I started my undergraduate studies in economics in the late 1970s after starting out as…

When does no evidence mean no evidence?

I keep reading that the inflationary expectations genie is about to jump out of the bottle and far from being benign and supportive will wreak havoc on real wealth. I also keep reading that the gold price is rising because of these increasingly robust fears of future inflation. It is one of those themes that get trotted out to alert us to the dangers of government intervention in the economy. It takes about one sentence to get to Zimbabwe and usually Weimar then gets dropped in. I know the characters that perpetuate this sort of stuff have had their minds poisoned by their undergraduate macroeconomics indoctrination but we do become adults eventually and should be able to question everything. If I am doubt I work out the logic of a problem and then confront the logic with some real world data to see if the logic at least is consistent with what actually happens. I am no empiricist but I don’t buy the idea that if the facts refute the theory then the facts must be wrong. Today I went off looking for those pesky inflationary expectations. I found them … looking forlorn. Just another ruse!

Former US Treasury secretary Robert Rubin wrote an Op-Ed in the Financial Times (November 1, 2010) – How America can withstand the headwinds. It contains many errors and his judgement of economic trends remains very poor.

Rubin was a senior member (then Chairman) of Citigroup after his political career ended. He left just before its near collapse amidst criticism of his performance. In 2001, he used a mate in the US Treasury Department to try to put pressure on the bond-rating agencies to avoid downgrading Enron’ debt which was a debtor of Citigroup. In January 2009, he was named by Marketwatch as one of the “10 most unethical people in business”.

So an all-rounder really. Please read my blog – Being shamed and disgraced is not enough – for more discussion of Rubin and who he keeps company with (Alan, Larry!).

The headwinds he identifies include:

… high unemployment and low job growth; both a decline in fiscal demand and unsustainably high federal deficits; excess capacity; business uncertainty; weak consumer financial conditions; and much else.

He concludes these headwinds are so strong that “the probabilities are much greater that growth will be slow and bumpy, and unemployment high, for an extended period”.

That will happen if people like him continue to perpetuate the myth that the US federal deficit is unsustainably high. In relation to what? Answer: there is no application to expressions like “unsustainably high” when dealing with a federal budget outcome when at the same time you note the other headwinds which are all deflationary.

A budget outcome is only effectively unsustainable if it pushes nominal aggregate demand beyond the capacity of the economy to absorb that spending in real terms (that is, beyond the capacity to increase real output). The budget of a sovereign government is never unsustainable in narrow financial terms. A sovereign government can run whatever deficit it chooses from a perspective of financial viability. It might be unwise to push the economy into inflation but it can always do that.

So I found this assessment curious and decided to read on. I regret doing so.

Rubin then juxtaposed what could be a constructive further fiscal stimulus – one that supports small business etc and has a “real, trusted and enacted long-term structural deficit reduction” to a “major new stimulus” that could be “counterproductive” because:

It could seriously increase business uncertainty about future economic conditions and policy, or change market psychology unexpectedly and dramatically, causing serious market disruptions. Or, even if a major new stimulus worked initially, it could fail to generate lasting momentum due to the headwinds, leaving us worse off than we would have been, with more debt but no greater gross domestic product … And a large, new round of quantitative easing has real risks: undermining confidence in the Fed’s ultimate refusal to monetise our debt; undesirably heightened inflationary expectations more broadly, now or later, or actual inflation; and competitive devaluations and trade restrictions.

So this uncertainty argument again – the type of argument that is repeatedly being use to underpin the deficit terrorist attack on fiscal policy.

Fiscal austerity is being justified by empirically-failed notions of Ricardian Equivalence which alleges that the withdrawal of government spending will be more than replaced by consumer and investment spending.

The claim is that consumers and firms are what the mainstream macroeconomists call Ricardian agents Private spending is currently extremely flat at present because according to the crackpot mainstream economists (Rubin is one of them) all private agents are so fearful of the budget deficits that they are saving up to ensure they can meet the future tax hikes that they think will be required to pay back the deficits.

