Yesterday, the Reserve Bank of Australia finally lowered interest rates some months after it became…

Australia’s minimum wage rises – but not sufficient to end working poverty

Today, the Australian Fair Work Commission (FWC), which is a judicial institution charged with setting minimum wages and conditions announced the outcome of their – Annual Wage Review – 2016-17. The FWC decided to lift the National Minimum wage by 3.3 per cent over the next year at a time when the inflation rate is running around 2.1 per cent. In other words, the lowest-paid workers are finally get a a much-needed real wage increase when other workers (on higher wages) are experiencing record low wages growth and real wage cuts. For years, the relatively between those on minimum wages and those on average earnings has been increasing as the low-paid have been forced to endure regular real wage cuts. In the last year or so that position has reversed as the non-minimum wage workers have been forced to endure record low wage increases and in recent quarters real wage cuts and the FWC has awarded modest real wage increases to the minimum wage workers. However, while today’s decision provides for some real wage growth for the lowest paid workers it is hardly anything to write homeabout, and, in the words of the FWC itself, not sufficient to lift the minimum wage workers who are experiencing working poverty out of that state. Life for low-wage workers in Australia is tough and would be much tougher if there were not enforced regulations to stop the capitalists from taking more and dishing out capricious treatment to the workers.

In their Annual Wage Review 2016-17 Statement, the FWC said:

We have determined that it is appropriate to increase the NMW and the factors identified in our decision have led us to award an increase of 3.3 per cent. The national minimum wage will be $694.90 per week, or $18.29 per hour. The hourly rate has been calculated by dividing the weekly rate by 38, on the basis of the 38-hour week for a full-time employee. This constitutes an increase of $22.20 per week to the weekly rate or 59 cents per hour to the hourly rate.

They justified this decision in the following way:

1. “The economy has continued to grow, slightly below trend, with real GDP increasing by 2.4 per cent over the year to the December quarter 2016 … Wages growth remained subdued … The subdued inflation means that there is little risk to the macroeconomic inflationary environment from our decision.”

2. “The prevailing economic circumstances provide an opportunity to improve the relative living standards of the low paid and to enable them to better meet their needs.”

3. “Our consideration of the international research on the impact of increases in minimum wages on employment, particularly the UK research, has fortified our view that modest and regular wage increases do not result in disemployment effects. ”

4. “… we acknowledge that the increase we propose to award will not lift all award-reliant employees out of poverty …”

5. “The level of increase we have decided upon will not lead to inflationary pressure and is highly unlikely to have any measurable negative impact on employment. It will, however, mean an improvement in the real wages for those employees who are reliant on the NMW …”

So that is very clear – a wage increase for the lowest-paid workers in Australia (around 196,000 workers) will not, as the employers’ representatives and the Federal government had argued in calling for much lower increases (which would have delivered further real wage cuts) – be inflationary or damage the employment prospects of the low-paid.

Our conservative federal government’s submission had urged the FWC to only pass on modest increases in the NMW because otherwise job creation would be impaired.

The FWC rejected that old line of argument.

The government had claimed that adjusting the minimum wage:

… was not an efficient way to address relative living standards or the needs of the low-paid.

This is also a standard line. The claim is that it is better to address poverty through the transfer system rather than the wage system.

But this is from a government that is hacking into the welfare and the transfer system at the expense of the poorest Australians.

Their hypocrisy knows no bounds.

The peak union body, the Australian Council of Trade Unions (ACTU) had called for a $45 per week rise, twice the amount that was subsequently awarded by the FWC today.

On the other hand, the employers had called for a $8.10 per week increases (that is, 1.2 per cent), which amounts to 75 per cent of the increase in the inflation rate – in other words, they were content for the lowest-paid workers to continue to endure real wage increases.

Last year’s FWC decision had increased the NMW by just 2.4 per cent, which depending on the way you measure the inflation rate amounted to a very small real wage gain, a static real outcome or a modest real wage cut.

But the two decisions before that had seen the real wage cut for the minimum wage workers.

The hourly increase in today’s decision amounts to around 59 cents. Hardly anything really given the on-going hardships that this cohort of workers have to endure in terms of housing costs.

It is also not much at all for vulnerable workers under relentless attack from capricious employers who are facing a major cut in total incomes in the coming period as a result of the decision by the FWC to cut penalty rates for weekend work.

I will come back to what today’s decision means in terms of relativities and real wage movements soon. But first some minimum wage principles are important to lay down.

Minimum wage principles

I regularly write analytical reports for trade unions who are defending industrial matters on behalf of the members in the Fair Work Commission in Australia. That often requires me to appear as an expert witness in the relevant matter.

There is a growing trend among employers to try their hand in the FWC to revise the legal award determinations for particular sectors and eliminate job protection, penalty rates, etc. It is a sort of spray gun approach – attack everything just in case you get something.

