I have been thinking about the recent inflation trajectory in Japan in the light of…

With corporate profits booming, business can afford to pay higher wages

Last week, I provided a graph in this blog post – The Left/Right distinction is as relevant as ever as corporations gouge profits out of pushing inflation (May 2, 2022) – which showed negotiated wages growth in Europe was declining and real negotiated wages had fallen sharply over the last several months. I am continually on the lookout for evidence that the current inflationary episode, no matter how alarming, is not being driven by structural forces in the labour market even though unemployment rates have fallen somewhat. A music segment follows.

Wages outlook in Europe

There was an interesting graphic presented by Philip Lane, a ECB Executive Board member during a speech he gave on May 5, 2022 – The euro area outlook: some analytical considerations.

The ECB is one central bank that hasn’t pursued the kneejerk interest rate rise, which increasingly mark a reimposition of the old NAIRU mentality that I had hoped was being abandoned.

So I watch what its officials say and write because every nuance provides information on what they might do.

Philip Lane identified three major challenges facing “the economic and inflation outlook for the euro area.”

1. The on-going pandemic – a “first-order driving force”.

2. The “significant jump in energy prices … represents a major macroeconomic shock” – which, importantly, he noted correctly was “ultimately a level effect” rather than necessarily being an on-going source of inflationary pressure.

The rising energy price level has effectively been a redistributive process – transferring income to the oil companies and their shareholders at the expense of the rest of us.

It can only drive higher inflation rates, if the oil prices keep rising continuously, and a major global recession that would follow would bring an end to that anyway.

3. “the Russian invasion of Ukraine” – which has amplified the “energy shock”, created new supply bottlenecks, and pushed down “consumer and business confidence”.

Together, these factors impart both an inflationary impulse on nominal aggregates and a recessionary impact on the real aggregates (output).

That is, of course, a difficult duo to deal with.

It would have been worse in Europe if not for government spending.

Philip Lane showed that “consumption and investment remain below pre-pandemic levels, whereas government spending (the sum of public consumption and public investment) has been substantially above the pre-pandemic level since the second half of 2020.”

We use words in different ways.

Substantially to Lane is government consumption and investment spending being around 5.5 percentage points above the December-quarter 2019 level, whereas to me that is a relatively modest fiscal response, given the circumstances that were being faced in early 2020.

Private consumption is about 4 points below the December-quarter 2019 level and private capital formation (investment) is around 10.2 points below.

So it is no wonder real GDP is still below the pre-pandemic level, which tells me the fiscal intervention was too weak.

He also showed that these factors are killing manufacturing new orders and export demand in Europe.

This is a contagion effect arising from the initial supply disruptions that then work their way through the supply chain.

One factory stops producing or has trouble delivering materials to another process further down the chain and the disruption multiplies.

And then the OPEC oil restrictions pushing up energy prices have spread throughout the entire sectoral landscape.

It was always going to be difficult avoiding inflationary impulses in these circumstances.

Philip Lane does acknowledge the transitory nature of these impulses:

Bottlenecks are also generating temporary upward pressure on costs, even if the eventual resolution of these bottlenecks should reverse these cost pressures in the future …

To the extent that the increase in energy costs is ultimately a level effect and bottlenecks eventually are resolved, this suggests that there is a temporary component in the current rate of goods inflation.

Which is why I maintain my position that the current inflation, however difficult for low income families to deal with, is transitory in nature.

And I repeat, what some commentators, including ABC finance tweeters do no seem to get.

Transitory doesn’t necessarily mean short-lived. It means as long as the extraordinary drivers are driving.

And that view is reinforced by the next part of his analysis.