The theoretical models used to derive these results are from La-la land which then means we are not surprised that their main predictions have regularly failed when real world events have given the theory a chance to shine.

On the existence of Ricardian households and firms please read my blogs – Its simple – more public spending is required and Even the most simple facts contradict the neo-liberal arguments and Pushing the fantasy barrow – for more discussion.

There is a contradictory thread running through the mainstream narrative at present which is also present in Rubin’s quote above. Ricardian agents also employ rational expectations (RATEX). This literature evolved to challenge the notion that fiscal policy could be effective in stimulating (or reducing) real activity.

RATEX theory argues that people (you and me) “know” the true economic model that generates actual outcomes. Accordingly, they anticipate everything the central bank or treasury is going to do and render it neutral in real terms but lethal in nominal terms. In other words, the government cannot increase real output with a fiscal or monetary stimulus but will always cause inflation.

Please read my blog – The myth of rational expectations – for more discussion on this point.

The rise of RATEX led to a re-prioritisation of policy targets – towards inflation control and away from broader goals like full employment and real output growth. Indeed, whereas previously unemployment had been a central policy target, it became a policy tool in the fight against inflation under this new approach to monetary policy.

So if any of this was a reliable indicator of the way people behave we should expect rising inflationary expectations (noted as a current policy danger by Rubin). In which case, why would people postpone consumption if they thought everything was going to become more expensive? There is no mainstream literature covering the apparent contradiction between the Ricardian consumers who are terrified of budget deficits and postpone consumption to save in order to service the future (higher – allegedly) tax rates (to pay the deficit back!) and the same RATEX consumers who believe the deficits will be inflationary.

The fact is that this is all nonsense!

In terms of Rubin’s article, it is clear that most of the headwinds he mentions are currently deflationary in nature and placing huge constraints on US economic growth. The unemployed would love to spend some more on gaining quality housing and/or better access to services but they won’t because they have no income.

Remember the golden rule: spending equals income and income generates more spending. All of which creates jobs.

Within this deflationary environment we keep hearing about the inflation threat. Rubin also buys into the erroneous position that the increase in base money is likely to lead to “undesirably heightened inflationary expectations”. So we better have a look for some reliable evidence of these heightened inflationary expectations.

The rest of the article is US-Hurrah-Hurrah sort of stuff – who could be listening to that nonsense any more and “working together one and all” sort of motherhood statements that get us nowhere. Whenever I hear that sort of talk I am immediately on alert for which business lobby is trying to screw the government and the workers while being there for “one and for all”.

Reuters journalist Felix Salmon had a lovely short analysis of the Rubin article (November 2, 2010):

The op-ed, which is written in borderline-unreadable technocratese, has a simple structure: there are headwinds in the economy. What should we do about them? Spending more might be problematic. Expansionary monetary policy likewise. So what should be done? The administration should be more business-friendly. And it should put together a “serious fiscal plan”.

I loved that assessment! The rest of Salmon’s discussion of Rubin’s arguments is also classic. For example, “Does Rubin really think it probable that the announcement of extra government spending would cause some kind of crazy market crash?” and “Rubin seems to be asking us to give up investment today on the grounds that it might cause business uncertainty tomorrow” etc.

Anyway, with all this talk of growing inflationary pressures I thought I better go hunting for them. Two sources of data can help us. Time series that capture price expectations and bond market data which allows us to construct the yield curve.