The claim is always the same – we cannot pay the conditions we agreed. It says more about their management skill and sense of business ethics than anything else.

Yet the FWC has repeatedly found that the wage determinations over many years across many sectors have not undermined the profitability of the firms.

However, I do not consider minimum wages should be set on private sector capacity to pay principles. The employers should adjust not the workers.

The principle that the FWC should follow is clear.

The minimum wage as a statement of how sophisticated you consider your nation to be or aspire to be. Minimum wages define the lowest material standard of wage income that you want to tolerate.

Accordingly, it should be a wage that allows a person (and family) to participate in society in a meaningful way and not suffer social exclusion or alienation through lack of income.

It is a statement of national aspiration.

In any country it should be the lowest wage that society considers acceptable for business to operate at. Capacity to pay considerations then have to be conditioned by these social objectives.

If small businesses or any businesses for that matter consider they do not have the ‘capacity to pay’ that wage, then a sophisticated society will say that these businesses are not suitable to operate in their economy.

Such firms would have to restructure by investment to raise their productivity levels sufficient to have the capacity to pay or disappear.

This approach establishes a dynamic efficiency whereby the economy is continually pushing productivity growth forward and allowing material standards of living to rise.

I consider that no worker should be paid below what is considered the lowest tolerable material standard of living just because some low wage-low productivity operator wants to produce in a country and make ‘cheap’ profits.

I don’t consider that the private ‘market’ is an arbiter of the values that a society should aspire to or maintain. That is where I differ significantly from my profession.

The employers always want the wages system to be totally deregulated so that the ‘market can work’ without fetters. This will apparently tell us what workers are ‘worth’.

The problem is that the so-called ‘market” in its pure conceptual form is an amoral, ahistorical construct and cannot project the societal values that bind communities and peoples to higher order considerations.

The minimum wage is a values-based concept and should not be determined by a market.

All of that is in addition to the usual disclaimers that the pure ‘competitive market, cannot exist for labour given the imbalances between workers and employers and the fact that the use value of the labour power is derived within the transaction (that is, the worker has to be forced to work). This is unlike other exchanges where the parties make the deal and go their separate ways to enjoy the fruits of their trade.

Anyway, those principles govern the way I operate as a professional and make me a ‘martian’ relative to my professional colleagues.

Staggered wage decisions and real wages

The annual minimum wage adjustment cycle that exists in Australia means that minimum wage workers have to endure systematic cuts in their real wages more than they would if the adjustments were indexed through the year after an annual review decision.

With inflation being a continuous process (more or less), the annual adjustments by the Fair Work Commission hand employers huge gains and deprive the workers of real income in between decisions. The following discussion and diagram explain why.

Assume that at the time of policy implementation, the real Federal Minimum Wage (FMW) wage was w1 and there was no inflation. The wage setting authority manipulates a nominal minimum wage (the $ weekly value) and the real wage equivalent of this nominal wage is found by dividing the nominal wage by movements in the price level. Assume that inflation assumes a positive constant rate at Point 0 onwards.

The nominal wage is the $-value of your weekly wage whereas the real wage equivalent is the quantity of real goods and services that you can purchase with that nominal wage. For a given nominal wage, if prices rise then the real wage equivalent falls because goods and services are becoming more expensive.

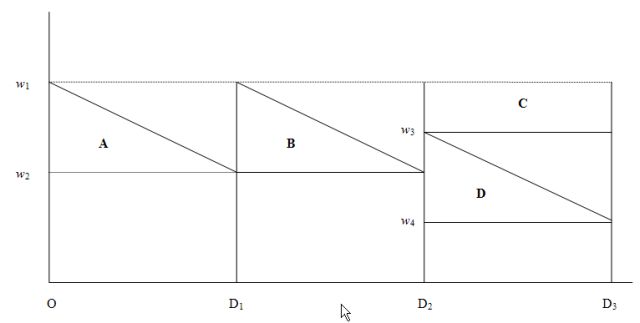

The following diagram depicts the real income losses that arise when wage adjustment is not indexed to the price level on a continuous basis – as is the case when the Fair Work Commission makes an annual adjustment in the FMW:

Over the period O-D1 the rising price level continuously erodes the real value of the nominal wage and immediately before the next indexation decision, the real wage equivalent of the fixed nominal FMW is w2. The real income loss is computed as the area A, which is half the distance (0-D1) times distance (w1-w2).

At point D1 the wage setting authority increases the nominal wage to match the current inflation rate which restores the real wage to w1, but the workers do not recoup the deadweight real income losses equivalent to area A.

The same process occurs in the period between the D1 and the next decision D2, resulting in further real income losses equivalent to area B.

These losses are cumulative and are greater: (a) the higher is the inflation rate; (b) the longer is the period between decisions; and (c) the higher is the real interest rate (reflecting the opportunity cost over time).