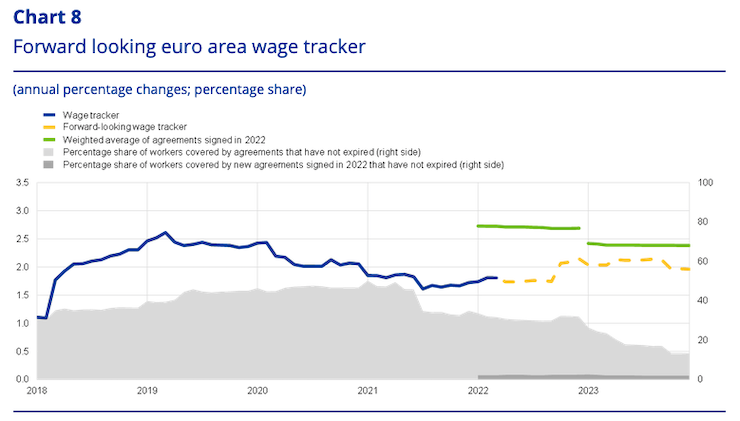

He presented this interesting graph (Chart 8), which is the “development of nominal wages, including the information embedded in an experimental forward-looking wage tracker developed by the ECB staff”.

This is a very telling graph.

The evolution of wages since early 2019 has been firmly down until the latter half of 2021.

After that there has been a very modest rise.

Using the forward-tracker, which takes into account “microdata on wage agreements in Germany, Italy, Spain and the Netherlands”, the predicted trajectory is to flatten out well below the pre-pandemic growth rate.

That growth rate was not seen as being problematic.

Now the outlook is for wages to grow even more slowly than that.

Philip Lane concludes that:

The overall tracker indicates only sideways movement in aggregate wage growth at around an annual two percent rate … In assessing wage developments, it is also relevant that, under typical conditions and allowing for labour productivity growth at about one per cent, nominal wage growth at three per cent is consistent with the two per cent inflation target.

Which is why the ECB has not joined the rush to push up interest rates.

They clearly have a better understanding of what is driving the inflation than other economists who are getting ahead of themselves in calling for rate hikes.

He also shows that estimates of inflation expectations from the ‘market’ indicate that there is a convergence on a medium-term stable inflation rate around 2 per cent.

He concluded that:

For these reasons, the calibration of our policies will remain data-dependent and reflect our evolving assessment of the outlook.

Evidence not ideology.

A good thing in this case.

Fast track to the Australian election campaign

Yesterday, the Labor Opposition leader who remains in a good position to win the May 21, 2022 federal election from one of the worst conservative governments that we have had to endure here, was cornered about what he would do with respect to the federal minimum wage if he won government.

Each year the Fair Work Commission makes a judicial judgement on what the minimum wage will be for the next 12 months and takes submissions from all interested parties, including state and federal governments.

The conservative government doesn’t make a submission based on a percentage change and usually plays along with the wage moderation case presented by the business lobbies who typically argue for miniscule increases.

I saw the Chamber of Commerce CEO on the morning show early today and the presenter asked him whether the minimum should rise by 5.1 per cent (the current inflation rate), which is what the Australian Council of Trade Unions (ACTU) has submitted to the Fair Work Commission.

He said no that was reasonable for it to be a maximum of 3 per cent.

The presenter then said – so you think it is reasonable to cut the real purchasing power of the lowliest paid workers in Australia – many who are in cleaning and health care positions, which saved us during the pandemic.

He replied that it was not a cut in real living standards.

That is, saying, bold-faced, that black is white.

The current government refuses to say what the rise in July should be.

But the Opposition leader told reporters yesterday that he supported the ACTU’s position that the lowest paid should not fall behind the inflation rate.

Well the torrents of abuse he has received from the federal government – “undermining the economy”, “killing jobs”, and more is only matched by input from economists and their mates in the corporate lobbies who are claiming business cannot afford this and they would have to lay off workers as a result.

The usual problem these creeps present to the unknowing populace that says – things are bad whichever way we go, but it is better to keep working for us on poverty wages than get wage rises and lose your jobs.

Except, not everything is bad in this little play act the corporates spin out each time a wage rise is mentioned.

Early in the pandemic, the wage share in Australia (in national income) fell below 50 per cent for the first time since 1959.