Inflationary expectations

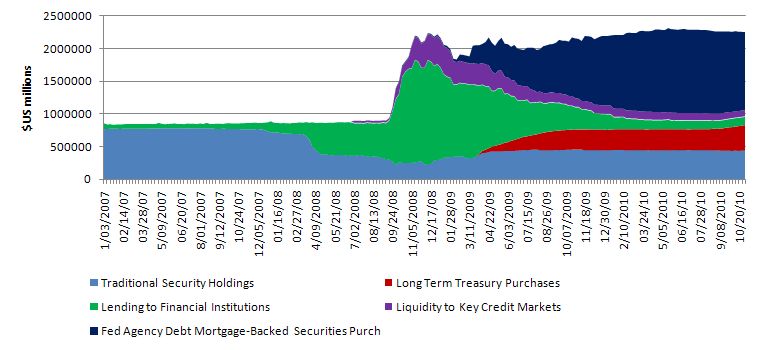

The balance sheet of the US Federal Reserve has grown amazingly over the last few years. We are all familiar by now with the following graph derived from data available from the Cleveland Federal Reserve Bank.

The mainstream macroeconomics textbooks are replete with discussions about base money or the central bank liabilities – which are held as reserves by banks and currency by the public. They claim that the ultimate money supplied is a multiple of the central bank liabilities. Please read my blogs – Money multiplier and other myths and Money multiplier – missing feared dead – for more discussion of this fairy tale.

Blanchard who is now IMF chief economist wrote a textbook that is representative of the genre. He said in his first edition that:

The central bank controls central bank money … an increase in central bank money leads, because of the money multiplier, to a more than one-for-one increase in the money supply …

The mainstream prediction is that the expansion of the Federal Reserve’s balance sheet (depicted above) will be inflationary because it has to mean a rapid expansion in the money supply. The Federal Reserve Board’s actions are equivalent in the mainstream models as “printing money” which makes it tantamount to their analysis of seignorage (when they “monetise” a budget deficit).

The question is how long does it take for our Ricardian/RATEX agents to build inflationary expectations given this sort of balance sheet expansion? Answer: the mainstream have no idea – they just assert that it happens. A rational agent should immediately adjust their expectations upwards.

Given the cliff-like nature of the Federal Reserve’s balance sheet expansion if any of this was true then there should be signs of inflationary expectations rising by now.

So we should be able to see this in the data given that the cliff was climbed more than two years ago and the Federal Reserve has shown no sign of reducing its balance sheet (exactly the opposite).

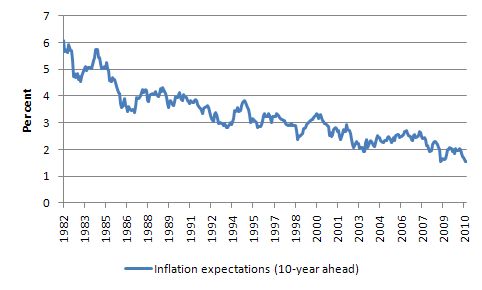

Data? The Cleveland Fed Estimates of Inflation Expectations data are a good source of data.

The following graph is drawn from that database and shows a time-series of inflationary expectations for a 10-year horizon. That is, the observations at each point in time reflect what the expected inflation rate would be in 10 years time from that observation.

So inflationary expectations continue to fall. Central banks claim they are interested in longer-term trends and that monetary policy today determines future inflation.

The Cleveland Federal Reserve Bank’s summary of their latest data release (graphed above) says:

… this suggests that the Federal Reserve still has credibility in keeping inflation low and that the massive increase in its balance sheet and the accompanying increase in banking system reserves has not served to unanchor the public’s expectations of inflation.

So where does Rubin get his idea that policy risks triggering “undesirably heightened inflationary expectations” from? Answer: Not the real world!

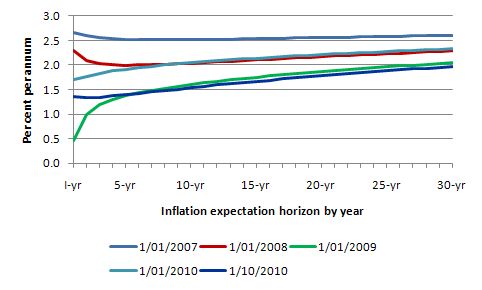

The next graph presents the US data in a different way. It shows for five different observations (the last being October 2010) what the structure of inflationary expectations was at that point in time from 1-year ahead predictions to 30-years ahead.

