint on the progress of many nations, particularly in Africa.

By the time this US session (recorded in LA) came to fruition, the band consisted of:

1. Bob Marley – vocals and guitar.

2. Peter Tosh – vocals and guitar.

3. Earl Lindo – keyboards (the fabulous organ you hear).

4. Carlton Barrett – drums.

5. Aston Barrett – electric bass.

6. Joe Higgs – percussion.

This version of the Wailers broke up soon after and only Aston Barrett remains alive.

This video is magic because it was shot before they were successful among white audiences and had not yet become an ‘act’.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

The commentary on Russia about the currency situation drives me up the wall. Every single one of them has the ‘truth by repeated assertion’ line in it.

As we know, it doesn’t. They use Rubles in Russia.

It is exporting oil and gas to the West to look good elsewhere in the world and to keep the oil wells from gumming up.

Is the inverted curve really a predictor for recessions? What are the studies on this? I’ve seen it often stated as fact, but given the small differences in yield between the different bonds I could see a sell off in longer dated bonds changing the prices enough temporarily that the yield curve inverts as an anomaly rather than any barometer of market sentiment about the economy.

Do you take the red pill or blue pill ?

It should be the real economy that sets where inflation is, where profit margins are, where employment is etc, but for years now the equity market leads the economy. The eye of Horus is the economy and we pay CEO’s casts amounts of money to produce nothing, we pay them to speculate.

The CEO’s are Shepard’s of the equity price. The minute the equity price falls they run to their sheds to get their axes and start cutting costs. We can see hiring freezes, lay offs. The eye of Horus is delighted that bond yields are down while ignoring the fact why bonds yields are going down. That is the pricing in of a recession and what that will mean for earnings. We end up with this feedback loop of insanity that eats itself.

The $ is desperately seeking an emerging market crises as the strength of it is about to do some very real harm to those loaded up with $ denominated debt and who can’t export to get enough $”s to cover what they have borrowed. Along with not being able to import what they need.

The EU is a complete mess and are in real trouble because if they think hiking rates is a way to get out of this mess. How can they when the bond market vigilantes are sitting waiting ready to pounce on the spreads of the Southern European markets. They are holding meetings just so to organise another meeting because they don’t know how to get out of what they have created.

Here’s how I see it. Both the FED and the ECB couldn’t have made it any clearer that they are going to do whatever it takes to bring down demand, by taking a wrecking ball to high asset prices and with it the economy. How resilient the consumer/ job market is will determine how far and how deep they go.

There is going to be some real pain for the emerging markets and for parts of Europe until they FED and ECB have completed what they have set out to do. The real pain will be used to get support on the geopolitical map. For example $ swap lines will be given to allies only. If you even think of joining China and Russia you won’t get any. Don’t even think about moving away from the EU or in this time of stress from the bond vigilantes you are on your own. The real pain is going to be used to try and hold the Washington rules based order together.

@Eugenio Triana

you can literally google your question verbatim to get your answer…

it is quite simple to describe the data…for example there is an article which shows a chart with the 10 year/2 year spread on US treasuries…the data in the chart shows that all US recessions since 1970s to present are preceded by this spread going negative…so you could also interpret that data as being consistent with…”a recession won’t occur until the 10yr yield is equal to or below the 2yr yield”

Russia is a behemoth and it’s stupid to belittle its might.

The US continues to look at Putin as another version of Gorbachev, easy to replace with some kind of Yeltsin.

Worst, Biden is speaking in the name of the EU, the UK, Japan and Australia, making their leaders look as fools, which makes people distrustfull of the real value of their elected leaders.

And then Biden reads “Repeat the line”.

Oh boy… Trump never made such lousy impression of himself, even when he said for everyone to drink bleach.

Simply Chart the Fed funds rate and annual changes in the Consumer Price Index, shows clearly that the relationship between interest rates and inflation are highly correlated and not in an inverse way.

Increasing the interest income channels

The increased cost of credit just getting passed onto the consumer via higher prices.

The spot and forward price for a non perishable commodity imply all storage costs, including interest expense. Therefore, with a permanent zero-rate policy, and assuming no other storage costs, the spot price of a commodity and its price for delivery any time in the future is the same. However, if rates were, say, 10%, the price of those commodities for delivery in the future would be 10% (annualized) higher. That is, a 10% rate implies a 10% continuous increase in prices.

Doesn’t sound like they are fighting inflation to me.

Stan Druckenmiller claims the bond market has not been giving signals since post-2010. Claims why macro fund managers are obsessed with what the bond market is pricing in.

You really have to take a step back from it all as Monetarism is a mental illness. There is a large probability of what everyone is witnessing right now is mainstream macro groupthink. As they are all taught the same way. The GROUPTHINK has retreated to the dollar because that’s what the mainstream macro playbook says to do. Just as every central bank has hiked interest rates because that’s what the mainstream macro GROUPTHINK says to do.