Of course, that means the profit share increased further.

In the June-quarter 2020, national accounts release we observed company profits jumping by an unprecedented 14.9 per cent in the quarter, while total wage bill paid to workers fell by a record 2.5 per cent.

The profit surge, was in part, funded by the fiscal support provided by the federal government. It shows that when designing fiscal interventions, governments have to be sure they don’t just transfer income to the corporate sector at the expense of the rest of us.

The situation hasn’t improved for workers since.

Company earnings in Australia are at record levels – 10 per cent higher in 2022 than in 2019

Corporate profits are also booming.

Just yesterday, we learned that the big four banks recorded first-half 2022 profits on around $A14.4 billion, which was an increase of 5.1 per cent on the results the year before.

Energy companies are ‘rolling’ in profits.

Russia’s invasion of the Ukraine “has led to ‘windfall gains’ tp Australian companies” that sell iron ore, gas, and base metals – that is huge profits. (Source)

The latest ABS data – Business Indicators, Australia – shows that for the year-ended December 2021, corporate profits overall rose by 13 per cent.

That is, a huge real gain in company profits.

So the question is why should the lowest paid workers in Australia endure real cuts to their wages when the firms they work for are going ahead in leaps and bounds?

What sense can we make of the claim that business cannot afford to pay higher wages (which are at record low growth rates) when their profits are booming?

No sense at all.

Music – the Lester Young Trio

This is what I have been listening to while working today.

It is played by one of the greatest tenor players – Lester Young – who I featured a few weeks ago playing Hoagy Carmichael’s Stardust from 1952.

I was talking with another sax player yesterday about the evolution in technique from Coleman Hawkins to Lester Young and so this morning I put this album from 19

He was also the mentor for one – Charles Christopher Parker Jr. – which means he played really well.

This song is the George and Ira Gershwin number – The Man I Love – which came out on the 1955 release from the – Lester Young Trio (the cover is from the 1994 Verve Records re-release of the 1946 Hollywood recordings).

The sonority of Lester Young’s playing was something else really.

The trio comprises 3 of the biggest jazz players ever:

1. Lester Young – tenor sax

2. Nat King Cole – piano

3. Buddy Rich – drums

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Bill have you listened to the new versions of two suns in the sunset and Mother by Pink Floyd?

They were recorded by Roger Waters new band during his lockdown sessions.

Very poignant considering what’s going on in the World.

https://m.youtube.com/watch?v=P_m2CZU9vdk&list=RDP_m2CZU9vdk&start_radio=1

What effect would the 5% wage increases across the board have on inflation considering

1. The on-going pandemic – a “first-order driving force”.

2. The “significant jump in energy prices … represents a major macroeconomic shock” – which, importantly, he noted correctly was “ultimately a level effect” rather than necessarily being an on-going source of inflationary pressure.

The rising energy price level has effectively been a redistributive process – transferring income to the oil companies and their shareholders at the expense of the rest of us.

It can only drive higher inflation rates, if the oil prices keep rising continuously, and a major global recession that would follow would bring an end to that anyway.

3. “the Russian invasion of Ukraine” – which has amplified the “energy shock”, created new supply bottlenecks, and pushed down “consumer and business confidence”.

Together, these factors impart both an inflationary impulse on nominal aggregates and a recessionary impact on the real aggregates (output).

Surely when it comes to wage increases just as much care has to be taken in the design as fiscal interventions, when governments have to be sure they don’t just transfer income to the corporate sector at the expense of the rest of us ?

Especially when the public sector is now just a rent extracting monopoly. For example when you look at the Skye Bridge economic model.

a) Government could buy all the skills and real resources needed to build the bridge so that it was free to cross between the Isle Of Skye and the Scottish mainland.

b) The bridge is privatised via a bank loan. The company or in this case an American bank then put a toll on the bridge and charged to cross the bridge for the next 100 years.

When the Scottish population got either pay rises or tax cuts the consortium just worked out how much more they could charge for crossing the bridge. So the population on the Isle Of Skye were no better off.

