Last Friday (December 5, 2025), I filmed an extended discussion with my Kyoto University colleague,…

Australia minimum wage rises but the Fair Work Commission still did not preserve real value as they claim

I am back at about 70 per cent but improving. This morning was good news although it should have been better. Australia’s minimum wage setting authority – the Fair Work Commission (FWC) – increased the federal minimum wage by 5.2 per cent or $A40 a week to $A812.60. In their decision – – Annual Wage Review 2021-22 – the FWC sought to protect the real living standards of the lowest-paid workers in the nation after receiving a ‘direction’ from the new Federal Labor Government to do so. They failed. Real wages for low-paid workers will still fall over the next 12 months, just not by as much as they would have had not the Federal government intervened and supported a 5.1 per cent rise (which was the March-quarter inflation rate). So good but should have been better. The major employer groups argued for variously very low nominal rises, while at the same, they enjoying booming profits and rising productivity growth. A scandalous indictment of our system.

In this blog post – Australia’s minimum wage rises – but not sufficient to end working poverty (June 6, 2017) – I outlined:

1. Progressive minimum wage setting principles.

2. The way staggered wage decisions (annually) lead to falling real wages in between the wage adjustment points.

I won’t repeat that analysis here. But it is essential background to understanding why the decisions taken by Fair Work Australia have been inadequate for a long time.

Where the parties stand

The FWC received bids (submissions) from various parties in the process of making its decision.

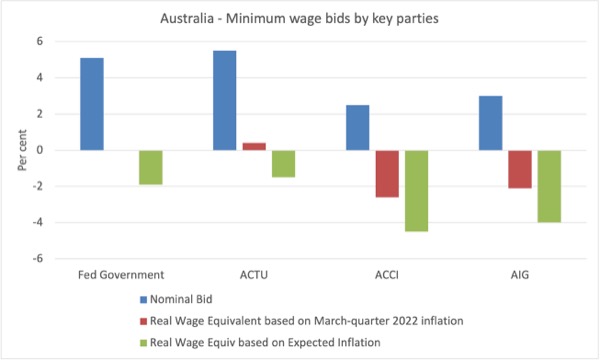

The follow graph summarises the key submissions from the Federal government – 5.1 per cent increase, the Australian Council of Trade Unions – 5.2 per cent increase, the Australian Chamber of Commerce and Industry (small business peak body) – 2.5 per cent increase, and the Australian Industry Group (large business peak body) – 3 per cent increase.

The red bars show the implications in real terms of those bids based on the March-quarter 2022 inflation rate, which means, in an environment of accelerating inflation, the impact is biased downwards.

The green bars show the implications for the real wage from the FWC decision based on what the RBA expects the peak inflation to be (about) and that is a more realistic assessment given that the inflation peak is likely to occur sometime before the FWC reconsiders the minimum wage adjustment in 2023.

So business wanted the lowest-paid workers and those most vulnerable to the current energy price crisis to endure sizeable real wage cuts – 4.5 per cent in the case of ACCI (but in fact, as I explain below that is also an understatement).

Lucklily for workers, the federal election came in time for the new government to change the narrative because the defeated conservative government typically lined up with business and would have refused to support even that “the real wages of low-paid workers do not go backwards”, which became the new Labor government’s entre in the matter (hence there is no red bar for that bid).

Although the new government’s position was welcome they did play dumb over the fact that if the FWC was really going to fulfill that aspiration then it would have to address expected inflation rather than just marking up to the March-quarter 2022 inflation figure.

By the time we are through the pay round (June 2023), the real wages of this cohort will have been seriously eroded, despite the 5.2 per cent award today.