The mass psychosis is not doing anything rational. They are just doing exactly what everybody in their peer group expects to see done. They are as willing as ever to please the Eye of Horus.

If you don’t step back from the disco lights of their BS. It is very easy to get sucked in.

Saying the sanctions aren’t hurting the Russians on the basis of the current BOPs data is premature.

Exports are up because oil and gas prices have shot up. It remains to be seen how long this sustains.

Declines in imports could be an indicator the Russian economy is under pressure.

Yet, another perfect example of When ” ALL” of the so called independent media say the same thing all at the same time in true Orwellian fashion.

Those who vote get trapped by the GROUPTHINK and forced to think in a certain way. Forced to think that some unelected face that has been handpicked out of the one of the big banks are the driving force of the economy because they raise or cut interest rates by 0.25%.

If there where FED symbols for Twitter all the guardian readers would have it hung up beside all their other sheep icons. Just to let everyone know they are still part of the flock.

Neil,

” They use Rubles in Russia. ”

The Russians are looking to replace imports from Europe/US etc with those from the BRICS countries.

I doubt that these countries will always and totally accept roubles for their exports. They might to the extent they can be used to purchase Russian goods. Other wise the Russians will need gold (which they have plenty of) or US$/Euros etc..

Thanks Bill once again for the economic insight and great music. The music reminds me that the verdict of the Court of Appeal is still awaited in the case of the Colston Four. Readers may know that the Colston Four are four good citizens of Bristol who were selected by the police as leaders in the toppling of the statue of slave trader Colston in June 2020, tried with criminal damage, but acquitted by jury in January 2022. The Attorney General (now candidate for PM) referred the case to the Court of Appeal, not to reverse the jury’s decision, but to undermine future juries’ moral considerations. One of the defences in the original trial was that the statue’s removal ended the more serious crime of public indecency: Bristol Council, presiding over a multi-racial city, had failed to act on citizens’ wishes over many years.

Here in the UK we are currently looking on at the ghastly farce of Con MPs selecting our next Prime Minister. And, as leaked to the G, the Shadow Chancellor, never one to miss out on an opportunity to show herself as equally unsuitable, drawn into binding a Labour Government to borrowing limits to protect the public finances. The Establishment can’t lose.

@Derek Henry: ‘Do you take the red pill or blue pill ?’ Neither. Just as Stalin and Mao, the most prolific mass murderers of the 20th century, weren’t the answer, neither is Putin’s medieval dream of Great Russia involving invasion, mass murder and destruction, or Xi’s continuance of imperialism and murder in Tibet and Xinjiang.

“I doubt that these countries will always and totally accept roubles for their exports.”

That’s the Fixed Exchange Rate Foreign reserve myth.

The reality in any floating exchange rate system is that the customer pays with the currency they have and the supplier receives the currency they wish to hold or need to use. And if that doesn’t happen, then there is no deal. The finance industry gets rich greasing the wheels and ensuring everybody pays with what they have and receives what they want to receive – creating and destroying money and money things as required to make that happen.

Russia is looking to internally substitute, is clearly more than capable of operating without most imports, and is running an export surplus. Therefore it isn’t really using money at all to obtain imports. It’s swapping oil gas and other resources for stuff, and somebody else is reordering a few ownership tags on accounting entries.

Patrick never said they are the answer ?

I’m very confused how you got that idea from what I posted ?

Or did you just do the liberal left thing and put your own words in my mouth to try and hide your own hypocrisy ?

Yup, pretty sure you just tried to pull off that liberal left (which is just really right wing ) Guardian comment section trick.

Good luck with that.

@vote for Pedro

But those sources don’t seem all that confident in the supposed predictive power of the yield curve inversion. According to the figures from the Fed, most years with recessions did have a yield curve inversion but sometimes it came before the recession began, sometimes during. And some years (i.e. 83) there was an inversion and no recession (https://www.chicagofed.org/publications/chicago-fed-letter/2018/404)

According to the Fed:

“Of course, the empirical results we have described in this article do not imply that a yield-curve inversion causes a recession. Rather, it could be that the slope itself fluctuates to reflect changing expectations about the economy, and these expectations are useful predictors of economic downturns.”

Which is what I was trying to get at, there is no fundamental causation between inversions and recessions, it is essentially a measure for how the bond market views the state of the economy. Fine as long as it’s seen in this context.

I love it when you post reggae. Because reggae is another bag.

With respect to the current micro effects of the US+ sanctions on Russia, a good place for anecdotal evidence can be found at Gilbert Doctorow’s blog, in particular his May 1 post entitled “The Eagle Has Landed: A voyage to St Petersburg via the far side of the moon” and his June 7 post entitled “Russia today at ground level: further observations”.