Since the public sector is now privatised in this way and now just a rent extracting monopoly this can happen right across the board so that the 5% wage increases once again gets absorbed by the monopoly rent increases and corporate profits soar.

You saw this happening when the deficits ( household savings) increased at the start of the pandemic. You saw it happen after the Brexit vote. Price gouging was rampant in both cases.

Is there a MMT paper anywhere you can point me to that describes the design of what really needs to be in place when fiscal interventions, wage increases, tax cuts are introduced that stops this predatory behaviour from happening ?

So that any increase in disposable income of households are not just automatically transferred into bigger profits via price gouging. In a world of monopoly rent extraction and the monopoly and competition authorities are not fit for purpose. The carpet bombing approach of tax increases or rate hikes will not do the job either. Stop them from charging whatever they like as the big 3 or 4 in each sector just manipulate the price between them. Exactly like Hotelling’s example of the 2 I’ve cream sellers on the beach.

The EU project, right now, is a two-pronged one: inflation on the prices side (to eat public and private debt) and deflation on the wages side (to increase finacialization, or, what is the same, to increase private debt).

The aim is always to increase profits of the FIRE sector… until it busts again, like it did back in 2008, and then private debt becomes public debt.

But, there are out there so many corporations on “life support” for so many years, that we have to conclude that they are failures and that they cannot survive without public money supporting their activity.

Shouldn’t it be a crime to shore up insolvent businesses?

And if it is, are we beeing ruled by criminals?

This why Labor will never be a friend of small business. Sure corporations may well be able to afford to pass the cost on to consumers, because that’s what will happen, but many small businesses are operating on the margin.

While Covid still rages through the workforce disrupting supply chains and impacting business owner’s capacity to operate, while small business owners are still under water compared to pre-pandemic levels (which was pretty lousy anyway), instead of offering tax cuts and a meaningful solution to under and unemployment by way of infrastructure spending and a job guarantee the Unions and Labor go after the hip pockets of the sector that employs nearly half of the nation’s workers.

Oh well, I guess we’ll do what we’ve been doing for the past 6 or 7 years – keep trimming hours, keep trimming positions, keep investment spending below what is needed for growth and focus on profitability ie staying open and keep cutting services.

@Tony. Corporates should be able to absorb higher wages given their profitability and small business will probably have to pass higher wage costs to consumers, just as they do for other cost increases such as rents, energy etc.

@Barri mundee, it doesn’t happen that way.

But that’s beside the point, if the private sector is incapable of creating growth or unwilling to meet consumer demand, then Labor and the Unions should be working for fiscal policy changes using publicly issued money rather than increasing the cost of business through the redistribution of privately earned money.

@Barri mundee, just to expand on my background, we’re in the hospitality industry. The latest data from the RBA shows a rise of 0.7% in prices for meals for the qtr for an annual rise of just over 2% or thereabouts. So price rises haven’t even kept up with inflation in inputs such as groceries, fuel etc.

@ Tony,

I’m no expert, however, if I divide the 2% per year by 4 to make ir0.5% per qtr,

I see the meals went up by 0.7% – 0.5% = 0.2% more increase in the selling price of meals than the 0.5% increase in costs.

Obviously, this is very crude, because the 2% figure includes many things not being used to make the meals or necessary to support the business. [I.e., new or used cars, etc.]

But, I’m no expert and may have done the math wrong, by using the numbers in the wrong way.

@Tony. If small businesses cannot earn a decent return they should exit. From my experience there are plenty of cafes doing quite well. Why should employees suffer? I note rents are rarely discussed, how about demanding a reduction in rent?

@Barri mundee, true, if SMEs can’t operate profitably they should exit. Remembering though that the price of labour is set artificially, rises in the cost of wages do not necessarily reflect supply and demand and can have little connection to market conditions. Neither workers nor business owners (including landlords) should suffer because of government mismanagement. MMT holds that if there is a shortage of money in the real economy then it is because governments are removing too much from the supply. Labor’s proposal ignore this fundamental, choosing instead to redistribute the already scarce resources in the private sector without consent. That has nothing to with MMT, it is a crude ideological solution that from my perspective (and ideology obviously I’m no leftie) actually flies in the face of how MMT attempts to direct public policy.