The data shows categorically that inflationary expectations across all forecast-horizons have fallen over the last few years as the Federal Reserve has been pumping up its balance sheet and the US Treasury pumping out its net spending. Even expected inflation 30-years out is lower now.

When does no evidence mean no evidence?

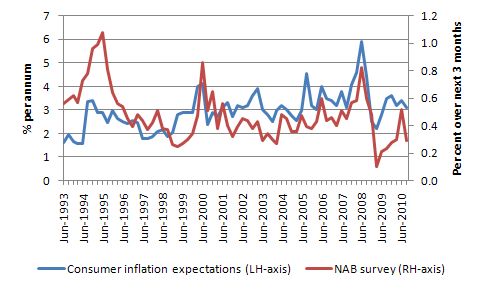

Australia? We are after all being touted as the one-in-a-hundred year (mining) boom economy at present and the central bank (RBA) is hiking rates because it thinks there is an inflation threat emerging. Well the latest evidence from the RBA – Other Price Indicators – Table G4 doesn’t support that line of reasoning.

The two series shown are the “Consumers’ inflation expectations” (Melbourne Institute median expected inflation rate for the year ahead) and the “NAB survey” of price expectations (National Australia Bank Quarterly Business Survey) – average expected increase in the price of final products in the next three months. These often-used data suggests that inflationary expectations in our “growth” economy are also moderating.

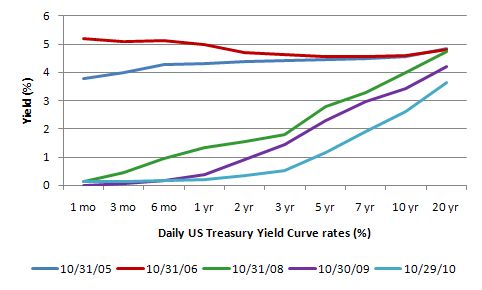

The yield curve says it ain’t so!

And what is the US Treasury Yield Curve telling us?

The yield curve is a graphical depiction of the term-structure of risk-free interest rates and plots the maturity of the government bond on the horizontal axis against the respective yields (return) on the vertical axis. We can use the term maturity and term interchangeably. So a 10-year Treasury bond matures in 10 years and in the meantime delivers some return (yield) to the bond-holder.

Please read my blog – Time to outlaw the credit rating agencies for more explanation of yield curves and Operation twist – then and now – for a brief a video presentation.

To understand the next point here are some essential yield concepts in fixed-income investments that are used in the markets. The yield indicates the money that will be returned from the investment and is usually expressed in percentage terms. There are several concepts of yield that can be defined.

- Coupon or Nominal Yield – If a bond has a face value of $1,000 and is paying 8 per cent in interest, the coupon rate, then the nominal yield is 8 per cent. The investor will thus receive $80 per annum until maturity. The coupon yield remains constant throughout the life of the bond.

- Current Yield – Suppose you purchase an 8 per cent $1,000 bond for $800 in the secondary market. Irrespective of the price you pay, the bond entitles you to receive $80 per year in coupon payments. But unlike the previous example, the $80 payment per year until maturity represents a higher current yield than 8 per cent. The actual yield is $80/$800 = 10 per cent. So to compute current yield you simply divide the coupon by the price you paid for the bond. In general, if you buy the bond at a discount to face value, the current yield will be greater than the coupon yield, and if you buy at a premium then the current yield will be below the coupon yield.

- Yield-to-Maturity (YTM) – The current yield does not take into account the difference between purchase price of the bond and the principal payment at maturity. YTM takes into account that as well as earning interest, an investor can make a realised capital gain or loss by holding the bond until its maturity date. YTM is a measure of the investor’s true gain over the life of the bond and is the most accurate method of comparing bonds with different maturity dates and coupon values.