The Federal Minimum Wage (FMW) Decision

In its 2022 decision – Fair Work Australia wrote:

The most significant changes since last year’s Review decision have been the sharp rise in the cost of living and the strengthening of the labour market …

The non-discretionary components of the CPI increased by 6.6 per cent over the year to the March quarter 2022. The increased cost of non-discretionary items such as basic food staples will particularly impact low-income households and many low-paid workers …

The level of minimum wage increases proposed by various employer bodies would result in real wage reductions for award-reliant workers, many of whom are low paid. If the Panel was to accept the submissions of some of the employer bodies, and award no increase, then the real wage reduction would be even more severe …

the Panel noted that it was conscious that the low paid are particularly vulnerable in the context of rising inflation. Further, given the sharp rise in the cost of living since last year’s Review, the increases awarded last year have resulted in a fall in the real value of the NMW and modern award minimum wages …

Taking all the relevant considerations into account led the Panel to award an increase of $40 to the NMW, which amounts to an increase of 5.2 per cent. The NMW will be $812.60 per week or $21.38 per hour. The Panel observed that this level of increase will protect the real value of the wages of the lowest-paid workers.

So, a rejection of the desire by all the employer groups to further impoverish their most vulnerable workers – at a time when corporate profits are booming and some segments of capital are making extraordinary gains as a result of the War in Ukraine and the inflationary chaos that is creating.

That is a good thing and demonstrates the value of public institutions (FWC) that can represent societal values rather than being an agent for capital.

But, of course, as I noted above, it is not quite true that a 5.2 per cent increase “will protect the real value of the wages of the lowest-paid workers”.

It helps but if they were really wanting to preserve then they would have increased the FMW by more than $119 rather than $40 to counter the immediate erosion of a nominal setting that starts on July 1, 2022 and remains unchanged until it is adjusted upwards 12 months later.

I won’t go into how I calculated that but it used extrapolate inflation rates.

More easily they could build into the system, a feature that is common on most multi-period bargains, escalation.

That is, they could easily award this shift in indexed quarterly steps to ensure that the expected inflation over the period that the nominal FWC remains unchanged is taken into account through the period.

Then I would take their claim to be protecting real wages more seriously.

But most people don’t see it at that level of detail and so the 5.2 per cent rise is celebrate – and it is surely better than what would have happened I suspect had the previous federal government won the May 21, 2022 election.

That regime took meanness and cruelty to a new level in this nation.

The FWC also ordered “a delayed operative date for modern awards in the aviation, tourism and hospitality sectors”.

The process of inflation is ongoing so while the FWC can talk about the damage real wage cuts inflict on living standards, the fact is that these workers will have to endure real wage cuts for the next several months, at least, which makes their claim to have rejected the ACCI (small business lobby) submission look pale.

These are the sectors ACCI represents, and, while they didn’t get the massive across the board real wage cuts they desired, they certainly got significant cuts in their key sectors.

The ACCI spokesperson was in the media today talking about “business stress” (Source) arising from the Decision.

He claimed that “businesses will either have to take to the bottom line or pass on to their customers”.

Or, just return their booming profits to more reasonable and historically normal levels (which are too high anyway).

One interesting statistic in the FWC Decision was that in April 2021, there were 13,040,400 persons employed in Australia with an official unemployment rate of 5.5 per cent.

In April 2022, there were 13,401,700 persons employed in Australia with an official unemployment rate of 3.9 per cent.

The slightly higher employment in April 2022, does not account for the large difference in the official unemployment rates.

The difference is largely because the growth in working age population flattened right out to around zero because the federal government closed the external border during the first two years of the pandemic.

This is one of those factors that is not getting any attention in the media.

As the border reopening gathers pace and inflows of short-term visa holding workers resumes and gets back to volume, the official unemployment rate will rise significantly given current labour demand.

All the talk of labour shortages (other than the massive number who are laid off sick with Covid and now the flu) are temporary and will evaporate quickly.

Then the idea that we are at full employment will be shown for what it is – another one of the many transitory factors distorting the economic data as as a result of the pandemic.

The Decision applies to around 2.7 million or 20 per cent of all employees in Australia through flow-on effects via Australia’s award pay system.

Real wage cuts for lowest paid workers

Now what is the impact of a 5.2 per cent increase in the NMW?

If we assumed all relevant workers were granted the increase on July 1, 2021 (see above = not!) then the following graph shows the annual percentage change in the real National Minimum Wage since the September-quarter 1998 up to September-quarter 2022 (the first quarter the new level will be applicable).

I assume the inflation rate will be constant at its March-quarter 2022 value for the next two quarters.

