These notes will serve as part of a briefing document that I will send off…

The class war is over, viva the class war – inflation and all that

Political leaders have been keen to promote individualism over the last several decades because it suits the class interests they serve. Margaret Thatcher denied the existence of society. John Major, who shafted her to take over the Tories in 1990 and pressured the UK to join the EU, claimed there was a society but that he would render it “classless” so that everyone has the opportunity to shine according to their talents. Within the Tory tradition, David Cameron, who effectively through bungling paved the way for the UK to leave the EU (finally) told the people “There is such a thing as society; it’s just not the same thing as the state” and promised to create a “Big Society” where we all worked together to volunteer and provide public services as charitable endeavours. On the Labour side, in 1999, Tony Blair clarified all these claims to classlessness by declaring that “the class war is over”. Class struggle is dead. We are all on the same side now. All sharing in a commonwealth that we create together. I recall a BBC program I saw around the turn of this century that declared the ‘class system’ was dead and that we had all become elevated, together, in the middle class.

‘Scuse me while I kiss the sky (Jimi Hendrix – Purple Haze – 1967).

That must be it.

I must have been so far out of it all these years that I missed something.

On September 28, 1999, the British Prime Minister Tony Blair addressed the Annual Labour Party Conference at Bournemouth and presented a rather extraordinary vision for the C21 Britain (and the world for that matter).

In his – Speech – he declared that his government was laying “the foundatinos of a New Britain” where we abandon “power to the people”, and, instead, extol the virtues of “power to each person”.

He then announced that:

The class war is over.

He considered the battle between capitalism and socialism was also over. Capitalism had won.

He claimed business (as a group) was now seeing the advantages of sharing the bounty rather than pursuing the old conservative approach of keeping workers down.

Things certainly didn’t pan out as he was dreaming.

The Financial Times ran an article on Tuesday (June 7, 2022) – Class war > rate hikes – that brought back memories of all that bunk about the class system disappearing.

The article discussed a US Federal Reserve research paper that I had previously written about in this blog post – US Federal Reserve Bank economists going Marxist on us (May 30, 2022).

It was quite an extraordinary article because it essentially abandoned the ‘Monetarist’ perspective on central banks and inflation and situated inflationary pressures in the battle between labour and capital over the real income shares in nominal income produced in the economy at any point in time.

At the basis of the conjecture was a Marxist construction of labour and capital struggling to gain the upper hand in the production and distributional process.

Mainstream gone wild in other words.

The Financial Times article accentuates this for its readers saying that:

… the impact of the “Volcker shock” has been vastly overplayed, and that the inflation of the 1970s was solved through de facto class war and the degradation of the union movement rather than monetary policy.

In other words, all the stories that it was Paul Volcker as the boss of the US Federal Reserve using interest rate hikes that killed the 1970s inflation

is not substantiated by the evidence.

The ideas of Milton Friedman and Robert Lucas Jr rejected in one paper – not from a heterodox paper (there have been many over the years expounding the same rejection which were ignored by the mainstream) – but from researchers deep inside the US central bank.

As I noted in the blog post I cite above, none of these ideas are new.

Marxists have been writing about the role that class struggle plays in determining the economic trajectory including any inflationary pressures for decades and it is at the core of progressive inflation theory – including Modern Monetary Theory (MMT).

Inflation went away in the 1980s and 1990s because of the “collapse in worker bargaining power since the 1980s”.

The Financial Times article adds to the scrutiny on monetary authorities, who think their one trick pony – increasing interest rates – will tame any inflationary episode.

The article also adds weight to my contention (which is increasingly being rejected by mainstream economists – which I take as a good sign), that the inflationary episode we are in at present is transitory.

I saw someone claim that Larry Summers was right because he predicted there would be inflationary pressures building up.

Well he was right about the latter but for the wrong reasons, which means he was wrong.

He claimed the inflation was the result of what he considered to be excessive fiscal stimulus.

In fact, the inflation has little to do with the conduct of fiscal policy over the course of the pandemic.

The Financial Times is accurate in concluding that:

If sustained inflation derives from class war, then the chances of the current bout becoming entrenched again are extremely low.

The working class as a cohesive social force no longer exists. Businesses can safely protect their margins and the burden of inflation will fall on labour as real wages fall. Sustained price rises will eventually subside as supply shocks from the pandemic and war fade and real spending power is eroded.