Example: – Assume you pay $800 for a $1,000 face value bond in the secondary market. The $200 discount on the face value is considered income or yield and must be included in the yield calculations. Assume that the 8 per cent $1,000 bond had 5 years left to maturity when it is bought for $800.

A comparison of three yield concepts gives:

- Coupon yield of 8 per cent ($80 income flow divided by $1,000 face value).

- Current yield of 10 per cent ($80 income flow divided by $800 discounted purchase price).

- YTM of 13.3 per cent ($120 divided by $900) – see below.

The computation of YTM is complex and can be simplified to the following rule of thumb:

YTM = (C + PD)/[0.5*(FV + P)]

where C is the coupon, PD is the prorated discount, FV is face value, and P is the purchase price. If the bond is trading at a premium, the numerator subtracts the prorated premium from the coupon.

In our example:

YTM = [80 + (200/5)]/[0.5*($1000 + $800)] = $120/$900 = 13.3 per cent.

When bond traders talk about yield they are usually referring to the YTM measure which is the only measure that asseses the effect of principal price, coupon rate, and time to maturity of a bond’s actual yield.

What determines the slope of the yield curve?

There are broadly three shapes that the curve will take:

- Normal – Under normal circumstances, short-term bond rates are lower than long-term rates. The central bank attempts to keep short rates down to keep levels of activity as high as possible and bond investors desire premiums to protect them against inflation in longer-term

maturities. Combined, the yield curve is upward sloping. - Inverted – Sometimes, short-term rates are higher than long-term rates and we say the yield curve is inverted. The usual events which lead to an inverted yield curve are that the economy starts to overheat and expectations of rising inflation lead to higher bond yields being demanded. The central bank responds to building inflationary pressures by raising short-term interest rates sharply. Although bond yields rise, the significant tightening of monetary policy causes short-term interest rates to rise faster, resulting in an inversion of the yield curve. The higher interest rates may then lead to slower economic growth.

- Flat – A flat yield curve is seen most frequently in the transition from positive to inverted, or vice versa. As the yield curve flattens the yield spreads drop considerably. A yield spread is the difference between, say, the yield on a one year and a 10-year bond. What does this signal about the future performance of the economy? A flat yield curve can reflect a tightening monetary policy (short-term rates rise). Alternatively, it might depict a monetary easing after a recession (easing short-term rates) so the inverted yield curve will flatten out.

There are various theories about the yield curve and its dynamics. All share some common notions – in particular that the higher is expected inflation the steeper the yield curve will be other things equal.

The basic principle linking the shape of the yield curve to the economy’s prospects is explained as follows. The short end of the yield curve reflects the interest rate set by the central bank. The steepness of the yield curve then depends on the yield of the longer-term bonds, which are set by the market. But the short end of the curve is the primary determinant of its slope. In other words, the curve steepens mainly because the central bank is lowering the official cash rate, and it flattens mainly because the central bank is raising the official cash rate.

Bond traders link the dynamics of the yield curve to their expectations of the future economic prospects. When the yield curve flattens it is usually accompanied by deflation or steady and low inflation and vice versa.

One of the risks in holding a fixed coupon bond with a fixed redemption value is purchasing power risk. Economists believe that most people would prefer to consume now rather than later if there was to be a trade-off. To encourage foregone consumption now, a yield on savings must be provided by markets. The yield is intended to allow a person to consume more in the future than has been sacrificed now. But if the prices of real goods and services increases in the meantime, then even with the yield, the individual’s command over real things is less than it would be if prices were stable. It is possible, that the inflation could wipe out yield.

Take this example of a zero real interest rate. A person invests in a one-year $1,000 coupon Treasury Bond with a single coupon payment expected of $100. The individual will expect to get $1,100 on the redemption date. Assume that over the holding period, prices rise by 10 per cent. At the end of the year, a basket of goods that previously cost $1,000 would now cost $1,100. In other words, the investor is no better off at the end of the year as a result of the investment. The nominal yield has been swallowed by the inflation.