Mr. Doctorow is a US-ian living in Brussels who currently comments on Russian affairs. He retired from his job for US and other multinational companies some years ago. His responsibilities were in marketing and general management with a focus on Russia.

Neil,

“And if that doesn’t happen, then there is no deal. ”

Exactly. Which is consistent with what I wrote.

“It’s swapping oil gas and other resources for stuff, and somebody else is reordering a few ownership tags on accounting entries.”

Agree. Russia’s oil and gas are as good as its gold.

“With respect to the current micro effects of the US+ sanctions on Russia, a good place for anecdotal evidence can be found at Gilbert Doctorow’s blog…”

Doctorow’s blog is interesting but blatantly promoting Russian propaganda and at every turn justifies the Russian invasion of Ukraine and denies any Russian involvement in war crimes. If that’s what you’re looking for, there’s plenty to consume.

Off topic: what has caused Sri Lanka’s economic crisis?

“Off topic: what has caused Sri Lanka’s economic crisis?”

I’m no expert. However, any 3rd world nation that suffered a 1 year drop in the food harvest of 50% would see inflation. AFAIK, the harvest drop was caused by the extreme ban on importing fertilizer. It should have been phased in over years.

However, the world (IMHO) is seeing the effects of its ignoring ACC and adopting neo-liberalism in the 80s. Neo-liberalism had the IMF load the 3rd world nations with debt that they could never pay back. Someone created the money that the IMF lent to them and the IMF doesn’t really need them to pay it back. It can create new money or be topped up by the US Fed.

. . . ACC is now reducing harvests all over the world. It is going to get worse fast, and become a disaster.

Neo-liberalism ignored the fact that international trade must be a zero sum game. This isn’t surprising, because N-L-ism also ignored the fact that national economies only work when the Gov. deficit spends to add cash to the economy.

.

“Doctorow’s blog is interesting but blatantly promoting Russian propaganda and at every turn justifies the Russian invasion of Ukraine and denies any Russian involvement in war crimes. If that’s what you’re looking for, there’s plenty to consume.”

It balances the constant Ukrainian and Western propaganda, every turn refusing to accept the provocation of Russia and denying any Ukrainian involvement in war crimes.

As well as promoting the continuing and needless deaths of thousands of Ukrainians rather than admitting the diplomatic hubris and failure of the West over the past eight years.

All of which is endlessly pushed on the mainstream media.

The holier-than-thou attitude is great fun as long as it isn’t your nation’s sons, fathers and brothers that are doing the dying.

@Derek Henry Well done for a second attempt at wildly inaccurate guesses about me. Rather ruins your credibility in commenting about anything else when you try to smear based on prejudice and zero knowledge.

@Neil Wilson May I suggest you read some history of Great and Little Russia to ‘balance’ the western mainstream media. Same applies to Derek Henry. It’s not a ‘holier-than-thou attitude’ to feel that the rather greater responsibility for thousands of deaths in Ukraine, and previously in Chechnya and Georgia lies with the invading imperialist dictator, or monster as my Russian speaking colleague from Kharkov (Kharkiv) refers to Putin, as her (abroad) and her family’s (in Kharkov) lives are destroyed. Not great fun.

Informative as ever.

I think its important when talking about C19 that we also nclude the backlog of the sick.

Currently in the UK there are 100,000 more children waiting to see a specialist as a result of backlogs. There are also more children dying as a result. While the obvious answer is to pump more money. It doesn’t create a specialist immediately. Taking from another country, would just mean one less doctor, nurse, specialist for that country, and we saw a lot of that with countries like Greece.

While there is also an argument for education, it is not as clear as child mental health.

Over the last 10 years, typically mental health for under 18s was usually no greater than 540,000. And would be typical for it to be around 300,000 (average).

Covid lockdowns and policies, have left child/young adult, mental health in crisis. It is estimated that 1.5 million under 18s have been referred by doctors. The median wait times are from 1-182 days to have treatment. Although there are no wait times for urgent mental health treatment.

Also, under-18 suicides have almost doubled in 2020-2021. With it being around 200. Numbers like this have never been seen in the UK. Also, suicide has killed more young people than children that died with covid, from covid, and 6 died with no underlying health conditions.

More children will die because of backlogs than covid, and further testing, lockdown policies will mean further disruptions in people being treated as well as disruptions in education, which we cannot afford, if we want future doctors, nurses and specialists.

Neil,

I cannot understand how anyone could support the monstrous fascist regime running Russia, responsible for the needless deaths of ten of thousands of Ukrainians and Russians.

All for what?

There was no provocation of Russia. Putin’s propaganda is all a smoke screen for his narcissistic delusions of grandeur which he no longer even bothers to conceal.