The class war is dead. Viva the class war.

Which is exactly where we are at now.

The supply shocks have created a cost impulse into the economy.

One might then claim that with the supply disruption, demand would have to adjust downwards.

Except that would require the creation of mass unemployment, increased poverty.

That is exactly what central banks are engineering at present with their interest rate rises.

They are not admitting that – claiming things that the labour market is in good shape and people have saving buffers that will protect their consumption spending from price rises (in other words, allowing the inflation to eat into their wealth portfolio rather than their spending flow).

But that is exactly what they are up to – creating a demand shock to solve a supply shock.

Which is exactly the worst thing for them to be doing.

And as the Financial Times article notes – there is no danger of a wage-price spiral breaking out and perpetuating the supply shock beyond its initial impact because workers are unable to force wage increases onto businesses.

Trade unions are weak and have limited coverage.

Several decades of neoliberal governments around the world have legislated to make it difficult for trade unions to function and achieve better wage outcomes for their diminishing stock of members.

So business can just pass on the rising costs and “protect their margins”, which means all the burden falls onto workers.

Which means that a supply shock can introduce inflationary impulses into an economy but cannot really gain traction beyond the impulse because one or both price setting groups (labour and capital) in the society are powerless to defend their real wage or profit margin.

In the context of workers’ bargaining power being weakened, the inflationary impulse is just passed on through prices broadly and real wages fall.

Exactly what is happening now.

Once the supply factors ease, the inflation will ease.

When will that be?

Who knows when Covid will become a non-issue.

Who knows when Putin will end his attack on the Ukraine.

I did a radio interview yesterday where I was asked, in the context of public service workers going on strike in NSW, whether these workers should have more responsibility and not force higher costs onto firms who are struggling with the supply shock.

I said that it was not sensible to force one set of workers to endure burdens if they could escape them through industrial action just because other segments of the work force were unable to achieve that aim.

Setting one segment of the working class against another misses the point.

Class struggle is about the workers as a collective up against capital.

And it is clear that capital is winning hands down.

Last week’s National Accounts data (reviewed in this blog post – Australia National Accounts – growth moderates but wage share falls below 50 per cent (June 1, 2022)) – showed that the wage share in Australia fell again the March-quarter and was now below 50 per cent.

It used to be around 60 per cent.

The winners – profits.

And the data showed that productivity growth was relatively strong.

What does that mean?

Productivity growth means workers are working harder, longer, and/or more intensely – to achieve higher unit output per unit of labour input.

It means unit costs are falling and thus provides the non-inflationary space for real wages to grow (based on mark-up pricing models).

The fact that productivity growth is rising but workers cannot defend their real wages tells us that the capacity of the working class to defend itself is severely weakened.

That is what the Financial Times article concludes also.

It means that the inflationary pressures will “eventually subside” – aka transitory.

The last thing policy makers should do now is worsen the cost of living pressures by creating unemployment.

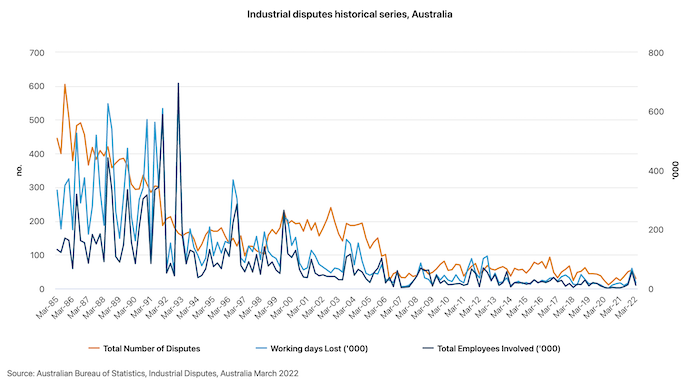

The Australian Bureau of Statistics published the latest data on – Industrial Disputes, Australia – for the March-quarter 2022, today (June 9, 2022).

They produced this rather stark graphic which helps to reinforce the narrative presented here.

This decline in industrial disputation is the result of deliberate public policy to weaken unions and make it easier for bosses to prosecute unions who engage in industrial action.

As a parting aside, even progressives fall short in their understanding of class.

