Well my holiday is over. Not that I had one! This morning we submitted the…

The British Labour Fiscal Credibility rule – some further final comments

Over the last weekend, it seemed that we had a return of the Spanish Inquisition with a prominent British academic, who by his own words designed the fiscal rule that British Labour has unwisely adopted, repeatedly demanding that MMT Tweeters confess to knowing that I was completely wrong on my interpretation of the fiscal rule. It is apparent that my meeting with the British Shadow Chancellor in London recently and my subsequent discussion of that meeting has brought the issues relating to the fiscal rule out into the open, which is a good thing. It is now apparent that British Labour is still, to some extent, back in the 1970s, carrying an irrational fear of what financial markets can do when confronted with the legislative authority of a sovereign government. I am not a psychologist so I cannot help them heal that irrational angst. But the claims that I misunderstood the fiscal rule – which are being repeated daily now by the fanboys of the rule are just ludicrous. The rule is simple. And it will bring Labour grief politically. Rolling windows or not!

As background to my view on the matter, the following blog posts (among others) are relevant:

1. British Labour Party is mad to sign up to the ‘Charter of Budget Responsibility’ (September 28, 2015).

2. The non-austerity British Labour party and reality – Part 2 (September 29, 2015).

3. The full employment fiscal deficit condition (April 13, 2011).

4. Seeking zero fiscal deficits is not a progressive endeavour (June 18, 2015).

5. Jeremy Corbyn’s ‘New Politics’ must not include lying about fiscal deficits (September 15, 2015).

6. British Labour has to break out of the neo-liberal ‘cost’ framing trap (April 12, 2017).

7. British labour lost in a neo-liberal haze (May 4, 2017).

8. When neoliberals masquerade as progressives (November 9, 2017).

9. The lame progressive obsession with meaningless aggregates (November 23, 2017).

10. The New Keynesian fiscal rules that mislead British Labour – Part 1 (February 27, 2018).

11. The New Keynesian fiscal rules that mislead British Labour – Part 2 (February 28, 2018).

12. The New Keynesian fiscal rules that mislead British Labour – Part 3 (March 1, 2018).

13. MMT is just plain good economics – Part 1 (August 9, 2008).

14. MMT is just plain good economics – Part 2 (August 13, 2008).

15. A twitter storm of lies … (August 15, 2018).

16. A summary of my meeting with John McDonnell in London (October 17, 2018).

I provide links to previous blog posts I have written for two reasons: (a) to avoid detailed repetition; and (b) to help people navigate through related issues on what is now a rather complex body of writing.

Introduction

In this blog post, I want to clarify a few things about the rule that inform my previous assessments.

First, it is now clear from both my meeting with John McDonnell and his staff advisors that they genuinely believe that the financial markets in Britain will crucify a government that runs a progressive policy campaign without the fiscal rule.

This was reiterated in the Twitter exchanges I saw at the weekend.

It means that British Labour has not advanced much since the mid-1970s when Dennis Healey mislead the British people by claiming that the government had run out of money and had to borrow from the IMF.

I was told at the meeting that Britain is ‘exceptional’ (my word) with regard to the size of its financial system. This apparently gives the system more power although no explanation followed as to what the ‘system’ could actually do without government consent to damage the British prosperity.

Amorphous sorts of claims about destroying a currency etc abound but the fact is that if the government brings its legislative capacity to bear the financial markets are the losers not the power brokers.

Iceland, a tiny little country with a huge financial system (relatively), has demonstrated exactly how that legislative capacity can overpower even the most powerful foreign banking interests.

The point is that – Labour’s Fiscal Credibility Rule – which was released in October 2017, is a document for the financial markets.

It is some mumbo jumbo that British Labour naively thinks will placate the currency traders and others who might bear malice against its undoubted progressive policy agenda.

The problem is that this reinforces the narrative that deficits and public debt are in some way ‘bad’ and as I note below this will not turn out well.

Second, the other thread that has emerged is that the Fiscal Rule is there because there is a general distrust of politicians among its designers.

They think ceding primary counter stabilisation responsibility to an unelected and unaccountable technocracy (MPC) delivers better policy outcomes.

This sort of logic was the centrepiece of Monetarism – the rules over discretion literature – and underpinned the depoliticisation of macro policy that has been the hallmark of neoliberalism (see below).

I think the public discussions in the week or so following my meeting has flushed these points out into the open, which is good. At least, the Labour Party members now are more clear on what they are dealing with.

The Fiscal Rule

All my comments here are based on the public document describing – Labour’s Fiscal Credibility Rule.

If this is not the rule, then of course, I am guilty of misrepresenting it!

I cannot find a more recent version and all my previous comments were also based on this policy statement (although I think there were minor revisions made along the way).

As you will see, the current statements made by proponents of the Rule on social media appear to be at odds with the wording of this official document.

The wording of the document is itself inconsistent and open to misinterpretation.

The Fiscal Rule is neoliberal issue

One of the discussions is whether the Fiscal Rule is a neoliberal construct or not. I have clearly made this point often and I reiterated it at my meeting with the Shadow Chancellor.

Clearly the designers and proponents refute that categorisation. They point out that their intent is not to impose a neoliberal policy solution (in this case, austerity). And the Labour Manifesto makes that clear.

But intent and image are different things.

The Shadow Chancellor and his advisors may have every intention of pursuing a progressive agenda untainted by the sort of austerity mentality that has characterised British Labour policy in the past.

However, if they frame those intentions in the metaphorical language of the neoliberals then they just privilege those frames and reinforce the attitudes that are triggered by them.

First, a feature of the way neoliberals talk about fiscal policy is to define credibility in terms of financial ratios rather than functional purpose.

A credible progressive policy response is one that honours the political mandate given to the people as part of the democratic process.