Clearly, the patterns of real income loss are different if the wage setting authority adopts a decision rule other than full indexation (that is, real wage maintenance). For example, say it decides not to adjust nominal wages fully at the time of its decision (or in fact at the implementation date of its decision) to the current inflation rate then the real income losses increase, other things equal.

So at time D1 the authority decides to discount the real wage (less than full indexation) and increases the nominal wage rate such that the real wage at that point is equal to w3.

Over the next period to D3, the real wage falls to w4 and at the time of the next decision (implementation time D3) the real income losses would be equal to the triangle D (reflecting the inflation effect over the period D2- D3, plus the rectangle C, which reflects the losses arising from the decision to partially index at D2.

Similarly, one can imagine that the adjustment at a particular time might involve a real wage increase (more than full compensation for the current inflation rate) which would then partially offset some of the real income loss borne in the previous period when nominal wages were unadjusted but inflation was positive.

So if you understand the saw tooth pattern of indexation shown here you will see that the triangles A and B represent real losses for the workers between wage setting points even if real wage maintenance is the preferred policy.

These losses are worse (areas C and D) if there is only partial adjustment. These losses occur because inflation is a more continuous process than the adjustments in FMW and accrue to the employer. The employers are pocketing these wage losses every day because their revenue is geared to the price rises and they are paying constant nominal wages to the workers.

The other problem is that the usual source of growth in real wages for workers is to share in the productivity growth of the nation.

Workers not reliant on the annual Federal minimum wage adjustment achieve that through their enterprise bargains although over the last twenty years even those workers have been mostly unsuccessful in achieving a proportionate increase in real wage relative to productivity growth as sequential federal governments have legislated against trade unions and undermined the capacity of workers to bargain on a reasonable basis.

Wage Parity

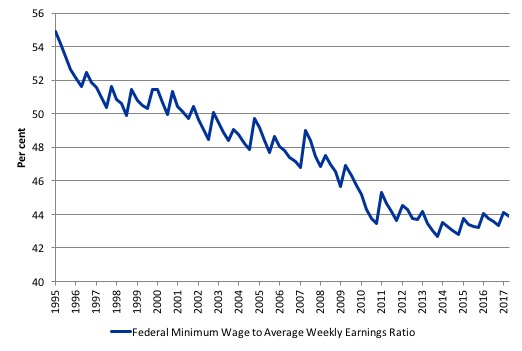

In terms of parities with other wage earners, the following graph shows the ratio of the Federal minimum wage to the Full Time Adult Ordinary time earnings series provided by the ABS (the latest being for the December-quarter 2015). This series in now bi-annual (previously quarterly). I have interpolated on the basis of the most recent growth.

I simulated this series out to December-quarter 2017 (the quarter after which the latest FWC Annual Wage decision will start impacting) based on a constant growth in earnings (assessed over the last 12 months).

The new FWC applies from July 1, 2017 so will be constant over the rest of the 2017-18 financial year.

The logic of the neo-liberal period which encompasses the data sample shown was to at least achieve cuts at the bottom of the labour market, given that workers with more bargaining power would put up resistance against generalised cuts.

Successive minimum wage decisions have forced workers at the bottom of the wage distribution to fall further behind in relative terms.

In the December-quarter 1993, minimum wage workers earned around 55 per cent of the Full Time Adult Ordinary time earnings. By June 2017, this ratio will have fallen to around 44.3 per cent. There has been a serious erosion of parity over the last 18 years.

But in the last two years, as the general Wage Price Index grows at record low levels and the FWC awards slight real wage increases to the minimum wage workers, the erosion in the parity has started to reverse – albeit modestly.

Another way of looking at this dismal outcome is to compare the movement in the Federal Minimum Wage with growth in GDP per hour worked (which is taken from the National Accounts). GDP per hour worked is a measure of labour productivity and tells us about the contribution by workers to production.

Labour productivity growth provides the scope for non-inflationary real wages growth and historically workers have been able to enjoy rising material standards of living because the wage tribunals have awarded growth in nominal wages in proportion with labour productivity growth.

That relationship has been severely disrupted by the neo-liberal attacks on unions, wage fixing tribunals and other legislative initiatives that have eroded the capacity of workers to share in labour productivity growth.

The widening gap between wages growth and labour productivity growth has been a world trend (especially in Anglo countries) and I document the consequences of it in this blog – The origins of the economic crisis.

But the attack on living standards has been accentuated at the bottom end of the labour market.