Some so-called ‘leftists’ have used the pandemic to pour scorn on the workers in professional occupations who were able, as a result of their particular workplace circumstances, to escape the worst of the Covid burst by working from home.

Apparently these lucky workers – are the ‘woke’ who allowed lockdowns and vaccination rules to be imposed on the true workers who lost out as a result.

This segmentation of workers into woke and true workers reflects a misunderstanding of class.

Class is not about occupational structure.

Sure some workers have more discretion and independence from bosses.

Some have higher incomes.

Some, fortunately, can work from home and thereby gain more ‘freedom’ in their daily hours management.

And the fact that there is no real sense of community among workers across the occupation divide doesn’t negate the concept of class.

It is clear that capital is operating as a class and reaping massive profits now while taking advantage of the weakened position of the workers as a collective.

Conclusion

The idea that the class war is over was just a furphy introduced by those who wanted to further the interests of capital and pretend that the working class had vanished and we were all moving towards some classless nirvana where your background didn’t matter, who your parents were didn’t matter and all the rest of that bunk.

With profits booming and real wages falling across the board, it is easy to see that class persists as a powerful force.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

It appears there are cracks in the thinking on the other side too.

I was astonished to read this from Jeremy Warner in the UK Telegraph

Of course the proposed solution is just the same – whack up interest rates to give free money to rentiers.

In other words give free money to rich people and then cut taxes to give more money to rich people. Then wonder why we still have inflation because the understanding of the linkages is backward.

The same argument is made on the Left via the ‘safe asset’ school of thought. If government gives free money to rich people then they will stop ‘crowding out’ all those people who are just waiting to plough money into growth investing but won’t because assets are too expensive.

Or perhaps Occams Razor applies – there aren’t any growth investors because time horizons have become too short due to free money from government, large dividends from oligopolies and uncertain credit conditions.

End stage Capitalism.

Note how this state is not amenable to adjustment by trying to influence the amount of private credit. Perhaps the economists obsession with trying to control the system by changing the amount of private credit available has helped push the system towards short-termism. Perhaps it would be better if private credit/liquidity was always available as required at a relative price that remains fixed into the long term – by keeping the base interest rate at zero permanently. Then we’d know where we are and can plan long term.

What we really need is to increase taxation on employment in businesses in cash cow mode – the ones currently providing the free money to rentiers – and then government invests in new competitors using the labour freed up. If the private sector won’t do growth investing then the public sector will have to – in competition with the existing oligopolies.

Once we have low interest rates and appropriate high levels of industrial competition the rentier has nowhere else to go.

Inflation stems from the fact that GOVERNMENT is waning all over the western world (in the eurozone, we don’t elect governments anymore; rather, we elect governors).

The elites are ruling the west, and they think with their pockets.

We can see this in the demise of the old parties in europe.

They failed and are loosing voters.

Some parties disapeared completely.

They are beeing replaced by new parties, with diferent names, new faces, but with the same ideas (albeit in some new guises).

But there’s another major diference: they are owned by oligarchs.

With the old parties, oligarchs owned some key players, but now they own the all thing.

There is no dispute in leadership: someone decides who will lead these parties and so leaders are elected with +90% of votes.

“Once we have low interest rates and appropriate high levels of industrial competition the rentier has nowhere else to go.”

Excellent!

But you find them sitting in the EU treaties and the NATO charters and the IMF and World Bank and trade agreements. Sitting in the paragraphs of the rule based order ready to pounce. To extract rent from abroad.

Somebody has to be first to show other countries how to do it. To stop this rampant theft abroad of other countries real resources. That leads to real suffering and war. Stop the use of countries as chess pieces on the geopolitical map.

It won’t be easy as once real power is entrenched it is very difficult to remove and is utterly brilliant at absorbing change, so that no real change ever happens. COP 26 at Glasgow was a complete masterclass in how they achieve that. Students will study COP 26 for years to come to learn how to frame and control a narrative, that entrenched the status quo in a time of real change. Prevented any real change from happening with very little push back. Supported by the media ALL saying the SAME thing at the SAME time.

The leisure class and capital have the process down to a fine art with hundreds of years of experience. History shows this battle will never be won in the class room it has to be won on the streets.

From the very first “nudging unit” the church to the printing press to radio to TV to the internet to social media. The street is where these battles are won. Workers rights to the women’s vote to civil rights. Change happens when millions finally decide to leave their comfy armchairs and get organised.