When British Labour talks about its mission – for the many not the few – they are acknowledging that the purpose of government is to advance broad welfare concerns, which pertains to wages, employment, equity, price stability, environmental sustainability, and the like.

The purpose of fiscal policy is not to achieve financial balance between revenue and outlays, whether recurrent, capital or total, or to achieve a particular debt or debt ratio dynamic.

Modern Monetary Theory (MMT) demonstrates that the fiscal balance is driven in no small part by the spending and saving decisions of the non-government sector.

The government can obviously adjust discretionary spending and taxation but can easily see its fiscal target blown out of the water by movements in the automatic stabilisers which are triggered by shifts in non-government spending.

In other words, a progressive government should refrain from couching their fiscal ambitions in ratios that they cannot control.

History shows us many examples of social democratic governments that have held out an acceptance of ‘fiscal rules’ as a way of allegedly appeasing the conservative forces in the economy including the media and financial markets only to be tripped up by cyclical swings in economic activity and face censure for ‘failing’ to meet their fiscal targets.

The primacy of these rules (and fiscal commissions and the like) is a key part of the way that the neoliberal era has imposed a conservative control on governments that might be intent on redistributing national income, or improving welfare services and the like.

They are unnecessary and only bring grief.

Second, the language of policy is also extremely important. I have noted this point often.

On August 7, 1978, Milton Friedman published a column in Newsweek magazine – The Kemp-Roth Free Lunch – where he was discussing Congress moves to cut personal and corporate taxes and the claim that the positive impact on economic activity would be such that tax revenue would rise even as rates fall.

He wrote that:

… the only effective way to restrain government spending is by limiting government’s explicit tax revenue – just as a limited income is the only effective restraint on any individual’s or family’s spending.

Which, of course, invokes the ‘household budget analogy’, which is a core part of mainstream economics and the neoliberal politics that stems from it.

The concept of a ‘government budget constraint’ goes back to the 1960s where mainstream economics was preparing to take over macroeconomics (from the Keynesians) and decided that a government is just like an individual consumer who faces financial constraints when determining their spending choices.

This was part of the push to introduce so-called ‘micro foundations’ into macroeconomics and is one of the claims to superiority that New Keynesian mainstreamers use in the present day – that their theory is ‘micro founded’ and reflects rational human behaviour.

Well as I have argued elsewhere, there are actually no ‘humans’ in New Keynesian theory only fudged ‘representative agents’ and there is no macro because the agents are singular. But no more here on that as it is a distraction.

The point is that the household budget analogy is one of the most powerful ways in which citizens are mislead about fiscal policy and the capacities of government.

A currency issuing government has no financial constraints. Our experience as householders using the currency the government issues provides us with no knowledge of the choices and constraints facing such a government.

So why would a progressive political party want to reinforce the neoliberal narrative – trigger neoliberal frames?

But in the Fiscal Rule document we read just that:

While there are exceptional times when shocks from the private sector mean that government has to step in to help, everybody knows that if you’re putting the rent on the credit card month after month, things needs to change.

Pure neoliberal framing and neoliberal metaphorical language.

The British government does not have a ‘credit card’ that will default if continually spends more than its revenue.

If Labour is trying to break out of the neoliberal narrative why use this language?

I find it amazing that the defenders of the rule blithely dismiss this issue under the ruse that I just don’t understand the rule.

Language really matters. And the language of the document is not progressive at all.

Suspension of the Fiscal Rule

There has been a lot of talk about the so-called suspension of the Fiscal Rule. The Labour Party document is clear that:

When the Monetary Policy Committee decides that monetary policy cannot operate (the “zero-lower bound”), the Rule as a whole is suspended so that fiscal policy can support the economy. Only the MPC can make this decision …

We will reserve the right, for as long as monetary policy is unable to undertake its usual role due to the lower bound, suspend our targets so that monetary and fiscal policy can work together.

… Rather than an arbitrary cut off for GDP forecasts, we will give the Bank of England’s Monetary Policy Committee the authority to suspend the rule in the circumstances when it is clear that fiscal policy needs to work together with monetary policy to get the economy moving again.

So the MPC is in charge and it is its judgement that triggers the suspension of the targets.

As I have noted before, just the fact that the Chancellor has to wait for the MPC to tell him/her what to do is a sop to neoliberalism.

The subordination of fiscal policy (accountable and elected representatives) to monetary policy (unelected and unaccountable technocrats) is one of the classic ‘Monetarist’ coups over the last several decades.

It is consistent with what Thomas Fazi and I denoted depoliticisation in our recent book – Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World (Pluto Books, 2017).

I know the mainstream economists like to dismiss this issue as simply a choice or preference for ‘monetary assignment’ over ‘fiscal assignment’ but there is deeper ideological issues operating as well including claims (noted above) that politicians (our representatives) cannot be trusted.

But in determining whether a rule suspension would occur, we have to know what constitutes the zero-lower bound.

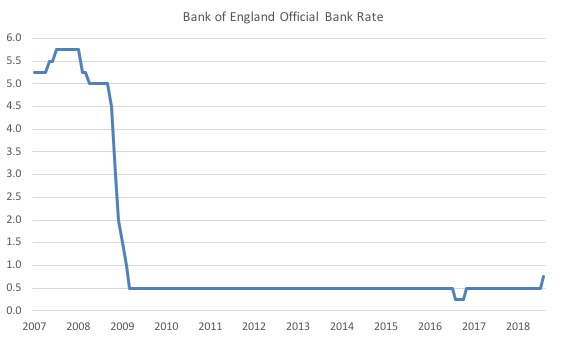

Here is the recent history of the Bank of England’s policy rate (from January 2007 to August 2018).

Britain recorded its peak real GDP prior to the GFC in the March-quarter 2008. It dropped rapidly in the subsequent five quarters and by the June-quarter 2009, the British economy was 5.1 per cent smaller.