Purchasing power risk is more threatening the longer is the maturity. So it is one reason why longer maturity rates will be higher. The market yield is equal to the real rate of return required plus compensation for the expected rate of inflation. If the inflation rate is expected to rise, then market rates will rise to compensate. In this case, we would expect the yield curve to steepen, given that this effect will impact more significantly on longer maturity bonds than at the short end of the yield curve.

So what does the current US yield curve tell us about inflationary expectations? The following graph shows the US Treasury yield curve for four separate observations over the last several years (2-pre and 2-post crisis). You can get daily data across the term-structure from the US Treasury.

The yield curve is telling us that the long-term/short-term yield spread is narrowing and this suggests that the markets are not foreseeing rising inflation in the long-term. This is another piece of evidence that refutes the Rubin nonsense.

Conclusion

So the latest evidence using indicators that are popularly deployed within the markets and produced by the markets does not support the inflation hysteria. Inflation might occur in the future but it will not be because of today’s deficits or monetary operations.

And if it does then a rapid fiscal policy response could easily contain it.

That is enough for today!

In regards to RATEX, one of my favorite quotes by Bill Wollman of Business Week is that most people think the Federal Reserve is a brand of whiskey. And, I (not Bill) would be willing to bet that ninety percent of the people have no idea what the Treasury does. But, I guess RATEX fits in with the idea of a stock market wealth effect. I know that most people I know can’t wait to buy because the price of stocks are bubbling up. Thanks for the blog.

This is what Bernanke said about QE1.

“Although asset purchases are relatively unfamiliar as a tool of monetary policy, some concerns about this approach are overstated. Critics have, for example, worried that it will lead to excessive increases in the money supply and ultimately to significant increases in inflation.

Our earlier use of this policy approach had little effect on the amount of currency in circulation or on other broad measures of the money supply, such as bank deposits. Nor did it result in higher inflation. ”

http://www.washingtonpost.com/wp-dyn/content/article/2010/11/03/AR2010110307372.html

Looks like the Rubins of the world are alive and well. Today the German Council of Economic Experts published its yearly report. In regard to the € they are in complete denial. Then their usual yearly attack on low income groups and the unemployed. Low income earners should pay higher taxes because the lower VAT must be abolished. And they dream up a myriad of supply side measurements to unwind the unemployed from their nasty preference for leisure. So much for when does no evidence mean no evidence? It’s unbelievable. Why is somebody still listening to the Rubins of the world?

Wasn’t it Galbraith that said that orthodox economics is based on the assumption that the rich don’t work because they are paid too little and the poor don’t work because they are paid too much.

“The yield curve is telling us that the long-term/short-term yield spread is narrowing and this suggests that the markets are not foreseeing rising inflation in the long-term.”

I think quite the opposite, the yield curve is steepening and in comparisson to your past observations, is at the steepest its been. Sorry, but the yield curve doesn’t support your argument of no inflation-anticipatory effects from QE.

How many billy blog readers are familiar with the term ‘plutonomy’? I learned the definition by watching/listening to Bill Moyer’s address at Boston U:

http://vodpod.com/watch/4847140-buniverse-bill-moyers-at-the-howard-zinn-lecture?u=dandelionsalad&c=dandelionsalad

I bring this to the attention of any blog readers who may be interested in accelerating promotion of the ideas being promoted by Bill Mitchell, Warren Mosler, L R Wray, and others who have been leaders in developing a better understanding of how modern money could work if appropriately trained and motivated expediters were to utilize the appropriate tools and techniques to facilitate full employment and a more nearly desirable culture. In order to facilitate information, the technique ‘RSA Animate’:

http://www.thersa.org/home

might be employed to translate such ideas as those offered at the ‘fiscal sustainability conference’ held earlier this year at GW Univ and which has recently been linked on billy blog. In addition, the interviews which Warren Mosler conducted with Norwich (CT) News might facilitate further definition of a financial expert’s recommendations to deal with the problems which currently plague the USA.