Conclusion: The real purchasing power equivalent of the NMC would still decline – just by less than in the last few quarters as a result of the FWC decision.

Staggered adjustments in the real world

The following graph shows the evolution of the real Federal Minimum Wage (FMW) since the June-quarter 2005 extrapolated out to September-quarter 2022 (the quarter in which the recent decision will start impacting) based on a constant (current) inflation rate.

This is the FMW expressed in purchasing power terms.

You can see the saw-tooth pattern that the theoretical discussion I provided in this blog post – Australia’s minimum wage rises – but not sufficient to end working poverty (June 6, 2017) – describes.

Each period that curve heads downwards the real value of the FMW is being eroded. Each of the peaks represents a formal wage decision by the Fair Work Commission.

You can gauge the annual growth in the real wage by comparing successive peaks.

The decisions since 2012 have provided for some modest real income retention by these workers although it depends on how inflation is measured.

You can also see the troughs became shallower between 2012 and 2016 than in the past because the inflation rate moderated as a result of the GFC and the austerity since that has kept economic activity at moderate levels.

In more recent years the peak-trough amplitude has risen again.

So while each adjustment provides some immediate real wage gain for workers, those gains are ephemeral and the inflation process systematically cuts the purchasing power of the FMW significantly by the time the next decision is due – these are permanent losses.

As a result of today’s decision, the new peak in the FMW will still be below the peak achieved for the September-quarter 2020, which means the FWC has not really followed through on the Federal government’s desire to protect real wage standards for low-paid workers.

Poverty wages do not improve as a result of the FWC decision

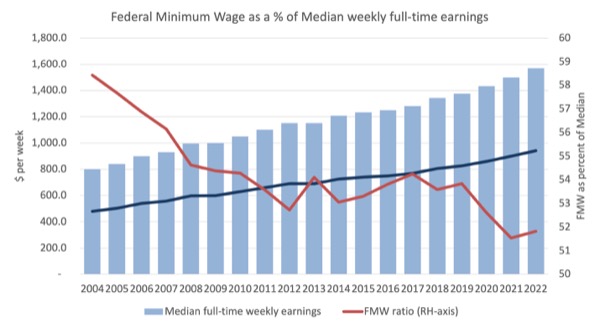

There was a lot of discussion about a “fair” minimum wage and the concept of a living wage, which is often considered to be 60 per cent of the median wage.

This is sometimes expressed as the 60 per cent of median income poverty line.

The Fair Work Commission agreed that there were many workers in highly disadvantaged situations and contested the claims from the employers that the Commission had no role to play in setting living standards.

The following graph shows Median weekly earnings of full time employees from 2004 to 2022 (blue bars) and the Federal weekly minimum wage as a proportion of the median (red line, right-axis, per cent).

For 2022 median earnings I extrapolated the annual growth from 2020-21, which is likely to understate the outcome.

The dark blue line is the 60 per cent of median income poverty line.

Since 2010, this desired ratio has languished well below 60 per cent, which is the benchmark that is universally used to denote a ‘poverty threshold’.

It is currently at 51.8 per cent and the new FMW decision increased it by 0.3 points – nothing.

What is the weekly shortfall?

Conclusion: The Federal Minimum Wage is around $128 per week shy of reaching the 60 per cent of median benchmark.

That should put the claims from the employer groups into perspective.

This is in an environment where profits and productivity have been rising.

Depriving workers a share of productivity growth

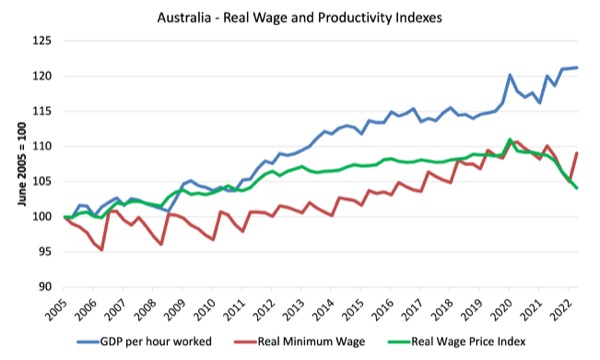

Another perspective is to compare the movement in the Federal Minimum Wage with growth in GDP per hour worked (which is taken from the National Accounts). GDP per hour worked is a measure of labour productivity and tells us about the contribution by workers to production.