The Bank of England policy rate at the peak was 5.25 per cent (having been adjusted downward from 5.5 per cent on February 7, 2008).

The Bank then made a series of small cuts to the Bank Rate as production was collapsing – they clearly misunderstood the severity of the recession that was unfolding.

Some might claim that once the Bank Rate fell to 0.5 per cent on March 5, 2009 that it had hit the zero lower bound.

For example, on May 22, 2017, Simon Wren-Lewis wrote in his blog post – Still not getting it after all these years

There was one reason, and one reason alone, that we had fiscal stimulus in 2009. It was because nominal interest rates had hit their lower bound. A recession in itself is not a sufficient condition for a fiscal stimulus if monetary policy can do all the work of getting us out of the recession … But when interest rates are stuck at their lower bound, monetary policy has lost its ability to regulate the economy, which means we are either stuck in a recession or are vulnerable to any negative demand shock. Unconventional monetary policy, although better than nothing, is far, far less reliable than conventional monetary or fiscal policy …

In the UK, at this very moment, we are once again at the lower bound for interest rates.

His ‘fiscal rule’ co-author Jonathan Portes also claimed that Britain was at the zero lower bound.

He wrote (with Dawn Holland) in the National Institute of Economic Review (October 2012) article – Self-Defeating Austerity – that:

… that in today’s environment of substantial economic slack, monetary policy constrained by the zero lower bound, and synchronized fiscal adjustment across numerous economies, multipliers may be well above 1

Many other mainstream economists followed their lead in proclaiming that monetary policy was now constrained by a zero lower bound.

But, significantly, that is not what the Bank of England thought.

In the Press Release (August 4, 2016) – Bank of England cuts Bank Rate to 0.25% and introduces a package of measures designed to provide additional monetary stimulus – which accompanied that day’s Monetary Policy Committee decision, the Bank noted that its decision to cut rates to 0.25 (from 0.5 per cent) was in response for the need for monetary policy “to provide additional support to growth” – which means they believed that policy rate manipulation was still performing as an effective counter stabilisation role.

It also noted additional policy changes designed to stimulate growth including “the purchase of up to £10 billion of UK corporate bonds; and an expansion of the asset purchase scheme for UK government bonds of £60 billion” which would be “financed by the issuance of central bank reserves”.

That is, liquidity created out of thin air!

The Bank asserted that its intervention would “help to eliminate the degree of spare capacity over time” by lowering “borrowing costs for households and businesses”.

It also acknowledged that “as interest rates are close to zero … banks and building societies” might find it hard to lower their deposit rates and as a consequence, the Bank of England decided to provide funding to these private institutions at the policy rate “to ensure that households and firms benefit from the MPC’s actions”.

I won’t debate the logic of this here to avoid being sidetracked – but it is flawed reasoning.

But importantly, for the argument here, the Bank also noted that the MPC “can act further along each of the dimensions of the package by lowering Bank Rate” (and the QE and lending initiatives) and if the new inflation data (to be released in the “August Inflation Report forecast”) was ratified by the “incoming data”, then:

… a majority of members expect to support a further cut in Bank Rate to its effective lower bound at one of the MPC’s forthcoming meetings during the course of the year. The MPC currently judges this bound to be close to, but a little above, zero.

So by the MPC’s own estimate a Bank Rate of 0.25 per cent was not yet at the effective zero lower bound.

That was in August 2016.

Note the language “effective lower bound”. The point is that at that lower bound manipulation of the policy rate is no longer considered to be an effective tool for altering aggregate demand in the economy.

So it is clear that even at 0.25 per cent, the MPC would not have informed the Treasury that it was time to scrap the Fiscal Rule had it been in operation.

And thinking retrospectively, this means that over the entire course of the GFC, the MPC would never have decided:

… that monetary policy cannot operate (the “zero-lower bound”) …

Which given that the Fiscal Rule says that “Only the MPC can make this decision”, this means that there was no way that the Fiscal Rule would have been “suspended so that fiscal policy … [could] … support the economy”.

So history tells us that despite the worst recession in decades, British Labour Party would still have been forced to follow its Fiscal Credibility rule.

And all of this is without having to discuss issues relating to institutional inertia, silo mentalities, power plays between policy making hierarchies that the sociology of policy making tells us is important.

At my meeting with the Shadow Chancellor, his advisor James Meadway asserted that he believed the zero bound would be hit at the next recession.

I responded by saying that such an event was very rare and unlikely. My assessment, was, of course, influenced by my reading of the Bank of England MPC minutes over the course of the crisis.

I wonder whether the Labour advisors kept track of those minutes in the same way.

It is clear their faith in the Fiscal Rule is conditioned by a confidence that in a bad recession, the MPC hands over control to the Chancellor and the Rule would be suspended.

Well, as noted above, that would not have happened in the worst recession in decades (the GFC).

And that influences what I say next about debt dynamics.

Debt dynamics

Labour’s Fiscal Credibility Rule is also inconsistent on its treatment of public debt.

First, we read that:

Labour make sure government debt is falling at the end of five years

So apart from the strained English, this is a fixed point commitment in levels.

Further on, we read that:

And because we want to ensure that the Government’s debt is set on a sustainable path, we will commit to ensuring that, at the end of every Parliament, Government debt as a proportion of trend GDP is lower than it was at the start.

So now we have a relative concept – the debt to GDP ratio, with the GDP being expressed in trend terms, although how they might calculate the trend is not specified.

And, in fact, it doesn’t really matter how trend GDP growth is computed in this case.

But there are two points:

1. The written rule is ambiguous and poorly expressed.

2. This part of the rule (whether in level or ratio) offers a fixed point commitment – “at the end of every Parliament” – which despite all the talk of rolling windows places a firm discipline on the conduct of fiscal policy that is independent of context and cannot be pushed forward in time.

The constraint “at the end of every Parliament” means just that – at the end of the first term in office.