Of course, a revolution will have to occur if honest government were ever to occur; if things continue, as at present, we can try to obtain an optimal viewing station as we watch the coming degeneration/disintegration.

John,

What the yield curve is saying is that to the extent money is poured into the economy it does what MMT predicts and pushes the interest rate toward zero. The further you get from present reality where this is clearly playing out, the Monetarist mythology still prevails where no one can really believe we are on fiat currency and the natural interest rate is zero. The punditocracy is tumescent with the notion that inflation will bugger us all and supports the twenty year inflation myth.

Mainstream economists, like the military, are always ready with the tools to fight the last war, rather than the current one.

As asset prices become more and more volatile due to currency expansion that frightens small scale investors away from stocks or real estate and makes the least volatile assets the least bad of a bad bunch. Even if small scale investors presume that they will lose purchasing value by buying government bonds they will still do so if they think they would lose more by attempting to invest in other assets. Over the past decade the stockmarkets have been a fantastically efficient engine for transferring wealth from small scale investors to the elite investors. Small investors can see that.

I think quite the opposite, the yield curve is steepening and in comparisson to your past observations, is at the steepest its been. Sorry, but the yield curve doesn’t support your argument of no inflation-anticipatory effects from QE.

Huh? No big blow off in TIPS either. I guess the bond market doesn’t know or care much about inflation?

sorry to bust in, but this made me giggle – http://www.telegraph.co.uk/finance/economics/8121048/IMF-warns-austerity-measures-may-have-to-be-reconsidered.html

Dear john derpanopoulos (at 2010/11/10 at 23:41)

Thanks for your comment.

You asserted:

The following graph shows the 5-year, 10-year and 30-year US Treasury Bonds spreads against the 1-month bond yield for the period 2/09/2006 to 10/29/2010. The vertical red line is about the time (March 2009) when the FOMC announced their first bout of QE. So there has been plenty of time for long-spreads to increase to reflect any worries about inflation.

The spreads have fluctuated a bit they are now lower than they were at the start of this year. And they are lower or around the same level as they were when QE1 was implemented.

The evidence definitely supports my contention. I am sorry. I don’t make idle remarks if there is data available.

best wishes

bill

Thanks Bill. Very well written for a wide audience. The effort in keeping the explanations simple is very much appreciated by me.

apj that is very interesting, so the IMF can say they told us so no matter which way it goes. Thanks.

Word for the day from john is tumescent. Tumescent means bloated. The context is “bloated commentators”. Brings to mind a toad fish. Good one John.

I am not a Ratex Agent and I am not a Ricardian Agent. I am just part of the 80% majority who are confused. Not confused because I cant understand, just confused because the people who are paid to inform me don’t agree with each other. I believe this would be the same for 80% of the population.

In this uncertainty I must make decisions.

Punchy,

Echo that “confused because the people who are paid to inform me don’t agree with each other”.

After reading through hundreds of economic arguments I finally arrived at Billy Blog. At first, I instinctively rejected the ideas as I suspected another fringe crackpot interest group. After a while, I realised Bill is very open with his own political preferences and very accomodative to other opposing views. I find the MMT arguments consistent and largely supported by empirical evidence.

MMT forums are the only economic forums that provide a consistently satisfactory explanation and can link real effects with actual causes.

Billy Blog is definitely the least worst of the bunch 😉

Very interesting discussion on bond yields.

I think it is very difficult to extract any sort of inflation expectation from US nominal bond yields in isolation at the moment. How can we really argue that bond yields alone are telling us anything about QE, when the very act of QE involves buying bonds and hence moving the yields?

What we can do, though, is look at bond breakeven inflation rates. This is the spread between nominal bond yields and inflation-linked bonds yields. Breakeven inflation rates are the best guide to what the bond market thinks inflation will be.

I think the 10y breakeven inflation rate is around 2.20%. The 5y5y breakeven rate is up around 2.70%. I don’t have these exact figures to hand, if anyone can confirm recent figures, please do. These breakeven rates are not suggesting rampant inflation by any means. They are also are long way from expecting deflation. They are suggesting modest inflation.