@Steve_American, the smallest increase in input price rises were breads and cereals at 3%, non-durables were the highest at 8% for the preceding 12 months. Price rises for inputs are racing ahead of prices of the finished product.

@Tony,

1st when I replied to you I used your numbers. I was just showing you that your numbers didn’t demonstrate what you had claimed that they did. OK, now you have provided better numbers. What is a non-durable thing that it an input for a cafe’. Paper towels?

In reply to your reply to Barri, Mainstream “experts” are claiming that the inflation now is a result of too much money in the economy. Are you asserting that now there is too little money in the economy? It seems like you are.

All MMTers are asserting that wages are too low because the labor laws favor corps too much. That we can see this when we note that profits are way too high. This is evidence that the mega rich are sucking too much money out of the functioning economy and saving it in their bank accounts. This hurts the small business people as well as the workers.

Yesterday I saw a video on native peoples’ myth stories about how ‘greed’ can enter a man’s heart. That is is a pandemic in the Europeans who colonized the natives lands. This cause me to remember I opinion on this. It is like the rich woman who has 3000 pairs of shoes. She gets a seratonan (spelling?) hit when she buys another pair and she is addicted to those hits. So, she keeps buying shoes that she has no need for. IMHO, the mega rich have the same problem. They are addicted to the hits they need that come from knowing that they have increased their profits. They are destroying the US economy (and the world with ACC) to get the feeling that comes from those hits. I wish they just used cocaine. They are addicted to greed or the feeling that comes from successfully acting on greed. Way too much is never going to be enough.

.

@tony. Thanks for your comments. How do you think wages should be determined?

@Barri Mundee, good question, I don’t know.

@Steve_American, the 2% was just an approximation based on ABS stats, it was actually 2.6%, food and grocery products rose 4.3 and 5.3% respectively.

I would say non-durable goods would be those goods that can be consumed once or used over a short space of time (less than 3 years) that are not included in other data sets, maybe cooking oils, and possibly stuff like paper towels, I don’t know exactly.

Yes, I’m asserting that there is too little money circulating in the real economy. Hence we’re in a balance sheet recession where business owners (and consumers) are reluctant to take on more debt for investment or to fuel consumption. Governments have failed to spend enough money.

If the advocates of MMT are asserting that wages are too low because of greedy corporations then their assumption is ideologically based rather than being based on the principles of MMT. If MMT advocates are asserting that wages are too low because of flawed policies around employment (NAIRU, buffer stock etc) then their assumption is based upon economic principles governed by MMT. You don’t have to be an advocate of MMT or follow left-wing political theories to acknowledge that QE and other monetary policies favour the rich at the expense of everyone else. The solution though is not an ideological one, rather one based on sound economic theory. Redistributing wealth within the private sector is primarily an ideological solution which as far as my understanding goes does not feature in the framework provided by MMT. MMT is is apolitical.

As far as your comments regarding greed and the motive for consumption, that’s a philosophical discussion around the subjective nature of value and beyond the scope of where my interest in the topic of wage rises remains.

OK, too little money in the economy.

I have been saying for many months now that the Gov. needs to accommodate the current inflation by sending more checks each month to all adult citizens. This will then provide food and fuel wholesalers more money to buy more food and fuel on the international market. Bad for poor people overseas, good for Americans.

I think that Billionaires have the power to sink the Dems by continuing the inflation just because they can and they don’t like the Dems. They own monopolies that can charge whatever they want.

3% pay rise for workers, not forgetting that that will be taxed and that is the real reason wages have been declining in Australia since the late 80’s when we had the recession Paul Keating had to have. Wages have not been keeping up with inflation once tax is taken into account