This is one the reasons I have been critical of the rule. To satisfy it, a new Labour Government cannot guarantee it will not be forced to impose austerity, despite their protestations that the Fiscal Rule is free from such compulsion.

Consider the following historically-based example, and we will assume the Rule is targetting a debt ratio not a level of debt.

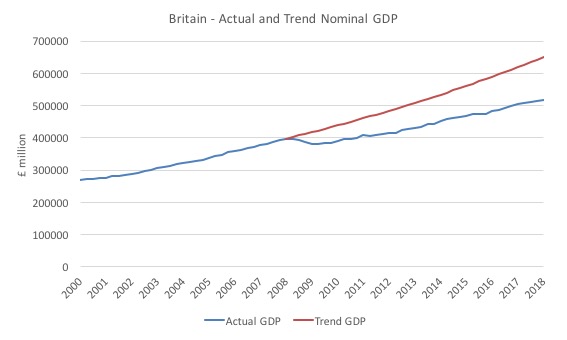

In the March-quarter 2008, British GDP peaked and at that point, the public debt ratio was 41 per cent of GDP.

Between the March-quarter 2000 and the March-quarter 2008, British nominal GDP had grown on average each quarter by 1.2 per cent and real GDP had grown on average by 0.6 per cent per quarter. The difference between the two growth rates is the inflation rate (approximately).

If we assume that nominal GDP kept growing after the March-quarter 2008 by that average growth rate then the divergence between trend growth and actual growth would be as depicted in the next graph.

And the next graph shows the actual movement in the public debt ratio (in actual GDP) up to the March-quarter 2018 (blue line) and the movement in the debt ratio (in terms of trend GDP) (red line).

The green line is the five-year mark assuming a new government came to power in March 2008.

Now obviously things might have been different had different policy choices been made at the outset of the GFC.

The simple arithmetic of the dynamics of the public debt ratio is captured in the following equation:

In English, the change in the public debt ratio is the sum of two terms on the right-hand side:

(a) the difference between the real interest rate (r) and the GDP growth rate (g) times the initial debt ratio. B being the total outstanding debt and Y being nominal GDP.

(b) the ratio of the primary fiscal deficit (G-T) to GDP.

A primary fiscal balance is the difference between government spending (excluding interest rate servicing) and taxation revenue.

The real interest rate is the difference between the nominal interest rate and the inflation rate.

When British public debt was 41 per cent of GDP (2008), the interest payments on that debt were around 2.2 per cent of GDP (Eurostat data). By 2011, they had rise to 3.2 per cent of GDP (with an overall fiscal deficit of 7.5 per cent of GDP).

By 2017, interest payable was still 2.7 per cent of GDP (and the debt ratio was 87.4 per cent).

You can do the arithmetic (or let me do it) and you will find that if trend GDP growth was sustained after 2008 (1.2 per cent per annum) and we assume that the nominal interest rate and inflation rate were similar (and stable), then for the public debt ratio to remain stable, the primary fiscal balance would have had to be very small.

An overall fiscal deficit of around 2.7 to 3 per cent would probably stabilise the public debt ratio under these circumstances.

And most of that would be interest payments, not large scale investment plans etc.

But imagine that British Labour had been newly elected in March 2008 and then the crash came.

And because they were committed to shunning austerity they offset the collapse in non-government spending with a strong fiscal stimulus – capital investment and they allowed the deficit on recurrent items to grow as well.

The stimulus would probably allow them to keep GDP growing on trend if they so desired. Australia, after all, did not have a technical recession during the GFC because the Federal government introduced a well-timed and relatively large fiscal intervention.

It doesn’t really matter how they constructed the stimulus for this argument because either way the debt level would have risen, given the institutional arrangements that Labour would follow where they would (unnecessarily) match fiscal deficits with debt-issuance.

In the Australian case, for example, the fiscal balance shifted from a surplus of 1.7 per cent of GDP in 2007-08 to deficit of 4.2 per cent of GDP in 2009-10 as a result of the stimulus.

Even with a rapid return to growth albeit below the previous trend rate, the deficit was still 3 per cent of GDP through 2013-14.

In the Australian case, total Federal debt rose from $A 60,451.2 million in 2008 to $A531,936.8 now.

The fiscal stimulus pushed the total debt ratio from 6.7 per cent of GDP in 2008 to 27.8 per cent of GDP in 2018.

Five years from the outset of the crisis (2013), the debt ratio had risen from 4.9 per cent in 2008 to 16.4 per cent.

It would have been impossible for the Australian government to deliver a lower public debt ratio (against actual GDP or trend GDP) after five years and provide sufficient stimulus to avoid a recession, given the shift in non-government spending.

The point is that we do not really know how much the British debt ratio would have risen had the economy been saved via a massive fiscal intervention.

The British Labour Fiscal Rule clearly allows for a rise in the deficit via the capital component and the rolling five-year window on the recurrent balance can be pushed out at will (technically, more about which later).

But there is no doubt that, given the size of the intervention that would have been required to offset the collapse in non-government spending, the debt ratio would have risen substantially.

The rise in the deficit (both recurrent and capital components) would have had to be significant – well above the 2.7 to 3 per cent noted above (which includes mostly interest payments on outstanding debt).

One might argue that the debt might not have risen quite as much as actually happened because the stronger growth would have ultimately generated lower deficits via the automatic stabilisers.

But it is impossible to argue that it would not have risen substantially and even with the low interest rates, interest payments would also have risen somewhat.

All that is rather moot though.

The question is how would the Labour government, faced with a major downturn at the beginning of its term or early in its term use fiscal policy to support growth as non-government spending collapses (anti-austerity) and ensure that the debt ratio (however defined) is lower after five years?

The answer is that it is highly unlikely that they could do both, which is why I am so opposed to these restrictive rules.