Labour productivity growth provides the scope for non-inflationary real wages growth and historically workers have been able to enjoy rising material standards of living because the wage tribunals have awarded growth in nominal wages in proportion with labour productivity growth.

The widening gap between wages growth and labour productivity growth has been a world trend (especially in Anglo countries) and I document the consequences of it in this blog post – The origins of the economic crisis (February 16, 2009).

But the attack on living standards has targetted more than the bottom end of the labour market, although the minimum wage workers have certainly been more deprived of the chance to share in national productivity growth than other workers.

The following graph shows the evolution of the real Federal Minimum Wage (red line), GDP per hour worked (blue line), and the Real Wage Price Index (green line), the latter is a measure of general wage movements in the economy.

The graph is from the June-quarter 2005 up until September-quarter 2022 (indexed at 100 in June 2005 and extrapolated as above out to September 2022).

By June 2022, the respective index numbers were 121.1(GDP per hour worked), 105.2 (Real WPI), and 105 (real FMW).

All workers have failed to enjoy a fair share of the national productivity growth.

Like all graphs the picture is sensitive to the sample used. If I had taken the starting point back to the 1980s you would see a very large gap between productivity growth and wages growth, which has been associated with the massive redistribution of real income to profits over the last three decades.

In my view this represents the ultimate failure of capitalism.

Conclusion

Today’s decision is better than what would have been the case had not Labor won the May 2022 election.

But it still falls short of where things should be.

The FWC did not protect the real wage for the low-paid workers – they just made the cut smaller than otherwise.

In terms of the accepted 60 per cent of median full-time weekly earnings, the Federal Minimum Wage remains some $128 per week shy of reaching that benchmark, which is the commonly accepted poverty line for workers.

The gap reflects a history of decisions by Australia’s wage setting tribunals which have undermined the capacity of low-paid workers to enjoy real wage gains and keep pace with productivity growth.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Non-discretionary CPI rose 6.6% through the year…it would feel like a real wage cut already took place to many.

Does this process and decision making take into consideration the external sector and the exchange rate ?

2012 seems to be when the real wage price index moved away from GDP hours worked recently and the exchange rate was at 1.10 the highest point for 25 years. Wondering if they use this process and decision making to dampen down demand for imports?

As the strong currency would have affected Australia’s export industry. Australia’s balance of trade was at one of the lowest points over the last 25 years.

As rate hikes or rate cuts don’t effect private sector credit the way the central bank thinks it does. Does this process and decision making play any role in trying to effect private sector credit growth ?

As I am trying to work out how it effects the sectoral balances and the thought process at the heart of the white paper from 1945 and what their main concerns were.

http://www.billmitchell.org/White_Paper_1945/index.html

My thought process might be all back to front, but apart from obvious greed by the lobbying groups. I was wondering if there was any other reason for what happened from 2012. What effects the minimum wage has on the sectoral balances. What tools the Australian government uses to try and affect the exchange rate and private sector credit. If any, or do they just let it float.

Neoliberalism and globalism trademark is to reduce government spending and replace it with bank lending and reduce household savings. What they call small government.

Looking at the exchange rate now and the real terms of trade for Australia compared with 2012 there was plenty of room for manoeuvre for a bigger increase. seems like they are Scared of their own shadows because of inflation.

NEOLIBERALISM’S COLONIAL ORIGINS

https://moneyontheleft.org/2021/06/14/neoliberalisms-colonial-origins/

“Sound finance, regressive taxation systems, central bank independence, and the direction of the credit system by oligopolistic banks-were already applied in the European colonies, particularly in Africa.

During colonial times, sound finance had much more basic and transparent justifications than it does today. As an imperial doctrine by essence, it amounted to saying that the metropolis did not intend to participate financially in the colonial enterprise, which was supposed to be self-financing.