However it’s worth keeping in mind that because the Fed’s bond buying programme only involves nominal bonds (not TIPS, to my knowledge), then it’s possible QE might be keeping breakeven inflation rates lower than most investor’s actual expectations are.

Whatever bond yields say about future inflation, can only reflect the average inflation forecasts of bond buyers. If half are projecting 10% inflation pa and half are projecting 2% the average forecast might 6% inflation. They will also have a different methodology to calculate the desired bond yield. No doubt the players will have differing philosophy on risk and yield expectations.

Nobody has a crystal ball to the future. Black swan events happen, political and demographic directions may change. Global warming/ peak oil may bite our butts sooner than later. If the current status of economic expertise and forecasting ability is taken into account. I’d say the ability of bond yield curves to predict inflation is about as good as throwing a bunch of sticks into the air.

Gamma, QE is not the only buyer (owner) of treasuries. It is a marginal buyer since FED is not allowed to own more than 35% of any single issue (relaxed now with QE2). So since there are other buyers and owners and since FED is targeting amounts and not yields, then these buyers should be happy with nominal as well as real yields.

I’d like to echo Andrew Wilkins@13:54 re searching other blogs and Gamma@17:53 re the interesting nature of the bond discussion (and Billyblog in general). I too experienced much the same thing as Andrew.

Bill, your blog is great and I appreciate it immensely. I use its insights daily in my work as well.

Dear Bill,

Thanks for your reply and the graph of the different yield curves you posted across time. If you focus on this graqph, you will see that all 3 yeild curves steepened from the onset of QE1 until its conclusion in Macrh 2010. Once the QE stropped, both the stock markets and the yield curve went into a dive until the summer. Since then, the markets have staged a big rebound once they were “introduced’ to the QE2 concept (at the Jackson Hall speech). The yield curve has again steeepened since then, but not as much as during QE1. My conclusion form this is that the yield curve prices-in nominal growth and/or inflation uncertainty -possiblity of higher inflation. This time around it seems the bond market is not as optimistic about the recovery prospects as the stock market, hence the less pronounced current steepening of the yield curve.

In either case, I find it ironic to say the least that the effects on the targetted instrument (the bond market) have been negative or adverse, whereas the effects on the supposedly dependent variable (equity prices) have been unambiguously positive. I know your response will be “that they fixed quantity not price,” but I think there is more to it than that. Unless you are willing to agree that they fixed qauantity with respect to the amount of bonds they would monetize while all along fixing price in terms of the stock indices (through the Fed banks/ primary dealers).

A brief note.

1. As I have explained in past comments long time ago, there is more to explaining the level, slope and curvature of the yield curve than inflationary explanations, such as default perceptions, exchange rates, economic prospects, animal spirits, uncertainty, policy rate perceptions, etc., too complex to control (entropy) towards the tail of the structure as control theory will point out!

2. Nonconventional facility measures of the CB (“easing”), beyond the policy rate induced OMO, should be presented by the following taxonomy. They occur as a) Liquidity facility (easing) that targets the money market spread via lability expansion of the CB balance sheet, b) Credit facility (easing) as duration easing of private portfolios exhanging long assets for reserves and spread easing that targets risk and tail spreads measured by expected shortfall and performed by CB asset portfolio reallocation for a given size, d) “qualitative” facility (easing) by changing collateral and investment qualification requirements.

A brief question for thinking economists.

Is liquidity a market? Or maybe as the Radcliffe Report implied it is a mind projection of the variable and not stable trade acceptance attribute of assets? Is it a public good?

Should a CB relay on an interbank market for the allocation of reserves in the presence of destabilizing counterparty risk or act as the monopoly issuer of direct bilateral operations as being the only banker to banks and internalizing all externalities of the liquidity attribute? Notice that this has nothing to do with the money multiplier concept!