And this has nothing to do with rolling windows or golden rules, which I will deal with next.

The rolling window issue

In my empirical work over the course of my career I have used very advanced statistical and econometric techniques, including very complex rolling window filters etc.

I know what a rolling window is.

The response to my criticism of the Labour Fiscal Rule has been to avoid the detail by simply saying I have misrepresented the Rule by not understanding the rolling window built into the commitment to balance the recurrent fiscal position every five years.

The Fiscal Rule states in the context of not “putting rent on the credit card month after month” that:

Labour will close the deficit on day-to-day spending over five years …

… we would commit to always eliminating the deficit on current spending in five years, as part of a strategy to target balance on current spending after a rolling, five-year period.

Nothing I have written in the past demonstrates I have misunderstood that construct.

Sure enough the rolling window means that Labour can maintain a recurrent deficit forever if they chose (ignoring the five-year debt constraint). In my very first blog post on the Fiscal Rule I acknowledged that there was plenty of scope within the Rule to run deficits.

But as I’ve also written many times in the past, if a nation encounters a serious recession that results in a significant deficit, and then within the last years of the rolling window, it may have to introduce major cuts in recurrent outlays in order to move the recurrent balance towards zero.

Why?

Well, first, the Rule contains a fixed point debt constraint discussed above.

Second, and it is ironic that I have to articulate this. One of the claims against Modern Monetary Theory (MMT) is that people like me are politically naive.

James Meadway admitted to me at the end of the meeting that the ‘economics’ of MMT are not what he is concerned about. Rather, it is the politics of some of the things that follow from that economic reasoning.

So imagine this.

The Fiscal Rule is intended, by their own admission in the last week, to placate those interests who might adopt negative views about fiscal deficits and public debt.

All the wording is couched in those terms.

And then, we have a situation where in a recession, a large deficit arises.

No problem. The Rule allows for a rolling window.

The Chancellor says there will be a recurrent balance at the end of five years.

Things get worse (as they did).

No problem. The new data comes in and the rolling window now allows the Chancellor to say well at the end of the sixth year (after the crisis) there will be a recurrent balance.

And so on.

What do you think will happen?

Think back to the period after the GFC began.

At the outset of the crisis, as banksters and their ilk were being bailed out by fiscal and monetary policy interventions, there was relative silence.

Then once their positions were safe the deficit terrorism began in earnest.

The media was full of stories of profligate governments and public debt crises and claims that governments would run out of money, leave massive debt burdens for our kids, that there would be hyperinflation, skyrocketing interest rates etc etc.

Ad nauseam.

It was hysteria. And daily.

Debt clocks appeared and other ruses.

The result was that governments were pressured into imposing austerity and some were voted out because their deficits were too high.

British Labour lost office. Australian Labor lost office. The Eurozone went crazy.

And millions, unnecessarily, lost their jobs as a consequence.

Thus:

It is simply unbelievable to have a situation where, on the one hand, one constructs a Fiscal Rule because they have a fear of the powers of those who use ‘sound finance’ to push their own self-interested agendas, but on the other hand, to think that these self-interested powers are going to sit back and let the Chancellor keep pushing the window out until the cows come home.

That is why I opposed the rule.

It was not because I misunderstood the rolling window.

Conclusion

I have a clearer picture after my meeting with the Shadow Chancellor.

His team thinks there is plenty of flexibility built into the Rule that will allow them to meet all circumstances and still pursue a progressive agenda.

I suspect, now, that that view is based on their belief that if things get bad enough the MPC will hand over control to the Chancellor who would suspend the operation of the Rule.

That means the fixed debt constraint could be relaxed.

The problem is that even in the GFC – the worst crisis in decades – the suspension clause would not have been triggered.

Yes, the Chancellor could tear the Rule up. But then the politics would get tricky. That is why I have been critical.

It is better in my view to start educating the public so that the ‘financial market’ fears fade away and progressive policy agendas can be pursued without these damaging distractions.

And the fan boys of the Rule can dis me for all they are worth but, ultimately, it is their nation that will bear the brunt.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

I saw a TED talk a year ago. You can still see it I’m sure.

The speaker claimed that the cause of the GFC/2008 was a new accounting rule, “Mark to Market” that got imposed on Wall Street. And removing the rule had a lot to do with the recovery.

I think what Bill said above relates to that. That is, going by the deficit to GDP ratio is automatically going by a Mark to Market rule. When the GDP goes down in a Recession the ratio goes up even if the deficit doesn’t change $1 or 1 euro.

At a minimum, the rue should adjust the GDP as if it had continued up or at least not fell. But, this is not going to fly in the typical Neo-liberal economic system.

Of course, Bill also thinks that the national debt is not any kind of problem for a sovereign nation with a fiat currency. So, Bill thinks *any* such rule to go by the ratio is going to not work as well for the common citizen as ignoring the ratio altogether.

.

Labour’s fiscal rule makes sense to me. The balanced budget element will of course tend to lead to inadequate demand, but when interest rates hit zero, the budget deficit kicks in to deal with that problem. The result is that interest rates will tend to bump along just above or at zero, which meshes nicely with Warren Mosler’s “permanent zero interest rate” idea, which I support. And that in turn isn’t a hundred miles from the claim made by Milton Friedman and Bill Mitchell that governments should borrow nothing.

My only objection to the rule is that it goes along with the popular and flawed idea that public investment justifies public borrowing. Every small business knows that investment does not justify borrowing, though apparently economists don’t understand the point. That is if a small business wants to make an investment and happens to have enough cash, it probably won’t borrow. And governments have near limitless amounts of cash at their disposal in that they can grab limitless amounts of cash from taxpayers.

Plus education is one HUGE investment, but for some strange reason no one ever suggests the entire education budget be funded via borrowing, so the “investment justifies borrowing” brigade have a along way to go before they get their act together.