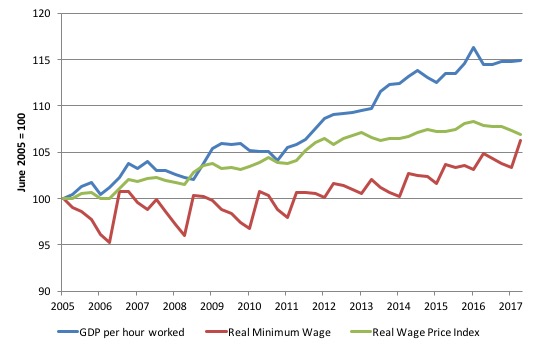

The following graph shows the evolution of the real Federal Minimum Wage (red line), GDP per hour worked (blue line), and the Real Wage Price Index (green line), the latter is a measure of general wage movements in the economy. Th graph is from June 2005 up until June 2017 (indexed at 100 in June 2005).

By June 2017, the respective index numbers were 114.4 (GDP per hour worked), 107.4 (Real WPI), and 103.3 (real FMW). This tells us that all workers have failed to enjoy a fair share of the national productivity growth, and that minimum wage workers in Australia have been largely excluded from sharing in any of the productivity growth.

The wage tribunals have only allowed the most modest growth in the real standard of living that the minimum wage workers over the last 10 years.

Of-course, like all graphs the picture is sensitive to the sample used. If I had taken the starting point back to the 1980s you would see a very large gap between productivity growth and wages growth, which has been associated with the massive redistribution of real income to profits over the last three decades.

Please read my blog – The origins of the economic crisis – for more discussion on this point.

Staggered adjustments in the real world

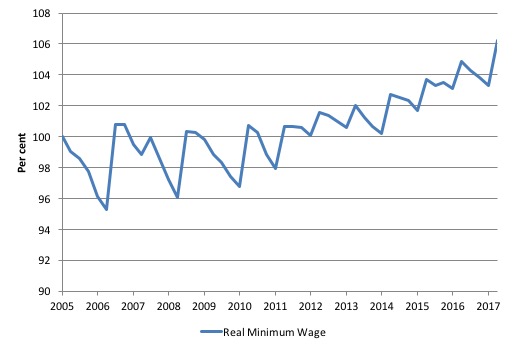

The following graph shows the evolution of the real Federal Minimum Wage (FMW) since June 2005 extrapolated out to September 2017 (the quarter in which today’s decision will start impacting) based on a constant (current) inflation rate.

This is the FMW expressed in purchasing power terms.

You can see the saw-tooth pattern that the theoretical discussion above describes.

Each period that curve heads downwards the real value of the FMW is being eroded. Each of the peaks represents a formal wage decision by the Fair Work Commission. If the trough in the saw-tooth lies below the 100 line on the vertical axis then the real wage falls by the end of the period.

If the trough lies above the 100 point then the inflation during the year after the last wage decision has not fully eroded the real wage increase and so there is some modest net real wage increase for Federal minimum wage workers over the period.

The decisions since 2012 have provided for some modest real income retention by these workers although it depends on how inflation is measured.

You can also see the troughs are shallower in recent years than in the past because the inflation rate has moderated as a result of the GFC and the austerity since that has kept economic activity at moderate levels.

So while each adjustment provides some immediate real wage gain for workers, those gains are ephemeral and the inflation process systematically cuts the purchasing power of the FMW significantly by the time the next decision is due – these are permanent losses.

Conclusion

The conclusion is that today Australia’s lowest-paid workers received a small wage rise – but the rise was not sufficient to end working poverty.

It also provides for the most modest real wage increase and fails to share the productivity growth Australia is creating with this cohort in any significant way.

But if the employers and Federal government had their way, these workers would be enduring harsh real wage cuts. So at least the FWC rejected their calls.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

Bill, I can understand you wishing the FWC had been politically braver and set the minimum wage at where they actually think it should be, but you shouldn’t let that blind you to the fact that for the first time in many years they actually think it should be higher. The FWC accepted the reasoning and evidence behind the ACTU’s, not the employers or governments’, submissions and basically argued in its decision that a high minimum wage was a Good, not a Bad, Thing. This is a big change in mindset from previous decisions.

In particular, they have clearly accepted two things they have never accepted before:

– any disemployment effects of a high minimum wage are exceedingly modest

– wages growing slower than labour productivity is a serious macroeconomic problem, which will not necessarily self-correct in time, as well as a direct problem for income distribution.

Their decision is worth a careful read.

So the Australian assault on the middle class gains momentum, in a climate of calls to cut penalty rates, education subsidies, corporate tax to make us ‘competitive’ and Centrelink benefits to ‘bludgers’. And when (if) the middle class wake up to what has been done, they will express their anger by voting for an Australian Trump, who promises to stop giving the middle class’s money to welfare dependent working class bludgers and bring the jobs back. In other words, the middle class won’t wake up. They never have. They never will. Our only hope is the Millennials will use the tiny time window they have to engage politically and turn this around while there are enough old lefties around to help with numbers. You’re our only hope, Obi Young Kenobies.