The “colonial self-sufficiency policy,” as historians call it, implied that the colonised territories had to pay for the costs of military conquest, the current expenditures of the colonial administrations as well as their investment expenditures, which were often oriented towards infrastructure projects that favoured the profitability of private metropolitan capital. The metropolis was just supposed to intervene sporadically, by granting subsidies or loans, when the financial situation of the colonies required it.

This extractive orientation was accentuated by colonial monetary arrangements and by the behavior of the banking sector, dominated from the outset by oligopolistic banks. In parallel with fiscal austerity, the fixed parity between the colonial and metropolitan currencies in a context of free capital mobility between the colonies and the metropolis and the obligation to cover the money supply entirely with foreign exchange reserves (as with the currency boards in the British Empire) gave a highly restrictive character to monetary policy. The idea that private banks should organize the credit system with some freedom-the freedom not to finance productive activities as opposed to extractive activities-while colonial governments should maintain balanced budgets was part of the imperial credo. ”

Throw in the IMF, world bank , EU treaties and NATO charters and we have come full circle. When the Berlin wall fell and the old Soviet Union collapsed the West didn’t need to create a new economic paradigm. They just picked up a very old economic model from the archives and blew the dust off it.

There’s a fantastic book still to be written by somebody out there, that compares all of the old colonial economic policies that empires used with the policies of today by the IMF, world bank , EU treaties and NATO charters. Frames them into today’s context. Which will show the human race clearly moved backwards in time and not as forward as many think.

You can probably replace the names of today’s Australian government and exchange the them with names from the past. As history flows through the breeze and rattles the wind chimes.

When you take a brief look at their concerns nothing has really changed that much especially with inflation. Who actually had the real power and the economic arguments that were being made at the time.

We have all been at this point in time before. The history books suggest more than once it continues to happen over and over again.

Warren Mosler and Phil Armstrong covered the Weimar Republic inflationary episode.

https://gimms.org.uk/2020/11/14/weimar-republic-hyperinflation-through-a-modern-monetary-theory-lens/

When you dig a little bit deeper there was a lot of interesting stuff going on. Vladmir Woytinksy and Rudolf Hilferding were very interesting characters. Because you can probably replace the names of today’s Australian government and exchange the them with names from Australia’s past. You can certainly do the same with most political and economic debates of today.

“Vladmir Woytinksy big idea was the ” WTB Plan,” a union-backed public works program, which was rejected by the Social Democratic Party (or “SPD”) on seemingly Marxist grounds. Vladmir Woytinksy, the Russian-born socialist economist responsible for drafting the WTB plan and Rudolf Hilferding, the Austrian-Marxist theorist and politician who turned the SPD against it. The stakes and fate of Weimar-era fiscal politics in light of a hegemonic gold standard that ruled across Europe and the United States, growing unemployment and suffering, and the German fascist movement that rose to answer such problems in violent and genocidal ways. How unrealized Weimar futurities in the past can help inform the struggle for public full employment today. ”

A brief history of the debate

https://moneyontheleft.org/2022/04/01/weimar-futurities-with-engelbert-stockhammer/

It is not even a challenge when you read the history of what was taking place at the time to replace the leading players of the debate at that time with the names of the leading players of today. You can have a bit of fun deciding who you can exchange Vladmir Woytinksy and Rudolf Hilferding with names from today.

Have a bit of fun comparing the stage this debate took place with the current state of affairs today. Who you would replace with who today on the stage.

If you come to the same conclusion as me and very quickly figure out why real change very rarely takes place. Why what I believe is happening in Australia today with the new government. Is a flash back to the old debates of the day.

You can replace Australia with any country really and take them back in time and they wouldn’t look out of place in the world of Vladmir Woytinksy and Rudolf Hilferding. Especially with the added advantage of Looking at this period of history through the MMT lens.

Readers in their own countries will have fun replacing Vladmir Woytinksy and Rudolf Hilferding with people they know in their own countries.

The MMT lens has spoiled history for me. I can’t read history nowadays without giggling and laughing all the way through or ending up with a heart full of rage.

I dunno how MMT economists can teach mainstream economics. They must react to economics in the same way. MMT must have spoiled economics for them in some way.