Dear Ralph Musgrave (at 2018/10/23 at 5:31 pm)

You obviously did not take in the contents of the blog post. The Fiscal Rule is unworkable as it stands in a major recession. Even in the GFC, the Bank of England did not consider the low interest rates (0.25 per cent) to be a zero lower bound.

best wishes

bill

The three Lerner fundamental rules of Functional Finance, that ought to be tattooed on the forehead of every Finance Ministers on the planet upon assuming office:

1. The government shall maintain a reasonable level of demand at all times. If there is too little spending and, thus, excessive unemployment, the government shall reduce taxes or increase its own spending. If there is too much spending, the government shall prevent inflation by reducing its own expenditures or by increasing taxes.

2. By borrowing money when it wishes to raise the rate of interest, and by lending money or repaying debt when it wishes to lower the rate of interest, the government shall maintain that rate of interest that induces the optimum amount of investment.

3. If either of the first two rules conflicts with the principles of ‘sound finance’, balancing the budget, or limiting the national debt, so much the worse for these principles. The government shall (create) any money that may be needed to carry out rules 1 and 2.

That’s all there is to it folks 🙂

Dear Bill,

The article is clear and strong.

The image of Labour politicians still cowering before markets is depressing. I hope your exposure of and resistance to the Fiscal Rule results in its revision, or preferably, abandonment, in time for the next GE.

On another point, sorry to be in sub-editing mode once again, but this typo did make me chuckle, and while I’m in favour of using fiscal policy to improve the lot if the millennial generation, this kind of pampering might be a step too far! 😉

“…leave massage debt burdens for our kids…”

Best, Mr S.

Perhaps they are just too scared to sit down and nut out what a functional finance approach to the deficit would mean in practice. The job guarantee etc. So they hide behind rules which mean they don’t have to have a coherent plan for governing in a progressive way. Labour gets its ecstatic moment of winning. Big party. And then the next day?….same old…which makes me think they fear genuine substantial change as much as they claim to embody it.

Went to a Labour party event in Gloucester a few days ago. McDonell spoke in terms of placating markets which was deeply depressing. No discussion about how socially useless the City is and how the Government could control the bond market (as Bill incessantly points out) it was a proclamation for arse licking the financial sector.

T o make it worse, Danny Dorling (who has dome some good work on challenging austerity) banged on about Brexit impoverishing the country with no mention that our sovereign status could blow the austerity agenda apart with Brexit making it easier!

Only brief moment of light was when the Labour M.P for Stroud (with a 700 majority!) pointed out that Brexit didn’t hinder a progressive program but he said this in passing and din’t expand on it.

Poor stuff. I’m still going to vote Labour because things are so terrible in the UK at present (massive private debt, stress, poor mental health, crap jobs, NHS struggling, virtual disappearance of social housing) that even a scintilla of improvement is welcome. Still a bleak picture though if Labour won’t challenge the City big time.

Your article is very well argued and for the most part user-friendly for non-specialists. It appears to be a a very substantive reply to Simon’s recent article and you make a lot of very telling points in my opinion, anyway. However, Simon did also reference the tone of debate which he finds, well let’s say not cricket. It would have been good if you could have held out an olive branch or grasped his. Many, including Simon, have been understandably frustrated with mainstream economics and the media narrative over the years, and I am sure you both could accommodate disagreement without becoming a cultural pommie necessarily.

MMT has really done a lot to penetrate an apparently immovable barrier and advance the debate politically, but the last thing we need is for progressive economics to be crippled by unnecessary infighting. Your arguments appear to stand on their own merit as it is and seem sufficient by themselves to rebut any perceived slights.

i.b,

Bill has made it clear on this issue of politeness and respect. In his blog, last week on this issue, he wrote:

The last part of the discussion centred on the use of social media. I indicated that the British MMTers who were strong supporters of JMD and the Labour Party in general were regularly vilified by JMD’s advisers on social media.

‘JM (James Meadway) said that the MMTers were rude to him and that I should control them. I said something like it was not a cult under my control and that I had actually noted at the MMT conference in NYC that a more respectful dialogue on social media should be the aim of both sides.’

Unfortunately (and I include myself in this at times) some MMT supporters can behave a little ‘evangelically’. Understandable in that once one discover the MMT lens there can be a lot of anger about the way we are deceived and scammed by ideology parading as truth. Eventually I learnt to tone down the indignation the more I realised my knowledge base was rocky and try and learnmore!

Dear Bill,

Thanks for your response. Strikes me you’re putting a bit of a circular argument, i.e. you’re saying “in the GFC, the Bank of England did not consider the low interest rates (0.25 per cent) to be a zero lower bound”, which as you say means that under Labour’s fiscal rule there’d have been no fiscal stimulus during the GFC. But had there been no fiscal stimulus, then the BoE would presumably have cut rates even further, perhaps to 0% and then (under Labour’s fiscal rule) told the Treasury that fiscal stimulus was OK.

But I’m not suggesting the amount of stimulus implemented by the BoE and government during the GFC was enough: I agree that both bodies are still mesmerised by deficit and debt phobia. I.e. I agree that aiming for SPECIFIC debt targets as a % of GDP or whatever is nonsense.

Best wishes, Ralph Musgrave.

My instinct is to emphasize the ‘no need to borrow’ aspect of macroeconomics for monetary sovereign nations. After this is stated, then the next obvious step leadership should introduce is ‘what do we need spending to do? And do we have the resources to accomplish those goals?’ Resources utilization is the first task–the ‘nut out what a functional finance approach to the deficit would mean in practice’ as cs expressed it. No borrowing required. So much for the looming debt. Let it ‘run off’ at maturity. My view is this approach would avoid the neo liberal narrative entirely. If the debt is unnecessary, and functionally it is, then simply point out we’re ‘taking care’ of the debt. So stop whining about it already.