The leisure class and capital know this weakness and they have learned from their previous mistakes. Why the police force now resembles an army and the Right to protest laws have become very authoritarian.

To achieve real change in 2022 is not going to be easy. As history shows very cleary it is going to be extremely difficult and sacrifices will need to be made. Or any change that does happen will be absorbed in a way that keeps the status quo in place.

The French seems to be the only people that understand history and what it takes. Or the only people who are willing to stand up against their own leisure class and capital for a considerable length of time.

Where are the anti war protest movements that used to rally and protest against war ?

They died along with the trade unions as it was the trade unions that helped them to organise. As this generation plays call of duty on their I phones and I pads. Or battle royale on the game fortnite on the latest console.

Twitter is the street when it comes to protesting against this war. Just the way the leisure class and capital like it with thousands of fake Twitter accounts.

I suppose people could always do a ” Paul Mason ” plan an assault on the UK left.

https://thegrayzone.com/2022/06/07/paul-masons-covert-intelligence-grayzone/

“John Major … pressured the UK to join the EU”?

Even John McDonnell on Radio 4 this lunchtime (commenting on rail strike threat) said current inflation spike is transitory and was proposing the same mitigations as you.

Are we trapped in a microeconomics world where only rising prices are inflation? Why aren’t we also talking about the fact that the “other side” of that transaction is a gain for the seller? When milk prices go up, is that inflation if the farmer gets more income for the sale of his product? Where is the analysis of the loss of over $5 trillion in the stock market decline? Doesn’t that offset the prolific government spending and monetary “ease” of the Federal Reserve? The implication is that inflation lowers standards of living, yet the US government gave over $7 trillion to the private sector to survive Covid. That injection of funds should be the “inflationary” element in the economy and it showed up in all kinds of speculation. And fiscal policy is now contractionary taking trillions out of the private sector in the form of rising taxes. Are we about to experience an historic shift from the inflation story?

Have you seen the Wall Street Journal?

https://www.wsj.com/articles/an-economic-article-5-to-counter-china-11613084046?mod=opinion_lead_pos9

Former Nato chief calls for economic version of ‘Article 5’ defence pledge.

@Thomas E. Nugent

I’d say that inflation is a zero-sum game…….but only in very narrow sense.

It’s logical of course that if I’m paying more then it has to also be true that somebody else is simultaneously getting more.

But it doesn’t automatically follow that this causes the economy-wide effects to net to zero. How everything gets distributed is always a crucial factor. If I’m paying more for milk, it doesn’t necessarily mean that a dairy farmer somewhere is now slightly better off with a gain equal to my loss that he will spend back into the economy so that nothing overall changes. The farmer might be charging more for milk because a fundamental input into production – say, energy – has spiked and he may be doing little more than offsetting the rise, leaving him no better off in real terms.

Energy is such a fundamental input into all economic functioning that nothing can occur without it – the loss incurred by millions of producers and consumers paying higher prices for both energy and everything produced with it may be not getting redistributed back into the broader economy at all but rather, simply being funnelled into a small number of extremely well-off hands.

This is the situation in Australia right now – Australia is absolutely swimming in fossil fuel production, far more than we can use ourselves (these polluting energy sources need to be replaced by cleaner ones of course but we are talking about the immediate crisis in the here and now) – but it’s all controlled by a handful of interests who are taking advantage of the geopolitical fallout of the war in Ukraine to profiteer like never before. They are driving the price of energy through the roof and because nothing can happen without energy input, this is starting to flow through to generalised inflation. Everybody has been paying more for (non-discretionary especially) consumption but the losses incurred by the country at large are not being redistributed as gains back into the broader economy but are instead largely being slurped up by a handful of fat cats.

A trillion dollar (or whatever, pick a number) loss from the pockets of millions of consumers can’t be offset by an equivalent trillion dollar gain into the pockets of a small number of rich people – they can’t consume widely enough to keep everything ticking over as before.

That’s my take on things at least – inflation is technically a zero-sum game but how the effects actually pan out depend very much on distribution.

Well, we say that Kapital has been winning (which I do not dispute), but, in my country, Canada, the most recent labour force survey has employment continuing to increase and unemployment at lows not seen since the early 1970s. And because of electoral realities and a change in central bank views over the last 12 years or so, we can expect labour’s bargaining power to increase, at least until 2025. Women, youth, and persons with disabilities are charging into the labour force.