Nguyen van Tuan,

I like your idea of tattooing the principles of functional finance to the forehead of all finance ministers.

However I’ve never been happy with Lerner’s point No 2, i.e. that bureaucrats or politicians know the optimum rate of interest for investment purposes. There’s a widely accepted principle in economics that absent good evidence of market failure, the optimum price for anything including the price of borrowed money is the free market price, so I’d let markets determine the rate of interest (though occasional artificial adjustments to interest rates to deal with booms or slumps might be justified).

Plus as argued by M.Friedman, W.Mosler and B.Mitchell, there is no good reason for government borrowing, a point I agree with. I.e. government borrowing artificially raises interest rates. So I’d have little or no government borrowing, and let markets set interest rates.

From the average person’s point of view, the underlying benefit from letting existing Treasury debt mature is that interest expense in the national operating budget will decline in an orderly fashion. The other more nuanced benefit is the owners of existing debt will get their principal back guaranteed, with interest. I should think it would be difficult to ‘corner’ the Treasury market and speculate under this scenario simply because ‘buy and hold’ owners of Treasury will be unaffected. And there are no new Treasuries being offered! From my point of view this is the ‘euthenasia of the rentier’ Keynes wrote about.

@cs,

“…which makes me think they fear genuine substantial change as much as they claim to embody it.”

The very definition of a Liberal!

When what we need are Socialists.

Clause “but on the other hand, to think that these self-interested powers are going to sit back and let the Chancellor keep pushing the window out until the cows come home.” lacks a conclusion.

I noticed that typo, too, Mr S. Very good. 🙂

That Labour is frightened of the finance sector reinforces Mark Ames’ view that the Left in general rejected finance in particular and economics in general and thus left them ignorant of how that system worked and thus prone to anxiety about what might happen. If they knew that, for the most part, what happens in finance doesn’t bring the real world crashing down, they could relax and maybe educate themselves. In particular, they must take on board the notion that sovereign with sovereign currency systems governments can intervene in the market, if they know what they are doing, to good effect.

Osborne was worried about the ratings of the UK that they might provide. Such ratings applied to the UK government economic system are irrelevant. They have no application at all in this regard. That he was worried showed that he didn’t know what he was talking about.

i.b, Wren-Lewis is ruder to those who criticize him than you seem to realize. Bill is being polite. Frank, but polite.

Hello,

Very obvious that the Labour Party is the host for neoliberal parasites. No great change can be expected. It is as per Professor Michael Hudson’s book Killing the Host.

The discussion needs to be about:

1. Removing the legislation that says deficits must be matched by bond issuance.

2. The interest rate should be a support rate and not a target rate.

The so called national debt needs to be eliminated as a factor of discussion, the above measures would do that.

Until this matter is taken away the discussion cannot advance. That is my view. To keep those 2 things plays to neoliberal framing.

An interesting comment from Meadway where he stated he finds nothing wrong with MMT but rather it’s political implications. That’s exactly what the elite fear. A worker uprising, were we begin demanding more public goods and a fair share of output, reducing their share of national income and therefore their hold on power. It’s pathetic that such a comment comes from within an otherwise progressive platform.

If I’ve learned anything over the years, it is to begin arguing what you want (full employment, tertiary education) and then explain why that’s possible.

Xenji,

‘Meadway where he stated he finds nothing wrong with MMT but rather it’s political implications.’

Not sure about your interpretation, Xenji. I think Meadway said that because he misunderstands MMT’s understanding of Tax issues. Meadway still thinks ‘money grows on rich people’, to use Steph kelton’s phrase. So he thinks because MMTers don’t stress taxing the crap out of the rich and clawing back assets in Cayman Islands they are not progressive. That’s my sense of it, anyway.

As usual, I think Bill’s step by step illustration of how the fiscal rule will become a political stick with which it will be clobbered is very clear and well explained in plain English with counter-arguments fully addressed.

Wren-Lewis on the other hand, in my opinion, has a very unreadable blog that uses impenetrable jargon freely and assumptions that are never fully explained or justified. He talks to his “in-crowd” that way and makes out like he is some whizz at fancy modelling incorporating neo-classical ideas or something and therefore mere mortals shouldn’t expect to understand. The blogs remind me of trying to read French Post Modernist pseudo philosophy – full of assertions in jargon that aren’t explained. The Krugman, Wren Lewis types are all a bit like that – they pretend they are super sophisticated (remember Krugman on endogenous money??). But I think it’s just covering for the fact that they don’t have a real answer and they can’t fully admit that they’ve been wrong a long time because their career is based on their supposed expertise. Which boils down to saying interest rates can do almost everything and then maybe a bit more fiscal stimulus at the zero-bound that’s paid down quickly. Very far from functional finance.

“Arse licking the financial sector” as Simon Cohen states above does seem to have become some kind of deeply embedded Labour Party specialty in the UK. Some socialist party! The phrase has become meaningless. Why would anybody with half-brain vote for an Arse Licker Party given the extent of the UK’s problems? Keir Hardie is rolling in his grave!

Simon Cohen is on form! The UK Labour Party leadership is cowed by the deeply brain-washed conviction “Money only grows on rich people!” In a nutshell.

I don’t think its ideological with McDonnell, for his advisers it almost certainly is, either because they’re poorly informed or because they’ve wasted their entire career fine tuning the Ptolemaic theory of the retrograde motion of Mars.

I said this 3 years ago, when it became clear two weeks after Corbyn was elected that McDonnell was going to follow this path – i think they know full well what MMT means, in the sense it completely changes the paradigm. I also think they know they simply don’t have the ability to articulate and persuade others on this basis. They have instead headed for safe ground politically – this is a profound mistake for all the reasons Bill outlines.