There is a huge backlash from the establishment, notably in the form of attacks against the government from ETHICALLY-DUBIOUS former Conservative-aligned mandarins, such as Paul Teller, who say that the Government is not listening to senior executives (who rose to senior positions under the ultra-neoconservative Harper and hard neo-liberal Martin eras). They mean that Trudeau’s Cabinet is insufficiently anti-worker, but the “political rapport de forces” is such that for the duration of the current parliament worker bargaining power is set to rise. An aging population will help too.

So why so glum? The main danger for us is that high energy and other resource prices will create a resource trap and damage manufacturing in central Canada, but I remain hopeful.

If petrol and energy prices stabilise for a year annual inflation rates begin to stabilise.

The problem is what victories the class warriors of capital manage in the meantime.

@Carol,

I think Bill must have meant to say “EMU”; European Monetary Union – precursor to the euro.

If, like me, you remember 15% interest rates attempting to prop up Sterling at DM2.95, you’ll know what a disaster that was, and how the economy improved almost immediately once the UK pulled out, and Sterling free-floated.

Of course, MrS, silly me – Lamont’s ‘green shoots of recovery’ which never appeared till we were mercifully slung out. That was the whole of the Thatcher/Major economic policy: propping up sterling. That’s what destroyed our manufacturing base and caused mass unemployment. I remember the fire sale of new high quality capital goods in the early 80s.

My husband had only 15 months of real work after he was made redundant in 1982, until he died in 2005. That last job was permanent night work, which ramped up his addictions. I’ve recently made a submission to the Labour Party on night work: maximum 4 hours’ at double pay.

I’m ashamed to say that I voted tory for the only time 1979, because I had such little understanding of economics until it hit me in the face.

@Carol, I’m so sorry that you and your husband had such a rough time of it.

1979 was the first time I could vote, and the result was the first of many political disappointments to follow.

You were not alone though – apparently the first UK GE when the majority of women *didn’t* vote Tory was… get this… 1997!

I hope your circumstances are much improved.

Best, MrS.

“Today’s publication shows that if a major UK bank failed today it could do so safely: remaining open and continuing to provide vital banking services to the economy. Shareholders and investors, not taxpayers will be first in line to bear the costs, overcoming the ‘too big to fail’ problem. The Bank of England is publishing its first assessment of the eight major UK banks’ preparations for resolution under the Resolvability Assessment Framework (RAF). ” https://www.bankofengland.co.uk/news/2022/june/resolvability-assessment-of-major-uk-banks-2022 My question is: Are the Banks expected to fail with the ongoing quantitative tightening ? Also, if “Shareholders and investors, not taxpayers will be first in line to bear the costs,” whom is to be next in line if this assessment fails ?

@Maria

MMT has proven that in nations like the UK, US, Canada, Japan, etc., the taxpayers are never hurt much by deficit spending.

For example, in the GFC/2008 the Fed created $27T to prop up banks in the US and at least Europe. Did the US taxpayers have their taxes raised? No. Did they see inflation, before covid caused shortages of things in 2020? No. So, it looks like the taxpayers suffered no negative effects. In fact MMTers assert that the American people did feel negative effects from the GFC, but they came from slow economic growth that was caused by not enough deficit spending to move the economy faster, i.e. fast enough.

I don’t think this is ever going to change Steve. Even though the currency issuing governments can invest in needed services at the tap of a key, it isn’t and hasn’t been used for the benefit of everyday people. I have lost heart that things will change. People still strongly believe that tax is needed for government expenditure, although taxes for revenue are obsolete and have been for such a long time. The 2005/2008 Global Financial Crisis was used as a vessel to convince people to accept state austerity was needed, even though it was not. If the banks fail again, I believe that austerity will be rolled out with all the usual excuses, and the further reduction of needed public services will be accepted by the electorate as the state withdraws. The way that things are, people will suffer due to political ideology stamping out needed economic investment that would benefit good health etc.. MMT is a lens showing what can be accomplished, however, huge amounts have been spent to cover this lens over. It is like banging your head against a brick wall, god knows how Bill Mitchell a professor of economics feels, all his academic work can be constantly overridden by media propaganda with no merit. It is heartbreaking to see how much unneeded suffering is being felt in society.