To see it from their perspective for a moment, tax & spend and their version of the household budget analogy is easy to explain and easy for the public to understand in broad terms. They also believe that they can fudge any rule once they’re in power and do what they want fiscally regardless. They also believe it makes it more difficult to attack them politically (not that it will stop the right wing press anyway). Additionally it should be noted that they have as many political enemies within the Labour party ,especially the neoliberals on the PLP, as they do outside it, perhaps they think offering this olive branch will help in some way. It won’t, its all a mistake.

I really don’t believe any progressive in parliament will grasp this nettle, or have the wherewithal to do so even if they wished. Yes we need allies in the House, it would help tremendously, but we should continue to work from the ground up and target the next generation, that in my opinion is our best hope.

It seems the real problem with the Fiscal Credibility Rule is the lack of recognition for the role of automatic stabilisers. If unemployment benefits are “recurrent” then you’re obviously cactus. If Job Guarantee is “investment” then the rule is maybe fairly harmless.

Seems we need some more folksy analogies to show the foolishness of “sound” finance.

Something like using a compass heading to navigate through a mountain pass (sound finance) when you should be following the white lines on the road (functional finance).

Larry, you’re quite correct. I tried to engage his faith in technocrats with a little example of a real world problem. The results are here. tldr: your example doesn’t agree with my theory, therefore your example is wrong.

https://twitter.com/lutherb91898797/status/1054737545119100928

It finished with one of the most arrogant and ignorant things anyone has ever said to me. Even by the regular standards of clueless Oxford Professors it is my misfortune to interact with.

I can personally never forgive or forget the humiliation I was subjected to during the last Labour government. They sent me on 18 months of workfare. The humiliation started when I needed 3 suits,shirts and ties with a budget of £30 and a weeks notice. I honestly thought things had changed. Shame on me.

By Jeff:

“They also believe that they can fudge any rule once they’re in power and do what they want fiscally regardless. They also believe it makes it more difficult to attack them politically (not that it will stop the right wing press anyway). ”

It’s totally going to be different this time, guys. Every single “socialist” who failed at this for 4 decades just didn’t try hard enough.

This is the sort of idiocy we must endure in Canada:

https://nationalpost.com/opinion/andrew-coyne-liberals-spend-so-much-now-imagine-if-things-turn-bad

One thing I think everyone but a professional MMTer forgets is that it makes a HUGE difference if your nation has a trade surplus or a trade deficit. If you are Norway a balanced budget just limits the increase of the private sector’s financial assets to that amount. But, if the nation has a trade deficit, as US and UK(?) have, then a balanced budget means the private sector has a deficit equal to the trade deficit. So, year after year the people have less and less income, and this is compounded by the tendency for the rich to suck up more income every year.

It seems to me that keeping the nation’s workers alive and healthy is an investment in the future of the nation. The same for the children of the nation as they will be its workers someday.

OTOH, as a sop to the City, maybe the UK should count the medical expenses of its retired population as day to day expenses. I say “maybe”.

Luther, sorry to hear about your health problems. I also read your tweet about illegal actions in Denmark. Very good. Back to SWL. He may be one of the most arrogant people I have ever read. Krugman is pretty bad but SWL takes the biscuit. He clearly has no understanding of MMT and seemingly doesn’t think he needs to. But that doesn’t stop him commenting.

By “the last Labour government”, do you mean the Brown or Blair one? Blair was pretty neoliberal and Brown sucked up to the City. I would think you might agree that this lot is the worse group of incompetent fanatics we have had in a while. While Blair and Brown weren’t great, this group are unspeakable.

By, “If you are Norway a balanced budget just limits the increase of the private sector’s financial assets to that amount,”

.

I meant — If you are Norway a balanced budget just limits the increase of the private sector’s financial assets (= its surplus) to the amount of the trade surplus.

Not “putting rent on the credit card month after month” is not a problem for government. The problem for government is when households and businesses do this, and end up in debt deflation or a financial crisis. The City do not care. They will harvest the bailout, one of the automatic stabilisers, I think. This is why they lobby for light touch regulation.

The rolling window vaguely reminds me of John Smith’s prawn cocktail offensive, appeasing the City while trying to be progressive seems to me to be rather incompatible. Like running with the hares and hunting with the wolves. https://en.wikipedia.org/wiki/Prawn_Cocktail_Offensive

larry, luther : I don’t think twitter is well suited to SWL. He tends to offer very short, brusque tweets that can easily be taken as rude as he is not really engaged for time. The twitter character limit not a problem for him, obviously! That’s my read anyway.

If it’s any consolation, he probably spends vast quantities of his time answerable to the managerialists who set targets etc against which his performance is monitored. Tenure or no tenure, it’s not the elysian experience it might once have been to be a prof there. In addition to banging his head up against the mainstream household economists infecting politics and media. (Of course you might think no medium would suit him, but I quite like his blog – even when I disagree – although the ‘wonky’ stuff goes over my head too…..)

ib, tenure isn’t an issue for SWL as he is retired and Emeritus. His attitude to critics is also present in his comments in his blog. Twitter is not really different. Your perspective here I think is an inaccurate assessment of reasons for his behavior.

larry I don’t know him so am not in a position to make a judgement. I generally try to avoid making those kinds of judgements, not always successfully. His archive posts from 4 years ago re mmt seemed civil enough though not necessarily that substantive if I recall.

Some people can be a bit curmudgeonly in comments sections, that’s something everyone can agree on. Such is life I guess.

Sorry, ib, if I seemed to be a little harsh. It is just that I have difficulty putting up with SWL’s rubbish.

Thanks for the clear but sobering post. I previously thought that the Fiscal Rule in practice would be fairly benign and that the opposition to it was more about ideology than practicalities. You’ve put me straight on that.

Thanks larry, I had my troubles with workfare under Blair. I think it was called the ‘flexible new deal’. Happened to quite a lot of us in areas where we were considered too educated for factory/manual work, but not experienced for office work.